- Home

- »

- Next Generation Technologies

- »

-

Robotic Sensors Market Size, Share, Industry Report, 2033GVR Report cover

![Robotic Sensors Market Size, Share & Trends Report]()

Robotic Sensors Market (2025 - 2033) Size, Share & Trends Analysis Report By Sensor Type (Vision Sensors/Cameras, Proximity Sensors, Ultrasonic Sensors), By Application, By Robot Type, By Region And Segment Forecasts

- Report ID: GVR-4-68040-627-3

- Number of Report Pages: 139

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Robotic Sensors Market Summary

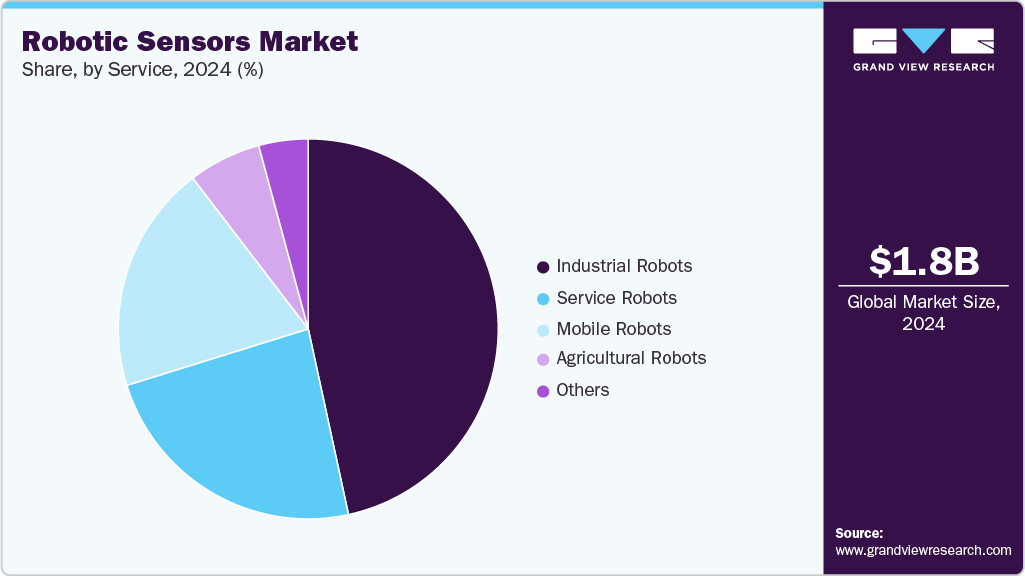

The global robotic sensors market size was estimated at USD 1,819.4 million in 2024 and is projected to reach USD 3,625.8 million by 2033, growing at a CAGR of 8.1% from 2025 to 2033. This growth is primarily driven by the rising adoption of automation across industrial sectors, along with the increasing deployment of autonomous mobile robots (AMRs) and collaborative robots (cobots) for tasks ranging from logistics and inspection to precision manufacturing and safety monitoring.

