Silk Textiles Market Size & Trends

The global silk textiles market size was valued at USD 124.2 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 8.0% from 2024 to 2030. Growing consumer demand for sustainable and eco-friendly products is the main driver for the silk textile market. As environmental awareness continues to rise, more consumers are seeking silk textiles produced using environmentally responsible methods, such as organic silk farming and eco-friendly dyeing processes. This trend is bolstered by the preference for natural and luxurious fabrics like silk in various industries, from fashion to home furnishings.

The Covid-19 pandemic had a significant impact on the silk textile market. With lockdowns and restrictions in place, the fashion industry, which is a major consumer of silk, witnessed a decline in demand for luxury clothing and accessories. Manufacturing and supply chain disruptions also affected silk production and distribution. Moreover, as social events and gatherings were limited, the demand for formal and occasion wear, often made from silk, decreased. However, there was a surge in demand for comfortable and breathable silk loungewear and pajamas as people spent more time at home. E-commerce platforms became crucial for sales as brick-and-mortar stores faced restrictions. The market’s recovery was contingent on factors like economic stability, changing consumer preferences, and the ability to adapt to the evolving retail landscape amidst the ongoing uncertainties of the pandemic.

The global silk textile market has witnessed notable growth in recent years. This expansion can be attributed to several factors, including an increase in consumer preference for luxury and natural fabrics from the fashion and furnishings industries. The rise of the middle class in emerging economies has created a larger customer base with the purchasing power to buy silk products. Additionally, the silk market has benefited from innovations in silk farming and production techniques, leading to increased affordability and availability. Furthermore, the growing awareness of sustainability and eco-friendly practices has encouraged the adoption of organic and responsibly produced silk textiles. As a result, the global silk textile market is expected to continue its growth trajectory in the coming few years, with potential for further diversification and innovation.

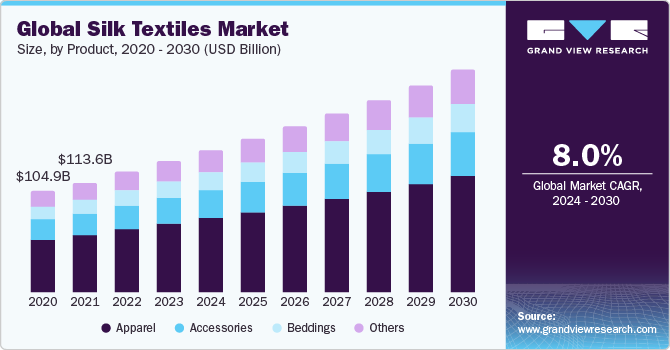

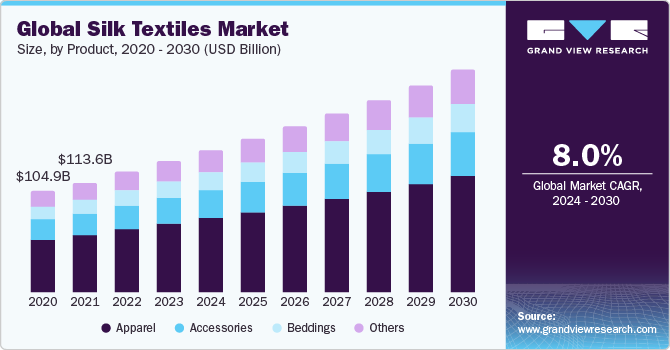

Product Insights

Based on the product, the silk textiles market is segmented into apparel, accessories, bedding, and others. The fashion segment held the largest market share in 2023. High-quality silk products, particularly those aligned with sustainability, have gained traction. The market’s growth is shaped by consumer demand for luxurious, eco-friendly items across segments, enhancing the market’s overall growth.

