Shoulder Replacement Market Size & Trends

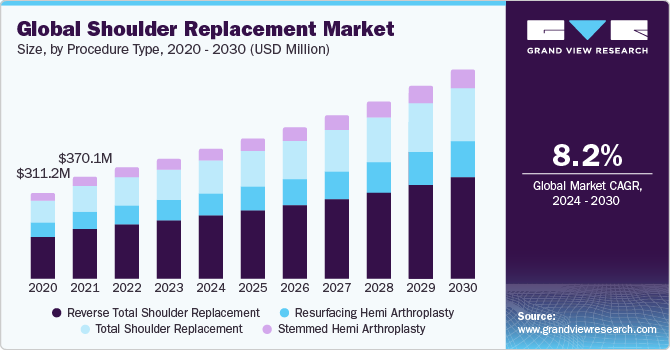

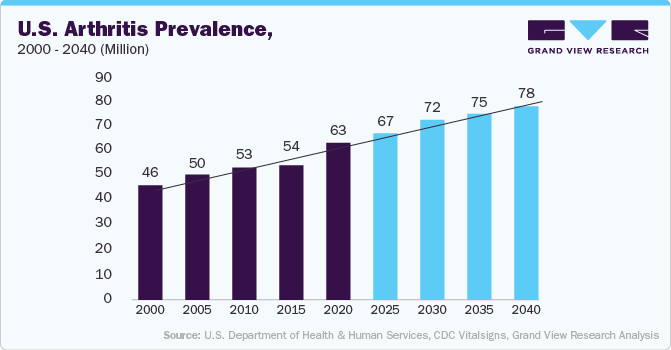

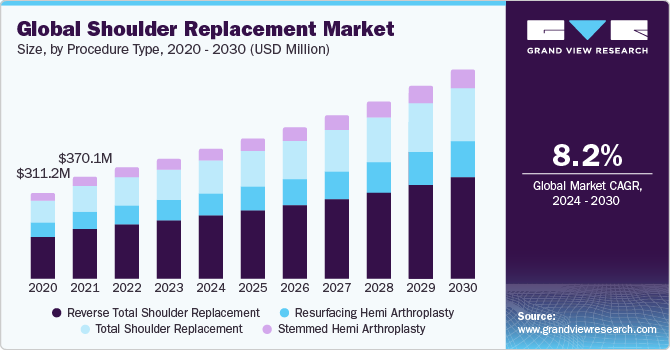

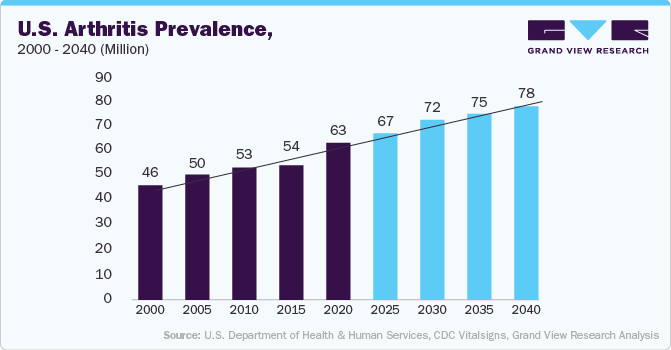

The global shoulder replacement market size was valued at USD 400.81 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 8.24% from 2024 to 2030. The increasing incidence of arthritis is the major contributor to disability amongst adults and the geriatric population. According to the National Institute for Health and Care Research (NIHR), in 2021, 90% of shoulder replacements last for at least a decade, boosting market demand and growth. The growing global geriatric population and increased susceptibility to osteoarthritis are other key market demand drivers. According to World Population Prospects data estimates, the global population aged 65 years and above is expected to rise from 727 million in 2020 to 1.5 billion in 2050. The patient pool suffering from arthritis is rapidly growing, boosting the demand for shoulder replacement.

The shoulder replacement market witnessed a significant decline in revenue earnings in 2020 owing to the COVID-19 pandemic and its related restrictions on travel & local lockdowns, which resulted in decline in the number of non-emergent surgical procedures. Renowned market players recorded a dramatic dip in their business performance owing to the downfall in demand. As per an article published in Annals of Surgery, the cost incurred due to postponement or cancellation of non-emergent surgeries in the U.S. was estimated to be USD 22.3 billion.

