- Home

- »

- Plastics, Polymers & Resins

- »

-

Seed Packaging Market Size & Share, Industry Report, 2030GVR Report cover

![Seed Packaging Market Size, Share & Trends Report]()

Seed Packaging Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Paper & Paperboard, Plastic, Jute, Fabric), By Product (Pouches, Containers, Bags, Bottles & Jars), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-617-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Seed Packaging Market Summary

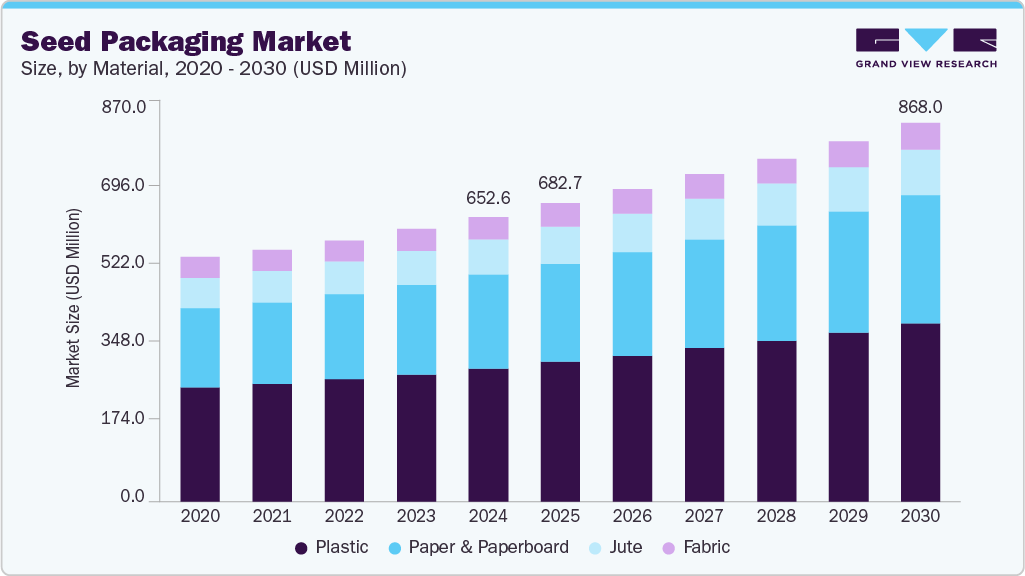

The global seed packaging market size was estimated at USD 652.6 million in 2024 and is projected USD 868.0 million by 2030, growing at a CAGR of 4.9% from 2025 to 2030. The market is driven by rising demand for high-quality, protected seeds to ensure better crop yield and the increasing adoption of sustainable and moisture-resistant packaging solutions.