Key Market Trends & Insights

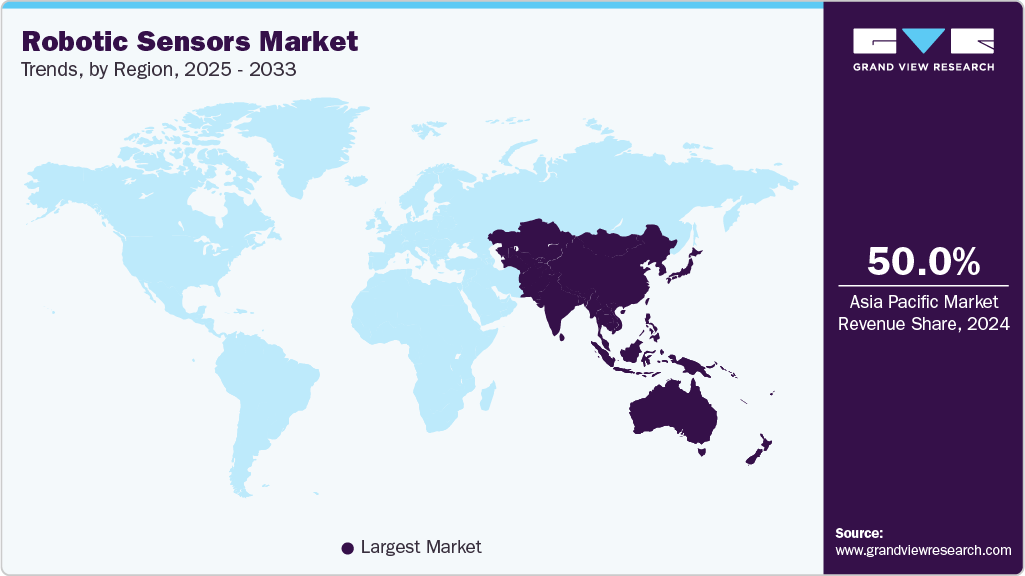

- Asia Pacific dominated the global robotic sensors market with the largest revenue share of 50% in 2024.

- The robotic sensors market in the China led the Asia Pacific market and held the largest revenue share in 2024.

- By sensor type, force/torque sensors led the market and held the largest revenue share of 25.7% in 2024.

- By application, navigation & mapping segments held the dominant position in the market and accounted for the leading revenue share of 23.7% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1,819.4 Million

- 2033 Projected Market Size: USD 3,625.8 Million

- CAGR (2025-2033): 8.1%

- Asia Pacific: Largest market in 2024

The global robotic sensors market is experiencing significant growth, largely driven by the increasing adoption of industrial automation and the widespread influence of Industry 4.0. Industries are progressively integrating robots to improve efficiency, precision, and overall productivity in manufacturing, logistics, and healthcare sectors. This demand is further bolstered by advancements in sensor technologies, such as LiDAR, ultrasonic, and tactile sensors, which are becoming more sophisticated, compact, and cost-effective. The rising focus on workplace safety and the necessity for high-quality, precise operations across various applications also act as important market drivers.

A key trend in the global robotic sensors market is the growing integration of Artificial Intelligence (AI) with robotic systems. AI algorithms are transforming how sensors process data, allowing robots to interpret complex environmental cues, recognize patterns, and make autonomous, real-time decisions. This synergy is crucial for applications ranging from autonomous vehicles and drones to advanced smart robotics, enabling machines to adapt to dynamic environments with unprecedented intelligence and flexibility. This development significantly enhances robot functionality and broadens their applicability across new domains.

Another notable trend influencing the market is the increasing demand for collaborative robots (cobots) and the convergence of the Internet of Things (IoT) with robotic sensors. Cobots are designed to work safely alongside humans and rely heavily on advanced sensors for accurate human-robot interaction and collision avoidance. In addition, the integration of IoT connectivity enables seamless data sharing and remote monitoring of robotic systems, leading to predictive maintenance and optimized performance. The emphasis on sustainability and energy efficiency in sensor design is also gaining importance, aligning with global environmental goals.

Key companies in the robotic sensors industry are actively engaged in strategic initiatives to strengthen their market position. These efforts include expanding product offerings with advanced sensor technologies, such as new 3D laser snapshot sensors and omnidirectional tactile sensors. Major players are also pursuing mergers, acquisitions, and collaborations, along with significant investments in research and development to innovate next-generation sensors. Companies such as FANUC Corporation, Omron Corporation, Keyence Corporation, and ATI Industrial Automation (now Novanta Inc.) are leading the way in driving advancements and meeting evolving industry demands.

Sensors Type Insights

The force/torque sensors segment accounted for a significant share of the robotic sensors industry in 2024. These sensors enable robots to measure applied pressure, load, or force during operation, which is essential for tasks such as assembly, polishing, and inspection. They are widely utilized in both industrial and collaborative robots, where consistent control and feedback are crucial to avoid damage and ensure accuracy. With the increasing automation in production, the demand for these sensors is expected to persist due to their role in maintaining balance, enhancing process control, and supporting safety standards.

