- Home

- »

- Advanced Interior Materials

- »

-

Rubber Gloves Market Size, Share, Industry Report, 2030GVR Report cover

![Rubber Gloves Market Size, Share & Trends Report]()

Rubber Gloves Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Latex, Nitrile), By Distribution Channel, By Type (Powdered, Powder Free), By Product (Disposable), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-269-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Rubber Gloves Market Summary

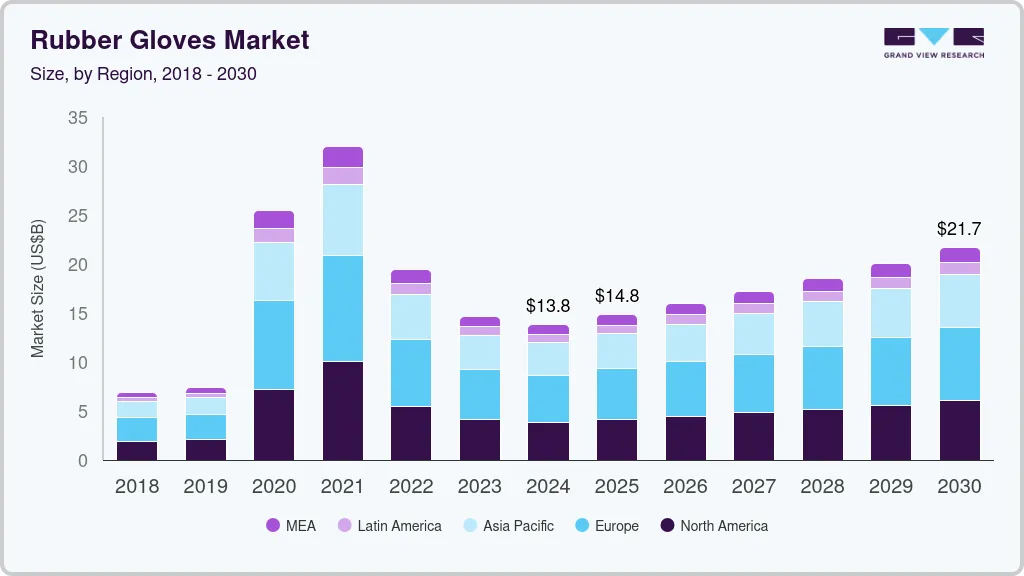

The global rubber gloves market size was estimated at USD 13,791.1 million in 2024 and is projected to reach USD 21,671.6 million by 2030, growing at a CAGR of 7.9% from 2025 to 2030. Stringent regulations, high costs related to workplace hazards, and increasing awareness of worker safety and security are expected to drive industry growth during the forecast period.

Key Market Trends & Insights

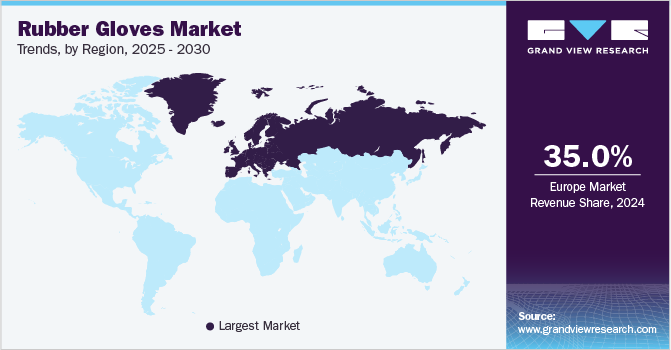

- In terms of region, Europe was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, natural rubber/latex accounted for a revenue of USD 5,859.6 million in 2024.

- Nitrile is the most lucrative material segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 13,791.1 Million

- 2030 Projected Market Size: USD 21,671.6 Million

- CAGR (2025-2030): 7.9%

- Europe: Largest market in 2024

They are often more affordable than specialized gloves, providing a balance of protection and value.

In addition, rubber gloves are being used in many heavy-duty industries, such as construction, chemicals, automotive, oil and gas, and waste management. These gloves also provide a better grip and ease of use than bare hands, which is another benefit. Rubber gloves, available in materials like latex, nitrile, and vinyl, offer versatility to suit various needs. Nitrile gloves, in particular, are favored for their resistance to chemicals and long-lasting strength. The growing emphasis on workplace safety and strict regulations imposed by governments globally are contributing to the rising demand and market expansion.

