- Home

- »

- Advanced Interior Materials

- »

-

Silicon Carbide Market Size & Share, Industry Report, 2033GVR Report cover

![Silicon Carbide Market Size, Share & Trends Report]()

Silicon Carbide Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Black, Green), By Application (Steel, Automotive, Aerospace & Defense, Electronics, Healthcare), By Region, And Segment Forecasts

- Report ID: 978-1-68038-153-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Silicon Carbide Market Summary

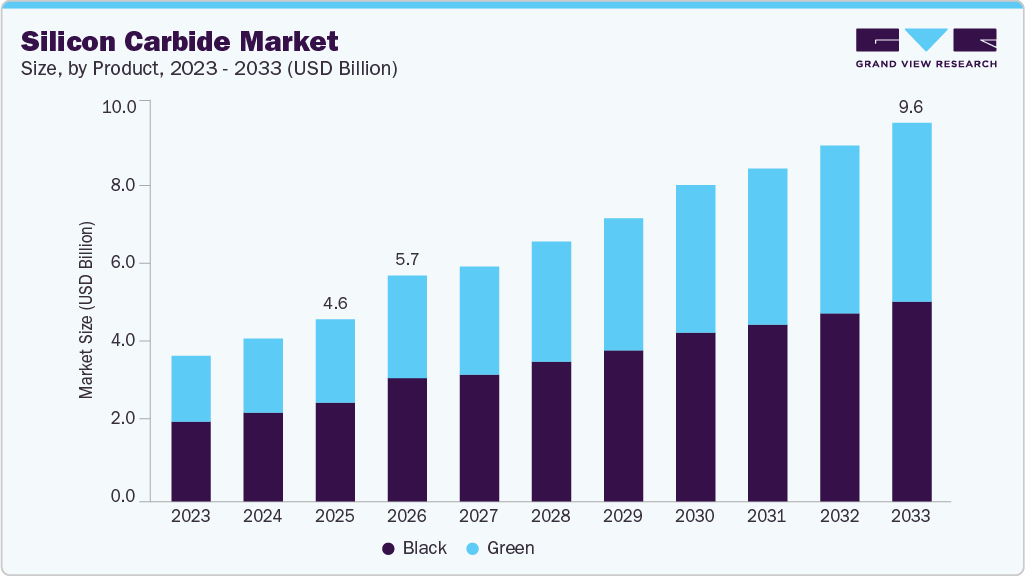

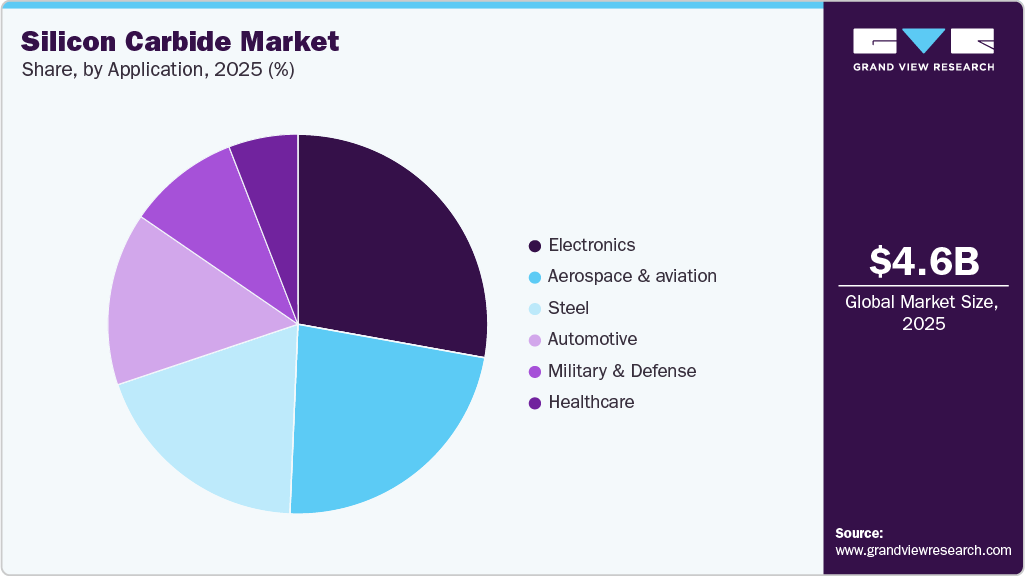

The global silicon carbide market size was estimated at USD 4.59 billion in 2025 and is projected to reach USD 9.56 billion by 2033, growing at a CAGR of 7.7% from 2026 to 2033. The increased use of the product to manufacture refractory materials for the steel industry is projected to aid the market growth during the forecast period.

Key Market Trends & Insights

- Asia Pacific dominated the steel market with the largest market revenue share of over 61.0% in 2025.

- By product, black silicon carbide accounted for the largest market revenue share of over 54.0% in 2025.

- By application, healthcare is anticipated to grow at the fastest CAGR over the forecast period.

Market Size & Forecast

- 2025 Market Size: USD 4.59 Billion

- 2033 Projected Market Size: USD 9.56 Billion

- CAGR (2026-2033): 7.7%

- Asia Pacific : Largest Market Region in 2025

- Middle East & Africa : Fastest Market Region in 2025

Silicon carbide is used as a raw material for refractory on account of its high-temperature resistance. The refractory products are widely used in the linings of kilns, furnaces, and reactors across various industries, including cast iron, steel, aluminum, and metal. The production growth in the aforementioned ferrous and non-ferrous industries is expected to drive the market for refractory materials. The silicon carbide (SiC) industry is experiencing significant growth, driven by its superior properties such as high thermal conductivity, voltage resistance, and efficiency in power electronics. These attributes make SiC an ideal material for applications in electric vehicles (EVs), renewable energy systems, and high-performance industrial equipment. The global shift towards electrification and decarbonization, supported by government initiatives like the U.S. Department of Energy's USD 544 million loan to expand SiC wafer production in Michigan and the European Union's approval of Italian state aid for a USD 5.4 billion STMicroelectronics SiC chip plant in Sicily, underscore the strategic importance of SiC in achieving energy efficiency and sustainability goals.

