- Home

- »

- Green Building Materials

- »

-

Sandwich Panels Market Size, Share & Trends Report, 2030GVR Report cover

![Sandwich Panels Market Size, Share & Trends Report]()

Sandwich Panels Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (PU Panels, Glass Wool Panels), By Application (Cold Storage, Roofs), By End-use (Non-residential, Residential), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-090-2

- Number of Report Pages: 99

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Sandwich Panels Market Summary

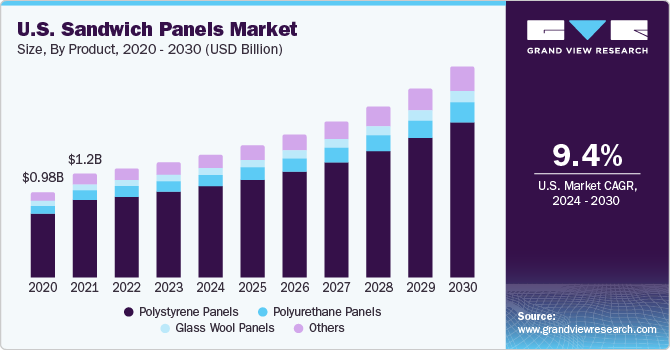

The global sandwich panels market size was estimated at USD 9.03 billion in 2023 and is expected to grow at a CAGR of 7.7% from 2024 to 2030. The growth can be attributed to flourishing global construction industry, which is a key consumer of sandwich panels.

Key Market Trends & Insights

- Europe dominated the market in 2023 with a volume share of 28.8%.

- By product, the polystyrene panels segment dominated the market in 2023 and accounted for a revenue share of 72.4%.

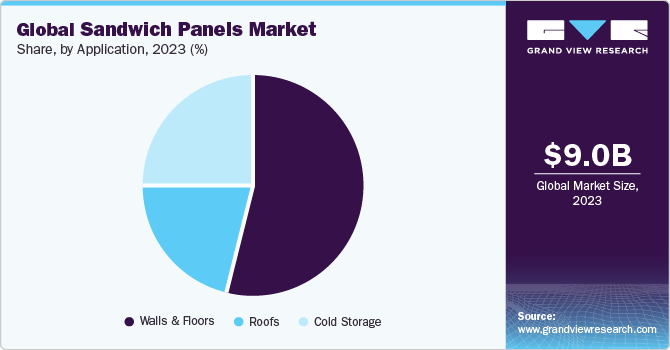

- By application, the walls and floors application segment was valued at the highest revenue share of 53.96% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 9.03 Billion

- 2030 Projected Market Size: USD 14.99 Billion

- CAGR (2024-2030): 7.7%

- Europe: Largest market in 2023

In addition, there has been a surge in number of initiatives undertaken by governments of different countries across the world to encourage and promote construction of green and energy-efficient buildings. This, in turn, is fueling product consumption worldwide.

Market Dynamics

The worldwide construction sector is expanding rapidly as a result of increased public and private investment in transportation infrastructure, residential spaces, and commercial buildings. Factors, such as rising per capita income, growing global population in countries, such as the U.S., Mexico, India, and China, as well as continued urbanization, are driving the construction of residential and non-residential buildings worldwide. This is expected to boost product demand. However, as homeowners, architects, and businesses install green materials in their buildings, the presence of strict rules is propelling the usage of conventional insulation products, such as plastic foams and recyclable insulation. These eco-friendly items are biodegradable and recyclable. This trend is expected to reduce demand for conventionally utilized raw materials in the production of sandwich panels, affecting market growth.

The demand for energy-efficient buildings is increasing owing to the presence of stringent government regulations, and rise in global awareness regarding environmental preservation is anticipated to fuel the installation of thermal insulation in residential, non-residential, commercial, and industrial buildings. Favorable government policies, coupled with increasing awareness in Asia Pacific and Central & South America, are also projected to drive market growth. Over time, sandwich panels have emerged as a superior economical insulation method in construction projects. They are quick and easy to install, help in reduction of overall weight of structures, are durable, and offer weather resistance. Sandwich panels consist of core insulating materials, which are covered with face sheets on both sides.

