- Home

- »

- Pharmaceuticals

- »

-

Semaglutide Market Size & Share, Industry Report, 2035GVR Report cover

![Semaglutide Market Size, Share & Trends Report]()

Semaglutide Market (2025 - 2035) Size, Share & Trends Analysis Report By Product (Ozempic, Wegovy, Rybelsus), By Application (Type 2 Diabetes Mellitus, Obesity), By Route Of Administration, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-549-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Semaglutide Market Summary

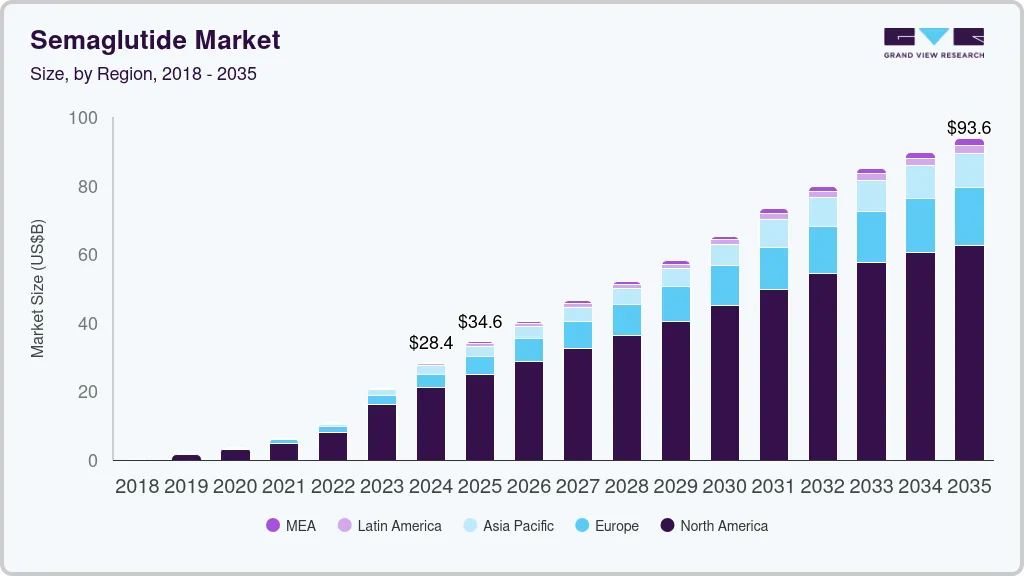

The global semaglutide market size was estimated at USD 28,429.9 million in 2024 and is projected to reach USD 93,598.8 million by 2035, growing at a CAGR of 10.5% from 2025 to 2035. The global semaglutide industry is driven by the increasing prevalence of type 2 diabetes and obesity, rising demand for GLP-1 receptor agonists, and growing adoption of weight management treatments.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, Japan is expected to register the highest CAGR from 2025 to 2035.

- In terms of segment, ozempic (semaglutide) accounted for a revenue of USD 19,454.8 million in 2024.

- Rybelsus (oral semaglutide) is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 28,429.9 Million

- 2035 Projected Market Size: USD 93,598.8 Million

- CAGR (2025-2035): 10.5%

- North America: Largest market in 2024

Expanding clinical applications, regulatory approvals, and strong sales performance further support market growth. Key players invest in R&D, while favorable reimbursement policies and patient preference for once-weekly dosing contribute to market expansion. Pharmaceutical collaborations and geographic expansion strategies also influence market dynamics.

The rising global obesity rate is a key driver for the semaglutide market growth, particularly for Wegovy. WHO data (March 2024) reports 890 million obese adults, with associated healthcare costs projected to exceed USD 18 trillion by 2060. Obesity-related conditions, including type 2 diabetes and cardiovascular diseases, are increasing demand for effective pharmacological interventions. Wegovy, a GLP-1 receptor agonist, addresses obesity by regulating appetite and caloric intake. Regulatory support and clinical evidence further accelerate adoption. With obesity’s growing burden on healthcare systems and economies, the market is expanding, positioning Wegovy as a leading solution in medical weight management.

