- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Silicone Coating Market Size & Share, Industry Report, 2033GVR Report cover

![Silicone Coating Market Size, Share & Trends Report]()

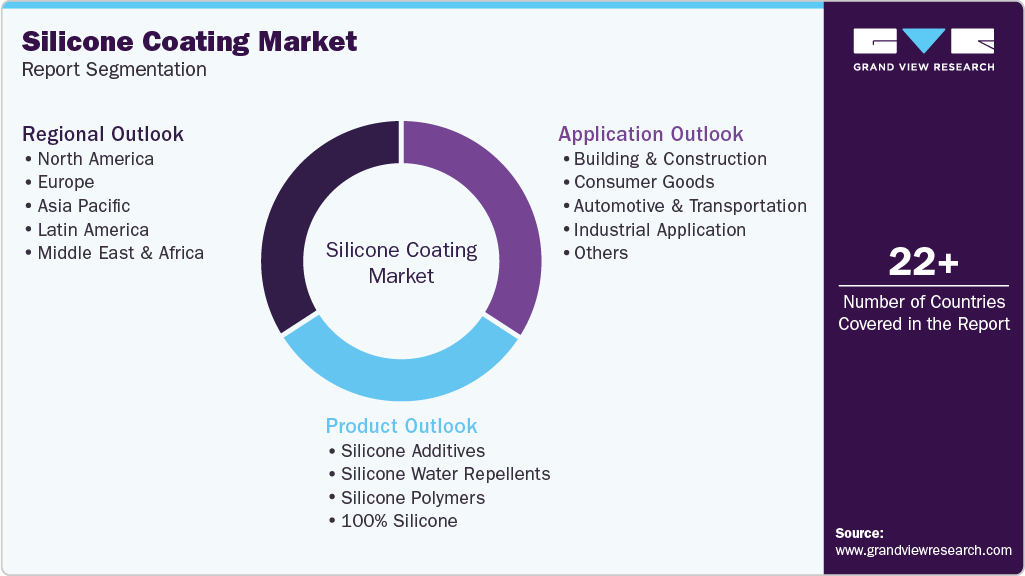

Silicone Coating Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Silicone Additives, Silicone Water Repellents, Silicone Polymers, 100% Silicone), By Application, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-627-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Silicone Coating Market Summary

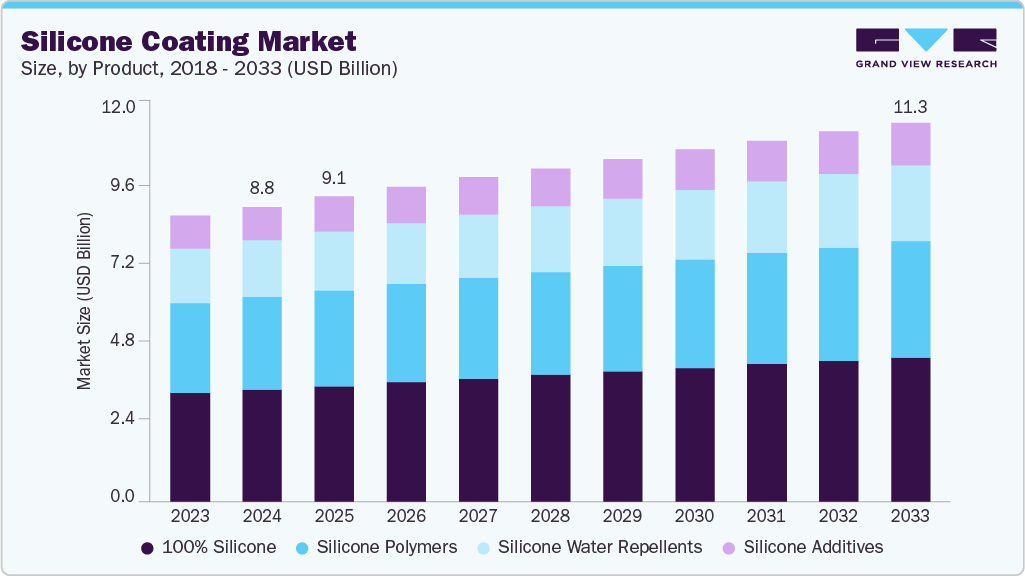

The global silicone coating market size was estimated at USD 8,765.9 million in 2024, and is projected to reach USD 11,268.7 million by 2033, growing at a CAGR of 2.8% from 2025 to 2033. The growth in the silicon coatings market is driven by their widespread application in consumer goods, particularly in the electronics and automobile sectors.

