- Home

- »

- Automotive & Transportation

- »

-

Search And Rescue Helicopter Market Size Report, 2022-2030GVR Report cover

![Search And Rescue Helicopter Market Size, Share & Trends Report]()

Search And Rescue Helicopter Market (2022 - 2030) Size, Share & Trends Analysis Report By End-use (Commercial & Civil, Military), By Type (Light, Heavy), By Component (Engine, Rescue Equipment), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-986-0

- Number of Report Pages: 300

- Format: PDF

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global search and rescue helicopter market size was valued at USD 1.91 billion in 2021 and is anticipated to grow at a compound annual growth rate (CAGR) of 4.1% from 2022 to 2030. The increasing demand for advanced search and rescue helicopters by various countries for military, law enforcement, public safety, and other search and rescue applications is expected to drive the growth of the industry over the forecast period. For instance, in July 2022, The Maritime and Coastguard Agency (MCA) of the U.K. signed a ten-year deal worth 1.6 billion pounds with Bristow Helicopters Ltd., which includes delivery of 18 search and rescue helicopters.

This contract combines the existing rotary and fixed-wing services into fully integrated solutions, which Bristow Helicopters, Ltd. will deliver. This, in turn, is expected to fuel the industry expansion during the forecast period. During the COVID-19 pandemic, the use-case and demand for search and rescue helicopters grew significantly for essential and medical purposes. For instance, in February 2021, Airbus helicopters were used to transport the COVID-19 vaccines to remote areas. The operation enabled the safe, quick, and efficient transport of the vaccines in their low-temperature freezers to remote locations.

Similarly, search and rescue helicopters cater to the demand for the quick and secure transportation of human organs for medical purposes. In addition, search and rescue helicopters are also deployed to assist in mass evacuations in events of natural disasters. For instance, in August 2022, search and rescue helicopters were deployed to mass rescue people affected by the severe floods in Pakistan. Similarly, commercial and civil companies maintain their own search and rescue helicopter fleets to provide safety to their employees working in dangerous or remote locations. For instance, in February 2022, Milestone Aviation successfully delivered the last of the 21 Leonardo AW139 search and rescue helicopters to Saudi Aramco Ltd. as part of their fleet renewal deal.

The hardware improvements and advanced software integration to help pilots and rescue personnel in SAR operations will drive the demand. The advanced technology integrated with military search and rescue helicopters differs from the technology integrated with regular search and rescue helicopters, as military SAR operations are conducted in combat zones. These upgrades have made it possible to conduct SAR operations under challenging conditions over the years. Manufacturers integrate cutting-edge technologies, such as a night vision capable cockpit, satellite flight following & communication, enhanced ground proximity sensors, and more in search and rescue helicopters.

This is fueling the industry's growth. Furthermore, the trend of leasing search & rescue helicopters is driving the industry growth as more commercial & civil entities can operate a leased fleet. Helicopter leasing companies are providing SAR helicopters or SAR services as a service. For instance, LCI Aviation Operations Ltd. has partnered with Sumitomo Mitsui Finance and Leasing Company to establish a joint SAR helicopter lease venture worth USD 230 million. The joint venture will offer Leonardo, Airbus, and Sikorsky helicopters for multiple SAR missions on lease.

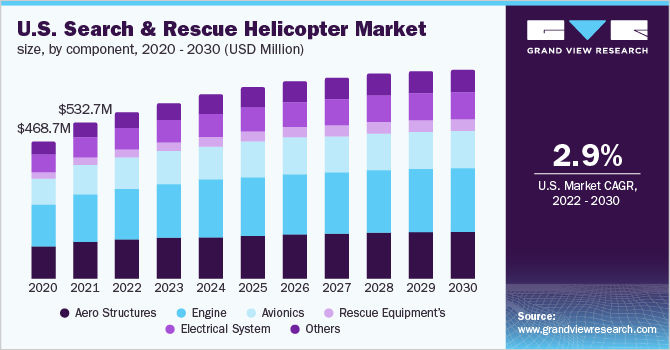

Component Insights

The rescue equipment segment is expected to grow at the fastest CAGR of over 6.0% during the forecast period. The segment growth results from the demand for lower operational costs and robust high-end products for reduced risk during SAR operations. An increase in the number of rescue operations as a result of adversities, such as natural calamities, has resulted in governments undertaking the upgradation of search & rescue equipment across the globe to be prepared in case of any unforeseen calamity. Furthermore, rapid urbanization, along with a focus on human safety, positively impact segment growth and extends promising opportunities to the industry players. For instance, in February 2020, Hindustan Aeronautics Ltd.’s Light Utility Helicopter (LUH) received operational clearance at the DefExpo 2020 in Lucknow, India.

