- Home

- »

- Distribution & Utilities

- »

-

Shunt Reactor Market Size & Share, Industry Report, 2030GVR Report cover

![Shunt Reactor Market Size, Share & Trends Report]()

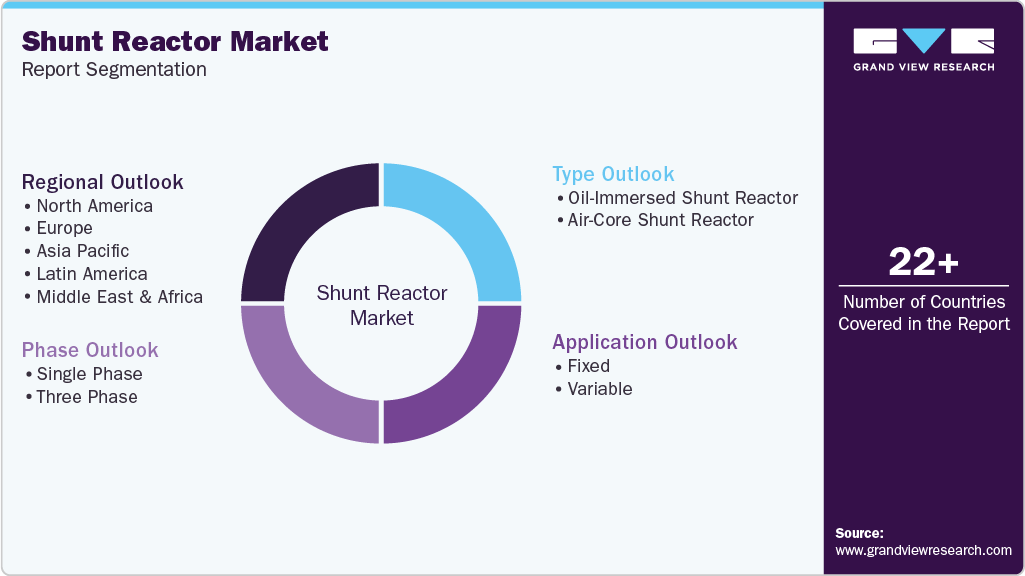

Shunt Reactor Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Oil-Immersed Shunt Reactor, Air-Core Shunt Reactor), By Phase (Single Phase, Three Phase), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-393-8

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Shunt Reactor Market Summary

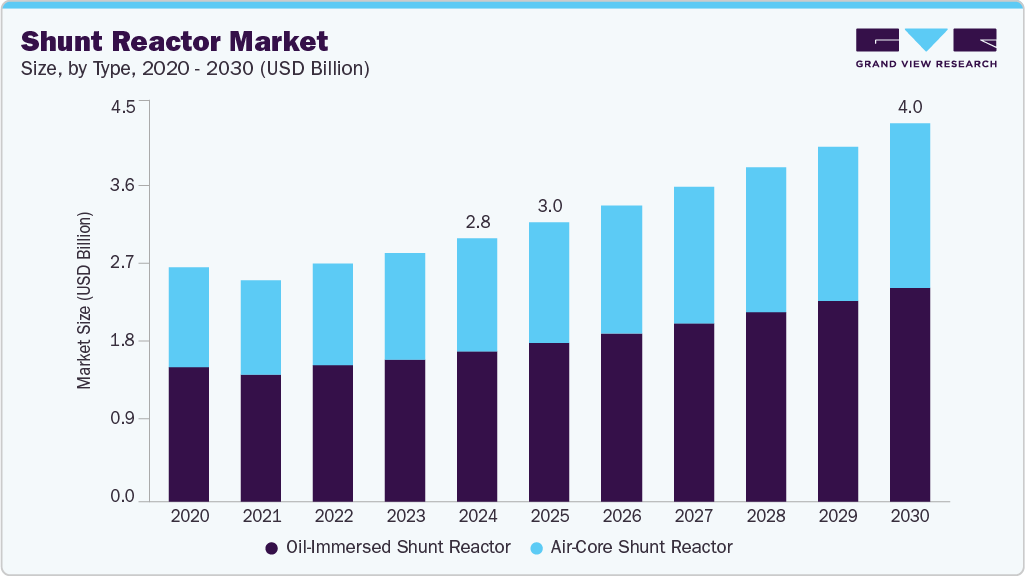

The global shunt reactor market size was estimated at USD 2.82 billion in 2024, and is projected to reach USD 4.05 billion by 2030, growing at a CAGR of 6.3% from 2025 to 2030. This growth is driven by rising demand across various applications, particularly in power transmission and distribution systems.

