- Home

- »

- Digital Media

- »

-

Retail E-Commerce Market Size, Share, Growth Report 2030GVR Report cover

![Retail E-Commerce Market Size, Share & Trends Report]()

Retail E-Commerce Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Groceries, Apparels & Accessories, Footwear), By Model, By Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-668-4

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Retail E-Commerce Market Summary

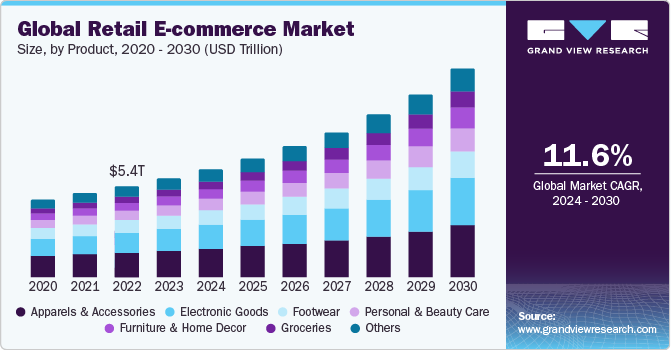

The global retail e-commerce market was estimated at USD 5,858.04 billion in 2023 and is projected to reach USD 12,349.94 billion by 2030, growing at a CAGR of 11.6% from 2024 to 2030. Increasing usage of smartphones and the convenience of purchasing daily essentials and luxury products from the comfort of home are primarily driving market growth.

Key Market Trends & Insights

- Asia Pacific dominated the market and accounted for more than 42.0% of revenue share in 2023.

- The retail e-commerce market in the U.S. is growing significantly at a CAGR of 10.0% from 2024 to 2030.

- By product, the apparel and accessories segment dominated the market in 2023 and was valued at USD 1,585.39 billion.

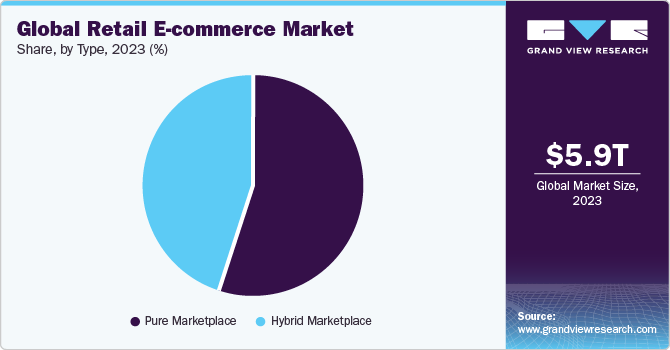

- By type, the pure marketplace is expected to grow at a significant rate during the forecast period.

- By model, the B2B segment was valued at USD 3,916.6 million in 2023.

Market Size & Forecast

- 2023 Market Size: USD 5,858.04 Billion

- 2030 Projected Market Size: USD 12,349.94 Billion

- CAGR (2024-2030): 11.6%

- Asia Pacific: Largest market in 2023

Moreover, the availability of a plethora of options, lower prices compared to physical stores, and technology-enabled online trials of apparel and accessories are also contributing to the burgeoning demand for retail e-commerce across the world. In addition, the internet has revolutionized the retail industry by increasing the reach of retailers from the local area to overseas, allowing businesses to reach the expediency of customers and increasing cross-broader success.

The demand for the retail e-commerce platform is driven by Various factors such as access to a very wide range of products, including cross-border and domestic markets, shopping at home, easier price comparison, and access to other consumers' views on the products. The evolution of mobile phones from mere communication devices to multipurpose devices has propelled online retailing and the penetration of internet users. As per the real-time intelligence data, Global System for Mobile Communications (GSMA) report, in 2022, mobile technologies and services accounted for 5% of the global GDP; 55% of the global population accounted for mobile internet users.

Thus, increasing consumer spending and a rising number of smartphone users worldwide have driven the demand for retail e-commerce. The internet has typically facilitated a plethora of online services, a convenient communication mode, and the exchange of information. Simultaneously, the growing adoption of smartphones and other mobile devices is allowing users to access the internet conveniently on the go.