The vision sensors/cameras segment is projected to experience the highest growth rate during the forecast period. These sensors assist robots in performing tasks that require position checking, quality inspection, or object tracking. By analyzing items or surroundings through captured images or depth data, these systems are becoming essential as more industries adopt robotics for managing logistics, sorting, and monitoring tasks. The demand for reliable vision systems will be bolstered by advancements in sensor hardware and software that enhance image processing and data accuracy.

Application Insights

The object detection & recognition segment accounted for a significant market share of over 20.7% in 2024. These applications utilize sensors to identify parts, tools, or other items during a robot's tasks. The sensors facilitate sorting, packaging, and pick-and-place operations in industries such as manufacturing and logistics. Their implementation reduces errors, improves speed, and increases task consistency. As industries seek to enhance throughput and reduce manual effort, the adoption of object detection and recognition in robotic systems is likely to continue growing.

On the other hand, the navigation & mapping segment is expected to experience the fastest growth in the robotic sensors industry during the forecast period. Robots operating in warehouses, hospitals, or outdoor environments rely on sensors such as LiDAR, ultrasonic, or motion sensors to interpret their surroundings and navigate safely. These sensors contribute to path planning, obstacle avoidance, and location tracking. As autonomous mobile robots and delivery robots become more prevalent, robust navigation and mapping functions will be essential for maintaining stable and efficient operations.

Robot Type Insights

The industrial robots segment accounted for a significant share of the robotic sensors industry in 2024. These robots are primarily employed in manufacturing for tasks such as welding, painting, and assembly. They rely on sensors to monitor their movements, positioning, and interactions with materials. Force and vision sensors play a critical role in improving productivity and mitigating operational issues. As automation continues to expand across various sectors, industrial robots will increasingly depend on sensor systems to support safe, accurate, and efficient production processes.

The service robots’ segment is projected to experience the highest growth rate during the forecast period. These robots are utilized in healthcare, agriculture, cleaning, and logistics. They use sensors to detect obstacles, monitor movements, and interact with their environments or people. The growth in this segment is driven by the rising demand for robots that perform routine or supportive tasks in both indoor and outdoor settings. As applications for service robots expand, the need for sensor-based systems is expected to grow steadily.

Regional Insights

Asia Pacific accounted for the largest market share of more than 50% in 2024. The market growth is driven by increasing industrial automation and expanding manufacturing capabilities. Countries such as China, Japan, South Korea, and India are heavily investing in robotics to enhance productivity and reduce reliance on manual labor. Robotic sensors are widely utilized in applications such as assembly, inspection, and logistics, particularly in the automotive and electronics sectors. The emergence of smart factories and government-supported digitalization programs are also facilitating the deployment of sensors. There is a rising demand for integrated sensor systems in collaborative robots and service applications across sectors like healthcare, agriculture, and e-commerce.

China represents the largest market for robotic sensors in Asia Pacific, supported by its robust industrial base and policy-driven support for automation technologies. The country’s ongoing efforts to modernize its manufacturing sector have led to the widespread adoption of robots equipped with advanced sensor systems, including force, vision, and proximity sensors. Applications cover a wide range, including automotive, consumer electronics, logistics, and public services such as sanitation and surveillance. Domestic sensor development is gaining momentum, with companies investing in AI-based sensor fusion and real-time control systems. The shift towards smart warehousing and unmanned delivery systems is further driving the demand for precision robotic sensing.

In India robotic sensors is gradually increasing, fueled by a growing interest in factory automation, supply chain optimization, and industrial safety. The automotive and pharmaceutical sectors are among the early adopters, using robots for material handling, packaging, and quality inspection. Technologies such as ultrasonic, infrared, and vision sensors are gaining traction as businesses strive to enhance operational efficiency. Startups and academic partnerships are contributing to localized sensor innovations designed for cost-sensitive environments. Although the market is still emerging, government initiatives promoting smart manufacturing and skill development programs in robotics are expected to support long-term growth in the robotic sensor ecosystem.

