- Home

- »

- Medical Devices

- »

-

Silver Wound Dressing Market Size, Industry Report, 2030GVR Report cover

![Silver Wound Dressing Market Size, Share & Trends Report]()

Silver Wound Dressing Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Traditional, Advanced), By End Use (Hospitals, Clinics, Home Healthcare), By Application, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-874-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Silver Wound Dressing Market Summary

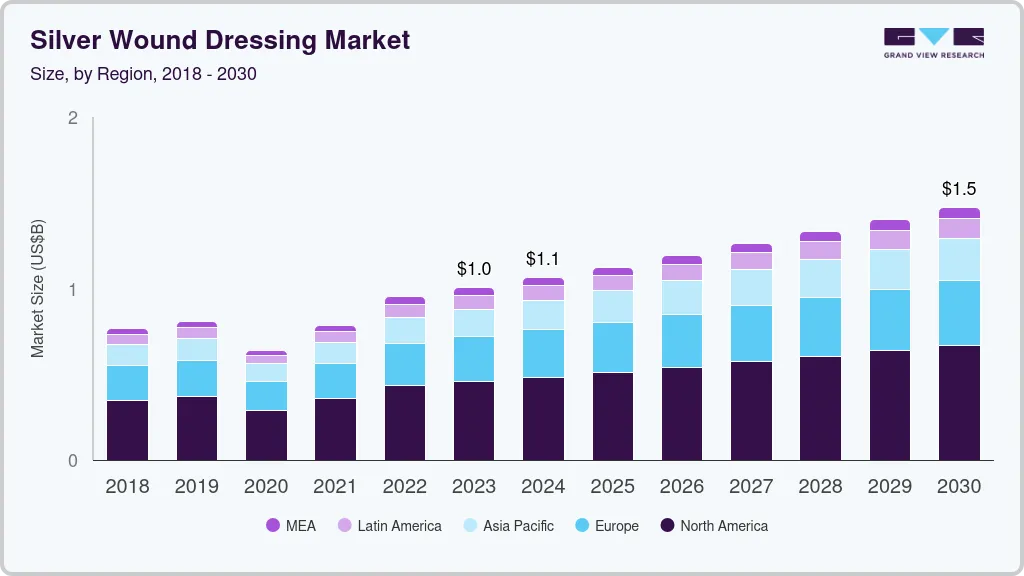

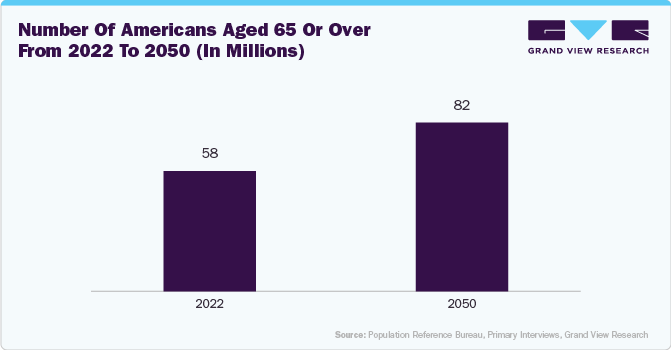

The global silver wound dressing market size was estimated at USD 1.03 billion in 2024 and is projected to reach USD 1.36 billion by 2030, growing at a CAGR of 4.73% from 2025 to 2030. The aging population is a significant driver influencing the market for silver-based dressings. Older people are more susceptible to chronic wounds due to factors like reduced mobility, comorbidities, and impaired healing processes.

Key Market Trends & Insights

- North America silver wound dressing market dominated the global market with a revenue share of 48.44% in 2024.

- The silver wound dressing market in the U.S. held the largest share in North America in 2024.

- By product, advanced silver wound dressing segment led the market with a revenue share of 61.75% in 2024

- By application, chronic wound segment led the market with a revenue share in 2024.

