- Home

- »

- Medical Devices

- »

-

Sharps Container Market Size, Share, Industry Report, 2030GVR Report cover

![Sharps Container Market Size, Share & Trends Report]()

Sharps Container Market (2025 - 2030) Size, Share & Trends Analysis Report By Product Type (Patient Room Containers, Phlebotomy Containers), By Usage (Single-use Containers, Reusable Containers), By Size, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-494-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Sharps Container Market Size & Trends

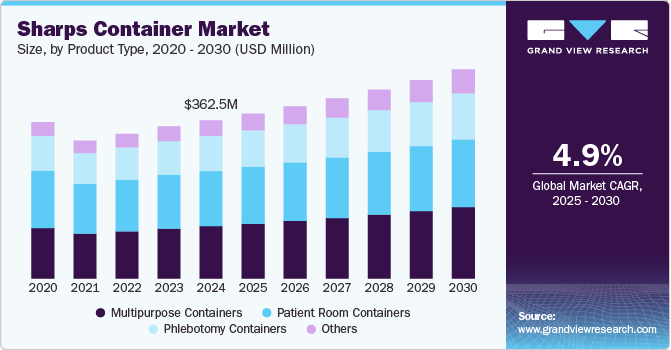

The global sharps container market size was estimated at USD 362.46 million in 2024 and is projected to grow at a CAGR of 4.86% from 2025 to 2030. The expanding healthcare sector, driven by aging populations and increasing disease prevalence, significantly contributes to the market growth.

As hospitals and outpatient facilities perform a rising number of diagnostic tests, vaccinations, and surgical procedures, the generation of medical waste, including sharps, continues to increase. According to a CDC report published in February 2024, in the U.S., approximately 129 million people live with at least one major chronic disease. In addition, five of the top ten leading causes of death in the U.S. are closely linked to preventable and treatable chronic conditions. This is particularly prominent in regions like North America and Asia-Pacific, where healthcare spending is climbing rapidly. Moreover, the growth of home-based healthcare services, such as diabetes management and elderly care, has increased the use of portable sharps containers for self-administered injections. The rising number of healthcare facilities and services creates sustained demand for sharps disposal solutions, making it a critical driver for market expansion.

Healthcare institutions, including hospitals, clinics, and research labs, prioritize safe disposal practices to prevent needle-stick injuries and reduce the risk of infections caused by improper handling of sharp medical instruments. Regulatory mandates such as the U.S. OSHA's Bloodborne Pathogens Standard and similar guidelines in other regions have made the use of sharps containers mandatory. In addition, growing public health campaigns on the dangers of improper disposal of needles in non-clinical settings have encouraged individuals and small-scale healthcare providers to adopt these containers. In December 2023, the City of Naperville launched the Naperville Residential Sharps Disposal Program, providing residents with a free and easy way to dispose of medical needles safely. This shift toward safer waste management practices enhances worker safety and protects the general public, boosting demand for sharps containers globally.

The ongoing expansion of healthcare services, including hospitals, clinics, outpatient centers, and home healthcare, bolsters the demand for sharps containers. As medical facilities increase in developed and developing regions, the volume of medical waste increases proportionately, necessitating efficient disposal solutions. Moreover, the rise of home-based healthcare services for managing chronic conditions and elderly care has significantly increased the use of portable sharps containers. Patients administering self-injections, such as those for diabetes or fertility treatments, require safe, convenient disposal options, further driving the market growth. In addition, initiatives to establish healthcare facilities in rural and underserved areas are expanding the market's reach, particularly in emerging economies. With the healthcare industry’s growth showing no signs of slowing, the demand for sharps disposal solutions is poised to grow, creating sustained opportunities for market players.

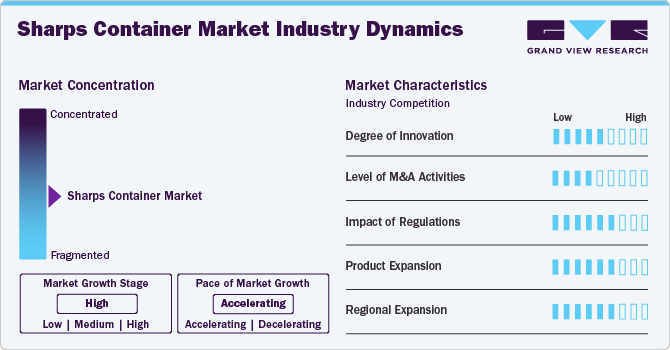

Market Concentration & Characteristics

The sharps container industry exhibits a moderate to high degree of innovation, driven by the need for improved safety, compliance with stringent regulations, and growing environmental concerns. Manufacturers focus on designing containers with enhanced features such as tamper-proof lids, leak-proof designs, and clear visual indicators for maximum fill levels to improve user safety and ease of use.