Despite its advantages, the market faces challenges that could impede its growth. The high cost of SiC devices, attributed to complex manufacturing processes and the need for specialized equipment, remains a significant barrier. Besides, the brittleness of SiC materials complicates fabrication, requiring advanced techniques and skilled labor. Supply chain constraints, including limited availability of high-quality SiC substrates and geopolitical factors affecting raw material sourcing, further exacerbate these issues. Addressing these challenges is crucial for the widespread adoption of SiC technologies across various industries.

Drivers, Opportunities & Restraints

The SiC market is driven by the increasing demand for energy-efficient semiconductor devices, particularly in the EV and renewable energy sectors. Governments worldwide are promoting the adoption of EVs and sustainable energy solutions, leading to the growth of SiC applications in power electronics and charging infrastructure. For instance, the U.S. Department of Energy's initiatives to expand SiC production and the European Union’s funding for advanced semiconductor facilities highlight the strategic push toward reducing carbon emissions and enhancing energy efficiency. Additionally, the high thermal conductivity and power handling capabilities of SiC make it crucial in high-performance industrial applications, driving market adoption.

The industry presents significant opportunities in the expanding EV ecosystem, where SiC-based power modules enable faster charging, higher power density, and improved performance. The automotive industry's shift towards SiC technology for inverters and onboard chargers is gaining traction due to its efficiency. In addition, increasing investments in smart grid infrastructure and high-voltage applications are paving the way for SiC’s integration into energy distribution systems. Collaborations between government bodies and private manufacturers to localize production and reduce supply chain vulnerabilities further bolster opportunities for market players.

