- Home

- »

- Biotechnology

- »

-

Sample Preparation Market Size And Share Report, 2030GVR Report cover

![Sample Preparation Market Size, Share & Trends Report]()

Sample Preparation Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Instruments, Consumable), By Technique (Protein Preparation, Solid-phase extraction), By Application (Genomics, Proteomics), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-999-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Sample Preparation Market Summary

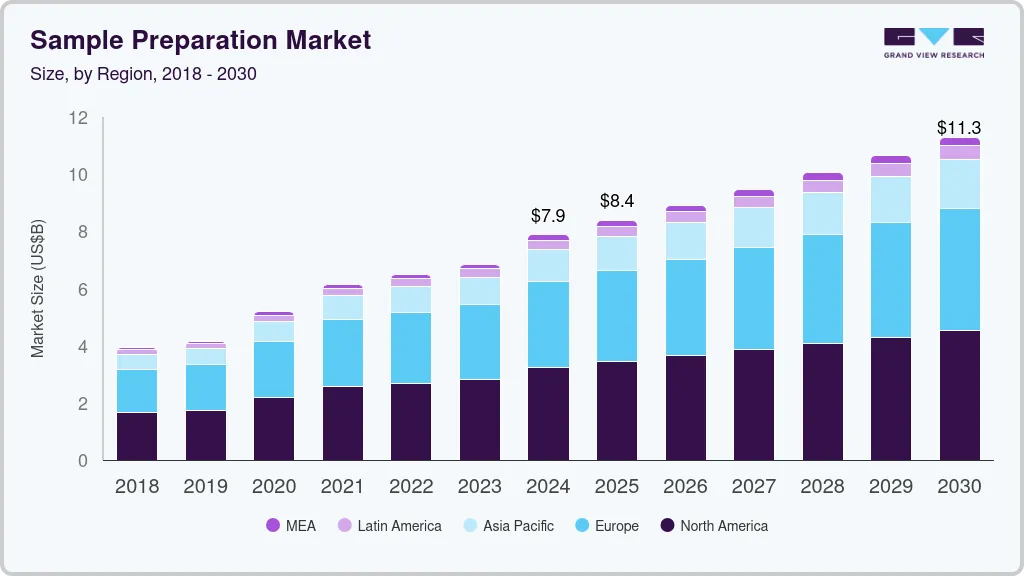

The global sample preparation market size was estimated at USD 7.88 billion in 2024 and is projected to reach USD 11.27 billion by 2030, growing at a CAGR of 6.1% from 2025 to 2030. Sample preparation is the first step in any analytical process. The increasing advancement of technology in the collection and preparation of specimen is anticipated to be the key determinant of growth in the market.

Key Market Trends & Insights

- North America sample preparation market has established global dominance in 2024 with a 41.21% share.

- The sample preparation market in the U.S. is primarily driven by advancements in biopharmaceutical research, drug discovery, and clinical diagnostics.

- In terms of product, The consumables segment dominated the market in 2024, with a share of 61.99%.

- In terms of technique, The protein preparation segment dominated the market in 2024, with a share of 45.06%.

- In terms of application, The genomics segment dominated the market in 2024, with a share of 30.94%.

Market Size & Forecast

- 2024 Market Size: USD 7.88 Billion

- 2030 Projected Market Size: USD 11.27 Billion

- CAGR (2025 - 2030): 6.1%

- North America: Largest market in 2024

For instance, in October 2022, Thorne HealthTech, Inc. collaborated with GenTegra to develop a next-generation collection and extraction kit for whole blood DNA. The partnership will allow companies to develop a new product by integrating GenTegra patented technology of active chemical protection with Thorne’s collection device. This strategy is to the used comparative advantage of both companies to generate high revenue at low costs of R&D.The market has witnessed a substantial increase in revenue due to the COVID-19 pandemic. Increasing demand for sample preparation in various applications assisted startups in the fundraising process. For instance, in September 2022, two startups, Inso Biosciences, Inc. and Halomine, Inc. announced to receive grants for developing and commercializing solutions for COVID-19 research. The aggregate amount for 18 grants by the New York State Biodefense Commercialization Fund was USD 15.3 million. While Inso Biosciences, a platform developer for genomic sample preparation received USD 955,000.

