- Home

- »

- Biotechnology

- »

-

Single-use Filtration Assemblies Market Share Report, 2030GVR Report cover

![Single-use Filtration Assemblies Market Size, Share & Trends Report]()

Single-use Filtration Assemblies Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Membrane Filtration, Depth Filtration, Others), By Product (Filters, Cartridges), By Application, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-141-2

- Number of Report Pages: 135

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global single-use filtration assemblies market size was valued at USD 2,989.7 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 18.70% from 2023 to 2030. The market has seen a surge in popularity as a result of their ability to provide a contamination-free solution to traditional stainless steel systems. These filtration assemblies are made using reinforced hose and welding applications, which eliminates the need for associated validation protocols and sterilization steps. Many biopharmaceutical companies are opting for single-use filtration assemblies for final and bulk fill operations due to the increased importance of maintaining sterile conditions. This has been driven by a growing demand for biopharmaceuticals, low risk of cross-contamination, faster implementation, and an increase in life sciences research and development activities.

The COVID-19 pandemic had a significant impact on the market, as single-use technology was adopted for research activities in COVID-19 vaccine development. This resulted in increasing investments from key market players. For instance, in September 2022,Merck invested over Euro 130 million in Molsheim, France to improve its manufacturing capabilities for single-use filtration assemblies, which is a novel technology used in producing COVID-19 vaccines and other life-saving therapies. The increased adoption of single-use filtration assemblies in the biopharmaceutical and pharmaceutical companies during the development and manufacture of COVID-19 vaccines and other disease therapies is further driving the industry growth.

The market is experiencing significant growth due to increasing investments in research and development by biopharmaceutical companies. In 2022, the annual report published by the European Federation of Pharmaceutical Industries and Associations (EFPIA) states that Euro 41.5 (USD 44.47) billion was invested in research and development activities by the European pharmaceutical industry. Additionally, the report indicates that the production value of the European pharmaceutical industry has risen from Euro 127.5 (USD 136.63) billion in the year 2000 to Euro 300 (USD 321.50) billion in 2021. The significant R&D expenditure is expected to drive the growth of the market as biopharmaceutical companies continue to adopt these assemblies in their manufacturing processes.

The adoption of single-use technology in the pharmaceutical industry is driven by factors such as increased demand for personalized therapies, smaller batch sizes, and the need for flexible and scalable solutions. Single-use filtration systems provide a high degree of flexibility and versatility, allowing for easy and quick adaptation to changing requirements.In addition to their flexibility, single-use filtration systems are also cost-effective, which is anticipated to drive market growth.

Moreover, the increasing market player’s activities and rising adoption of various business strategies such as acquisition, partnerships, and product launches are also contributing to the growth of the market. For instance, in August 2022, Thermo Fisher launched the largest single-use technology manufacturing facility in Greater Nashville, with the aim of accelerating the production of its single-use technologies product, while also enabling pharmaceutical companies to deliver medicines to patients more quickly.

In addition, in June 2021, Avantor acquired RIM Bio, a China based company that produces single-use assemblies and bioprocess bags for biopharmaceutical production. This acquisition grants Avantor access to RIM's Changzhou facility, which will be one of Avantor's initial single-use production units in the AMEA region.Such instances lead to an increasing adoption of single-use filtration assemblies across different geographies, which is expected to drive the market growth.

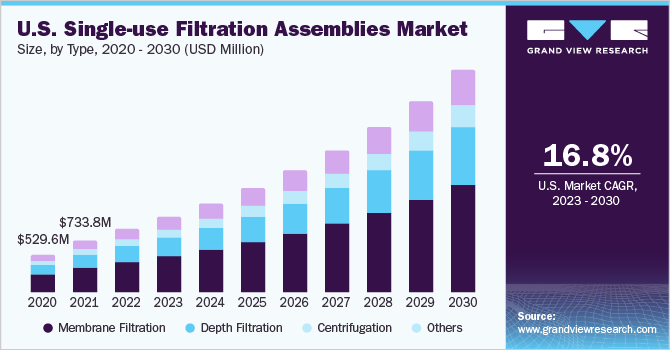

Type Insights

The membrane filtration segment accounted for the largest share of over 47.8% in 2022. This growth can be attributed to the increasing adoption of filtration systems by various industries. Membrane filtration sub segmented into TFF and Direct Flow Filtration (DFF) /dead-end filtration /normal flow filtration. Within this segment, Tangential Flow Filtration (TFF) accounted for the largest share of 59.9% in 2022. TFF is a filtration technique used for separation and purification of biomolecules. TFF operates by passing the solution over a membrane that retains the biomolecules while allowing the solvent to pass through. The demand for TFF has increased in recent years due to the growth of the biopharmaceutical industry.

Furthermore, the launch of new single-use TFF systems has further accelerated the growth of this segment. For instance, in September of 2021, ABEC, Inc. introduced a new single-use TFF (tangential flow filtration) system with the goal of enhancing downstream productivity through faster processing times and increased flow rates.

Depth filtration segment is expected to register the fastest CAGR of 19.15% from 2023 to 2030This is due to its exceptional performance in terms of high throughput, low protein binding, and high dirt holding capacity. The depth filtration media usually consists of numerous layers of particles or fibers of varying sizes, which allows for the efficient elimination of a broad range of impurities and contaminants.As a result, depth filtration is gaining popularity in biopharmaceutical manufacturing,where high-quality and purity standards are essential.