Concerns among users over the collection and potential use of personal data by e-commerce websites are emerging as a potential restraint for the growth of the retail e-commerce market. While advances in technology bode well for market growth, any misuse of customer data can lead to financial and personal losses for consumers. Having realized that e-commerce firms handle large volumes of confidential and critical information, ranging from strategic data and customer information to commercial data and employee-related data, hackers are particularly targeting e-commerce websites. This creates the potential for individuals to experience personal and financial loss while the business's reputation can be tarnished. The chances of potential misuse of the data are also very high. Hence, while e-commerce businesses are maintaining backups of critical data, they are placing a strong emphasis on ensuring adequate data security.

Key players in the market include Alibaba Group Holding Limited, Amazon.com, Inc., Coupang, Inc., and Walmart Inc. These market players are actively pursuing various initiatives, such as strategic partnerships, new product launches, and mergers and acquisitions, as part of their efforts to retain or increase their market share. For instance, in January 2024, Coupang, Inc. announced the successful acquisition of the assets of the global online luxury company Farfetch Holdings plc. This acquisition, which grants access to USD 500 million in capital, enables Farfetch to sustain its delivery of exceptional services to its boutique partners and over four million customers globally. By leveraging Coupang's innovative logistics capabilities and operational excellence, Farfetch is strategically positioned to pursue consistent growth.

Market Concentration & Characteristics

The market growth stage is high, and the pace of the market growth is accelerating.The Retail E-commerce Market is fairly concentrated. The e-commerce market continues to evolve and experience high growth in both developing and developed markets. E-commerce is playing an increasingly critical role in retail and is restructuring the global retail market. Online shopping has grown considerably as access to the internet has reached all corners of the world, and smartphones have become an integral part of the lives of billions of people. While global e-commerce giants such as Alibaba Group Holding Ltd and Amazon.com, Inc. are well known across the globe, the growth of e-commerce is providing exciting growth opportunities for several organizations in all sizes and shapes, from key brick-and-mortar players to small industries. E-commerce has transformed how consumers shop for a range of products and services, providing them with access to a much greater assortment and helping meet their rising demand for convenience.

Advanced technologies such as Augmented Reality (AR) and Virtual Reality (VR) are creating new ways for customers to interact with products online. AR allows virtual try-ons of clothes, furniture placement in homes, or product visualization in real-world environments. VR can create immersive shopping experiences, such as taking a virtual tour of a store. Retailers are creating a seamless shopping experience across all channels, such as online, in-store, or mobile. This involves various features such as click-and-collect, ordering online and picking up in-store, and buying online and returning online purchases to a physical store.

Retail e-commerce companies need to consider several regulations to safeguard customer data collected by e-commerce businesses, such as the General Data Protection Regulation (GDPR), which is a comprehensive regulation governing data privacy and user rights within the European Union (EU). Similarly, the California Consumer Privacy Act (CCPA) protects consumer privacy rights related to the collection and use of personal data by businesses in California. There are also numerous regulations focused on preventing fraud and protecting customer financial information. For instance, the Payment Card Industry Data Security Standard (PCI DSS) is an industry-wide standard for securing credit card transactions and protecting cardholder data.

Product Insights

The apparel and accessories segment dominated the market in 2023 and was valued at USD 1,585.39 billion. The apparel and accessories segment witnessed a significant surge in demand on e-commerce platforms, driven by access to designer and latest fashion items at direct-from-factory prices. E-commerce retailers expanded their clients by appealing to those sensitive to price while also offering hassle-free returns to foster trust and providing the option for cash on delivery. In addition, consumer-to-consumer (C2C) shopping is becoming more popular through social media channels. Features like the Facebook “Buy” button and Instagram's checkout function facilitate purchases between individuals. Furthermore, platforms like Shopify are integrating their online stores with social media to tap into a broader customer base.

The groceries segment is anticipated to grow at a fastest CAGR of 13.6% during the forecast period. Consumers are increasingly adopting e-commerce platforms for comparing prices and buying a wider selection of grocery items. E-commerce applications allow users to create and manage shopping lists, which can help plan meals and avoid impulse purchases. Moreover, these applications offer the flexibility to choose between having groceries delivered to consumers’ doorstep or picking them up at a designated location. Delivery windows and fees are displayed clearly, which adds to the convenience of online shopping. Thus, there is an increasing adoption of e-commerce platforms for purchasing groceries among consumers.

