- Home

- »

- Next Generation Technologies

- »

-

Global Safe City Market Size & Share Report, 2022-2030GVR Report cover

![Safe City Market Size, Share & Trends Report]()

Safe City Market (2022 - 2030) Size, Share & Trends Analysis Report By Technology (Cybersecurity, EMS), By Component (Hardware, Service, Software), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-980-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Safe City Market Summary

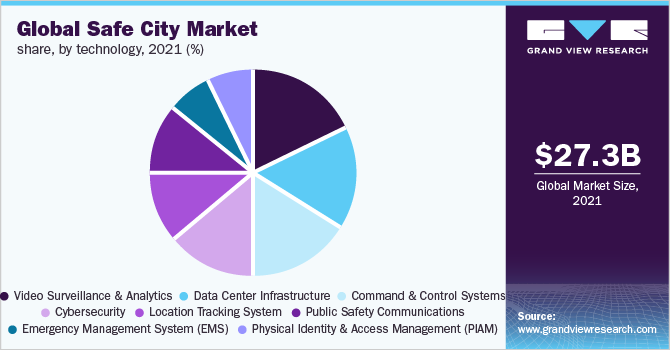

The global safe city market size was estimated at USD 27.28 billion in 2021 and is projected to reach USD 87.07 billion by 2030, growing at a CAGR of 14.5% from 2022 to 2030. The industry growth can be attributed to the increasing government investment in improving the safety & security of the cities and the development of advanced technologies, such as Artificial Intelligence (AI), big data analytics, and cloud computing.

Key Market Trends & Insights

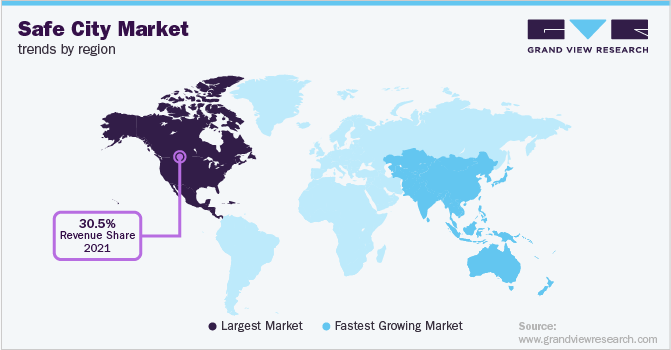

- North America dominated the global industry in 2021 and accounted for the highest share of more than 30.5% of the overall revenue.

- Asia Pacific is expected to register the fastest CAGR over the forecast period owing to increasing population and growing investment in smart city solutions.

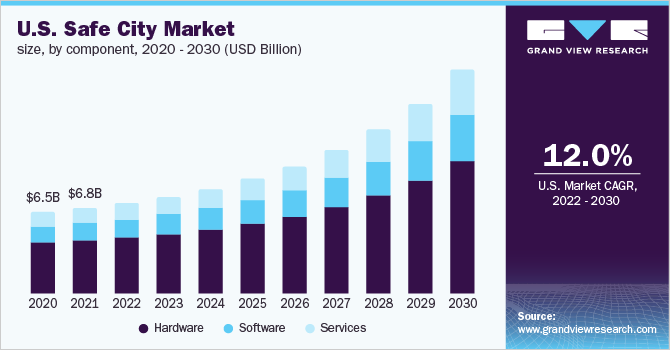

- Based on component, the hardware segment held the largest share of more than 62.5% in 2021.

- Based on technology, the video surveillance and analytics segment accounted for the largest revenue share of more than 17.5% in 2021.

Market Size & Forecast

- 2021 Market Size: USD 27.28 Billion

- 2030 Projected Market Size: USD 87.07 Billion

- CAGR (2022-2030): 14.5%

- North America: Largest market in 2021

- Asia Pacific: Fastest growing market

The growing investments in smart city projects by various governments are creating growth opportunities for the industry. The COVID-19 pandemic adversely impacted the industry growth in 2020 till the first quarter of 2021. The industry was negatively affected amid the pandemic as various safe city projects were canceled due to stringent safety measures enforced by governments to control the virus transmission. However, with significant investments in infrastructure development activities by various governments from mid-2021 to revive the pandemic-affected economy, the industry is expected to witness growth. Rapid urbanization and substantial economic growth across the globe are propelling the adoption of integrated safe city systems to enhance the safety of the overall city through unified digital platforms. With the notable increase in the population, high levels of monitoring systems are required to control the crime rate in the city.