The sharps container industry experiences moderate mergers and acquisitions (M&A) as companies aim to expand product portfolios, enhance market reach, and improve technological capabilities. Key players strategically acquire smaller firms specializing in innovative or eco-friendly sharps disposal solutions to strengthen their competitive edge and address evolving regulatory and environmental demands.

Regulations significantly impact the sharps container industry by driving demand for compliant disposal solutions. Stringent guidelines from organizations like OSHA, the FDA, and the WHO mandate the safe handling and disposal of sharps to prevent injuries and infections. These rules encourage the adoption of standardized, tamper-proof containers. In addition, environmental regulations promote the development of eco-friendly and reusable sharps disposal systems, compelling manufacturers to innovate while ensuring compliance and safety in medical waste management.

Product expansion in the sharps container industry is driven by increasing demand for tailored solutions across diverse healthcare settings. Manufacturers are introducing innovative designs, including portable containers for home healthcare, tamper-proof options for hospitals, and reusable models for environmentally conscious facilities. For instance, in March 2022, Hamilton Beach Brands, Inc., a subsidiary of Hamilton Beach Brands Holding Company, and HealthBeacon plc, a developer of smart solutions for managing injectable medications at home, announced the launch of the Hamilton Beach Health Smart Sharps Bin, powered by HealthBeacon, which is now available in the U.S. These expansions cater to specific user needs, enhance safety, and align with growing regulatory and sustainability requirements, fueling market growth.

Regional expansion in the sharps container industry is fueled by increasing healthcare infrastructure development in emerging economies, alongside stricter waste management regulations worldwide. Key players are entering markets in Asia-Pacific, Latin America, and the Middle East to address growing medical waste concerns. This expansion enhances accessibility to innovative disposal solutions, meeting global demand while supporting healthcare safety standards.

Product Types Insights

The patient room containers segment led the market with the largest revenue share of 34.88% in 2024, driven by the increasing number of hospital admissions and the rising demand for safe medical waste disposal solutions. The American Hospital Association's 2024 report reveals that there are 6,120 hospitals in the U.S., with a total of 33,679,935 admissions across all hospitals. Hospitals and healthcare facilities focus more on maintaining safe environments for patients and healthcare professionals. The growth is fueled by the increasing awareness of the risks posed by improperly disposed sharps and the adoption of stringent health and safety regulations. As hospitals expand to accommodate more patients, the need for effective sharps disposal systems, including patient room containers, continues to rise, further boosting market growth.

The multipurpose containers segment is anticipated to grow at the fastest CAGR during the forecast period, due to the increasing demand for versatile and durable medical waste disposal solutions. These containers are designed to safely store sharps and other types of hazardous medical waste, making them an essential component in various healthcare settings. With hospitals, clinics, and research facilities expanding, there is a growing need for reliable and multifunctional disposal systems. In addition, regulatory bodies emphasize the need for safe waste management practices, further driving the adoption of multipurpose containers. The shift towards more sustainable and cost-effective solutions also contributes to this segment's growth.

Usage Insights

Based on usage, the single-use containers segment led the market with the largest revenue share of 69.60% in 2024 and is anticipated to grow at the fastest CAGR during the forecast period, driven by the rising demand for safe and convenient disposal solutions. For Instance, this trend is the program launched in December 2022 by the Choctaw Nation and Covanta Environmental Solutions, in collaboration with the Product Stewardship Institute. The initiative seeks to expand sharps take-back infrastructure in Oklahoma, providing health clinics in eight regions with easy-to-use single-use containers for sharps disposal. These containers enable users to safely drop off mail in used sharps, ensuring public health and environmental protection. Such initiatives are fueling the widespread adoption of single-use containers, thereby supporting market expansion.

The reusable containers segment is anticipated to witness at a significant CAGR during the forecast period. Reusable sharps containers reduce the overall cost of waste management, particularly in high-volume healthcare settings. They eliminate the need for frequent purchases of single-use containers, making them an economically viable option over time. Increasing awareness about environmental sustainability has led healthcare facilities to adopt reusable options. These containers help minimize sharp medical waste and align with global efforts to reduce environmental impact, driven by stricter regulations and organizational green policies.

Size Insights

Based on size, the 1-2 gallons segment led the market with the largest revenue share of 14.91% in 2024, driven by the increasing need for compact and portable disposal solutions. These containers are particularly popular in healthcare settings such as hospitals, clinics, and nursing homes, where they are ideal for managing moderate amounts of sharps waste. The growing emphasis on safety, hygiene, and compliance with healthcare waste disposal regulations is further propelling the demand for these containers. In addition, the rising adoption of smaller, user-friendly containers for home care and personal use is boosting the segment, contributing significantly to the overall market growth.