Key Market Trends & Insights

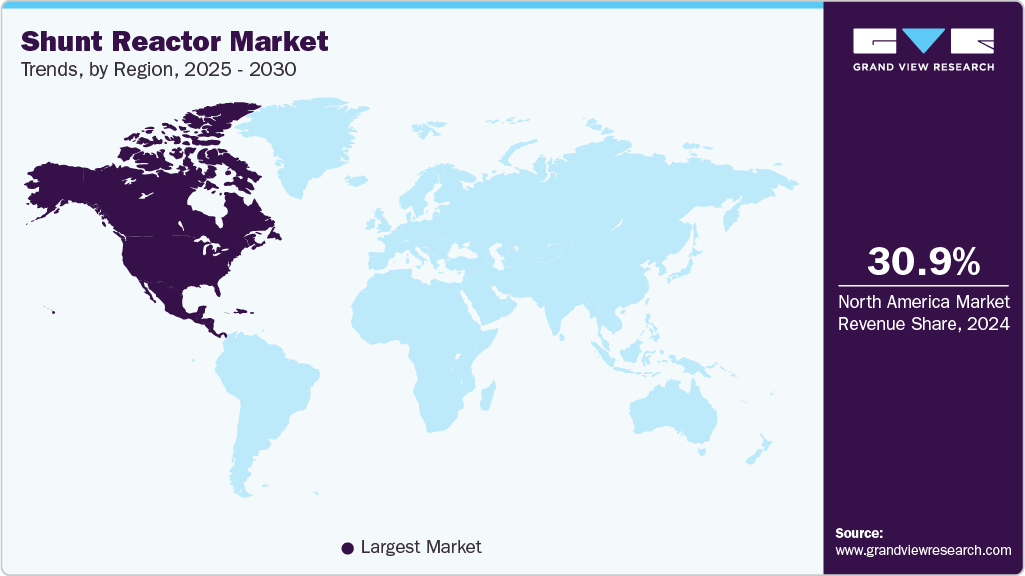

- North America's shunt reactor market dominated the global market, with the largest revenue share of 30.9% in 2024.

- The U.S. shunt reactor market held the largest share in 2024.

- By type, the oil-immersed shunt reactor segment dominated the market with the largest revenue share of 57.0% in 2024.

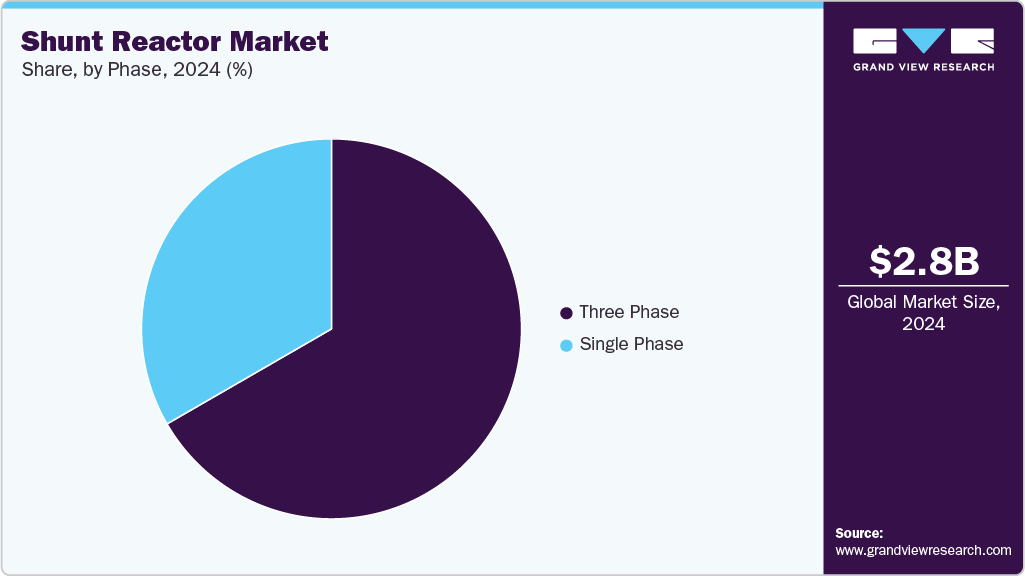

- By phase, the three phase segment held the largest revenue share in shunt reactor industry in 2024.

