- Home

- »

- Advanced Interior Materials

- »

-

Selective Laser Melting In Mining Market Size Report, 2033GVR Report cover

![Selective Laser Melting In Mining Market Size, Share & Trends Report]()

Selective Laser Melting In Mining Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Equipment, Materials, Services, Others), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-798-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Selective Laser Melting In Mining Market Summary

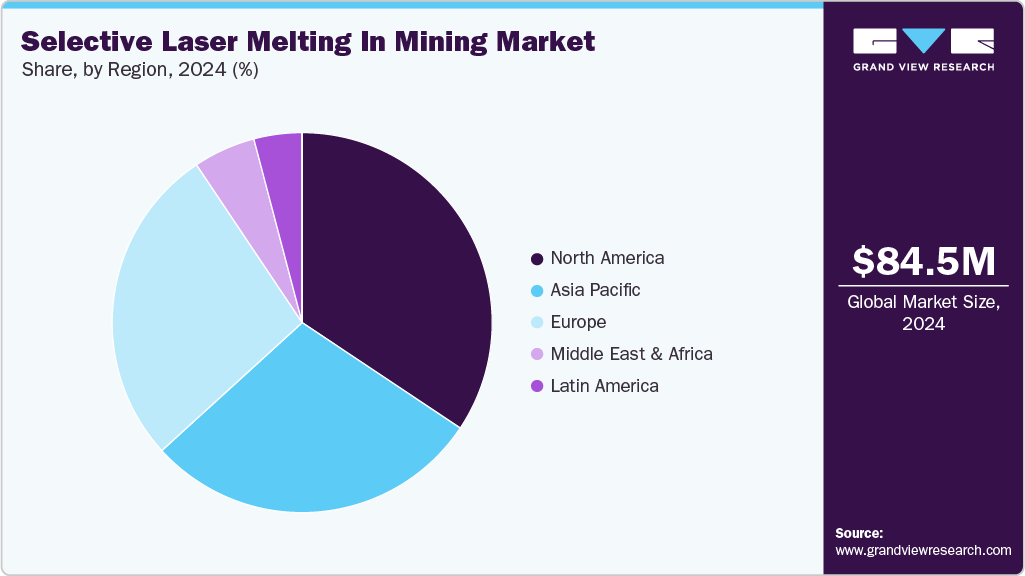

The global selective laser melting in mining market size was estimated at USD 84.5 million in 2024 and is projected to reach USD 235.8 million by 2033, at a CAGR of 12.3% from 2025 to 2033. Selective Laser Melting (SLM) in mining involves using high-powered lasers to fuse metal powders layer by layer, creating complex components for mining equipment.

Key Market Trends & Insights

- North America dominated the global selective laser melting in mining industry with the largest market revenue share of over 34%.

- In the U.S. selective laser melting in mining industry, SLM is experiencing rapid growth as companies strive to enhance operational resilience and reduce their dependence on conventional manufacturing supply chains.

- By component, equipment accounted for the largest market revenue share of over 50% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 84.5 Million

- 2033 Projected Market Size: USD 235.8 Million

- CAGR (2025-2033): 12.3%

- North America : Largest market in 2024

- Europe: Fastest growing market

This technology enhances part durability, reduces material waste, and supports on-site manufacturing efficiency. The growth of the market is driven by the increasing need for on-demand manufacturing of metal spare parts at remote mining locations. Mining operations frequently encounter challenges related to equipment downtime, often stemming from delays in part replacement and logistical limitations. SLM technology enables the on-site or near-site production of complex components, thereby minimizing inventory requirements and reducing repair timelines. This flexibility improves operational efficiency and reduces costs associated with equipment maintenance and transportation.

Advancements in materials science and printing precision are strengthening the adoption of SLM in the mining sector. Improvements in metal powders, laser power, and process stability have enhanced the mechanical strength and durability of printed parts. Mining companies are now utilizing SLM to produce wear-resistant tools, drilling components, and pump parts that can withstand extreme conditions. The technology’s capability to produce high-quality, functional components has increased trust among mining engineers and equipment manufacturers, encouraging wider industrial deployment.

Another significant driver is the design flexibility that SLM offers compared to traditional manufacturing. It enables engineers to create parts with complex internal geometries, optimized weight distribution, and integrated functions. This design freedom helps in reducing overall equipment weight and energy consumption while improving performance. Mining machinery and vehicles benefit from such innovations, as lighter and more efficient components contribute to longer equipment life and reduced fuel usage during operations.

Rising cost pressures and disruptions in global supply chains are also encouraging mining companies to invest in additive manufacturing capabilities. SLM reduces dependence on centralized suppliers and allows localized production of critical components. This resilience is particularly valuable in remote mining regions, where logistical delays can lead to substantial production losses. By incorporating SLM facilities, companies ensure greater self-reliance and continuity in operations while achieving long-term cost savings.