Materials used for developing face sheets are selected based on applications wherein they are to be used. For core insulating material in sandwich panels, polystyrene is used in foam form, which is mainly of two types, expanded (EPS) and extruded (XPS). XPS foams are lightweight and low-density materials with superior sound and thermal insulation. EPS foams are lightweight and enable heat preservation. However, sandwich panels developed using polystyrene foams easily catch fire. This is expected to hamper the demand for panels developed from them. The U.S. market is expected to witness significant growth over the forecast period owing to an increased demand for energy-efficient construction solutions.

Moreover, rising awareness regarding sustainable construction among customers as well as the government is expected to contribute to market growth in the country. Manufacturers carry out installation of sandwich panels through their network of certified contractors and installers. Installation of these systems requires expert services, which can affect overall price of a product. Companies invest significantly in research and development activities for the development, supply, and installation of products, thereby resulting in dynamic market conditions. They carry out extensive innovations for manufacturing and supplying sandwich panels to enhance their product portfolios and increase their penetration in industry.

Product Insights

The polystyrene panels segment dominated the market in 2023 and accounted for a revenue share of 72.4%. Foamed plastics, also known as cellular polymers or expanded plastics, are insulation materials that offer superior sound absorption. They are lightweight and quakeproof, which is further driving their demand. In sandwich panels, polystyrene is used in form of foams. It is utilized in these panels either as EPS or XPS. EPS is one of the most commonly used insulating core materials in sandwich panels. To create glass wool, manufacturers heat silica sand to high temperatures, between 1,200°C and 1,250°C, turning it into fine fibers.

This material is excellent for insulating buildings, providing both thermal and acoustic benefits, and it's fire-resistant. Using glass wool helps reduce energy usage and keeps temperature fluctuations in check within a structure. Glass wool sandwich panels are constructed by bonding an insulating core with two outer metal sheets (usually aluminum or galvanized steel) using specialized adhesives Apart from excellent thermal insulation, glass wool sandwich panels also exhibit superior fire resistance and noise insulation. As a result, they are often used on walls and roofs of commercial and industrial buildings.

In addition, glass wool is lightweight and possesses high tensile strength. Polyurethane (PU) sandwich panels are relatively more expensive than panels based on polystyrene and glass wool. PU sandwich panels are highly preferred in the insulation of cold chain storage units owing to their superior thermal insulation and vapor diffusion resistance properties. Growing investments in establishment of cold chain infrastructure in North America, Asia Pacific, and Central & South America are expected to drive overall demand for PU sandwich panels.

Application Insights

The walls and floors application segment was valued at the highest revenue share of 53.96% in 2023 and is projected to expand at a CAGR of 7.6% from 2024 to 2030. Insulation of walls and floors is essential for enhancing energy efficiency of buildings. In addition, insulated walls, roofs, and floors create a protective envelope to prevent heat transfer from the external environment through conduction and convection radiation. Polystyrene core sandwich panels are the most popular products used for external wall insulation owing to their low costs, high durability, and convenient installation.

The roof application segment is projected to expand at a CAGR of 7.1% from 2024 to 2030. Insulated roof panels offer heat retention and prevention benefits resulting in cozy spaces in houses and workspaces. Temperature regulated by insulated roofs leads to improvement in an energy efficiency of buildings through a reduction in usage of air-conditioning systems and heaters. Moreover, these roofs act as protective barriers against harsh climatic conditions. Thus, aforementioned benefits are projected to drive overall demand for insulation materials, such as sandwich panels, used in roofs in coming years.

End-use Insights

The non-residential sub-segment dominated the market with a revenue share of 58.5% in 2023 and is further expected to grow at the highest rate from 2024 to 2030. This segment is further divided into buildings for office spaces, universities, hypermarkets, supermarkets, departmental stores, shopping malls, hospitals & clinics, restaurants & hotels, resorts, and others. Rapidly emerging trend of sustainable buildings is one of the major factors driving the growth of insulation products, such as sandwich panels. In addition, rising number of office spaces in emerging economies, especially located in subtropical regions, is expected to lead to notable demand for insulation systems to maintain energy benchmarking as well as regulate temperature levels.

