- Home

- »

- Pharmaceuticals

- »

-

Retinal Disorder Treatment Market Size & Share Report, 2030GVR Report cover

![Retinal Disorder Treatment Market Size, Share & Trends Report]()

Retinal Disorder Treatment Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Macular Degeneration, Diabetic Retinopathy), By Dosage Form, By Distribution Channel, By Product Type, And Segment Forecasts

- Report ID: GVR-3-68038-766-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Retinal Disorder Treatment Market Summary

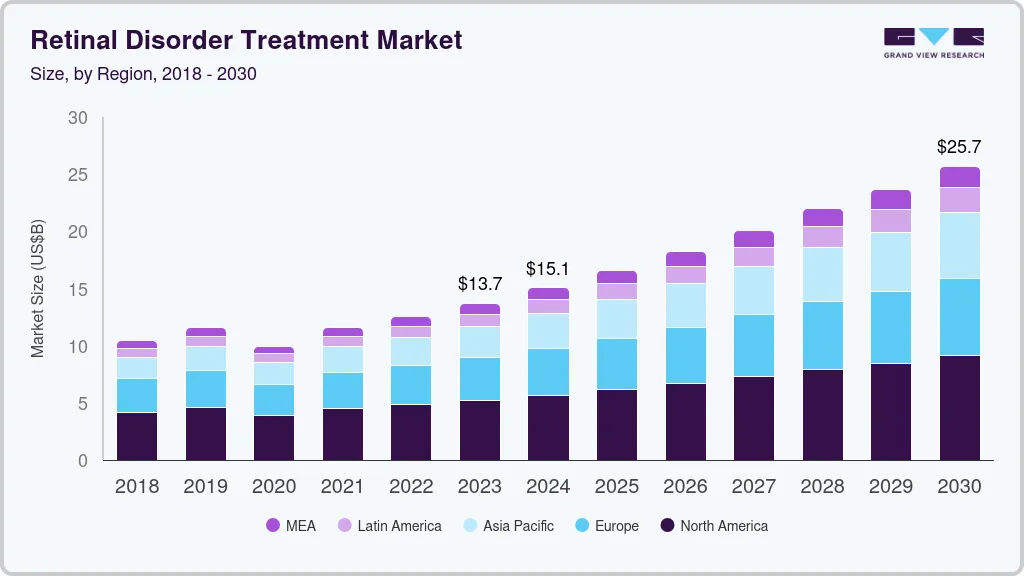

The global retinal disorder treatment market size was estimated at USD 13.69 billion in 2023 and is expected to reach USD 25.69 billion by 2030, growing at a CAGR of 9.4% from 2024 to 2030. The retinal disorder treatment industry is witnessing growth due to factors such as the growing incidence of retinal disorders globally and the need for efficient and cost-effective treatment options.

Key Market Trends & Insights

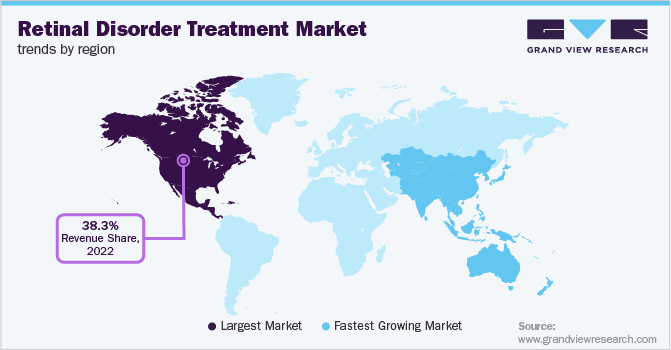

- The North America retinal disorder treatment market held the largest revenue share of 38.3% in 2022.

- By type, the macular degeneration segment held the largest revenue share of 43.6% in 2022.

- By dosage form, the eye drops dosage form segment held the largest revenue share in 2022.

- By distribution channel, the hospital pharmacy segment held the largest revenue share in 2022.

Market Size & Forecast

- 2023 Market Size: USD 13.69 Billion

- 2030 Projected Market Size: USD 25.69 Billion

- CAGR (2024-2030): 9.4%

- North America: Largest market in 2022

The presence of promising pipeline products is expected to boost the market growth in the forecast period. The rising prevalence of retinal disorders is anticipated to propel market growth over the forecast period. For instance, as per the NCBI in 2020, in patients aged over 40, the prevalence of retinal disorders ranges between 5.35% and 21.02%. In developed nations, retinal disorders are the most common cause of irreversible blindness, as they are asymptomatic till the later stages of the disease.Age-related macular degeneration treatment is expected to exhibit lucrative growth, as multiple market players are increasingly focusing on R&D to develop innovative treatments. Furthermore, the acquisition of promising molecules is on the rise. In December 2020, the rights for AMD gene therapy HMR59 were bought by Janssen Pharmaceutical.