Sales Channel Insights

On the basis of sales channels, the market is segmented into retail stores, E-commerce, and specialty stores. The retail store channel is the largest sales channel in 2023. The sales channel in the silk textile market has witnessed a significant change in the last few years. Traditional retail stores faced challenges due to the Covid-19 pandemic, leading to a surge in online sales. E-commerce platforms have become crucial for selling silk textiles as consumers increasingly prefer the convenience of shopping from home. Additionally, collaborations with high-end boutiques, pop-up shops, and sustainable fashion marketplaces have gained momentum. Brands are exploring D2C models to establish a more personalized connection with customers.

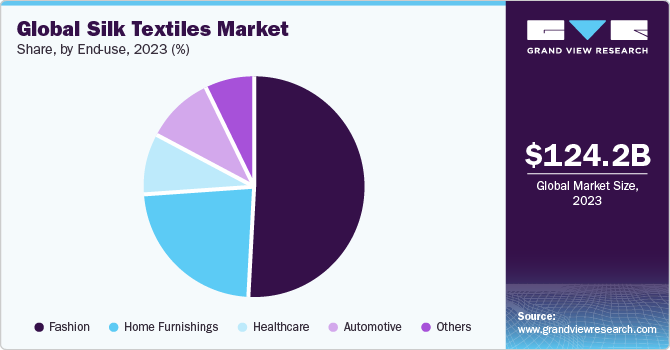

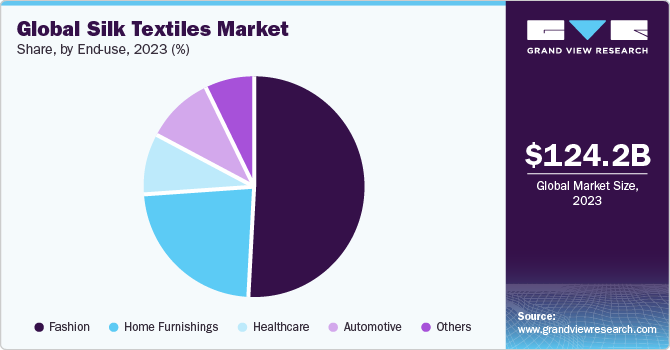

End-use Insights

Based on end use, the silk textiles market is segmented into fashion, home furnishings, healthcare, automotive, and others. The silk textile market is experiencing dynamic growth trends across various end-use sectors. In fashion, there is a growing demand for luxurious silk apparel, especially among the middle class in emerging countries. Home furnishings are also on the rise, with silk bedding and upholstery gaining popularity due to their comfort and elegance. Additionally, the healthcare industry is increasingly incorporating silk for its hypoallergenic and antibacterial properties. Furthermore, the automotive sector is exploring silk textiles for interior applications to enhance aesthetics and comfort. These diverse end-use applications are expected to boost the overall market throughout the forecast period.

Regional Insights

Asia Pacific dominated the largest market share in 2023. As a hub for silk production, Asia Pacific countries like China and India continue to dominate the market, benefiting from their rich silk heritage. The rising disposable incomes of the middle class in these regions have increased the demand for silk products, particularly in the fashion and home furnishings sectors. Additionally, E-commerce and digital platforms have played a pivotal role in making silk textiles accessible to a broader audience, contributing to the region’s growth as a key player in silk textiles market.

Competitive Insights

Key players operating in the market are Jiangsu Sutong Cocoon and silk Co. Ltd, Anhui Silk Co.Ltd., Ranks Silks, American Silk, Tillett Silk, Liberty Silk, The silk Company, and Mantero Seta The market participants are constantly working towards M&A activities, and other strategic alliance to gain new market avenues. The following are some instances of such initiatives.

-

In 2022, Jiangsu Sutong Cocoon and Silk Co. Ltd and Japan’s Gunze formed a strategic alliance to jointly develop sustainable silk products. The two organizations will work to increase their market share globally.

-

In 2021, the Nalli and Italy’s Como Serica formed a strategic alliance to bring Indian silk to the Italian Market. The two companies will work together to develop new silk products and designs.