The residential end-use segment is expected to witness a CAGR of 7.4% from 2024 to 2030. This segment is further categories into residential buildings, apartments, complexes, and small houses. A rise in the number of single-family houses in developing economies and rising disposable incomes of consumers are among the key factors projected to drive residential construction activities. Thus, growth of residential construction sector, along with growing building energy consumption norms, is projected to positively influence product demand. Furthermore, innovation in product varieties using advanced technology and hassle-free installation of insulation systems in various spaces or buildings are also projected to drive market growth due to a rising product demand from residential application segment.

Regional Insights

Europe dominated the market in 2023 with a volume share of 28.8%. According to the European Commission, the economy of the region is highly dependent on its construction industry. According to the European Construction Industry Federation (FIEC), growth of a construction industry in this region increased by 2.4% in 2022 compared with its growth in 2021. Thereby, growing construction sector in this region is expected to propel product growth. The product demand in the UK is majorly driven by residential construction activities in the country owing to rising demand for energy-efficient homes. Moreover, growing preferences in the UK for energy-saving and cost-effective buildings for use as government offices and other public utility spaces are expected to increase the product penetration in the country.

Asia Pacific is expected to witness the fastest revenue CAGR of 8.8% from 2024 to 2030. Expansion of the residential, commercial, and industrial sectors on account of sustainable economic growth in Asia Pacific is expected to boost construction activities, thereby driving product demand. Flourishing tourism in this region has led to an increasing requirement for restaurants, resorts, and food chains. In addition, rapid urbanization and rising standard of living due to increasing per capita consumer income are anticipated to boost the expansion of residential and commercial construction sectors, including shopping malls and retail chains. This is anticipated to augment overall product demand in this region.

Key Companies & Market Share Insights

The market is characterized by the presence of several large- and small-scale players as well as a number of established players. The market exhibits high competition owing to vast distribution networks and diverse product portfolios. To retain their positions in market, major manufacturers around the globe are concentrating on geographical expansion, new product developments, and mergers & acquisitions to gain a competitive advantage.

Key Sandwich Panels Companies:

- Kingspan Group

- Owens Corning

- Isopan

- PFB Corporation

- Metecno Group

- Green Span Profiles

- American Insulated Panel

- Metl-Span

- KPS Global

- Dana Group of Companies

- American Buildings Company

- Ingreen Building Systems

- Structural Panels Inc.

- Hemsec Manufacturing Ltd.

- FischerSIPS

Sandwich Panels Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 9.59 billion

Revenue forecast in 2030

USD 14.99 billion

Growth rate

CAGR of 7.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report upated

December 2023

Quantitative units

Volume in million square meters, revenue in USD billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; China; India; Japan; Australia; Brazil; Argentina; UAE

Key companies profiled

Kingspan Group; Owens Corning; Isopan; PFB Corp.; Metecno Group; Green Span Profiles; American Insulated Panel; Metl-Span; KPS Global; Dana Group of Companies; American Buildings Company; Ingreen Building Systems; Structural Panels Inc.; Hemsec Manufacturing Ltd.; FischerSIPS

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sandwich Panels Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the sandwich panels market report on the basis of product, application, end-use, and region:

-

Product Outlook (Volume, Million Square Meters; Revenue, USD Billion, 2018 - 2030)

-

Polystyrene Panels

-

Polyurethane Panels

-

Glass Wool Panels

-

Others

-

-

Application Outlook (Volume, Million Square Meters; Revenue, USD Billion, 2018 - 2030)

-

Walls & Floors

-

Roofs

-

Cold Storage

-

-

End-use Outlook (Volume, Million Square Meters; Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Non-residential

-

-

Regional Outlook (Volume, Million Square Meters; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global sandwich panels market size was estimated at USD 9.03 billion in 2023 and is expected to reach USD 9.59 billion in 2024.

b. The sandwich panels market is expected to grow at a compound annual growth rate of 7.7% from 2024 to 2030 to reach USD 14.99 billion by 2030.

b. The walls and floors application segment of sandwich panels market accounted for the largest revenue share of 53.9% in 2023. Insulation of walls and floors is one of the essential elements for enhancing the energy efficiency of buildings.

b. Some of the key players operating in the sandwich panels market include Kingspan Group, Owens Corning, Isopan, PFB Corporation, METECNO GROUP, Green Span Profiles, American Insulated Panel, and Metl-Span.

b. The key factors that are driving the sandwich panels market include the growing construction activities around the world coupled with rising construction of sustainable and energy-efficient buildings.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.