- Home

- »

- Automotive & Transportation

- »

-

Route Optimization Software Market Size, Share Report 2030GVR Report cover

![Route Optimization Software Market Size, Share & Trends Report]()

Route Optimization Software Market (2024 - 2030) Size, Share & Trends Analysis Report By Solution (Software, Services), By Deployment, By Enterprise Size, By Industry Vertical, By Functionality, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-074-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Route Optimization Software Market Summary

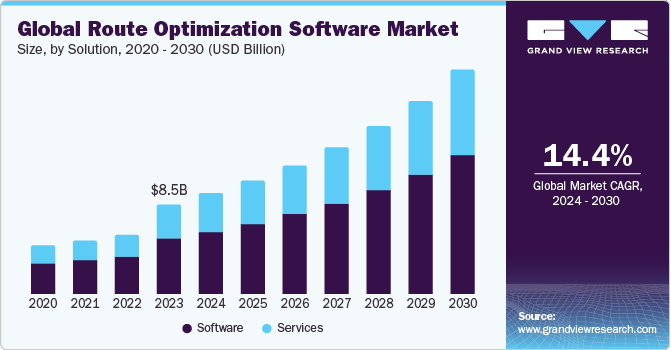

The global route optimization software market size was estimated at USD 8.51 billion in 2023 and is projected to reach USD 21.46 billion by 2030, growing at a CAGR of 14.4% from 2024 to 2030. The market is expected to expand due to the rising demand for effective transportation management.

Key Market Trends & Insights

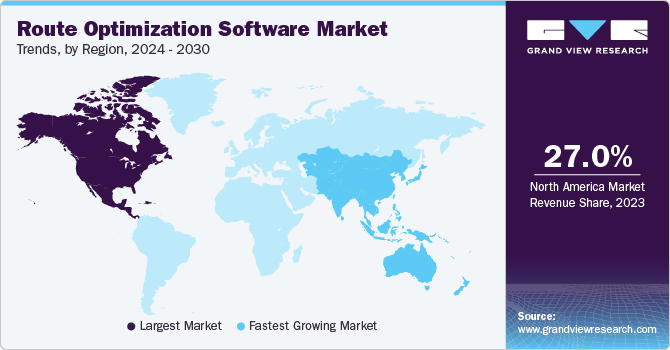

- In terms of region, North America dominated the market in 2023, with a revenue share of 27.01%.

- India route optimization software market is expected to register the fastest CAGR of 16.8% from 2024-2030 in APAC Market.

- By solution, the software segment dominated the market with the largest revenue share of 62.31% in 2023.

- By industry vertical, the ride-hailing & taxi services segment is expected to grow at a substantial CAGR of 14.8% from 2024-2030.

- By enterprise size, the large enterprises segment dominated the market with the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 8.51 Billion

- 2030 Projected Market Size: USD 21.46 Billion

- CAGR (2024-2030): 14.4%

- North America: Largest market in 2023

As the global population grows and urbanization speeds up, transportation systems face increasing challenges from congestion, delays, and inefficiencies. Route optimization software solves these problems by determining the quickest and most efficient routes, which optimizes delivery schedules, shortens travel time, and boosts overall transportation efficiency.

Rapid technological advancements are driving market growth significantly. Technologies such as the Internet of Things (IoT), big data analytics, and cloud computing offer real-time insights and analytics, enabling route optimization software to learn from historical data and forecast traffic patterns, road closures, and weather conditions. This results in more precise and efficient routing decisions. These technological developments help businesses streamline transportation operations and reduce costs, making route optimization increasingly vital for logistics and transportation companies.

The increasing focus on sustainability is a key driver of the market. As both consumers and businesses heighten their awareness of transportation's environmental impact, there's a growing need for more eco-friendly transportation solutions. Route optimization plays a crucial role in this by helping companies cut down on their carbon footprint through distance minimization and vehicle usage optimization. For instance, by utilizing real-time updates, route optimization software empowers companies to swiftly adapt to traffic or weather conditions, allowing for route adjustments that mitigate unnecessary idling and fuel consumption.

The adoption of route optimization software among businesses might face challenges due to the perceived costs associated with implementing new technologies. However, market players can mitigate this hurdle by offering potential customers the opportunity to experience the software through free trials or demonstrations, allowing them to evaluate the solutions before making a financial commitment. Additionally, vendors could introduce flexible pricing models, such as pay-per-use or subscription-based services, enabling businesses to leverage the software without incurring significant upfront costs.