The rising diabetes burden is a key driver for the semaglutide industry, particularly for Ozempic and Rybelsus. The IDF Diabetes Atlas (2021) reports 537 million adults (20-79 years) living with diabetes, projected to rise to 643 million by 2030 and 783 million by 2045. Over 90% have type 2 diabetes, driven by urbanization, aging populations, and obesity. Nearly 240 million remain undiagnosed, increasing demand for effective treatments. Semaglutide-based therapies, including Ozempic (injectable) and Rybelsus (oral), improve glycemic control and cardiovascular outcomes, positioning them as critical solutions amid the growing diabetes epidemic and rising healthcare expenditure.

Novo Nordisk has made substantial strides in expanding its diabetes and obesity care product reach, with a 6% increase in the number of patients treated with diabetes products, reaching 43 million in 2024. The growth in obesity treatments was particularly notable, with the number of patients reaching 2.2 million in 2024, a 100% increase driven by the expanded launch of Wegovy in additional countries. However, the number of vulnerable patients treated with Diabetes care products decreased by 5%, primarily due to reduced access through affordability initiatives. The Changing Diabetes in Children program also showed strong progress, reaching 64,743 children by the end of 2024, toward a target of 100,000 by 2030.

The willingness to pay for semaglutide influences market expansion, pricing strategy, and adoption. Patients, healthcare providers, and payers recognize its clinical outcomes in weight management, type 2 diabetes, and cardiovascular risk reduction, supporting its pricing. Despite the treatment cost, patients seeking long-term health outcomes choose to pay out-of-pocket, particularly in markets with limited reimbursement.

Healthcare systems and insurers assess the cost-effectiveness of semaglutide in reducing obesity-related complications, which affects healthcare expenditures. This assessment leads to reimbursement approvals and access initiatives, supporting adoption. The cost-benefit profile of semaglutide, in comparison to existing therapies, sustains demand and revenue growth.

Semaglutide Clinical Trials - Pipeline Analysis

The pipeline for semaglutide-based interventions highlights a broad spectrum of indications beyond diabetes and obesity, areas where approved drugs like Ozempic and Wegovy already dominate. Key ongoing trials focus on conditions such as Alzheimer's disease, non-alcoholic steatohepatitis (NASH), cardiovascular disease, and chronic kidney disease, addressing unmet needs in these therapeutic areas. While diabetes and obesity remain central, with several studies in advanced phases (Phase 3 and 4), the exploration of semaglutide for conditions like early Alzheimer's and liver diseases opens avenues for market expansion. The focus on novel combinations and specialized treatments for these additional indications could significantly enhance the clinical profile of semaglutide, potentially broadening its therapeutic impact and driving growth in emerging treatment areas.

Table: Notable clinical trials for semaglutide - Pipeline Analysis

NCT Number

Study Title

Conditions

Sponsor

Phases & Completion Date

Market Impact

NCT06739044

Efficacy and Safety of Semaglutide Injection Vs Ozempic in Patients with Type 2 Diabetes

Type 2 Diabetes

Hangzhou Zhongmei Huadong Pharmaceutical Co., Ltd.

PHASE3

2/10/2025Potential expansion in diabetic treatment market, especially with biosimilars.

NCT04777409

A Research Study Investigating Semaglutide in People With Early Alzheimer's Disease (EVOKE Plus)

Early Alzheimer's Disease

Novo Nordisk A/S

PHASE3

10/6/2026Could establish semaglutide as a novel treatment for Alzheimer’s disease, opening new revenue streams.

NCT06604624

Semaglutide in Treatment of Obesity

Weight Management

CSPC Baike (Shandong) Biopharmaceutical Co., Ltd.

PHASE3

3/1/2026Increased market penetration for weight management therapies.

NCT04822181

Research Study on Whether Semaglutide Works in People With Non-alcoholic Steatohepatitis (NASH)

Non-alcoholic Steatohepatitis

Novo Nordisk A/S

PHASE3

4/25/2029Significant market potential if approved for NASH treatment, an unmet medical need.

NCT04596631

A Research Study to Compare a New Medicine Oral Semaglutide to a Dummy Medicine in Children and Teenagers With Type 2 Diabetes

Type 2 Diabetes

Novo Nordisk A/S

PHASE3

2/4/2026Expansion of market scope to pediatric diabetes management.

NCT05669755

REDEFINE 3: A Research Study to See the Effects of CagriSema in People Living With Diseases in the Heart and Blood Vessels

Cardiovascular Disease

Novo Nordisk A/S

PHASE3

10/13/2027Broadens semaglutide’s application for cardiovascular disease treatment.

