- Home

- »

- IT Services & Applications

- »

-

Risk Management Market Size, Share, Industry Report, 2033GVR Report cover

![Risk Management Market Size, Share & Trends Report]()

Risk Management Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Solutions, Software, Services), By Deployment (On-Premises, Cloud-Based), By Risk Type, By Organization Size, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-684-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Risk Management Market Summary

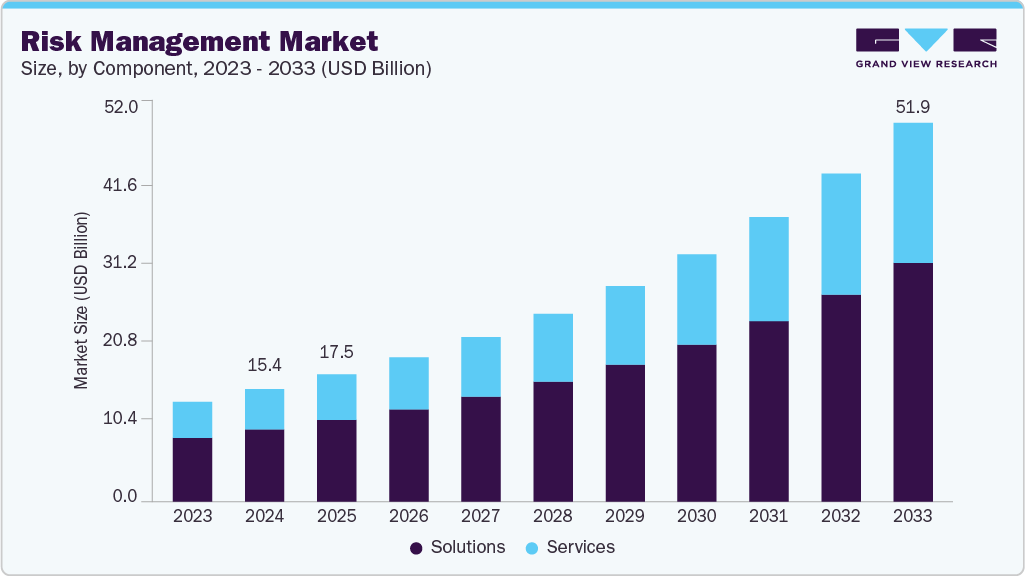

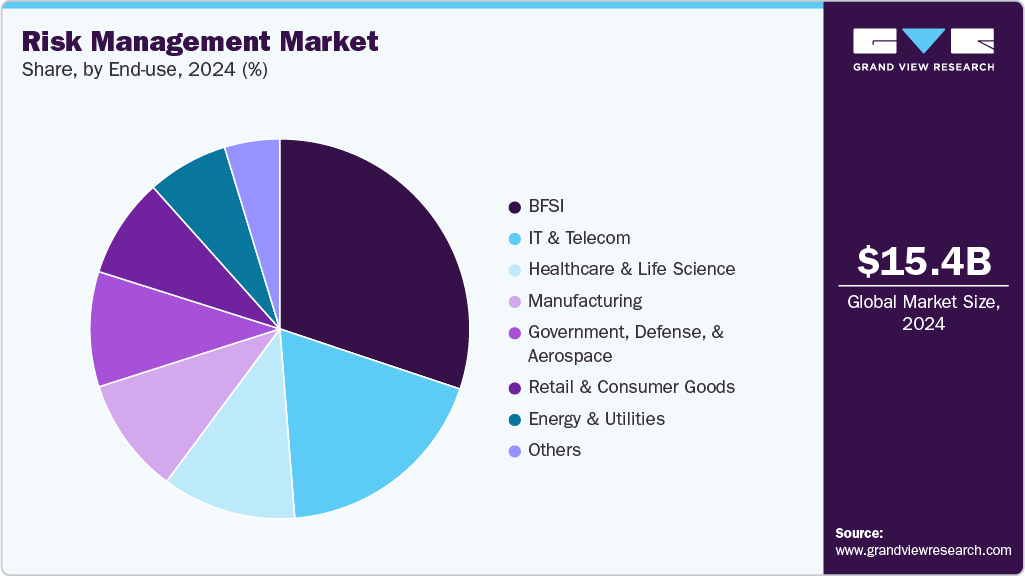

The global risk management market size was estimated at USD 15.40 billion in 2024 and is projected to reach USD 51.97 billion by 2033, growing at a CAGR of 14.6% from 2025 to 2033. The market growth is driven by rising operational complexity, escalating cyber threats, and increasing global focus on corporate governance and compliance.

