- Home

- »

- Medical Devices

- »

-

Robotic Prosthetics Market Size, Share & Growth Report, 2030GVR Report cover

![Robotic Prosthetics Market Size, Share & Trends Report]()

Robotic Prosthetics Market (2023 - 2030) Size, Share & Trends Analysis Report By Extremity (Upper, Lower), By Technology (MPC, Myoelectric), By Region (North America, Europe, APAC, Latin America, MEA), And Segment Forecasts

- Report ID: GVR-1-68038-583-0

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2016 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Robotic Prosthetics Market Summary

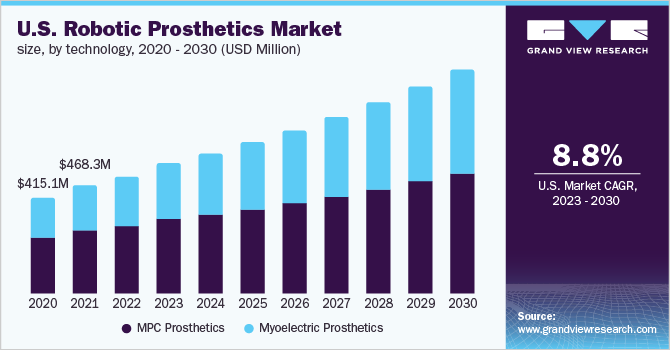

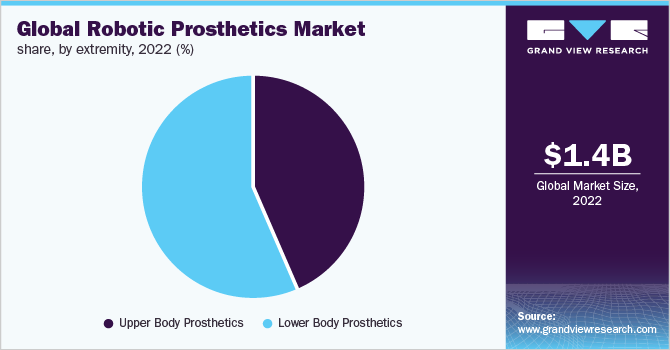

The global robotic prosthetics market size was estimated at USD 1.4 billion in 2022 and is projected to reach USD 2.8 billion by 2030, growing at a CAGR of 8.8% from 2023 to 2030. The market is primarily driven by the high rate of innovation in the field of robotics by deploying artificial intelligence, 3D printing and increased demand for custom made bionic prosthesis.

Key Market Trends & Insights

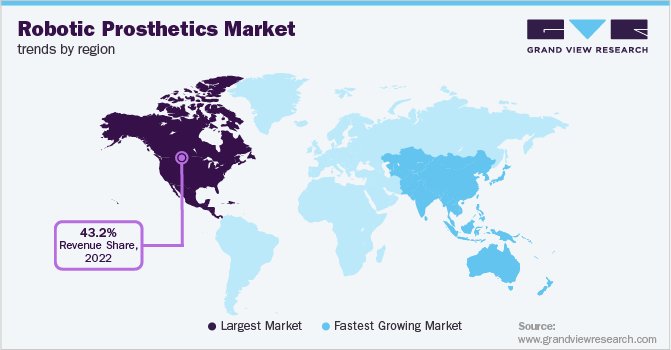

- North America dominated the global robotic prosthetics market with the largest revenue share of 43.2% in 2022.

- By technology, the microprocessor prosthetics segment led the market, holding the largest revenue share of 58.2% in 2022.

- By extremity, the lower body extremity segment held the dominant position in the market and is expected to register fastest growth of 9.0% from 2023 to 2030.

Market Size & Forecast

- 2022 Market Size: USD 1.4 Billion

- 2030 Projected Market Size: USD 2.8 Billion

- CAGR (2023-2030): 8.8%

- North America: Largest market in 2022

High rate of amputation due to injuries, chronic diseases and congenital diseases are also key to the rise in demand for robotic prosthetics. As per the Amputee Coalition, 2.1 million people are currently living with limb loss, in the U.S. Chronic diseases like diabetes, vascular diseases and cancer are among the leading causes for amputation. The global prevalence of chronic diseases is exploding, they account for 71% of global death, annually, as per the WHO. Out of these, cardiovascular diseases cause the most deaths, approximately 17.9 million annual deaths, cancers, respiratory diseases and diabetes are the three other major fatal chronic diseases.