NCT06269107

A Research Study to See How Well New Weekly Medicine IcoSema Controls Blood Sugar Levels in People With Type 2 Diabetes (T2D), Compared to Daily Insulin Glargine (COMBINE 4)

Type 2 Diabetes

Novo Nordisk A/S

PHASE3

6/30/2025If successful, could challenge existing insulin treatments with improved efficacy.

NCT05726227

A Research Study on How Well Semaglutide Helps Children and Teenagers With Excess Body Weight Lose Weight

Obesity

Novo Nordisk A/S

PHASE3

12/7/2026Potential to establish semaglutide as a pediatric weight management treatment.

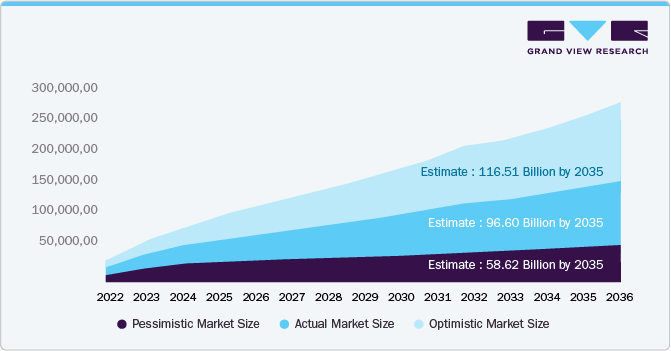

Growth Scenarios for the Global Semaglutide Market (2035) - Opportunity Analysis

To provide a comprehensive understanding of the future growth potential of the semaglutide industry, we have conducted a detailed market size analysis considering multiple growth scenarios. This analysis aims to offer strategic insights into how various factors-such as regulatory developments, adoption rates, reimbursement policies, and market expansion into new therapeutic indications-might influence the market's trajectory over the next decade.

Market size projections for the global market for semaglutide vary based on different growth scenarios, each accounting for factors such as regulatory developments, adoption rates, reimbursement policies, and market expansion into new indications. These projections provide a strategic outlook on potential market trajectories and the variables influencing overall growth.

The pessimistic market size represents the lower-end estimate, assuming regulatory hurdles, slower adoption rates, and market saturation. Under this scenario, the market is projected to reach approximately USD 58.6 billion by 2035. Factors such as pricing pressures, supply constraints, competition from alternative therapies, and restrictive reimbursement policies could contribute to slower market growth.

The actual market size reflects the most likely scenario, incorporating current market trends, demand projections, and sustained commercial investments. The market is expected to reach approximately USD 93.60 billion by 2035, driven by expanding therapeutic applications, increasing patient adoption, and continued investment in research and development. This scenario assumes stable regulatory support and steady market expansion.

The optimistic market size represents the higher-end estimate, assuming accelerated adoption, favorable reimbursement policies, and expansion beyond diabetes management into new indications. Under this scenario, the semaglutide market could grow to approximately USD 116.5 billion by 2035. Factors such as wider global accessibility, expanded indications in obesity and cardiovascular diseases, and further clinical advancements would support this level of growth.

Regulatory landscapes, supply chain dynamics, innovation, and accessibility strategies will shape the semaglutide industry trajectory. Continuous investment in research, pricing strategies, and market expansion initiatives will determine the final market size, influencing the long-term commercial success of semaglutide-based therapies.

Off-Label Use and Counterfeit Semaglutide: Regulatory and Market Implications

The FDA has raised concerns over the off-label use of unapproved and compounded semaglutide, citing risks such as dosing errors, safety concerns, and over 455 adverse event reports as of February 2025. The growing demand for GLP-1 receptor agonists in weight management has led to an influx of illegally marketed and counterfeit versions, including counterfeit Ozempic. The FDA warns that compounded semaglutide, especially in salt forms, lacks regulatory oversight, raising concerns over efficacy and safety.

Regulatory actions targeting compounded and counterfeit semaglutide could disrupt supply chains, impact prescribing trends, and increase scrutiny over off-label use. As more patients turn to semaglutide for weight loss-despite its primary FDA approvals for diabetes-these developments could influence market availability and healthcare provider decisions. The FDA’s recent investigations into counterfeit Ozempic reflect a broader effort to curb unauthorized versions of the drug.