Type Insights

The pure marketplace is expected to grow at a significant rate during the forecast period. Consumers increasingly favor pure marketplaces for convenience and diverse product offerings with the rising inclination toward online shopping. These platforms facilitate easy access to a wide array of products, allowing shoppers to compare prices and explore options effortlessly. Moreover, the competitive pricing on pure marketplaces enhances their appeal, attracting budget-conscious consumers seeking value for their money. This surge in demand reflects a growing reliance on e-commerce for everyday shopping needs, driven by the seamless experience and extensive choices afforded by pure marketplace platforms.

The hybrid marketplace is anticipated to grow at a high rate during the forecast period. Hybrid marketplaces provide businesses with a versatile platform to engage with diverse customer segments, including both B2B and B2C clients. This flexibility enables sellers to adjust their sales strategies in response to evolving market dynamics and changing consumer preferences. By catering to a wide range of customers and adapting to varying demand scenarios, hybrid marketplaces empower businesses to optimize their offerings and maximize their revenue potential in a dynamic e-commerce landscape.

Model Insights

The B2B segment was valued at USD 3,916.6 million in 2023. B2B e-commerce streamlines procurement processes, cutting costs by bypassing traditional manual methods like phone calls and meetings. Bulk purchasing options and negotiated discounts available on online platforms further drive savings for buyers. By automating transactions and offering competitive pricing structures, B2B e-commerce enhances efficiency and reduces overhead expenses associated with traditional procurement, resulting in significant cost savings for businesses across various industries.

The C2C segment is expected to grow at a CAGR of 16.5% during the forecast period. The emergence of online marketplaces like eBay, Craigslist, and Facebook Marketplace has revolutionized consumer-to-consumer (C2C) e-commerce by democratizing the selling and buying process. These platforms offer individuals a convenient and accessible way to connect and transact directly with each other, eliminating the need for traditional intermediaries. By providing a virtual space for individuals to list, discover, and purchase goods, online marketplaces have expanded the reach of C2C commerce, fostering a vibrant ecosystem of peer-to-peer transactions. This phenomenon has empowered individuals to monetize unused items, find unique deals, and build communities around shared interests, driving significant growth in the C2C segment.

Regional Insights

North America held the share of over 30% of the Retail E-commerce market in 2023. The market is expected to be influenced by factors such as evolving purchase patterns, secured internet transactions, and increasing consumer awareness. The high penetration of smartphones and other mobile computing devices in the region enables consumers to have access to the internet on the go, allowing them to browse e-commerce websites, search for products, and make purchases even from remote locations with convenience. Moreover, advancements in logistics, including faster delivery times, wider coverage areas, and innovative options such as same-day delivery, enhance the online shopping experience.

U.S. Retail E-commerce Market Trends

The retail e-commerce market in the U.S. is growing significantly at a CAGR of 10.0% from 2024 to 2030. The U.S. market is influenced by factors such as the high disposable incomes of the citizens in the country and the growing preference for convenient and more accessible shopping platforms to align with the busy lifestyles of many U.S. customers. E-commerce platforms make it easy for consumers to browse, compare, and purchase products from the comfort of their homes or on-the-go via mobile devices.

Europe Retail E-commerce Market Trends

The Retail E-commerce market in Europe is growing significantly at a CAGR of 10.8% from 2024 to 2030. The shifting preference of consumers from brick and mortar shops to digital platforms, which offer better convenience and flexibility, is one of the key factors driving market growth. According to Eurostat, a statistical office of the European Union, in 2023, 92% of European citizens used the Internet. Nearly 69% of citizens in the region bought or ordered products or services online in 2022.

The retail e-commerce market in the UK is growing significantly at a CAGR of 10.1% from 2024 to 2030. Factors such as high internet penetration rate and widespread smartphone use make online shopping convenient and accessible in the country. Moreover, the U.K. has a well-established logistics infrastructure with reliable delivery services. This ensures efficient product movement and timely deliveries.

Germany retail e-commerce market is growing significantly at a CAGR of 9.7% from 2024 to 2030. According to Eurostat, nearly 93% of the German population has internet access. This large potential customer base is a significant driver of the country’s retail e-commerce growth. Moreover, Germany has a well-established logistics infrastructure with reliable delivery service providers such as Deutsche Post AG (DHL Group). This ensures efficient product movement and timely customer deliveries.

