- Home

- »

- Plastics, Polymers & Resins

- »

-

Sauces, Dressings And Condiments Packaging Market, 2030GVR Report cover

![Sauces, Dressings And Condiments Packaging Market Size, Share & Trends Report]()

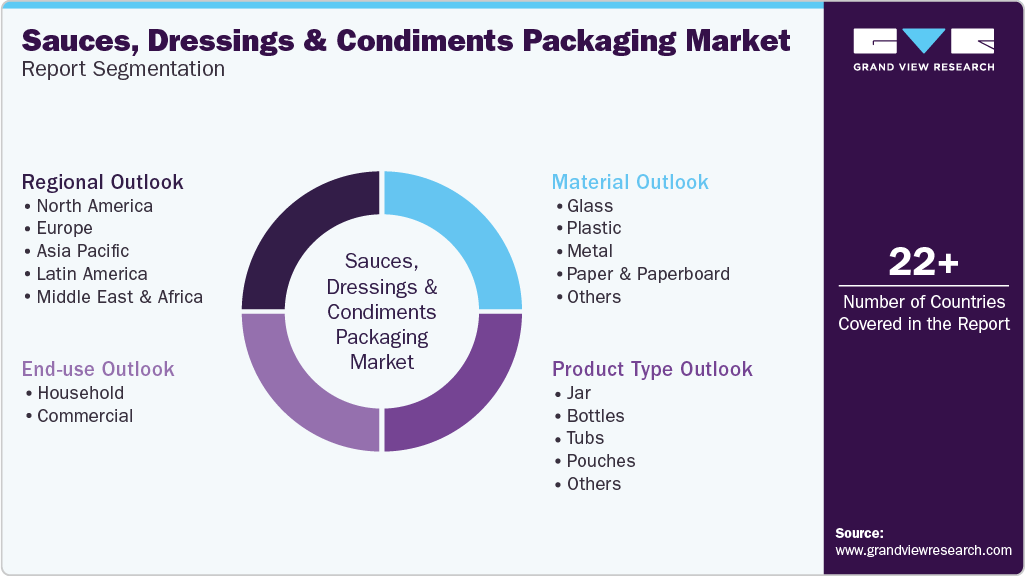

Sauces, Dressings And Condiments Packaging Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Glass, Plastic, Metal, Paper & Paperboard, Others), By Product Type (Jars, Bottles, Tubs), By End Use (Household, Commercial), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-593-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

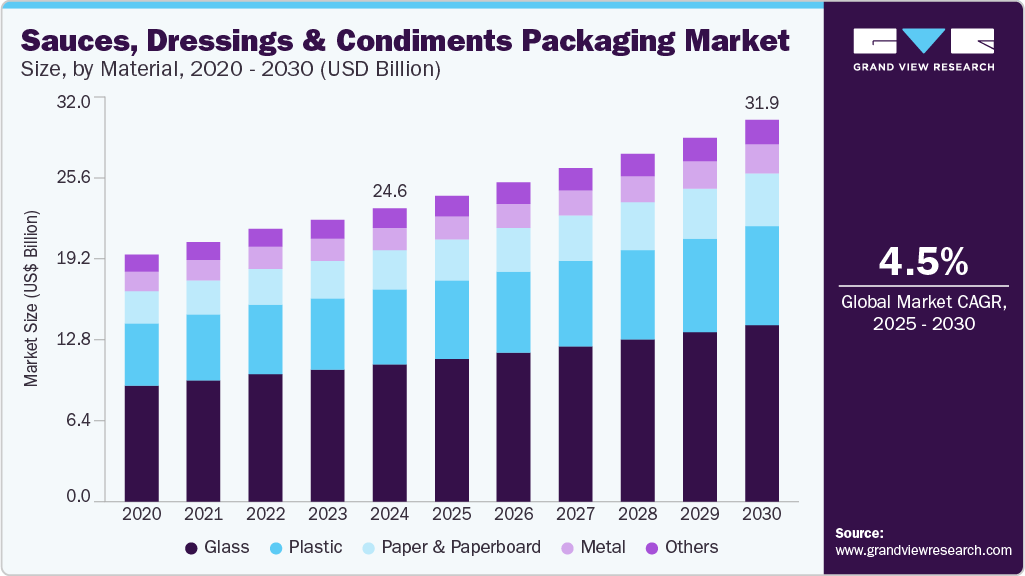

The global sauces, dressings and condiments packaging market was estimated at USD 24.59 billion in 2024 and is expected to grow at a CAGR of 4.5% from 2025 to 2030. Rising demand for convenient, ready-to-use food products and increasing global consumption of fast food are key drivers of the sauces.

