- Home

- »

- Homecare & Decor

- »

-

Shower Heads Market Size & Share, Industry Report, 2030GVR Report cover

![Shower Heads Market Size, Share & Trends Report]()

Shower Heads Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Fixed, Handheld, Dual-Purpose), By Application (Residential, Commercial), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-015-4

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Shower Heads Market Summary

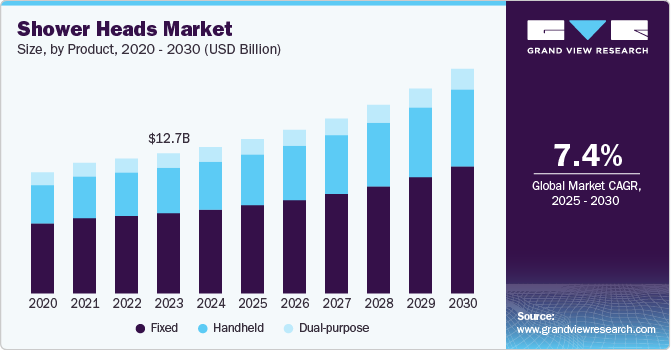

The global shower heads market size was estimated at USD 13,308.3 million in 2024 and is projected to reach USD 20,412.6 million by 2030, growing at a CAGR of 7.4% from 2025 to 2030. The market growth is primarily driven by increasing consumer demand for water-efficient, customizable, and aesthetically pleasing shower solutions.

Key Market Trends & Insights

- The shower heads market in Asia Pacific dominated, with a revenue share of 40.3% of the global market revenue in 2024.

- Based on product, the fixed shower heads segment accounted for a revenue share of 57.3% in the overall shower heads market in 2024.

- Based on application, the residential segment accounted for a share of 73.2% in the overall shower heads industry in 2024.

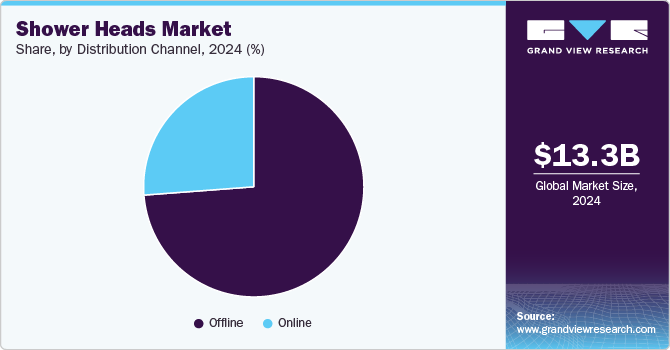

- Based on distribution channel, the offline segment accounted for a share of 78.3% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 13,308.3 Million

- 2030 Projected Market Size: USD 20,412.6 Million

- CAGR (2025-2030): 7.4%

- Asia Pacific: Largest market in 2024

Rising awareness of water conservation, along with innovations in design and technology, are fueling demand across both residential and commercial segments. Increased spending on home improvement projects or home remodeling is boosting product demand. This trend is primarily fueled by rising home prices and mortgage rates being at an all-time low. Growing home values have doubled homeowners’ equity in five years till 2019, indicating a surge in spending capacity on home improvement. In 2023, 4.09 million existing homes sold in the U.S., per the National Association of REALTORS.The U.S. Census Bureau reported that new single-family house sales in May 2024 had a seasonally adjusted annual rate of 619,000. Over 360,000 real estate brokerage firms operate in the U.S. (2022). The U.S. Energy Information Administration's preliminary data indicated 5.9 million commercial buildings in 2018, totaling 97 billion square feet. The 2023 home buyers and sellers profile noted a typical first-time buyer age of 35 and a repeat buyer age of 58. In 2022, 66.1% of families owned their primary residence.

The emergence of advanced technology, ergonomic concerns, open floor plans, simplified design trends, and customer desires for ease of use are notable trends driving the industry's growth. According to a report published by the National Kitchen & Bath Association (NKBA), rising homeowner expenditures on bathroom and kitchen remodeling projects would boost the demand for shower heads and panel products. Elevated consumer living standards, backed by their rising disposable income levels, have pushed the demand for high-end and exquisite bathroom accessories, including shower heads.

