- Home

- »

- Next Generation Technologies

- »

-

Signals Intelligence Market Size, Share, Industry Report 2033GVR Report cover

![Signals Intelligence Market Size, Share & Trends Report]()

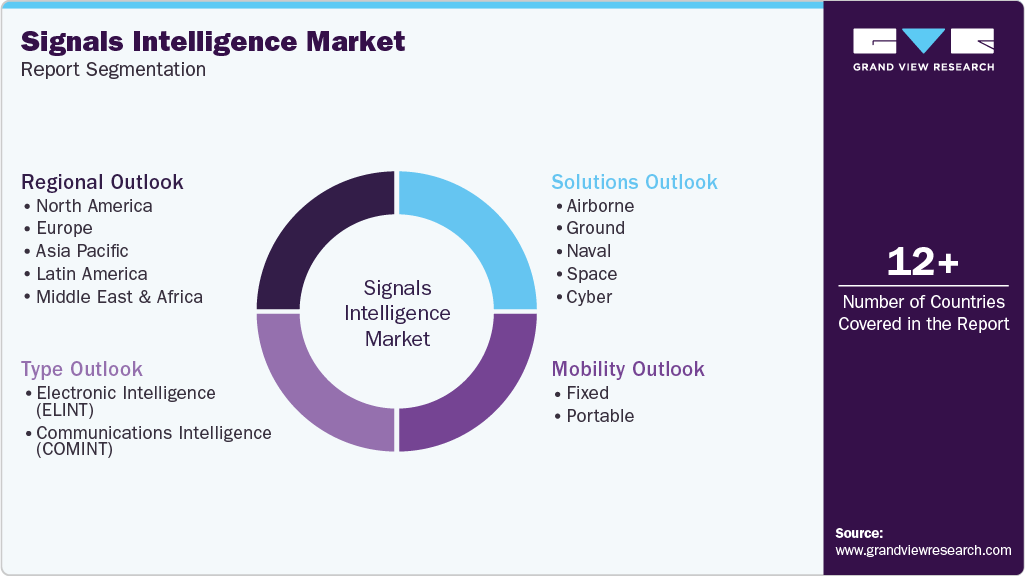

Signals Intelligence Market (2026 - 2033) Size, Share & Trends Analysis Report By Solutions (Airborne, Ground, Naval, Space, Cyber), By Type (ELINT, COMINT), By Mobility (Fixed, Portable), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-256-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Signals Intelligence Market Summary