Despite its promising applications, the market faces challenges primarily related to high manufacturing costs and limited availability of raw materials. The complexity of SiC crystal growth and the need for advanced processing techniques make the production expensive compared to conventional silicon-based materials. Moreover, the brittle nature of SiC complicates machining and device fabrication, requiring specialized expertise. Geopolitical tensions affecting the supply of raw materials, especially from countries with significant SiC reserves, also pose a risk to the steady growth of the market. Addressing these technical and supply chain hurdles is crucial for broader adoption across industries.

Product Insights

Black silicon carbide is available in various forms, including blocks, grains, and powders. The grain form of the product is widely popular, especially in the iron and steel manufacturing processes through electric arc furnaces. The rising consensus towards the adoption of electric arc furnaces to reduce the usage of natural raw materials is likely to boost the segment's growth during the forecast period.

The green SiC product segment is anticipated to register the fastest CAGR during the forecast period. The product is defined as one of the hardest man-made minerals, which possesses high strength at extreme temperatures. On account of its resistance to high temperatures, the product is widely utilized in the development of special kinds of ceramics. The growing use of specialty ceramics to produce metal-matrix composites, wear-resistant seals, nozzles, and other applications is likely to positively influence the growth of the green SiC segment during the forecast period.

Application Insights

The electronics and electrical segment is growing due to the rapid shift toward high-efficiency power electronics. Silicon carbide enables devices to operate at higher voltages, temperatures, and switching frequencies compared to conventional silicon, directly improving energy efficiency and reducing system size. This performance advantage is driving strong adoption of silicon carbide MOSFETs and diodes in electric vehicles, fast-charging infrastructure, renewable energy inverters, and industrial motor drives.

Silicon carbide-based components help minimize power losses and reduce cooling requirements, which directly lowers operating costs and enhances system reliability. With rising global electricity consumption and increasing focus on energy optimization, utilities and technology companies are integrating silicon carbide solutions into power conversion and distribution equipment.

In the military and defense sector, silicon carbide's unique combination of strength, lightweight, and thermal stability makes it invaluable. SiC ceramics are widely used in the manufacturing of ballistic armor for personnel and vehicles, offering enhanced protection against high-velocity projectiles while maintaining maneuverability due to their reduced weight.

Moreover, SiC's superior electronic properties are harnessed in advanced radar and communication systems. Its high thermal conductivity and ability to operate at elevated temperatures enable the development of compact, high-power electronic devices essential for modern defense applications. The U.S. Department of Defense has recognized the strategic importance of SiC, investing in domestic production capabilities to ensure a reliable supply for critical defense technologies.

Silicon carbide is emerging as a transformative material in the healthcare industry, particularly in the development of medical implants and devices. Its biocompatibility, chemical inertness, and mechanical strength make it suitable for long-term implantation in the human body. SiC is being explored for use in orthopedic implants, dental prosthetics, and cardiovascular devices, where durability and compatibility with biological tissues are paramount.

Regional Insights

The silicon carbide industry in the Asia Pacific region is a significant hub for SiC adoption, driven by the rapid growth of EVs, renewable energy, and telecommunications. Countries such as China, Japan, and South Korea are investing heavily in SiC technologies to enhance power electronics and improve energy efficiency. The region's focus on reducing carbon emissions and improving energy infrastructure has led to an increased demand for SiC-based components in solar inverters, wind turbines, and EV powertrains. Additionally, the expansion of 5G networks and data centers is propelling the use of SiC in high-frequency and high-power applications.

The China silicon carbide industry is a dominant player in the global market, with substantial investments in EVs, renewable energy, and semiconductor manufacturing. The government's policies promoting clean energy and technological self-reliance are accelerating the development and adoption of SiC technologies. Chinese companies are expanding their SiC production capacities to meet domestic demand and reduce dependence on foreign suppliers. Additionally, China's focus on 5G deployment and smart grid infrastructure is creating new avenues for SiC applications.

North America Silicon Carbide Market Trends

The silicon carbide industry in North America is bolstered by the growing emphasis on energy-efficient solutions and the electrification of transportation. The U.S., in particular, is witnessing increased adoption of SiC in EVs, driven by stricter emissions regulations and the push for sustainable mobility. SiC's superior thermal conductivity and voltage resistance make it ideal for high-performance power electronics in automotive and industrial applications. Furthermore, government initiatives and investments are supporting the domestic production of SiC to strengthen the supply chain and reduce reliance on imports.