Furthermore, companies can showcase the benefits and return on investment (ROI) of their route optimization tools by providing compelling case studies and testimonials from satisfied customers. By addressing concerns related to costs and highlighting the tangible advantages of their products, market players can facilitate the adoption of their technology and foster market growth opportunities.

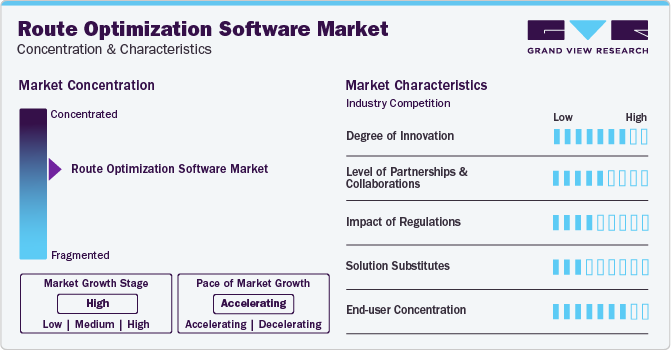

Market Concentration & Characteristics

The industry is characterized by intense competition among various players, each striving to offer innovative solutions that cater to the evolving needs of businesses across diverse industries. This market's competitiveness is driven by the increasing demand for efficient logistics and transportation management, fueled by the growth of e-commerce and the need for timely deliveries.

Numerous vendors operating in this space offer a wide range of route optimization software solutions, each with its unique capabilities and features. These solutions typically leverage advanced algorithms and machine learning techniques to optimize delivery routes, taking into account factors such as traffic conditions, vehicle capacities, and customer preferences. The market is witnessing a continuous influx of new entrants, as well as strategic partnerships and acquisitions among existing players, further intensifying the competitive landscape.

Key players in the market are actively investing in research and development efforts to enhance their product offerings and stay ahead of the competition. They are continuously exploring new technologies, such as artificial intelligence and the Internet of Things (IoT), to provide more accurate and real-time route optimization capabilities. Additionally, the market is witnessing a growing emphasis on cloud-based solutions, which offer scalability, flexibility, and cost-efficiency advantages over traditional on-premises software.

To differentiate themselves in this highly competitive market, vendors are focusing on providing customizable and industry-specific solutions tailored to the unique requirements of various sectors, such as last-mile delivery, field service management, and transportation logistics. They are also offering value-added services, such as real-time tracking, advanced analytics, and integration with other enterprise systems, to provide a comprehensive solution that addresses the diverse needs of their customer.

Another notable characteristic of the route optimization software market is the increasing emphasis on sustainability and environmental consciousness. As businesses strive to reduce their carbon footprint and promote eco-friendly practices, vendors in this market are incorporating features that enable clients to optimize routes in a manner that minimizes fuel consumption and greenhouse gas emissions. This not only aligns with corporate social responsibility goals but also offers cost-saving benefits through improved fuel efficiency.

Furthermore, the market is witnessing a growing trend toward the integration of route optimization software with other complementary technologies, such as telematics and fleet management systems. This integration enables organizations to gain a holistic view of their operations, allowing for real-time monitoring, analysis, and optimization of delivery routes, vehicle performance, and driver behavior. Such comprehensive solutions are becoming increasingly attractive to businesses seeking to streamline their operations and improve overall efficiency.

Solution Insights

Based on solution, the software segment dominated the market with the largest revenue share of 62.31% in 2023. The prevalence of route optimization software is primarily due to its numerous advantages, including optimized fleet routing, automated carrier operations, and online access to route schedules coupled with real-time delivery status tracking. These features fuel market demand by facilitating precise pickup and delivery coordination, boosting driver efficiency and dispatcher productivity, and curbing fuel expenses through optimized routing and scheduling.

The services segment is expected to grow at the highest CAGR of 14.6% from 2024-2030. The service segment is divided into consulting, map integration & software deployment, and support & maintenance. Route optimization software is intricate, necessitating expertise for installation, configuration, and upkeep. Hence, many companies opt to delegate these responsibilities to specialized service providers, ensuring seamless and efficient software deployment. Consequently, the demand for services like consulting, training, and support is escalating. Moreover, service providers furnish businesses with the requisite expertise, assistance, and customization to maximize their route optimization software output.

