- Home

- »

- Homecare & Decor

- »

-

Short-term Vacation Rental Market, Industry Report, 2030GVR Report cover

![Short-term Vacation Rental Market Size, Share & Trends Report]()

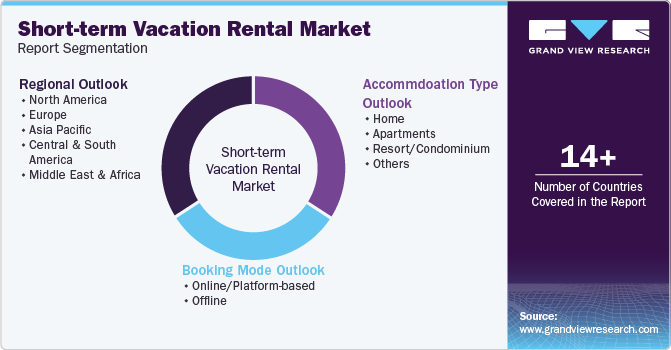

Short-term Vacation Rental Market (2025 - 2030) Size, Share & Trends Analysis Report By Accommodation Type (Home, Resort/Condominium), By Booking Mode (Online/Platform-based, Offline), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-979-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Short-term Vacation Rental Market Summary

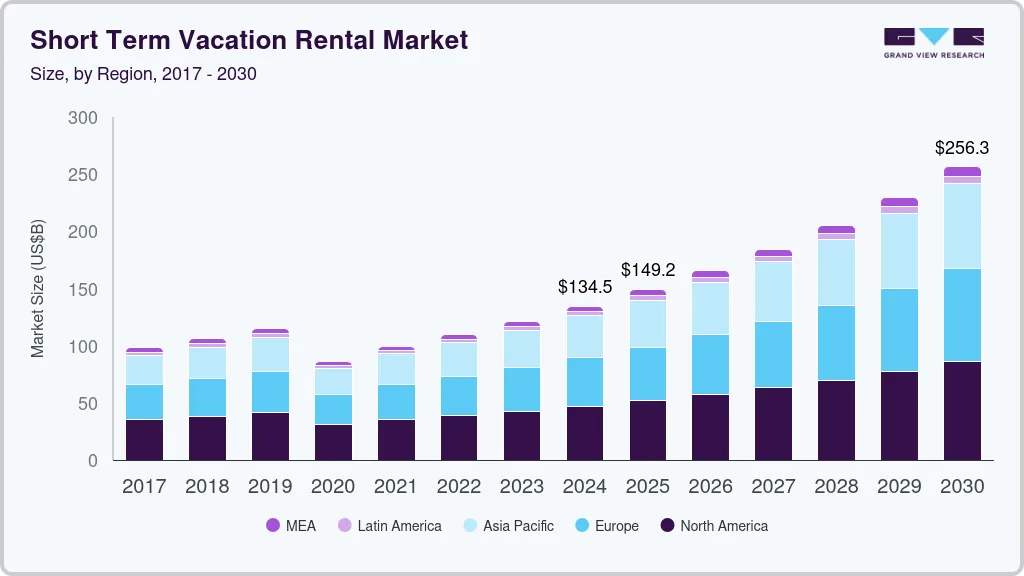

The global short-term vacation rental market size was valued at USD 134.51 billion in 2024 and is projected to reach USD 256.31 billion by 2030, growing at a CAGR of 11.4% from 2025 to 2030. The market has experienced remarkable growth in recent years, driven by changing consumer preferences, advancements in technology, and evolving travel patterns.

Key Market Trends & Insights

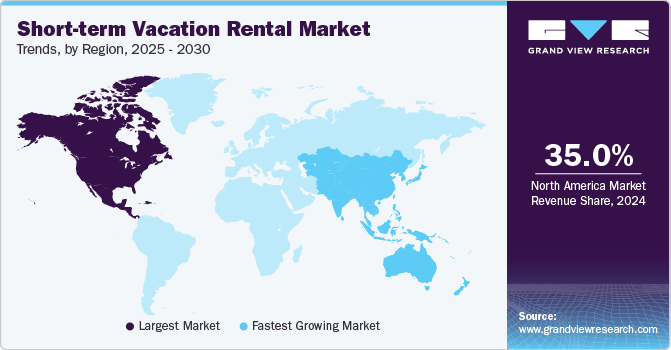

- North America short-term vacation rental market held a share of 35.03% of the global revenue in 2024.