Key Market Trends & Insights

- North America dominated the silicone coating market with the largest revenue share of 35.71% in 2024.

- Japan held over 12.9% revenue share of the Asia Pacific silicone coating Market.

- By product, the 100% silicone-based silicone coating segment led the market with the largest revenue share of 38% in 2024.

- By product, the silicone water repellents form segment is anticipated to grow at the fastest CAGR during the forecast period.

- By application, the consumer goods-based chemical absorbents segment led the market with the largest revenue share of 30% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 8,765.9 Million

- 2033 Projected Market Size: USD 11,268.7 Million

- CAGR (2025 - 2033): 2.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

These coatings offer superior thermal stability, water repellency, corrosion resistance, and electrical insulation, making them essential for protecting delicate electronic components and automotive parts from harsh environmental conditions. As the demand for high-performance, durable, and energy-efficient devices and vehicles increases, silicon coatings have become integral to enhancing product lifespan and performance. Silicones provide strength, adhesion, durability, and fuel efficiency essential for vehicle performance under extreme temperature conditions. They shield electronic components from intense heat, moisture, salt, corrosion, contaminants, and vibration. In applications like airbags, silicone-based textile coatings and sealants prevent rupture by withstanding the high pressure from gas deployment. In addition, silicone enhances service life and offers load-bearing support and shock-absorbing protection, playing a key role in components such as shock absorbers, inflatable curtain coatings, and lubricants that deliver cushioning and impact resistance.

Rising utilization of conformal coatings in various sectors such as defense, automotive, industrial, and building & construction is anticipated to push the manufacturers towards backward integration in the value chain over the coming years. Higher integration across the value chain components is likely to result in time reduction for transforming raw materials into finished products and in gaining a cost advantage. Integration of processes from inbound logistics to after-sales services is expected to become the new trend in the silicone coating industry. This will lead to improved quality and low-cost products, which will ensure optimum performance and provide maximum lifetime value.

Silicone manufacturers are expanding their production capacity and infrastructure with an aim to cater to the growing market requirements. Moreover, the key coating industry players are involved in acquisitions and partnerships to ensure uninterrupted raw material supply. Acquisitions and joint ventures are an integral part of this industry and help companies to strengthen their market position.

Fluctuation in crude oil prices is adversely affecting the chemical, and paint & coating market. The major product in the silicone coating industry is 100% silicone. The coatings primarily consist of phenyl and ethyl silicone. Fluctuations in prices of raw materials is adversely affecting the market by creating a situation of uncertainty in raw material procurement as well as in demand and supply of the finished product.