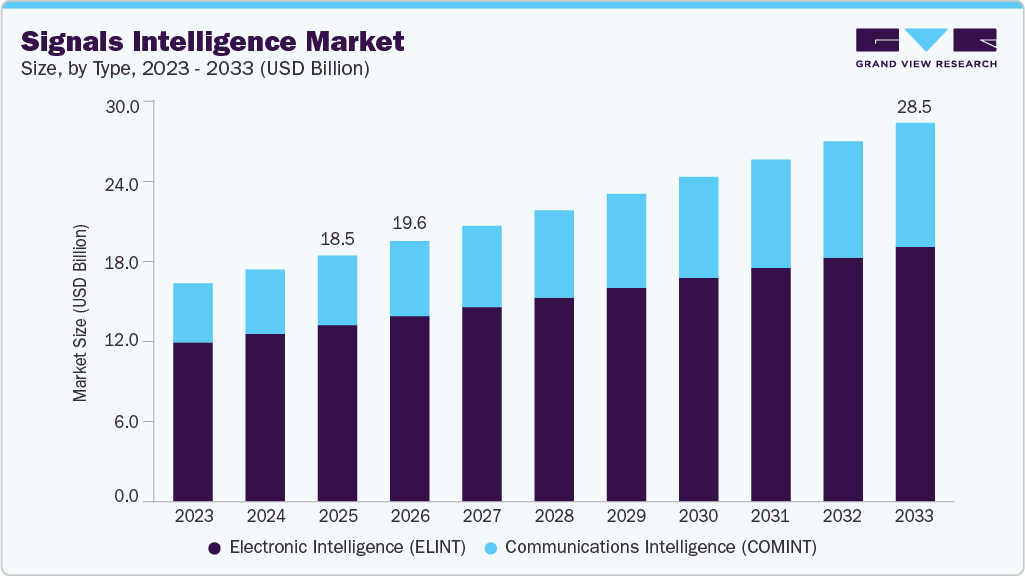

The global signals intelligence market size was estimated at USD 18.51 billion in 2025 and is projected to reach USD 28.51 billion by 2033, growing at a CAGR of 5.5% from 2026 to 2033. The market growth is driven by rising geopolitical tensions, increasing defense surveillance spending, the rapid adoption of advanced electronic warfare and cyber intelligence capabilities, the growing use of AI and big data analytics for real-time signal processing, and the expanding demand for border security, counterterrorism, and maritime domain awareness solutions.

Key Market Trends & Insights

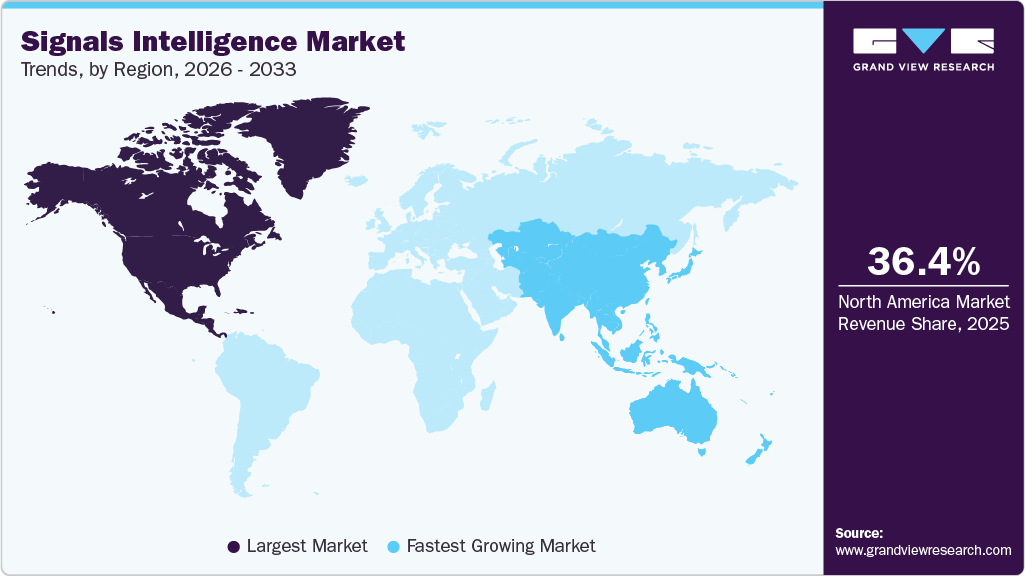

- North America dominated the global signals intelligence market with the largest revenue share of 36.4% by 2025.

- The signals intelligence market in the U.S. accounted for the largest market revenue share in North America in 2025.