- The short-term vacation rental market in the U.S. is expected to grow at a CAGR of 10.6% over the forecast period.

- By accomomodation type, the homes segment accounted for the largest market share of 41.78% in 2024.

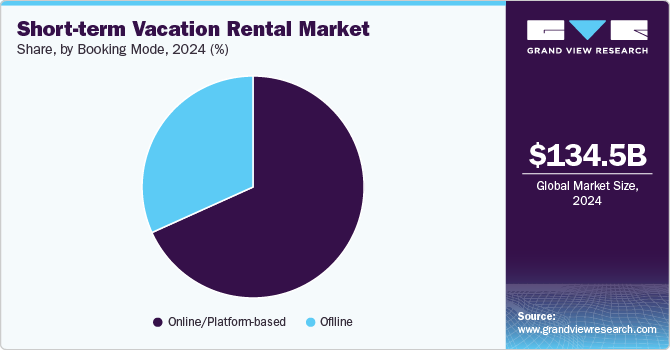

- By booking mode, the online/platform-based bookings accounted for a market share of 72.67% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 134.51 Billion

- 2030 Projected Market Size: USD 256.31 Billion

- CAGR (2025-2030): 11.4%

- North America: Largest market in 2024

The global shift toward more personalized and flexible travel experiences has amplified the appeal of short-term rentals, offering unique accommodations that cater to diverse traveler needs. According to industry data, the market's growth trajectory has been bolstered by the proliferation of digital platforms such as Airbnb, Vrbo, and Booking.com, which have democratized access to these properties. For instance, Airbnb reported over 393 million guest arrivals globally in 2023, a significant increase compared to previous years, illustrating the sector’s growing consumer demand.

The rise of remote work and flexible living arrangements has further fueled the growth of the short-term rental market. The pandemic-era adoption of remote work has led to an increase in "work-from-anywhere" lifestyles, enabling professionals to combine work and leisure in attractive destinations. Markets such as Bali, the Canary Islands, and Tulum have become hotspots for digital nomads, with a noticeable uptick in bookings for longer stays. For example, Airbnb’s data shows a 25% year-over-year increase in long-term bookings (stays of 28 days or more) as of 2023, indicating a shift in consumer behavior toward extended vacation rentals.

Technology and data-driven innovations have also played a critical role in scaling the short-term vacation rental industry. Hosts and property managers now leverage sophisticated tools for dynamic pricing, property management, and guest communication, improving operational efficiency and guest satisfaction. Platforms like Beyond Pricing and Guesty exemplify the integration of AI and analytics to optimize rental income and enhance guest experiences. These technological advancements have also allowed property owners to maximize occupancy rates and cater to niche traveler segments, such as eco-conscious tourists or luxury seekers, further diversifying the market.

Regulatory frameworks have increasingly shaped the growth of the short-term rental sector. Governments worldwide are implementing policies to address concerns around housing availability, zoning, and taxation while balancing the economic benefits of tourism. For instance, cities like Paris and Barcelona have introduced licensing systems and caps on short-term rental days to mitigate housing shortages, while regions like Florida have embraced the economic opportunities by streamlining compliance for property owners. Such regulations, though varied, have encouraged the professionalization of the sector, with a growing number of property managers adopting standards akin to the hospitality industry.

Increasing tourist arrivals significantly contributes to the growth of the short-term vacation rental industry by driving higher demand for diverse accommodation options. As international and domestic travel recovers post-pandemic, the rise in the number of tourists boosts occupancy rates, expands host revenues, and encourages property owners to list more accommodations. For instance, the United Nations World Tourism Organization (UNWTO) reported a 63% increase in global international arrivals in 2023 compared to 2022, signifying a robust rebound in tourism activity. This uptick directly benefits short-term rental markets, particularly in regions renowned for leisure travel, such as Europe, Southeast Asia, and the Americas.

