- Home

- »

- Plastics, Polymers & Resins

- »

-

Rubber Processing Chemicals Market Size Report, 2030GVR Report cover

![Rubber Processing Chemicals Market Size, Share & Trends Report]()

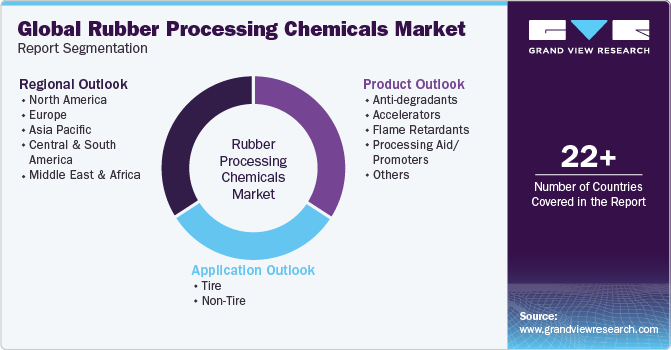

Rubber Processing Chemicals Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Anti-Degradants, Accelerators, Flame Retardants), By Application, By Region, And Segment Forecasts

- Report ID: 978-1-68038-866-4

- Number of Report Pages: 105

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Rubber Processing Chemicals Market Trends

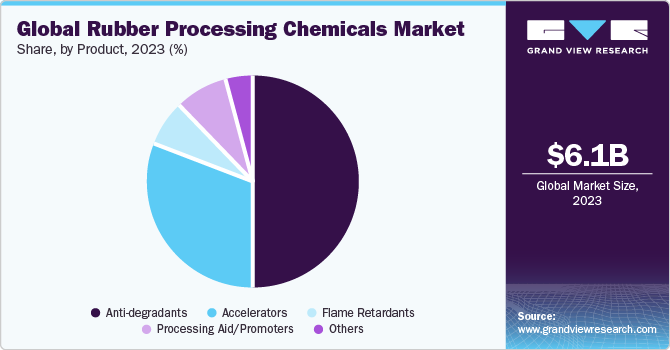

The global rubber processing chemicals market size was estimated at USD 6.09 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 4.2% from 2024 to 2030. It is attributed to the increasing demand from end-use industries such as automotive, construction, and building. The need for improved resistance against the effects of heat, sunlight, oxygen, mechanical stress, and ozone and the increasing demand for high-quality rubber products are fueling the market growth. The growing focus on sustainability and eco-friendly solutions, the transition towards electric vehicles and greener technologies in the automotive sector, and the increasing adoption of industrial products are also driving the market growth.

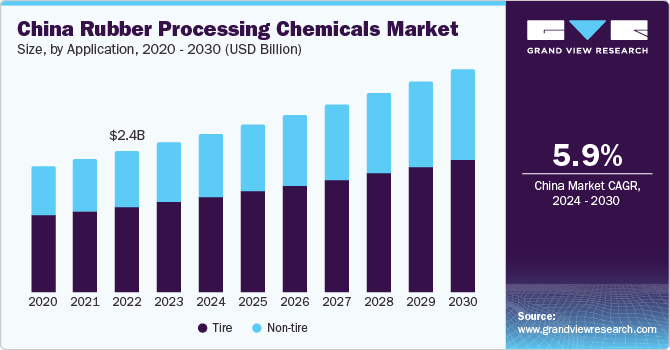

The Chinese rubber processing industry is a significant contributor to the global market. The automotive industry is a major end-user, with the Chinese automotive industry being one of the topmost industries in the world. The rising popularity of electric vehicles (EVs) is also driving the market growth, with consumer demand for EVs growing in China with a push from global EV car manufacturers such as Tesla, Lucid Motors, Rivian, and other local manufacturers. Moreover, technological advancements in processing, including automation and precision engineering, have significantly enhanced the efficiency and quality of products.

The automotive industry's demand for high-performance rubber products is a significant trend in the global rubber processing chemicals industry. As the automotive sector continues to evolve, there is a growing need for advanced compounds that offer improved durability, fuel efficiency, and safety. This trend has led to the development of specialized chemicals to meet the stringent performance requirements of the automotive industry. For instance, the demand for low rolling resistance tires, which contribute to fuel efficiency and reduced carbon emissions, has driven the development and use of advanced chemicals and additives that enhance the performance characteristics of compounds.

With growing environmental awareness and concerns about the ecological impact of traditional chemicals, there is a notable shift towards sustainable and bio-based alternatives. For instance, bio-based processing chemicals derived from renewable sources, such as natural oils and biomass, are gaining traction in the market due to their reduced environmental footprint and potential for enhancing the sustainability of rubber processing. Moreover, the development of bio-based products presents opportunities for collaboration between the rubber industry and the agricultural sector, developing a more integrated and sustainable supply chain.