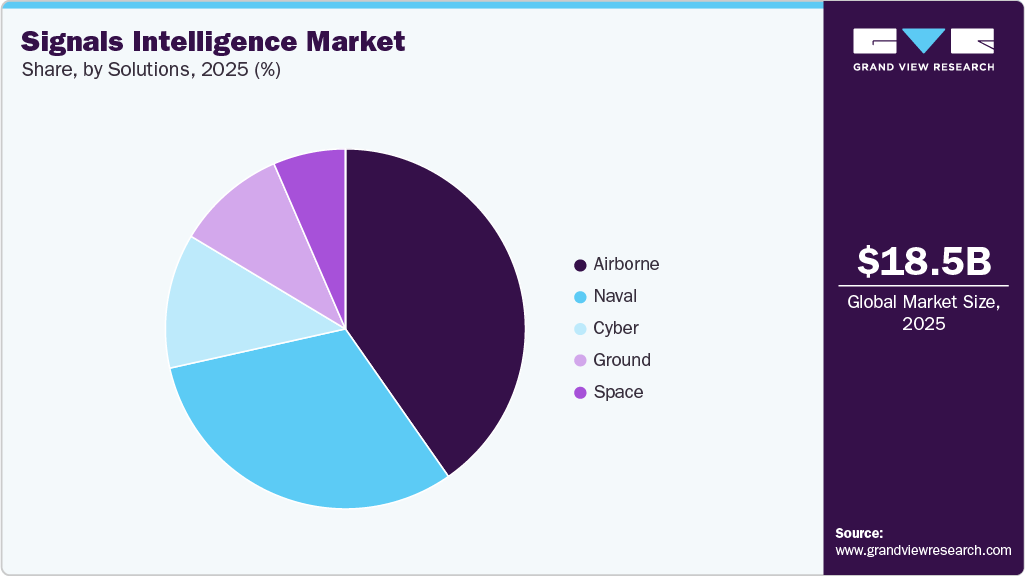

- By solutions, the airborne segment led the market with the largest revenue share of 40.3% in 2025.

- By type, the electronic intelligence (ELINT) segment accounted for the largest market revenue share in 2025.

- By mobility, the portable segment is expected to grow at the fastest CAGR of 8.2% from 2026 to 2033.

Market Size & Forecast

- 2025 Market Size: USD 18.51 Billion

- 2033 Projected Market Size: USD 28.51 Billion

- CAGR (2026-2033): 5.5%

- North America: Largest Market in 2025

- Asia Pacific: Fastest growing market

The global signals intelligence (SIGINT) industry is being driven by the rapid integration of artificial intelligence and machine learning, which enable real-time signal processing, automated classification, and faster threat detection.The growing demand for software-defined and modular SIGINT systems enables militaries to rapidly upgrade and configure platforms for multi-mission applications, thereby enhancing operational flexibility. Multi-domain intelligence fusion across land, air, sea, space, and cyber domains is increasingly critical, providing comprehensive situational awareness for complex threat environments. Portable and network-centric SIGINT platforms, combined with space-based signal processing, are expanding tactical reach and enabling faster data dissemination to command centers. In addition, rising defense budgets and escalating geopolitical tensions continue to fuel investments in advanced SIGINT capabilities, ensuring militaries remain resilient against evolving electronic threats.

The increasing demand for end-to-end mission support is reshaping the ground segment of the space industry as governments and commercial operators expand their satellite fleets. This shift is accompanied by a growing preference for integrated ground infrastructures that combine control, communications, navigation, and data processing to enhance mission resilience and reduce operational silos. For instance, in June 2025, Indra Group launched enhanced ground-segment capabilities through its newly established Indra Space business unit. The company now offers comprehensive solutions covering satellite command and control, data downlinking, mission operations, control centers, earth stations, and integrated communication and navigation systems. This initiative reinforces Indra’s position as a full-value space solutions provider by reducing reliance on external partners and strengthening its competitiveness across defense, civil, and commercial space applications.

The signals intelligence industry is increasingly influenced by growing requests for real-time data processing and AI-enabled space-domain awareness in response to a more contested and congested operational environment. Stakeholders are showing heightened interest in developing integrated ground, space, and on-orbit signal processing capabilities that leverage AI to detect, classify, and track objects, enabling anticipatory decision-making and effective threat response.

For instance, in June 2024, Voyager Space announced a partnership with Palantir Technologies to integrate Palantir’s advanced AI tools across Voyager’s space and defense operations. The collaboration utilizes Palantir’s AI platform to enhance payload management systems for the International Space Station and the Starlab commercial space station, aiming the reduce data processing burdens and complexity in mission operations. This partnership establishes a new benchmark for AI-powered signal intelligence in space, allowing Voyager to deliver more advanced, responsive, and comprehensive capabilities to both defense and commercial customers.