Popular tourist destinations often see an exponential impact on their short-term rental markets due to increasing arrivals. For example, in 2023, cities like Lisbon and Barcelona experienced an influx of international visitors, leading to a 20-30% increase in short-term rental bookings during peak seasons. Similarly, in the U.S., states like Florida and Hawaii have seen a surge in vacation rental demand corresponding to higher domestic and international tourist inflows. Events such as cultural festivals, sports tournaments, and large-scale conferences further amplify this trend, driving temporary spikes in bookings and revenues. Rising tourism also encourages diversification within the short-term rental industry. Property owners increasingly tailor accommodations to cater to various traveler segments, including families, solo adventurers, and luxury tourists, thus broadening the market's scope. For instance, during the FIFA World Cup Qatar 2022, short-term rentals experienced unprecedented demand, with hosts offering unique high-end properties to meet the needs of affluent travelers. Such adaptability in response to increased tourist arrivals highlights the sector's capacity to absorb and capitalize on growing visitation trends.

The increase in tourist arrivals also incentivizes innovation in marketing and distribution channels within the short-term rental industry. Platforms like Airbnb and Vrbo actively partner with local tourism boards and governments to promote regional attractions, drawing more visitors to secondary and rural destinations. For example, Airbnb's collaboration with the Italian government to promote under-touristed towns resulted in a 25% rise in bookings for rural properties in 2023. Such initiatives not only distribute tourist traffic more evenly but also expand the market’s geographical reach.

Accommodation Type Insights

Homes accounted for the largest market share of 41.78% in 2024. The rising demand for home accommodations in the short-term vacation rental market is primarily fueled by the need for personalized and spacious lodging options. Travelers, particularly families and groups, prefer homes for their multiple bedrooms, fully equipped kitchens, and private living spaces, which provide both convenience and cost-effectiveness. For instance, Airbnb data from 2023 indicates that family bookings represent nearly a quarter of total stays, underscoring the preference for home-like environments. Additionally, the ability to maintain routines, such as preparing meals or enjoying private outdoor areas, makes home rentals a favored choice for extended vacations and work-from-anywhere travelers. This trend is particularly evident in suburban and rural destinations, where standalone homes offer privacy and a sense of retreat away from urban crowds.

The demand for resort/condominiums is projected to grow at a CAGR of 12.3% from 2025 to 2030. Resort and condominium accommodations are experiencing heightened demand as travelers seek high-end, amenity-rich stays that combine luxury with convenience. These accommodations often feature premium offerings such as swimming pools, spas, fitness centers, and private beach access, making them ideal for leisure-focused travelers and those desiring all-inclusive experiences. For example, luxury resort condominiums in Bali and the Maldives have reported increased bookings in 2023 from international tourists seeking unique, upscale vacations. Additionally, resort condominiums cater to diverse travel groups, including couples, families, and corporate retreats, by providing flexible layouts and access to curated experiences such as guided tours and wellness activities. Their scenic locations, combined with the exclusivity they offer, make them an attractive choice in a competitive hospitality market.

Booking Mode Insights

The online/platform-based bookings accounted for a market share of 72.67% in 2024. The rise of online/platform-based booking in the short-term vacation rental industry has been a defining trend over the past decade, driven by the growing preference for convenience, accessibility, and personalized experiences. Digital platforms like Airbnb, Vrbo, and Booking.com have revolutionized the way travelers find and book accommodations, providing a user-friendly interface that allows for seamless transactions, transparent pricing, and instant communication between hosts and guests. The convenience of browsing listings, reading reviews, viewing photos, and comparing properties in real-time has made online bookings the preferred mode for a majority of consumers.

Technology-driven innovations such as mobile applications, dynamic pricing algorithms, and artificial intelligence have further fueled the growth of online bookings. Travelers can now make last-minute reservations, adjust itineraries on the go, and receive real-time notifications, offering an unmatched level of flexibility and immediacy. For instance, Airbnb’s mobile app facilitates instant booking and allows users to chat with hosts directly, ensuring swift communication and personalized service. Furthermore, the introduction of features like "Instant Book" on platforms has removed previous friction points, making it easier for guests to secure accommodations quickly without waiting for host approval. As consumer behavior continues to evolve, with an increasing number of travelers relying on digital tools for trip planning, online platforms are poised to capture an even larger share of the market.