The other segment is expected to grow at the fastest CAGR over the forecast period. Healthcare facilities require sharps containers for specific medical settings or procedures. This demand for customized solutions has led to the development and increased adoption of containers in sizes beyond the standard categories, catering to unique disposal needs. Stringent regulations mandate the proper disposal of medical waste, including sharps. Facilities are compelled to utilize appropriately sized containers to ensure compliance, boosting the demand for diverse container sizes.

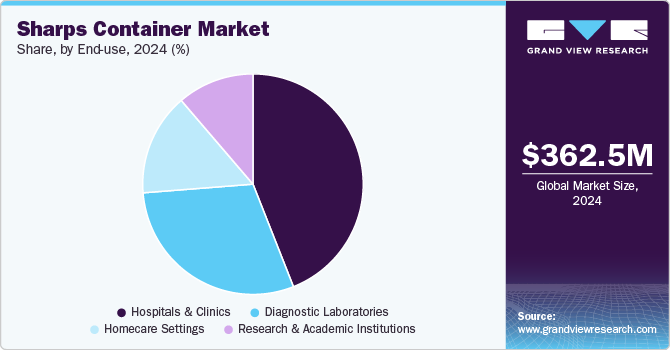

End Use Insights

Based on end use, the hospitals & clinic segment led the market with the largest revenue share of 33.82% in 2024, due to the increasing number of admissions and medical procedures requiring sharp instruments. With a focus on patient safety and proper waste disposal, healthcare facilities are adopting advanced sharps containers to manage medical waste effectively. Rising awareness about the risks of sharps injuries and stricter regulations are driving hospitals and clinics to invest in compliant and safe disposal solutions, further fueling market expansion.

The diagnostic laboratories segment is projected to experience at a significant CAGR over the forecast period, due to the rising number of diagnostic tests and laboratory procedures that involve sharps, such as needles and lancets. With increasing concerns over safety and waste management, diagnostic labs are investing in effective sharps disposal solutions to prevent injuries and contamination. Strict regulatory guidelines and growing awareness about proper waste handling are driving the adoption of sharps containers in this sector, contributing to the market's expansion.

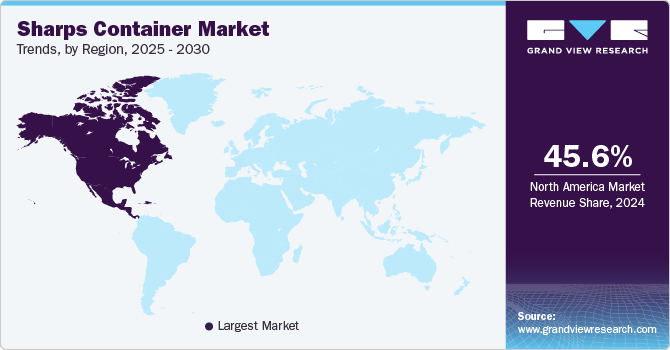

Regional Insights

North America dominated the sharps container market with the largest revenue share of 45.62% in 2024, fueled by expanding healthcare infrastructure, stringent regulatory standards, and growing awareness of safe medical waste disposal. In October 2024, the Health Products Stewardship Association launched a return program to enable the secure disposal of unused consumer medications and used medical sharps at designated collection points. This program is designed to enhance public safety and encourage responsible waste management, further driving the market’s growth.

U.S. Sharps Container Market Trends

The sharps container market in the U.S. is experiencing robust growth, driven by rising healthcare demands, stricter regulations, and an increasing focus on public safety. The growing prevalence of chronic diseases, along with the expansion of home healthcare services, is further accelerating the demand for safe and efficient sharps disposal solutions across the country.

Europe Sharps Container Market Trends

The sharps container market in Europe is expanding, driven by the rising number of hospital surgical procedures. As surgical operations increase across the region, the need for efficient and safe sharps disposal solutions has become more critical. Strict regulations and heightened awareness of infection control further contribute to the demand for high-quality sharps containers, supporting market expansion in Europe’s healthcare sector.

The UK sharps container market is anticipated to grow at a significant CAGR during the forecast period, driven by the increasing adoption of reusable containers. According to a Grundon report in June 2024, reusable sharps containers reduce carbon usage by an average of 87% over their lifetime, significantly decreasing the number of single-use containers disposed of annually. This sustainability factor, combined with cost-effectiveness, is propelling the demand for reusable sharps disposal solutions across healthcare facilities in the UK.

The sharps container marketing Germany is witnessing significant growth, driven by an increase in surgical procedures and stringent regulations for safe medical waste disposal. Rising awareness of infection control in healthcare settings further fuels demand. Hospitals and surgical centers prioritize sharps safety, encouraging innovations in container design, and boosting market expansion.