North America Robotic Sensors Market Trends

The North America robotic sensors market is being driven by advancements in automation across various sectors, including manufacturing, logistics, defense, and healthcare. Companies are making significant investments in robotic systems equipped with sensors to enhance precision, reliability, and safety for tasks ranging from industrial assembly to warehouse automation. The increasing adoption of collaborative robots and autonomous mobile robots is fueling the demand for sensors such as force/torque sensors, proximity sensors, and vision systems. The region benefits from a strong presence of technology firms and sensor developers, alongside growing research into AI integration and sensor fusion. These trends are contributing to steady long-term growth in the market.

U.S. Robotic Sensors Market Trends

The U.S. robotic sensors market is experiencing significant growth, driven by increasing focus on industrial productivity, labor optimization, and workplace safety. Manufacturing facilities are integrating advanced sensor solutions to enable real-time monitoring, error detection, and adaptive control within robotic operations. The logistics and warehousing sectors, particularly among e-commerce and retail companies, are significantly increasing the use of navigation and object recognition sensors. In healthcare, the demand for surgical robots and assistive technologies is driving the need for tactile and visual sensing capabilities. In addition, government-funded research and development initiatives, along with university-industry collaborations, are further promoting innovation in sensor technologies and their integration across various robotic platforms.

Europe Robotic Sensors Market Trends

The European robotic sensors market is experiencing steady growth, driven by the increasing use of automation in both industrial and service applications. Manufacturers across the region are integrating sensors into robots to enhance functionalities such as positioning, obstacle detection, force measurement, and visual analysis. Industries like automotive, logistics, and food processing are witnessing a wider deployment of collaborative robots, which rely heavily on sensors to ensure safe and efficient operations. Furthermore, the regional focus on smart manufacturing and workplace safety standards is leading to a greater adoption of advanced sensor systems. Ongoing investments in artificial intelligence integration and system interoperability are also shaping the direction of the market.

The UK robotic sensors market is growing as more businesses adopt automation to address labor shortages and improve productivity. The logistics and retail sectors are employing robots equipped with vision and distance sensors for inventory management, packaging, and last-mile delivery. In addition, healthcare applications such as robotic surgery and rehabilitation are driving interest in tactile and motion sensors. Government support for innovation in robotics and AI is contributing to research and pilot projects involving sensor technologies. Despite some operational challenges related to integration and cost, companies are exploring custom sensor solutions to meet niche requirements across emerging industries.

Germany's robotic sensors market growth is driven by its robust industrial base and emphasis on precision engineering. Industrial automation in sectors such as automotive manufacturing and electronics continues to be a significant catalyst, with robots utilizing a combination of force, torque, and vision sensors for complex assembly and inspection tasks. Companies are also focusing on integrating sensors with edge computing and Internet of Things (IoT) frameworks to enable real-time monitoring and predictive maintenance. Germany's approach to smart factory implementation fosters sensor innovation, with research centers and firms collaborating on multi-sensor fusion and adaptive sensor systems for flexible automation environments.

Key Robotic Sensors Company Insights

Some of the key players operating in the market are SICK AG, Orbbec 3D Technology International, Inc., Keyence Corporation, among others.

-

SICK AG offers a comprehensive range of sensors used in robotics and industrial automation. The company manufactures 2D and 3D vision sensors, LiDAR systems, safety laser scanners, encoders, and proximity sensors. These components are utilized in mobile robots, robotic arms, and safety zones to assist with navigation, object detection, collision avoidance, and process monitoring. SICK has also ventured into AI-driven localization and environmental mapping technologies through recent acquisitions. Its sensors are commonly integrated into warehouse robots, Automated Guided Vehicles (AGVs), and collaborative robots for industrial applications.

-

Orbbec develops and supplies 3D vision systems used across a wide range of robotic applications. The company’s offerings include structured light sensors, time-of-flight cameras, and stereo vision systems that enable robots to perform depth sensing, gesture recognition, object localization, and indoor navigation. Orbbec's products find applications in collaborative robots (cobots), autonomous mobile robots (AMRs), and industrial automation systems. Recently, the company expanded its product line to include support for Ethernet interfaces and AI-enhanced imaging, aimed at improving performance in logistics, healthcare robotics, and manufacturing environments.