Similarly, companies are taking the initiative to enhance and maintain the integrity of the specimen for accurate results. For instance, in September 2022, an Australian-based bioanalytical lab, Agilex Biolabs established its first satellite processing lab to support the clinical trials. The lab is expected to conduct time-sensitive sample processing approaches in the same location as clinical trial participants. Hence, this stores the integrity that might decline during the transportation of the specimen. The lab also has expertise in numerous sample preparation techniques, such as whole blood stimulation for cytokine release assays.

Expanding the scope of sample preparation techniques in various types of sequencing is anticipated to drive the growth of the market. The techniques differ according to the type of sequencing being conducted, and the use of technology is considered for sample preparation. For instance, in target sequencing, the requirement of sample input is less as compared to other sequencing types. The key approaches are amplicon sequencing and hybridization capture. The volume of sequencing data is growing, hence driving the requirement for further diverse protocols for sample preparation.

Moreover, in October 2022, 10x Genomics collaborated with Oxford Nanopore Technologies to build a comprehensive sequencing solution for full-length isoform single-cell and spatial sequencing. The collaboration is to allow a streamlined sequencing workflow with integrated sample preparation on highly accessible devices. Hence, the solution is anticipated to improve the result's resolution and process high-yield whole genome sequencing data in hours rather than days.

However, the installation and maintenance of equipment for sample preparation are complex. Along with that, the technology for sample preparation differs depending on the applications, adding further cost and time for the users.

Product Insights

The consumables segment dominated the market in 2024, with a share of 61.99%, and is expected to witness the fastest growth rate over the forecast period. The consumables are primarily recurring in nature and are less susceptible to the seasonality of the market and industry cycles as compared to instruments. For instance, in May 2022, PacBio announced a 22.16% increase in the consumables revenue from USD 10.4 million in the previous year to USD 12.7 million having a positive impact on segment growth.

The instruments segment is considered to have a stable growth rate during the forecasted period. The purchase frequency of instruments by the End-uses is low owing to a higher lifespan and pricing than consumables. For End-uses, it is essential to incorporate accurate quality instruments to eliminate potential interfering contamination from the sample. For instance, the nucleic acid extraction sample preparation system by Bioteke Corporation is an automated instrument for the extraction process of DNA/RNA.

The increasing innovation in product offerings by the players is anticipated to support the market share of instruments during the forecast period. For instance, in October 2022, Thermo Fisher Scientific launched a comprehensive and automated system for sample preparation of chromatography. It is considered to be the first of its kind to extract and concentrate components from semi-solid and solid samples in a single instrument. The product eliminates the need for manual transferring from a walk-away sample to a vial workflow.

Technique Insights

The protein preparation segment dominated the market in 2024, with a share of 45.06%, and is expected to witness the fastest growth rate over the forecast period. The increasing innovation in proteomics is likely to surge the overall market. The extraction process from the sample can result in the loss of proteins by eliminating contaminants and lowering the data reproducibility. In July 2022, researchers from the Babraham Institute advanced the conventional protocols of sample preparation in proteomics by developing a new approach. The technique increases the inclusion of hard to capture cellular proteins, hence improving the readouts of proteomics.

The solid-phase extraction segment accounted for a considerable revenue share in 2021. The expansion of techniques in various fields, such as food and environment, is likely to impact the overall market growth. For instance, in October 2022, Waters Corporation announced to launch Extraction+ connected device that can perform automation preparation of forensics, biological, environmental, and food specimens via solid phase extraction. The solution eliminates the requirement for a manual pipette and extraction of the sample.

Similarly, the development of supplementary products to perform liquid-liquid extraction techniques is considered to be a supporting factor for market growth. For instance, in October 2022, nRichDX introduced two products for use with a sample preparation system. This strategic initiative assisted the company in enhancing its applications in liquid biopsy.