Industry Vertical Insights

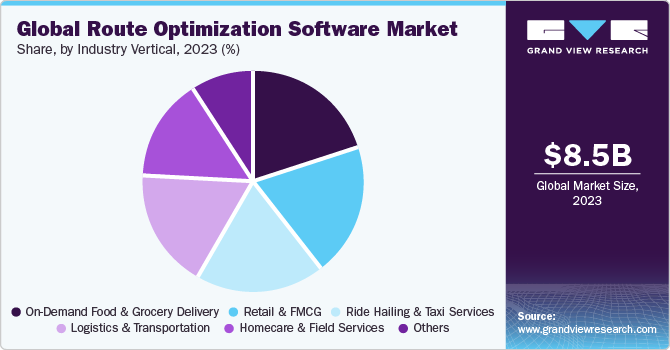

Based on industry vertical, the on-demand food & grocery delivery segment dominated the market with the largest revenue share in 2023. Route optimization tools are instrumental for on-demand food and grocery companies in enhancing their delivery efficiency, a critical factor that provides a competitive edge in this sector. The route analytics capabilities of these software solutions enable companies to streamline their operations, ensuring faster deliveries compared to their rivals. By leveraging advanced route optimization, businesses in this space can differentiate themselves through superior delivery times and customer experiences.

The ride-hailing & taxi services segment is expected to grow at a substantial CAGR of 14.8% from 2024-2030. Route optimization software empowers ride-hailing and taxi service companies to offer their customers the fastest and most efficient routes. In an industry where estimated time of arrival (ETA) is a critical metric, consumers gravitate towards providers that deliver the best ETA. These solutions enable companies to circumvent traffic congestion and other potential delays, thereby improving customer satisfaction through real-time tracking information and timely arrivals.

Deployment Insights

Based on deployment, the on-premises segment dominated the market with the largest revenue share in 2023. On-premises deployment remains a preferred choice for numerous businesses when it comes to route optimization software, as it grants them full sovereignty over the application and the associated data. This deployment model holds significant importance for organizations dealing with sensitive or confidential information, as well as those operating within strictly regulated sectors that demand robust data privacy and security protocols. Moreover, an on-premises approach enables businesses to customize the software solution to align with their unique operational requirements and facilitates seamless integration with other enterprise systems already in place, ensuring a cohesive and tailored implementation.

The cloud segment is anticipated to grow at the highest CAGR from 2024-2030. Cloud-based deployment offers a centralized approach to safeguarding sensitive data across an enterprise, including delivery route optimization algorithms. This deployment method reduces the expenses associated with software upgrades and updates. Moreover, organizations are favoring cloud-based deployment due to its ease of implementation and greater scalability compared to on-premises software, all at a lower cost. These factors contribute to the growth of this segment.

Enterprise Size Insights

Based on enterprise size, the large enterprises segment dominated the market with the largest revenue share in 2023. Large enterprises leverage route optimization software to streamline operations, cut costs, and enhance customer satisfaction. Additionally, large enterprises engaged in field service operations, such as utilities, telecommunications, and healthcare providers, utilize this software to optimize their service schedules. These tools aid in dispatching field technicians to the appropriate location at the designated time, thereby reducing travel time and fuel expenses while improving response time.

The SME segment is expected to grow at the fastest CAGR from 2024-2030. As these businesses with limited resources prioritize maximizing output and minimizing costs, driving their demand for cost-effective solutions that optimize operations. Route optimization software enables these companies to efficiently manage multiple delivery stops, preventing increased expenses and delays from improper routing. Moreover, the need to boost revenue, maintain a competitive edge, and safeguard mission-critical data prompts these businesses to adopt advanced route optimization software solutions.

Functionality Insights

Based on functionality, the out bound segment dominated the market with the largest revenue share in 2023. The outbound segment’s dominance is primarily driven by the rapid growth of e-commerce and the increasing emphasis on efficient last-mile delivery services. As consumers demand faster and more convenient deliveries, businesses are turning to route optimization software to streamline their outbound logistics operations, minimize delivery times, and enhance customer satisfaction.

Moreover, route optimization software plays a pivotal role in cost optimization by reducing transportation expenses through optimized routes, minimizing travel distances, and improving vehicle utilization. This not only leads to substantial cost savings through reduced fuel consumption and maintenance costs but also enhances driver productivity. Furthermore, the software enables businesses to meet stringent service level agreements with their customers, ensuring timely and reliable deliveries. Additionally, route optimization software finds applications in reverse logistics processes, such as product returns and recycling initiatives, aligning with sustainable practices and customer satisfaction goals.