Solutions Insights

The airborne segment led the market with the largest revenue share of 40.3% in 2025 and is expected to continue to dominate the industry over the forecast period. This growth is driven by rising demand from defense and intelligence agencies for faster AI-enabled intelligence collection to counter evolving electronic threats. There is also an increasing preference for modular, compact SIGINT systems that can be rapidly integrated into unmanned platforms, accelerating industry partnerships and platform upgrades. For instance, in December 2025, TEKEVER partnered with Avantix to integrate advanced tactical SIGINT and electronic warfare payloads with AI-powered unmanned aerial systems, strengthening next-generation airborne ISR capabilities for defense and homeland security missions.

The cyber segment is expected to experience at the fastest CAGR over the forecast period, driven by accelerating investments from national security agencies in advanced data collection and analytics to counter increasingly sophisticated threat environments. Growing demand for modernized SIGINT architectures is encouraging multi-year commitments toward system upgrades, analytics platforms, and mission-support services across global intelligence organizations. For instance, in April 2025, Leidos secured a contract valued at up to USD 390 million from the National Security Agency to enhance and sustain next-generation signals intelligence capabilities. The award covers advanced system development, analytical and reporting tool upgrades, and end-to-end engineering, integration, testing, deployment, training, and lifecycle sustainment services, reinforcing the market’s shift toward long-term, capability-driven cyber intelligence modernization.

Type Insights

The ELINT segment accounted for the largest market revenue share in 2025, driven by rising military demand for advanced detection and analysis capabilities in increasingly complex electronic warfare environments. Armed forces are shifting toward turnkey, end-to-end ELINT solutions that integrate sensing, data processing, real-time analytics, and emitter-database management for faster and more cost-efficient deployment. Global investments, particularly from NATO members, are accelerating the adoption of flexible ELINT systems that can be integrated across various platforms, including ground, naval, airborne, and vehicle-based systems, to support multi-domain operations. Advancements in automation, remote operability, wideband receivers, digital signal processing, and software analytics are further enhancing threat detection while reducing manpower requirements and improving decision-making speed.

The COMINT segment is expected to grow at the fastest CAGR during the forecast period, owing to defense organizations’ increasing focus on realistic, simulation-driven training to prepare operators for complex and congested electromagnetic threat environments. Growth is further driven by the shift toward software-based EW and CEMA training solutions, which enable full-cycle intelligence practice without live RF emissions, thereby improving safety, scalability, and cost efficiency. For instance, in October 2025, MASS introduced the NEWTS IQ platform to deliver immersive, classroom- and field-realistic COMINT training through digitally replicated, contested electromagnetic scenarios. Such platforms enhance operational readiness by strengthening detection, analysis, and reporting capabilities while providing a scalable, technology-led training infrastructure for modern electronic warfare missions.

Mobility Insights

The fixed segment accounted for the largest market revenue share in 2025, driven by the shift toward multi-sensor fusion that integrates COMINT, ELINT, cyber intelligence, and real-time analytics to deliver comprehensive electromagnetic situational awareness. Growth is further supported by strong naval investments in next-generation SIGINT vessels featuring low-noise propulsion, extended endurance, and higher payload capacities to enable persistent maritime surveillance. Advancements in AI-assisted signal classification and software-defined architectures are accelerating intelligence extraction while allowing rapid upgrades to counter evolving adversary waveforms. In addition, the rising adoption of satellite-linked intelligence dissemination is strengthening the role of fixed SIGINT platforms as network-centric assets for national-level early warning, wide-area surveillance, and continuous monitoring.

The portable segment is expected to grow at the fastest CAGR during the forecast period, driven by demand for mobile, rapidly deployable SIGINT systems that support frontline and remote intelligence operations. Adoption of AI-enabled emitter identification, automated geolocation, and hybrid ground and drone configurations extends sensing range and improves situational awareness. The shift toward modular, software-defined radios allows compact platforms to perform COMINT, ELINT, and direction-finding missions, supporting multi-role tactical flexibility. Improvements in battery efficiency, ruggedized designs, and low-SWaP components are increasing endurance and reliability, accelerating the adoption of agile portable SIGINT solutions for infantry, border security, and special forces.