Application Insights

The genomics segment dominated the market in 2024, with a share of 30.94%, and is expected to witness the fastest growth rate over the forecast period. Increasing strategic initiatives by companies in the market for genomics applications are expected to surge the overall growth rate. For instance, in October 2022, Bionano Genomics, Inc. and Hamilton announced the joint development of a product to extract and isolate Ultra High Molecular Weight DNA as the initial part of the sample preparation workflow. The use of long string vantage is in optical genome mapping.

One of the key drivers of this application is expanding the technique for developing personalized treatment through genomics research. For instance, in October 2022, Sight Diagnostics, a technology developer in blood sample preparation, installed its first portable instrument for hematology analysis in the Caribbean. The instrument is installed to offer immediate complete blood count to Tobago and Trinidad patients and assist in diagnosing patients with oncology, critically ill, and pediatrics.

Similarly, numerous approaches such as extraction and separation, are developing aligned with smart devices, lab automation, and biosensors. Technological advancement in the market is anticipated to ease the adoption rate by the end users. For instance, in April 2020, an article published on a portal by Cambridge Healthtech Institute stated that sample preparation has substantial potential in a point-of-care setting. The article underlined developing sample-preparing techniques such as electrokinetic-like separation and electrowetting, which can be incorporated in a PoC setting.

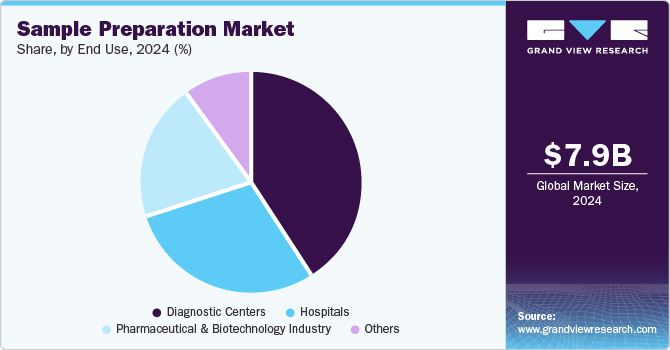

End Use Insights

The diagnostic center segment dominated the market in 2024, with a share of 40.66%, and is expected to witness the fastest growth rate over the forecast period. The segment in the sample preparation market is estimated to be skewed toward the mature regions, majorly in Western Europe, North America, and Japan. However, increasing spending on human health in emerging markets is likely to drive the market.

The sample preparation has become an integrated part of the multiple areas’ value chain, including therapeutic research, discovery and development, clinical trials, manufacturing and quality assurance, and quality control. Hence, advancement in collection methods is expected to ease the preparation process for the End-uses. For instance, in October 2022, Tasso collaborated with Catapult Health to commercialize its U.S. FDA-cleared device for collecting blood specimens at home. Hence, pharmaceutical and biotechnology companies also showcased stable growth in the market.

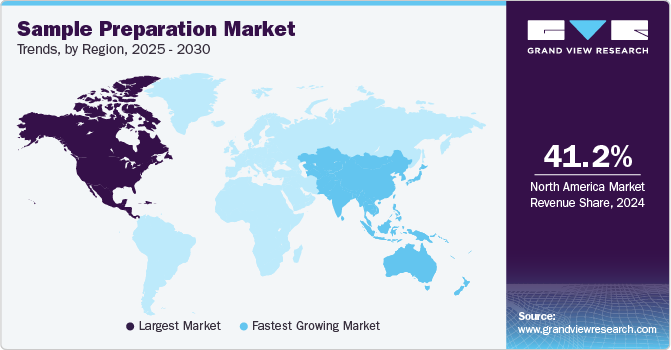

Regional Insights

North America sample preparation market has established global dominance in 2024 with a 41.21% share. The important parament of the largest market share is the presence of well-established suppliers and buyers of the sample preparation solutions in the region. Hence, this speeds up the delivery process from supplier to buyer at a minimal cost. Additionally, increasing accessibility and availability of funds through government and private investors support startup companies to enter the market.

