- Home

- »

- Next Generation Technologies

- »

-

Security Printing Market Size, Share & Trends Report, 2030GVR Report cover

![Security Printing Market Size, Share & Trends Report]()

Security Printing Market (2023 - 2030) Size, Share & Trends Analysis Report By Printing Type (Screen Printing, Letterpress Printing, Digital Printing, Lithographic Printing, Intaglio Printing), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-628-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Security Printing Market Summary

The global security printing market size was estimated at USD 3.14 billion in 2022 and is projected to reach USD 5.51 billion by 2030, growing at a CAGR of 7.4% from 2023 to 2030. Numerous companies are investing in the R&D of a secure technology for prime security.

Key Market Trends & Insights

- North America held a significant revenue share of over 28% in 2022 and is expected to be among the most influential markets globally.

- Asia Pacific is projected to witness remarkable growth, expanding at the highest CAGR over the forecast period, owing to the adoption of advanced technology.

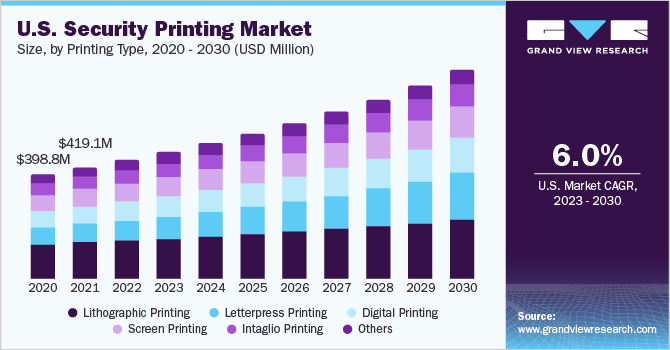

- Based on printing type, the lithographic printing segment held the largest revenue share of more than 32% in 2022, and it is expected to exhibit a CAGR of nearly 5.6% from 2023 to 2030.

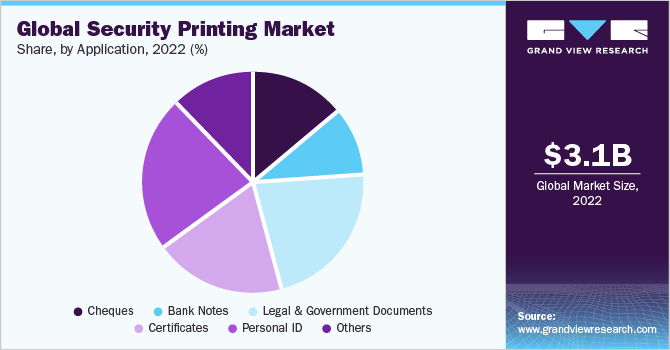

- In terms of application, the personal ID application segment held the largest revenue share of more than 22% in 2022, and it is expected to exhibit a CAGR of nearly 8.1% from 2023 to 2030.

Market Size & Forecast

- 2022 Market Size: USD 3.14 billion

- 2030 Projected Market Size: USD 5.51 billion

- CAGR (2023-2030): 7.4%

- North America: Largest market in 2022

Governments of many developed and developing economies are also adopting and backing these advancements to minimize economic loss due to tampering and counterfeiting. The implementation of hybrid papers or security printing papers in the production of currency is anticipated to control corruption, money laundering, and currency counterfeiting, making this a burgeoning market. Security printing is integral to producing items that require authentication, such as banknotes, cheques, identity cards, passports, stock certificates, and postage stamps. This encompasses a range of techniques, including intaglio printing, holography, specialty paper, microprint, security threads, copying marks, anti-magnetic inks, watermarks, and serial numbers.

The purpose of security printing is to safeguard against unlawful activities like counterfeiting, forgery, and tampering. In computer systems, it plays a role in ensuring crucial aspects of protection. Holographic stickers designed to tear when removed are often employed to prevent software forgery. These holographic stickers serve as a visible indicator of authenticity, deterring unauthorized duplication and ensuring the integrity of the product. Hence, incorporating security measures is imperative to guarantee users that items remain unaltered post-manufacturing or packaging, a task effectively achieved through security printing practices.

Security inks are an important factor propelling the global market growth. Security regulations combined with law enforcement are a significant factor boosting the expansion of this market. Moreover, increasing fraudulent activities in financial institutions, personal identities, and tax and postage stamps coupled with alternation and tampering in the branding of industry products is a driving factor for the growth of the security printing industry. Additionally, awareness regarding fraud and counterfeit activities among consumers is predicted to support the growth during the forecast period.