Regional Insights

North America dominated the global signals intelligence market with the largest revenue share of 36.4% in 2025, driven by sustained increases in defense spending and rapid advancements in AI. Escalating geopolitical tensions and evolving security threats have prompted governments across the region to prioritize investments in intelligence, surveillance, and reconnaissance capabilities, including advanced SIGINT systems. The integration of AI is significantly enhancing signal processing efficiency, data analytics depth, and the accuracy of real-time decision-making. Moreover, the strong presence of leading defense contractors, technology firms, and research institutions positions North America at the forefront of AI-enabled SIGINT innovation, reinforcing its competitive leadership in the global market.

U.S. Signals Intelligence Market Trends

The SIGINT market in the U.S. accounted for the largest market revenue share in North America in 2025, owing to sustained defense modernization initiatives focused on strengthening intelligence, surveillance, and reconnaissance capabilities. Market growth is primarily driven by the rapid integration of artificial intelligence, machine learning, and automation to improve real-time signal processing, threat detection, and decision-making accuracy. Increasing emphasis on countering cyber-enabled warfare, electronic attacks, and multi-domain threat scenarios is further driving demand for advanced SIGINT solutions. Additionally, ongoing upgrades of legacy intelligence systems and deeper integration of space, cyber, and terrestrial intelligence assets are reinforcing long-term market expansion.

Europe Signals Intelligence Market Trends

The signals intelligence market in Europe is expected to witness at a significant CAGR over the forecast period, primarily driven by higher defense budgets and a focus on strengthening electronic warfare and intelligence capabilities amid geopolitical uncertainty. European countries are increasing investments in advanced SIGINT platforms to improve border security, maritime surveillance, and situational awareness. Adoption of AI-enabled analytics, data fusion, and software-defined systems is enhancing real-time threat detection and intelligence accuracy. Collaborative defense programs and interoperability initiatives among NATO members are also modernizing regional SIGINT infrastructure and supporting market growth.

Asia Pacific Signals Intelligence Market Trends

The SIGINT market in Asia Pacific is expected to grow at the fastest CAGR of 7.0% during the forecast period, driven by rising geopolitical tensions and increased defense spending in key economies. Governments are investing in advanced SIGINT, electronic warfare, and surveillance systems to strengthen border security, maritime awareness, and regional deterrence. The rapid adoption of AI-enabled signal processing, data fusion, and real-time analytics is enhancing intelligence effectiveness in complex threat environments. Ongoing military modernization and growth in indigenous defense manufacturing are also supporting long-term regional growth.

Key Signals Intelligence Company Insights

Some of the key players operating in the market include Lockheed Martin Corporation, BAE Systems, Northrop Grumman Corporation, L3Harris Technologies, Inc., Thales Group, and RTX Corporation.

-

Lockheed Martin Corporation offers a comprehensive range of advanced intelligence, surveillance, and reconnaissance (ISR) solutions. These include ground and airborne radar systems, electronic warfare capabilities, satellite and sensor technologies for remote intelligence collection, and integrated C4ISR platforms for real-time data fusion and analytics. Its SIGINT products, such as the Terrestrial Layer System-Brigade Combat Team (TLS-BCT) and Terrestrial Layer System-Echelons Above Brigade (TLS-EAB), are designed to improve situational awareness and operational decision-making across tactical, operational, and multi-domain environments. These solutions provide scalable, interoperable capabilities that support complex military operations and enhance real-time intelligence processing for defense and allied partners.