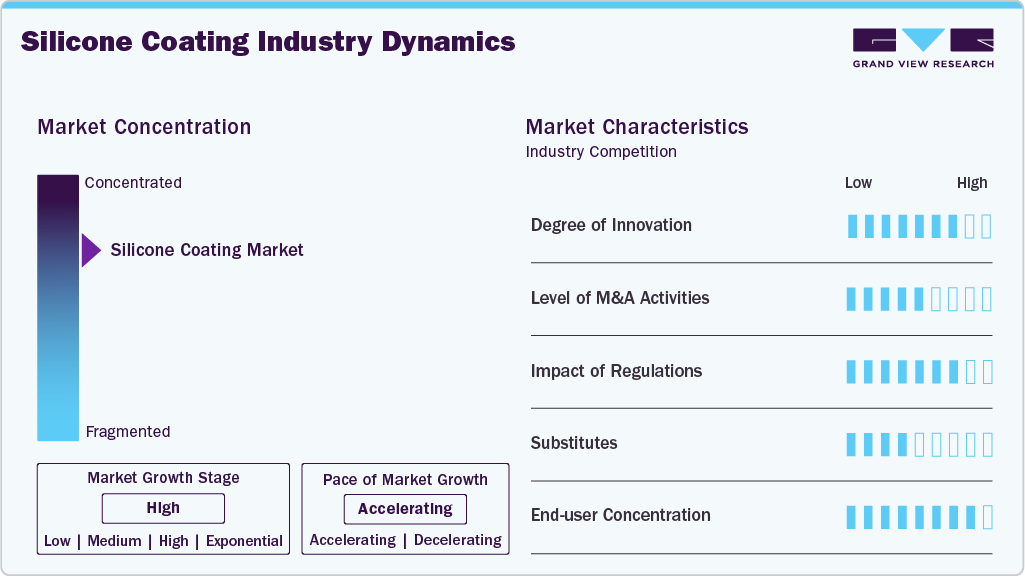

Market Concentration & Characteristics

The global silicone coating industry is moderately concentrated, with several dominant multinational corporations competing alongside a growing number of regional and niche players. These companies serve diverse end-use industries, including construction, automotive, electronics, and industrial manufacturing, where performance, durability, and environmental compliance are critical. While traditional silicone coatings remain prevalent due to their superior heat resistance, flexibility, and weatherability, there is a rising demand for low-VOC, water-based, and energy-efficient formulations driven by stricter environmental regulations and green building initiatives.

The threat of substitution is moderate, with alternatives like acrylics or polyurethanes available for lower-performance needs; however, they often fail to match silicone's longevity and resilience in harsh environments. As industries increasingly prioritize sustainability and performance, innovation in eco-friendly and high-performance silicone coatings is expected to accelerate, shaping future market dynamics.

Product Insights

The 100% silicone-based silicone coating segment led the market with the largest revenue share of 38% in 2024, due to its properties such as light weight, high tensile strength, clarity for transparency, and electromechanical resistance results in its suitability for various high heat applications such as exhaust stacks, furnaces, wood - burning stoves, lighting fixtures, and barbeque grills. Apart from heat-resistant coatings, it is also used as abrasion-resistant and food contact release coatings. In addition, the product sealants' superior flexibility, weather resistance, and durability make them ideal for sealing joints exposed to extreme temperatures and moisture fluctuations. They are widely used in construction and home improvement for applications like windows, doors, siding, and trim, offering long-lasting, waterproof performance.

The silicone water repellents form segment is anticipated to grow at the fastest CAGR during the forecast period, due to growing needs for long-lasting protection in construction, automotive, and textile industries. These materials enhance durability by preventing water absorption, reducing weather-related damage, and extending surface lifespan. They are widely applied to concrete, masonry, fabrics, and glass. Increased infrastructure development and emphasis on energy efficiency are further fueling market growth for silicone in building and construction is driven by its ability to deeply penetrate porous materials, offering long-lasting protection against moisture, staining, and structural damage. Its hydrophobic properties and environmental resistance make it ideal for enhancing the durability and maintenance of concrete, masonry, and other building surfaces.

Application Insights

The consumer goods-based chemical absorbents segment led the market with the largest revenue share of 30% in 2024, due to their exceptional thermal stability, electrical insulation, and mechanical flexibility. Silicone's applications span conformal coatings, encapsulation, thermal management, adhesives, and next-gen wearables and sensors. As miniaturization and performance expectations grow, silicone's reliability in harsh environments and compatibility with emerging technologies like soft robotics and stretchable electronics fuel further market growth.

The automotive and transportation segment is anticipated to grow at the fastest CAGR during the forecast period, due to their high-demand use in harsh environments like automotive under-hood applications. These products are highly resistant to high temperatures and can form thick, vibration-dampening films. Their effectiveness depends on strong adhesion and wetting to electronic surfaces, preventing moisture penetration and protecting underlying circuitry from damage.

Regional Insights

North America dominated the silicone coating market with the largest revenue share of 35.71% in 2024, due to its critical role in the building and construction sector. These coatings are widely used to protect, preserve, and enhance the durability and energy efficiency of residential and commercial buildings. In the U.S., where there is a strong emphasis on sustainable construction and energy-efficient infrastructure, silicone coatings are increasingly favored for applications such as masonry protection, kitchen and bathroom waterproofing, and exterior weather-resistant finishes. Their use extends to insulation systems, sealants for windows and solar panels, LED lighting assembly, and structural adhesives.