The increasing number of innovative products for retinal disorders is creating new revenue generation channels for the players. For instance, in January 2022, Vabysmo by Roche was approved by the FDA for the treatment of wet age-related macular degeneration and macular edema in diabetic patients. The approval of this bispecific antibody is expected to enhance the management of patients. In July 2022, Iveric Bio paid DelSiTech for the development of sustained-release retinal disease prospects.

However, the high cost of novel drugs for retinal disorders is a major restraint. For instance, Luxturna, approved in 2017, is a one-time treatment for retina hereditary degeneration and is sold for USD 850,000 in the U.S., thus making it one of the world’s most expensive treatments. Luxturna is the first American therapeutic medication to emerge from gene therapy, which consists of repairing defective genes.

Type Insights

The macular degeneration segment held the largest market share of 43.6% in 2022, owing to the increasing prevalence of macular degeneration, regulatory support, and increasing interest of key players in the segment. For instance, in September 2021, the U.S. FDA approved a biosimilar referencing Lucentis named Byooviz, for the treatment of neovascular age-related macular degeneration (AMD), developed by Biogen Inc. and Samsung Bioepis Co., Ltd. In December 2022, two Korean firms Chong Kun Dang and Samsung Bioepis are expected to launch a biosimilar version of Lucentis for the treatment of age-related macular degeneration. Moreover, various studies are going on to develop novel therapeutics, for instance, in November 2022, REGENXBIO Inc. announced positive interim results for the ALTITUDE trial of RGX-314 used for the treatment of diabetic retinopathy.

The Diabetic retinopathy segment is expected to witness the fastest growth rate, which is attributable to the rising prevalence of the disorder. For instance, as per the NCBI in 2018, globally, 51% of the total population blindness is attributable to diabetic retinopathy and around 56% of people suffering from diabetic retinopathy come from the Asia-Pacific. The prevalence of diabetic retinopathy among those with diabetes ranged from 10% in India to 43% in Indonesia within the Asia-Pacific. In June 2022, Ocuphire Pharma, Inc. received a U.S. patent for APX3330, a late-stage oral drug candidate for the treatment of patients with diabetic retinopathy.

Dosage Form Insights

The eye drops dosage form segment held the largest market share in the global market in 2022 and is expected to show the fastest growth rate during the forecast period, owing to the cost-effectiveness and rising initiatives to develop novel eye drops for facilitating better absorption of the drugs. For instance, in July 2021, EyeCRO, a subsidiary of Charlesson LLC, announced its expansion into diabetic retinopathy treatment with eye drops of Fenofibrate. The step has been taken in order to enhance the availability of the medicine in the eye, which is limited when the treatment is taken orally. Moreover, the advent of generic formulations is further driving the market growth; for instance, in February 2022, the first generic of Restasis was approved by FDA.

The eye solution segment is expected to witness lucrative growth during the forecast period, owing to the increasing usage of injectable drugs for treatment. This includes major drugs such as Lucentis and Eylea. In addition, R&D is rising in the segment. For instance, AGN-241622, a pipeline drug of AbbVie Inc., is under phase III clinical trial for the treatment of presbyopia. The drug is an alpha-2 agonist and will be available as an ophthalmic solution.

Distribution Channel Insights

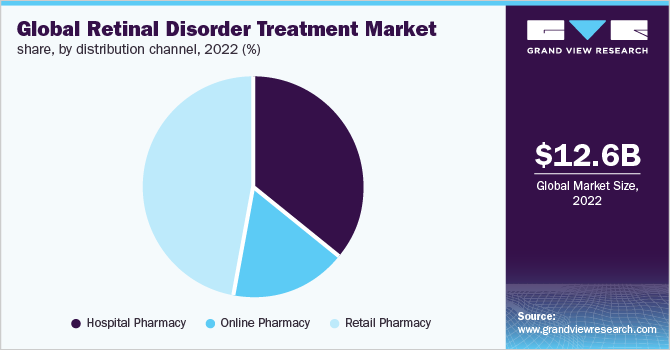

The hospital pharmacy segment held the highest market share in 2022. This can be attributed to the increasing use of drugs that require an injectable form of administration, which makes access to a hospital pharmacy easier. Moreover, hospitals offer extensive patient care, treatment, quick reimbursement, and insurance policies, owing to which patients opt for hospital pharmacies.