The offline bookings are projected to grow at a CAGR of 10.2% from 2025 to 2030. Offline booking remains an important and growing mode in the short-term vacation rental industry, particularly for specific traveler segments that prioritize personal touch and customized experiences. Many travelers, particularly older demographics and those seeking high-touch, bespoke services, still prefer the traditional method of booking accommodations through agents or direct communication with hosts. Offline booking channels provide a sense of security and personal connection, allowing guests to speak directly with property owners or managers to clarify details, negotiate terms, or discuss special requests. This mode is particularly prevalent in high-end luxury vacation rentals, where guests may require a higher level of service, such as concierge arrangements, private chefs, or personalized itineraries. For example, many luxury villas in destinations like the French Riviera or the Caribbean are often booked offline through specialized agents, offering tailored experiences that online platforms may not provide.

Regional Insights

North America short-term vacation rental industry held a share of 35.03% of the global revenue in 2024. In North America, demand for short-term vacation rentals continues to grow, bolstered by increased domestic and international travel, particularly in the post-pandemic period. The expanding popularity of destinations beyond traditional tourist hubs, aided by the ease of access to alternative accommodations via online platforms, is further fueling growth. Advances in booking technology, coupled with enhanced customer service features such as flexible cancellation policies and personalized travel experiences, are positioning short-term rentals as the preferred option for both business and leisure travelers. Government initiatives, including favorable regulations in cities such as Austin and Toronto, have contributed to the sector's expansion. The rise of new site launches and marketing strategies focused on unique, experiential stays—ranging from luxury to eco-friendly accommodations—has expanded the appeal of vacation rentals to a broader demographic.

U.S. Short-term Vacation Rental Market Trends

The short-term vacation rental market in the U.S. is expected to grow at a CAGR of 10.6% from 2025 to 2030. In the U.S., the demand for short-term vacation rentals is being driven by shifting consumer preferences for personalized travel experiences, increased flexibility, and the rise of remote work. Technological advancements, particularly the widespread use of online booking platforms such as Airbnb and Vrbo, have simplified the booking process, offering a diverse range of properties to cater to different travel needs. The COVID-19 pandemic accelerated this trend, as travelers sought private, self-contained accommodations to ensure safety and social distancing. Additionally, government support for the short-term rental sector, including local tax incentives for property owners and relaxed regulations in certain states, has further fueled market growth. New site launches and service innovations, such as the integration of smart home technology and enhanced concierge services, are elevating the overall rental experience, making it more attractive for both property owners and travelers.

Asia Pacific Short-term Vacation Rental Market Trends

The short-term vacation rental market in Asia Pacific accounted for a revenue share of around 27.02% in the year 2024. The demand for short-term vacation rentals in Asia Pacific is growing rapidly, spurred by rising disposable incomes, increasing tourism, and a growing middle class across key markets such as China, Japan, and India. The region’s expanding digital infrastructure has made it easier for consumers to access online booking platforms, significantly boosting the availability of vacation rental options. Technological advancements, including the integration of AI-driven recommendation engines and virtual reality (VR) property tours, have transformed the way travelers interact with rental listings. New site launches and the rise of localized platforms have also played a crucial role in meeting the specific needs of regional consumers. Additionally, government support for tourism and favorable regulations for property owners are fueling the sector’s growth. Service innovation, such as tailored local experiences and flexible check-in/check-out policies, is further enhancing the appeal of vacation rentals, catering to the evolving preferences of both international and domestic travelers.

Europe Short-term Vacation Rental Market Trends

The short-term vacation rental market in Europe is projected to grow at a CAGR of 11.5% from 2025 to 2030. In Europe, the growth of short-term vacation rentals is driven by both the region's rich cultural and historical attractions and the increasing demand for more flexible, authentic travel experiences. Technological advancements have played a key role, with platforms like Booking.com and Airbnb continuing to enhance their user interfaces and algorithms, offering travelers more tailored search results and property options. In addition, government initiatives in countries like France and Spain have introduced regulations that balance the interests of property owners, local communities, and tourists, creating a more sustainable market for short-term rentals. New site launches focusing on niche markets, such as luxury rentals in major cities or rural stays in the countryside, have diversified the offering. Service innovations, such as enhanced digital check-ins, contactless services, and personalized itineraries, are increasing the convenience and appeal of short-term vacation rentals, further accelerating market demand.