As of December 2023, the FDA has seized thousands of units of counterfeit Ozempic and issued warnings for products labeled with lot number NAR0074 and serial number 430834149057. These counterfeit versions contain unverified ingredients and non-sterile needles, increasing the risk of infections. While five adverse events have been reported, none were classified as severe. The FDA advises pharmacies to source Ozempic only from authorized distributors and urges patients to verify their prescriptions.

With the semaglutide shortage now resolved, the FDA has clarified compounding policies. As of February 21, 2025, state-licensed pharmacies and physicians (503A facilities) can compound semaglutide until April 22, 2025, while outsourcing facilities (503B) can continue until May 22, 2025, or pending a court ruling in Outsourcing Facilities Association (OFA) v. FDA. However, the FDA may take action against substandard or unsafe compounded products. These regulatory updates and ongoing legal challenges could reshape compounding policies and market competition in the GLP-1 receptor agonist space, affecting both diabetes management and weight-loss treatments.

Patent Expiry Outlook and Market Implications

The patent loss for Ozempic, Rybelsus, and Wegovy, all under the semaglutide market, presents significant opportunities and challenges. As patents expire between 2026 and 2032, generic competition will likely intensify, potentially reducing market share and pricing power. However, this opens pathways for biosimilars and alternatives, potentially boosting patient access and driving market growth. Companies will need to focus on differentiation, innovation, and extended indications to maintain a competitive edge. Additionally, the expiration of patents may shift the focus toward next-generation therapies, further impacting the market landscape.

Product

U.S.

China

Japan

Europe

Ozempic

2032

2026

2031

2031

Rybelsus

2032

2026

2031

2031

Wegovy

2032

2026

2031

2031

Pricing Dynamics and Affordability Impact for Semaglutide-Based Treatments

The cost of semaglutide-based treatments, including Ozempic, Wegovy, and Rybelsus, is a significant factor influencing their market dynamics. These medications are positioned within a specialized segment targeting diabetes and obesity, where accessibility and affordability are key to broad adoption. The impact of insurance coverage, discounts, and patient assistance programs on out-of-pocket costs is substantial, allowing for greater patient access and adherence. For patients without insurance or with limited coverage, the availability of savings programs can significantly reduce financial barriers, ensuring continued demand. Moreover, as competition grows in the weight management and diabetes treatment sectors, pricing strategies and cost transparency will be critical in maintaining market share. The ongoing adjustments to pricing structures and cost-saving measures directly influence both patient outcomes and long-term market growth, as the affordability of such treatments remains central to addressing the increasing global burden of these chronic conditions.

Product

Dosage

List Price (USD)

Wegovy

1 package

1349.02

Ozempic

0.25 or 0.5 mg (1 x 1.5-mL pen)

997.58

1 mg (1 x 3-mL pen)

997.58

2 mg (1 x 3-mL pen)

997.58

RYBELSUS

3 mg (1 package)

997.58

7 mg (1 package)

997.58

14 mg (1 package)

997.58

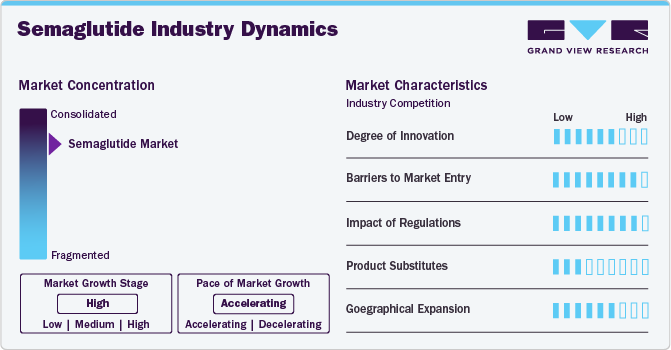

Market Concentration & Characteristics

The market is advancing with innovations in drug formulations, delivery mechanisms, and combination therapies. Extended-release formulations, oral versions, and novel co-therapies are improving patient adherence and therapeutic outcomes. Innovations focus on optimizing bioavailability, reducing gastrointestinal side effects, and expanding indications beyond diabetes and obesity to cardiovascular and neurodegenerative disorders.