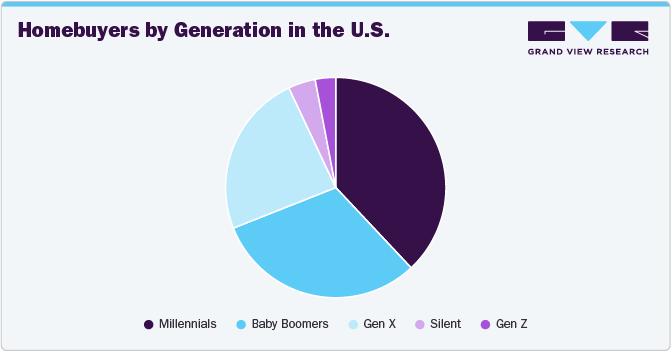

Consumer Survey & Insights

Millennial homeownership reached a milestone, with 52% of millennials owning homes as of 2022, in the U.S., up from 49% in 2021, according to a blog by Motley Fool Money published in 2024. This generational shift influences demand for home fixtures like shower heads. Millennials accounted for 38% of home buyers in 2023, becoming the largest home-buying generation. However, their delayed homeownership, only 42% owned homes by age 30 compared to 48% of Gen X and 51% of Baby Boomers-indicates unique challenges such as economic hurdles and high mortgage rates. As millennials embrace homeownership later in life, they prioritize energy-efficient and sustainable fixtures, driving demand for modern shower head designs.

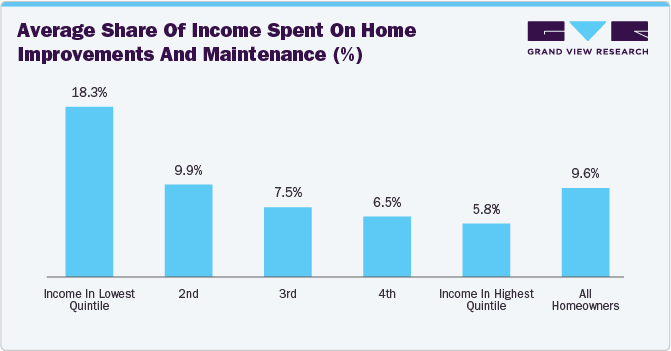

Income levels significantly influence spending on home repairs, remodeling, and maintenance, with lower-income homeowners disproportionately impacted. In 2019, according to an analysis by the Center’s Remodeling Futures Program of HUD’s latest American Housing Survey, homeowners in the lowest-income quintile (incomes below USD 32,000) spent an average of USD 2,290 on home maintenance and improvements, far below the USD 4,120 average for all homeowners and the USD 7,610 spent by the highest-income quintile (incomes above USD 144,000). Limited budgets force lower-income households to prioritize essential repairs and maintenance, leaving minimal resources for discretionary updates like new showerheads.

The financial burden of home improvement is far greater for lower-income homeowners, consuming on an average 18.3% of their incomes, compared to 9.6% for all homeowners and just 5.8% for the highest earners. This disparity limits their ability to invest in upgrades such as premium or smart showerheads, which are often viewed as discretionary luxuries rather than necessities. Consequently, demand for innovative or high-end showerheads is predominantly driven by higher-income segments.

Lower-income homeowners’ reduced spending on discretionary improvements, including bathroom upgrades, highlights challenges for manufacturers of showerheads targeting this demographic. Many of these households allocate resources to urgent needs like disaster repairs or critical system replacements, with 30% reporting no spending on home maintenance or improvements in 2019. Companies may need to focus on affordability and functionality, emphasizing water-saving features and essential upgrades that appeal to budget-conscious consumers.

Product Insights

Fixed shower heads accounted for a revenue share of 57.3% in the overall shower heads market in 2024. Rising home renovation activities, especially in urban areas, are propelling this segment, with consumers seeking luxury experiences even in everyday fixtures like showerheads. In particular, technological advancements and innovations like water-saving features, customizable spray options, and enhanced durability are shaping the market.

Demand for handheld shower heads is expected to grow at a CAGR of 8.7% from 2025 to 2030. Increasing consumer demand for flexibility, convenience, and personalized shower experiences. As bathroom renovations and remodels gain momentum, particularly in urban residential spaces, consumers are opting for multi-functional fixtures like handheld showerheads that offer versatility in both residential and commercial settings. This growth is fueled by the increasing adoption of modern bathroom fittings, where handheld models provide users with more control over water flow, better accessibility for elderly or disabled individuals, and ease of cleaning.