U.S. Sample Preparation Market Trends

The sample preparation market in the U.S. is primarily driven by advancements in biopharmaceutical research, drug discovery, and clinical diagnostics. The rising demand for personalized medicine, genomics, and proteomics research has fueled the adoption of automated and high-throughput sample preparation systems. Moreover, government initiatives supporting biotechnology and pharmaceutical industries play a pivotal role, coupled with increasing R&D spending in the healthcare sector.

Europe Sample Preparation Market Trends

The sample preparation market in Europe is supported by strong research institutions and pharmaceutical companies. Countries like Germany, France, and the UK are prominent players, benefiting from government-funded research projects and the growing focus on personalized healthcare solutions. Additionally, the rising focus on environmental testing and food safety regulations has further bolstered the demand for advanced sample preparation technologies.

The UK sample preparation market benefits from a robust pharmaceutical and biotechnology sector, driving the need for efficient sample preparation methods. The increasing use of advanced technologies in molecular diagnostics and genomics research, coupled with substantial government funding and collaborative projects between academic institutions and industry players, propels the market growth.

The sample preparation market in France is supported by government initiatives to support research and development in the life sciences sector. The country’s focus on genomic research and the growing importance of personalized medicine contribute to the demand for innovative sample preparation techniques. Additionally, collaborations between pharmaceutical companies and academic institutions boost technological advancements in this market.

Germany sample preparation market is driven by its well-established biotechnology and pharmaceutical industries which has a high demand for automated sample preparation systems in proteomics, genomics, and drug discovery. The country's focus on precision medicine, coupled with its strong R&D infrastructure and government support for healthcare innovation, is a significant market driver.

Asia Pacific Sample Preparation Market Trends

The sample preparation market in Asia Pacific is projected to experience the fastest CAGR in the market. This can be attributed to the increasing adoption of sequencing in China and India for numerous applications, including the development of personalized medicines. Furthermore, the increasing attention to genomics and proteomics research in the Asia Pacific region is anticipated to impact the market with significant growth opportunities during the forecast period.

China sample preparation market is expanding rapidly due to increasing investments in biotechnology, healthcare, and pharmaceutical research. The country’s focus on improving healthcare infrastructure, along with rising demand for molecular diagnostics and genomics, drives the adoption of advanced sample preparation technologies. Government support and growing interest in drug discovery and development further fuel market growth.

The sample preparation market in Japan is driven by advancements in genomics, proteomics, and personalized medicine. The country’s strong focus on healthcare innovations, combined with significant investment in R&D by pharmaceutical and biotech companies, boosts demand for high-throughput and automated sample preparation systems. Additionally, Japan’s aging population increases the need for advanced diagnostic solutions, which enhances the market.

India sample preparation market is driven by its growing pharmaceutical and biotechnology industries, alongside increasing investments in healthcare R&D. The rising prevalence of chronic diseases and the growing focus on molecular diagnostics and drug discovery boost the demand for efficient sample preparation techniques. Additionally, government initiatives to improve healthcare infrastructure and boost biopharmaceutical production further support market growth.

Middle East & Africa Sample Preparation Market Trends

The sample preparation market in the Middle East & Africa is driven by increasing investments in healthcare infrastructure and rising demand for advanced diagnostic tools. The region is focusing on improving clinical research capabilities, with countries like South Africa and UAE playing a crucial role in market growth. The need for efficient sample preparation in diagnostic labs and research centers is rising due to growing disease prevalence.

Saudi Arabia sample preparation market is driven by significant investments in healthcare and clinical research, as the country focuses on developing its biotechnology and pharmaceutical sectors. The growing demand for molecular diagnostics, coupled with the government’s Vision 2030 initiative to modernize healthcare, boosts the need for advanced sample preparation techniques.

