- Home

- »

- Advanced Interior Materials

- »

-

Sandstone Market Size And Share, Industry Report, 2033GVR Report cover

![Sandstone Market Size, Share & Trends Report]()

Sandstone Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Building & Construction, Monuments & Memorials, Paving & Civil Engineering, Others), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-631-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Sandstone Market Summary

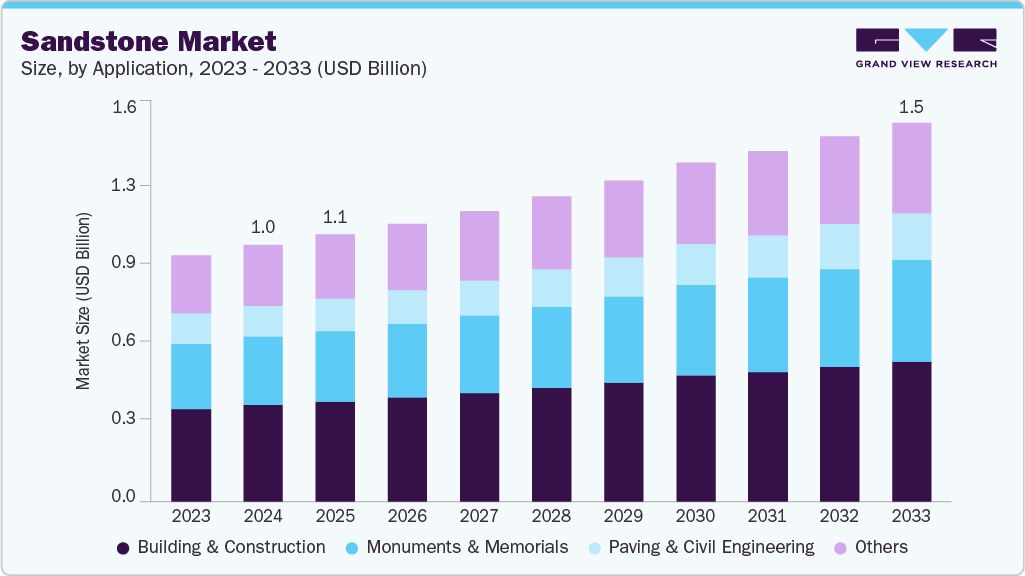

The global sandstone market size was estimated at USD 1.03 billion in 2024 and is projected to reach USD 1.52 billion by 2033, at a CAGR of 5.0% from 2025 to 2033. Sandstone is widely used in residential, commercial, and public infrastructure projects due to its aesthetic appeal, durability, and versatility.

Key Market Trends & Insights

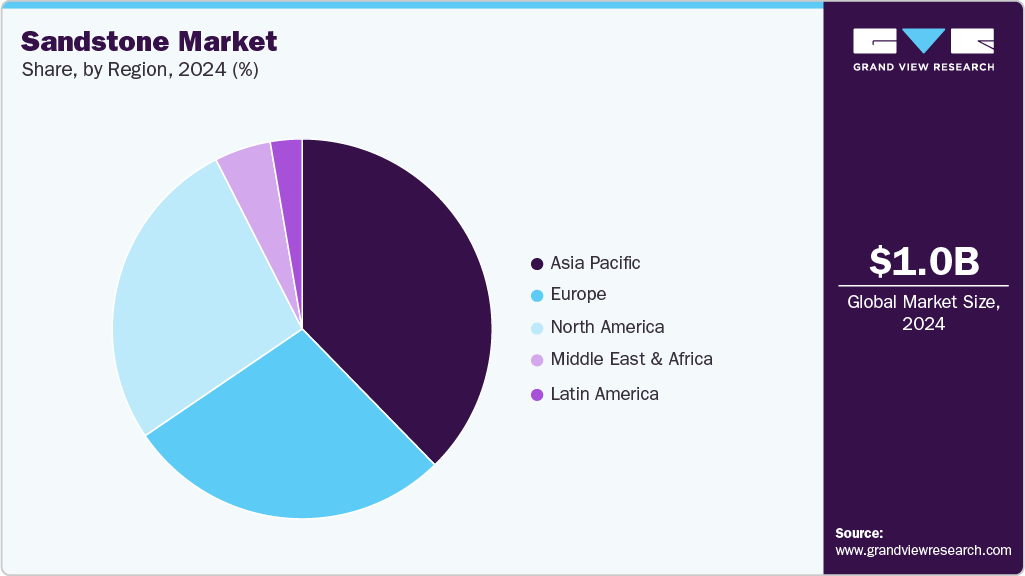

- Asia Pacific dominated the market with the largest market revenue share of 37.7%.