Key Highlights:

- Asia Pacific sauces, dressings and condiments packaging market dominated the global market. It accounted for the largest revenue share of over 36.0% in 2024

- The growth of China sauces, dressings and condiments packaging market is due to its massive food industry and export capabilities

- In terms of segment, the glass segment recorded the largest revenue share of over 46.0% in 2024

- In terms of segment, the jar segment recorded the largest market revenue share of over 39.0% in 2024

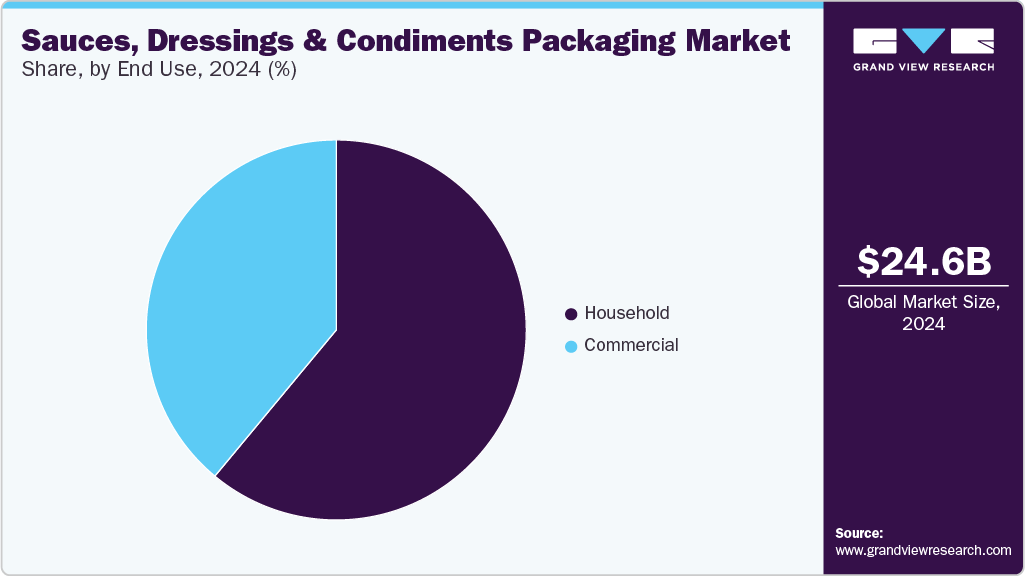

- In terms of segment, the household segment recorded the largest revenue share of over 61.0% in 2024

Dressings, and condiments packaging market. Additionally, innovation in packaging formats such as squeezable bottles and single-serve pouches is fueling market growth. The sauces, dressings, and condiments packaging market is driven by the evolving consumption patterns among global consumers, especially the rising demand for convenience foods. With busy lifestyles and increased urbanization, consumers are looking for easy-to-use, portable, and resealable packaging that preserves freshness and allows portion control. For instance, single-serve sachets and squeezable pouches are gaining traction for ketchup, salad dressings, and mayonnaise, particularly in fast food chains, airline meals, and lunchboxes. This convenience factor is prompting brands to invest in innovative packaging formats that align with the on-the-go consumption trend.

A strong emphasis on sustainability is another major driver influencing packaging decisions in this market. Environmental awareness among consumers and pressure from governments to reduce plastic waste have led companies to adopt eco-friendly materials such as recyclable plastics, biodegradable films, and paper-based packaging. For example, Hellmann’s introduced a 100% recycled plastic bottle for its mayonnaise, which not only caters to eco-conscious consumers but also strengthens the brand’s sustainability credentials. Such initiatives are becoming increasingly important for differentiation and consumer loyalty in a competitive market.

Branding and product differentiation also play a critical role in driving packaging innovation. The shelf appeal of sauces and condiments is heavily influenced by packaging aesthetics, as vibrant, informative, and premium-looking containers often sway consumer preferences at the point of sale. Glass jars with embossed logos or high-quality squeeze bottles with flip-top caps can convey a sense of premium quality and gourmet positioning. Transparent packaging, which allows consumers to see the product inside, is another emerging trend that boosts trust and drives purchasing decisions.

Additionally, the rise of e-commerce and direct-to-consumer food channels has prompted a shift in packaging priorities. Products now require packaging that ensures durability during transit while maintaining brand identity and user experience. For instance, rigid PET bottles and leak-proof closures are increasingly preferred for online retail. Moreover, QR codes and smart labels are being embedded into packaging to offer consumers traceability, recipe ideas, or promotional content, enhancing engagement and fostering brand loyalty in a digital-first retail environment.