The sample preparation market in Kuwait is driven by increasing healthcare investments and a growing focus on improving diagnostic capabilities. The rising prevalence of chronic diseases, coupled with the country’s efforts to upgrade its healthcare infrastructure, creates a demand for efficient and automated sample preparation technologies in diagnostic and research laboratories.

Key Sample Preparation Company Insights

Companies in the sample preparation market are constantly indulging in numerous strategies such as technology development, innovation in the product line, collaborations, building a strong market presence through mergers and acquisitions, startups, and expanding regional footprint, to generate higher revenue.

Key Sample Preparation Companies:

The following are the leading companies in the sample preparation market. These companies collectively hold the largest market share and dictate industry trends.

- Merck KGaA

- Thermo Fisher Scientific Inc.

- Bio-RAD Laboratories Inc.

- Tecan Group Ltd.

- Agilent Technologies Inc.

- Hamilton Company

- Promega Corporation

- Illumina Inc.

- Danaher

- Qiagen N.V.

Recent Developments

-

In November 2023, QIAGEN expanded its sample technology offerings with the launch of two new solutions designed to assist researchers in processing a range of materials such as bone, tissue, and soil samples. The newly introduced products, TissueLyser III and the RNeasy PowerMax Soil Pro Kit, reflect QIAGEN's dedication to advancing its automated sample preparation tools. TissueLyser III, in particular, underscores the company’s commitment to continuously enhancing efficiency and innovation in sample preparation and analysis workflows.

-

In September 2023, DPX Technologies, a producer of laboratory consumables for sample preparation, announced its business expansion. This growth includes the introduction of new product lines focused on proteomics and genomics testing, as well as the construction of a larger storage facility to support its increased capacity and future product development efforts.

-

In October 2022, Thermo Fisher Scientific announced it to expand its clinical research lab in Kentucky by investing USD 59 million. The expansion is to support customers for their clinical testing requirements, including sample management, processing, storage, and preparation.

Global Sample Preparation Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.39 billion

Revenue forecast in 2030

USD 11.27 billion

Growth rate

CAGR of 6.1% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technique, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico, Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Merck KGaA, Thermo Fisher Scientific Inc., Bio-RAD Laboratories Inc., Tecan Group Ltd., Agilent Technologies Inc., Hamilton Company, Promega Corporation, Illumina Inc., Roche Applied Science, Danaher Corporation, Qiagen N.V.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Sample Preparation Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global sample preparation market report on the basis of product, technique, application, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Extraction System

-

Workstation

-

Automated Evaporation System

-

Liquid Handling Instrument

-

Liquid handling workstations

-

Pipetting systems

-

Reagents dispensers

-

Microplate washer

-

Other liquid handling systems

-

-

-

Consumable

-

Kits

-

Purification Kit

-

Isolation Kit

-

Extraction Kit

-

-

-

Technique Outlook (Revenue, USD Million, 2018 - 2030)

-

Protein Preparation

-

Solid-phase extraction

-

Liquid-liquid extraction

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Genomics

-

Proteomics

-

Epigenomics

-

Transcriptomics

-

Metabolomics

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Centers

-

Pharmaceutical and Biotechnology Industry

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global sample preparation market size was estimated at USD 7.88 billion in 2024 and is expected to reach USD 8.39 billion in 2025.

b. The global sample preparation market is expected to grow at a compound annual growth rate of 6.1% from 2025 to 2030 to reach USD 11.27 billion by 2030.

b. North America dominated the sample preparation market with a share of 41.21% in 2025. This is attributable to well-established diagnostic centers and healthcare facilities.

b. Some key players operating in the sample preparation market include Merck KGaA; Thermo Fisher Scientific Inc.; Bio-RAD Laboratories Inc.; Tecan Group Ltd.; Agilent Technologies Inc.; Hamilton Company; Promega Corporation; Illumina Inc.; Roche Applied Science; Danaher Corporation; Qiagen N.V.

b. Key factors that are driving the sample preparation market growth include technological advancement in the collection and preparation of samples and increasing adoption of NGS

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.