-

BAE Systems provides a broad range of intelligence and security solutions, with strong capabilities across cyber intelligence, counterintelligence, signals intelligence, and electronic warfare. Its portfolio includes advanced communications and data networks, along with intelligence-gathering sensors deployed on ground vehicles, aircraft, and maritime platforms. Key offerings include unmanned SIGINT and electronic warfare systems, airborne and maritime SIGINT and electronic support solutions, as well as the Eclipse RF product line, which supports scalable and mission-critical intelligence operations.

Key Signals Intelligence Companies:

The following are the leading companies in the signals intelligence market. These companies collectively hold the largest market share and dictate industry trends.

- Lockheed Martin Corporation

- BAE Systems

- Thales Group

- Northrop Grumman Corporation

- L3Harris Technologies, Inc.

- Raytheon Technologies

- General Dynamics Corporation

- HENSOLDT AG

- Elbit Systems Ltd.

- Saab AB

- Mercury Systems

Recent Developments

-

In November 2025, Thales Group received two PERSEUS awards from the French Navy and defense authorities for its innovations in electronic warfare and AI-enabled intelligence systems. The awards recognized CURCO, a compact radar detection payload for real-time electromagnetic spectrum monitoring, and Golden AI, an advanced tool that accelerates analysis of electronic support measures data. These solutions improve threat detection, situational awareness, and decision-making in contested electromagnetic environments. The recognition further establishes Thales as a leader in next-generation EW and SIGINT technologies for modern defense operations.

-

In November 2025, HENSOLDT AG launched TAERVUS as a fully integrated Electromagnetic Warfare system combining radio direction finders, receivers, jammers, and signal processing for COMINT (communications intelligence) and ELINT (electronic intelligence) across HF/VHF/UHF to microwave bands, enabling spectrum dominance and threat disruption.

-

In October 2025, Raytheon, a subsidiary of RTX Corporation, began initial production of its SharpSight multi-domain surveillance radar. The system delivers high-altitude, real-time, high-resolution imaging for land and maritime missions. It integrates proven radar technologies and can be deployed on manned or unmanned platforms to improve search, tracking, and situational awareness. Its open, upgradeable architecture enhances ISR capabilities, operational flexibility, and mission adaptability across various defense scenarios. This milestone demonstrates Raytheon’s commitment to advancing multi-domain radar solutions for global defense and allied partners.

Signals Intelligence Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 19.60 billion

Revenue forecast in 2033

USD 28.51 billion

Growth rate

CAGR of 5.5% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solutions, type, mobility, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; Saudi Arabia; UAE; and South Africa

Key companies profiled

Lockheed Martin Corporation; BAE Systems; Thales Group; Northrop Grumman Corporation; L3Harris Technologies, Inc.; Raytheon Technologies; General Dynamics Corporation; HENSOLDT AG; Elbit Systems Ltd.; Saab AB; Mercury Systems

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Signals Intelligence Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global signals intelligencemarketreport based on, solutions, type, mobility, and region:

-

Solutions Outlook (Revenue, USD Million, 2021 - 2033)

-

Airborne

-

Ground

-

Naval

-

Space

-

Cyber

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Electronic Intelligence (ELINT)

-

Communications Intelligence (COMINT)

-

-

Mobility Outlook (Revenue, USD Million, 2021 - 2033)

-

Fixed

-

Portable

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global signals intelligence market size was estimated at USD 18.51 billion in 2025 and is expected to reach USD 19.60 billion in 2026

b. The global signals intelligence market is expected to grow at a compound annual growth rate of 5.5% from 2026 to 2033 to reach USD 28.51 billion by 2033

b. North America dominated the SIGINT market, accounting for over 36% share in 2025. Factors such as the increasing defense budget and the rising innovations in artificial intelligence (AI) are propelling market growth in the region.

b. Some key players operating in the signals intelligence market include Lockheed Martin Corporation; BAE Systems; Thales; Northrop Grumman; L3Harris Technologies; Raytheon Technologies; General Dynamics; HENSOLDT AG; Elbit Systems; Saab; Mercury Systems

b. Factors such as the emergence of geopolitical uncertainties and the increase in criminal activities are fueling the market growth

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.