Technological advancements have been instrumental in fortifying protection against counterfeiting and enhancing document security. For instance, the integration of microprinting and nanotechnology, which implements the use of intricate patterns, text, and nanoparticles to create unique, difficult-to-reproduce security features that are almost impossible to replicate by counterfeiters and forgers. In addition, the adoption of other technologies such as optically variable inks, QR codes & data matrix codes, machine-readable elements, color-shifting inks, and secure substrates & papers are anticipated to be well for the growth of the target market.

COVID-19 Impact

The security printing industryhas encountered profound repercussions due to the COVID-19 pandemic, necessitating swift and strategic recalibrations. Supply chain disruptions, workforce constraints, and rigorous health and safety protocols have posed formidable operational complexities for security printing companies & service providers. The production and distribution lifecycles of security-printed materials, encompassing critical items like currency, identification documents, and secure labels, have been notably impeded by stringent travel restrictions and widespread lockdowns, translating to consequential delays.

The industry's response has been marked by the accelerated assimilation of digital innovations and automated workflows to mitigate disruptions. Essential remedial measures now encompass the strategic deployment of virtual collaboration tools, cutting-edge remote monitoring systems, and the implementation of contactless production methodologies. As global conditions gradually ease, the market is poised for resiliency and resurgence, leveraging technology to optimize operational efficiency, ensure uninterrupted business continuity, and aptly cater to the evolving requisites for secure printed materials within an ever-adapting landscape.

Printing Type Insights

Based on printing type, the security printing market is segmented into letterpress printing, screen printing, digital printing, intaglio printing, lithographic printing, and others. In 2022, the lithographic printing segment held the largest revenue share of more than 32% and is expected to exhibit a CAGR of nearly 5.6% from 2023 to 2030. Lithographic printing is the most popular and used method in all spheres of printing production. The revolution that came with lithographic printing has brought a wide variety of possibilities. Not only it has increased the speed and revolutionized the history of slow and complex print processes, but it has played an important role in enhancing security as well.

The lithographic technique offers a distinct edge over alternative methods due to its capability to deliver consistently high image quality. The latest in-line multi-press print systems have seamlessly integrated advanced processes like flexographic printing, intaglio, rotary screen, holographic application, numbering, and variable data imaging. This integration not only enhances image quality but also significantly optimizes cost-effectiveness through streamlined single-pass operations. This strategic approach finds valuable applications in diverse sectors including corporate and government document print, precise asset management, robust brand safeguarding, secure cheque and high-value document printing, as well as the efficient generation of tickets and event passes, reflecting its pivotal role in today's dynamic business landscape.

Application Insights

Based on application, the industry has been segmented into cheques, bank notes, legal and government documents, certificates, personal IDs, and others. In 2022, the personal ID application segment held the largest revenue share of more than 22% and is expected to exhibit a CAGR of nearly 8.1% from 2023 to 2030. Growing international travel, expanding business opportunities, and enhanced mobility for education and employment purposes have fueled the need for secure identification and travel documents.

Additionally, geopolitical shifts, cross-border collaborations, and the rise of global supply chains have intensified the requirement for streamlined and reliable travel credentials. This surge in demand presents a lucrative market opportunity for the target industry to provide innovative solutions that not only adhere to stringent security standards but also facilitate seamless international movement and authentication processes. The expansion is further facilitated by progressive developments in printing solutions, exemplified by the evolution of RFID technology. This technology's increased integration across various end-use applications like driving licenses, personal identification, passports, birth certificate issuance, and ticketing has significantly contributed to market growth.

Counterfeiting practices are most prevalent in passports, banknotes, identity cards, postage stamps, security printing papers, and stock certificates. These practices aid in the prevention of forgery and counterfeiting of the instruments mentioned above. The key end-market verticals using security printing include supply chain and Banking, Financial Services, and Insurance (BFSI). Legal authorities are responsible for issuing legal stamps, passports, unique personal IDs, security printing papers, driving licenses, and birth and death certificates. The rising cases of forgery and tempering are expected to result in the increasing application of security printing across various applications, hence helping the overall market growth.

Regional Insights

North America held a significant revenue share of over 28% in 2022 and is expected to be among the most influential markets globally. This dominance can be attributed to the region's extensive adoption of lithographic and screen printing. North American nations, including the United States, Canada, and Mexico, have become pioneers in incorporating these advanced methods across diverse manufacturing operations. The adoption of an array of techniques aimed at combating forgery-such as photo integration, barcoding, biometric identifiers, reversed out text, fluorescent serial numbers, embossing stamps, iFADO (intranet False and Authentic Documents Online), gravure print, and ink stamp-is poised to drive market expansion throughout North America significantly.