The demand was further accelerated by the COVID-19 pandemic, which highlighted the crucial role of personal protective equipment (PPE). The growth of healthcare services, medical treatments, and diagnostics, along with expanding research and biotechnology sectors, drives the ongoing demand for gloves in hospitals, clinics, labs, and research environments to ensure safety when handling chemicals, biological materials, and pharmaceuticals. Disposable gloves eliminate the need for cleaning or sanitizing reusable gloves, offering a more efficient and hygienic solution.

Material Insights

The natural rubber/latex segment dominated the global rubber gloves market, accounting for a revenue share of 39.8% in 2024. These gloves are known for their excellent elasticity, comfort, and superior fit. Their high tactile sensitivity makes them ideal for medical and dental procedures that require precision. They also offer effective protection against biological hazards like viruses and bacteria, making them widely used in healthcare. Disposable rubber/latex gloves, are relatively inexpensive, making them a cost-effective choice for various industries needing protection at scale.

The nitrile segment is expected to grow significantly at a CAGR of 8.9% over the forecast period. Nitrile gloves are preferred by individuals with latex allergies, boosting demand in healthcare and other sectors. Their resistance to chemicals, oils, and solvents makes them ideal for pharmaceuticals, automotive, and cleaning industries. Known for durability and puncture resistance, nitrile gloves are essential in medical, laboratory, and industrial settings. Increasing workplace safety standards and hygiene regulations further drive their adoption.

Distribution Channel Insights

The physical distribution channel led the rubber gloves market and accounted for a revenue share of 64.4% in 2024. These channels provide convenient supply chain management, where gloves are made and delivered to end customers through wholesalers and retailers. Online deliveries might be prolonged due to insufficient availability or a remote delivery address, which further boosts the demand for physical channels. Many offline retailers provide bulk buying options, offering cost savings for businesses requiring large quantities. Customers often favor established offline retailers due to the trust and credibility they have built over time.

The online distribution channel is expected to grow at the fastest CAGR of 9.4% over the forecast period, fueled by the COVID-19 pandemic, where governments in many different nations instituted stringent lockdowns and customers refrained from going outdoors. During the pandemic, online businesses heavily invested in expanding their supply chains, keeping shipping costs low, and obtaining economies of scale which drove consumers toward online platforms. Online platforms break down geographical barriers, allowing customers worldwide to access rubber gloves, thus expanding the market beyond local or regional suppliers.

Type Insights

Powder free gloves dominated the rubber gloves market and accounted for a revenue share of 71.6% in 2024, as they are typically double-chlorinated and simple to put on. These gloves have high demand in medical, food processing, and chemical industries as they have a textured surface that enhances grip. Powder-free gloves prevent residue from transferring onto surfaces, equipment, or skin, ensuring a cleaner environment. Therefore, salons and beauty settings use these gloves to avoid the transfer of powder on clients' skin or products.

The powdered gloves market is expected to grow significantly at a CAGR of 6.7% over the forecast period. The powder aids in easy donning and removal, improves grip, and reduces perspiration and moisture within the gloves. Cornstarch and calcium carbonate are the two most common powders utilized in these gloves. Due to their low cost and easy availability, they continue to be in demand for applications such as laboratory studies in schools and colleges and daily use among the general public.

Product Insights

Disposable gloves led the rubber gloves market and accounted for a revenue share of 72.1% in 2024. Workers in the medical and food processing industries are predicted to strongly demand disposable gloves, as they use multiple pairs of gloves for different procedures. Disposable gloves are designed for single use and are cost-effective. Disposable gloves are simple to use and discard after one use, removing the need for cleaning or sanitizing, which saves both time and effort. Each pair offers a fresh layer of protection, reducing contamination risks from reuse.

The durable gloves segment is estimated to grow significantly at a CAGR of 7.0% over the forecast period, as these gloves are intended for usage in harsh environments, such as oil and gas, construction, chemicals, and automobiles. They can be reused numerous times and have high durability, strength, reduced waste output, and other environmental benefits. Furthermore, these gloves are thicker than disposable ones, provide superior tear resistance, and assure better hand protection. Their extended lifespan makes them cost-effective for industries needing reliable hand protection.