U.S. Silicon Carbide Market Trends

The U.S. silicon carbide industry is experiencing significant growth due to federal support for advanced manufacturing and clean energy technologies. Companies are expanding their SiC production capacities to meet the rising demand from the EV sector and renewable energy projects. The government's focus on enhancing domestic semiconductor manufacturing capabilities is also contributing to the development of SiC technologies. Additionally, collaborations between industry players and research institutions are fostering innovation in SiC applications across various sectors.

Europe Silicon Carbide Market Trends

The silicon carbide industry in Europe is driven by the region's commitment to sustainability and the transition to green energy. The automotive industry, particularly in countries like Germany and France, is increasingly integrating SiC components to improve the efficiency and performance of EVs. Moreover, Europe's investments in renewable energy infrastructure, such as wind and solar power, are creating opportunities for SiC in power conversion and grid applications. The region's focus on reducing carbon emissions and enhancing energy security is further propelling the adoption of SiC technologies.

The Germany silicon carbide industry stands out in Europe's SiC landscape due to its strong automotive and industrial sectors. German manufacturers are leveraging SiC to develop high-efficiency power electronics for EVs, aiming to extend driving range and reduce charging times. The country's emphasis on Industry 4.0 and smart manufacturing is also driving the use of SiC in automation and control systems. Furthermore, Germany's commitment to renewable energy is fostering the integration of SiC in energy storage and distribution solutions.

Latin America Silicon Carbide Market Trends

The silicon carbide industry in Latin America is gradually gaining traction, primarily driven by the region's focus on renewable energy and industrial modernization. Countries like Brazil and Mexico are investing in wind and solar power projects, where SiC's efficiency in power conversion is beneficial. The automotive sector's growing interest in EVs is also creating opportunities for SiC in powertrain and charging infrastructure applications. While the market is still in its nascent stages, supportive policies and international collaborations are expected to accelerate SiC adoption in the region.

Key Silicon Carbide Company Insights

Some of the key players operating in the market include AGSCO Corporation, Carborundum Universal Limited, and Washington Mills, among others.

-

Carborundum Universal Limited (CUMI), established in 1954, is a leading Indian materials science company headquartered in Chennai and is part of the Murugappa Group. CUMI specializes in manufacturing a diverse range of products, including abrasives, ceramics, refractories, and electro minerals, serving industries such as engineering, automotive, and energy.

-

Founded in 1868, Washington Mills is one of the world's largest producers of abrasive grains and fused mineral products, headquartered in North Grafton, Massachusetts. As a family-owned enterprise, it manufactures a wide range of materials, including silicon carbide, aluminum oxide, and boron carbide, catering to industries such as aerospace, automotive, and electronics.

Key Silicon Carbide Companies:

The following are the leading companies in the silicon carbide market. These companies collectively hold the largest market share and dictate industry trends.

- AGSCO Corporation

- Carborundum Universal Limited

- Washington Mills

- Coorstek

- Entegris, Inc.

- ESD-SIC b.v.

- Snam Abrasives Pvt. Ltd.

- Gaddis Engineered Materials

- Grindwell Norton Ltd.

- SK Siltron Co.,Ltd.

Recent Developments

-

In February 2025, Infineon Technologies AG announced the release of its first products based on advanced 200 mm silicon carbide technology, marking a significant milestone in the company's efforts to enhance SiC device performance and production capacity.

-

In January 2025, China's Silan Microelectronics and STMicroelectronics advanced their 8-inch SiC production lines, with STMicroelectronics' facility in Chongqing expected to commence wafer production by late February, aiming to meet the growing demand for SiC devices in electric vehicles and power grids.

Silicon Carbide Market Report Scope

Report Attribute

Details

Market definition

The market represents the consumption of silicon carbide in various applications.