-

Keyence Corporation produces a wide range of sensors used in robotics for inspection, positioning, and quality control. Its offerings include laser displacement sensors, 3D scanners, optical profilers, and machine vision systems. These sensors are implemented in applications such as robotic assembly lines, automated inspection, and bin-picking systems. Keyence’s vision systems are extensively used in pick-and-place robots across the electronics, automotive, and pharmaceutical sectors. The company designs its plug-and-play integration models for ease of use in both new and retrofit automation systems.

Omron Corporation, Basler AG, and Mann + Hummel are some of the emerging market participants in the Robotic Sensors Market.

-

Omron Corporation provides sensor technologies that support robotic automation in manufacturing and logistics environments. Its product range includes proximity sensors, vision systems, laser displacement sensors, and safety sensors, which are utilized in mobile robots and robotic arms. Omron also offers integrated sensing solutions that combine hardware and software for real-time control and predictive maintenance. Its vision sensors are frequently found in robotic applications involving packaging, inspection, and sorting. The company focuses on enabling safety zones for collaborative robots and enhancing task efficiency through real-time feedback loops.

-

Basler AG manufactures industrial cameras and vision components used in robotics and automated systems. The company offers area scan cameras, line scan cameras, and embedded vision modules that provide high-resolution imaging for robotic guidance, inspection, and object recognition. Basler’s imaging solutions are typically used in pick-and-place robots, quality control applications, and AMRs. The cameras support various communication interfaces and software development kits, making them adaptable to different robotic platforms across industries such as electronics, food processing, and logistics.

Key Robotic Sensors Companies:

The following are the leading companies in the robotic sensors market. These companies collectively hold the largest market share and dictate industry trends.

- ATI Industrial Automation, Inc.

- Baumer Group

- FANUC CORPORATION

- Futek Advanced Sensor Technology, Inc.

- Honeywell International Inc.

- Infineon Technologies

- Omron Corporation

- Sensata Technologies, Inc.

- TE Connectivity Ltd.

- Tekscan, Inc.

- SICK AG

- Orbbec 3D Technology International, Inc.

Recent Developments

-

In 2025, SICK AG acquired Accerion, a Netherlands-based tech startup that specializes in AI-based image processing and infrastructure-free localization technologies for autonomous mobile robots (AMRs). This acquisition strengthens SICK’s AMR portfolio by integrating Accerion’s Triton and Jupiter technologies into its product offerings. The newly formed subsidiary, SICK Accerion B.V., will focus on enhancing AMR localization and navigation capabilities across various industrial automation applications.

-

In 2025, ABB launched its next-generation autonomous mobile robot (AMR) featuring Visual SLAM (Simultaneous Localization and Mapping) and AI capabilities, along with the AMR Studio software suite. This new solution allows robots to adapt in real time to dynamic environments without relying on predefined infrastructure. This launch reinforces ABB’s strategy to provide highly flexible and intelligent automation solutions for the manufacturing and logistics sectors.

-

In 2025, Orbbec introduced the Gemini 335LE, a stereo vision 3D camera equipped with Ethernet connectivity. This marks the company’s first line of stereo vision cameras to support USB, GMSL2, and Ethernet interfaces. Announced at ProMat 2025, the new camera offers enhanced depth sensing, making it ideal for use with robotic arms, autonomous mobile robots, and warehouse automation applications. This development reflects Orbbec’s ongoing expansion into industrial-grade 3D vision systems.