The market has high entry barriers due to strict regulatory requirements, significant R&D investments, and Novo Nordisk’s strong intellectual property protections. The complexity of peptide-based drug development, specialized manufacturing processes, and the need for extensive clinical trials further restrict potential competitors. Additionally, Novo Nordisk’s established market presence and control over global supply chains reinforce its dominance.

Regulatory agencies, including the FDA and EMA, impose stringent guidelines on semaglutide products, requiring extensive clinical trials to establish long-term safety and efficacy. Pricing and reimbursement policies significantly influence market access, as high treatment costs necessitate favorable insurance coverage. Regulatory harmonization across regions is essential for global adoption, particularly in emerging markets.

Semaglutide competes with other GLP-1 receptor agonists, DPP-4 inhibitors, SGLT2 inhibitors, and insulin therapies. Non-pharmacological approaches, including bariatric surgery and lifestyle modifications, also serve as alternatives. However, semaglutide’s efficacy in weight management, cardiovascular benefits, and patient preference for less frequent dosing contribute to its market expansion.

Novo Nordisk is expanding its semaglutide portfolio into high-growth markets such as Asia-Pacific, Latin America, and the Middle East, driven by rising diabetes and obesity prevalence and improving healthcare infrastructure. The company focuses on securing regulatory approvals, optimizing pricing strategies, and strengthening reimbursement frameworks to enhance patient access. Strategic partnerships with healthcare providers and government initiatives support market penetration, while investments in local manufacturing and distribution networks address supply chain challenges.

Product Insights

The Ozempic segment dominated with a revenue share of 59.62% in 2024, driven by strong clinical efficacy, broad regulatory approvals, and increasing adoption for type 2 diabetes. Novo Nordisk’s extensive distribution network, favorable reimbursement policies, and ongoing clinical trials reinforced its leadership. The drug’s once-weekly dosing, cardiovascular benefits, and expanding indications fueled growth. Strong sales in North America and Europe, along with market expansion in Asia-Pacific and Latin America, solidified its position. Continued R&D, supply chain optimization, and strategic pricing sustained Ozempic’s dominance despite demand pressures.

A study published in Diabetes Care, "Economic Costs of Diabetes in the U.S. in 2022," analyzed diabetes' financial burden on the U.S. economy. The total cost of diagnosed diabetes in 2022 was USD 412.9 billion, with USD 306.6 billion in direct medical expenses and USD 106.3 billion in indirect costs. The report highlights a rising economic burden, with hospital inpatient care, prescription medications, and diabetes supplies as major contributors. Indirect costs include productivity loss, absenteeism, and disability. The study underscores the urgent need for improved prevention and management strategies to curb escalating costs.

Wegovy is projected to grow at a significant CAGR over the forecast period, driven by rising demand for GLP-1 receptor agonists in weight management. Increasing obesity rates, expanding insurance coverage, and strong clinical outcomes support market expansion. Novo Nordisk’s production scale-up and regulatory approvals in multiple regions further enhance growth prospects. Competition from Eli Lilly’s Zepbound and regulatory scrutiny on off-label semaglutide use may influence market dynamics. However, with sustained consumer interest and physician adoption, Wegovy is expected to maintain strong momentum, reinforcing its position in the obesity treatment market. Future sales growth will depend on supply stability and pricing strategies.

Application Insights

The type 2 diabetes mellitus segment dominated the market and accounted for a revenue share of 71.90% in 2024, driven by its rising global prevalence and increasing adoption of advanced therapies. The growing use of GLP-1 receptor agonists, including semaglutide (Ozempic, Wegovy), has significantly influenced treatment trends. Expanding healthcare access, favorable reimbursement policies, and continued innovation in insulin formulations further support market growth. While Type 1 Diabetes treatments remain essential, Type 2 Diabetes accounts for the majority of diagnosed cases, reinforcing its market leadership. Pharmaceutical investments and regulatory approvals will shape competitive dynamics and treatment accessibility in 2024.

The obesity segment is expected to witness the fastest CAGR during the forecast period, driven by increasing demand for GLP-1 receptor agonists like Wegovy for weight management. Rising obesity prevalence, expanding insurance coverage, and growing physician acceptance of pharmacological interventions contribute to market expansion. Regulatory approvals and clinical evidence supporting semaglutide’s efficacy in weight loss further accelerate adoption. As consumer awareness increases and supply constraints ease, the obesity segment will outpace other applications, positioning semaglutide as a key driver in the evolving weight management market.

