- Home

- »

- Organic Chemicals

- »

-

Silica Flour Market Size, Share, Growth, Trends Report, 2030GVR Report cover

![Silica Flour Market Size, Share & Trends Report]()

Silica Flour Market Size, Share & Trends Analysis Report By Type (Quartz, Cristobalite), By End-use (Glass & Clay, Foundry, Fiberglass, Oil Well Cement), By Region (North America, Asia Pacific), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-147-4

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

Silica Flour Market Size & Trends

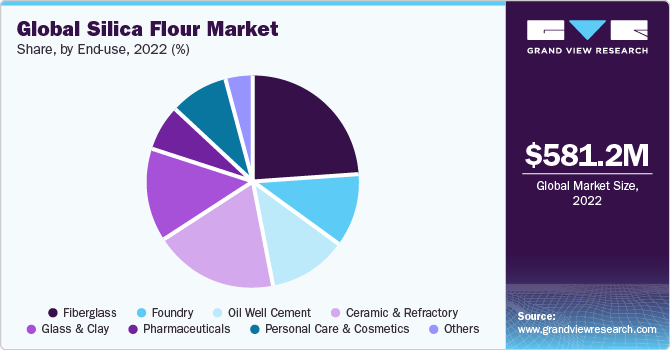

The global silica flour market size was estimated at USD 581.2 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.1% from 2023 to 2030. This growth is attributed to its versatile applications across various industries. Silica flour, which is finely ground silica sand, is known for its exceptional purity and high silica content, making it a valuable raw material in numerous manufacturing processes. One of the primary drivers behind the increasing demand is the booming construction and infrastructure sectors, where silica flour is extensively used in the production of concrete, mortars, and grouts. According to the World Paints & Coatings Industry Association, the global construction market witnessed substantial growth from USD 6.4 trillion in 2020 to USD 8.2 trillion in 2022.

Its unique properties, such as improved strength, durability, and resistance to chemical attacks, make it an ideal additive in these applications. In addition, the electronics industry has witnessed a surge in product demand due to its use in the manufacturing of semiconductors and optical fibers. Moreover, the pharmaceutical and cosmetics industries have also witnessed a growing need for silica flour as an excipient in various formulations, owing to its ability to enhance the flow properties and stability of drugs and cosmetic products. With its wide-ranging benefits and increasing utilization in diverse sectors, the product demand is expected to increase in the coming years.

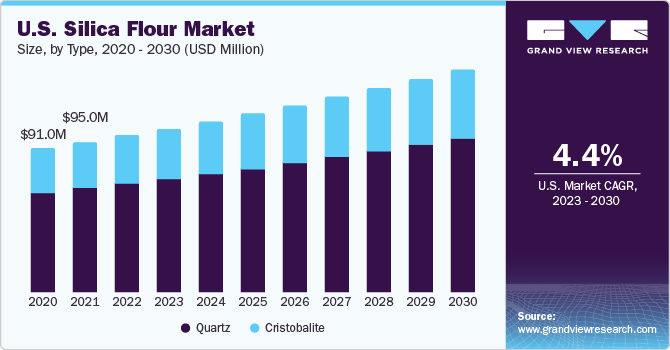

The U.S. is a major product consumer in North America with a revenue share of over 78% in 2022. The growth of the product market during the forecast period can be attributed to the booming construction industry in the country, which requires silica flour for the production of high-strength concrete, mortars, and grouts. Silica flour's unique properties, such as improved durability and resistance to chemical attacks, make it an essential additive in construction materials. According to the Associated General Contractors of America (AGC), the U.S. creates around USD 1.8 trillion worth of structures each year with the completion of over 0.92 million construction establishments in the 1st quarter of 2023.

Thus, the advancing construction activities in the country are anticipated to drive product demand over the forecast period. In addition, the fiberglass industry in the U.S. is witnessing a surge in demand for silica flour. Fiberglass is extensively used in various applications, including automotive parts, wind turbine blades, and aerospace components. Silica flour is a crucial ingredient in the manufacturing of fiberglass, as it enhances the strength and performance of the final product.

Type Insights

The quartz segment dominated the market with a revenue share of over 69% in 2022. This is attributed to the fact that quartz type influences the physical and chemical properties of silica flour, including its particle size distribution, surface area, and reactivity. These properties, in turn, impact the performance of the product in various applications. For example, finer quartz particles may provide better flow properties and enhance the strength and durability of construction materials. Quartz particles are typically in the form of fine grains, which are smaller than gravel and coarser than silt. Different types of quartz, such as crystalline quartz and amorphous quartz, can be used to produce silica flour. The choice of quartz type depends on the desired properties and applications of the product.

The cristobalite segment is anticipated to witness growth over the forecast period. This is attributed to its unique properties, improved performance in certain applications, and safety considerations compared to other forms of crystalline silica like quartz. Cristobalite offers high thermal stability, low thermal expansion, and good electrical insulation properties, making it suitable for high-temperature applications in industries, such as construction, ceramics, and foundries. In addition, cristobalite is considered a safer alternative to crystalline quartz in terms of worker safety and health risks associated with inhalation. As industries continue to expand and seek high-performance materials, the demand for cristobalite in silica flour is expected to increase.

End-use Insights

The fiberglass end-use segment dominated the market with a share of over 24% in 2022. This is attributed to the fact that Silica flour is widely used as a reinforcement agent in the manufacturing of fiberglass. It is added to the resin matrix during the production process to improve the mechanical properties and overall strength of fiberglass composites. The fine particles of the product blend seamlessly with the resin, providing enhanced reinforcement and increasing the structural integrity of the final fiberglass product. Furthermore, silica flour finds application as a surface coating and smoothing agent in the production of fiberglass materials. Its role is to create a polished and uniform surface finish, resulting in improved aesthetics and visual appeal of the fiberglass products.