The high-performance properties of silicone, such as UV resistance, flexibility, and durability, make it ideal for addressing climatic challenges and extending the lifecycle of building materials. With the construction industry rebounding and federal incentives promoting green building solutions, the demand for silicone-based coatings and materials is expected to rise significantly across both new constructions and renovations.

Asia Pacific Silicone Coating Market Trends

Japan held over 12.9% revenue share of the Asia Pacific silicone coating Market. The silicone coating market in Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period, because electrical insulation coatings are applied to circuit boards and semiconductor components across various control systems and modules to safeguard against moisture, pollutants, and corrosion. These coatings also protect high-voltage or high-current electrodes by preventing flashovers and short circuits. By forming a moisture-resistant and insulating layer, they minimize the risk of short circuits from contaminants, reduce environmental exposure, and slow down corrosion. In addition, they shield metal contacts within electronic devices from external damage, significantly enhancing ecological durability. A common application includes protecting circuit boards in systems like wipers using solvent-free conformal coatings to block water and other liquids.

The Japan silicone coating market is a key market in glass glazing applications, and is growing steadily, driven by the increasing need for energy-efficient, durable, and weather-resistant building envelopes. These coatings, especially in insulating glass systems, offer superior adhesion, long-term elasticity, and resistance to UV radiation, extreme temperatures, and moisture. Their ability to maintain structural integrity while allowing flexibility makes them ideal for high-performance architectural glazing, especially in skyscrapers and commercial facades. With global trends emphasizing green construction, smart buildings, and sustainable infrastructure, silicone sealants and coatings are essential in meeting both aesthetic and functional demands of modern glazing systems.

Europe Silicone Coating Market Trends

The silicone coating market in Europe is growing steadily, driven by the growing demand for automotive & transportation. Silicone is extensively applied in vehicle sealing systems to dampen road-induced noise and vibrations, ensuring a smoother ride. It also prevents air and water ingress, contributing to a well-insulated cabin. In glass seals, silicone provides a tight bond between glass and vehicle body, shielding interiors from dust and withstanding prolonged exposure to harsh weather conditions. In addition, the product is used in black thermal pads on luggage racks, which maintain structural form and shield cargo from damage. These pads offer long-term durability and moisture resistance, ensuring the racks remain effective and secure over time, driving the silicon coatings' market growth.

Middle East & Africa Silicone Coating Market Trends

The silicone coating market in the Middle East & Africa is fueled by the critical need for water-based silicone coatings due to growing consumer and regulatory pressure for environmentally friendly coatings. These elastomers offer superior UV resistance, flexibility in extreme temperatures, water repellency, and high durability, making them ideal for long-lasting building and infrastructure applications. Their use spans waterproofing, anti-graffiti coatings, roof coatings, sealants, and weather barriers. As they are low in VOCs and compatible with waterborne systems, they align well with the shift toward sustainable, high-performance architectural and industrial coatings.

Latin America Silicone Coating Market Trends

The silicone coating market in Latin America is gradually expanding, due to its use of silicon as a vital role in agriculture by enhancing crop resistance to diseases and pests. When applied as a fertilizer, silicon strengthens plant tissues by forming a protective silica layer, which acts like armor against fungal, bacterial, viral, and insect attacks. It also boosts the plant’s natural defense mechanisms, including the activation of defense-related genes and the release of compounds that attract beneficial insects. Overall, silicon improves crop resilience, reduces the need for chemical treatments, and supports sustainable farming practices.