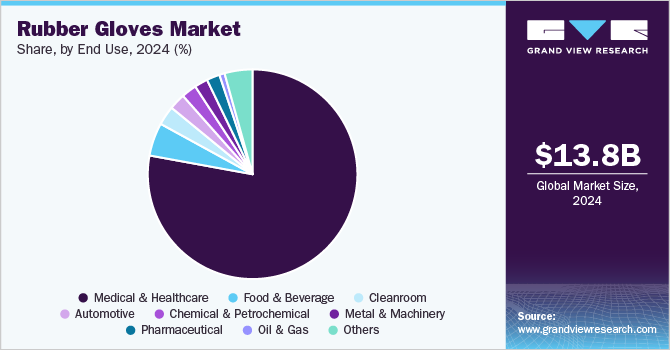

End Use Insights

The medical & healthcare sector led the rubber gloves market and accounted for a revenue share of 77.9% in 2024, owing to their common use by doctors and patients to prevent cross-contamination and the transmission of pathogens during medical tests and procedures. Furthermore, the COVID-19 pandemic boosted the demand for examination gloves among healthcare personnel for testing and examination. Rubber gloves are essential for tasks like administering injections, dressing wounds, conducting physical exams, ensuring cleanliness, and infection prevention. They are a key component of personal protective equipment (PPE), helping healthcare settings meet strict safety and hygiene regulations.

The pharmaceutical industry’s demand for rubber gloves is expected to grow significantly at the CAGR of 8.0% over the forecast period. Breakthroughs in medical research, biotechnology, and personalized medicine have led to new treatments and therapies, further increasing the demand for the industry. Rubber gloves act as a barrier, preventing contamination of drugs, chemicals, and pharmaceutical products during manufacturing. During formulation and testing, they protect workers from hazardous substances like toxic chemicals and active pharmaceutical ingredients (APIs).

Regional Insights

Europe rubber gloves market dominated the global market and accounted for the largest revenue share, 35.0%, in 2024. Rubber gloves are in high demand in the region due to the rising need for protective gloves in food & beverage, metal production, oil & gas, automotive, and chemical sectors. The rise in medical and healthcare spending can be ascribed to greater public awareness about the importance of prevention of infection and communicable diseases. As environmental awareness grows, rising demand for sustainable, eco-friendly gloves and increased hygiene and safety awareness in workplaces such as factories, labs, and schools drives the market growth.

Germany Rubber Gloves Market Trends

The rubber gloves market in Germany held the European market with the highest revenue share in 2024. Germany's growing healthcare spending, driven by an aging population, medical advancements, and higher hygiene standards, is boosting demand for hand protection. The country’s industrial sector, particularly in the automotive, chemicals, machinery, and electrical industries, is also driving this demand. Additionally, increased electricity generation and solar installations require specialized safety equipment. To meet these needs, manufacturers are expanding through acquisitions, mergers, new products, and geographic growth to address evolving technological and application demands.

Asia Pacific Rubber Gloves Market Trends

The rubber gloves market in Asia Pacific is estimated to grow at the highest CAGR of 8.5% over the forecast period. This can be linked to government expenditures in emerging countries, such as India, South Korea, Thailand, and the Philippines, to support the medical business and encourage medical tourism to gain foreign currency. Governments in major economies such as China and India are investing heavily in the creation of medical supply chains, such as gloves, masks, and sanitizers.

China's rubber gloves market held the Asia Pacific market with the highest revenue share in 2024. This increase is driven not only by the demands created by the pandemic but also by strong manufacturing capabilities, strategic investments, and shifting global trade dynamics. As China’s healthcare system grows to support its large population, the demand for rubber gloves in medical facilities for infection control and patient care has increased. Additionally, as a key producer of rubber gloves, China’s global demand boosts domestic consumption. Stricter workplace safety regulations across various sectors further drive the adoption of protective gloves in industries throughout the country.

North America Rubber Gloves Market Trends

North America rubber gloves market held a substantial market share in 2024. The rise in medical and healthcare spending in North America can be ascribed to greater public awareness about the importance of preventing infection and communicable diseases. Stringent health and safety regulations in North America, especially within healthcare, food handling, and industrial sectors, mandate the regular use of rubber gloves to maintain hygiene and safety standards. Additionally, the pandemic has significantly increased the demand for personal protective equipment (PPE), including rubber gloves, across both healthcare and non-healthcare industries, such as retail, manufacturing, and food services.

