- Home

- »

- Advanced Interior Materials

- »

-

Safety Helmets Market Size & Share, Industry Report, 2030GVR Report cover

![Safety Helmets Market Size, Share & Trends Report]()

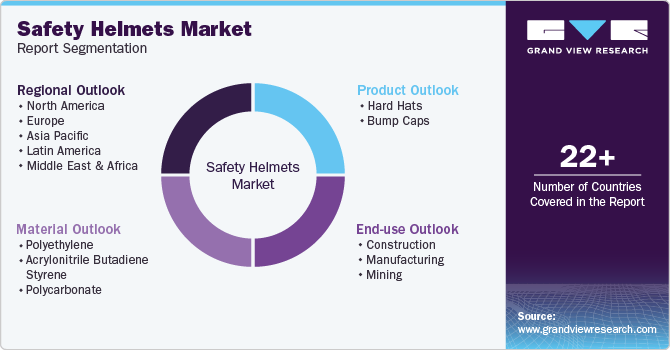

Safety Helmets Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Polyethylene, Acrylonitrile Butadiene Styrene, Polycarbonate), By Product (Hard Hats, Bump Caps), By End-use, And Segment Forecasts

- Report ID: GVR-4-68038-903-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Safety Helmets Market Summary

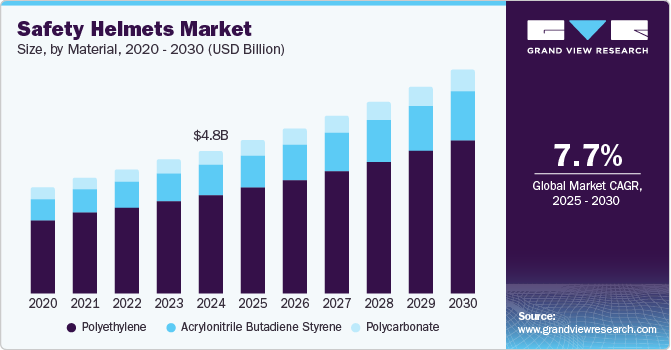

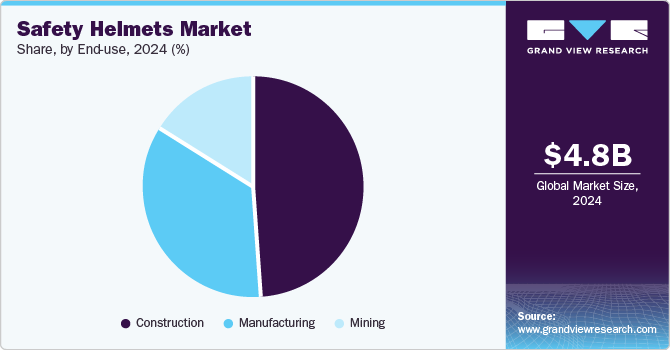

The global safety helmets market size was estimated at USD 4.84 billion in 2024 and is projected to reach USD 7.47 billion by 2030, growing at a CAGR of 7.7% from 2025 to 2030. The market growth is driven by the construction, mining, oil and gas, and power generation industries.

Key Market Trends & Insights

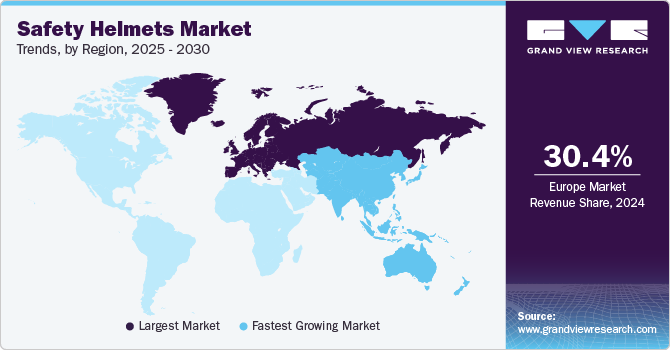

- The Europe safety helmets market dominated the global market and accounted for the largest revenue share of 30.4% in 2024.

- The France safety helmet market led the European market and accounted for the largest revenue share in 2024.

- Based on material, polyethylene dominated the global safety helmets market and accounted for the largest revenue share of 65.7% in 2024, primarily driven by their affordability and effectiveness.

- In terms of product, Hard hats dominated the global safety helmets market and accounted for the largest revenue share of 87.6% in 2024, primarily driven by the increased safety regulations and awareness in multiple industries and workplaces to prevent head injuries and accidents.

- On the basis of end use, the construction industry dominated the global safety helmets market and accounted for the largest revenue share of 42.9% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.84 billion

- 2030 Projected Market Size: USD 7.47 billion

- CAGR (2025-2030): 7.7%

- Europe: Largest market in 2024

With the rapid growth in the technological, chemical, textile, and manufacturing industries, the use of safety helmets is expected to rise to improve safety and productivity.