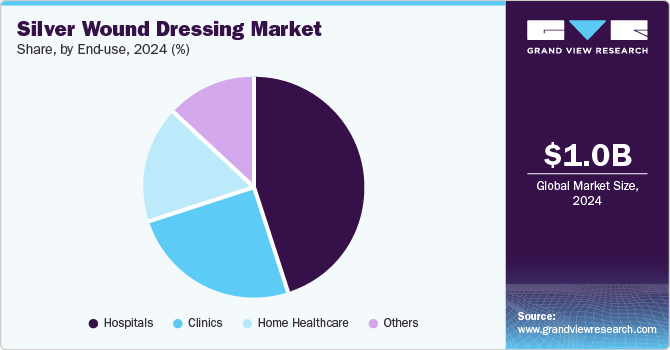

- By end-use, hospitals segment dominated the market and accounted for a share of 49.58% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.03 Billion

- 2030 Projected Market Size: USD 1.36 Billion

- CAGR (2025-2030): 4.73%

- North America: Largest market in 2024

According to the Health Innovation Program, approximately 2 million citizens in the U.S. develop diabetic foot ulcers annually, a statistic that underscores the urgent demand for effective wound care solutions. This rising prevalence is not limited to the U.S.; countries such as Mexico, with about 126 million people and 10% of its population aged 60 and older, are witnessing a similar surge in chronic wounds as this demographic expands. Moreover, Brazil, with a population of around 213 million and 9% aged 65 and above, reflects a broader trend in emerging markets, further intensifying the demand for advanced wound management products. A study published in the Journal of Diabetes Research in December 2024 found that most patients with diabetic foot ulcers were in the 50-to-59 age group, while the majority of deaths occurred in the 70-to-79 age group.

According to data published by the WHO in October 2024, the number of older people is estimated to increase significantly in the coming years. Below are some projections given by the WHO:

-

By 2030, 1 in 6 people worldwide will be aged 60 or older, with the population in this age group growing from 1 billion in 2020 to 1.4 billion.

-

By 2050, the worldwide population of individuals aged 60 and above is estimated to double, reaching 2.1 billion.

-

The number of people aged 80 or older is expected to triple from 2020 to 2050, reaching 426 million.

Furthermore, the data published by the Population Reference Bureau in January 2024 estimated that the number of livings in America aged 65 and older is estimated to rise by 47% from 2022 to 2050. This age group’s share of the total population is estimated to increase from 17% to 23%.

The increasing prevalence of chronic diseases such as diabetes and cancer is anticipated to boost the demand for the silver wound dressings market. According to the data published by the CDC in October 2024, chronic diseases such as diabetes and cancer are the leading causes of disability and death in the U.S. The increasing prevalence of chronic diseases is anticipated to increase hospitalization. According to the study published by the MDPI in August 2024, approximately 80% of people diagnosed with cancer will undergo some surgical procedure as part of their treatment regimen, which is expected to drive the demand for silver wound dressings. In addition, according to the data published by the Oncology Nursing Society Congress in April 2024, the use of pure silver-plated wound dressings helps to reduce the occurrence of radiation dermatitis (RD) in patients undergoing radiotherapy for head and neck cancer. More than 90% of patients treated with radiotherapy for cancer develop RD. Thus, the benefits of silver dressings for cancer patients are anticipated to drive market growth.

-

According to the data published by the National Cancer Institute in May 2024, an estimated 2,001,140 new cases of cancer were estimated to be recorded in the U.S., and around 611,720 individuals were projected to succumb to it in 2024.

-

As per the statistics published by the American Cancer Society in January 2023, around 609,820 cancer deaths and 1,958,310 new cancer cases were projected to occur in the U.S.

The rising burden of wounds, such as diabetic foot ulcers, burns, and pressure ulcers, is anticipated to propel the market growth in the coming years. According to the article published by the Jama Network in November 2023, diabetic foot ulcers, a chronic wound disease, affect about 18.6 million individuals worldwide and 1.6 million in the U.S. annually. Furthermore, according to an article published by Trios Health in October 2023, around 2 million Americans develop diabetic foot ulcers each year.