The retail e-commerce market in France is growing significantly at a CAGR of 12.0% from 2024 to 2030. Social media platforms such as Instagram and Pinterest are increasingly influencing buyers’ purchase decisions in France. The ability to discover products through social media and influencers is a major driver of online traffic for e-commerce businesses. The vast use of mobile computing devices such as smartphones and tablets for online shopping in France has compelled market players to prioritize mobile-friendly platforms and user-friendly mobile experiences.

Asia Pacific Retail E-commerce Market Trends

The retail e-commerce market in Asia Pacific is growing significantly at a CAGR of 12.7% from 2024 to 2030. Factors such as the rapidly growing mobile internet user base, the growing preference for more convenient and accessible shopping platforms, busy lifestyles, and growing urbanization are expected to drive the market in the region. In addition, retail e-commerce platforms offer a faster alternative to traditional shopping.

The retail e-commerce market in China is growing significantly at a CAGR of 12.6% from 2024 to 2030. China has heavily invested in its digital infrastructure, ensuring widespread internet access and reliable connectivity. This strong foundation supports retail e-commerce growth. China is home to e-commerce platforms such as Alibaba Group Holding Ltd, JD.com, Inc., and Pinduoduo, Inc. These platforms offer a wide range of products, payment options, and marketing strategies to attract consumers. Furthermore, China boasts a highly developed logistics network with efficient delivery systems. This ensures fast and affordable delivery options, making online shopping a reliable alternative for consumers.

Japan retail e-commerce market is growing significantly at a CAGR of 11.7% from 2024 to 2030. Japan's aging population is primarily contributing to the growth of the retail e-commerce market in the country. Moreover, the labor shortage in Japan also demands user-friendly retail e-commerce platforms to drive the retail sector.

Retail E-commerce market in India is growing significantly at a CAGR of 15.9% from 2024 to 2030. India is experiencing a digital revolution, thanks to the rapid penetration of high-speed internet. The country’s growing online population creates a massive potential customer base for e-commerce businesses. In addition, India has a young and tech-savvy population increasingly comfortable with online transactions and embracing e-commerce for convenience and competitive pricing. Furthermore, growing disposable incomes, rapid urbanization, and busy lifestyles encourage Indian consumers to spend more online, fueling the e-commerce market's expansion.

Middle East & Africa Retail E-commerce Market Trends

The retail e-commerce market in Middle East & Africa is growing significantly at a CAGR of 11.4% from 2024 to 2030. The Middle East region presents significant growth opportunities in the field of cybersecurity training due to factors such as the increasing digitization across industries in the region has heightened the importance of cybersecurity measures to protect sensitive data and critical infrastructure. This heightened awareness has created a demand for skilled cybersecurity professionals capable of implementing and managing robust security frameworks.

The retail e-commerce market in Saudi Arabia is growing significantly, at a CAGR of 11.5% from 2024 to 2030. Saudi Arabia’s ambitious Vision 2030 initiative, supported by a surge in foreign investment in emerging technologies, including IoT, AI, and cloud computing, is also driving the need for Retail E-commerce and certification programs among professionals.

Key Retail E-Commerce Company Insights

Some of the key companies operating in the market include Alibaba Group Holding Limited, Amazon.com, Inc., Walmart Inc., and among others are some of the leading participants in the Retail E-commerce market.

-

Alibaba is a leading e-commerce conglomerate that operates several online marketplaces, including Alibaba.com (B2B platform), Taobao (C2C platform), and Tmall (B2C platform). Alibaba also offers cloud computing services, digital payments, and logistics solutions.

-

Amazon operates one of the largest online marketplaces in the world, offering a vast selection of products across various categories, including electronics, fashion, home goods, books, and more. Amazon's marketplace allows third-party sellers to list and sell their products alongside Amazon's own offerings, creating a diverse and competitive marketplace for consumers.

-

Walmart operates Walmart.com, an online marketplace that offers a vast selection of products across various categories, including electronics, home goods, groceries, clothing, and more. Walmart.com serves as a digital extension of Walmart's brick-and-mortar stores, providing customers with convenient access to a wide range of products and services.