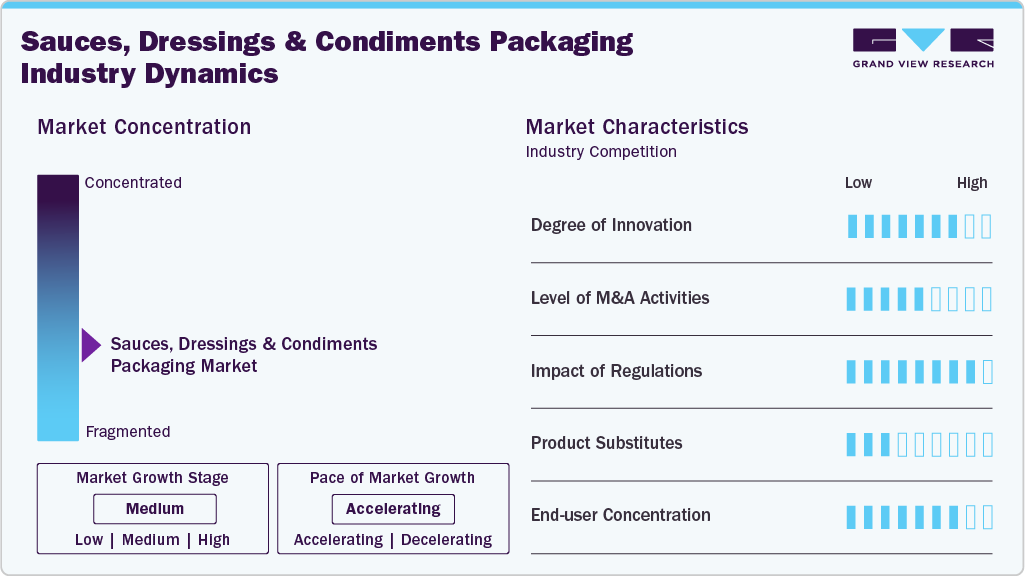

Market Concentration & Characteristics

The industry serves a highly fragmented and diversified market, encompassing a wide range of sauces (e.g., hot sauces, pasta sauces), dressings (e.g., vinaigrettes, creamy dressings), and condiments (e.g., mustard, ketchups, chutneys). Each product has different viscosity, shelf life, and storage requirements, which means packaging must be tailored to match. For example, tomato-based sauces often need high-barrier pouches to prevent oxidation, while oil-based dressings may require UV-resistant bottles. This results in the need for flexible, customizable packaging solutions in terms of materials, closures, and form factors.

The industry is innovation-intensive, particularly in response to sustainability demands and consumer convenience. New developments include compostable film wraps, lightweight PET alternatives, and refillable container systems. Besides, there is an increasing adoption of eco-friendly and recyclable materials, driven by consumer expectations and tightening environmental regulations.

For instance, in November 2024, MasterFoods, a flagship brand of Mars Food & Nutrition Australia, announced a pioneering trial of Australia’s first paper-recyclable single-serve tomato sauce packs, which use 58% less plastic than the original packaging and can be recycled via standard kerbside collection. The trial witnessed over one million units distributed for consumer evaluation at locations such as sporting stadiums, petrol stations, mining sites, and pie shops.

Material Insights

The glass segment recorded the largest revenue share of over 46.0% in 2024. Glass is a traditional and premium packaging material used widely for sauces, dressings, and condiments such as ketchup, mayonnaise, mustard, and specialty sauces. Its non-reactive nature ensures product integrity, and it offers excellent barrier properties against oxygen and moisture, helping preserve flavor and shelf life. Glass packaging is driven by its premium brand positioning, chemical inertness, and recyclability. Consumers increasingly associate glass with purity and sustainability. Additionally, high-end and organic brands often prefer glass for its aesthetics and perceived quality.

The paper & paperboard segment is expected to grow at the fastest CAGR of 5.0% during the forecast period. Paper and paperboard are emerging as eco-friendly alternatives for secondary and, increasingly, primary packaging in the sauces and condiments market. Common uses include cartons, wraps, and laminated paper-based pouches or boxes. The main drivers for the paper & paperboard segment are sustainability trends, government regulations favoring biodegradable materials, and consumer preference for eco-friendly packaging.

Product Type Insights

The jar segment recorded the largest market revenue share of over 39.0% in 2024 and is expected to grow at the fastest CAGR of 4.8% during the forecast period. Jars, typically made of glass or rigid plastic, are favored for premium sauces and condiments such as pesto, chutney, or mayonnaise. They offer a durable, resealable packaging solution with strong product visibility. Their wide-mouth openings make scooping or spooning easier, which enhances consumer convenience. The premium appearance and reusability of jars appeal to environmentally conscious and health-conscious consumers. Additionally, the rising demand for clean-label and artisanal products supports the use of jars as they symbolize quality and freshness.