Route of Administration Insights

The parenteral route of administration dominated the market and accounted for a revenue share of 88.46% in 2024, driven by the widespread adoption of Ozempic and Wegovy, both available as injectable formulations. The strong efficacy and established usage of these GLP-1 receptor agonists in diabetes and obesity management contributed to market leadership. Although an oral formulation of semaglutide is in development for both Ozempic and Wegovy, the injectable form remains the standard due to proven patient adherence and efficacy. Continued innovation in drug delivery may influence future market dynamics, but parenteral administration currently holds the majority share.

The oral route of administration is projected to experience the fastest CAGR over the forecast period, driven by the development of non-injectable alternatives. Novo Nordisk is advancing oral formulations of Ozempic (semaglutide) and Wegovy (semaglutide), which are currently in the pipeline. These developments aim to improve patient compliance and expand market accessibility. While injectable formulations remain dominant, increasing preference for convenient oral options and advancements in drug delivery technology is expected to accelerate market adoption, positioning oral semaglutide as a key growth driver in the coming years.

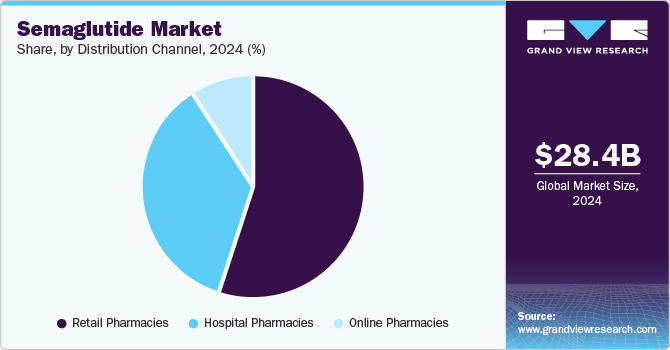

Distribution Channel Insights

The retail pharmacies segment led the market and accounted for a revenue share of 55.09% in 2024, driven by increasing consumer demand for GLP-1 receptor agonists like Ozempic and Wegovy. The accessibility of these medications through retail chains enhanced patient convenience, contributing to higher sales volumes. Expanded insurance coverage and direct patient purchases further supported dominance in this segment. While hospital and online pharmacies also play significant roles, retail pharmacies benefited from widespread distribution networks and pharmacist-driven patient engagement, solidifying their position as the primary distribution channel for semaglutide-based therapies.

The online pharmacies segment is expected to grow at the fastest CAGR during the forecast period, due to increasing consumer preference for digital healthcare solutions. The rising demand for Ozempic and Wegovy, coupled with home delivery convenience, drives this expansion. Enhanced telemedicine services and direct-to-consumer sales models have further accelerated adoption. Regulatory approvals for online prescription fulfillment and expanding insurance coverage contribute to market penetration. While retail pharmacies remain dominant, online platforms benefit from accessibility, competitive pricing, and discreet purchasing options, positioning them as the fastest-growing distribution channel for semaglutide-based therapies.

Regional Insights

The North America semaglutide industry holds a leading position in 2024, accounting for 74.35% of the global share, driven by high obesity and diabetes prevalence, strong healthcare infrastructure, and widespread adoption of GLP-1 receptor agonists like Ozempic and Wegovy. The region benefits from favorable reimbursement policies, increasing weight management awareness, and rising prescriptions for off-label use. The U.S. dominates due to robust pharmaceutical regulations, active patient engagement, and significant investments in obesity therapeutics. Additionally, market growth is fueled by ongoing clinical advancements, including oral semaglutide formulations. With continuous regulatory oversight and expanding treatment accessibility, North America remains the largest market for semaglutide-based therapies.

U.S. Semaglutide Market Trends

The U.S. dominates the North America semaglutide industry, driven by increasing demand for GLP-1 receptor agonists in diabetes and obesity management. Early regulatory approvals, and extensive R&D activities contribute to market expansion. The rising adoption of semaglutide for weight loss, despite its primary approval for diabetes, is reshaping prescribing trends. Retail pharmacies are the dominant distribution channel, with online pharmacies gaining traction due to convenience and direct-to-consumer models.