Key Market Trends & Insights

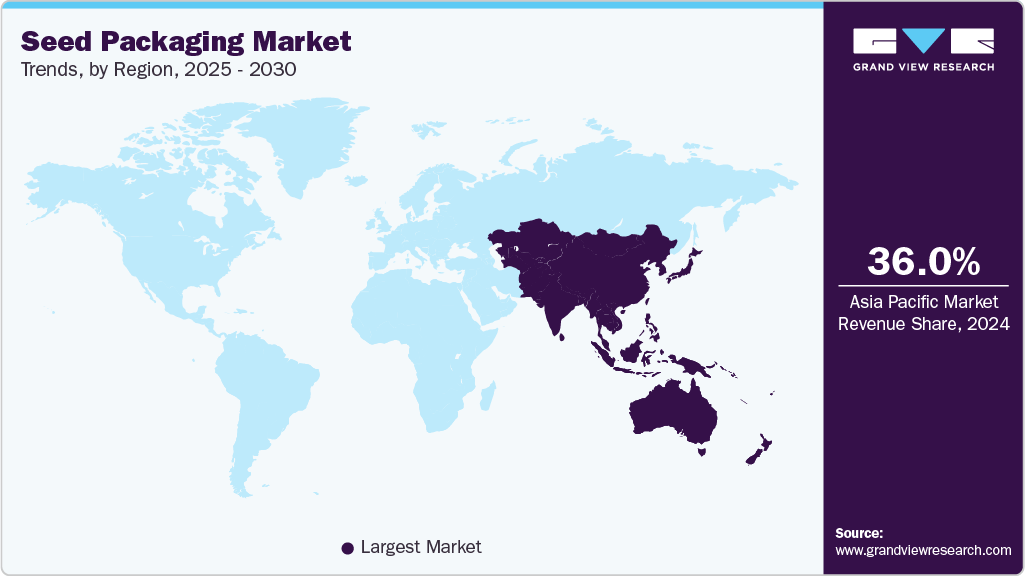

- Asia Pacific seed packaging market dominated the global market and accounted for the largest revenue share of over 36.0% in 2024

- China seed packaging market dominates the seed packaging market in Asia Pacific Region.

- By material, the plastic material segment recorded the largest market revenue share of over 46.0% in 2024.

- By product, the bags segment recorded the largest market revenue share of over 45.0% in 2024.

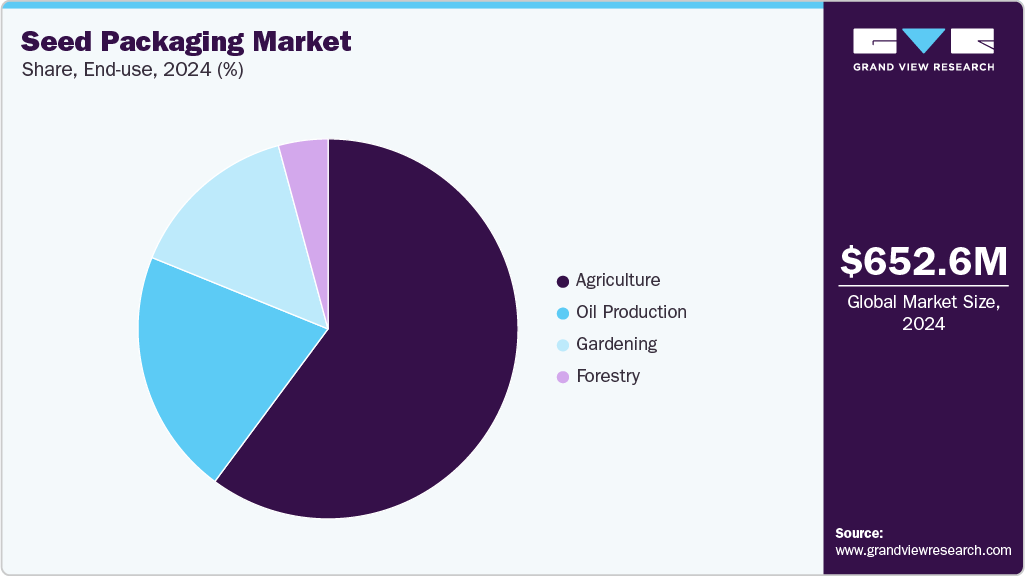

- By end use, the agriculture segment recorded the largest market share of over 60.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 652.6 Million

- 2030 Projected Market Size: USD 868.0 Million

- CAGR (2025-2030): 4.9%

- Asia Pacific: Largest market in 2024

Growing awareness among farmers about seed quality and brand authenticity also fuels market growth. As the world population expands, farmers increasingly seek hybrid and genetically modified (GM) seeds that offer higher yields, disease resistance, and climate adaptability. Seed packaging plays a vital role in preserving seed viability, ensuring accurate labeling, and preventing contamination. Key players invest in packaging solutions to maintain seed integrity during storage and transport, especially in harsh climates.Another key driver is the stringent regulatory environment governing seed quality and traceability. Governments and international bodies, such as the International Seed Testing Association (ISTA), mandate strict packaging standards to prevent counterfeit seeds and ensure genetic purity. For instance, in India, the Protection of Plant Varieties and Farmers' Rights Authority (PPV&FRA) requires certified seed packaging with QR codes for authentication. Such regulations push seed producers to adopt tamper-proof and moisture-resistant packaging, boosting demand for innovative materials such as multi-layer films and biodegradable pouches.