Moreover, a study published by Springer Nature Limited in January 2024 found that approximately 25% of individuals with diabetes will develop a diabetic foot ulcer at some point in their lives. The study also reported that the annual incidence of DFUs globally ranges from 1.9 million to 26.1 million cases.

The growing technological advancements in the development of silver wound dressings is anticipated to create lucrative opportunities for the industry players. Various types of dressings, coatings, nanofibers and hydrogels have been developed to maximize the therapeutic benefits of silver.

Some of the recent clinical trials and approvals for silver dressings incorporating advanced technologies are mentioned below:

Manufactures Name

Month

Year

Technology

Description

Imbed Biosciences

November

2024

Microlyte Matrix technology platform

U.S. FDA approved clearance for Microlyte Ag/Lidocaine, the first antimicrobial wound dressing combining silver and lidocaine to manage painful skin wounds.

Convatec

May

2024

Hydrofiber Technology +MORE THAN SILVER Technology

31% higher healing rate of venous leg ulcers than standard dressing with their AQUACEL Ag+ Extra dressing.

Source: Company Websites, Grand View Research Analysis

In November 2024, Imbed Biosciences received clearance for Microlyte Ag/Lidocaine, the first antimicrobial wound dressing that combines silver and lidocaine to manage painful skin wounds effectively. This dressing utilizes the company’s patented Microlyte Matrix technology, which delivers metallic and ionic silver and lidocaine. This combination provides local anesthetic effects and antimicrobial protection. Microlyte Ag/Lidocaine aims to reduce infection rates and alleviate pain, potentially decreasing the reliance on systemic antibiotics and opioids.

“Last year, more than 100,000-unit applications of Microlyte Matrix were used in wounds. This next-gen version of Microlyte Matrix, combining silver and lidocaine, strengthens commitment to advancing wound care standards and reassures clinicians to choose Microlyte as their preferred synthetic wound matrix in the protocols of wound management.” Co-founder and Chief Scientific Officer at the Imbed Biosciences.

Market Concentration & Characteristics

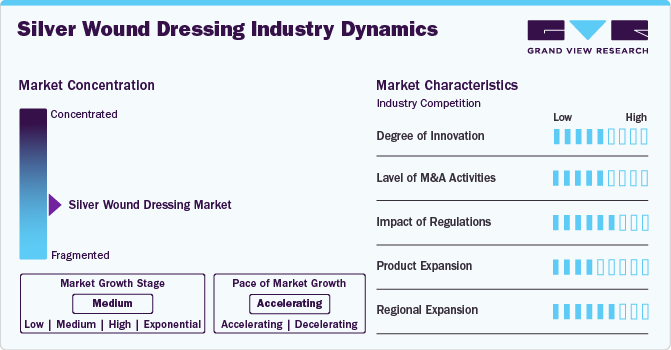

The market growth stage is moderate, and the pace of growth is accelerating.

The silver wound dressing market demonstrates a moderate to high degree of innovation, driven by advancements in nanotechnology, sustained-release formulations, and integration with bioactive compounds. Innovations focus on enhancing antimicrobial efficacy, reducing healing time, and improving patient comfort. For instance, in January 2025, a student at the University of Wolverhampton created a groundbreaking biodegradable wound dressing that combines the natural healing properties of thyme and ginger with the powerful antimicrobial effects of silver nanoparticles for enhanced wound healing. This dressing employs nanotechnology, facilitating easier wound monitoring.

The silver wound dressing market has seen a moderate level of mergers and acquisitions (M&A), primarily driven by the need for portfolio diversification, geographic expansion, and access to advanced technologies. Larger healthcare and wound care companies are acquiring smaller firms with innovative silver-based products or proprietary technologies to strengthen their market position.

Regulations play a significant role in shaping the silver wound dressing market, mainly due to the classification of these products as medical devices. In regions like the EU and the U.S., strict regulatory frameworks such as the EU MDR (Medical Device Regulation) and FDA guidelines ensure product safety, efficacy, and quality. Compliance requirements can increase time-to-market and development costs, especially for innovative or combination products. However, strong regulation also enhances market credibility and patient safety. Additionally, growing scrutiny over the environmental impact of silver and concerns about antimicrobial resistance influence future regulatory policies and product formulations.