- Sandstone market in the U.S. is expected to grow at a substantial CAGR of 3.3% from 2025 to 2033.

- By application, building & construction accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.03 Billion

- 2033 Projected Market Size: USD 1.52 Billion

- CAGR (2025-2033): 5.0%

- Asia Pacific: Largest Market Region in 2024

- Middle East & Africa:Fastest Growing Market

Rapid urbanization, especially in emerging economies, creates a strong demand for cost-effective and visually appealing building materials, with sandstone being a preferred choice for flooring, wall cladding, façades, and landscaping.The global sandstone industry is significantly driven by rising demand from the construction and infrastructure sector, especially in emerging economies. For instance, in India and China, massive urban development projects and smart city initiatives have spurred the use of sandstone in flooring, wall cladding, and pavements due to its affordability and aesthetic flexibility. In Rajasthan, India, home to some of the world's largest sandstone reserves, government-backed housing and urban development schemes have bolstered sandstone mining and processing activities to meet rising demand.

Sustainability and the global push toward eco-friendly building materials further strengthen the market. Many European architectural projects are shifting toward natural stones to meet LEED and BREEAM green building certifications. For example, sandstone is being chosen over concrete for exterior facades and walkways in Germany and France due to its lower embodied energy and environmental impact. For instance, the "Green Building" project in Paris incorporated locally sourced sandstone to reduce transportation emissions and promote regional stone industries.

Restoration and conservation of heritage sites are other major factors propelling the demand for sandstone. The material's compatibility with older architectural styles makes it essential for restoration. Notably, the restoration of the British Parliament building and numerous forts and palaces in India, such as those in Jaipur and Jodhpur, has relied on matching sandstone blocks from nearby quarries. These projects create a consistent demand for high-quality, historically accurate sandstone types.

The hospitality and luxury real estate industry increasingly incorporates sandstone to enhance the visual appeal of resorts and premium properties. A prominent example is the use of pink sandstone in the luxury hotels of Dubai and Abu Dhabi, where the natural look of sandstone complements desert architecture. Similarly, high-end resorts in Bali and Thailand use intricately carved sandstone panels for spa areas and garden landscaping, reinforcing their use in aesthetic and thematic construction.

Lastly, technological advancements in quarrying and finishing techniques make sandstone more attractive to global buyers. Companies like Levantina in Spain and Stonemart in India use automated cutting machines, CNC routers, and waterjet technologies to create precisely cut sandstone tiles and slabs with smoother finishes. These improvements have helped sandstone gain traction in international markets like the U.S., Canada, and the UK, where consumers are willing to pay a premium for quality natural stone products that combine heritage with modern finishes.

Drivers, Opportunities & Restraints

Sandstone's durability, natural aesthetic appeal, and ease of workability make it a popular choice for cladding, flooring, paving, and other architectural applications. In addition, rising urbanization and government initiatives for smart cities and heritage restoration projects fuel the demand for sandstone in residential and commercial construction. The tourism industry's investment in restoring cultural monuments and sites using natural materials like sandstone also contributes to market growth.

Technological advancements in stone cutting and surface finishing have opened new avenues for customized sandstone products, catering to premium architectural designs and landscaping applications. There is also growing interest in eco-friendly and sustainable building materials, positioning sandstone as a viable alternative to synthetic options. Moreover, untapped reserves in regions like Africa, Latin America, and parts of Asia present significant opportunities for expansion in mining operations and export potential. The demand for natural stone in interior décor and luxury real estate offers additional growth prospects for sandstone suppliers and manufacturers.