Another key driver is the stringent regulatory environment governing seed quality and traceability. Governments and international bodies, such as the International Seed Testing Association (ISTA), mandate strict packaging standards to prevent counterfeit seeds and ensure genetic purity. For instance, in India, the Protection of Plant Varieties and Farmers' Rights Authority (PPV&FRA) requires certified seed packaging with QR codes for authentication. Such regulations push seed producers to adopt tamper-proof and moisture-resistant packaging, boosting demand for innovative materials such as multi-layer films and biodegradable pouches.

Sustainability trends are also reshaping the seed packaging industry, with a growing preference for eco-friendly materials. Traditional plastic packaging is being replaced by biodegradable, compostable, and recycled materials to reduce environmental impact. For example, Biogreen Bags are developing plant-based seed bags that decompose after use. Additionally, seed giants such as Corteva Agriscience are adopting recyclable paper-based packaging to align with corporate sustainability goals and consumer expectations for greener agricultural practices.

Market Concentration & Characteristics

The seed packaging industry is highly seasonal, closely tied to planting and harvesting cycles in various regions. This dependence on agricultural timelines influences demand fluctuations, with peak packaging production occurring ahead of major sowing seasons. For example, in North America and Europe, demand spikes during spring and autumn, while tropical regions may see more staggered cycles depending on local cropping patterns.

A defining characteristic of the industry is the requirement for protective packaging solutions that can withstand harsh environments. Seeds must be protected from humidity, pests, mechanical damage, and UV exposure. Therefore, the industry heavily emphasizes materials science, often using multi-layer films, laminated pouches, and vacuum-sealed bags to preserve seed viability. The packaging must also be strong enough for long-distance transport, especially in global seed trade.

Seed packaging serves a strategic role beyond its functional utility, acting as a critical tool for brand positioning and market differentiation. Companies allocate resources toward developing customized packaging solutions that incorporate visually compelling designs, distinctive brand elements, and comprehensive labeling to strengthen market presence and foster customer confidence. In highly competitive markets, where purchasing decisions are significantly influenced by brand reputation and demonstrated seed performance, effective packaging design serves as a crucial factor in customer acquisition and retention.

Material Insights

The plastic material segment recorded the largest market revenue share of over 46.0% in 2024. Plastic seed packaging offers excellent moisture resistance, durability, and flexibility. It is widely used for both small retail packets and bulk agricultural seed packaging. Plastics such as polyethylene (PE), polypropylene (PP), and laminated films are used to ensure seed integrity during transportation and storage. The convenience of resealable closures, longer shelf life, and lightweight characteristics make it a preferred choice among commercial seed producers.

The paper & paperboard segment is expected to grow at the fastest CAGR of 5.3% during the forecast period. The growing demand for sustainable and environmentally friendly packaging is a major driver for the paper & paperboard segment. Increasing regulatory pressures to reduce plastic use, coupled with consumer preference for compostable and recyclable materials, further push the adoption of paper-based seed packaging. Additionally, advancements in moisture-resistant coatings for paper packaging are enhancing its utility in humid environments.

Product Insights

The bags segment recorded the largest market revenue share of over 45.0% in 2024. Bags are the most traditional and widely used packaging format in the seed industry, available in woven polypropylene, jute, or paper variants. These are ideal for bulk storage and transportation of seeds, particularly for high-volume crops such as wheat, corn, rice, and soybeans. Bags offer moderate protection and are cost-effective for large-scale agricultural applications. High demand for bulk packaging solutions and cost-effectiveness are key drivers for bags. Additionally, advancements in printing and branding on bag surfaces support marketing efforts in rural and semi-urban regions.

The pouches segment is expected to grow at the fastest CAGR of 5.3% during the forecast period. Pouches are lightweight, flexible packaging options made primarily from plastic films or laminated materials. They are commonly used in the seed industry due to their resealability, moisture resistance, and efficient storage capabilities. The rising demand for user-friendly, compact, and portable packaging in the agricultural retail sector is a key driver for pouches. Additionally, the growth of e-commerce seed sales has favored flexible packaging such as pouches due to their lower shipping costs and reduced material usage.