Bottles are among the most widely used packaging formats for sauces and condiments such as ketchup, mustard, and salad dressings. Available in both glass and plastic, bottles offer convenience in dispensing and effective sealing to maintain freshness. Squeeze and flip-top designs also enhance user convenience, boosting their popularity in both household and foodservice segments.

Flexible pouches, particularly stand-up and spouted variants, are gaining rapid traction for packaging condiments, salad dressings, and marinades. They offer lightweight and space-saving benefits and are considered a sustainable alternative to rigid packaging. The shift toward lightweight, portable, and environmentally friendly packaging solutions supports the growth of pouches. They also offer cost advantages in logistics and appeal to convenience-focused consumers seeking easy squeeze and minimal-waste designs.

End Use Insights

The household segment recorded the largest revenue share of over 61.0% in 2024. Household packaging caters to individual consumers and families who purchase sauces, dressings, and condiments for daily domestic use. These packages are typically smaller in size and are designed for convenience, resealability, and shelf-stability. Driving factors for the household segment include the increasing trend of at-home cooking and meal customization, especially post-pandemic, where consumers have grown accustomed to experimenting with global cuisines at home. The rising popularity of online grocery shopping and private-label sauces has also supported the growth of this segment.

The commercial segment is projected to grow at the fastest CAGR of 4.7% during the forecast period. Commercial packaging serves restaurants, catering services, hotels, and institutional foodservice providers. These packages are generally larger and are optimized for high-volume use, cost-efficiency, and storage. The commercial segment is driven by the expanding global foodservice industry, particularly the growth of fast-food chains, cloud kitchens, and quick-service restaurants (QSRs). Increasing urbanization, out-of-home eating, and delivery-centric business models have elevated the demand for bulk and portion-controlled packaging.

Regional Insights

Asia Pacific sauces, dressings and condiments packaging market dominated the global market. It accounted for the largest revenue share of over 36.0% in 2024 and is projected to grow at the fastest CAGR of 4.8% during the forecast period. This outlook is due to the rapid urbanization, increasing disposable incomes, and a growing preference for convenience foods. Countries such as China, India, and Japan are witnessing a surge in demand for packaged sauces, driven by busy lifestyles and the influence of Western cuisine. For example, in India, brands such as Kissan and Maggi use single-serve sachets for ketchup and sauces, catering to price-sensitive consumers.

China Sauces, Dressings And Condiments Packaging Market Trends

The growth of China sauces, dressings and condiments packaging market is due to its massive food industry and export capabilities. The country’s demand for soy sauce, oyster sauce, and chili pastes is met with a mix of traditional (glass bottles) and modern (flexible pouches) packaging. For example, Lee Kum Kee uses PET bottles and portion-controlled sachets for its sauces. E-commerce and food delivery growth have increased the need for spill-proof, lightweight packaging.

North America Sauces, Dressings And Condiments Packaging Market Trends

North America sauces, dressings and condiments packaging market’s growth is due to a high consumption of processed foods and a strong presence of major food brands. The U.S. and Canada favor convenient, resealable packaging such as squeeze bottles (e.g., Heinz ketchup), plastic jars (e.g., Hellmann’s mayonnaise), and portion-controlled packets for foodservice. Health trends are driving demand for clean-label and organic products, leading to innovations in recyclable and lightweight packaging. For instance, Primal Kitchen uses glass bottles for its organic dressings to appeal to health-conscious consumers.

The U.S. sauces, dressings and condiments packaging market dominates the North American market due to its high consumption of ketchup, BBQ sauces, and salad dressings. Brands such as Kraft and Hidden Valley use squeeze bottles with flip-top caps for convenience, while startups such as Sir Kensington’s use glass bottles for premium positioning. The rise of meal kits, such as Blue Apron, has increased demand for single-serve condiment packets. The foodservice sector further boosts demand for bulk packaging formats such as bag-in-box for restaurants.

Europe Sauces, Dressings And Condiments Packaging Market Trends

Europe sauces, dressings, and condiments packaging market is driven by stringent sustainability regulations and consumer demand for premium, eco-friendly packaging. Countries such as Germany, France, and the UK are shifting toward glass jars, recyclable PET bottles, and compostable pouches to reduce plastic waste. For example, brands such as Knorr (Unilever) use recyclable paper-based packaging for dry sauces in Europe. The region also sees a rise in gourmet and ethnic sauces, leading to innovative packaging designs with enhanced shelf appeal.

