- Home

- »

- Pharmaceuticals

- »

-

Scleroderma Therapeutics Market Size, Industry Report 2030GVR Report cover

![Scleroderma Therapeutics Market Size, Share & Trends Report]()

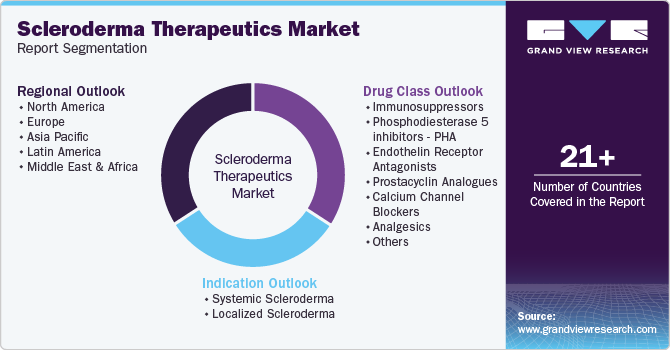

Scleroderma Therapeutics Market (2025 - 2030) Size, Share & Trends Analysis Report By Drug Class (Immunosuppressors, ERA, CCBs, PA), By Indication (Systemic, Localized), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-219-8

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

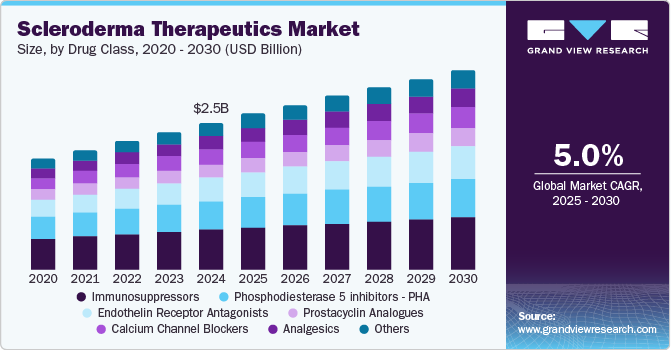

The global scleroderma therapeutics market was valued at USD 2.53 billion in 2024 and is projected to grow at a CAGR of 5.0% from 2025 to 2030. The increasing prevalence of autoimmune disease globally, the rising need to develop effective and advanced treatment options, and the growing emphasis on research and development are major drivers for the growth of this market.

According to the National Organization for Rare Disorders, systemic scleroderma is more prevalent in the 30-to 50-year-old age group, and approximately one in every 10,000 individuals is affected by it. In addition, the disease can cause further complications in patients. For instance, according to Boehringer Ingelheim Pharmaceuticals, Inc., approximately 53% of patients with dcSSc and 35% of patients with IcSSC can develop ILD. This further drives the need for early diagnosis and treatment of scleroderma, which will likely drive market growth.

In addition, there is no cure for the overproduction of collagen caused by scleroderma, and treatments only help manage symptoms. This is driving the need for research and development to find effective treatment options. This is further expected to increase the number of clinical trials and boost the development of biologics for scleroderma, further driving market growth. For instance, F. Hoffman La-Roche Ltd also conducted a study to assess the safety and efficacy of Tocilizumab in patients with systemic sclerosis (SSc) (FocuSSced).

Drug Class Insights

The immunosuppressors segment accounted for the largest share of 27.4% in 2024. Immunosuppressive therapies help manage severe symptoms in scleroderma, particularly those affecting internal organs such as the lungs, heart, and kidneys. For instance, a research study published by the BMJ Publishing Group Ltd. in July 2024 showed that. Immunosuppressive treatment was associated with lower GIT scores in patients with SSc, which can further help with symptom management and drive segment growth.

The endothelin receptor antagonists segment is expected to grow at the fastest CAGR of 5.7% over the forecast period from 2025 to 2030. Endothelin receptor antagonists are effective in managing pulmonary arterial hypertension (PAH), a common and severe complication in scleroderma patients. This significance of endothelin receptor antagonists is likely to add to the segment's further growth.