Key Market Trends & Insights

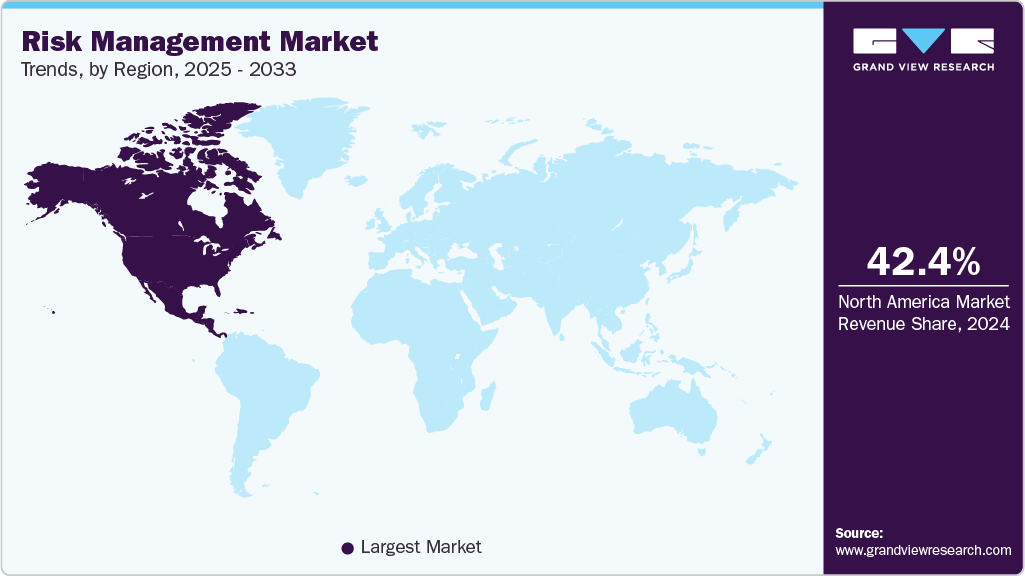

- North America risk management dominated the global market with the largest revenue share of over 42.0% in 2024.

- The risk management industry in U.S. is expected to grow significantly over the forecast period.

- By component, solutions led the market and held the largest revenue share of around 64.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 15.40 Billion

- 2033 Projected Market Size: USD 51.50 Billion

- CAGR (2025-2033): 14.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

As digital transformation accelerates, the adoption of cloud, AI, and big data analytics is reshaping industries, prompting significant investments in proactive risk management. These technologies are pushing organizations into new, complex risk landscapes, making advanced risk solutions essential for navigating evolving threats and regulatory demands. The global regulatory landscape is becoming increasingly stringent, compelling organizations to strengthen their risk management frameworks. In the financial sector, regulations such as Basel III, MiFID II, and SOX have established strict guidelines for capital requirements, transparency, and corporate accountability, making comprehensive risk controls mandatory. Beyond financial compliance, the rise of Environmental, Social, and Governance (ESG) regulations directives further emphasize the need for robust compliance measures. These evolving mandates span industries, pushing businesses to adopt advanced regulatory risk management solutions that ensure adherence while minimizing financial and reputational risks. As governments around the world implement stricter regulations, organizations face pressure to adopt automated compliance systems that can handle multi-jurisdictional requirements. This tightening regulatory environment is a key driver for the growth of risk management platforms, particularly those offering real-time monitoring, reporting, and risk analytics.

Comprehensive risk management solutions often come with high implementation costs, including expenses for software licenses, IT infrastructure, system integration, and employee training. These upfront investments can be substantial, particularly for small and medium-sized enterprises (SMEs) operating with limited budgets. As a result, many SMEs hesitate to adopt advanced risk management systems, limiting their ability to proactively manage risks. This financial barrier slows market penetration in the SME segment and creates a gap between large enterprises and smaller firms in adopting modern risk management tools and practices.

Component Insights

The solutions segment dominated the market and accounted for the revenue share of 63.95% in 2024. Solutions offering real-time, multi-dimensional insights coupled with automated threat response are increasingly in demand as businesses face evolving threats and complex regulatory requirements. Enterprises and financial institutions are rapidly adopting these solutions to comply with emerging regulations such as DORA, Basel III, and ESG mandates. Beyond regulatory compliance, these tools improve organizational decision-making by providing advanced analytics that surpass basic data interpretation. They also build resilience against financial and non-financial risks, thereby supporting long-term operational sustainability and risk-informed strategic planning.