According to the Amputee Coalition, of the more than 2 million people living with a loss of limb in the U.S., majority (54%) were due to diseases like diabetes, peripheral arterial disease etc. and 45% were due to trauma. A paper published in Prosthetics and Orthotics International stated the global prevalence of amputations due to trauma was more than 57 million, as of 2017. The increasing rate of amputations and increasing need to find better technologies to restore quality of life for amputees is driving the growth of the market.

Rapid advancements in technology especially in robotics has also been a key driver for the growth of the robotic prosthetics market. The use of better materials, biosensor technology, use of artificial intelligence as well as other tools are behind the rapidly evolving field of robotics. Bionic prosthetics are making robotic limbs feel more and more like regular limbs with more agile, human like movements and aesthetically appealing looks for robotic prosthetics. However, the only downside is the cost of these technologies which make them non-approachable to the general public. These advanced technologies are still in development and testing phase and are poised to bring about a revolution in the market. For instance, in Sweden, researchers have been studying and improving a new version of consciously controlled prosthetic arm, capable of significantly improving the quality of life for amputees. The prosthesis is surgically attached to bone, muscle and nerves, implanted electrodes pick up brain signals and help in movement, touch, etc., just like a normal, natural arm would. Innovations like these are significant contributors to the overall growth of the robotic prosthetic market, globally.

Government initiatives and support for growing number of research and development activities in the field of AI and robotics also propelling the market towards growth. The Defence Advanced Research Projects Agency (DARPA) is also involved in development of novel prosthetic systems for veterans, one such example of their developments is the LUKE arm system which was developed in collaboration with DEKA Research and Development Corporation. It is a modular system and is powered by batteries, it enables dextrous arm movements through an intuitive controlling system which enables the users to make movements in multiple joints, simultaneously.

COVID-19 pandemic has drastically affected all industries due to rising cost of raw material procurement, increase in transportation costs etc., on top of that, the ban on cross-border transport also caused a slowdown in the industry. However, the ever-increasing number of R&D initiatives by the robotic industry or IT industry in the field of artificial intelligence has been a key driver of the market. The global level of research done in the field is driving the market towards unprecedented growth. Improvement in the type of materials used to make prosthetics is also furthering the growth of the market. The above-mentioned factors all contribute towards uplifting the market.

Technology Insights

The microprocessor prosthetics segment held the largest market share of 58.2% in 2022. The microprocessor prosthetics provide amputees with better stability, more natural movements and overall improved functionality of the prosthetic limb. This technology has revolutionized the prosthetics industry and has made lives of lower limb amputees better. These have better adaptability to supply more mobility by adjusting to walking patterns of the wearer.

Myoelectric prosthetics are anticipated to register the fastest growth rate of 9.7% over the forecast period. This new technology where-in the prosthesis is controlled by mind rather than mechanically, is the new rage, many companies and institutes are continuously improving the technology to bring out the best version of a truly bionic prosthesis. These are much nearer in terms of mimicking the natural movement of limbs as compared to mechanical or even microprocessor prosthetics. A number of companies have developed myoelectric prosthetics with currently available technologies which offer wider range of movements and a better quality of life. For instance, In September 2021, Steeper introduced a myoelectric system which includes Myo Kinisi hand which is easy to control along with auto grip function providing amputees to grip or hold objects much more efficiently.

Extremity Insights

As of 2022, the lower body extremity section held the largest market share of 56.4%. It is also predicted to register the fastest growth rate of 9.0% during the forecast years. The number of lower limb amputations in general are more common than the upper limb amputations. The rising prevalence of chronic illnesses like diabetes and PAD are the main reason for amputations that are due to non-traumatic injuries. A research article published on Trauma Monthly studying the number of amputations over a period of 10 years reported the lower limb amputations accounted for more than 79% of the total cases.

The leading non-traumatic amputations were due to diabetes (over 26%) and vascular diseases (over 10%). The growing demand for prosthetics in the geriatric population manages the growth of the market. The global geriatric population is on a staggering, all time high, a total of 727 million people were aged above 65, as of 2020, as per a report by WHO. The older generation in need to replace limbs with prosthetics to improve quality of life and over functionality has been driving the growth of the market.