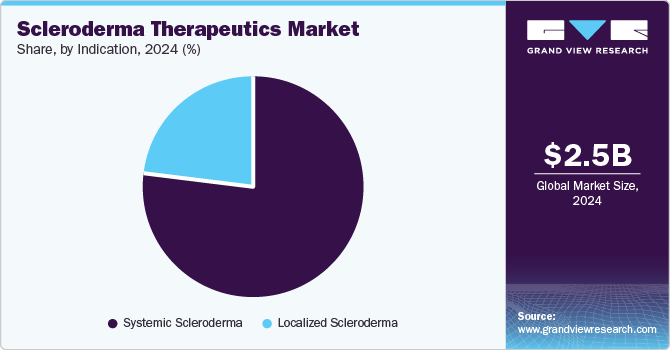

Indication Insights

Systemic scleroderma accounted for the largest market share of 77.4% in 2024, owing to the increasing prevalence of the disease. For instance, according to the Boehringer Ingelheim International GmbH, the disease affects approximately 100,000 people in the U.S. and 2.5 million worldwide and can develop further health complications such as interstitial lung disease (ILD). This has led to the need to develop advanced solutions that are likely to drive segment growth.

Localized scleroderma, which affects a part of the body and causes thick patches on the skin, is expected to grow at the fastest CAGR of 8.0% over the forecast period. Most symptoms related to localized scleroderma are managed with observation, topical medications, phototherapy, or systemic immunosuppressive therapy. However, only limited evidence supports these treatment options, which is expected to boost further research and investment in the segment, driving market growth.

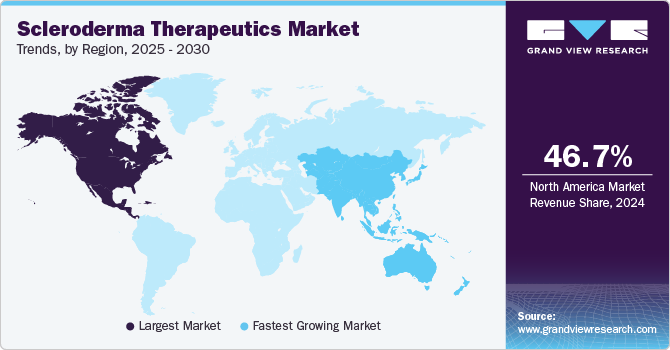

Regional Insights

North American scleroderma therapeutics market accounted for the largest market revenue share of 46.7% in 2024. The growth of the market can be attributed to the presence of a well-established healthcare system in the region, increasing awareness regarding autoimmune diseases, and the availability and access to advanced treatment options.

U.S. Scleroderma Therapeutics Market Trends

The U.S. market accounted for 90.6% share of the North America scleroderma therapeutics market in 2024. The increasing awareness and availability of treatment options for autoimmune diseases are majorly driving the market growth in the country. For instance, according to the information published by the National Institute of Environmental Health Sciences, approximately 50 million people in the U.S. suffer from autoimmune diseases, which is further expected to drive demand in the market.

Europe Scleroderma Therapeutics Market Trends

The European scleroderma therapeutics market is expected to grow significantly over the forecast period owing to well-established healthcare infrastructure, increasing awareness regarding rare diseases, and the presence of key players in the market, such as F. Hoffman La-Roche Ltd. and Sanofi. According to the European Union's data, approximately 27 to 36 million people in the region live with rare diseases.

The UK scleroderma therapeutics market is expected to grow significantly over the forecast period. The increasing research and development support from the government and the presence of organizations to work to create awareness and help patients with scleroderma are driving the market growth in the country. For instance, Scleroderma & Raynaud's UK (SRUK) is a UK-based organization that works to help people with Scleroderma and Raynaud's by investing in research and improving awareness and understanding about the disease.

The German scleroderma therapeutics market held the largest market share in 2024. The presence of a well-established healthcare system in the country and increasing efforts by private and public players to invest in the development of advanced healthcare solutions are expected to drive market growth in the country.

Asia Pacific Scleroderma Therapeutics Market Trends

The Asia Pacific scleroderma therapeutics market is anticipated to grow at the fastest CAGR of 7.8% over the forecast period. The economic growth in countries such as Japan, China, and India and their increasing investments in increasing access to diagnostic tools and advanced therapies are major factors driving market growth in the region. In addition, the presence of key regional players and their expansion activities are further expected to drive regional development. For instance, in July 2024, Boehringer Ingelheim collaborated with the Asian Hospital and Medical Centre in the Philippines to support the management of rare diseases, such as interstitial lung disease (ILD).

