- Home

- »

- Medical Devices

- »

-

Sex Toys Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Sex Toys Market Size, Share & Trends Report]()

Sex Toys Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Vibrators, Masturbation Sleeves, Dildos, Sex Dolls), By Distribution Channel (E-commerce, Specialty Stores), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-981-4

- Number of Report Pages: 145

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Sex Toys Market Summary

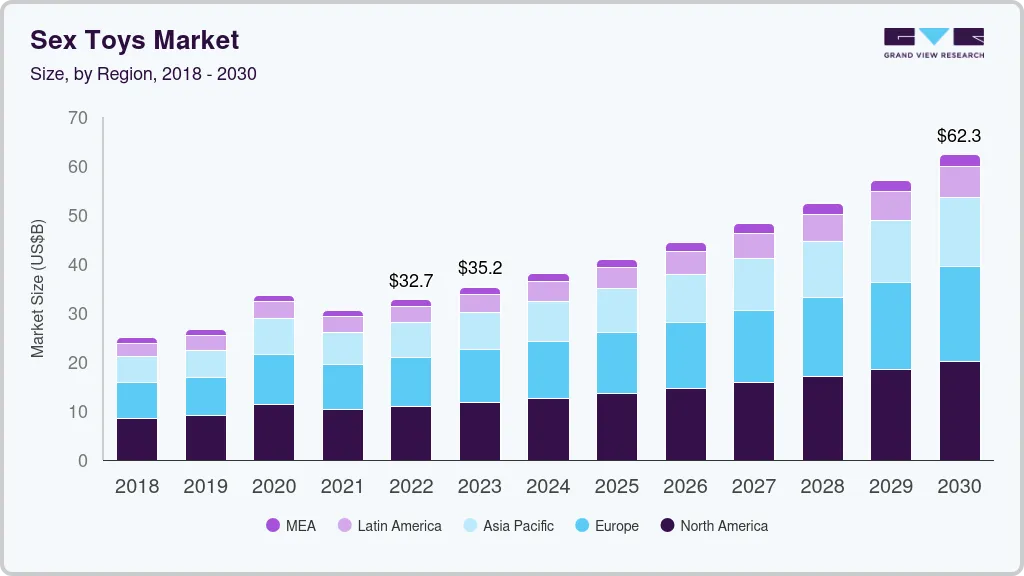

The global sex toys market size was estimated at USD 35.2 billion in 2023 and is projected to reach USD 62.7 billion by 2030, growing at a CAGR of 8.69% from 2024 to 2030. The growth of this market can be attributed to the increasing use of sex toy products and the rising awareness of sexual health among adolescents & young adults.

Key Market Trends & Insights

- North America held the largest revenue share of 33.24% in 2023.

- The Canada sex toys market is expected to witness significant growth over the forecast period.

- Based on product, the vibrators segment dominated the market with a revenue share of 22.48% in 2023.

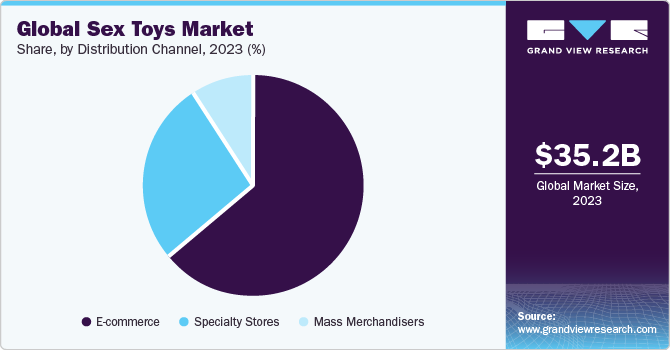

- Based on distribution channel, the e-commerce segment held the largest revenue share of 63.8% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 35.2 Billion

- 2030 Projected Market Size: USD 62.7 Billion

- CAGR (2024-2030): 8.69%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

The increasing penetration of Artificial Intelligence (AI) with sex toys, such as sex robots, bots, and dolls is contributing to the growth.