Key Short-term Vacation Rental Company Insights

The competitive landscape of the short-term vacation rental market is highly dynamic, characterized by the dominance of a few global players alongside a growing number of regional and niche operators. Leading platforms such as Airbnb, Vrbo, and Booking.com continue to dominate, leveraging their vast user bases, advanced technology, and expansive global networks. These platforms offer a comprehensive range of properties, from budget accommodations to luxury estates, and utilize sophisticated algorithms to provide personalized recommendations, thereby enhancing the user experience. Additionally, these players benefit from extensive marketing budgets, strategic partnerships, and global reach, enabling them to capture a significant portion of the market.

The market sees increasing competition from local and specialized platforms that cater to specific niches, such as luxury rentals, eco-friendly accommodations, or long-term stays. These platforms often differentiate themselves through unique value propositions, offering curated experiences that appeal to a growing segment of travelers seeking authentic and tailored vacation experiences. Additionally, the rise of property management companies and independent operators who directly market their listings has introduced a level of fragmentation in the sector.

Key Short-term Vacation Rental Companies:

The following are the leading companies in the short-term vacation rental market. These companies collectively hold the largest market share and dictate industry trends.

- 9flats.com PTE Ltd.

- Airbnb, Inc.

- Booking Holdings Inc.

- Expedia Group, Inc.

- Hotelplan Management AG

- MakeMyTrip Pvt. Ltd.

- NOVASOL A/S

- Oravel Stays Private Limited

- Tripadvisor, Inc.

- Wyndham Destinations, Inc.

Recent Developments

-

In May 2023, MakeMyTrip Pvt. Ltd., a short-term vacation rental company, announced a collaboration with Microsoft to broaden access to travel planning by introducing voice-assisted booking in Indian languages. Azure Cognitive Services and Microsoft Azure OpenAI Service have been combined to develop a technology stack that enables personalized travel recommendations based on user preferences. This partnership aims to make travel planning more inclusive and enhance the overall experience for a wider audience.

-

In January 2023, the Interhome Group, a fully owned subsidiary of the Hotelplan Group-expanded its portfolio to include Denmark through a strategic relationship with Sol og Strand, a Danish vacation rental broker that offers more than 6,000 vacation homes and flats.

Short-term Vacation Rental Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 149.20 billion

Revenue forecast in 2030

USD 256.31 billion

Growth rate

CAGR of 11.4% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Accommodation type, booking mode, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S., Canada, Mexico, U.K., Germany, France, Italy, Spain, China, India, Japan, Australia & New Zealand, South Korea, Brazil, and South Africa

Key companies profiled

9flats.com PTE Ltd.; Airbnb, Inc.; Booking Holdings Inc.; Expedia Group, Inc.; Hotelplan Management AG; MakeMyTrip Pvt. Ltd.; NOVASOL A/S; Oravel Stays Private Limited; Tripadvisor, Inc.; and Wyndham Destinations, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Short-term Vacation Rental Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global short-term vacation rental market report on the basis of accommodation type, booking mode, and region:

-

Accommdoation Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Home

-

Apartments

-

Resort/Condominium

-

Others

-

-

Booking Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

Online/Platform-based

-

Offline

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global short-term vacation rental market was estimated at USD 134.51 billion in 2024 and is expected to reach USD 149.20 billion in 2025.

b. The global short-term vacation rental market is expected to grow at a compound annual growth rate of 11.4% from 2025 to 2030 to reach USD 256.31 billion by 2030.

b. The North American region dominated the short-term vacation rental market, with a share of 34.83% in 2024. This is owing to the increasing income levels among travelers, coupled with the desire to experience new types of vacations.

b. Some key players operating in the short-term vacation rental market include 9flats.com PTE Ltd, Airbnb Inc., Booking Holdings Inc., Expedia Group, Inc., Hotelplan Management AG, MakeMyTrip Pvt. Ltd., NOVASOL A/S, Oravel Stays Pvt. Ltd., TripAdvisor, Inc., and Wyndham Destinations Inc.

b. Key factors that are driving the short-term vacation rental market growth include the rising demand for staycations, rising expenditure on travel and tourism, and travelers’ inclination toward budget-friendly accommodations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.