Application Insights

Sales of shower heads in residential applications accounted for a share of 73.2% in the overall shower heads industry in 2024, driven by the increasing rate of home construction and renovation activities worldwide. According to the U.S. Census Bureau, the U.S. homeownership rate, which stood at 65.7% in the fourth quarter of 2023, reflects a stable market where homeowners are more likely to personalize and enhance their bathrooms.

Home renovation trends are another major growth driver for the residential shower head market, as homeowners upgrade their bathrooms to reflect contemporary styles and improve energy efficiency. In the U.S., home improvement spending reached over USD 400 billion in 2022, driven by both first-time homebuyers and long-term homeowners looking to enhance comfort.

Shower heads sales in commercial settings is expected to grow at a CAGR of 8.8% from 2025 to 2030. The demand for the product in commercial applications, such as hotels, resorts, gyms, and institutions, is driven by increased construction activities across key regional markets. For instance, the U.S. construction industry continues to grow, with non-residential construction activity projected to rise by 5.7% in 2024, according to the American Institute of Architects (AIA). This trend is also reflected in regions like the Middle East, where major investments in hospitality and infrastructure for upcoming events, such as Expo 2025 in Osaka, drive demand for commercial bathroom fixtures, including shower heads. The global emphasis on enhancing guest and user experiences, particularly in hospitality, contributes significantly to the need for modern, high-efficiency shower heads in commercial bathrooms.

Distribution Channel Insights

In 2024, sales of shower heads through offline channels accounted for a share of 78.3%. This preference for offline purchasing is particularly strong in markets where customers like to physically examine products before buying. Major home improvement stores such as The Home Depot, Lowe's, Walmart, and Menards in the U.S., as well as B&Q and Leroy Merlin in Europe, make up a significant portion of shower head sales. These retailers provide a wide variety of brands and models, enabling customers to compare important features like water pressure, materials, and spray patterns.

Online sales are expected to grow at a CAGR of 8.8% from 2025 to 2030. The convenience of online shopping, where customers can browse a wide variety of products, compare prices, and read reviews, has led to a surge in sales. Platforms like Amazon, Home Depot, and specialized bathroom fixture websites have made it easier for homeowners, renovators, and contractors to purchase shower heads without visiting physical stores.

In addition, the availability of smart shower heads and other innovative products has fueled demand in the online market. Tech-savvy consumers are increasingly turning to online platforms to purchase shower heads with advanced features like water-saving capabilities, customizable spray settings, and Bluetooth integration for temperature control. Many online retailers offer detailed product descriptions, comparison tools, and virtual consultations, allowing customers to make informed decisions. For instance, Lowe's surpassed Q3 2024 expectations with 6% rise in online sales reflecting a growing consumer preference for convenience.

Regional Insights

The shower heads market in Asia Pacific dominated, with a revenue share of 40.3% of the global market revenue in 2024, driven by rapid urbanization, rising disposable incomes, and a growing middle-class population. The region has seen significant infrastructural development, especially in emerging economies such as China, India, and Southeast Asian countries, where there is increased investment in residential and commercial construction.

Europe Shower Heads Market Trends

The shower heads industry in Europe accounted for a revenue share of 28.8% of the global market revenue in 2024. The hotel industry in Europe is undergoing a technological and luxury transformation to adapt to new and innovative products and services. Players in the hospitality industry are likely to focus on renovating bathrooms, which is expected to drive the demand for bathroom fixtures such as shower heads. With growing environmental awareness and an emphasis on sustainability, there is a rising demand for water-efficient showerheads in Europe. Water-saving shower heads help conserve water while still providing a satisfying shower experience. The shower heads industry in Europe has witnessed technological advancements, such as integrating smart features like temperature control, LED lighting, and wireless connectivity.

North America Shower Heads Market Trends

The shower heads industry in North America is set to grow at a CAGR of 7.1% from 2025 to 2030. The increasing spending on residential renovations and repairs drives the region’s growth. North America is a key region for this market owing to several luxurious hotels that provide world-class facilities and exquisite bathroom fittings. Another noteworthy trend in North America is the increase in investments in residential construction.