Europe Semaglutide Market Trends

Europe exhibits steady semaglutide industry growth, led by Germany, France, and the UK. The region benefits from strong clinical research infrastructure, government initiatives for obesity and diabetes management, and increasing prescriptions of GLP-1 receptor agonists. Regulatory policies supporting obesity therapeutics further drive adoption.

The UK semaglutide market growth is propelled by increasing funding for diabetes and obesity treatments, along with growing demand for personalized medicine. Expanding weight management programs and clinical trials evaluating new formulations contribute to market expansion. Retail pharmacies play a crucial role in semaglutide accessibility, complementing traditional hospital pharmacy channels.

Semaglutide market in Germany is expected to grow during the forecast period. Germany leads the Europe market due to its advanced biopharmaceutical manufacturing and robust healthcare system. Increasing adoption of GLP-1 receptor agonists for metabolic disorders and obesity fuels growth. Hospital pharmacies dominate the distribution landscape, with online pharmacy expansion improving patient access to semaglutide-based therapies.

France semaglutide market benefits from strong regulatory support and public healthcare initiatives aimed at diabetes and obesity management. Increased awareness and reimbursement policies for GLP-1 receptor agonists contribute to higher adoption rates. Hospital pharmacies remain the primary distribution channel, with retail and online pharmacies gradually gaining presence.

Asia Pacific Semaglutide Market Trends

The Asia Pacific semaglutide industry is witnessing rapid expansion, driven by rising obesity and diabetes prevalence, increasing healthcare investments, and regulatory approvals for GLP-1 therapies. China, Japan, and India lead the market, supported by domestic pharmaceutical manufacturing and growing patient awareness. The region is experiencing increasing adoption of semaglutide in both hospital and retail pharmacy settings.

Japan’s semaglutide market is expanding due to government-backed initiatives for diabetes and obesity management. The aging population and increasing prevalence of obesity contribute to demand. Retail pharmacies dominate semaglutide distribution, with hospital pharmacies enhancing disease management strategies.

Semaglutide market in China is growing rapidly, supported by government policies promoting healthcare modernization and local biopharma expansion. Increasing demand for diabetes and obesity treatments, coupled with the rise of online pharmacies, is transforming market accessibility. The country is seeing significant investments in GLP-1 receptor agonist research and manufacturing.

Latin America Semaglutide Market Trends

Latin America is experiencing moderate growth in the semaglutide industry, led by Brazil and Argentina. Increasing healthcare expenditures and rising awareness of obesity treatments are driving market penetration. Expanding government programs for diabetes management support semaglutide adoption in the region.

Brazil’s semaglutide market is growing due to high obesity rates and increasing government efforts to improve healthcare access. Investments in local biopharmaceutical production and partnerships with international firms contribute to expanding semaglutide availability. Retail pharmacies are playing a key role in making GLP-1 therapies more accessible.

Middle East & Africa Semaglutide Market Trends

Middle East and Africa is experiencing growing demand for semaglutide, particularly in Saudi Arabia and the UAE. Government healthcare initiatives and increasing obesity rates are key drivers. The market is expanding as healthcare infrastructure improves and semaglutide accessibility increases through both hospital and retail pharmacies.

Saudi Arabia’s semaglutide market is expanding, driven by healthcare reforms and rising obesity-related complications. Government investments in biotechnology and chronic disease management support semaglutide adoption. Retail and hospital pharmacies are key distribution channels, with growing online pharmacy penetration enhancing patient access.

Key Semaglutide Company Insights

Novo Nordisk dominates the semaglutide market, holding a leading position due to its exclusive development, manufacturing, and commercialization of Ozempic, Wegovy, and Rybelsus. The company's strong market presence is supported by continuous product innovation, global regulatory approvals, and expanding production capacity to meet rising demand. Novo Nordisk’s strategic investments in supply chain expansion and ongoing research in oral semaglutide formulations further strengthen its leadership. With no direct competitors for branded semaglutide, the company maintains control over market dynamics, pricing strategies, and distribution channels, ensuring sustained growth in the GLP-1 receptor agonist segment. However, as the drug approaches patent expiration, the market landscape is expected to shift, with biosimilar competition and alternative GLP-1 receptor agonists or combination therapies challenging its dominance

Competitive Landscape & Emerging Players

-

Lexicon Pharmaceuticals: Lexicon licensed LX9851 to Novo Nordisk for obesity treatment, exploring combination with semaglutide, with up to USD 1 billion in payments.