The services segment is anticipated to grow at the fastest CAGR of 14.8% during the forecast period. The increasing complexity of today’s risk environment, driven by rising regulatory requirements, advanced cyber threats, and various operational risks, makes it difficult for organizations to handle risks on their own. Businesses are facing intricate compliance requirements, cross-border risks, and evolving threat vectors that demand specialized knowledge and strategic insight. As a result, there is a rising need for professional consulting and advisory services to assist organizations identify, assess, and mitigate risks effectively. These services provide expert guidance on risk frameworks, regulatory compliance, and proactive risk management strategies, supporting organizations in maintaining resilience and governance.

Deployment Insights

The cloud-based segment dominated the market and accounted for the largest revenue share in 2024. The shift toward remote work and globally distributed business operations has heightened the need for accessible, real-time risk management solutions. Cloud-based platforms address this by offering secure, anytime, anywhere access to critical risk data, dashboards, and analytics. This capability supports seamless collaboration among teams spread across different locations and time zones, ensuring timely decision-making and coordinated risk responses. By enabling centralized visibility and shared access, cloud solutions enhance organizational agility, helping businesses manage risks more effectively in today’s interconnected and fast-paced global environment.

The on-premises segment is expected to grow at a significant CAGR during the forecast period. On-premises deployments offer organizations greater control over their risk management infrastructure by reducing reliance on third-party cloud vendors. This minimizes the risk of vendor lock-in, where businesses become dependent on a single provider for software, data storage, or system management. With on-premises solutions, companies retain autonomy over system configurations, updates, and integrations, allowing for greater flexibility in adapting to changing business needs or regulatory requirements. This control also helps organizations manage long-term costs and avoid restrictive service agreements tied to cloud platforms.

Risk Type Insights

The financial risk segment dominated the market and accounted for the largest revenue share in 2024. The rapid rise of high-frequency trading, digital transactions, and 24/7 global financial markets has intensified the need for continuous, real-time risk monitoring. Financial institutions and enterprises now operate in highly dynamic environments where risks such as market volatility, credit exposure, and liquidity challenges can shift within seconds. Traditional periodic risk assessments are no longer sufficient to manage these fast-evolving threats. As a result, organizations are adopting advanced risk management platforms capable of real-time data analysis, automated alerts, and instant response mechanisms. These systems enable timely detection, assessment, and mitigation of emerging risks, helping businesses protect assets, comply with regulations, and maintain financial stability in volatile market conditions.

The cybersecurity risk management segment is expected to grow at a significant CAGR during the forecast period. The sharp rise in ransomware attacks reportedly surging by around 49% in the first half of 2025 has intensified the demand for cybersecurity risk management solutions. The growth of ransomware-as-a-service models and the security gaps exposed by widespread remote work have made organizations, particularly mid-sized firms with limited cybersecurity resources, prime targets. This escalating threat landscape compels businesses to invest in advanced cyber risk management platforms for real-time threat detection, vulnerability assessment, and incident response, ensuring stronger defense mechanisms against evolving cyber threats and minimizing potential financial and reputational damage.

Organization Size Insights

The large enterprises segment dominated the market and accounted for the largest revenue share in 2024. Large enterprises operate under stringent regulatory scrutiny, often facing complex compliance demands across multiple jurisdictions. Frameworks such as Basel III, SOX, ESG mandates, GDPR, and the Digital Operational Resilience Act (DORA) impose strict requirements on financial reporting, data protection, operational resilience, and sustainability. To meet these obligations, large organizations invest in advanced risk and compliance management platforms that ensure timely regulatory reporting, risk monitoring, and adherence to evolving laws. These platforms mitigate financial, legal, and reputational risks while enabling enterprises to maintain trust with regulators, investors, and stakeholders.