The Kroger Co., JD.com, Inc., and Albertsons Companies, Inc. are some of the emerging market participants in the Retail E-commerce market.

-

Kroger offers online grocery shopping through its website and mobile app, allowing customers to order groceries for pickup or delivery. Customers can browse through a wide selection of products, including fresh produce, pantry staples, household essentials, and more, and choose convenient delivery or pickup options.

-

JD.com operates an online retail platform that offers a wide range of products, including electronics, fashion, home goods, groceries, and more. Customers can browse through a vast selection of items from various brands and sellers and place orders for delivery to their doorstep.

Key Retail E-Commerce Companies:

The following are the leading companies in the retail e-commerce market. These companies collectively hold the largest market share and dictate industry trends.

- Albertsons Companies, Inc.

- Alibaba Group Holding Limited

- Amazon.com, Inc.

- Coupang Inc.

- eBay Inc.

- Inter IKEA Systems B.V.

- Otto (GmbH & Co KG)

- Rakuten Group, Inc.

- Target

- The Kroger Co.

- Walmart Inc.

Recent Developments

-

In March 2024, Alibaba Group Holding Limited announced its plan to invest USD 1.1 billion in South Korea within the next three years. This investment will primarily focus on establishing a logistics center and expanding business operations. In 2024, Alibaba plans to allocate USD 200 million for the logistics hub construction and USD 100 million to facilitate small and medium-sized South Korean enterprises' international sales. Furthermore, the company plans to invest approximately USD 74.67 million to strengthen consumer protection measures in South Korea.

-

In January 2024, Coupang, Inc. announced the successful acquisition of the assets of the global online luxury company Farfetch Holdings plc. This acquisition, which grants access to USD 500 million in capital, enables Farfetch to sustain its delivery of exceptional services to its boutique partners and over four million global customers. Farfetch is strategically positioned to pursue consistent growth by leveraging Coupang's innovative logistics capabilities and operational excellence.

-

In July 2023, eBay Inc. acquired Certilogo S.p., an Italian company that provides AI-powered digital IDs and authentication for apparel and fashion goods. The acquisition helped establish eBay as a trusted pre-owned fashion and apparel shopping destination. Certilogo's platform allows consumers to confirm the authenticity of products and access reliable information about them.

Retail E-commerce Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6,397.83 billion

Revenue forecast in 2030

USD 12,349.94 billion

Growth rate

CAGR of 11.6% from 2024 to 2030

Base year

2023

Historical year

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Product, model, type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Albertsons Companies, Inc.; Alibaba Group Holding Limited; Amazon.com, Inc.; Coupang, Inc.; Rakuten Group, Inc.; eBay Inc.; Inter IKEA Systems B.V.; Otto (GmbH & Co KG); Target; The Kroger Co.; Walmart, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Retail E-commerce Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global retail e-commerce market report based on product, model, type, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Groceries

-

Apparels and Accessories

-

Footwear

-

Personal and Beauty Care

-

Furniture and Home Decor

-

Electronic Goods

-

Others

-

-

Model Outlook (Revenue, USD Billion, 2018 - 2030)

-

Business to Business (B2B)

-

Business to Consumer (B2C)

-

Consumer to Consumer (C2C)

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Pure Marketplace

-

Hybrid Marketplace

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

U.A.E

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global retail e-commerce market was valued at USD 5,858.04 billion in 2023 and is expected to reach USD 6,397.83 billion in 2024.

b. The global retail e-commerce market is expected to register a compound annual growth rate of 11.6% from 2024 to 2030 to reach USD 12,349.94 billion by 2030.

b. Asia Pacific dominated the market and accounted for more than 42.0% of revenue share in 2023. The region is expected to witness rapid growth over the forecast period of the pandemic on account of increasing mobile internet usage and changing lifestyles.

b. Some key players operating in the retail e-commerce market include Alibaba Group Holding Ltd; Amazon.com, Inc.; Coupang Corp.; Ebates Inc. dba Rakuten; eBay Inc.; Inter IKEA Systems B.V.; Otto (GmbH & Co KG); Taobao; The Kroger Co.; and Walmart Inc.

b. Key factors that are driving the market growth include the Increasing usage of smartphones and the convenience of purchasing daily essentials and luxury products from the comfort of home is primarily driving the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.