Safety helmets provide head protection and are primarily used to lower the risk of harm in challenging workplaces. In addition, stringent regulations regarding employee safety and substantial penalties for non-compliance with safety standards have surged product adoption. Safety helmets are available in multiple types and products, such as hard hats, bump caps, and others. The higher acceptance of the product in various end-user industries is likely to change the market dynamics.

The lack of safety helmets in various industries, such as manufacturing, mining, and construction activities, coupled with low responsiveness regarding employee safety, resulted in severe head injuries and accidents, hence raising the importance of personnel safety during work hours. With the growth in the mining industry, the demand for safety helmets is expected to rise as it is a critical segment because of its high-risk nature. Furthermore, the surge in industrialization in various emerging economies is expected to drive growth in the global safety helmets market.

Furthermore, the driving factors of the safety helmet market are technological advancements and innovations in safety helmet design and materials that have enhanced their functionality and comfort. The development of smart helmets equipped with features such as integrated communication systems and sensors for monitoring environmental conditions is attracting consumers as it not only improves safety but also enhances user experience.

Material Insights

Polyethylene dominated the global safety helmets market and accounted for the largest revenue share of 65.7% in 2024, primarily driven by their affordability and effectiveness. The low cost of polyethylene helmets makes them accessible to a wider range of consumers, particularly in budget-constrained industries such as construction and manufacturing. Furthermore, rapid urbanization is accelerating infrastructure projects in emerging countries, hence becoming a driving factor for the growth of the polyethylene safety helmets market.

Acrylonitrile Butadiene Styrene is expected to grow at the fastest compound annual growth rate (CAGR) of 8.5% over the forecast period from 2025 to 2030 due to its durability, dimensional stability, flame retardant, and tough nature, hence lowering the cost of replacement of these products. The helmets with this material are manufactured by injection molding, which is easier, time-saving, and cost-effective. Furthermore, with the rise in the automobile, manufacturing, and chemical industries, there is a growth in the demand for these helmets as they are more dent-resistant, protect passengers during accidents, and are resistant to hard chemicals.

Product Insights

Hard hats dominated the global safety helmets market and accounted for the largest revenue share of 87.6% in 2024, primarily driven by the increased safety regulations and awareness in multiple industries and workplaces to prevent head injuries and accidents. In addition, there is an increased demand for hard hats in the electrical, manufacturing, chemical, and mining industries as they have electric shock protection, chemical resistance, and dent resistance. Furthermore, the demand for hard hats is also rising with the surge in these industries. Multiple variations and specifications and the high functionality of these hard hats make them applicable to a wider range of consumers, driving the growth of the hard hats market.

The bump caps market is expected to grow at a significant compound annual growth rate (CAGR) of 6.6% over the forecast period from 2025 to 2030 due to their mobility and less pressure on the wearer’s neck, hence making it applicable for protection from objects overhead and to industries with a lower risk of accidents. With the rise in government projects for road construction, the demand for bump hats is expected to grow as these projects are less prone to accidents. The rising demand for lightweight and accessible gear for a better working experience and the rise in E-commerce platforms, which makes it easier for businesses to access a wide range of safety products, are driving factors for the increase in the bump caps market.

End-use Insights

The construction industry dominated the global safety helmets market and accounted for the largest revenue share of 42.9% in 2024, primarily driven by the increased demand for improved public infrastructure, such as airports, harbors, roadways, and rail transport systems. In addition, the increase in urbanization and investments in infrastructure development has given a surge to the safety helmets market. Safety helmets have shock absorption, which is useful for protecting against vertical and lateral impact of bumps that can cause severe injury to the workers. Stringent government safety regulations for mandatory safety helmets in construction sites have also given rise to the safety helmet industry.

The demand for safety helmets in the mining industry is expected to grow at a significant compound annual growth rate (CAGR) of 7.7% over the forecast period from 2025 to 2030 due to increased mining for resources, impacted by the surge in urbanization and industrialization, and government regulations to use safety helmets for the safety of workers. Furthermore, technological advancements such as the addition of wireless sensors and necessary sensors, which help monitor the health condition of the miners, have increased the demand for safety helmets.

Regional Insights

Europe safety helmets market dominated the global market and accounted for the largest revenue share of 30.4% in 2024. The rapid growth of several industrial sectors in the region has given rise to the demand for safety helmets to prevent workplace accidents and improve worker safety. Stringent regulations by the European government and investment in several infrastructures such as roads, bridges, and commercial buildings have fueled the growth of the safety helmets market. Furthermore, the applicability of safety helmets in oil & chemical, mining, and other industries has contributed to the rise in the safety helmets industry.

The France safety helmet market led the European market and accounted for the largest revenue share in 2024. This was primarily driven by their thriving industrial sectors, which translated into a higher urgency for safety helmets and compliance with the French government's safety regulations. French industrialists pay a lot of attention to advanced technologies in safety helmets, such as built-in communication systems and improved ventilation, to appeal to their workers, hence giving rise to the safety helmets market.