Asia Pacific Sharps Container Market Trends

The sharps container market in Asia Pacific is experiencing significant growth propelled by increasing hospital admissions and healthcare innovations. In October 2024, Mun Australia launched an eco-conscious initiative to redefine medical waste management. The company introduced new sharps containers made with up to 75% recycled plastic, aligning safety with sustainability. This innovative program reflects a commitment to reducing environmental impact while maintaining strict compliance with medical standards. Rising demand for sustainable healthcare solutions and stringent regulations in hospitals are driving the market's expansion, making eco-friendly products like Mun Australia's sharps containers a benchmark for the future of medical waste management.

The China sharps container market is growing rapidly, driven by rising hospital admissions and increasing prevalence of infectious diseases. Stringent regulations for medical waste disposal and infection control further boost demand. As healthcare infrastructure expands, hospitals prioritize safe waste management solutions, fueling innovation and market growth for sharps containers to mitigate disease transmission risks effectively.

Latin America Sharps Container Market Trends

The sharps container market in Latin America is experiencing steady growth, driven by increasing healthcare infrastructure, rising awareness of medical waste management, and stricter regulations on biohazard disposal. The expansion of healthcare services in countries like Brazil and Mexico, coupled with initiatives promoting sustainable and reusable sharps containers, further propels market demand across the region.

Middle East And Africa Sharps Container Market Trends

The sharps container market in the Middle East and Africa is growing due to expanding healthcare facilities and government-backed programs promoting safe medical waste disposal. Hospital development and awareness initiatives are driving increased adoption of sharps containers across the region.

The Saudi Arabia sharps container market is expected to grow at the fastest CAGR over the forecast period, driven by the expansion of healthcare infrastructure and stringent waste management regulations. Rising investments in hospitals, increased surgical procedures, and awareness of safe medical waste disposal practices are boosting the adoption of sharps containers across the country.

Key Sharps Container Company Insights

Key players operating in the sharps container industry are undertaking various initiatives to strengthen their market presence and increase the reach of their product types and services. Strategies such as expansion activities and partnerships are playing a key role in propelling market growth.

Key Sharps Container Companies:

The following are the leading companies in the sharps container market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific Inc.

- BD

- BondTech Corporation (Atlas Copco AB)

- Cardinal Health

- Medline Industries, LP.

- EnviroTain

- Stericycle

- Sharps Medical Waste Services

- Daniels Sharpsmart Inc.

- GPC Medical Ltd.

Recent Developments

-

In June 2024, the NHS Trust launched a reusable sharps container service in collaboration with Grundon Waste Management. Developed in partnership with Inpress Precision, a manufacturer in the medical and healthcare sector, the service utilizes Sharpak Zero reusable containers for safe sharps disposal.

-

In August 2023, Stericycle, Inc. unveiled its revamped one-gallon SafeDrop Sharps Mail and one-gallon CsRx Controlled Substance containers. The redesigned containers feature a more contemporary look, improved ease of use, and a more environmentally friendly solution compared to the company’s previous models.

-

In April 2023, HPSA launched new 1.8L sharps containers, now available at many pharmacies across the province. These containers feature a sustainable, recycled plastic design and an updated instruction label.

Sharps Container Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 377.68 million

Revenue forecast in 2030

USD 478.72 million

Growth rate

CAGR of 4.86% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, usage, size, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; and Kuwait

Key companies profiled

Thermo Fisher Scientific Inc.; BD; BondTech Corporation (Atlas Copco AB); Cardinal Health; Medline Industries, LP.; EnviroTain; Stericycle; Sharps Medical Waste Services; Daniels Sharpsmart Inc.; GPC Medical Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sharps Container Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global sharps container market report based on product type, usage, size, end use, and region.

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Patient Room Containers

-

Phlebotomy Containers

-

Multipurpose Containers

-

Others

-

-

Usage Outlook (Revenue, USD Million, 2018 - 2030)

-

Single-use containers

-

Reusable containers

-

-

Size Outlook (Revenue, USD Million, 2018 - 2030)

-

0-1 Gallons

-

1-2 Gallons

-

3-5 Gallons

-

6-8 Gallons

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Diagnostic Laboratories

-

Homecare Settings

-

Research & Academic Institutions

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global sharps containers market size was estimated at USD 362.46 million in 2024 and is expected to reach USD 377.68 million in 2025.

b. The global sharps containers market is expected to grow at a compound annual growth rate of 4.86% from 2025 to 2030 to reach USD 478.72 million by 2030.

b. North America dominated the sharps containers market with a share of 45.70% in 2024.

b. Some key players operating in the sharps containers market include Thermo Fisher Scientific Inc.; BD; BondTech Corporation (Atlas Copco AB); Cardinal Health; Medline Industries, LP.; EnviroTain; Stericycle; Sharps Medical Waste Services; Daniels Sharpsmart Inc.; GPC Medical Ltd.

b. Increased investment in healthcare globally is expanding hospital networks, clinics, and diagnostic centers, which boosts demand for sharps containers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.