Governments ofvarious countries, such as the U.K., India, Australia, and Norway, are investing in city street safety systems to make streets safer for women and children. For instance, in July 2022, the Government of the U.K. awarded USD 41.40 million through its Safer Street Fund program for street & police authorities to tackle Violence Against Women and Girls (VAWG). The funding will be used to integrate Closed-Circuit Television (CCTV) and smart street lighting across various streets in the U.K. Rising government investmentsare encouraging key players to adopt various business strategies to gain high-value contracts from the government for a continuous revenue stream.

These players are focusing on collaboration with state governments to integrate their safe city systems across various places. For instance, in June 2022, Axis Smart City partnered with City of Melbourne authorities to upgrade the Geelong and Melbourne city's CCTV cameras with Axis PTZ cameras. These advanced technologies equipped with a camera enable automatic detection between vehicles & pedestrians and assist traffic controllers in understanding the traffic flow and controlling the traffic in the region. The cameras are integrated with a centralized control system, which is handled by Victoria police and other specially-trained council staff. Increasing public and private investments in smart cities are creating growth opportunities for the industry.

Through the smart city project, city authorities are highly emphasizing increasing the safety & security of the cities by installing smart street lighting, central command & control systems, automatic fire detection & suppression systems, and location tracking systems, among others. Companies are undertaking mergers & acquisitions to enhance their service offerings and attract potential business clients. For instance, in January 2022, Batic Investments and Logistics Co. acquired an undisclosed stake in Smart Solutions Co. for USD 3.19 million for its Information Technology (IT) and communication solutions in Saud Arabia. The company will leverage Smart Solution's expertise in communication systems to improve its services for public safety communications.

High capital investments and rising digital security concerns are two major factors challenging the industry growth. The safe city solution development process is costly, and the industry players need to invest frequently in R&D for new technological innovations to remain competitive. Furthermore, much technical staff and advanced R&D capabilities are required in the development process, thereby increasing the initial costs of safe city solutions. The rising digital threats, such as ransomware and virus, among others for data stealing and manipulations, can affect the industry statistics through 2030. To tackle these issues, industry players are partnering with technology providers to minimize their R&D costs and strengthen the security of their safe city solutions, supporting the industry growth.

Component Insights

The hardware segment held the largest share of more than 62.5% in 2021. The segment growth can be attributed to the advancements in various safe city hardware solutions, such as CCTV, servers, Internet of Things (IoT) modules, smart lights, Global Positioning Systems (GPS), communication systems, and other control room devices. Companies are focusing on various business strategies, such as mergers and acquisitions, to improve their product offerings and increase their customer base. For instance, in December 2021, Honeywell International Inc. acquired the communications solutions provider, U.S. Digital Designs, Inc., for an undisclosed amount.

With this acquisition, Honeywell International Inc. aims to improve its public safety communication portfolio. Honeywell International Inc. will develop various hardware solutions, including dispatch & alerting communication solutions enabling easy collaboration between first responders with quick emergency response time.The service segment is expected to register a significant CAGR during the forecast period.The service segment offers various benefits, such as easy installation, flexible payment services, customized solutions, and robust aftersales services. Several governments are shifting to safe city solution services.

This is encouraging industry players to unveil their new safe city solution services to improve their brand representation. For instance, in August 2021, Motorola Solutions opened its Network And Security Operations Center (NSOC) in Gatineau, Canada, to support, protect, and manage the command center software and communication network of first responders to improve public safety in the region. The company also provided its cybersecurity facilities for the Ottawa-Gatineau region, which include dark web intelligence services, 24/7 proactive threat detection throughout the year, security patching, vulnerability scanning & assessments, and end-point protection.

Technology Insights

The video surveillance and analytics segment accounted for the largest revenue share of more than 17.5% in 2021. As the population in the major cities across the globe is increasing, city police authorities are adopting advanced video surveillance systems for traffic and crowd management. Increasing video surveillance and analytics technology providers are forcing players to invest in R&D for technological innovations to increase their brand identity and sustain in this highly competitive sector. For instance, in March 2022, Quantum Corp., a video solution provider, launched Unified Surveillance Platform (USP) software to store and record video surveillance data securely.

Furthermore, the company also introduced Smart Network Video Recording Servers (NVRs) for Quantum Unified Surveillance Platform to efficiently manage the video surveillance system in the city. The Emergency Management System (EMS) segment is anticipated to register the highest CAGR over the forecast period. Shifting government focus on controlling the violence and casualties in various incidents, such as fire outbreaks, vehicle crashes, and riots, are propelling the industry growth.