The small and medium-sized enterprises segment is expected to grow at a significant CAGR during the forecast period. Small and medium-sized enterprises (SMEs) are rapidly adopting digital technologies, including cloud platforms, automation, and analytics, to enhance operational efficiency and stay competitive. Cloud-based risk management solutions are particularly attractive to SMEs as they provide scalable, cost-effective access to advanced risk analysis, monitoring, and compliance tools without the need for significant upfront investments. These subscription-based models allow SMEs to leverage enterprise-grade capabilities, such as real-time risk insights and automated reporting, helping them address risks proactively while maintaining financial flexibility and reducing the burden of in-house IT infrastructure management

End Use Insights

The BFSI segment dominated the market and accounted for the largest revenue share in 2024. The BFSI sector’s rapid shift toward digital services such as mobile banking, open APIs, and digital payments has significantly increased its exposure to cybersecurity threats and fraud risks. This heightened risk environment drives financial institutions to invest in advanced fraud detection tools powered by AI and machine learning. Real-time risk management platforms are now critical for identifying suspicious activities, preventing financial crimes, and ensuring secure, seamless customer transactions.

The IT & Telecom segment is expected to grow at a significant CAGR over the forecast period. The deployment of 5G networks and the rapid growth of IoT ecosystems have revolutionized connectivity with faster speeds and reduced latency. However, this expansion has also significantly widened the attack surface, making networks more vulnerable to cyber threats. The proliferation of connected devices, coupled with complex API integrations, increases security risks for telecom operators. To address these challenges, telecom providers are making substantial investments in advanced cybersecurity solutions aimed at securing networks, endpoints, and data flows. These measures are critical for ensuring safe, reliable service delivery in the evolving digital landscape.

Regional Insights

North America risk management market dominated the global market with the largest revenue share of 42.39% in 2024. North America accounts for 43% of global cyberattacks, highlighting its heightened vulnerability. In 2023 alone, ransomware-related damages surpassed USD 4.5 billion, as per FBI IC3 data. This surge in sophisticated cyber threats is driving organizations across the region to adopt advanced risk management and cybersecurity solutions to safeguard operations and data.

U.S. Risk Management Market Trends

The risk management market in the U.S. is expected to grow significantly at a CAGR of 13.4% from 2025 to 2033. U.S. companies operate under strict regulatory regimes, including SOX, HIPAA, SEC disclosure rules, Dodd-Frank, and growing ESG mandates. These regulations demand strong risk management frameworks and automated compliance systems to ensure transparency, safeguard sensitive data, and meet complex reporting obligations driving sustained investment in advanced risk management solutions.

Europe Risk Management Industry Trends

The risk management market in Europe is anticipated to register considerable growth from 2025 to 2033. European businesses operate in a dynamic environment shaped by geopolitical tensions, supply chain disruptions, and financial market volatility. These interconnected risks create operational uncertainties, compelling organizations to adopt advanced risk management solutions. Proactive frameworks assist firms anticipate threats, safeguard operations, and navigate the complexities of regional and global business landscapes.

The risk management market in UK is expected to grow rapidly in the coming years. The Cyber Security and Resilience Bill in the UK mandates stricter incident reporting, enhanced resilience standards, and improved supply chain security measures. This legislative push is driving organizations especially in critical infrastructure, finance, and services sectors to adopt advanced cybersecurity and risk management platforms, ensuring regulatory compliance and operational resilience.

The Germany risk management market held a substantial market share in 2024. Germany’s export-driven economy centered on automotive, machinery, and chemicals—faces constant exposure to global trade fluctuations, geopolitical risks, and supply chain disruptions. These vulnerabilities drive German companies to adopt advanced risk management and supply chain resilience tools, ensuring business continuity, regulatory compliance, and adaptability amid shifting international market conditions.

Asia Pacific Risk Management Market Trends

Asia Pacific held a significant share in the global market in 2024. Asia Pacific businesses are accelerating cloud adoption, IoT deployment, and digital infrastructure expansion, particularly with the rise of hybrid work environments. This shift increases exposure to cyber, operational, and compliance risks, prompting organizations to invest in advanced risk management platforms that enable real-time monitoring, threat detection, and secure remote access.

The Japan risk management market is expected to grow rapidly in the coming years. Japan’s Active Cyberdefence Law enforces mandatory breach reporting and authorizes proactive cyber operations, particularly for critical infrastructure sectors. This legal shift compels organizations to enhance their cybersecurity frameworks, adopt advanced risk management platforms, and strengthen overall resilience to meet compliance requirements and defend against increasingly sophisticated cyber threats.

The risk management market in China held a substantial market share in 2024. China’s rapid digitalization driven by widespread adoption of cloud computing, IoT devices, and AI technologies has expanded risk exposure across industries. This digital shift increases the demand for advanced risk management platforms that can secure hybrid IT environments, provide intelligent threat detection, and support predictive analytics for proactive risk mitigation.