The growing demand for advanced wound care across various clinical settings drives product expansion in the silver wound dressing market. Manufacturers are diversifying their portfolios by introducing dressings with enhanced features such as sustained silver release, moisture control, and compatibility with negative pressure wound therapy. There's also a trend toward developing specialized dressings for chronic wounds, surgical incisions, and burns.

Regional expansion is a key growth strategy in the silver wound dressing market, with manufacturers increasingly targeting emerging economies in Asia-Pacific, Latin America, and the Middle East. These regions offer significant potential due to rising healthcare expenditure, increasing incidence of chronic wounds and diabetes, and growing awareness of advanced wound care solutions. Companies are establishing local partnerships, distribution networks, and manufacturing facilities to improve accessibility and reduce costs. For instance, in August 2024, Cardinal Health announced plans to develop a new distribution center in Walton Hills, Ohio, to enhance its U.S. Medical Products and Distribution business. This facility will incorporate advanced technology solutions, improve operational efficiencies, and increase capacity in the Cleveland area.

Product Insights

Advanced silver wound dressing led the market with a revenue share of 61.75% in 2024, attributed to its superior antibacterial efficacy that significantly reduces infection risks and promotes healing. The category includes silver foam dressings, silver plated nylon fiber dressings, silver hydrogel/hydrofiber, silver alginates, and nanocrystalline silver dressings, among others, as healthcare providers increasingly recognize their benefits for acute and chronic wound management amid rising chronic conditions and an aging population.

Traditional silver wound dressing is expected to grow rapidly over the forecast period. These dressings, typically made from cotton gauze treated with silver, offer a cost-effective solution for clean, dry wounds with minimal exudate. Their broad-spectrum antibacterial properties enhance their reliability, and their established reputation ensures continued use, especially in budget-constrained environments, despite the availability of advanced alternatives.

Application Insights

Chronic wound led the market with a revenue share in 2024. The increasing prevalence of chronic wounds, such as diabetic foot ulcers, venous leg ulcers, and pressure ulcers, is expected to improve the demand for silver wound dressing products. Moreover, the rise in the number of people with diabetes is expected to increase the number of DFU patients. For instance, as per INSTITUTE FOR HEALTH METRICS AND EVALUATION, in June 2023, over half a billion people globally are currently living with diabetes, impacting individuals of all ages and genders across every country. This number is expected to more than double, reaching 1.3 billion people within the next 3 decades. Hence, with the increasing number of diabetic patients, the risk of diabetic foot ulcers is predicted to surge, propelling the segment growth.

Acute wound is expected to grow rapidly over the forecast period. The rise in accidents, injuries, and surgical procedures has increased the number of acute wounds requiring advanced care. According to the National Safety Council data published in July 2024, around 3.7 million individuals were treated in emergency departments for injuries related to recreational and sports equipment in 2023. In addition, the National Safety Council reports that the number of sports and recreational injuries increased by 20% in 2021, 12% in 2022, and 2% in 2023. Hence, the rising number of sports injuries and road accidents is expected to drive the demand for silver wound dressings in the forecast years.

Distribution Channel

The online distribution channel dominates the silver wound dressing market, fueled by the digital transformation of healthcare and increasing consumer preference for convenience and accessibility. E-commerce platforms, telemedicine integration, and direct-to-consumer sales are making advanced wound care products more readily available, particularly in remote or underserved areas. Online channels also support price transparency, product comparisons, and access to a broader range of offerings, driving growth among individual consumers and smaller healthcare providers.

The offline distribution channel continues to grow significantly in the silver wound dressing market due to the strong presence of hospitals, clinics, and pharmacies serving as primary care points. Healthcare professionals rely on trusted suppliers and established procurement processes for advanced wound care products, including silver-based dressings. Institutional purchasing, bulk procurement, and direct supplier relationships contribute to the offline segment’s stronghold, especially in developed markets where regulations and clinical protocols play a key role in product adoption.