- By application, the variable segment accounted for the largest shunt reactor industry share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.82 Billion

- 2030 Projected Market Size: USD 4.05 Billion

- CAGR (2025-2030): 6.3%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The surge is supported by increasing global electricity consumption, fueled by industrialization, urbanization, and infrastructure development. As the adoption of renewable energy sources, such as solar and wind power, increases, their inherently variable nature introduces volatility into the system. Shunt reactors are essential for maintaining grid stability and ensuring a reliable power supply by managing voltage fluctuations. In high-voltage transmission networks, they play a key role in voltage regulation under varying load conditions. These reactors are strategically engaged and disengaged to provide necessary reactive power compensation, in alignment with the prevailing voltage demands.Environmental considerations and strict government regulations promoting energy efficiency are driving the adoption of shunt reactors in power networks. A growing emphasis on reducing carbon emissions and enhancing grid reliability is prompting utilities to embrace supportive technologies. In 2023, the Australian government emphasized the importance of integrating renewable energy sources into the grid without compromising environmental integrity, as outlined by the Environment Protection and Biodiversity Conservation Act. This legislation ensures that new energy initiatives, including those involving shunt reactors, meet stringent environmental criteria, fostering technology adoption for improved grid stability and efficiency.

Advancements in grid infrastructure and integrating renewable energy sources are expected to drive market expansion. As renewable energy generation grows, reactive power compensation becomes essential for maintaining voltage levels and ensuring system stability. The U.S. EPA has also underscored the role of advanced technologies in enhancing grid resilience and reliability, which is crucial as more intermittent renewable energy sources, such as wind and solar, are incorporated into the energy mix.

Rising demand for grid stability and reliability, as well as the increase in the adoption of electric vehicle (EV), are anticipated to propel the growth of the shunt reactor industry. The growing number of EVs places added pressure on power grids, especially with increased charging needs, highlighting the importance of maintaining voltage stability. Shunt reactors are critical in regulating voltage and mitigating overvoltage issues, ensuring smooth grid operations. With grids becoming more complex and EVs expanding, the demand for efficient power distribution solutions, including shunt reactors, is expected to rise.

Type Insights

The oil-immersed shunt reactor segment dominated the market with the largest revenue share of 57.0% in 2024, fueled by its exceptional performance and reliability. These reactors use mineral oil as a coolant and an insulating medium, providing excellent heat dissipation and insulation qualities that make them well-suited for continuous operation in large-scale power grid applications. Their robust design and low maintenance requirements enhance long-term efficiency, especially under fluctuating load conditions.

The air-core shunt reactor segment is anticipated to be the fastest-growing segment, with a CAGR of 6.5% over the forecast period, driven by advancements in high-voltage direct current transmission and renewable energy projects that demand superior performance in voltage control and stability. Unlike oil-immersed reactors, air-core reactors use air as the core material, reducing energy losses and environmental impact. Their lightweight construction and reduced footprint make them suitable for installation in compact spaces, such as urban substations and offshore wind farms.

Phase Insights

The three phase segment held the largest revenue share in shunt reactor industry in 2024, propelled by its widespread application in high-voltage transmission systems, where it effectively manages reactive power and enhances voltage stability. Its ability to handle large amounts of reactive power compensation is essential for maintaining grid reliability, especially with the increasing integration of renewable energy sources. Furthermore, major players like Siemens and ABB have developed advanced three-phase shunt reactors to cater to the growing demand for efficient power transmission, further solidifying their market dominance.

The single phase segment is expected to grow at a significant CAGR from 2025 to 2030, owing to their suitability for lower voltage applications and ease of installation in urban environments with space limitations. The increasing demand for localized reactive power compensation in distribution networks has driven the surge in one-phase shunt reactor adoption. For instance, in 2023, Hitachi Energy introduced compact one-phase shunt reactors designed specifically for urban areas, addressing space constraints while providing effective voltage regulation.

Application Insights

The variable segment accounted for the largest shunt reactor industry share in 2024 due to its flexibility in adjusting reactive power compensation based on dynamic grid conditions and varying loads. These reactors feature adjustable tapping points or electronically controlled switching mechanisms that precisely regulate voltage levels in response to fluctuating demand or grid disturbances. Their ability to dynamically manage reactive power ensures optimal grid stability and efficiency, particularly in networks facing variable operational conditions or integrating renewable energy sources.

The fixed segment is anticipated to grow at a significant CAGR during the forecast period, propelled by expanding applications in traditional power transmission networks and industrial installations where steady-state voltage control is paramount. These reactors have a fixed number of tapping points or fixed impedance values designed to provide consistent reactive power compensation under normal operating conditions. They are essential for maintaining grid stability and power quality in large-scale transmission lines and substations.