Sustainability initiatives in the mining sector further support the growth of SLM adoption. The technology reduces material waste by producing near-net-shape parts, allowing for the reuse of leftover powder material. It also supports part refurbishment and component recycling, which extend product life cycles and align with industry goals to lower carbon emissions. As environmental regulations tighten and sustainability becomes integral to mining operations, SLM stands out as a cleaner and more efficient manufacturing approach.

Drivers, Opportunities & Restraints

The growing demand for rapid and efficient on-site manufacturing of critical metal components drives the expansion of the selective laser melting in the mining industry. Mining operations often occur in remote areas, where obtaining spare parts quickly and efficiently can be challenging and costly. SLM technology enables companies to produce durable and customized parts directly at or near mining sites, minimizing downtime and enhancing productivity. Continuous improvements in laser precision, metal powder quality, and printing speed have made SLM a dependable manufacturing solution, supporting its growing use in mining equipment maintenance and production.

The expansion of digitalization and sustainability initiatives within the mining sector is creating strong opportunities for SLM adoption. The technology’s ability to reduce material waste and energy consumption aligns with global sustainability goals and decarbonization efforts. Mining companies are also exploring lightweight, high-strength components to improve energy efficiency in vehicles and machinery, and SLM provides the flexibility to design and manufacture such optimized parts. Partnerships between mining firms and additive manufacturing providers are fostering innovations in component design and prototyping, especially in developing markets with expanding mining infrastructure.

However, several restraints limit the widespread adoption of SLM in mining. The high cost of equipment installation and maintenance, combined with the need for specialized technical expertise, presents a significant challenge for many companies. Production speeds remain slower than those of traditional manufacturing processes, which affects scalability and efficiency.

Component Insights

Equipment held the revenue share of over 50% in 2024. The equipment segment is experiencing strong growth due to the increasing adoption of advanced 3D printing systems, which enhance operational efficiency and reduce material wastage. Mining companies are integrating SLM equipment to produce complex metal components with high precision for use in drilling tools, wear-resistant parts, and customized machinery. The demand is further supported by the capability of SLM machines to manufacture lightweight and durable components that extend the lifespan of mining equipment, reducing downtime and maintenance costs.

These materials offer superior mechanical strength, heat resistance, and corrosion resistance, making them ideal for manufacturing mining components such as drill bits, pump housings, and structural parts. The shift toward lightweight yet durable materials has gained prominence as mining companies seek to reduce equipment weight while maintaining structural integrity under harsh operational environments.

Regional Insights

North America accounted for the largest market revenue share of 34.4% in 2024. The North America selective laser melting in mining industry is strongly adopting SLM as companies focus on improving productivity, equipment reliability, and operational efficiency. The technology allows for rapid manufacturing of high-strength metal components directly from digital designs, enabling miners to reduce lead times for critical spare parts. Growing investments in advanced 3D printing infrastructure across the U.S. and Canada are further supporting the integration of SLM into mining operations. This shift is driven by the need to minimize equipment downtime, optimize resource utilization, and enhance sustainability through reduced material waste.

U.S. Selective Laser Melting In Mining Market Trends

In the U.S. selective laser melting in mining industry, SLM is experiencing rapid growth as companies strive to enhance operational resilience and reduce their dependence on conventional manufacturing supply chains. The technology enables American miners to produce durable metal components with high geometric accuracy, supporting applications such as replacement parts for drills, pumps, and excavation tools. The U.S. government’s emphasis on advanced manufacturing and digital transformation within the industrial sector has also encouraged the adoption of SLM, particularly in remote mining regions where sourcing spare parts is time-consuming and costly.

Asia Pacific Selective Laser Melting In Mining Market Trends

The selective laser melting in mining industry in Asia-Pacific is gaining momentum as companies’ transition to advanced manufacturing and local production of complex components. Nations such as China, Japan, and Australia are investing heavily in additive manufacturing technologies to enhance operational efficiency and self-sufficiency in equipment supply. The growing emphasis on precision engineering, reduced material waste, and energy-efficient production has led mining equipment manufacturers to explore SLM for producing intricate parts used in extraction and processing machinery. Government initiatives promoting smart manufacturing are further accelerating the integration of this technology across regional industries.

Europe Selective Laser Melting In Mining Market Trends

The European selective laser melting in mining industry is steadily gaining importance as the region focuses on technological innovation and sustainable manufacturing practices. Countries such as Germany, the UK, and Sweden are at the forefront of adopting additive manufacturing solutions to optimize mining operations and equipment performance. European companies are leveraging SLM to produce complex geometries in metal components, reduce material wastage, and improve mechanical strength in harsh mining environments. The strong presence of advanced manufacturing infrastructure and supportive EU policies toward digital transformation are also fostering wider adoption of SLM technologies in the industrial and mining sectors.