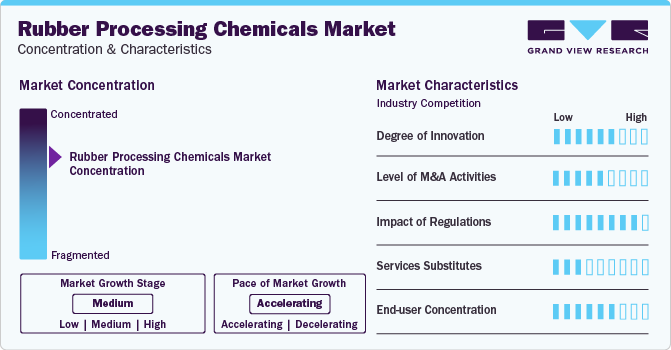

Market Concentration & Characteristics

The global rubber processing chemicals industry is consolidated, with key players such as Solvay, BASF SE, and Lanxess dominating the industry. This consolidation is driven by factors such as high standards of barriers for entry, including the need for significant capital required in research and development, production infrastructure, and distribution networks. These companies have a wide range of chemicals in their product portfolios and have established strong relationships with manufacturers in the rubber industry.

The market's consolidated nature is also influenced by the increasing demand for rubber processing chemicals in various end-use industries. Factors such as economic growth, industrialization, and the performance of industries like automotive and construction significantly impact the market growth. For instance, sustained periods of economic growth in developing economies have resulted in an increased demand for rubber-based products, leading to a higher demand for processing chemicals.

The market is characterized by continuous innovation and product development. Companies in this industry invest in research and development to develop new and improved products that offer enhanced performance, durability, and environmental sustainability. These innovations use additives that enhance the properties of rubber, such as increased elasticity, heat resistance, and durability.

The market is also influenced by changing regulations and standards in different regions. For instance, the European Union has implemented strict regulations regarding the use of chemical products. These regulations include restrictions on using certain chemicals or the implementation of waste management practices to prevent environmental contamination. Safety standards are another crucial aspect of regulatory compliance in the market. These standards focus on ensuring the safe handling, storage, and transportation of chemicals to protect workers and the surrounding communities.

Product Insights

The anti-degradants segment dominated the market with a share of 50.03% in 2023. This high percentage can be attributed to its growing usage in the tire industry to improve abrasion resistance, superior road grip, and high load-bearing capacity. These chemicals are designed to protect materials from degradation caused by exposure to oxygen and UV radiation, enhancing the durability and lifespan of rubber products. In addition, the non-tire segment, including industrial products such as conveyor belts, hoses, gaskets, and seals, also utilizes anti-degradants to enhance the durability and performance of components.)

Accelerators are another form of rubber processing chemicals. The increasing demand for high-performance products, particularly in the automotive and construction sectors, is a key driver for the accelerators market. They play a crucial role in the vulcanization process, which is critical in the production of rubber products. Vulcanization involves the crosslinking of molecules to enhance their strength, elasticity, and durability. Accelerators are chemicals that speed up the vulcanization process, reducing the time required for curing and improving the overall performance of products.

Flame retardants are a significant product segment in the rubber processing chemicals industry. They are applied to materials to prevent burning or impede the spreading of fire. Flame retardants play a crucial role in enhancing the fire safety properties of products, making them less susceptible to ignition and reducing the rate of flame spread. They are particularly important in industries with possibility of fire accidents, such as automotive, construction, and electronics. The growing awareness of fire safety among consumers and the increasing emphasis on fire protection measures contribute to the demand for flame retardants.

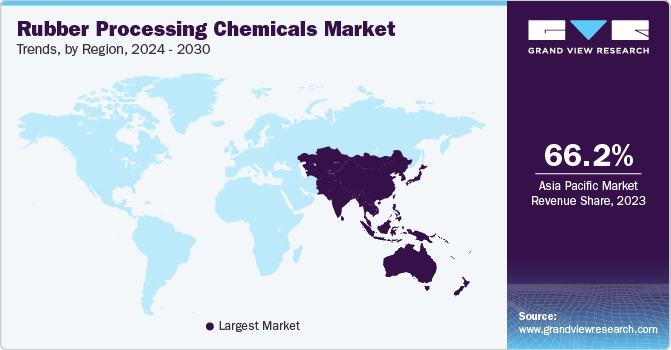

Regional Insights

Asia Pacific dominated the market with revenue share of 66.2% in 2023. It is attributed to rapid industrialization, urbanization, and economic growth, which have increased the demand for rubber products across various industries. The growing automotive, construction, and manufacturing sectors in countries like China, India, and Japan are major drivers in the Asia Pacific region. Many global manufacturers have set up production facilities in countries like China and India to take advantage of lower production costs.

North America is anticipated to witness significant growth in the rubber processing chemicals industry. It is attributable to a strong presence of industries such as automotive, construction, and manufacturing, which are leading consumers of rubber products. The demand is driven by the growing industry in North America and regulatory bodies such as the Environmental Protection Agency (EPA) have implemented strict guidelines to ensure the safety and compliance of products. This has led to an increased demand for high-quality chemicals that meet regulatory standards.

The European market for rubber processing chemicals is driven by emphasis on sustainability and environmental regulations. European countries have stringent regulations and standards to promote sustainable manufacturing practices and reduce the environmental impact of processing. This has led to the development of eco-friendly chemicals that are low in VOCs and agree with the European Union regulations. Manufacturers in Europe are investing in research and development to develop sustainable and innovative rubber processing chemicals.