Environmental regulations and land-use restrictions can limit quarrying activities, especially in regions with strict ecological preservation laws. Due to sandstone's weight and fragility, high transportation costs further impact its trade, particularly in international markets. In addition, cheaper substitutes such as concrete, ceramic tiles, and engineered stone in construction can hinder the adoption of sandstone, especially in cost-sensitive markets.

Application Insights

Building & construction held the revenue share of 37.5% in 2024. The building and construction segment represents the largest application area within the market, driven by the material’s widespread use in residential, commercial, and institutional infrastructure. Sandstone is highly favored for its natural texture, aesthetic appeal, and long-lasting durability, making it a preferred choice for exterior cladding, facades, flooring, wall tiles, and paving. Its resistance to weathering and ability to withstand heavy foot traffic also contribute to its extensive use in public buildings, heritage restorations, and landscaping elements like garden walls, fountains, and patios.

Monuments & memorials are anticipated to register the fastest CAGR over the forecast period. Sandstone has been used for centuries in constructing iconic monuments, temples, and memorials due to its ability to withstand weathering while retaining its structural integrity and aesthetic appeal. Its availability in various colours and textures makes it ideal for sculptural detailing and intricate carvings, essential features in many cultural and religious structures. Countries with rich architectural heritage, such as India, Egypt, and Greece, continue to rely on sandstone for restoration and preservation projects.

Regional Insights

The North American sandstone industry is primarily driven by steady residential and commercial construction growth, coupled with a rising preference for natural building materials. As sustainable architecture gains momentum, architects and developers across the U.S. and Canada increasingly incorporate sandstone into green building designs. Its natural appearance and recyclability make it a favorable alternative to synthetic and high-emission materials, aligning with LEED certification goals and other sustainability standards.

U.S. Sandstone Market Trends

The U.S. sandstone industry is driven by strong demand from both traditional and modern construction practices. Sandstone has historically played a key role in American architecture, particularly in regions like the Midwest and Northeast, where local quarries supplied materials for universities, courthouses, and public buildings. Its use continues in residential and commercial landscaping, urban redevelopment, and premium housing projects where natural aesthetics and long-term durability are prioritized.

Asia Pacific Sandstone Market Trends

Asia Pacific accounted for the largest market revenue share of 37.7% in 2024. The Asia Pacific sandstone industry is witnessing robust growth, fueled by large-scale infrastructure and construction activities, particularly in India, China, and Vietnam. In India, sandstone is both widely available and culturally significant, with its extensive use in architectural landmarks such as the Red Fort, Qutub Minar, and Akshardham Temple.

The government's Smart Cities Mission and AMRUT (Atal Mission for Rejuvenation and Urban Transformation) drive urban redevelopment and public infrastructure projects using sandstone for pavements, cladding, and decorative applications. Similarly, China's Belt and Road Initiative (BRI) and increasing investment in public infrastructure have accelerated demand for building materials, including natural stones like sandstone, for structural and aesthetic use.

Europe Sandstone Market Trends

The European sandstone industry is driven by the strong architectural tradition and a widespread emphasis on cultural heritage preservation drive. Countries such as Germany, France, the UK, and Italy have long histories of using sandstone to construct historic buildings, churches, castles, and civic structures. Restoration and conservation of these structures remain key market drivers, supported by government and EU-level funding to protect Europe’s built heritage. Sandstone’s ability to match the original material in texture, color, and weathering makes it indispensable in renovation projects.

Latin America Sandstone Market Trends

The Latin American sandstone industry is witnessing gradual growth, primarily driven by increasing investments in infrastructure, tourism, and urban development. Brazil, Mexico, and Argentina use natural stone like sandstone for public plazas, pedestrian pathways, government buildings, and upscale residential developments. Moreover, Latin America's cultural and historical restoration efforts contribute to the sandstone market, especially in regions with colonial-era architecture that originally incorporated natural stone. In countries like Peru and Colombia, where tourism is closely linked to heritage sites, sandstone is increasingly used to maintain and enhance culturally significant landmarks.