Companies are introducing their EMS for various applications in the city, such as schools, public offices, malls, and flats & houses. For instance, in December 2021, Vector Solutions launched its Incident Management System for K-12 schools. The system is equipped with various features, such as an email alert system, mobile applications for inspection report generation & access, configurable risk matric enabling school authorities to evaluate their EMS systems, and various analytical & dashboard tools.

Regional Insights

North America dominated the global industry in 2021 and accounted for the highest share of more than 30.5% of the overall revenue. The significant regional growth can be attributed to supportive government initiatives for smart cities, the presence of established players, and remarkable digitization. Established regional players, such as Honeywell International Inc., IBM Corp., and Teledyne FLIR Systems, focuson improving their product portfolio to remain competitive. In addition, state governments in the region are heavily investing in enhancing the security of their respective areas. For instance, in April 2022, the state government of New York City invested around USD 900 million to tackle the crisis of traffic violence, pedestrian street space, and public transportation improvement with the integration of smart street and safety solutions through 2030.

Asia Pacific is expected to register the fastest CAGR over the forecast period owing to increasing population and growing investment in smart city solutions. Governments of various countries, such as China, Japan, India, and Singapore, are establishing partnerships with key industry participants to integrate safe city solutions in the cities. For instance, in October 2021, the Government of India awarded Bengaluru Safe City Project to Honeywell Automation Pvt. Ltd. with an investment of USD 66.28 million through the Nirbhaya Fund. Under this project, the company will install public safety communication systems at various buildings & public places and use drones & CCTVs for 24*7 surveillance of the city.

Key Companies & Market Share Insights

Key players invest resources in research & development activities to support growth and enhance their internal business operations. Companies are undertaking strategies like mergers & acquisitions and partnerships to further upgrade their products and gain a competitive advantage. They are also working on new product development and enhancement of existing products to acquire new customers and capture higherindustry shares. For instance, in July 2022, Affluence Corp.’s subsidiary, OneMind Technologies, collaborated with facial recognition solution provider Corsight Al to develop safe & smart city solutions.

OneMind Technologies will use Corsight Al Facial Recognition Technology (FRT) technology to enhance biometric detection accuracy in crowded places. Moreover, in June 2019, AI-based video analytics and cloud-based video surveillance solution provider, Iveda, collaborated with AXIOM to launch its safe city solutions in South Africa. The company launched its cloud-based video surveillance platforms, IvedaAL and Sentir, for public safety authorities in the region. Some of the key players in the global safe city market are:

-

ABB Ltd.

-

ALE International SAS

-

BAE Systems PLC

-

Bosch Energy and Building Solutions

-

Esri

-

Honeywell International Inc.

-

Identiv, Inc. (3VR)

-

NEC Corporation

-

Siemens AB

-

Teledyne FLIR LLC

Safe City Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 29.49 billion

Revenue forecast in 2030

USD 87.07 billion

Growth rate

CAGR of 14.5% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component,technology, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; China; India; Japan; Mexico; Brazil

Key companies profiled

ABB Ltd.; ALE International SAS; BAE Systems PLC; Bosch Energy and Building Solutions; Esri;Honeywell International Inc.; Identiv, Inc. (3VR); NEC Corp.; Siemens AB; Teledyne FLIR LLC

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Safe City Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global safe city market report based on component, technology, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Software

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Command & Control Systems

-

Cybersecurity

-

Public Safety Communications

-

Emergency Management System (EMS)

-

Video Surveillance and Analytics

-

Location Tracking System

-

Data Center Infrastructure

-

Physical Identity and Access Management (PIAM)

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global safe city market size was estimated at USD 27.28 billion in 2021 and is expected to reach USD 29.49 billion in 2022.

b. The global safe city market is expected to grow at a compound annual growth rate of 14.5% from 2022 to 2030 to reach USD 87.07 billion by 2030.

b. The hardware segment in the safe city market captured the largest revenue share of over 60% in 2021. The segment growth can be attributed to the advancements in various safe city hardware solutions such as CCTV, servers, Internet of Things (IoT) modules, smart lights, Global Positioning Systems (GPS), communication systems, and other control room devices.

b. Key industry players operating in the safe city market include ABB Ltd., BAE Systems, Bosch Energy and Building Solutions, Esri, Honeywell International Inc., Identiv, Inc. (3VR), NEC Corporation, Siemens AB, Thales Group, and Wipro Limited.

b. The safe city market growth can be attributed to increasing government investment in improving the safety & security of the cities and the development of advanced technologies such as Artificial Intelligence (AI), big data analytics, and cloud computing.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.