Application Insights

The tire segment dominated the market with a 60.2% total revenue share in 2023. This large share is attributable to the increasing demand for high-performance tires. The increasing demand for eco-friendly tires, which offer better grip in braking and cornering, is also driving the market growth. The major factors driving the tire segment include the growing demand for improved abrasion resistance, superior road grip, and high load-bearing capacity. The tire segment is driven by the increasing demand for tires with specific performance characteristics, such as those required for electric vehicles.

The non-tire segment is projected to grow at the fastest CAGR over the forecast period. The non-tire segment is driven by the rising demand for eco-friendly additives and the increasing adoption of chemicals in industrial products. Rubber hose and belting products find applications across diverse sectors, including construction and oil & gas. These products are essential for conveying materials and ensuring operational efficiency in various industrial settings. For instance, conveyor belts are widely used in construction, excavation, bulk and package handling, food processing, and mining, reflecting their versatility and importance in different industries. The market in non-tire applications is further bolstered by its use in other manufacturing sectors, such as the paper industry, where large diameter rolls are employed, and steel mills, which utilize rubber covered rolls for chrome-plating and galvanizing.

Key Companies & Market Share Insights

Some of the key players operating in the market include Lanxess, Solvay, BASF SE, and China Petrochemical Corporation.

-

Lanxess specializes in manufacturing rubber additives used for the purpose of tire making and other products such as seals, treads, and drive belts. The company also specializes in producing aroma chemicals, microbial control, urethane systems, and colorants.

-

China Petrochemical Corporation produces rubber and plastic additives under the fine & specialty chemicals segment. The company also produces adhesives & coatings, disinfectants, lubricant additives, polyethers, and other products.

-

Paul & Company, Eastman Chemical Company, and KUMHO PETROCHEMICAL are some of the emerging market participants in the market.

-

Paul & Company is a producer of chemicals such as Poly Butadiene Rubber (PBR Cisamer), Styrene Butadiene Rubber (SBR), and Carbon Black Phillips. It is a key supplier of chemical and pharma industries, supplying intermediates for the end-user industries.

-

Eastman Chemical Company is a manufacturer of rubber additives under its brand Flexysys. It also offers other products such as advanced materials, specialty additives and fibers, acetate yarn, and others under its portfolio.

Key Rubber Processing Chemicals Companies:

- Lanxess

- Solvay

- Akzo Nobel N.V.

- BASF SE

- Arkema

- Eastman chemical company

- R.T. Vanderbilt Holding Company, Inc.

- Behn Meyer

- KUMHO PETROCHEMICAL

- Paul & Company

- China Petrochemical Corporation

- Merchem Limited

Recent Developments

-

In April 2023, China Petroleum & Chemical Corporation (Sinopec) started operations in its copolymer-producing plant in Hainan. The new facility will produce 1,70,000 tons of SBS and SEBS goods annually, forming one of the biggest manufacturing facilities in the world.

-

In April 2023, Ecore International, a key player engaged in recycling and processing reclaimed products into performance driver surfaces, announced acquisition of 360 Tire Recycling Group. The move is expected to help Ecore International access a large array of recyclable rubber tires and enhance its production scale.

-

In April 2022, Sailun Tire Group introduced a new mixing technology named 'Eco Point3'. The technology would enable continuous and uniform mixing of rubber compounding materials under liquid phase conditions. The technology offers resistance and efficiency for tires while improving the product's traction and durability.

Rubber Processing Chemicals Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.39 billion

Revenue forecast in 2030

USD 8.52 billion

Growth rate

CAGR of 4.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

January 2024

Quantitative units

Volume in kilotons, Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Lanxess, Solvay; Akzo Nobel N.V.; BASF SE; Arkema; Eastman Chemical Company; R.T. Vanderbilt Holding Company, Inc.; Behn Meyer; KUMHO PETROCHEMICAL; Paul & Company; China Petrochemical Corporation; Merchem Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Rubber Processing Chemicals Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global rubber processing chemicals market report based on product, application, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Anti-degradants

-

Accelerators

-

Flame Retardants

-

Processing Aid/Promoters

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Tire

-

Non-Tire

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global rubber processing chemicals market size was estimated at USD 6.09 billion in 2023 and is expected to reach USD 6.39 billion in 2024.

b. The global rubber processing chemicals market is expected to grow at a compound annual growth rate of 4.2% from 2024 to 2030 to reach USD 8.52 billion by 2030.

b. Anti-degradant dominated the rubber processing chemicals market with a share of 50.03% in 2023. This is attributable to the fact that anti-degradants are mixed with natural rubber to get better results, increased tensile strength, better finishing, and high resistance from heat during the vulcanization process.

b. Some key players operating in the rubber processing chemicals market include Lanxess AG; BASF SE; Solvay SA; AkzoNobel N.V.; Arkema S.A.; and R.T. Vanderbilt Holding Company, Inc.

b. Key factors that are driving the market growth include ascending demand for rubber from end-use industries including automotive and building and construction.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.