Serum Separation Gel Market Size & Trends

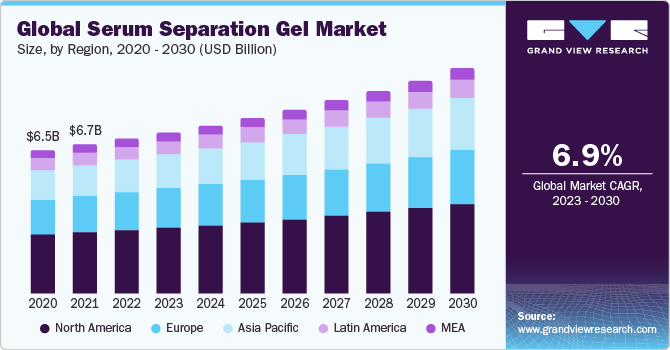

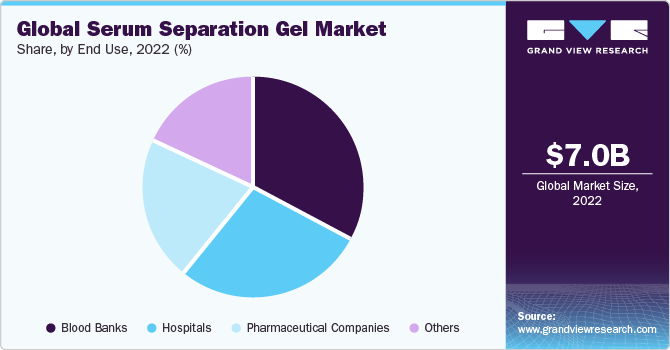

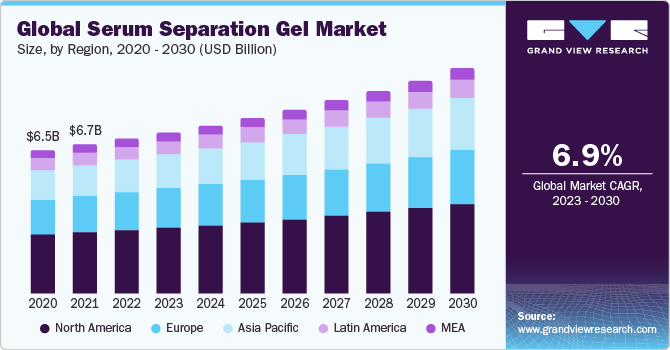

The global serum separation gel market size was valued at USD 7.00 billion in 2022 and is expected to grow at a Compound Annual Growth Rate (CAGR) of 6.90% over the forecast period. This can be attributed to the growing use of serum separation gels and wide applications in various healthcare settings. Hospitals, clinics, blood banks, biotechnological companies, research & academics, and others are major buyers of serum separation gels for various applications like faster and complete separation of serum and blood clots.

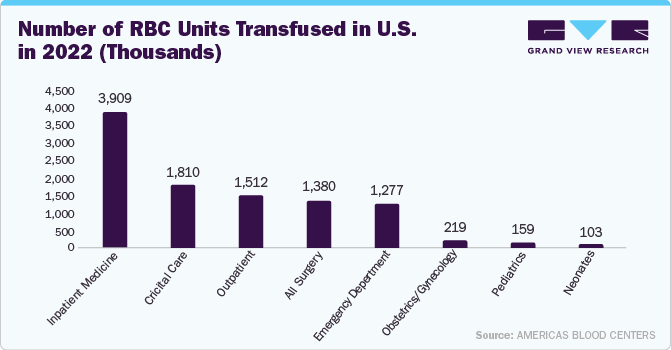

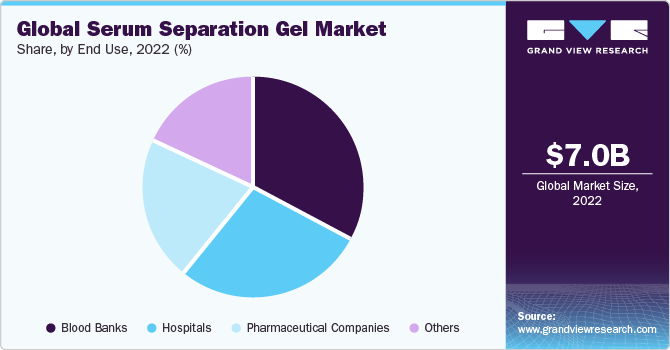

The rise in blood banks globally is a key factor contributing to market growth. According to the World Health Organization (WHO) 2023, around 13,300 blood bank centers are available worldwide. In addition, according to the U.S. FDA Blood Establishment Registry, in 2022, 90 hospitals and 53 community-based blood centers were available in the U.S. These independent blood centers collect approximately 60% of the country blood supply, and the American Red Cross collects nearly 40%. Blood banks have played a significant role in collecting, storing, and distributing blood pockets to hospitals and surgical centers for blood transfusion. Blood sample tubes with a separating gel are frequently utilized to extract blood serum for laboratory testing. Thus, an increasing number of blood banks is anticipated to drive market growth during the forecast period.

