- Home

- »

- Communication Services

- »

-

Satellite Payloads Market Size, Share, Industry Report, 2030GVR Report cover

![Satellite Payloads Market Size, Share & Trends Report]()

Satellite Payloads Market (2025 - 2030) Size, Share & Trends Analysis Report By Size (LEO, MEO, GEO), By Application (Communication & Navigation, Remote Sensing, Surveillance), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-876-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Satellite Payloads Market Summary

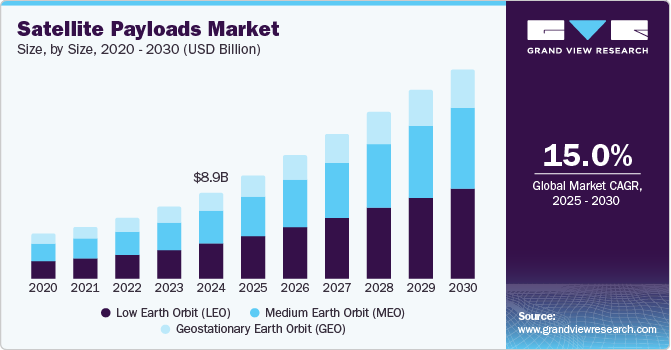

The global satellite payloads market size was estimated at USD 8.95 billion in 2024 and is projected to reach USD 21.79 billion by 2030, growing at a CAGR of 15.0% from 2025 to 2030. The increasing demand for advanced satellite technologies across various sectors, including telecommunications, earth observation, and scientific research, has driven the market.

Key Market Trends & Insights

- The North America satellite payloads market dominated the overall market with the largest revenue share of 34.6% in 2024.

- The Asia Pacific satellite payloads market is expected to grow at the highest CAGR over the forecast period.

- Based on size, the low earth orbit (LEO) segment dominated the satellite payloads market with the largest revenue share of 41.4% in 2024

- Based on application, the communication and navigation segment dominated the satellite payloads industry with the largest revenue share in 2024.

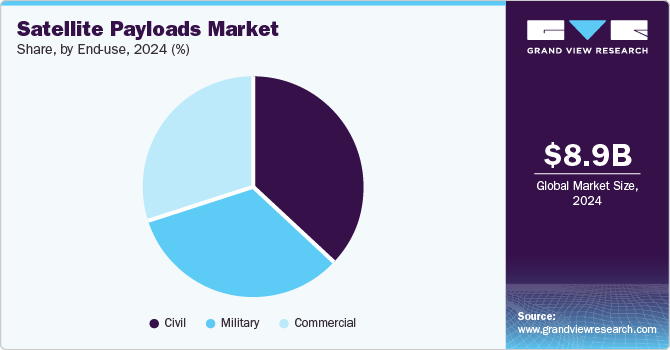

- Based on end use, the civil segment dominated the market with the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 8.95 Billion

- 2030 Projected Market USD 21.79 Billion

- CAGR (2025-2030): 15.0%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

As the reliance on satellite communication continues to rise, particularly with the rollout of 5G networks and the growing need for high-speed internet in remote areas, the market is expected to experience robust growth.

Moreover, the trend toward miniaturization of satellites is contributing to the growth of the satellite payloads industry. Smaller satellites are launched more economically and are often equipped with cutting-edge payloads that enhance their functionality. For instance, companies such as SpaceX are actively launching small satellite constellations for broadband services, increasing connectivity and boosting demand for sophisticated satellite payloads.

In addition, government investments in space exploration and defense applications are further driving the market growth. Many countries are expanding their satellite programs to enhance national security and communication capabilities. For instance, the U.S. government has increased funding for satellite systems that support military operations and intelligence gathering, thereby driving demand for specialized payloads.

Furthermore, the growing emphasis on sustainability in space operations is influencing the satellite payloads industry. Companies are increasingly focusing on developing environmentally friendly technologies and practices to mitigate space debris and enhance the longevity of satellites. This shift toward sustainable practices is likely to attract additional investments and innovations in the sector, positioning the satellite payloads market for continued expansion in the coming years.

Size Insights

The Low Earth Orbit (LEO) segment dominated the satellite payloads market with the largest revenue share of 41.4% in 2024 due to the increasing demand for high-speed internet and enhanced global connectivity. This demand is particularly evident in remote and underserved regions, where LEO satellites, such as those deployed by Starlink, aim to bridge the digital divide by providing reliable broadband access. In addition, advancements in satellite technology, including miniaturization and cost-effective manufacturing processes, have made it feasible to launch large constellations of small satellites, further driving market growth.