Asia Pacific is projected to witness remarkable growth, expanding at the highest CAGR over the forecast period owing to the adoption of advanced technology related to security printing in countries like India, China, and Japan. Increasing concerns over corruption, fake currency, and terror funding will surge the market in the countries. Factors such as alternative modes of payment (including bank checks and payment cards) and large-scale ID programs initiated by enterprises are projected to boost the market in the region.

The Europe market for security printing is estimated to grow significantly over the forecast period, due to increased migration and the adoption of advanced technology to fight corruption, money laundering, and fake currency.

Competitive Insights

The market is fragmented with the presence of several security printing service providers. The players adopt strategies such as partnerships & collaborations, product launches, and mergers & acquisitions to gain a competitive edge. For instance, in October 2021, TROY Group, Inc. formed a strategic partnership with Loffler Companies, a print solutions provider, to enhance its MICR (Magnetic Ink Character Recognition) print program. This collaboration aims to leverage Loffler's expertise to strengthen TROY's MICR print solutions, benefiting organizations seeking secure and efficient check processes. The partnership aims to provide enhanced MICR solutions to customers, improving the accuracy, security, and effectiveness of check operations. Some prominent players in the global security printing market include

-

Agfa-Gevaert Group

-

Amgraf, Inc.

-

GRAPHIC SECURITY SYSTEMS CORPORATION

-

Ennis, Inc.

-

The Flesh Company

-

TROY Group, Inc.

-

Wellspring Software, Inc.

-

CETIS d.d.

Security Printing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.35 billion

Revenue forecast in 2030

USD 5.51 billion

Growth rate

CAGR of 7.4% from 2023 to 2030

Historic year

2017 - 2021

Base year for estimation

2022

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Printing type, application, region.

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Brazil

Key companies profiled

Agfa-Gevaert Group; Amgraf, Inc.; DSS; Graphic Dimensions Inc.; GRAPHIC SECURITY SYSTEMS CORPORATION (GSSC); Plus Technologies LLC; Ennis, Inc.; The Flesh Company; TROY Group, Inc.; Wellspring Software, Inc.; CETIS d.d.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

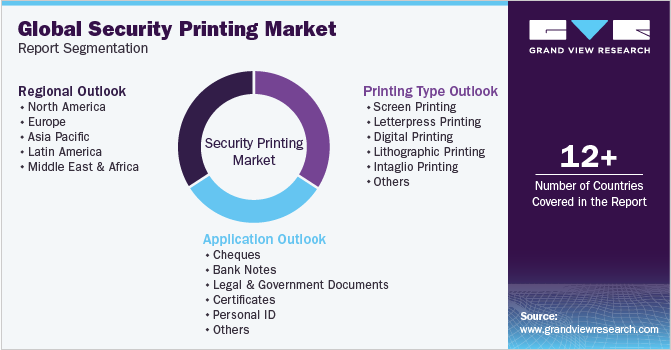

Global Security Printing Market Report Segmentation

This report forecasts revenue growths at global, regional, and country levels and offers qualitative and quantitative analysis of the industry trends for each of the segment and sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global security printing market report based on printing type, application, and region:

-

Printing Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Screen Printing

-

Letterpress Printing

-

Digital Printing

-

Lithographic Printing

-

Intaglio Printing

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Cheques

-

Bank Notes

-

Legal & Government Documents

-

Certificates

-

Personal ID

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global security printing market size was estimated at USD 3.14 billion in 2022 and is expected to reach USD 3.35 billion in 2023.

b. The global security printing market is expected to grow at a compound annual growth rate of 7.4% from 2023 to 2030 to reach USD 5.51 billion by 2030.

b. North America dominated the security printing market with a share of 28.3% in 2022. This is attributable to the early adoption of security printing techniques in various manufacturing processes by North American countries, such as the U.S., Canada, and Mexico.

b. Some key players operating in the security printing market include Agfa-Gevaert Group; Amgraf, Inc.; GRAPHIC SECURITY SYSTEMS CORPORATION, Ennis, Inc.; The Flesh Company; TROY Group, Inc.; Wellspring Software, Inc; CETIS d.d.; among others.

b. Key factors that are driving the security printing market growth include rising innovations in printing solutions, like the evolution of RFID marks and their increasing implementation across several end-use applications, such as the driving license, personal ID, passport, birth certificate issuing, and ticketing.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.