- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Silane Market Size, Share & Trends Analysis Report, 2030GVR Report cover

![Silane Market Size, Share & Trends Report]()

Silane Market Size, Share & Trends Analysis Report By Product By Application (Paints & Coatings, Adhesives & Sealants, Rubber & Plastics), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-613-4

- Number of Pages: 70

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Bulk Chemicals

Silane Market Size & Trends

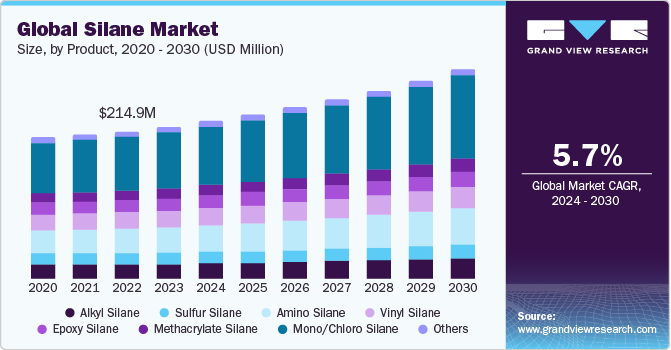

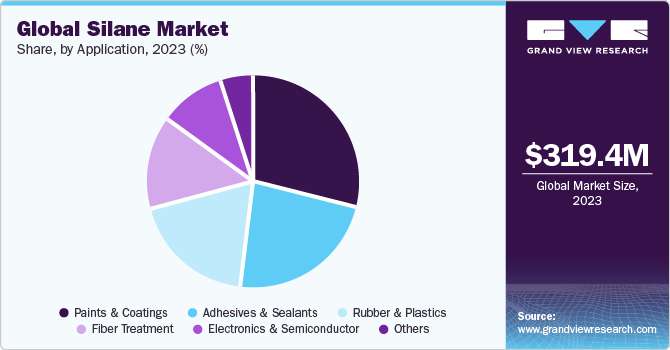

The global silane market size was estimated at USD 319.39 million in 2023 and is anticipated to grow at a CAGR of 5.7% from 2024 to 2030. The growth is attributed to the increasing usage of silane in the construction and infrastructure development activities along with its rising utilization in the electronics and semiconductor industry. The growth is also driven by the increasing product demand from rapidly developing end-use sectors. Rising demand for paint & coating products from the growing construction sector, which uses silane-based coatings is projected to drive the demand over the forecast period.

New construction project outcomes in the Asia Pacific coupled with increasing infrastructural renovation activities in North America and Western Europe have led to a surge in demand for various industrial coatings, adhesives, plastic components, and more. Furthermore, growing demand for automobiles in the Middle East and South America regions has led to a surge in demand for various light-weight, durable plastic components, and tires, which requires a significant amount of silane products for continued production operations.

The global demand for silane is observed to be growing due to high product requirements from paints & coating formulators, followed by adhesive & sealant manufacturers. Asia Pacific is the fastest-growing market due to increasing penetration of paint & coating and adhesives & sealant formulators across countries, such as China, Japan, South Korea, India, Thailand, and Malaysia. Factors, such as the construction of green buildings, residential complex expansions, and rising renovation activities, have resulted in increased demand for adhesives used in the construction sector in the region.

Furthermore, the product is a key component in the electronics industry, wherein silane gas is widely utilized in semiconductors, which are eventually an integral component in the electronics industry. The growing requirement for electronic gadgets and devices across the globe is projected to remain a major contributing factor to the market.

Rising environmental awareness has fueled the demand for highly efficient, solvent-free, and UV-cured coatings, thereby increasing the use of silane in the formulation of solvent-free coatings. These factors are projected to drive the paints & coatings application segment.

In addition, with the advancements in technology and growing urbanization, the requirement for electronic gadgets & devices is rapidly rising. Silane is widely utilized in the electronics segment in lithography & processing auxiliaries and as an insulating layer in the components of semiconductors. These factors are projected to increase the consumption of silane in the global electronics & semiconductors application segment over the coming years.

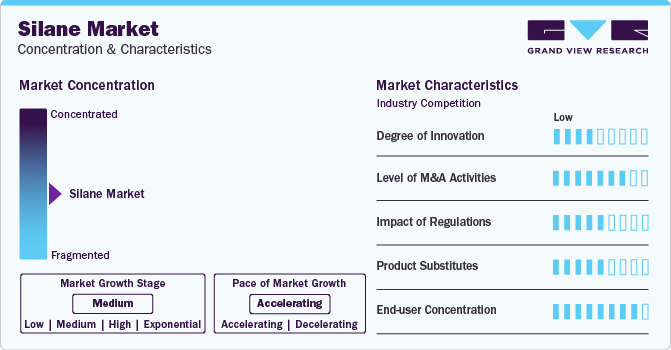

Market Concentration & Characteristics

The global market is characterized by the presence of major international players with integrated operations such as Evonik Industries; Shin-Etsu Chemical Co., Ltd.; Gelest, Inc.; Dow; and Wacker Chemie AG. These companies focus on widening their product portfolios to meet the varying needs of customers. They are also engaged in research and innovation to develop nanosilane exhibiting improved quality and performance.