Asia Pacific Safety Helmets Market Trends

Asia Pacific safety helmets market is expected to grow at the fastest compound annual growth rate (CAGR) of 8.9% over the forecast period from 2025 to 2030. The market's driving factor is the rapid industrialization and urbanization in several countries of the region. In addition, the government's increased investment in infrastructure projects and private industries has increased blue-collar employment, positively contributing to the demand for safety helmets. Furthermore, increasing awareness about occupational hazards has inclined industries to invest in quality safety helmets.

China safety helmets market led the Asia Pacific market and accounted for the largest revenue share in 2024, primarily driven by industrial expansion, booming construction activities, increasing awareness of workplace safety, stringent government regulations, growing infrastructure projects, and a rising demand for motorcycle helmets. In addition, with the rise in demand for motorcycles and bicycles among the younger generation, the demand for safety helmets has also increased. Furthermore, China’s dense population and emerging economy have given rise to multiple development projects. These projects have increased blue-collar employment, further increasing the safety helmets market.

North America Safety Helmets Market Trends

The North America safety helmets market is expected to grow significantly from 2025 to 2030 due to the increased expansion of construction projects and industrial activities and increased awareness of worker safety. In addition, the government's enforcement of mandatory safety standards in the workplace is a driving factor for the growth of the safety helmets market in North America. Furthermore, multiple workers are assigned to these construction and industrial sites to complete work faster, increasing the demand for safety helmets.

The U.S. safety helmets market dominated theNorth America market and accounted for the largest revenue share in 2024. Industrialization and urbanization are surging in the U.S. as it is the world’s largest economy. Therefore, industries are large contributors to the growing safety helmets industry. Due to the rising population, there is an increase in the construction of buildings where workers need to abide by the government’s safety regulations. Furthermore, the younger population is driven towards motorcycles and bicycles, hence making a surge in the automobile industry, which further contributes to the demand for safety helmets.

Key Safety Helmets Company Insights

Key global safety helmets market players include Delta Plus Group, Bullard, Honeywell International Inc., 3M, and others. These companies heavily invest in research and development to create advanced safety helmets with new technologies, such as integrated communication systems and enhanced ventilation. Furthermore, their quality assurance, strong brand presence, and adaptability to maintain competitiveness in the industry make them major players in the safety helmets industry.

-

Bullard is headquartered in Kentucky and has additional offices in Germany and Singapore. It is known for manufacturing hard hats for the industrial sector and firefighter helmets. They make customizable helmets according to workers' preferences, which makes them much more comfortable and also provides protection.

-

Delta Plus Group is a French company that designs, manufactures, and distributes personal protective equipment. It provides safety helmets with permanent fall protection systems for workers' safety.

Key Safety Helmets Companies:

The following are the leading companies in the safety helmets market. These companies collectively hold the largest market share and dictate industry trends.

- Delta Plus Group

- Bullard

- Honeywell International Inc.

- 3M

- MSA

- JSP Ltd.

- Polison Corporation

- Drägerwerk AG & Co. KGaA

- uvex group

- Centurion Safety Products Ltd

Recent Developments

-

In November 2024, Båstadgruppen’s Guardio, in partnership with Quin, launched an industrial safety helmet equipped with integrated sensor technology known as the Armet PRO helmet. This launch has set a new standard for safety as it detects falls and impacts, reducing the consequences of accidents.

-

In November 2024, Arai Helmets partnered with Triumph Motorcycles and launched a range of co-branded helmets, which are to be available in the summer of 2025. They have a wide range of models, including Concept-XE, Quantico, MX-V Evo, and Tour-X5, featured with protection and comfort.

-

In July 2024, MSA Safety, Inc. launched their latest innovation in safety helmets known as the V-Gard H2 safety helmet. It includes features such as the Mips brain protection system and is designed to comply with the government’s safety requirements for industry helmets.

Safety Helmets Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.15 billion

Revenue forecast in 2030

USD 7.47 billion

Growth Rate

CAGR of 7.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, product, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S., Canada, Mexico, France, Germany, Italy, Russia, Spain, UK, China, Japan, South Korea, India, Indonesia, Malaysia, Australia, Thailand, Argentina, Brazil, Saudi Arabia, UAE, South Africa

Key companies profiled

Delta Plus Group, Bullard, Honeywell International Inc., 3M, MSA, JSP Ltd., Polison Corporation, Drägerwerk AG & Co. KGaA, uvex group, Centurion Safety Products Ltd

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Safety Helmets Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global safety helmets market report based on material, product, end-use and region.

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Polyethylene

-

Acrylonitrile Butadiene Styrene

-

Polycarbonate

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Hard Hats

-

Bump Caps

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Construction

-

Manufacturing

-

Mining

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

France

-

Germany

-

Italy

-

Russia

-

Spain

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Indonesia

-

Australia

-

Thailand

-

Malaysia

-

-

Latin America

-

Argentina

-

Brazil

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.