End Use Insights

Hospitals dominated the market and accounted for a share of 49.58% in 2024. Hospitals serve as primary care environments where advanced wound management is crucial for infection prevention and healing, particularly for surgical wounds and chronic conditions such as diabetic foot ulcers. The increase in surgical procedures and chronic disease prevalence underscores the demand for effective wound care solutions.

Home healthcare is projected to grow at the fastest CAGR of 5.15% over the forecast period, driven by an increasing preference for at-home treatment among patients, particularly the elderly and those with chronic wounds. As individuals seek to manage their health outside hospital settings, the need for effective, user-friendly wound care solutions has escalated. Advanced silver wound dressings are preferred for their antimicrobial properties, reducing infection risks and promoting healing, especially among the growing geriatric population requiring frequent dressing changes.

Regional Insights

North America silver wound dressing market dominated the global market with a revenue share of 48.44% in 2024. The region’s robust medical technology and substantial healthcare investment promote the adoption of innovative wound care products. Furthermore, the rising incidence of diabetes and an aging population enhances the demand for effective wound management solutions, supported by favorable reimbursement policies and increased awareness of advanced options in North America.

U.S. Silver Wound Dressing Market Trends

The silver wound dressing market in the U.S. held the largest share in North America in 2024. Well-developed healthcare infrastructure, increasing awareness about the usage of advanced wound care products, and the presence of several key market players are the major drivers of the market. In addition, an increase in the number of surgical procedures due to the high prevalence of sports injuries is anticipated to drive the market. For instance, according to a study published by the National Library of Medicine in July 2020, around 310 million major surgical procedures are performed annually, of which around 40 to 50 million are conducted in the U.S. Silver dressings are known for their antimicrobial properties, which can significantly reduce the risk of infection in surgical wounds. As surgeries increase, advanced wound care products, including silver-based dressings, are needed.

Burn injuries in the U.S. drive the silver wound dressing market due to the high incidence of hospitalizations and the need for effective infection control. For burn cases requiring inpatient care annually, antimicrobial dressings like silver-based products are essential for preventing infections, reducing healing time, and lowering complications. The rising healthcare burden and the increasing adoption of advanced wound care solutions strengthen the demand for silver wound dressings in burn treatment.

As per the 2024 Annual Burn Injury Summary Report U.S.

-

Burn Incidence & Regional Distribution: The report highlights significant regional variations, with the Southern U.S. experiencing the highest case burden at 43.7% of cases.

-

Demographics & Causes: Males accounted for 66% of burn injury cases, with a median patient age of 40 years. The leading cause of burn injuries was flame or flash burns (45%), while scalds made up 58% of pediatric cases.

-

Hospitalization & Cost: An estimated 1 in 10,000 Americans require inpatient burn care annually. ICU stays were common, with 10,125 cases utilizing over 110,000 ICU days in 2023, costing over $660 million for intensive care alone.

-

Severity & Outcomes: Burns affecting ≥20% of Total Body Surface Area (TBSA) accounted for 18,539 cases in 2023. Cases involving additional trauma resulted in longer hospital stays and tripled mortality rates.

Europe Silver Wound Dressing Market Trends

The silver wound dressing market in Europe held a substantial market share in 2024. Healthcare professionals are prioritizing infection control and optimal wound care practices. Many hospitals in Germany and the UK are adopting evidence-based guidelines recommending silver dressings due to their antimicrobial properties. Educational workshops and seminars organized by healthcare institutions further boost awareness and encourage practitioners to comply with updated best practices. Chronic wounds are a significant challenge in healthcare, especially among the European elderly population. In countries such as Italy and Spain, this rise will continue to affect healthcare systems, leading to higher demand for effective wound care products. The European Burns Association (EBA) has developed comprehensive guidelines to standardize and enhance burn care across Europe. These guidelines serve as a framework for healthcare professionals, ensuring consistent and high-quality treatment for burn patients.