Sex toys are gaining popularity globally, with women and couples exploring a range of options such as luxury adult toys, Bluetooth vibrators, romantic devices, and automated toys to enhance their sexual experiences during intimacy or self-pleasure. These toys are recognized for their potential medical benefits. They play a role in the treatment of menopausal symptoms and in addressing neurological conditions such as lack of arousal. For men, these toys offer solutions to sexual challenges such as premature ejaculation, low libido, and erectile dysfunction. The increasing acceptance of sex toys as therapeutic tools for conditions is expected to fuel market growth over the forecast period.

AI is transforming the industry and is driving the shift from conventional sex toys to the SexTech products. AI is revolutionizing the industry with the launch of smart sex toys that can be controlled remotely. For instance, in January 2023, Lovense integrated ChatGPT API to launch the Lovense ChatGPT Pleasure companion. It can sync the company’s sex toys with the remote app and BLOOM’s audio erotica and can personalize the user experience based on emotional and physical experiences. Moreover, with the growing research on AI technology, the market has witnessed increasing demand for such AI-powered sex toys.

Market Concentration & Characteristics

The market has experienced a significant degree of innovation in recent years. Technological advancements, changes in societal attitudes toward sexuality, and a growing emphasis on sexual wellness have contributed to a dynamic and innovative landscape within the industry. The market is still stigmatized. However, the market is on the upswing due to technological advancements such as the integration of AI, VR, and AR, Bluetooth connectivity, smartphone apps, and remote-control features, and has transformed the way people interact with and control sex toys.

The market has experienced increased attention from investors and private equity firms in recent times. Larger, established companies are acquiring smaller innovative startups to enhance their product offerings, access new markets, or incorporate cutting-edge technologies.

Regulations can have a significant impact on the industry, influencing various aspects such as product safety, marketing, distribution, and overall market dynamics. The impact can vary across different regions and countries due to variations in cultural attitudes, legal frameworks, and societal norms. For instance, in India, there is no law per se which bans sex toys and the legally grey areas have kept the market away from the public.

Product expansion in the sex toys industry involves introducing new and innovative products to meet the diverse needs and preferences of consumers. Many companies are launching technologically advanced products to target a diverse consumer base. For instance, in September 2022, LELO launched an app-controlled massager, TIANI Harmony.

Regional expansion can be influenced by various factors, including cultural attitudes towards sexuality, regulatory standards, and evolving consumer preferences. While the industry has traditionally faced varying degrees of stigma, increased awareness of sexual wellness and changing societal attitudes have contributed to the growth of the market globally.

Product Insights

The vibrators segment dominated the market with a revenue share of 22.48% in 2023 and is expected to witness the fastest growth over the forecast period. This can be attributed to the integration of technology into existing products to provide new experiences to users. For instance, vibrators with a wand on one side & a massage ball on the other and numerous pulsating patterns for each provide users with multiple combinations of simultaneous massage & penetration. According to the WebMD study published in July 2023, more than 49.8% of homosexual males and 43.8% of heterosexual males in the U.S. use a vibrator with a partner or alone. In addition, about 52.5% of women aged 18 to 60 years used a vibrator in the U.S.

The sex dolls segment held a significant market share in 2023. The demand for sex dolls is high, especially among single men, and this demand increased further during the COVID-19 pandemic. According to the Bedbible Sex doll statistics published in August 2022, around 9.7% of men and 6.1% of women aged 18 years and above in the U.S. have bought or own a sex doll.

Distribution Channel Insights

The e-commerce segment held the largest revenue share of 63.8% in 2023. In the past few years, e-commerce and online sex stores have been the most used platforms for purchasing sexual wellness products. The anonymity in product delivery is a major advantage for customers opting for online purchase of sex toys over brick-and-mortar adult stores. Moreover, the convenience of choosing from a vast variety of products on a single platform at discounted prices provides added benefits. Increasing internet penetration and the number of customers across all age groups who are technology literate and comfortable with navigating e-commerce platforms is expected to boost the sex toys market’s growth.

