- Home

- »

- Advanced Interior Materials

- »

-

Scissor Lift Market Size, Share And Growth Report, 2030GVR Report cover

![Scissor Lift Market Size, Share & Trends Report]()

Scissor Lift Market (2025 - 2030) Size, Share & Trends Analysis Report By Engine Type (Electric, Engine-powered), By Lift Height (Less Than 10 M, 10 To 20 M, More Than 20 M), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-027-3

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Scissor Lift Market Summary

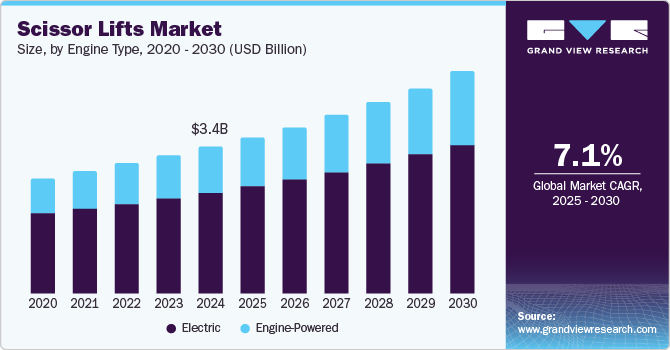

The global scissor lift market size was estimated at USD 3.43 billion in 2024 and is expected to grow at a CAGR of 7.1% from 2025 to 2030. This growth is attributed to the expanding infrastructure and construction activities worldwide, fueled by rapid urbanization and increasing investments in residential and commercial projects.

Key Market Trends & Insights

- North America dominated the global scissor lift market with the largest revenue share of 35.9% in 2024.

- The scissor lift market in the U.S. led the North America market and held the largest revenue share in 2024.

- By engine type, the electric segment led the market, holding the largest revenue share of 68.7% in 2024.

- By lift height, the 10 to 20-meter segment is expected to grow at the fastest CAGR of 6.9% from 2025 to 2030.

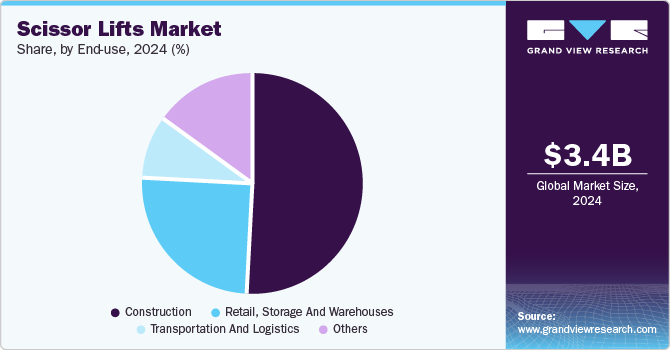

- By end use, the construction segment held the dominant position in the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.43 Billion

- 2030 Projected Market Size: USD 5.15 Billion

- CAGR (2025-2030): 7.1%

- North America: Largest market in 2024

In addition, technological advancements enhance the efficiency and safety of scissor lifts, making them essential for various industries, including manufacturing and logistics. Moreover, the growing emphasis on workplace safety regulations further propels demand, as scissor lifts offer a safer alternative to traditional access methods such as ladders.

A scissor lift, also referred to as an aerial work platform (AWP) or mobile elevated work platform (MEWP), is a motorized device designed to transport personnel and equipment to hard-to-reach heights. These versatile platforms support scaffolding, enhance operational efficiency, and provide a safer alternative to ladders and towers. Their mobility makes them invaluable across various sectors, including construction, retail, entertainment, and manufacturing, particularly for temporary maintenance tasks.

The market is experiencing significant growth due to several factors. Rapid industrialization and the increasing demand for streamlined operations are key drivers behind this expansion. In addition, electric scissor lifts are gaining popularity because they produce no harmful emissions, ensuring a safe indoor environment while minimizing noise pollution. Their high stability and operational efficiency make them ideal for residential construction, building maintenance, and utility projects.

In addition, substantial investments in infrastructure by governments and private entities are further propelling market growth. Manufacturers are also innovating by integrating technologies such as the Internet of Things (IoT) and Artificial Intelligence (AI) to enhance performance. Introducing compact electric scissor lifts equipped with smart control panels is expected to influence market dynamics positively.

Moreover, as industries prioritize safety and efficiency, the demand for scissor lifts continues to rise. These platforms facilitate tasks at elevated heights and contribute to improved productivity and reduced project timelines. With ongoing advancements in technology and design, the scissor lift market is poised for sustained growth as it adapts to meet the evolving needs of various sectors.

Engine Type Insights

The electric engine type dominated the market and accounted for the largest revenue share of 68.7% in 2024, attributed to the increasing demand for environmentally friendly and efficient lifting solutions. In addition, as industries become more aware of their carbon footprints, the preference for electric models has surged due to their zero-emission operation, which aligns with stringent environmental regulations. Furthermore, electric scissor lift engines are also favored for their lower operating costs and reduced noise levels, making them ideal for indoor applications. The construction sector's ongoing expansion further fuels this demand as electric lifts are increasingly utilized for various tasks, enhancing productivity while ensuring safety in elevated work environments.