Furthermore, the demand for serum separation gel has grown due to the rising occurrence of bloodstream infections such as nosocomial candidemia. According to a study report released by the National Centre for Biotechnology in 2023, nosocomial candidemia was the most prevalent bloodstream infection worldwide, with considerable morbidity and death rates. The incidence rate of bloodstream infections is 307 per 100,000 people per year. Thus, it is anticipated that the increasing prevalence of bloodstream infection and public awareness of the diagnosis of infectious diseases will lead to a higher volume of novel tests, which will drive the serum separation gel market.

Moreover, drug measurement tests are routinely ordered and carried out for both inpatients and outpatients in different healthcare settings for therapeutic drug monitoring and toxicological purposes. In order to avoid possible drug adsorption to the gel and preserve the integrity of the data, standard laboratory procedures for serum drug assays are required for specimen collection in gel-free tubes. Hence, appropriate specimen collection and storage may greatly impact the accuracy of these tests, which can then influence clinical decision-making further down the line. This decision-making frequently involves changes to medication dose or administration and treatment planning. Thus, increasing demand for drug measurement tests is expected to boost demand for the serum separation gel market over the forecast period.

Product Insights

On the basis of the product, the market is segmented into serum separation gel without integrated tubes and serum separation gel with integrated tubes. The serum separation gel with integrated tubes segment held the largest market share in 2022. This can be attributed to a surge in the use of these tubes for clinical research in pathology to manage the increasing worldwide burden of infectious illness. The increased demand for these tubes and expanded use may result from improved sample handling and simplicity. Additionally, the segment is anticipated to rise due to its benefits, which include less interference with clinical test results, increased resistance to radiation, and others.

End Use Insights

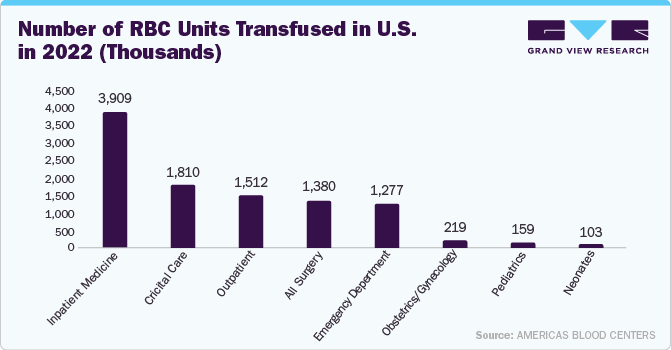

Based on the source, the serum separation gel market is segmented into blood banks, hospitals, pharmaceutical companies, and others. The blood banks segment held the largest market share in 2022. This can be attributed to the rising adoption of blood and its components, such as white blood cells (WBC), platelets, red blood cells (RBCC), and plasma for medical purposes. Here, serum separation gel plays an important role in separating these blood components. The American National Red Cross organization states that about 12,500 and 3,000 platelet donations are required to meet the daily demands of the country. This need is due to the growing number of burn victims, road accidents, organ transplant procedures, and heart surgeries. Therefore, increasing blood donations is projected to fuel demand for blood banks for their collections and storage, thereby driving segment growth.

Regional Insights

North America dominated the market in 2022. A sharp rise in the cases of infectious diseases and hematological disorders is one of the major factors responsible for the dominance of this region. Most cases were reported from the elderly population due to high comorbidities and weak immune systems. Additionally, more blood banks with cutting-edge infrastructure and readily available co-pay plans contribute to the market growth. Asia-Pacific is expected to witness the fastest CAGR over the forecast period. This can be attributed to the increased launch of new blood banks in countries such as China, Japan, South Korea, India, Thailand, Australia, and Singapore.

Competitive Insights

Several firms leading the market are Greiner Bio-One International GmbH, IntervacTechnology, BD, Cardinal Health Inc., and Sekisui Diagnostics. A number of well-known industry participants are employing diverse strategies, such as introducing novel products for laboratory test research.

Following are some instances of strategic initiatives:

-

In September 2022, Suneva Medical, Inc. launched Amplifine Platelet Rich Plasma (PRP) gel tubes to provide a good amount of PRP for clinical practices and patients to address different issues more effectively. In addition, it received clearance from the U.S. FDA earlier in the same year. This launch is expected to have a positive impact on market growth.

-

In August 2022, the U.S. Department of Health and Human Services (HHS) launched a new campaign, “Giving=Living,” to increase plasma and blood donations in the U.S. This will boost the serum separation gel market during the forecast period.