The mass merchandisers segment is expected to witness the fastest growth over the forecast period. Availability of sex toys such as vibrators, vibrating rings, and penile rings has increased in supermarkets, where more shelve space is allocated for these products. Wal-Mart, Sainsbury, ASDA, and Woolworths started the trend of displaying products for sex aid in the wellness aisle along with other products such as pregnancy tests, sanitary napkins, & other care products. This is expected to contribute to the market growth over the forecast period.

Regional Insights

North America held the largest revenue share of 33.24% in 2023, owing to the presence of numerous manufacturers and retailers providing easy access to products. Sex toy companies, such as Doc Johnson have manufacturing facilities in the U.S. and manufacture more than 75% of their products in the U.S. The company has R&D teams that provide continuous input for increasing its operations and output.

Canada Sex Toys Market Trends

The Canada sex toys market is expected to witness significant growth over the forecast period, due to the increasing demand for adult toys. Online retailers have a significant presence in Canada due to the customer preference for discrete delivery and offers provided by these retailers. Popular online retailers in Canada include PinkCherry, NaughtyNorth, and Fantasia. Adult stores, such as Sex Toys Canada, Stag Shop, Hush Canada, Fantasy Factory Adult Store, Trans Canada Adult, and Aren’t We Naughty are other popular stores.

Europe Sex Toys Market Trends

European countries, such as Germany, Italy, France, the UK, Denmark, and Belgium, are the leading contributors to the sex toys market in Europe. Traditional vibrators and dildos are the most popular toys in these countries. Presence of some of the leading brands, such as LELO, Lovehoney, Durex, and Fun Factory, which cater to the requirements of the European community had positioned Europe as the second-largest market in 2023.

The sex toys market in the UK is expected to grow significantly over the forecast period. This can be attributed to easy access to a variety of adult and novelty stores. In the UK, the use of sex toys is believed to help develop a healthy and positive relationship with partners. The belief that the older generation has a lower sex drive is not common in Britain, a majority of the population from 45 years to 54 years have admitted to using sex toys.

The Germany sex toys market held the second largest revenue share in Europe in 2023, owing to the high adoption of sex toys among consumers. Around 52% of adults admitted to using sex toys during partnered sex while 45% of adults used sex toys for masturbation. Sex toys are perceived as an important tool for sexual enhancement by German men and women.

Asia Pacific Sex Toys Market Trends

Asia Pacific is expected to witness the fastest CAGR over the forecast period with the highest number of manufacturing facilities in China and the growing demand from countries such as Australia, India, Japan, and New Zealand. China has more than 1,000 manufacturing facilities that provide Original Equipment Manufacturing (OEM) services to some of the leading brands in the industry. Reducing social stigma by changing customer perception of sex and increasing online retailers are expected to drive demand for sex toys in Asia Pacific. Countries such as Singapore and New Zealand are now catering to the sexual needs of women through the promotion of the sex toys industry.

The China sex toys market held the largest revenue share in Asia Pacific in 2023. This is attributable to the presence of OEM sex toy manufacturers in China. Domestic manufacturers in the country are launching innovative products with advanced technology to stay competitive in the market, as China is the major exporter of sex toys.

The sex toys market in Australia is expected to grow during the forecast period. Cultural liberalism has contributed significantly to high demand for sex toys and sexual wellness products in Australia. Moreover, sex toys are associated with positive and healthy sex life by Australians. Most customers like to use newer toys available in the market and tend to buy a new toy every few months.

Latin America Sex Toys Market Trends

Brazil, Mexico, Chile, Argentina, and Colombia have a major share of the Latin America market. A rise in disposable income and awareness of sexual health are some of the primary factors expected to boost the demand for sex toys in Latin America.