The Medium Earth Orbit (MEO) segment is expected to grow at a significant CAGR over the forecast period, driven by the escalating demand for Internet of Things (IoT) solutions and enhanced global connectivity. MEO satellites balance latency and coverage, making them ideal for various applications such as remote asset monitoring and environmental tracking. For instance, companies such as SES are expanding their MEO satellite constellations to provide high-speed internet services in underserved regions, effectively bridging the digital divide. In addition, advancements in satellite technology, including miniaturization and improved propulsion systems, have reduced costs and increased deployment efficiency.

Application Insights

The communication and navigation segment dominated the satellite payloads industry with the largest revenue share in 2024, driven by the growing demand for advanced communication infrastructure and precise navigation systems. This surge is largely attributable to the increasing reliance on satellite technology for global telecommunications, including internet services and mobile communications. For instance, companies such as OneWeb are deploying satellite constellations to provide broadband connectivity to remote areas, enhancing access to information and services. In addition, the development of autonomous vehicles and smart technologies has amplified the need for accurate navigation systems, further propelling market growth.

The remote sensing segment is expected to grow at a significant CAGR over the forecast period, driven by the escalating demand for high-resolution imagery and data analytics across various industries. This growth is particularly evident in agriculture, environmental monitoring, and urban planning sectors, where detailed satellite images are crucial for decision-making and resource management. For instance, companies such as Planet Labs utilize small satellites equipped with advanced imaging sensors to provide daily updates on land use changes, crop health, and disaster impact. Moreover, the increasing focus on climate change and natural resource management has heightened the need for accurate remote sensing data to monitor environmental conditions. Technological advancements, such as the miniaturization of sensors and the integration of artificial intelligence for data processing, further enhance the capabilities of remote sensing satellites.

End Use Insights

The civil segment dominated the market with the largest revenue share in 2024 due to the increasing reliance on satellite technology for various civilian applications, including telecommunications, disaster management, and environmental monitoring. The need for enhanced connectivity and real-time data access across multiple sectors drives this growth. For instance, satellite imagery is crucial for urban planning and agriculture, enabling governments and organizations to monitor land use changes and optimize resource allocation. The growing emphasis on climate change initiatives and sustainable development also fuels the demand for satellite-based solutions that provide critical insights into environmental conditions.

The commercial store segment is expected to grow at the highest CAGR over the forecast period, driven by the increasing demand for advanced satellite payloads in telecommunications and earth observation. This growth is largely fueled by the proliferation of satellite constellations aimed at providing high-speed internet access globally. The development of software-defined satellites and quantum-based technologies further enhances operational flexibility and efficiency, enabling commercial entities to meet diverse customer needs more effectively. In addition, as businesses increasingly rely on satellite data for applications such as logistics, agriculture, and disaster management, the demand for innovative payload solutions continues to rise in the satellite payloads industry. This trend underscores the critical role of the commercial segment in expanding satellite capabilities and improving connectivity across various sectors.

Regional Insights

The North America satellite payloads market dominated the overall market with the largest revenue share of 34.6% in 2024, primarily due to its advanced technological infrastructure and significant satellite development and deployment investments. The U.S. plays a pivotal role in this market, driven by leading aerospace and defense companies such as Lockheed Martin and Northrop Grumman, which are at the forefront of innovation in satellite technology. Furthermore, substantial government support from NASA and the Department of Defense fosters a robust ecosystem for research, development, and operational missions. The increasing demand for communication services, particularly high-speed internet access through satellite constellations, also contributes to market growth.

U.S. Satellite Payloads Market Trends

The U.S. satellite payloads market dominated North America in 2024, driven by its significant technological advancements and robust investment in space programs. In 2022, the U.S. government allocated approximately USD 62 billion to space programs, reflecting its commitment to both civil and military satellite initiatives. This funding supports a wide range of projects, including satellite constellations for broadband services and advanced military communication systems. For instance, the U.S. Space Force's development of jam-resistant communication satellites exemplifies the country's focus on enhancing national security through satellite technology, driving the satellite payloads industry.

Asia Pacific Satellite Payloads Market Trends

Asia Pacific satellite payloads market is expected to grow at the highest CAGR over the forecast period due to the rapid expansion of the commercial space sector and increasing investments in satellite technology by countries such as China, India, and Japan. These countries are enhancing their space capabilities by deploying small satellites for various applications, including communication, Earth observation, and navigation. For instance, India's Polar Satellite Launch Vehicle (PSLV) has successfully launched numerous satellites, showcasing the country's growing expertise in satellite technology and its commitment to expanding its space program. In addition, the rising demand for satellite-based services in sectors such as agriculture, disaster management, and urban planning is propelling market growth.