By incorporating silica flour, manufacturers can achieve a consistent texture, reducing any imperfections and ensuring a visually pleasing surface. Moreover, silica flour's exceptional thermal insulation properties make it an excellent choice for applications that require heat resistance. Incorporating silica flour in fiberglass manufacturing enhances the thermal insulation capabilities of the final product, making it suitable for industries, such as construction, automotive, aerospace, and marine, where thermal protection is of utmost importance. The oil well cement segment is anticipated to witness growth over the forecast period.

It enhances the strength and durability of the cement, ensuring a reliable seal between the well casing and the surrounding formation. With its excellent thermal stability, silica flour enables the cement to withstand high temperatures during drilling and production operations. In addition, it acts as a fluid loss control agent, regulates the setting time of the cement, and exhibits compatibility with various additives, allowing for tailored cement formulations to meet specific well requirements. Overall, the product application in oil well cement plays a vital role in maintaining the integrity and performance of oil wells.

Regional Insights

Asia Pacific dominated the market with a revenue share of over 38% in 2022. This is attributed to the advancing construction, fiberglass, foundry, and personal care & cosmetic industries in the region. According to the International Trade Administration, China is the world’s largest construction market and is further anticipated to witness a growth of around 8.6% from 2022 to 2030. In addition, according toOxford Economics, India is estimated to be the fastest-growing construction market in the world by 2030 with a construction growth rate almost twice that of China. The country was the world’s third-largest construction market in 2021.

The growth of the country’s construction sector is driven by the rising demand for urban housing infrastructure. Its urban population is predicted to grow by a staggering 165 million by 2030. This is likely to stimulate construction projects associated with housing infrastructure in the country. Furthermore, according to the International Trade Administration, the sale of cosmetic & personal care in China accounted for USD 88 billion in 2021, witnessing an increase of 10% compared to the previous year. Thus, the advancing end-use industries in the region are anticipated to drive product demand over the forecast period.

Europe is anticipated to witness growth over the forecast period. The glass industry in Europe is a major consumer of the product. Glass production requires high-quality silica flour as a key ingredient, and the growing demand for glass products in various sectors, such as construction, automotive, and packaging, is driving the product demand in the region. According to the Glass Alliance Europe, glass production in Europe accounted for 39.5 million tons in 2021 with Germany being the largest producer followed by Italy, France, the UK, Spain, and Poland.

The automotive industry in Europe is another significant consumer of the product. It is used in the production of tires to improve the performance and fuel efficiency of vehicles. With the growing demand for automobiles in Europe, the product demand in the tire manufacturing industry is also increasing. Thus, the advancing end-use industries are anticipated to drive the product demand in the region over the forecast period.

Key Companies & Market Share Insights

The product market is highly competitive, prompting companies to implement various strategic initiatives to expand their presence in different regions. As part of this strategy, Sibelco recently announced two significant acquisitions. Firstly, on March 2023, Sibelco acquired Kremer Zand en Grind (KZG), a Dutch producer of wet, dried, and calibrated silica sand and gravel. This acquisition not only broadens Sibelco's customer base but also increases its silica sand reserves and resources in Western Europe.

Sibelco acquired Echasa S.A., a mining company involved in extracting silica sand from the Laminoria quarry in Northern Spain. This acquisition allows Sibelco to expand its customer base in the glass, foundry, and construction markets in the northern part of Spain, while also extending its silica sand reserves and resources in Western Europe. These strategic moves demonstrate Sibelco's commitment to growth and strengthening its position in the Europe market.

Key Silica Flour Companies:

- U.S. Silica Holdings, Inc.

- Fineton Industrial Minerals Limited

- Sibelco

- Capital Sand Company

- Hoben International Ltd.

- AGSCO Corporation

- Sil Industrial Minerals

- Adwan Chemical Industries Co. Ltd.

- 3M

Silica Flour Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 603.6 million

Revenue forecast in 2030

USD 799.7 million

Growth rate

CAGR of 4.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD Million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico, Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

U.S. Silica Holdings, Inc.; Fineton Industrial Minerals Ltd.; Sibelco; Capital Sand Company; Hoben International Ltd.; AGSCO Corp.; Sil Industrial Minerals; Adwan Chemical Industries Co. Ltd.; 3M

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Silica Flour Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global silica flour market report on the basis of type, end-use, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Quartz

-

Cristobalite

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Fiberglass

-

Foundry

-

Oil Well Cement

-

Ceramic & Refractory

-

Glass & Clay

-

Pharmaceuticals

-

Personal Care & Cosmetics

-

Other End-uses

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global silica flour market is expected to grow at a compound annual growth rate of 4.1% from 2023 to 2030 to reach USD 799.7 billion by 2030.

b. Asia Pacific region dominated the silica flour market with a revenue share of over 38% in 2022. This is attributable to the advancing construction, fiberglass, foundry, and personal care & cosmetic industries in the region.

b. Some key players operating in the silica flour market include U.S. Silica Holdings, Inc., Fineton Industrial Minerals Limited, Sibelco, Capital Sand Company, Hoben International Ltd., AGSCO Corporation, Sil Industrial Minerals, Adwan Chemical Industries Co. Ltd., 3M

b. Key factors that are driving the market growth include the booming construction and infrastructure sectors, where silica flour is extensively used in the production of concrete, mortars, and grouts.

b. The global silica flour market size was estimated at USD 581.2 million in 2022 and is expected to reach USD 603.6 million in 2023.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."