Regional Insights

North America's shunt reactor market dominated the global market, with the largest revenue share of 30.9% in 2024, driven by robust investments in upgrading aging grid infrastructure and integrating renewable energy sources. The U.S. leads the market, supported by stringent regulatory frameworks and the growing need for a reliable electricity supply. In addition, government initiatives such as the U.S. Department of Energy's "Building a Better Grid" program are catalyzing investments in high-voltage transmission facilities and grid modernization.

U.S. Shunt Reactor Market Trends

The U.S. shunt reactor market held the largest share in 2024, driven by increasing demand for energy efficiency and the modernization of aging power infrastructure. Key trends include a heightened focus on environmentally sustainable solutions, with manufacturers like Hitachi Energy introducing variable shunt reactors that enhance voltage stability while minimizing environmental impact.

Europe Shunt Reactor Market Trends

The European shunt reactor market is anticipated to experience significant expansion during the forecast period, fueled by the region's focus on enhancing grid reliability and reducing transmission losses. Europe’s ambitious renewable energy targets and the need for stable integration of renewable power sources are creating strong demand for shunt reactors.

Asia Pacific Shunt Reactor Market Trends

Asia Pacific shunt reactor market is expected to witness the fastest CAGR of 6.6% from 2025 to 2030, attributed to rapid industrialization and urbanization in countries like China and India. The region's expanding power generation capacities and investments in renewable energy sources and smart grid technologies are key drivers of market growth.

China's shunt reactor market is projected to grow significantly during the forecast period due to rapid industrialization, urbanization, and increasing energy demands. As the country invests heavily in renewable energy sources, smart grid technologies, and high-voltage transmission infrastructure, stable and efficient power distribution becomes critical. Shunt reactors play a key role in regulating voltage and ensuring grid stability.

Key Shunt Reactor Company Insights

Some of the key companies in the shunt reactor industry include ABB; General Electric Company; Siemens; TOSHIBA CORPORATION; Fuji Electric Co., Ltd.; Mitsubishi Electric Corporation; and Hitachi Energy Ltd.

-

ABB, headquartered in Switzerland, is a global leader in power and automation technologies, offering advanced shunt reactor solutions designed for voltage regulation and stability in transmission networks. With a strong commitment to sustainability and innovation, ABB continues to expand its market presence through strategic partnerships and technological advancements.

-

Siemens, based in Germany, is a key player in the energy sector, providing comprehensive shunt reactor solutions aimed at optimizing grid performance and efficiency. Leveraging its extensive expertise in power transmission and distribution, Siemens delivers reliable and scalable shunt reactor systems that meet the evolving needs of utilities worldwide.

Key Shunt Reactor Companies:

The following are the leading companies in the shunt reactor market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- General Electric Company

- Siemens

- Crompton Greaves Consumer Electricals Limited

- TOSHIBA CORPORATION

- Fuji Electric Co., Ltd.

- Mitsubishi Electric Corporation

- NISSIN ELECTRIC Co., Ltd.

- Trench Group

- Hilkar

- TBEA

- Hitachi Energy Ltd

Recent Developments

-

In April 2024, Hitachi Energy announced plans to invest over USD 100 million to upgrade its power transformer factory in Quebec, Canada. The investment aims to enhance manufacturing capabilities to meet the growing demand for advanced power transmission technologies, such as shunt reactors.

-

In September 2023, Hitachi Energy announced a strategic partnership with TenneT to supply transformers and shunt reactors as part of TenneT’s transmission grid development program in Germany. By providing advanced shunt reactors, Hitachi Energy aims to improve reactive power compensation and voltage regulation within TenneT’s infrastructure, supporting the shift to a more sustainable energy system.

Shunt Reactor Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.99 billion

Revenue forecast in 2030

USD 4.05 billion

Growth Rate

CAGR of 6.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, phase, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; U.K.; Spain; France; Italy; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; UAE; and South Africa.

Key companies profiled

ABB; General Electric Company; Siemens; Crompton Greaves Consumer Electricals Limited; TOSHIBA CORPORATION; Fuji Electric Co., Ltd.; Mitsubishi Electric Corporation; NISSIN ELECTRIC Co., Ltd.; Trench Group; Hilkar; TBEA; Hitachi Energy Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Shunt Reactor Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global shunt reactor market report based on type, phase, application, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Oil-Immersed Shunt Reactor

-

Air-Core Shunt Reactor

-

-

Phase Outlook (Revenue, USD Billion, 2018 - 2030)

-

Single Phase

-

Three Phase

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Fixed

-

Variable

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

Spain

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.