The China satellite payloads market dominated the Asia Pacific region in 2024 with the largest revenue share, driven by its rapid advancements in space technology and significant government investment in satellite infrastructure. The Chinese government has prioritized space exploration and satellite development, leading to substantial funding and support for projects such as the Tiangong space station and the BeiDou Navigation Satellite System. These initiatives enhance national security and improve global positioning and communication capabilities. For instance, the BeiDou system has become a critical component for navigation services across Asia and beyond, competing with established systems such as GPS. In addition, China's growing commercial space sector, exemplified by companies such as China Aerospace Science and Technology Corporation (CASC), is driving demand for satellite payloads in telecommunications and Earth observation.

Europe Satellite Payloads Market Trends

Europe satellite payloads market is expected to grow significantly over the forecast period due to increasing demand for advanced satellite technologies and robust government support for space initiatives. Furthermore, there is a rising need for high-resolution Earth observation data, which is crucial for environmental monitoring, disaster management, and urban planning applications. For instance, the Copernicus Programme, an initiative by the European Union, aims to provide comprehensive Earth observation data to enhance environmental protection and climate change response. In addition, advancements in satellite miniaturization and the growing commercial space sector are facilitating the deployment of smaller, more efficient satellites at lower costs. Countries such as France and Germany are leading in satellite manufacturing and innovation, further bolstered by collaborative efforts with the European Space Agency.

Key Satellite Payloads Company Insights

Some key players in the satellite payloads market are AIRBUS, Lockheed Martin Corporation, Northrop Grumman, and Sierra Nevada Corporation. These companies employ various strategies to maintain a competitive edge, including investing heavily in research and development to innovate advanced satellite technologies. They focus on forming strategic partnerships and collaborations to enhance their product offerings and expand their market reach.

-

Lockheed Martin Corporation specializes in developing advanced satellite payload systems that support a wide range of applications, including communication, Earth observation, and defense. The company leverages innovative technologies to create high-precision payloads, such as imaging systems and radar, which enhance capabilities in surveillance and navigation.

-

Northrop Grumman is a key player in the satellite payloads market. It is known for its expertise in creating sophisticated payload systems tailored for communication, Earth observation, and national security applications. The company excels in developing high-performance sensors and imaging technologies that enhance satellite capabilities.

Key Satellite Payloads Companies:

The following are the leading companies in the satellite payloads market. These companies collectively hold the largest market share and dictate industry trends.

- AIRBUS

- Lockheed Martin Corporation

- L3Harris Technologies, Inc.

- Northrop Grumman

- Sierra Nevada Corporation

- Boeing

- General Dynamics Corporation

- Thales Group

- Honeywell International, Inc.

- MITSUBISHI HEAVY INDUSTRIES, LTD.

Recent Developments

-

In March 2024, Northrop Grumman Corporation successfully activated the U.S. Space Force's Enhanced Polar System - Recapitalization (EPS-R) payloads as part of the Arctic Satellite Broadband Mission (ASBM). These satellites, equipped with advanced X-band and Ka-band connectivity payloads for the Norwegian Ministry of Defense and Viasat, aim to enhance secure military communications in the Arctic region.

-

In November 2023, Lockheed Martin completed the final demonstration of its Advanced 5G Non-Terrestrial Network (NTN) Satellite Base Station, which marked a significant step toward launching the first 5G.MIL payload into orbit. This innovative satellite base station is designed to deliver advanced global communication capabilities from space, enhancing secure connectivity for military operations. The demonstration validated high-speed data transfers and live video streaming, showcasing compliance with industry standards.

Satellite Payloads Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 10.82 billion

Revenue forecast in 2030

USD 21.79 billion

Growth rate

CAGR of 15.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Size, application, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, Australia, South Korea, Brazil, South Africa, Saudi Arabia, UAE

Key companies profiled

AIRBUS; Lockheed Martin Corporation; L3Harris Technologies, Inc.; Northrop Grumman; Sierra Nevada Corporation; Boeing; General Dynamics Corporation; Thales Group; Honeywell International, Inc.; MITSUBISHI HEAVY INDUSTRIES, LTD.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Satellite Payloads Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global satellite payloads market report based on size, application, end use, and region:

-

Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Low Earth Orbit (LEO)

-

Medium Earth Orbit (MEO)

-

Geostationary Earth Orbit (GEO)

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Communication and Navigation

-

Remote Sensing

-

Surveillance

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Civil

-

Military

-

Commercial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.