The engine-powered is expected to grow at a CAGR of 7.8% over the forecast period, owing to its robustness and suitability for outdoor applications. These lifts are particularly advantageous in construction sites with common heavy lifting and rough terrain. In addition, engine-powered models provide greater power and can operate in diverse weather conditions, making them essential for extensive construction and industrial projects. Furthermore, global rising infrastructure development drives demand for these lifts, as they can handle significant loads and offer high mobility across challenging terrains. Moreover, advancements in engine technology are improving fuel efficiency and reducing emissions, making engine-powered scissor lifts a more appealing option for many industries.

Lift Height Insights

The less than 10 meters segment led the market and accounted for the largest revenue share of 46.8% in 2024, driven by its versatility and suitability for various indoor applications. These lifts are particularly favored in retail, warehousing, and maintenance sectors, where space constraints often limit the use of larger equipment. Furthermore, their compact size allows easy maneuverability in tight spaces, making them ideal for inventory management and building maintenance tasks. Moreover, the increasing focus on workplace safety and efficiency further propels the demand for these lifts, providing a safer alternative to ladders while enhancing productivity.

10 to 20-meter lift height is expected to grow at a CAGR of 6.9% over the forecast period, owing to the rising demand for medium-height access solutions in construction and maintenance operations. In addition, this range strikes an optimal balance between reach and stability, making it suitable for various applications, including electrical work and building repairs. Furthermore, the ongoing expansion of infrastructure projects globally contributes significantly to this segment's growth, as these lifts are essential for tasks that require elevated access without compromising safety. Moreover, technological advancements have led to the development of more efficient and ergonomic models within this height range, further driving their adoption across multiple industries.

End-use Insights

The construction segment dominated the market and accounted for the largest revenue share of 50.7% in 2024 attributed to the increasing infrastructure development and urbanization investments. As governments and private entities invest heavily in new construction projects, the demand for efficient lifting solutions rises. In addition, scissor lifts provide essential support for building maintenance, installation, and repairs at height, enhancing productivity and safety on job sites. Furthermore, the shift towards more complex construction projects also necessitates reliable equipment that can handle various tasks efficiently, further boosting the market.

The transportation and logistics segment is expected to grow at a CAGR of 8.6% from 2025 to 2030, owing to the rapid expansion of e-commerce and the need for efficient warehousing solutions. As online shopping continues to rise, logistics companies are investing in modernizing their warehouses to improve operational efficiency. In addition, scissor lifts are crucial in facilitating the movement of goods within these facilities, enabling efficient stacking, picking, and handling of products. Moreover, the emphasis on optimizing space and improving warehouse workflow drives demand for scissor lifts, making them indispensable tools in the logistics sector.

Regional Insights

The growth of the scissor lift market in North America dominated the global market and accounted for the largest revenue share of 35.9% in 2024 attributed to a surge in online shopping and the increasing demand for efficient logistics solutions. In addition, the expanding construction industry, supported by significant investments in infrastructure, further boosts the need for reliable lifting equipment. Furthermore, as retail and construction activities intensify, scissor lifts are becoming essential tools for enhancing productivity and safety on job sites, making North America a prominent market for these devices.

U.S. Scissor Lift Market Trends

The U.S. scissor lift market led the North American market and accounted for the largest revenue share in 2024, driven by substantial infrastructure investments and a booming construction sector. In addition, the ongoing development of residential and commercial projects necessitates effective access solutions for maintenance and installation tasks. Moreover, as various industries prioritize safety and efficiency, scissor lifts are increasingly recognized as vital equipment that enhances operational capabilities on construction sites.

Asia Pacific Scissor Lift Market Trends

The scissor lift market in the Asia Pacific is expected to grow at a CAGR of 7.2% over the forecast period, owing to urbanization and infrastructure development. Countries in this region invest heavily in construction projects to accommodate their growing populations. In addition, the rise of e-commerce also contributes to the demand for scissor lifts in the logistics and warehousing sectors as companies seek efficient ways to manage inventory and fulfill orders. This combination of factors positions Asia Pacific as a key player in the global scissor lift market.

The China scissor lift market dominated Asia Pacific in 2024, driven by significant government infrastructure and urban development investments. The focus on modernizing cities and enhancing transportation networks has increased construction activities. Furthermore, the growing emphasis on safety standards in construction drives demand for reliable lifting equipment such as scissor lifts. As China continues its infrastructure development, the need for efficient access solutions is likely to increase.

Europe Scissor Lift Market Trends

The scissor lift market in Europe is expected to grow significantly over the forecast period. This growth is attributed to stringent safety regulations and a strong focus on sustainability in construction practices. In addition, the commitment to reducing carbon emissions has led to a rise in electric scissor lifts, which aligns with environmental goals. Furthermore, ongoing renovations of aging infrastructure across many European countries create a consistent demand for lifting equipment.