Regional Insights

North America accounted for the largest market share of 43.2% of the global robotic prosthetic market as of 2022. The region’s development status as well as availability of modern and advanced technology, presence of large players in the market and increasing number of R&D activities in the field are all significantly contributing to the growth of this region. Furthermore, initiatives taken by the government to provide its veterans with prosthetics has also promoted considerable growth. Presence of companies pioneering in the field of robotics is also a key driving factor. Sarcos Robotics, a U.S. based company involved in development of highly advanced robotic systems which use AI, also creates wearable technology and has recently received funding for its R&D activities, amounting over USD 95.0 million.

Asia Pacific is anticipated to register the fastest growth rate of 10.2% owing to the growing economy of the region’s countries, growing geriatric population as well increasing number of amputations in the low-middle income countries in the region. A study published in Prosthetics and Orthotics International revealed that the highest number of traumatic amputations were done in the East and South Asia regions. Above mentioned factors are key factors responsible for the growth of robotic prosthetic market in the region.

Key Companies & Market Share Insights

The market is highly competitive due to the presence of several large players and is driven by the R&D activities done in the industry to constantly improve the functionality of the prosthetic limbs so as to get as near as possible to mimic the natural movements. Several robotics companies are now making prosthetics for upper and lower extremities. Some of the prominent players in the robotic prosthetics market include:

-

Ottobock

-

Touch Bionics, Inc.

-

EndoliteSynTouch, Inc.

-

HDT Global

-

Össur Americas

-

Shadow Robot Company

Robotic Prosthetics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.6 billion

Revenue forecast in 2030

USD 2.8 billion

Growth Rate

CAGR of 8.8% from 2023 to 2030

The base year for estimation

2022

Historical data

2016 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, extremity, region

Regional Scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; Italy; France; Spain; Russia; Japan; China; India; South Korea; Singapore; Australia; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Touch Bionics Inc.; Touch Bionics Limited; HDT Global; SynTouch, Inc.; Artificial Limbs & Appliances; Ottobock; Ossur Americas; Blatchford Group

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

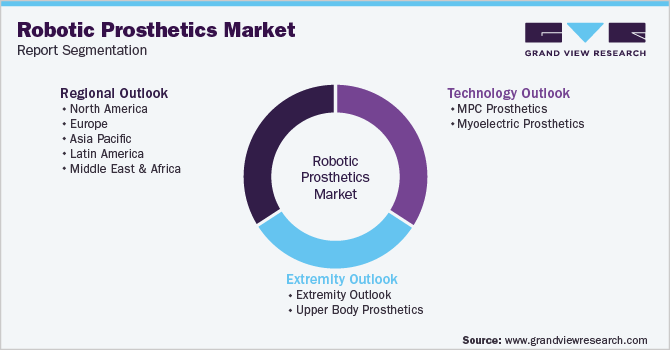

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of latest industry trends in each of the sub-segments from 2016 to 2030. For the purpose of this study, Grand View Research, Inc. has segmented the global robotic prosthetics market report on the basis of technology, extremity, and region:

-

Technology Outlook (Revenue, USD Million, 2016 - 2030)

-

MPC Prosthetics

-

Myoelectric Prosthetics

-

-

Extremity Outlook (Revenue, USD Million, 2016 - 2030)

-

Lower Body Prosthetics

-

Prosthetic Knee

-

Prosthetic Ankle

-

Others

-

-

Upper Body Prosthetics

-

Prosthetic Arm

-

Prosthetic Hand

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

Italy

-

France

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Singapore

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global market robotic prosthetics size was estimated at USD 1.4 billion in 2022 and is expected to reach USD 1.6 billion in 2023.

b. The global robotic prosthetics market is expected to grow at a compound annual growth rate of 8.8% from 2023 to 2030 to reach USD 2.8 billion by 2030.

b. MPC Prosthetics dominated the robotic prosthetics market with a share of 58.2% in 2022. This is attributable to owing to the easy availability of products using this technology as opposed to other product types.

b. Some key players operating in the robotic prosthetics market include HDT Global; Ottobock; EndoliteSynTouch, Inc.; Touch Bionics, Inc.; Shadow Robot Company; and Össur Americas.

b. Key factors that are driving the robotic prosthetics market growth include an increase in the number of amputation cases at a global level, advancements in robotic space, and initiatives taken by government organizations, to facilitate funding and purchases of prosthetic devices.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.