The rubber gloves market in the U.S. dominated the North America market with the highest revenue share in 2024. The COVID-19 pandemic accelerated the adoption of personal protective equipment (PPE), including rubber gloves, a trend that continues due to heightened awareness of hygiene and infection control. U.S. industries such as automotive, pharmaceuticals, and chemicals rely on gloves to protect workers and maintain safety standards. Additionally, as the U.S. is one of the world's largest economies and a key producer of rubber gloves, the U.S. benefits from rising global demand, further boosting the strength of its domestic market.

Key Rubber Gloves Company Insights

Key companies in the global rubber gloves market include Ansell Ltd., Top Glove Corporation Bhd, Hartalega Holdings Berhad, and Unigloves (UK) Limited. Companies stay competitive by developing innovative gloves, expanding global distribution, investing in advanced technology and automation, and ensuring compliance with stringent regulations. This allows them to meet growing demand, maintain high-quality standards, and cater to industries like healthcare, pharmaceuticals, and food processing.

-

Ansell Ltd. is headquartered in Melbourne, Australia. Its rubber gloves are widely used in the medical, industrial, and food sectors, offering protection against chemicals, infections, and hazards. The company offers a variety of gloves, such as nitrile gloves, latex gloves, vinyl gloves, cut-resistant gloves, and others.

-

Top Glove Corporation Bhd, based in Shah Alam, Malaysia, produces a wide range of disposable gloves, including latex, nitrile, and vinyl gloves, primarily for healthcare, medical, industrial, and food industries. The company serves customers globally, offering gloves for infection control, protection against chemicals, and general-purpose use.

Key Rubber Gloves Companies:

The following are the leading companies in the rubber gloves market. These companies collectively hold the largest market share and dictate industry trends.

- Ansell Ltd.

- Top Glove Corporation Bhd

- Hartalega Holdings Berhad

- Unigloves (UK) Limited

- The Glove

- Newell Co

- Adenna LLC

- MCR Safety

- Atlantic Safety Products

- Globus

Recent Developments

-

In November 2024, Ecore International, a global leader in circularity known for converting reclaimed rubber into sustainable, high-performance products, secured a minority growth investment from General Atlantic, a prominent global growth investor, through its BeyondNetZero climate growth fund. Ecore plans to utilize this investment and partnership to drive both organic and inorganic growth, enhance its operational and technological infrastructure, and accelerate its progress towards circularity and reaching net-zero objectives.

-

In February 2024, to mark its 130th anniversary, Ansell introduces the MICROFLEX Mega Texture 93-256, a durable, high-visibility nitrile glove designed for industrial and auto shop workers. It features enhanced grip, tear resistance, and protection from hazards and boosts dry grip strength by 50%.

Rubber Gloves Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 14.82 billion

Revenue forecast in 2030

USD 21.67 billion

Growth Rate

CAGR of 7.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

February 2025

Quantitative units

Revenue in USD Million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, distribution channel, type, product, end use and region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, UK, France, Russia, Italy, Spain, China, India, Japan, South Korea, Indonesia, Australia, Thailand, Malaysia, Brazil, Argentina, Saudi Arabia, UAE and South Africa

Key companies profiled

Ansell Ltd., Top Glove Corporation Bhd, Hartalega Holdings Berhad, Unigloves (UK) Limited, The Glove, Newell Co, Adenna LLC, MCR Safety, Atlantic Safety Products, and Globus

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Rubber Gloves Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global rubber gloves market report based on material, distribution channel, type, product, end use, and region.

-

Material Outlook (Revenue, USD Million; 2018 - 2030)

-

Natural Rubber/Latex

-

Nitrile

-

Neoprene

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million; 2018 - 2030)

-

Online

-

Physical

-

-

Type Outlook (Revenue, USD Million; 2018 - 2030)

-

Powdered

-

Powder Free

-

-

Product Outlook (Revenue, USD Million; 2018 - 2030)

-

Disposable

-

Durable

-

-

End Use Outlook (Revenue, USD Million; 2018 - 2030)

-

Medical & Healthcare

-

Automotive

-

Oil & Gas

-

Food & Beverage

-

Metal & Machinery

-

Chemical & Petrochemical

-

Pharmaceutical

-

Cleanroom

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Russia

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Indonesia

-

Australia

-

Thailand

-

Malaysia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.