The growth of Germany scissor lift market is fueled by robust industrial activity and a thriving construction sector. The country’s emphasis on high-quality engineering and innovation drives demand for advanced lifting solutions that enhance operational efficiency. Furthermore, Germany's commitment to sustainability encourages the adoption of electric scissor lifts, which are increasingly favored for their eco-friendly attributes. Moreover, as construction projects expand, Germany remains a vital market for scissor lift manufacturers.

Key Scissor Lift Company Insights

Some of the key players in the market include Terex Corporation, Galmon (S) Pte Ltd, Aichi Corporation, and others. These companies adopt various strategies to strengthen their market position. These strategies include new product launches focusing on innovative designs and advanced features, enhancing performance and safety. In addition, strategic collaborations with industry partners facilitate technology sharing and market expansion. Furthermore, mergers and acquisitions allow companies to consolidate resources, diversify their product offerings, and access new markets, ultimately driving growth and competitiveness in the scissor-lift sector. Other relevant strategies include investing in research and development to improve product efficiency and sustainability.

-

Terex Corporation manufactures various aerial work platforms, including electric and engine-powered scissor lifts. The company operates in the construction and industrial equipment segment, providing solutions that enhance productivity and safety for various applications. Terex's scissor lifts are designed for indoor and outdoor use, catering to diverse sectors such as construction, maintenance, and warehousing, where reliable access to elevated areas is essential.

-

JLG Industries produces electric and engine-powered models that offer versatility and efficiency for various tasks at height. Operating within the industrial equipment segment, JLG Industries emphasizes advanced technology and safety features in its products, ensuring that its scissor lifts meet customers' needs across multiple sectors, including logistics, entertainment, and infrastructure development.

Key Scissor Lift Companies:

The following are the leading companies in the scissor lift market. These companies collectively hold the largest market share and dictate industry trends.

- Terex Corporation

- Manitou Group

- JLG Industries

- Galmon (S) Pte Ltd

- Aichi Corporation

- EdmoLift AB

- Haulotte Group

- Wiese USA

- Linamar Corporation

- Advance Lifts, Inc.

- LGMG North America, Inc.

- Shandong Qiyun Group Co., Ltd.

Recent Developments

-

In March 2024, Manitou Group declared the launch of a new variety of scissor lifts, enhancing its offerings in the aerial work platform market. The initial lineup includes the SE 0808 and SE 1008, with working heights of 8 meters and 10 meters, respectively, and a third model, the SE 1212, expected later this year. These scissor lifts are designed for indoor and outdoor use and feature efficient AC motors, low maintenance costs, and user-friendly controls.

-

In February 2024, JLG Industries announced the launch of the ES4046 electric scissor lift, enhancing its lineup of mobile elevating work platforms. This new scissor lift features an application-driven design, improved performance capabilities, and a focus on operator support. The ES4046 includes standard JLG ClearSky Smart Fleet technology for fleet tracking and enhanced safety and efficiency options. With a platform height of 39 feet indoors and advanced features such as a zero-turning radius, this scissor lift is designed to meet the evolving demands of modern job sites.

Scissor Lift Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.66 billion

Revenue forecast in 2030

USD 5.15 billion

Growth rate

CAGR of 7.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Engine type, lift height, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, India, Japan, South Korea, Brazil, Argentina, South Africa, Saudi Arabia

Key companies profiled

Terex Corporation; Manitou Group; JLG Industries; Galmon (S) Pte Ltd; Aichi Corporation; EdmoLift AB; aulotte Group; Wiese USA; Linamar Corporation; Advance Lifts, Inc.; LGMG North America, Inc.; Shandong Qiyun Group Co., Ltd.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

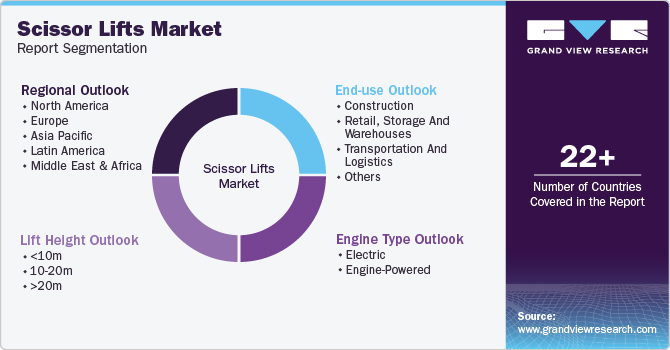

Global Scissor Lift Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global scissor lift market report based on engine type, lift height, end-use, and region:

-

Engine Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Electric

-

Engine-Powered

-

-

Lift Height Outlook (Revenue, USD Million, 2018 - 2030)

-

<10m

-

10-20m

-

>20m

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Construction

-

Retail, Storage and Warehouses

-

Transportation and Logistics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.