The inbound segment is expected to grow at the fastest CAGR from 2024-2030. This growth can be attributed to the increasing focus on supply chain optimization to reduce costs and enhance operational efficiency. Effective inbound logistics management through route optimization software enables businesses to streamline material and inventory flows, minimize transportation expenses, and improve overall supply chain performance. Growing emphasis on just-in-time (JIT) inventory management practices, which necessitates precise coordination and optimization of inbound deliveries to align with production schedules and minimize inventory holding costs. Expansion of the manufacturing sector and the consequent need for efficient inbound logistics to ensure timely delivery of raw materials and components from multiple suppliers across diverse locations is also helping the segment’s propagation.

Regional Insights

North America dominated the market in 2023, with a revenue share of 27.01%. The region boasts the presence of numerous well-established vendors and major software providers such as Trimble Inc., and Blue Yonder,Inc. The Descartes Systems Group Inc, and ESRI coupled with businesses being early adopters of advanced technologies. The high penetration of e-commerce, stringent service level agreements in the retail and logistics sectors, and the emphasis on supply chain optimization and sustainability initiatives have collectively driven the demand for efficient route planning and delivery solutions. Additionally, North America's well-developed infrastructure, supportive regulatory environment, and the availability of skilled professionals have further contributed to the market's growth and dominance, enabling software providers to continuously enhance their offerings and cater to the evolving needs of businesses across various industries.

U.S. Route Optimization Software Market Trends

The route optimization software market in the U.S. held the largest share of 43.47% in North America in 2023, and is also anticipated to grow at a significant CAGR from 2024 to 2030. This is due to the country's extensive logistics and transportation network, coupled with the presence of major e-commerce giants and leading logistics companies. The early adoption of advanced technologies by businesses in the U.S., along with the increasing focus on supply chain efficiency and sustainability, further fueled the demand for route optimization solutions across various industries.

Asia Pacific Route Optimization Software Market Trends

The route optimization software market in Asia Pacific is anticipated to grow at the fastest CAGR of 15.0% throughout the forecast period. The APAC region is home to some of the world's fastest-growing e-commerce markets, such as China and India. As e-commerce continues to grow, the demand for efficient and cost-effective logistics solutions, including route optimization software, is increasing. For instance, as per the Federation of Indian Chambers of Commerce & Industry (FICCI), by 2026, the Indian e-commerce sector is estimated to reach USD 120 billion.

India route optimization software market is expected to register the fastest CAGR of 16.8% from 2024-2030 in Asia Pacific Market, due to the country's rapid growth of the e-commerce sector, increasing logistics and transportation activities, and the government's initiatives to improve infrastructure and promote digitalization. The rising demand for efficient last-mile delivery services and the need for supply chain optimization are driving the adoption of route optimization software among businesses operating in India.

Europe Route Optimization Software Market Trends

The route optimization software market in Europe is witnessing growth due to the region's focus on sustainable transportation and logistics practices. The increasing emphasis on reducing carbon emissions and improving operational efficiency has led businesses across various sectors to adopt route optimization solutions. Additionally, the expansion of e-commerce and the need for timely deliveries, coupled with the presence of major logistics hubs, are driving the demand for advanced route planning software in Europe.

UK route optimization software market’s growth can be attributed the country's thriving e-commerce sector and the consequent increasing demand for efficient last-mile delivery services, necessitating the adoption of optimized routing solutions. Additionally, the presence of major logistics and transportation companies headquartered in the U.K., coupled with government initiatives and regulations focused on reducing carbon emissions and promoting sustainable logistics operations, has encouraged businesses to optimize their transportation routes through advanced software solutions.

Key Route Optimization Software Company Insights

Some of the key companies operating in the route optimization software market include Verizon, Trimble Inc., Blue Yonder,Inc., Samsara Inc. among others.

-

Verizon provides technology, communications, information, and entertainment products and services to businesses, consumers, and government entities. The company operates in two business segments, namely Verizon Business Group (Business) and Verizon Consumer Group (Consumer). The company’s telematics solutions, including connected vehicle software and services, are offered under the Verizon Connect brand. The fleet management solutions provided under the brand aid in tracking field vehicles, prioritizing safe driving, and improving productivity. Route optimization software solutions are also offered under the brand.

-

Samsara Inc. is a technology company providing Connected Operations Cloud, a system that enables physical operation-dependent businesses to improve their operations by generating actionable insights using Internet of Things (IoT). The company’s platform enables site visibility, equipment monitoring, and vehicle telematics. The company’s clientele includes the incumbents of various industries and industry verticals, including manufacturing, retail, and transportation & logistics.