To combat the stress of the pandemic, some Americans started turning their bathrooms into spa-like sanctuaries with interactive makeup mirrors, chronotherapy showers, smart showers, and no-touch faucets. Moreover, Canada is seeing a significant uptick in the use of smart buildings, both residential and commercial, which is significantly boosting the local market. The market for shower heads in North America is primarily driven by improved technology intended to improve cleanliness and energy efficiency.

The shower heads industry in the U.S. is expected to grow at a CAGR of 7.1% from 2025 to 2030. This growth is driven by urbanization, demand for luxurious bathroom experiences, technological advancements in water-saving devices, and trend toward sustainable and eco-friendly products. The industry is evolving to meet diverse consumer needs by offering innovative solutions that balance functionality, aesthetics, and environmental consciousness.

Key Shower Heads Company Insights

The shower heads market is fragmented primarily due to the presence of several globally recognized players as well as regional players. Some prominent companies in this market areAsian Granito India Limited, Brondell, Canopy, Kohler Co., Jaquar, and others.

-

Jaquar is a multi-diversified bathroom and lighting solutions company. It caters to various segments of the bathroom and lighting industry-luxury, premium, and value-through its brands Artize, Jaquar, and Essco, and has a presence in over 55 countries across Europe, the Middle East, Asia Pacific, and Africa.

-

Masco Corporation is engaged in designing, manufacturing, and distribution of home improvement and building products. The company sells its product to plumbers, building contractors, remodelers, smaller retailers, and to the consumers. Company operated in four segments Plumbing Products, Decorative Architectural Products, Cabinetry Products, Windows, and Other Specialty Products.

Key Shower Heads Companies:

The following are the leading companies in the shower heads market. These companies collectively hold the largest market share and dictate industry trends.

- Asian Granito India Limited

- Brondell

- Canopy

- Kohler Co.

- Jaquar

- TRITON

- Aqualisa

- Gainsborough Showers

- Masco Corporation

- FIMA CARLO FRATTINI S.P.A.

Recent Developments

-

In March 2025, Serein launched a premium filtered showerhead that eliminates chlorine, heavy metals, and harmful minerals from shower water. Designed to promote healthier skin and hair, the showerhead features a 3-jet mode system for high water pressure and an advanced filtration system using Calcium sulfate, Vitamin C, KDF 55, and Activated Carbon. This innovation aims to address contaminants in tap water that can cause skin irritation and hair damage.

-

In September 2024, Asian Granito India Limited (AGL) introduced a new collection of bathware and kitchen products. This bath ware line features one-piece water closets and showerheads.

-

In March 2024, Brondell launched a new line of showerheads under the Nebia Merced brand. Featuring patented Nebia spray technology, these showerheads offer up to 40% water savings compared to standard models. The company’s goal is to promote water conservation through this innovative product line.

Shower Heads Market Report Scope

Report Attribute

Details

Market revenue in 2025

USD 14.02 billion

Revenue forecast in 2030

USD 20.41 billion

Growth rate (Revenue)

CAGR of 7.4% from 2025 to 2030

Historical data

2018 - 2024

Forecast

2025 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and Middle East & Africa

Country scope

U.S; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia; Brazil; South Africa; UAE

Key companies profiled

Asian Granito India Limited; Brondell; Canopy; Kohler Co.; Jaquar; TRITON; Aqualisa; Gainsborough Showers; Masco Corporation; FIMA CARLO FRATTINI S.P.A.

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Shower Heads Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global shower heads market based on product, application, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Fixed

-

Handheld

-

Dual-purpose

-

-

Application Outlook (USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

-

Distribution Channel Outlook (USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global shower heads market was estimated at USD 13.31 billion in 2024 and is expected to reach USD 14.02 billion in 2025.

b. The global shower haeds market is expected to grow at a compound annual growth rate of 7.4% from 2025 to 2030 to reach USD 20.41 billion by 2030.

b. Asia Pacific dominated the shower heads market with a share of 40.31% in 2024. The regional growth is driven on account of rapid urbanization, rising disposable incomes, and a growing middle-class population.

b. Some of the key players operating in the shower heads market include Asian Granito India Limited; Brondell; Canopy; Kohler Co.; Jaquar; TRITON; Aqualisa; Gainsborough Showers; Masco Corporation; FIMA CARLO FRATTINI S.P.A.

b. Growth of the global shower heads market is majorly driven on account of increasing consumer demand for water-efficient, customizable, and aesthetically pleasing shower solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.