-

Viking Therapeutics: Viking Therapeutics' VK2735, a dual GLP-1/GIP agonist, showed significant weight loss efficacy in Phase 1/2 trials, competing with semaglutide.

-

Eli Lilly and Company: Lilly's Zepbound outperformed Wegovy in weight loss (20.2% vs. 13.7%) in SURMOUNT-5 trial, demonstrating superior efficacy in obesity management without diabetes.

-

Upcoming Biosimilars: As semaglutide’s patent nears expiration, biosimilar manufacturers, including major generic and biotech firms, are preparing to enter the market. Companies are exploring biosimilar versions, which could reshape the market landscape post-2032.

Key Semaglutide Companies

The following are the leading companies in the semaglutide market. These companies collectively hold the largest market share and dictate industry trends.

- Novo Nordisk

- Eli Lilly

- Viking Therapeutics

- Lexicon Pharmaceuticals

- Biocon

- AstraZeneca

Recent Developments

-

In February 2025, Novo Nordisk announced the FDA has declared the Wegovy and Ozempic shortage over, confirming U.S. supply meets demand. The company invested USD 6.5 billion to expand production and launched the AI-powered Find My Meds app. Novo Nordisk warns against counterfeit drugs and emphasizes responsible use of its FDA-approved semaglutide medicines.

-

In January 2025, Novo Nordisk announced that semaglutide 7.2 mg achieved 20.7% weight loss in the STEP UP trial, surpassing semaglutide 2.4 mg and placebo. The trial confirmed safety and tolerability. Another phase 3 trial, STEP UP T2D, is ongoing. Results reinforce semaglutide’s role in obesity treatment alongside Wegovy’s cardiovascular benefits.

-

In June 2024, Novo Nordisk’s Phase 3 FLOW trial showed Ozempic (semaglutide) 1 mg reduced kidney disease-related events by 24% in type 2 diabetes patients with CKD. The FDA is reviewing a label extension, with a decision expected in January 2025. Results were published in NEJM and presented at ADA 2024.

Semaglutide Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 34.57 billion

Revenue forecast in 2035

USD 93.60 billion

Growth rate

CAGR of 10.47% from 2025 to 2035

Actual data

2018 - 2024

Forecast period

2025 - 2035

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2035

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, route of administration, distribution channel, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Novo Nordisk; Eli Lilly; Viking Therapeutics; Lexicon Pharmaceuticals; Biocon; AstraZeneca

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Semaglutide Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2035. For this study, Grand View Research has segmented the global semaglutide market report based on product, application, route of administration, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2035)

-

Ozempic

-

Wegovy

-

Rybelsus

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2035)

-

Type 2 Diabetes Mellitus

-

Obesity

-

Others

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2035)

-

Parenteral

-

Oral

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2035)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2035)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global semaglutide market size was estimated at USD 28.43 billion in 2024 and is expected to reach USD 34.57 billion in 2025.

b. The global semaglutide market is expected to grow at a compound annual growth rate of 10.47% from 2025 to 2035 to reach USD 93.60 billion by 2035.

b. Based on product, Ozempic dominated the semaglutide market, accounting for 59.62% of the share in 2024, driven by strong clinical efficacy, broad regulatory approvals, and increasing adoption for type 2 diabetes.

b. Novo Nordisk dominates the semaglutide market, holding a leading position due to its exclusive development, manufacturing, and commercialization of Ozempic, Wegovy, and Rybelsus. However, some of the emerging players include Eli Lilly, Viking Therapeutics, Lexicon Pharmaceuticals, Biocon, AstraZeneca, among others.

b. The global semaglutide market is driven by the increasing prevalence of type 2 diabetes and obesity, rising demand for GLP-1 receptor agonists, and growing adoption of weight management treatments. Expanding clinical applications, regulatory approvals, and strong sales performance further support market growth. Key players invest in R&D, while favorable reimbursement policies and patient preference for once-weekly dosing contribute to market expansion. Pharmaceutical collaborations and geographic expansion strategies also influence market dynamics.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.