Caliper Corporation and WorkWave are some of the emerging market companies in the target market.

-

Caliper Corporation is a global technology solution provider that develops Geographic Information Systems (GIS) and transportation software. The company has an extensive list of products and services and provides solutions to organizations across the globe, including national governments and government agencies.

-

WorkWave provides cloud-based fleet management and field service software that can potentially help organizations transform their business and drive revenue and profit growth. The company offers field service software for various applications, such as pest control, residential cleaning, and plumbing, among others. The company also offers software solutions for transportation & logistics applications, such as courier, furniture delivery, and food delivery.

Key Route Optimization Software Companies:

The following are the leading companies in the route optimization software market. These companies collectively hold the largest market share and dictate industry trends.

- Trimble Inc,

- Caliper Corporation

- THE DESCARTES SYSTEMS GROUP INC

- ESRI

- Blue Yonder,Inc.

- Coupa Software Inc.

- Microlise Limited

- Omnitracs

- Ortec

- Paragon

- PTV Planung Transport Verkehr GmbH

- Route4Me, Inc

- Routific Solutions Inc.

- Verizon

- WorkWave

- Samsara Inc.

Recent Developments

-

In April 2024, Descartes Systems Group launched Descartes MacroPoint™ FraudGuard, aimed at helping freight brokers, 3PLs, and shippers identify and prevent fraud in carrier information and shipment tracking. This tool uses advanced technology to validate the locations of freight and drivers, block false tracking data, and enhance trust and efficiency within the logistics network. Included with the Descartes MacroPoint subscription, it seeks to reduce financial risks and improve supply chain management.

-

In April 2023, Trimble Inc. announced the acquisition of Transporeon, a leading cloud-based transportation management service provider. The acquisition enabled the company to attract new customers through innovative product/service offering.

Route Optimization Software Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 9.56 billion

Revenue forecast in 2030

USD 21.46 billion

Growth Rate

CAGR 14.4% from 2024 to 2030

Actual Data

2017 - 2023

Forecast period

2024 - 2030

Report updated

June 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solution, deployment, enterprise size, industry vertical, functionality, region

Regional scope

North America; Europe; Asia Pacific; South America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Trimble Inc.; Caliper Corporation; THE DESCARTES SYSTEMS GROUP INC; ESRI; Blue Yonder,Inc.; Coupa Software Inc.; Microlise Limited; Omnitracs; Ortec; Paragon; PTV Planung Transport Verkehr GmbH; Route4Me, Inc; Routific Solutions Inc.; Verizon; WorkWave; Samsara Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Route Optimization Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and offers an analysis of the qualitative and quantitative market trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global route optimization software market report based on solution, deployment, enterprise size, industry vertical, functionality, and region:

-

Solution Outlook (Revenue, USD Million, 2017 - 2030)

-

Software

-

Services

-

Consulting

-

Map Integration & Software Deployment

-

Support & Maintenance

-

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

On-premise

-

Cloud

-

Enterprise Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

Industry Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

Retail & FMCG

-

On-Demand Food & Grocery Delivery

-

Ride Hailing & Taxi Services

-

Homecare & Field Services

-

Logistics & Transportation

-

Others

-

-

Functionality Outlook (Revenue, USD Million, 2017 - 2030)

-

Out Bound

-

In Bound

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia-Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

South America

-

Brazil

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global route optimization software market size was estimated at USD 8.51 billion in 2023 and is expected to reach USD 9.56 billion in 2024.

b. The global route optimization software market is expected to grow at a compound annual growth rate of 14.4% from 2024 to 2030 to reach USD 21.46 billion by 2030.

b. North America dominated the route optimization software market with a share of over 27.01% in 2023. This is attributable to the advanced technological infrastructure, and large e-commerce market.

b. Some key players operating in the route optimization software market include Trimble Inc.,Caliper Corporation, THE DESCARTES SYSTEMS GROUP INC, ESRI, Blue Yonder,Inc., Coupa Software Inc., Microlise Limited, Omnitracs, Ortec, Paragon, PTV Planung Transport Verkehr GmbH, Route4Me, Inc, Routific Solutions Inc., Verizon, WorkWave, and Samsara Inc..

b. Key factors driving market growth include rising demand for logistics services globally, continued rollout of high-speed data networks and plummeting hardware costs, increasing demand for efficient transportation management, and cost reduction and operational efficiency.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.