The UK silver wound dressing market is expected to grow significantly in the forecast period. Some major companies operating in the market are adopting several strategies to increase their market share, including the launch of innovative products and expansion of R&D & manufacturing facilities. For instance, in June 2022, Smith & Nephew launched a new R&D and manufacturing facility in the UK, with an investment of more than USD 100 million. Such factors are expected to intensify competition in the UK.

In 2023, the UK recorded 1,695 road fatalities, with 1,624 occurring in Britain and 71 in Northern Ireland. Additionally, 28,967 individuals sustained serious injuries, including 28,087 in Britain and 880 in Northern Ireland. While road deaths saw a 5% decline compared to 2022, serious injuries slightly increased from 28,899 the previous year. Silver wound dressings are crucial in treating road accident victims due to their strong antimicrobial properties, which help prevent infections in traumatic wounds. These dressings promote faster healing, reduce scarring, and lower the risk of complications, making them an essential part of post-accident care. With a rising number of serious road injuries annually, hospitals, trauma centers, and emergency responders rely on advanced wound care products, fueling the growth of the UK silver wound dressing market.

The silver wound dressing market in Germany is growing due to the prevalence of chronic wounds, such as diabetic ulcers and venous leg ulcers, which is on the rise in Germany due to an aging population and the increasing rates of chronic diseases. This trend drives the demand for effective wound management solutions such as silver dressings. The proven antibacterial and antifungal properties of silver dressings help reduce infection rates and promote quicker healing. Research studies indicate that silver dressings can significantly expedite healing compared to traditional dressings, making them a preferred choice among clinicians in Germany. Germany's population aged 65 and older is projected to grow by 41 percent to 24 million by 2050, accounting for nearly one-third of the total population. Major companies in the wound care market are continuously expanding their product lines and investing in research and development. Collaborations and acquisitions by key players enhance product offerings and drive awareness of the benefits of silver dressings

Asia Pacific Silver Wound Dressing Market Trends

The silver wound dressing market in Asia Pacific is expected to register the fastest CAGR in the forecast period. The median age in countries such as Japan is rising, underscoring the need for effective wound management solutions. This demographic shift boosts demand for silver-infused dressings while increased awareness and investments in healthcare infrastructure enhance access to innovative wound care products.

India silver wound dressing market is anticipated to witness the fastest growth in the Asia Pacific market over the forecast period. Increased awareness of advanced wound care solutions among healthcare providers and patients fuels demand for silver-based dressings. India’s estimated population of 1.4 billion, with approximately 8% over 60 years old and prone to chronic wounds, highlights significant growth opportunities. Enhanced healthcare infrastructure and government initiatives further facilitate access to effective treatments in urban and rural areas.

The silver wound dressing market in China is growing. This growth is attributed to the significant increase in chronic conditions such as diabetes and obesity. These health issues lead to complications such as diabetic foot ulcers and pressure ulcers, necessitating advanced wound care solutions. Silver-infused dressings are favored for their antimicrobial properties, which help prevent infections and promote faster healing in chronic wound management. The demographic shift towards an older population in China has heightened the demand for effective wound care products. Elderly individuals are more susceptible to chronic wounds due to factors like reduced mobility and compromised skin integrity. Silver wound dressings offer effective infection control and support the healing process in this vulnerable group. For instance, according to data published by the National Library of Medicine in April 2023, the prevalence of diabetes among Chinese adults aged 20 to 79 years is estimated to rise from 8.2% to 9.7% between 2020 and 2030.

Middle East and Africa Silver Wound Dressing Market Trends

The silver wound dressing market in the Middle East and Africa (MEA) is expected to grow considerably over the forecast period. The countries with significant growth rates in this region are South Africa, Saudi Arabia, UAE, and Kuwait. Factors that can be attributed to the growth of the MEA silver wound dressing market are the growing geriatric population, increasing number of surgeries, and rising incidence of sports-related injuries. With increasing government initiatives to develop healthcare infrastructure, the region is expected to witness a rise in the number of surgeries, leading to an increase in demand for dressing products for postoperative care.