The global silane market has presence of multiple international brands with brand presence globally. These companies have distinct range of silane products for various application markets such as plastic and rubber processing, paints & coating formulations, adhesives & sealants industry, electronics & semiconductors and more. The market also has a few small & medium-scale enterprises across Asia Pacific and Central America regions which are innovating new products to cater the native marketspaces.

Product Insights

In terms of value, mono/chloro silane products led the market with a share of 37.0% in 2023. It is generally used to produce siloxanes. Mono/chloro product type also acts as intermediates in the production of ultrapure silicon, which used in the semiconductor industry, and as protecting agents for intermediates in the pharmaceutical industry. Mono/chloro silanes are used as coatings for glass surfaces & silicon and in the production of silicon polymers.

Amino products find application as a coupling agent, adhesion promoter, resin additive, and surface modifier. It improves the chemical bonding of resins in reinforcing materials and inorganic fillers. Amino-based products is also stable and reacts well with water, which makes it suitable for various applications. Several major market players manufacture amino silane for paints & coatings applications.

Vinyl silanes are used as crosslinking agents in the manufacturing of cross-linked polyethylene (PEX). They are also used as adhesion promoters and coupling agents in various end-use applications, such as paints & coatings. The expansion of end-use industries in India, China, and Brazil, coupled with the rising awareness about the product benefits is likely to fuel the segment growth over the forecast period. Increasing production activities in the U.S. are also expected to have a positive impact on the demand over the forecast period.

The growing demand for various silane products as crosslinking agents, adhesion promoters, and as coupling agents is projected to drive growth over the foreseeable future. Amino silanes are of significant importance on account of their widespread use in reinforcing materials, inorganic fillers, and more, across industries, such as plastic and rubber. Furthermore, with technological advancements by key product manufacturers worldwide, such as Evonik Industries, and Shin-Etsu Chemicals, to serve a broader market base, the demand for various products is projected to grow over the coming years.

Application Insights

The paints & coatings segment dominated the market with a revenue share of 28.7% in 2023. Its high share is attributable to the increasing use of products as it is widely used as a raw material in the production of anti-corrosion coatings, which are employed in building & construction, automotive, industrial machinery, and electronics sectors. The growth of these end-use industries is expected to augment the product demand over the forecast period. Further, increasing investments in infrastructure sector of emerging countries have considerably boosted the demand for coatings, which, in turn, is anticipated to have a positive impact on the market growth over the forecast period.

Silane is used in the crosslinking of polyethylene and its copolymers for application in cable insulation and electrical wires. Silane-based plastic compounds are used in places where high-temperature resistance is required. In addition, these plastic compounds are used in hot & cold water pipes and natural gas carrier pipes. Thus, expanding the electrical sector, especially in the Asia Pacific, is expected to drive the industry over the forecast period. Technological advancements in the construction and transport sectors are expected to further fuel the product demand, wherein plastic and rubber components are critically used across multiple application points.

Multiple large-scale manufacturers are constantly investing in research activities to enhance their product portfolios to meet the extensive product requirement from growing end-use industries. Paints & coatings followed by adhesives & sealants are among the largest consumers of the product globally due to the product’s ability to provide excellent adhesion boost as well as it is a highly effective coupling agent. Increasing construction activities across all major economies are promoting the demand for various industrial sealants and coating formulations, which is anticipated to boost the market growth over the coming years.

Regional Insights

The market expansion in North America is driven by the growing automotive and construction sectors. Residential construction is the fastest-growing sector, with countries, such as Canada and Mexico, witnessing significant development over the last five years. To cope up with the growing demand for adhesives & sealants from the regional construction market, there is a sizeable increase in the number of large-scale plant manufacturing adhesives as compared to other geographies, which mostly have subsidiary units.

U.S. Silane Market Trends

The U.S., which is a major market in North America, is characterized by technological advancements in plastic and rubber formulating methods and high awareness among consumers regarding health and environmental effects of rubber and plastics.

Asia Pacific Silane Market Trends

Asia Pacific dominated the market and accounted for 49.3% of the global volume in 2023. This is attributed to the expanding manufacturing sector in Vietnam, South Korea, Thailand, China, Japan, and India, which fueled the demand for plastic compounds and rubber substrates in the automotive, industrial machinery, construction, packaging, and electrical & electronics industries. In the recent past, India and China have witnessed a spike in automotive production owing to technology transfer to the sector from the Western regions. In addition, a well-established manufacturing base for electrical & electronics in Taiwan, China, and South Korea is anticipated to provide further impetus to the automotive sector in the region.

The China silane market is one of the crucial markets globally. The country emerged as the leading plastic manufacturer globally in 2023. It is self-sufficient in terms of plastic production, with an adequate number of plants and production capacity required to fulfill the local demand. Moreover, China supplies PET, PVC, and other types of plastics to neighboring countries due to its large production base. The country recycles a significant amount of waste plastic into various products such as fibers, sheets, and films, thereby, reflecting high demand for silane in plastics production in the country.