Robotic Sensors Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,943.6 million

Revenue forecast in 2033

USD 3,625.8 million

Growth rate

CAGR of 8.1% from 2025 - 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 - 2033

Report product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Sensor type, application, and robot type

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Australia; Japan; India; South Korea; Brazil; South Africa; Kingdom of Saudi Arabia; UAE

Key companies profiled

ATI Industrial Automation, Inc.; Baumer Group; FANUC CORPORATION; Futek Advanced Sensor Technology, Inc.; Honeywell International Inc.; Infineon Technologies; Omron Corporation; Sensata Technologies, Inc.; TE Connectivity Ltd.; Tekscan, Inc.; SICK AG, Orbbec 3D Technology International, Inc.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

Global Robotic Sensors Market Report Segmentation

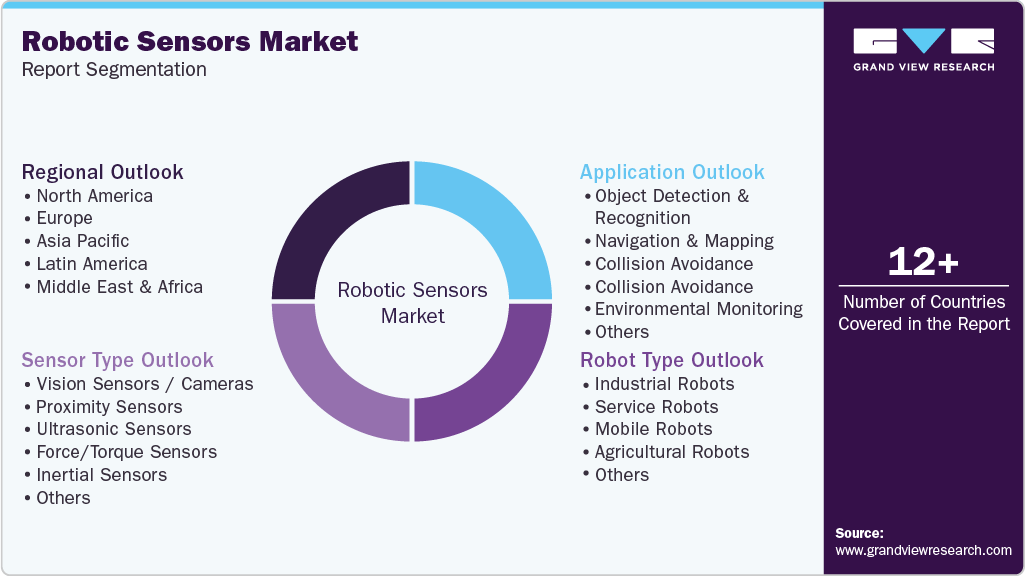

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technology trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the robotic sensors market report based on sensor type, application, and robot type:

-

Robotic Sensors Sensor Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Vision Sensors / Cameras

-

Proximity Sensors

-

Ultrasonic Sensors

-

Force/Torque Sensors

-

Inertial Sensors

-

Others

-

-

Robotic Sensors Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Object Detection & Recognition

-

Navigation & Mapping

-

Collision Avoidance

-

Collision Avoidance

-

Environmental Monitoring

-

Others

-

-

Robotic Sensors Robot Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Industrial Robots

-

Service Robots

-

Mobile Robots

-

Agricultural Robots

-

Others

-

-

Robotic Sensors Market Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global robotic sensors market size was estimated at USD 1.81 billion in 2024 and is expected to reach USD 1.94 billion in 2025.

b. The global robotic sensors market is expected to grow at a compound annual growth rate of 8.1% from 2025 to 2033 to reach USD 3.62 billion by 2033.

b. Asia Pacific accounted for the largest share of over 50% in 2024. The growth is primarily driven by rapid industrial automation across major economies, increased government spending on advanced manufacturing technologies, and the strong presence of both robotics and sensor manufacturing companies. Growing adoption of robotics in electronics, automotive, and logistics industries also contributed to the region’s dominance.

b. The key players in the robotic sensors market include ATI Industrial Automation, Inc., baumer group, FANUC CORPORATION, futek advanced sensor technology, inc., Honeywell International Inc., Infineon Technologies, Omron Corporation, sensata technologies, inc., TE Connectivity Ltd., Tekscan, Inc., SICK AG, Orbbec 3D Technology International, Inc.

b. Key factors driving market growth include rising industrial automation, advancements in sensor technologies, and growing adoption of collaborative robots. Increasing demand in logistics, healthcare, and smart manufacturing, along with miniaturization and cost reduction, is further accelerating market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.