Middle East & Africa Sex Toys Market Trends

In most Middle Eastern countries, selling sex toys and adult novelty products is prohibited. Discussing and displaying sexual products in public is taboo. However, the use of sex toys by married couples is legal in some countries. African countries have a weak presence in the market for sex toys due to low awareness of sexual health.

Key Sex Toys Company Insights

The market is highly competitive with the presence of global and local manufacturers & distributors. The competitive landscape in the industry is complex, encompassing various strategies related to product differentiation, branding, distribution, and compliance. BMS Factory and Fun Factory are some of the emerging players functioning in this market.

Key Sex Toys Companies:

The following are the leading companies in the sex toys market. These companies collectively hold the largest market share and dictate industry trends.

- Church & Dwight Co., Inc.

- Reckitt Benckiser Group plc

- LELO

- LifeStyles Healthcare Pte Ltd

- Doc Johnson Enterprises

- Lovehoney Group Ltd

- BMS Factory

- PinkCherry

- Tenga Co., Ltd.

- Fun Factory

- We-Vibe

Recent Developments

-

In May 2023, Doc Johnson Enterprises launched new signature Cocks dildos molded from performers Owen Grey and Small Hands.

-

In September 2023, LELO launched a new collection of next-generation stimulation massagers, ENIGMA Wave.

Sex Toys Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 38.0 billion

Revenue forecast in 2030

USD 62.7 billion

Growth rate

CAGR of 8.69% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; New Zealand; Brazil; Mexico; Argentina; South Africa

Key companies profiled

Church & Dwight Co., Inc.; Reckitt Benckiser Group plc; LELO; LifeStyles Healthcare Pte Ltd; Doc Johnson Enterprises; Lovehoney Group Ltd; BMS Factory; PinkCherry, Tenga Co., Ltd.; Fun Factory; We-Vibe

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sex Toys Market Report Segmentation

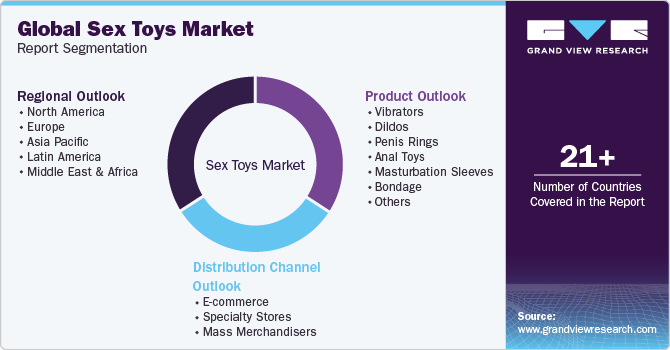

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global sex toys market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Vibrators

-

Dildos

-

Penis Rings

-

Anal Toys

-

Masturbation Sleeves

-

Bondage

-

Sex Dolls

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

E-commerce

-

Specialty Stores

-

Mass Merchandisers

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

New Zealand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global sex toys market size was estimated at USD 35.2 billion in 2023 and is expected to reach USD 38.0 billion in 2024.

b. The global sex toys market is expected to grow at a compound annual growth rate of 8.69% from 2024 to 2030 to reach USD 62.7 billion by 2030.

b. North America dominated the sex toys market with a share of 33.2% in 2023. This is attributable to social acceptance and liberal sexual lifestyle in the U.S. along with the presence of multiple adult stores.

b. Some key players operating in the sex toys market Church & Dwight Co., Inc.; Reckitt Benckiser Group plc; LELO; LifeStyles Healthcare Pte Ltd; Doc Johnson Enterprises; Lovehoney Group Ltd; BMS Factory; Tenga Co., Ltd.; Fun Factory; We-Vibe.

b. Key factors that are driving the sex toys market growth include growing demand from customers to enhance sexual experience, liberalization, penetration of social media, and the influence of pop culture is increasing awareness about the importance of sexual health.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.