The Japan scleroderma therapeutics market accounted for a significant market share in 2024 due to the rising prevalence of autoimmune diseases and government initiatives to improve healthcare access in the region. The key players are also expanding in the region to offer solutions for various autoimmune diseases, which is further expected to drive market growth. For instance, in August 2024, Biocon Biologics announced its collaboration with Janssen to launch a biosimilar medication for autoimmune diseases in different regions, including Japan.

The India scleroderma therapeutics market is expected to grow significantly owing to the advancements in diagnostic capabilities, increasing patient awareness, and expanding clinical trials and research initiatives in India. The presence of key pharmaceutical companies, both local and international, and their research and development initiatives are further expected to drive market growth over the forecast period.

Key Scleroderma Therapeutics Company Insights

Some of the key companies operating in the scleroderma therapeutics market include F. Hoffman La-Roche Ltd, Bristol-Myers Squibb Company, Bayer AG, and Boehringer Ingelheim International GmbH. To gain a competitive edge in the market, companies engage in various strategies, including mergers and acquisitions, new product development, and expansion.

-

Boehringer Ingelheim International GmbH is a global pharmaceutical company that provides human and animal health treatments for various diseases, including lung diseases, pulmonary fibrosis, COPD, Asthma, and scleroderma. The company operates in over 130 markets to address unmet medical needs while promoting sustainable and environmentally responsible practices.

-

F. Hoffmann-La Roche Ltd F is a global healthcare company that develops pharmaceuticals and diagnostics. It focuses on treatments for cancer, infectious diseases, immune disorders, and central nervous system diseases. The company is also engaged in various research and development activities for the treatment of scleroderma.

Key Scleroderma Therapeutics Companies:

The following are the leading companies in the scleroderma therapeutics market. These companies collectively hold the largest market share and dictate industry trends.

- F. Hoffman La-Roche Ltd

- Bristol-Myers Squibb Company

- Bayer AG

- Boehringer Ingelheim International GmbH

- Emerald Health Pharmaceuticals

- Sanofi

- Cytori Therapeutics Inc.

- Chemomab

- Corbus Pharmaceuticals Holdings, Inc.

- Calliditas Therapeutics AB.

Recent Developments

-

In September 2024, the U.S. FDA granted orphan drug designation to AISA-021, which is a calcium channel antagonist developed by Aisa Pharma, Inc., to treat systemic sclerosis (SSc).

-

In October 2023, the U.S. Food and Drug Administration (FDA) approved Kyverna Therapeutics' investigational new drug (IND) application, allowing the company to begin the Phase I/II KYSA-5 trial of KYV-101 for the treatment of diffuse cutaneous systemic sclerosis (scleroderma).

-

In August 2023, the Scleroderma Research Foundation (SRF) launched the Conquest Trial Platform, designed to tackle key challenges in clinical development and facilitate progress in scleroderma treatment developments.

Scleroderma Therapeutics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.69 billion

Revenue forecast in 2030

USD 3.44 billion

Growth rate

CAGR of 5.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Drug Class, Indication, Region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

F. Hoffman La-Roche Ltd., Bristol-Myers Squibb Company, Bayer AG, Boehringer Ingelheim International GmbH, Emerald Health Pharmaceuticals, Sanofi, Cytori Therapeutics Inc., Chemomab, Corbus Pharmaceuticals Holdings, Inc., Calliditas Therapeutics AB.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Scleroderma Therapeutics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global scleroderma therapeutics market report based on drug class, indication, and region:

-

Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Immunosuppressors

-

Phosphodiesterase 5 inhibitors - PHA

-

Endothelin Receptor Antagonists

-

Prostacyclin Analogues

-

Calcium Channel Blockers

-

Analgesics

-

Others

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Systemic Scleroderma

-

Morphea

-

Linear

-

-

Localized Scleroderma

-

Diffuse Systemic Sclerosis

-

Limited Cutaneous Systemic Sclerosis Syndrome

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.