Key Silicone Coating Company Insights

Some of the key players operating in the silicone coating industry include Evonik Industries AG and Wacker Chemie AG

-

Evonik Industries AG, headquartered in Essen, Germany, is a dominant and mature player in the silicone coatings market, renowned for its advanced specialty chemicals and materials. The company offers a broad portfolio of high-performance silicone-based additives, resins, and binders tailored for architectural, industrial, and automotive coatings. With a strong emphasis on sustainability and innovation, Evonik develops solutions that enhance durability, weather resistance, water repellency, and environmental compliance in coating applications. Backed by extensive R&D capabilities and global production infrastructure, Evonik enables customers to meet evolving regulatory demands and performance standards. As a trusted partner, Evonik supports sustainable development across the coatings value chain through strategic collaborations, cutting-edge formulations, and a commitment to circular economy principles.

Carboline Company and OMG Borchers GmbH is an emerging market participant in the silicone coating industry.

-

Carboline Company, headquartered in St. Louis, Missouri, U.S., is a recognized player in the silicone coatings market, specializing in high-performance protective coatings, linings, and fireproofing products for industrial and commercial applications. With decades of experience, Carboline focuses on delivering durable, corrosion-resistant silicone-based coatings designed to perform in extreme environments, including high-temperature and chemical exposure conditions. The company’s expertise lies in formulating advanced silicone technologies that ensure long-term asset protection in industries such as oil & gas, marine, power, and infrastructure. Backed by robust R&D, a global distribution network, and a commitment to quality, Carboline continues to be a trusted provider of innovative silicone coating solutions that meet rigorous safety and environmental standards.

Key Silicone Coating Companies:

The following are the leading companies in the silicone coating market. These companies collectively hold the largest market share and dictate industry trends.

- Evonik Industries AG

- Wacker Chemie AG

- Carboline Company

- OMG Borchers GmbH

- Shin-Etsu Chemical Co., Ltd.

- Momentive Performance Materials Inc.

- DOW Corning Corporation

- ACC Silicones Ltd.

- MAPEI SpA

- Sika AG

Recent Developments

-

In June 2025, Evonik Coating Additives has launched TEGO Foamex 8051, a highly efficient, siloxane-based defoamer designed for waterborne decorative coatings. This new additive offers strong defoaming performance at low use levels, supports high-shear and grinding applications, and aligns with global environmental standards due to its ultra-low VOC and SVOC content. It reinforces Evonik’s position in the silicone coatings market by combining high-performance formulation solutions with sustainability.

-

In May 2025, WACKER has expanded its specialty silicone production capacities in Zhangjiagang, China, to meet the growing demand for high-quality silicone coatings and related materials. The new facilities will produce silicone fluids, emulsions, and elastomer gels—key components in advanced silicone coatings. This investment aligns with WACKER’s “in China for China” strategy. It strengthens its position as a leading supplier in the Chinese silicone market, supporting growth in coatings and other high-performance applications.

Silicone Coating Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9,066.8 million

Revenue forecast in 2033

USD 11,268.7 million

Growth rate

CAGR of 2.8% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, Volume in Kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; Italy; France; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Evonik Industries AG; Wacker Chemie AG; Carboline Company; OMG Borchers GmbH; Shin-Etsu Chemical Co., Ltd.; Momentive Performance Materials Inc.; DOW Corning Corporation; ACC Silicones Ltd.; MAPEI SpA; Sika AG

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Silicone Coating Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global silicone coating market report based on product, application, and region

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Silicone Additives

-

Silicone Water Repellents

-

Silicone Polymers

-

100% Silicone

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Building & Construction

-

Consumer Goods

-

Automotive & Transportation

-

Industrial Application

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Italy

-

France

-

UK

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global silicone coating market size was estimated at USD 8.8 billion in 2024 and is expected to reach USD 9.1 billion in 2025.

b. The global silicone coating market is expected to grow at a compound annual growth rate of 2.8% from 2025 to 2033 to reach USD 11.3 billion by 2033.

b. North America dominated the silicone coating market with a share of 35.3% in 2024. This is attributable to rising demand from the industrial and automotive applications coupled with increasing investments in defense & aerospace sector.

b. Some key players operating in the silicone coating market include Evonik Industries AG, Wacker Chemie AG, Carboline Company. OMG Borchers GmbH, Shin-Etsu Chemical Co., Ltd. and Momentive Performance Materials Inc.

b. Key factors that are driving the market growth increasing coating demand from defense, automotive, industrial, consumer goods and construction industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.