End Use Insights

The agriculture segment recorded the largest market share of over 60.0% in 2024. It includes commercial-scale farming operations involving crops such as wheat, corn, rice, soybean, and cotton. High-quality seed packaging ensures preservation of germination rates, moisture protection, and prolonged shelf life, especially during long storage or transportation. The demand for increased agricultural productivity due to a rising global population is a primary driver. In addition, the adoption of hybrid and genetically modified (GM) seeds requires more secure and durable packaging to maintain seed integrity. Government subsidies, global food security initiatives, and climate-resilient farming practices are also fueling demand for high-performance seed packaging in agriculture.

The gardening segment is projected to grow at the fastest CAGR of 5.2% during the forecast period. The gardening segment targets home gardeners, nurseries, and urban farming communities. Packaging in this segment is often smaller in volume but emphasizes branding, resealability, and visual appeal to attract end consumers. The packaging may also include informative labels for planting instructions and organic certifications. The growing interest in home gardening, especially post-COVID-19, and the surge in organic and sustainable living trends are significant drivers. Increased participation in hobby gardening and urban agriculture in pushing manufacturers to produce user-friendly and informative seed packaging. Online retailing of garden supplies has also expanded the market reach for packaged seeds.

Region Insights

Asia Pacific seed packaging market dominated the global market and accounted for the largest revenue share of over 36.0% in 2024 and is expected to grow at the fastest CAGR of 5.5% over the forecast period. This positive outlook is due to its rapidly expanding agricultural sector, increasing adoption of hybrid and genetically modified seeds, and government initiatives supporting food security. Countries such as India and China are investing heavily in high-yield seed varieties to meet the demands of their large populations, boosting the need for durable and efficient seed packaging. For example, India’s "Seed Village Program" promotes quality seed distribution, requiring advanced packaging solutions to maintain seed viability. Additionally, the rise of contract farming and precision agriculture in countries such as Australia and Japan is driving demand for specialized seed packaging that ensures protection from moisture and pests during storage and transport.

China Seed Packaging Market Trends

China seed packaging market dominates the in Asia Pacific region due to its massive agricultural output and government focus on seed self-sufficiency. The country is the world’s largest producer of rice and vegetables, requiring high-quality packaging to protect seeds during storage and distribution. Hybrid rice seeds are often packed in aluminum foil bags to prevent moisture damage. The Chinese government’s push for "green agriculture" has also increased demand for sustainable seed packaging. Additionally, China’s growing seed export industry, particularly for crops such as soybeans and corn-necessitates durable, pest-resistant packaging that meets international phytosanitary standards.

North America Seed Packaging Market Trends

North America’s growth in the seed packaging market is due to its advanced agricultural technologies, high mechanization, and strong presence of global seed companies such as Corteva Agriscience, Bayer, Sakata Seed, Baker Creek, and BASF Agricultural Solutions. The U.S. and Canada are major producers of genetically modified (GM) seeds, particularly for corn, soybeans, and canola, which require high-barrier packaging to maintain genetic purity and prevent contamination. Precision farming and seed treatment technologies further drive demand for customized packaging with features such as UV protection and anti-counterfeiting labels.

The region also emphasizes sustainable packaging, with companies shifting toward bio-based plastics and paper-based solutions to meet environmental regulations. For instance, in Canada, seed packaging must comply with strict guidelines on biodegradability, pushing innovations in compostable seed bags. Additionally, the growing home gardening trend in the U.S. has increased demand for small, user-friendly seed packets. The combination of large-scale farming and retail gardening ensures North America remains a key market for diverse seed packaging solutions.

Europe Seed Packaging Market Trends

Europe’s seed packaging market is driven by stringent regulatory standards, high-quality seed production, and increasing demand for organic and non-GMO seeds. The European Union’s strict seed certification laws require tamper-proof and traceable packaging to ensure compliance with phytosanitary regulations. Countries such as France and the Netherlands, which are major seed exporters, use advanced packaging with QR codes and RFID tags for supply chain transparency. For example, Dutch companies such as Rijk Zwaan utilize smart packaging to track seed batches from production to planting.