The engine segment accounted for the largest revenue share in 2021 owing to the increment in the fleet of helicopters used for commercial and military SAR applications. Operations carried out by search and rescue helicopters require powerful engines due to the uncertainty of the operation conditions. As a result, one of the primary focuses of helicopter manufacturers is enhancing helicopter engine performance when the helicopter engine is under stress. For instance, the S-92 SAR helicopter is powered by two General Electric’s C17-8A engines with turboshaft, which help power the helicopter over a range of around 355 kilometers. In addition, the fuel system in the engine is in accordance with the crash-worthiness standard, which reduces the risk of a fire post-crash.

Type Insights

The medium-type segment dominated the industry and accounted for the highest revenue share of more than 50.80% in 2021. The segment is presumed to grow substantially over the forecast period owing to the multipurpose capabilities of medium search & rescue helicopters. The demand for operations, such as lifting tasks in extreme conditions, including remote hill search & rescue, and maritime, drives the segment. Furthermore, helicopters can perform multiple missions, expanding the employment of medium helicopters in firefighting and beyond. Medium-type helicopters are agile and capable of carrying generous rescue equipment. The heavy type segment is predicted to grow at the fastest CAGR during the forecast period

This can be credited to the extreme rescue operation capabilities they possess. The demand is attributed to the multiple advantages they provide, such as carrying significant rescue equipment, a longer flying range, and powerful engines. Furthermore, the acceleration in military budgets and a surge in the need for modernizing existing military systems for search & rescue operations will support the segment growth. Advanced technological features integrated into heavy-type search and rescue helicopters also increase their demand as they offer more control to the pilots and rescue personnel for SAR operations.

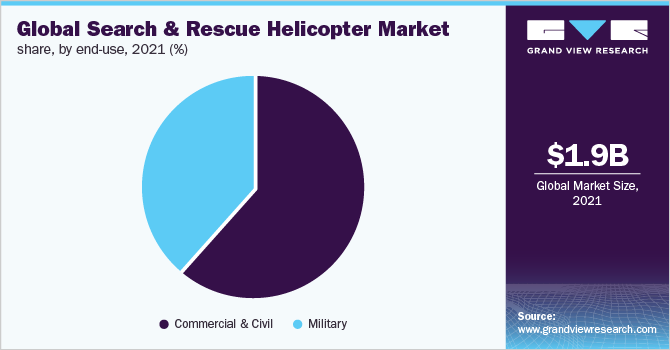

End-use Insights

The commercial & civil segment accounted for the largest revenue share in 2021 and is expected to expand further at the fastest CAGR of more than 4.0% during the forecast period. The segment growth is attributed to the operations, including emergency medical services, private patrolling, and more, conducted by commercial and civil users and operators on their own. Moreover, due to the COVID-19 pandemic, the market demand has risen, owing to factors, such as air ambulances to airlift patients, vaccines, and medical equipment transfer. The ongoing offshore energy exploration projects, rescue, evacuation, and surveillance activities are also expected to boost the demand in the industry.

The military end-use segment is anticipated to grow at a steady CAGR during the forecast period due to the demand for combat SAR activities including medical evacuations. Furthermore, growth in this segment is anticipated as militaries replace aging fleets with technologically advanced search and rescue helicopters. The industry is anticipated to grow due to the substitution of old helicopter components and systems and capacity development programs for search and rescue helicopters worldwide. The development of tilt helicopters and the next-generation technology compound in military search and rescue helicopters is expected to aid the market to grow further.

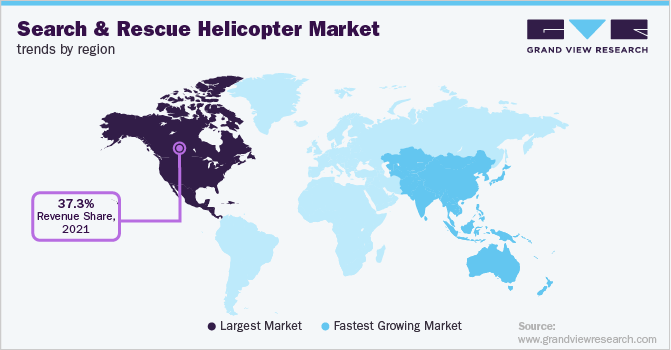

Regional Insights

North America accounted for the highest share of over 37.30% of the overall revenue in 2021. The high demand for search and rescue helicopters in North America is due to the presence of prominent search and rescue agencies in North America like the U.S. Defense Department, Royal Canadian Air Forces, the United States Coast Guard, and more, which provide different types of SAR missions like mountain rescue, urban search, and rescue, lowland or ground search and rescue, cave rescue, maritime and combat search and rescue. The distribution of SAR responsibilities in the region is divided as focused on the local, state, and national levels.