Market size value in 2026

USD 5.70 billion

Revenue forecast in 2033

USD 9.56 billion

Growth rate

CAGR of 7.7% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative Units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2026 to 2033

Report coverage

Revenue and volume forecast, company ranking, competitive landscape, growth factors, and trends

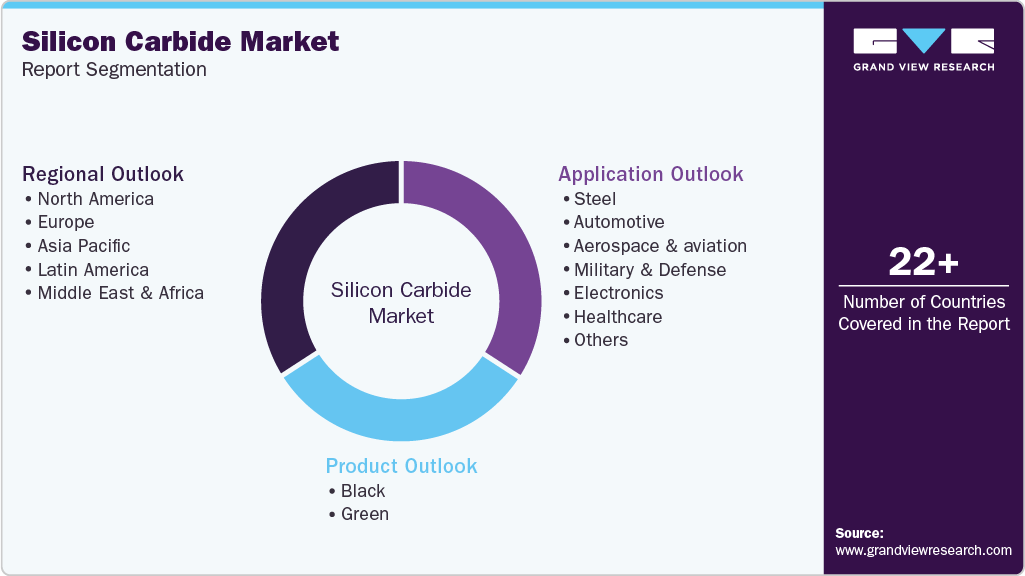

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; South Korea

Key companies profiled

AGSCO Corporation; Carborundum Universal Limited; Washington Mills; Coorstek; Entegris, Inc.; ESD-SIC b.v.; Snam Abrasives Pvt. Ltd.; Gaddis Engineered Materials; Grindwell Norton Ltd.; SK Siltron Co., Ltd.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Silicon Carbide Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global silicon carbide market report on the basis of product, application, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Black

-

Green

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Steel

-

Automotive

-

Aerospace & aviation

-

Military & Defense

-

Electronics

-

Healthcare

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million; 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

-

Latin America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global silicon carbide market size was estimated at USD 4.59 billion in 2025 and is expected to reach USD 5.04 billion in 2026.

b. The global silicon carbide market is expected to grow at a compound annual growth rate of 7.7% from 2026 to 2033 to reach USD 9.56 billion by 2033.

b. The black segment dominated the market and accounted for the largest revenue share of 54.3% in 2025 due to its extensive use in abrasive and metallurgical applications. Its high hardness and thermal resistance make it suitable for grinding wheels, cutting tools, and refractory linings. Strong demand from construction, metal processing, and manufacturing activities sustained high consumption volumes, reinforcing the segment’s leading market position.

b. Some of the key vendors of the global silicon carbide market are AGSCO Corporation; Carborundum Universal Limited; Washington Mills; Coorstek; Entegris, Inc.; ESD-SIC b.v.; Snam Abrasives Pvt. Ltd.; Gaddis Engineered Materials; Grindwell Norton Ltd.; SK siltron Co., Ltd.

b. Silicon carbide demand is rising because industries increasingly require materials that can perform reliably under extreme thermal, mechanical, and electrical conditions. Its unique balance of durability and efficiency makes it suitable for advanced applications, which has positioned silicon carbide as a material of growing commercial and strategic importance worldwide.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.