Middle East & Africa Selective Laser Melting In Mining Market Trends

The selective laser melting in mining industry in Middle East & Africa is anticipated to grow in the coming years as SLM is gradually emerging as a promising technology with the region focusing on modernizing its industrial base and reducing dependence on imported machinery components. Countries such as Saudi Arabia, the UAE, and South Africa are exploring metal additive manufacturing to enhance operational efficiency in mining and heavy industries. The growing investments in technological infrastructure and industrial diversification, under initiatives such as Saudi Vision 2030, are creating opportunities for SLM adoption in equipment production and maintenance. The ability of SLM to produce intricate metal parts with high precision aligns well with the region’s goal of building self-reliant and technologically advanced mining operations.

Latin America Selective Laser Melting In Mining Market Trends

The selective laser melting in mining industry in Middle East & Africa is anticipated to grow over the forecast period as SLM gaining traction in the Latin American mining market, as regional economies work toward industrial modernization and sustainable resource extraction. Countries such as Brazil, Chile, and Peru are investing in additive manufacturing technologies to strengthen their mining supply chains and reduce reliance on imported components. The growing focus on digital transformation, energy-efficient production, and waste reduction is encouraging mining equipment manufacturers to explore SLM for the fabrication of precision parts. Local initiatives promoting innovation and advanced engineering are helping accelerate the adoption of this technology within key mining regions.

Key Selective Laser Melting In Mining Company Insights

Some of the key players operating in the market include Nikon SLM Solutions AG, 3T Additive Manufacturing, and others.

-

Nikon SLM Solutions AG is a Germany-based pioneer in metal additive manufacturing, recognized for developing and commercializing advanced Selective Laser Melting (SLM) systems. The company became part of Nikon Corporation, which strengthened its global innovation and manufacturing capabilities. Nikon SLM Solutions focuses on high-precision, high-speed metal 3D printing systems tailored for industrial-scale production. Its technology enables the fabrication of intricate, durable, and lightweight metal components suited for applications in aerospace, automotive, energy, and mining.

-

3T Additive Manufacturing is a UK-based company recognized for its advanced metal additive manufacturing capabilities, particularly in the use of SLM for producing high-performance parts. The company has established expertise in developing complex geometries and lightweight components that meet the rigorous requirements of industries such as aerospace, automotive, and mining.

Key Selective Laser Melting In Mining Companies:

The following are the leading companies in the selective laser melting in mining market. These companies collectively hold the largest market share and dictate industry trends.

- 3T Additive Manufacturing

- Additive Industries

- DMG Mori AG

- EOS GmbH

- Farsoon Technologies

- GE Additive

- Nikon SLM Solutions AG

- Renishaw plc

- Trumpf GmbH + Co. KG

- Wipro 3D

Recent Development

- In June 2024, DMG MORI introduced its next-generation LASERTEC 30 SLM metal 3D printer, marking a significant step forward in additive manufacturing technology with the launch of its quad laser system and expanded build volume of 325 x 325 x 400 mm. The new machine features a floating process chamber to manage thermal expansion, an interchangeable build container for rapid material changeovers, and the automated rePLUG powder module system.

Selective Laser Melting In Mining Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 93.4 million

Revenue forecast in 2033

USD 235.8 million

Growth rate

CAGR of 12.3% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Component, region

Market definition

The market size represents total economic value of all 3D printing activity in the mining sector that uses SLM technology.

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Finland; Sweden; Poland; Russia; China; India; Australia; Brazil; South Africa; Iran

Key companies profiled

Nikon SLM Solutions AG; EOS GmbH; Renishaw plc; GE Additive; Trumpf GmbH + Co. KG; Additive Industries; DMG Mori AG; Farsoon Technologies; 3T Additive Manufacturing; Wipro 3D

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Selective Laser Melting In Mining Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global selective laser melting in mining market report based on component and region:

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Equipment

-

Materials

-

Services

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Finland

-

Sweden

-

Poland

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Iran

-

-

Frequently Asked Questions About This Report

b. The global selective laser melting in mining market size was estimated at USD 84.5 million in 2024 and is expected to reach USD 93.4 million in 2025.

b. The global selective laser melting in mining market is expected to grow at a compound annual growth rate of 12.3% from 2025 to 2033 to reach USD 235.8 million by 2033.

b. The equipment segment dominated the market with a revenue share of over 50% in 2024.

b. Some of the key players of the global selective laser melting in mining market are Nikon SLM Solutions AG, EOS GmbH, Renishaw plc, GE Additive, Trumpf GmbH + Co. KG, Additive Industries, DMG Mori AG, Farsoon Technologies, 3T Additive Manufacturing, Wipro 3D, and others.

b. The key factor driving the growth of the global selective laser melting in mining market is the increasing demand for efficient production of complex and high-strength metal components that enhance equipment durability, reduce downtime, and lower overall operational costs in mining operations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.