However, the online pharmacy distribution channel segment is expected to witness high growth over the forecast period. During the pandemic, there has been a direct spark that has accelerated the growth of e-commerce due to various travel restrictions and lockdowns across the globe. The online pharmacy also offers a number of benefits such as lower prices, discounts and offers, and convenience that further propel the growth of the segment.

Regional Insights

North America dominated the global market with a revenue share of 38.3% in 2022 and is anticipated to grow at a significant rate, driven by factors such as the growing geriatric population, the increasing launch of novel products, and enhanced awareness levels about eye conditions. As per BrightFocus Foundation, in 2019, 11 million people were suffering from AMD in the U.S., and the number is projected to double by 2050. With rising cases of the condition, there is a rising need for the development of effective therapeutics, which enable key players to launch newer drugs. For instance, in December 2022, Olix Pharmaceuticals completed the registration for phase 1 clinical trials of OLX301A for wet and dry muscular degeneration treatment in the U.S.

Asia Pacific is estimated to be the fastest-growing market during the forecast period owing to the increasing awareness among the population about early diagnosis & treatment, rising disposable income, and availability of effective and efficient treatment methods. For instance, as of 2021, India has 74 million diabetics, while 12.5 million of these suffer from diabetic retinopathy of some form. Thus, the presence of a high number of target patients is creating opportunities in the region.

Key Companies & Market Share Insights

Key players are rapidly opting for strategies such as strategic collaborations, geographical expansions, and partnerships through acquisitions and mergers in economically favorable and emerging regions. For instance, in March 2021, SemaThera Inc. announced a licensing agreement and a research collaboration with Roche in order to develop a new class of biologicals for the treatment of ischemic retinal diseases and diabetic retinopathy. Some of the key players in the global retinal disorder treatment market include:

-

Santen Pharmaceutical Co., Ltd.

-

Regeneron Pharmaceuticals Inc.

-

Graybug Vision, Inc.

-

Shire (Takeda Pharmaceutical Company Limited)

-

Bayer AG

-

Allergan plc. (AbbVie Inc.)

-

Genentech, Inc. (F. Hoffmann-La Roche Ltd.)

-

Acucela Inc.

-

Pfizer, Inc.

-

Kubota Pharmaceutical Holdings Co., Ltd.,

Retinal Disorder Treatment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 15.06 billion

Revenue forecast in 2030

USD 25.69 billion

Growth rate

CAGR of 9.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, dosage form, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Santen Pharmaceutical Co. Ltd.; Regeneron Pharmaceuticals Inc.; Graybug Vision, Inc.; Shire (Takeda Pharmaceutical Company Limited); Bayer AG, Genentech, Inc.; Acucela Inc.; Pfizer, Inc.; Kubota Pharmaceutical Holdings Co., Ltd.; Allergan plc. (AbbVie Inc.)

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Retinal Disorder Treatment Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global retinal disorder treatment market report based on type, dosage form, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Macular Degeneration

-

Dry Macular Degeneration

-

Wet Macular Degeneration

-

-

Diabetic Retinopathy

-

Others

-

-

Dosage Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Gels

-

Eye Solutions

-

Capsules & Tablets

-

Eye Drops

-

Ointments

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacy

-

Online Pharmacy

-

Retail Pharmacy

-

- Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global retinal disorder treatment market size was estimated at USD 12.57 billion in 2022 and is expected to reach USD 13.69 billion in 2023.

b. The global retinal disorder treatment market is expected to grow at a compound annual growth rate of 9.3% from 2023 to 2030 to reach USD 25.69 billion by 2030.

b. Macular degeneration dominated the retinal disorder treatment market with a share of 43.63% in 2022, owing to the increasing prevalence of macular degeneration, regulatory support, and increasing interest of key players in the segment. For instance, in September 2021 , U.S. FDA approved a biosimilar referencing Lucentis named Byooviz, for the treatment of neovascular age-related macular degeneration (AMD) developed by Biogen Inc. and Samsung Bioepis Co., Ltd.

b. Some key players operating in the retinal disorder treatment market include Santen Pharmaceutical Co., Ltd., Regeneron Pharmaceuticals Inc., Graybug Vision, Inc., Shire (Takeda Pharmaceutical Company Limited), Bayer AG, Genentech, Inc., Acucela Inc., Pfizer, Inc.

b. Key factor that are driving the market growth include growing incidence of retinal disorders globally and the need for efficient and cost-effective treatment options. The presence of promising pipeline products is expected to boost market growth over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.