Middle East & Africa Sandstone Market Trends

The Middle East & Africa industry is anticipated to register the fastest CAGR over the forecast period. In the Middle East, countries such as the UAE, Saudi Arabia, and Qatar incorporate sandstone into luxury real estate, religious structures, and public spaces due to its durability, heat resistance, and traditional aesthetic appeal. Major projects like NEOM and other Vision 2030 initiatives further boost demand for natural building materials like sandstone. In Africa, growth is supported by rising investments in housing and infrastructure, particularly in South Africa, Egypt, and Namibia, which also possess abundant local sandstone reserves. The region’s focus on restoring historic landmarks, expanding quarrying capabilities, and cost-effective material availability is helping strengthen the sandstone market across Middle Eastern and African nations.

Key Sandstone Company Insights

Some of the key players operating in the market include Graymont, Lafarge Canada, and others.

-

Graymont is a privately held global leader specializing in lime- and limestone-based materials. Since its founding in 1948, it has served the industrial, construction, and agricultural sectors. Among its construction stone portfolio, Graymont mines and supplies a variety of decorative natural stones, including red and brown sandstone, pink granite, river-washed pebbles, and brown flagstone, for retail garden centers and landscape distributors.

-

Lafarge Canada is one of Canada’s leading suppliers of construction materials, offering cement, ready-mix concrete, aggregates, and paving solutions. Within its aggregates division, the company provides dolomitic sandstone sourced from quarries such as Brockville, Hawthorne, and South Gloucester. This sandstone aggregate is certified for public works and infrastructure projects, meeting ministry standards for road building, concrete bedding, and general construction aggregates.

Key Sandstone Companies:

The following are the leading companies in the sandstone market. These companies collectively hold the largest market share and dictate industry trends.

- Antolini

- Graymont

- Kangli Stone Group

- Lafarge Canada

- Levantina

- Mumal Marbles

- Stonemart

- Vetter Stone

- Xiamen Wanli Stone Stock

- Xishi Group

Recent Developments

-

In February 2025, Gosford Quarry’s premium Wondabyne Sandstone played a key role in the multi-million-dollar upgrade of the Australian War Memorial in Canberra. Approximately 380 cubic meters (around 800 tons) of this sandstone were used to construct the new main entrance, ensuring a high-quality material that matches the heritage aesthetics of the original structure. The sandstone is also being utilized in the ongoing construction of Anzac Hall, further extending the quarry’s contribution to this important national site.

-

In December 2024, Canadian natural stone giant Polycor Inc. expanded its footprint by acquiring several sandstone and dimension stone quarries in Europe, particularly France and Germany. The move aligns with Polycor’s strategy to strengthen its global supply chain and diversify its offerings in architectural-grade sandstone. The acquired assets are expected to support large-scale restoration and construction projects in Europe and North America, enhancing the company’s ability to meet the rising demand for natural and sustainable building materials.

Sandstone Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.07 billion

Revenue forecast in 2033

USD 1.52 billion

Growth Rate

CAGR of 5.0% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative Units

Revenue in USD million, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; Russia; France; Italy; China; India; Japan; South Koreal; Brazil; UAE; Saudi Arabia

Key companies profiled

Levantina; Lafarge Canada; Graymont; Stonemart; Vetter Stone; Antolini; Mumal Marbles; Xiamen Wanli Stone Stock; Xishi Group; Kangli Stone Group; Others

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sandstone Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global sandstone market report based on application and region.

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Building & Construction

-

Monuments & Memorials

-

Paving & Civil Engineering

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Russia

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global sandstone market size was estimated at USD 1.03 billion in 2024 and is expected to reach USD 1.07 billion in 2025.

b. The global sandstone market is expected to grow at a compound annual growth rate of 5.0% from 2025 to 2033 to reach USD 1.52 billion by 2033.

b. The building & construction segment dominated the market with a revenue share of 37.5% in 2024.

b. Some of the key players of the global sandstone market are Levantina, Lafarge Canada, Graymont, Stonemart, Vetter Stone, Antolini, Mumal Marbles, Xiamen Wanli Stone Stock, Xishi Group, Kangli Stone Group, and others.

b. The key factor that is driving the growth of the global sandstone market is driven by the increasing demand from the construction and infrastructure sectors, particularly for use in flooring, wall cladding, paving, and decorative applications due to its durability, aesthetic appeal, and availability in various textures and colors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.