Germany sauces, dressings and condiments packaging market is shaped by sustainability and efficiency. Glass jars and recyclable plastic bottles dominate retail shelves, with brands such as Hengstenberg using resealable glass bottles for gourmet sauces. The country’s strict recycling laws encourage the use of mono-material plastics and biodegradable options. Germany’s strong export market also drives demand for durable, long-shelf-life packaging for products such as mustard and mayonnaise.

Key Sauces, Dressings And Condiments Packaging MarketInsights

The competitive environment of the sauces, dressings, and condiments packaging market is highly dynamic. Key players such as Amcor plc, Berry Global Inc., Huhtamaki, and ALPLA compete on factors such as material innovation, functional designs, and cost efficiency. Regional players also challenge global giants by offering localized, cost-effective solutions. Sustainability regulations and shifting consumer preferences toward eco-friendly packaging are reshaping the market, forcing players to invest in R&D and strategic partnerships to maintain competitiveness.

-

In April 2024, INAMED, a Mediterranean agro-food company, in collaboration with aseptic packaging provider SIG, launched a range of El Boustane sauces in Algeria featuring innovative carton packaging, a first for the country. The sauces are packaged in SIG Small carton packs of various volumes (150 to 350 ml), aseptically filled using the SIG Small 12 Aseptic filling machine, which can fill 12,000 packs per hour. This packaging offers consumers convenience and long-lasting quality without refrigeration or preservatives.

-

In April 2024, Kari-Out Co., an American foodservice packaging manufacturer and distributor, launched the first-ever plant-based, 100% compostable condiment packet, marking a significant innovation in sustainable food packaging. These new packets are TUV Certified, home compostable, and designed to maintain product quality and shelf life while protecting the environment.

Key Sauces, Dressings And Condiments Packaging Companies:

The following are the leading companies in the sauce, dressings and condiments packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Amcor plc

- Berry Global Inc.

- ALPLA

- Huhtamaki

- Silgan Plastics

- AptarGroup, Inc.

- ProAmpac

- CDF Corporation

- Graham Packaging

- Winpak LTD.

- Aran Group

- Constantia Flexibles

- SIG

- Novel, Inc.

- Tetra Pak

Sauces, Dressings And Condiments Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 25.62 billion

Revenue forecast in 2030

USD 31.93 billion

Growth rate

CAGR of 4.5% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, product type, end use, region

States scope

North America; Europe; Asia Pacific; Latin America; and Middle East & Africa

Key companies profiled

Amcor plc; Berry Global Inc.; ALPLA; Huhtamaki; Silgan Plastics; AptarGroup, Inc.; ProAmpac; CDF Corporation; Graham Packaging; Winpak LTD.; Aran Group; Constantia Flexibles; SIG; Novel, Inc.; Tetra Pak

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sauces, Dressings And Condiments Packaging Market Report Segmentation

This report forecasts revenue growth at a global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global sauces, dressings and condiments packaging market report based on material, product type, end use, and region:

-

Material Outlook (Revenue, USD Million 2018 - 2030)

-

Glass

-

Plastic

-

Metal

-

Paper & Paperboard

-

Others

-

-

Product Type Outlook (Revenue, USD Million 2018 - 2030)

-

Jar

-

Bottles

-

Tubs

-

Pouches

-

Others

-

-

End Use Outlook (Revenue, USD Million 2018 - 2030)

-

Household

-

Commercial

-

-

Region Outlook (Revenue, USD Million 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global sauces, dressings and condiments packaging market was estimated at around USD 24.59 billion in the year 2024 and is expected to reach around USD 25.62 billion in 2025.

b. The global sauces, dressings and condiments packaging market is expected to grow at a compound annual growth rate of 4.5% from 2025 to 2030 to reach around USD 31.93 billion by 2030.

b. The household segment dominated the sauces, dressings and condiments packaging market in 2024 with over 61.0% value share due to a rising popularity of online grocery shopping and private-label sauces.

b. The key players in the sauces, dressings and condiments packaging market include Amcor plc; Berry Global Inc.; ALPLA; Huhtamaki; Silgan Plastics; AptarGroup, Inc.; ProAmpac; CDF Corporation; Graham Packaging; Winpak LTD.; Aran Group; Constantia Flexibles; SIG; Novel, Inc.; Tetra Pak.

b. The sauces, dressings, and condiments packaging market is driven by rising consumer demand for convenient, ready-to-use food products and increasing preference for sustainable, innovative packaging solutions. Additionally, the growth of e-commerce and global foodservice sectors boosts demand for durable, attractive packaging.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.