Europe Silane Market Trends

The Europe market exhibits a substantially high demand for adhesives & sealants, which is dominated by growing demand from Germany, Finland, and Italy, in terms of consumption, across a wide range of applications. Furthermore, various stringent environmental regulations by regulatory bodies such as the European Chemicals Agency (ECHA) and the European Commission, among other federal-level agencies, characterize the markets in Europe, which, in turn, is expected to boost product development in the silane marketspace to back up high market growth of end-use segments.

The Germany silane market is expected to grow over the forecast period. The growing construction and renovation activities in Germany have also led to high demand for coatings and sealants across Germany, which is projected to boost the demand for silane in these applications over the coming years.

Central & South America Silane Market Trends

The demand for silane in Central & South America is mainly driven by the increasing manufacturing of consumer goods, which can be attributed to the increasing demand for plastics, rubber materials, and automotive components.

The silane market in Brazil is projected to grow during the forecast period. Brazil is one of the fastest-growing economies in the region. It has become a global hub for automotive manufacturers. Thus, several foreign and a few Brazilian brands manufacture vehicles in the country.

Middle East & Africa Silane Market Trends

The growth of the silane market in Middle East & Africa is expected to be driven by the growth of the automotive, packaging, industrial machinery, and consumer goods application sectors, which demand silane products for a range of utility purposes.

The Saudi Arabia silane market has introduced a series of initiatives to boost the growth of small and medium-sized enterprises (SMEs) involved in rubber and plastic processing to cater to the growing demand from the automotive and construction sectors.

Key Silane Company Insights

The global market is concentrated with multiple companies that have an international presence. These multinationals have an extensive product portfolio. The industry also has a few small- & medium-scale enterprises across the Asia Pacific and Central America regions that are innovating new products to cater to the native markets.

Manufacturers provide various types of products that can be used as coupling agents, crosslinkers, adhesion promoters, and surface modifiers as well as in bonding applications. Major players are developing newer products that could broaden the application scope. They are also heavily investing in research & development and expansion of their production capacities to sustain the market.

-

Evonik Industries is a specialty chemicals company headquartered in Essen, Germany. The resource efficiency segment includes high-performance materials such as activated nickel catalysts, precious metal powder catalysts, organosilane, and mono/chloro silane, which are used in construction and paints & coatings sectors.

-

Shin-Etsu Chemical Co., Ltd., headquartered in Tokyo, Japan, is engaged in the production and distribution of synthetic resins and various other chemical products. The company’s silicone division provides silicone-based products such as chemical reagents & intermediates, resins, fluids, sealants, and liquid rubber. It also produces silane coupling agents and functional silane.

Key Silane Companies:

The following are the leading companies in the silane market. These companies collectively hold the largest market share and dictate industry trends.

- Gelest, Inc.

- Shin-Etsu Chemical Co. Ltd.

- Nitrochemie Aschau GmbH

- Silar (Entegris)

- Dow

- Evonik Industries

- Wacker Chemie AG

- Power Chemical Corp

Recent Developments

-

On 15 March 2024, Cortec expanded its MCI portfolio to include MCI-2018 X, a 100% silane penetrating water repellent for concrete surfaces.

-

On 09 February 2023, BRB Silicones showcased novel silane, additive, resin and water repellent at European Coatings Show 2023.

Silane Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 333.92 million

Revenue forecast in 2030

USD 465.66 million

Growth rate

CAGR of 5.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia

Key companies profiled

Gelest Inc., Shin-Etsu Chemical Co. Ltd., Nitrochemie Aschau GmbH, Silar (Entegris), Dow Corning, Evonik Industries, Wacker Chemie AG, Power Chemical Corp

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Silane Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global silane market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Alkyl Silane

-

Sulfur Silane

-

Amino Silane

-

Vinyl Silane

-

Epoxy Silane

-

Methacrylate Silane

-

Mono/Chloro Silane

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Paints & Coatings

-

Adhesives & Sealants

-

Rubber & Plastics

-

Fiber Treatment

-

Electronics & Semiconductor

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global silane market size was valued at USD 319.39 million in 2023

b. The global silane market is anticipated to grow at a compound annual growth rate (CAGR) of 5.7% from 2024 to 2030.

b. Asia Pacific dominated the market and accounted for 49.3% of the global volume in 2023. This is attributed to the expanding manufacturing sector in Vietnam, South Korea, Thailand, China, Japan, and India, which fueled the demand for plastic compounds and rubber substrates in the automotive, industrial machinery, construction, packaging, and electrical & electronics industries.

b. Some key players operating in the silane market include Evonik Industries AG, Shin-Etsu Chemical Co. Ltd., Dow Corning, and Wacker Chemie AG.

b. Key factors that are driving the silane market growth include rising product demand from construction, pharmaceuticals, & consumer electronics industries and increasing adoption of the product as a coupling agent to improve rolling resistance & compression for manufacturing tires in the automobile industry.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."