Sustainability is a key trend, with the EU’s Circular Economy Action Plan pushing for recyclable and biodegradable seed packaging. Germany and the UK are seeing a rise in paper-based seed packets, particularly for organic and heirloom seeds sold in retail markets. Additionally, the growing popularity of urban farming and home gardening in countries such as Italy and Spain has increased demand for aesthetically appealing, resealable seed pouches.

Key Seed Packaging Company Insights

The competitive environment of the seed packaging market is characterized by a mix of global and regional players vying for market share through innovation, sustainability, and strategic partnerships. Key companies compete by offering advanced packaging solutions that ensure seed protection, extended shelf life, and improved handling efficiency. The market is witnessing a shift toward eco-friendly and biodegradable materials, driven by growing environmental concerns and regulatory pressures. Intense competition is also fueled by the need for product differentiation, efficient distribution networks, and customization to meet the specific needs of agricultural sectors across different regions.

Key Seed Packaging Companies:

The following are the leading companies in the seed packaging market. These companies collectively hold the largest market share and dictate industry trends.

- SÜDPACK

- XIFA Group

- Amcor plc

- Berry Global Inc.

- ProAmpac

- Jam Jams Group

- Dune Packaging Limited

- J&C Packaging

- NNZ

- Advanced Industries Packaging

- GT Packers

- JBM Packaging

- Giriraj Flexipack

- Marudhar Industries Limited

Recent Developments

-

In September 2024, SÜDPACK’s debut at “Seed meets Technology” represents a strategic initiative to strengthen its presence in the global seed technology and packaging market. By participating in this leading international event, SÜDPACK showcased its innovative packaging solutions directly to key industry stakeholders, fostered collaborations with seed technology leaders, and gained insights into emerging trends and customer needs. This move positions SÜDPACK to expand its network, enhance brand visibility, and accelerate the adoption of its advanced packaging technologies within the horticultural sector.

-

In February 2021, Chia Tai Company Limited, a major agricultural innovator in Thailand, launched new Chia Tai Home Garden seed packaging under the “Easy and Unique Planting Concept” to make home gardening more accessible and enjoyable, especially for urban dwellers. The revamped “Easy Package” features a modern design and provides comprehensive, easy-to-understand planting instructions, techniques, and useful information on both sides of the package, addressing frequent customer requests for clearer guidance.

Seed Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 682.7 million

Revenue forecast in 2030

USD 868.0 million

Growth rate

CAGR of 4.9% from 2025 to 2030

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, product, end use, region

States scope

North America; Europe; Asia Pacific; Latin America; and Middle East & Africa

Key companies profiled

SÜDPACK; XIFA Group; Amcor plc; Berry Global Inc.; ProAmpac; Jam Jams Group; Dune Packaging Limited; J&C Packaging; NNZ; Advanced Industries Packaging; GT Packers; JBM Packaging; Giriraj Flexipack; Marudhar Industries Limited

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Seed Packaging Market Report Segmentation

This report forecasts revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global seed packaging market report based on material, product, end use, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Paper & Paperboard

-

Plastic

-

Jute

-

Fabric

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Pouches

-

Containers

-

Bags

-

Bottles & Jars

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Agriculture

-

Oil Production

-

Gardening

-

Forestry

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global seed packaging market was estimated at around USD 652.6 million in the year 2024 and is expected to reach around USD 682.7 million in 2025.

b. The global seed packaging market is expected to grow at a compound annual growth rate of 4.9% from 2025 to 2030 to reach around USD 868.0 million by 2030.

b. Agriculture emerged as the dominating end-use segment in the seed packaging market due to the rising demand for high-quality, high-yield seeds in commercial farming. Enhanced seed protection, traceability, and efficient storage solutions further drive adoption in this sector.

b. The key players in the seed packaging market include SÜDPACK, XIFA Group, Amcor plc, Berry Global Inc., ProAmpac, Jam Jams Group, Dune Packaging Limited, J&C Packaging, NNZ, Advanced Industries Packaging, GT Packers, JBM Packaging, Giriraj Flexipack, and Marudhar Industries Limited.

b. The seed packaging market is driven by the rising demand for high-quality, durable packaging to preserve seed viability and the growing emphasis on sustainable, traceable, and tamper-proof packaging solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.