Key Silver Wound Dressing Company Insights:

Some key companies operating in the market include B. Braun Medical Inc., 3M, Convatec Group PLC, Coloplast Group, and Smith+Nephew. Strategic initiatives involve mergers, acquisitions, and collaborations to broaden product offerings and market presence, alongside focused research and development to improve product efficacy and utilize innovative technologies.

Key Silver Wound Dressing Companies:

The following are the leading companies in the silver wound dressing market. These companies collectively hold the largest market share and dictate industry trends.

- Smith+Nephew

- Mölnlycke AB

- URGO MEDICAL

- 3M

- MedWay Group

- Convatec Group PLC

- Coloplast Group

- Medline Industries, LP

- Cardinal Health

- PAUL HARTMANN AG

- Datt Mediproducts Private Limited

- Advanced Medical Solutions Group plc

- Bravida Medical

- B. Braun SE

- DermaRite Industries, LLC.

Recent Developments

-

In October 2024, Mölnlycke Health Care and Transdiagen announced a research collaboration to leverage TDG’s novel wound gene signatures, enhancing understanding and innovation in chronic wound care and management solutions.

-

In September 2024, 3M’s, Solventum announced the launch of the V.A.C. Peel and Place Dressing, an innovative dressing and drape designed for quick application in under two minutes. This product can be worn by patients for up to seven days. The V.A.C. Peel and Place Dressing represent the next advancement in V.A.C. Therapy. Featuring an all-in-one design that combines both dressing and drape, it streamlines the application process and minimizes the time and training needed for dressing application and changes. Additionally, it includes a built-in perforated, non-adherent layer that helps prevent tissue ingrowth, resulting in a less painful dressing removal experience.

-

In May 2024, Convatec announced results from a multinational RCT, revealing that AQUACEL Ag+ Extra dressing significantly outperformed standard care in healing venous leg ulcers, achieving a 74.8% complete healing rate at 12 weeks.

Silver Wound Dressing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.08 billion

Revenue forecast in 2030

USD 1.36 billion

Growth rate

CAGR of 4.73% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

April 2025

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, distribution channel, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Smith+Nephew; Mölnlycke AB; URGO MEDICAL; 3M; MedWay Group; Convatec Group PLC; Coloplast Group; Medline Industries, LP; Cardinal Health; PAUL HARTMANN AG; Datt Mediproducts Private Limited; Advanced Medical Solutions Group plc; Bravida Medical; B. Braun SE; DermaRite Industries, LLC.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Silver Wound Dressing Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global silver wound dressing market report based on product, application, distribution channel, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Traditional

-

Silver Bandages

-

Others

-

-

Advanced

-

Silver Foam Dressing

-

Silver Plated Nylon Fiber Dressing

-

Silver Hydrogel/Hydrofiber

-

Silver Alginates

-

Nano Crystalline Silver Dressings

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Chronic Wounds

-

Diabetic Foot Ulcers

-

Pressure Ulcers

-

Stage 1

-

Stage 2

-

Stage 3

-

Stage 4

-

-

Venous Leg Ulcers

-

Other Chronic Wounds

-

-

Acute Wounds

-

Surgical & Traumatic Wounds (skin tears included)

-

Burns

-

1st degree burns

-

2nd degree burns

-

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Home Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global silver wound dressing market size was estimated at USD 1.03 billion in 2024 and is expected to reach USD 1.08 billion in 2025.

b. The global silver wound dressing market is expected to grow at a compound annual growth rate of 4.7% from 2025 to 2030 to reach USD 1.36 billion by 2030.

b. The advanced silver wound dressing segment held the largest market share of over 59.86% in 2024 and is expected to witness the fastest growth rate over the forecast period.

b. Some key players operating in the silver wound dressing market include Mölnlycke Health Care AB, 3M, Coloplast, Medline, and Smith & Nephew PLC.

b. Key factors that are driving the market growth include the increasing prevalence of chronic diseases, technological advancement, rising cases of accidents & trauma, and rising geriatric population.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.