The transition from anatomic to reverse shoulder replacement surgeries in ambulatory surgery centers & orthopedic clinics is anticipated to accelerate the market growth. Market participants are focusing on expanding product portfolios and innovating product pipelines, which directly appeal to end-users, expand clientele, and drive lucrative sales opportunities. Growing awareness and trust amongst the patient population towards advanced surgeries such as reverse shoulder replacement surgery is further boosting the market. Advancing product pipelines is focused on enhancing patient clinical outcomes and minimizing failure rates.

Procedure Type Insights

Based on the product, the market is segmented into reverse total shoulder replacement, total shoulder replacement, resurfacing hemi arthroplasty, and stemmed hemi arthroplasty. The reverse total shoulder replacement segment held the largest market share in 2023. This is attributable to the availability of advanced healthcare infrastructure, skilled surgeons & practitioners, and the adoption of minimally invasive surgical techniques.

Growing geriatric population along with increasing prevalence of shoulder joint disorders is positively impacting the market growth. Reverse total shoulder replacement surgery is a procedure wherein the locations of the ball & socket joint are either reversed or switched. The humeral head is replaced with a plastic socket and the glenoid is replaced with a metal ball.

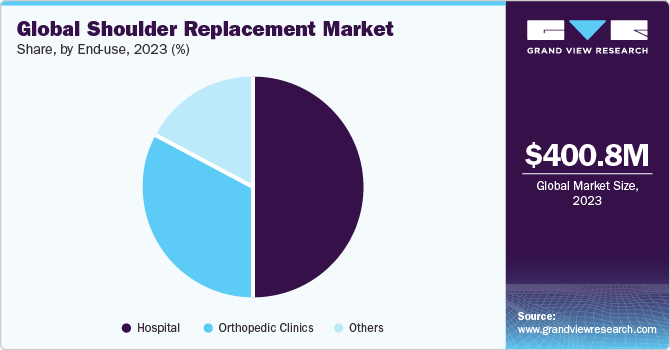

End-use Insights

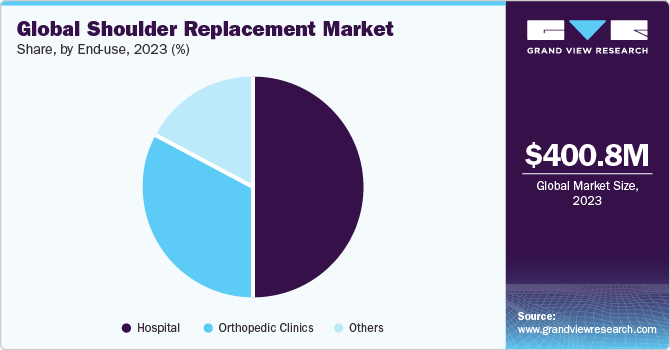

On the basis of end use, the market is segmented into hospitals, orthopedic clinics, and others. Hospitals was the largest sales channel in 2023. Technological advancements in the hospital settings and presence of skilled surgeons are boosting the segment growth.

Furthermore, hospitals across have collaborated with renowned insurance companies offering a seamless reimbursement process for patients.

Regional Insights

North America dominated the market in 2023. Presence of renowned multinational market players, technological advancements in the American & Canadian healthcare systems, and availability of favorable reimbursement coverage policies is driving the North American market. Growing participation in sporting & fitness events and increasing geriatric population is driving the demand for shoulder replacement market.

Competitive Insights

Key players operating in the market are Arthrex Inc, Wright Medical Group, DePuy Synthes, Stryker, Zimmer Biomet, Integra Lifesciences, and Smith+Nephew. The shoulder replacement market is moderately competitive and consists of local & multinational companies.

-

In August 2021, Smith & Nephew launched new total shoulder replacement technology and displayed it at the American Academy of Orthopedic Surgeons 2021 Annual Meeting in San Diego.

-

In August 2021, DePuy Synthes launched INHANCE Shoulder System, a fully integrated shoulder arthroplasty system.

-

In July 2021, Stryker launched the Tornier shoulder arthroplasty portfolio consisting of Tornier Perform Humeral System.