For instance, in June 2020, Bell Textron Inc. and Boeing partnered to deliver CMV-22B first of its kind fleet operator to the U.S. Navy. The Asia Pacific region is expected to record the fastest CAGR over the forecast period. The regional growth is due to the use of helicopters for SAR operations for providing vital services & products during natural disasters, such as floods and earthquakes, in developing countries in the Asia Pacific region. The region is vast, with developing countries looking to add to their search and rescue fleets, which is driving the region’s growth. In addition, the search and rescue helicopter manufacturers are trying to set up manufacturing plants in APAC countries as they offer favorable policies for foreign manufacturers to help get foreign investment, which helps drive the region’s growth.

Key Companies & Market Share Insights

The industry has a low threat of new entrants as the development and manufacturing of search and rescue helicopters require significant financial investments and long testing durations. Although the competition is high, technological development is allowing key companies to take on more customer orders. For instance, according to the market forecasts produced by Airbus Helicopters, around 20,000 civil helicopters and 14,000 military helicopters are anticipated to be manufactured over the next 20 years. The company also stated that its helicopter deliveries increased from 300 in 2020 to 338 in 2021 due to the increasing demand, which will enable commercial & civil segments to enter the industry at a faster pace.

Manufacturers, assemblers, and suppliers are increasingly undergoing collaborative projects to develop innovative solutions. For instance, in April 2021, Lockheed Martin partnered with Thales Group to develop and integrate cutting-edge technology for its private and military-based search & rescue helicopters. The corresponding research & development activities are expected to open significant opportunities for companies specializing in developing advanced helicopters, such as 2-axis autopilots, sonar systems, and more. These collaborations and development initiatives drive the growth of advanced technologies. Some of the key players in the global search and rescue helicopter market include:

-

Airbus S.A.S.

-

Lockheed Martin Corp.

-

Leonardo S.p.A

-

Bell Textron, Inc.

-

Hindustan Aeronautics Ltd.

Search And Rescue Helicopter Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 2.06 billion

Revenue forecast in 2030

USD 2.84 billion

Growth rate

CAGR of 4.1% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico

Key companies profiled

Airbus S.A.S; Bell Textron Inc.; Enstrom Helicopter Corp.; Hindustan Aeronautics Ltd.; Korea Aerospace Industries, Ltd.; Leonardo S.p.A; Lockheed Martin Corp.; MD Helicopters Inc.; Robinson Helicopter Company; Russian Helicopters JSC

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

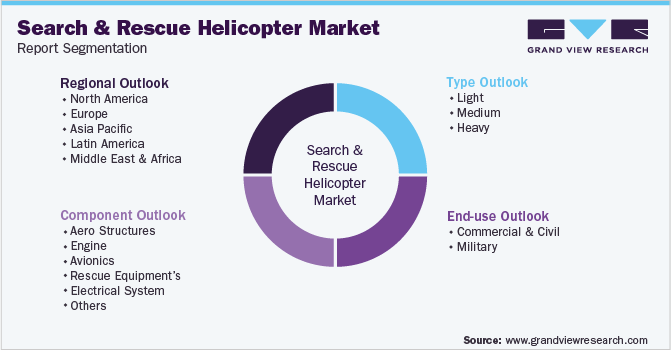

Global Search And Rescue Helicopter Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global search and rescue helicopter market report based on component, type, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Aero Structures

-

Engine

-

Avionics

-

Rescue Equipment’s

-

Electrical System

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Light

-

Medium

-

Heavy

-

- End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial & Civil

-

Military

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global search and rescue helicopter market size was estimated at USD 1.91 billion in 2021 and is expected to reach USD 2.06 billion in 2022.

b. The global search and rescue helicopter market is expected to grow at a compound annual growth rate of 4.1% from 2022 to 2030 to reach USD 2.84 billion by 2030.

b. North America dominated the search and rescue helicopter market with a share of 37.3% in 2021. This is attributable due to the presence of prominent SAR agencies like United States defense department, Canadian forces, and the United States coast guard, providing various types of SAR missions like mountain rescue, urban search and rescue, cave rescue, maritime and combat search and rescue.

b. Some key players operating in the search and rescue helicopter market include Airbus SAS, Bell Textron Inc., Enstrom Helicopter Corp., Hindustan Aeronautics Limited (HAL), Korea Aerospace Industries, Ltd., Leonardo S.P.A., Lockheed Martin Corporation, MD Helicopters, Inc., Robinson Helicopter Company, Russian Helicopter JSC.

b. Key factors that are driving the search and rescue helicopter market growth include increase in search and rescue operations for civilians and security purposes, integration of advanced technology for search and rescue operations and growing demand for helicopters.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.