Key Risk Management Company Insights

Key players operating in the risk management industry are BitSight, FIS Global, Fiserv, IBM Corporation, LogicGate, Inc., Microsoft Corporation, Moody's Corporation, NAVEX Global, Riskonnect, Inc., ServiceNow, Oracle Corporation, MetricStream, SAS Institute Inc., Qualys, Inc. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

Key Risk Management Companies:

The following are the leading companies in the risk management market. These companies collectively hold the largest market share and dictate industry trends.

- BitSight

- FIS Global

- Fiserv

- IBM Corporation

- LogicGate, Inc.

- Microsoft Corporation

- Moody's Corporation

- NAVEX Global

- Riskonnect, Inc.

- ServiceNow

- Oracle Corporation

- MetricStream

- SAS Institute Inc.

- Qualys, Inc.

Recent Developments

-

In April 2025, FIS Global announced the launch of the Treasury and Risk Manager Quantum Cloud Edition, a cloud-native platform designed for enterprise treasury and risk functions. The solution delivers real-time cash visibility, advanced risk analysis, and improved decision-making through enterprise integration and public-cloud scalability.

-

In November 204, Bitsight announced it has acquired Cybersixgill for USD 115 million, integrating its real-time cyber threat intelligence into its cyber risk management platform. This merger blends Bitsight’s asset‑mapping strengths with Cybersixgill’s dark‑web monitoring and AI‑driven insightsenhancing visibility into the extended attack surface and supply chain threats and enabling proactive threat detection and response.

-

In Decmeber 2024, NAVEX Global released its first-ever Risk Resilience Guide, providing organizations with a practical, step‑by‑step framework to establish systematic risk management. The 30‑page guide covers global regulatory shifts, third‑party risk, operational resilience, and techniques for building board-level support. It emphasizes proactive strategies such as continuous monitoring, horizon scanning, scenario planning, and data‑driven insights to evolve beyond reactive compliance and strengthen organizational resilience.

Risk Management Market Report Scope

Report Attribute

Details

Market size in 2025

USD 17.45 billion

Revenue forecast in 2033

USD 51.97 billion

Growth rate

CAGR of 14.6% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report Organization Size

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, risk type, organization size, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

BitSight; FIS Global; Fiserv; IBM Corporation; LogicGate Inc.; Microsoft Corporation; Moody's Corporation; NAVEX Global; Riskonnect, Inc.; ServiceNow; Oracle Corporation; MetricStream; SAS Institute Inc.; Qualys, Inc.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Risk Management Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the risk management market report based on component, deployment, risk type, organization size, end use, and region.

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Solutions

-

Risk Assessment & Analysis

-

Risk Control & Monitoring

-

Risk Reporting & Analytics

-

Others

-

-

Services

-

Professional Services

-

Managed Services

-

-

-

Deployment Outlook (Revenue, USD Billion, 2021 - 2033)

-

On-Premises

-

Cloud-Based

-

-

Risk Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Financial Risk Management

-

Compliance Risk Management

-

Cybersecurity Risk Management

-

Enterprise Risk Management

-

Operational Risk Management

-

Others

-

-

Organization Size Outlook (Revenue, USD Billion, 2021 - 2033)

-

Large Enterprises

-

Small and Medium-Sized Enterprises

-

- End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

BFSI

-

IT & Telecom

-

Government, Defense, and Aerospace

-

Healthcare & Life Science

-

Retail & Consumer Goods

-

Manufacturing

-

Energy & Utilities

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global risk management market size was estimated at USD 15.40 billion in 2024 and is expected to reach USD 17.45 billion in 2025.

b. The global risk management market is expected to grow at a compound annual growth rate of 14.6% from 2025 to 2033 to reach USD 51.97 billion by 2033.

b. North America risk management dominated the market with the largest revenue share of 42.39% in 2024, driven by rising cyber threats accounting for 43% of global attacks and over USD 4.5 billion in ransomware damages, prompting widespread cybersecurity adoption.

b. Some key players operating in the risk management market include BitSight, FIS Global, Fiserv, IBM Corporation, LogicGate, Inc., Microsoft Corporation, Moody's Corporation, NAVEX Global, Riskonnect, Inc., ServiceNow, Oracle Corporation, MetricStream, SAS Institute Inc., Qualys, Inc.

b. The market growth is driven by rising operational complexity, escalating cyber threats, and increasing global focus on corporate governance and compliance.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.