Application Insights

The bioprocessing/biopharmaceuticals market segment dominated the market in 2022, accounting for over 41.6% and also held the fastest revenue share. This growth can be attributed to the increasing research and development funding for the development of biopharmaceutical products. For instance, in October 2021, National Institute for Innovation in Manufacturing Biopharmaceuticals (NIIMBL) of the United States granted funding of USD 3 million for 6 new biopharmaceutical manufacturing project.

The funding recipients include the University of Georgia, the University of Michigan, the University of Delaware, North Carolina State University, Carnegie Mellon University, and the University of Massachusetts, which is expected to further drive growth in this segment.

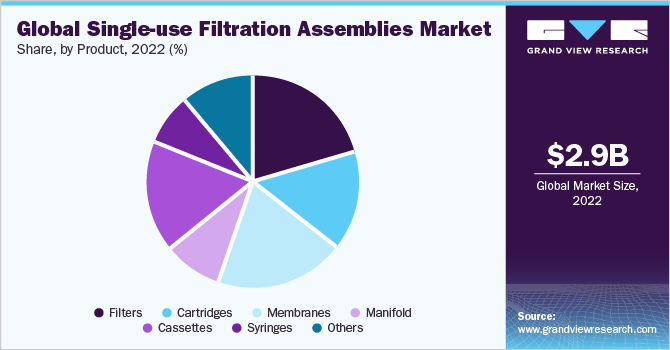

Product Insights

The filter segment dominated the market and held the largest revenue share of 21.1% in 2022 Single-use filters are one the most popular and widely used single-use technologies. The efficiency of depth filters during clarification processes can be increased by using flocculating agents, filter aids, and protective profilers. These approaches are utilized by Merck Millipore and Sartorius. In addition, automation in filtration methods is expected to propel market growth.

For example, the SciLog SciPure FD System by Parker Bioscience is a single-use, automated system for filtration and dispensing of products into bottles or bags. Furthermore, the Indian Institute of Technology Delhi has developed an automated method for continuous depth-filtration using a dead-end filtration skid to clarify microbial and mammalian cell-based biopharmaceuticals.

Besides single-use filters, single-use cassettes, cartridges, and membranes are estimated to account for a significant revenue share in the overall market. These products offer several advantages such as low capital investment, reduced cleaning and validation requirements, and improved flexibility. Moreover, they enable easy scalability, making them ideal for use in small and large-scale manufacturing processes.

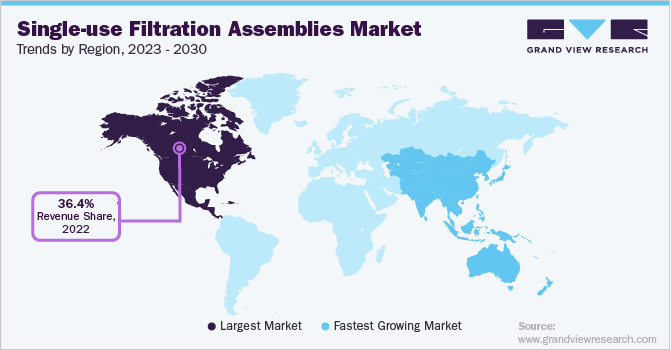

Regional Insights

North America accounted for the largest share of the market in 2022 with 36.4%.The well-established healthcare infrastructure and increasing demand for biopharmaceuticals are further propelling the growth of the market in this region. Furthermore, the presence of several key players in North America, such as Pall Corporation, Sartorius AG, and Thermo Fisher Scientific, Merck, has contributed to the market's growth. For instance, In July 2021, Pall Corporation and Cytiva invested USD 1.5 billion to meet the growing demand for biotechnology solutions, which will increase the production of essential products used to make biologics, including single-use technologies such as bioreactor bags and syringe filters. Such investments are expected to drive the growth of the market in North America.

Asia Pacific market is projected to experience the highest growth rate of 21.75% in the market during the forecast period. This growth is driven by the increasing demand for biopharmaceuticals and rising focus on research and development activities in the region. Furthermore, government and regulatory bodies are supporting the development of the biopharmaceutical industry, which is expected to boost the demand for single-use filtration assemblies. This presents significant opportunities for market players operating in this industry. For instance, in September 2022, China's NMPA approved 16 new drugs, including 12 chemical drugs and 4 biological products.

Key Companies & Market Share Insights

The market is witnessing several strategic initiatives adopted by key players to maintain their industry presence. For instance, in September 2022, Pall Corporation introduced three new Allegro Connect Systems to expand its bioprocessing solutions portfolio. These systems, in combination with Pall's Allegro single-use products, enable full automation of unit activities, which simplifies the manufacturing of a variety of vaccines and drugs. The Allegro Connect Systems portfolio includes systems that support Virus Filtration, Depth Filtration, and Bulk Fill of active pharmaceutical ingredients, as well as a Buffer Management System that streamlines production processes. Some of the key players in the global single-use filtration assemblies market include:

-

Sartorius AG

-

3M Purification

-

Danaher

-

Repligen Corporation

-

Merck Millipore

-

Cellab

-

Medela

-

Thermo Fisher Scientific, Inc.

-

MEISSNER FILTRATION PRODUCTS, INC.

-

DrM, Dr. Mueller AG

Single-use Filtration Assemblies Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3,555 million

Revenue forecast in 2030

USD 11.8 billion

Growth rate

CAGR of 18.70% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Sartorius AG; 3M Purification; Danaher; Repligen Corporation; Merck Millipore; Cellab; Medela; Thermo Fisher Scientific, Inc.; MEISSNER FILTRATION PRODUCTS, INC.; DrM, Dr. Mueller AG

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

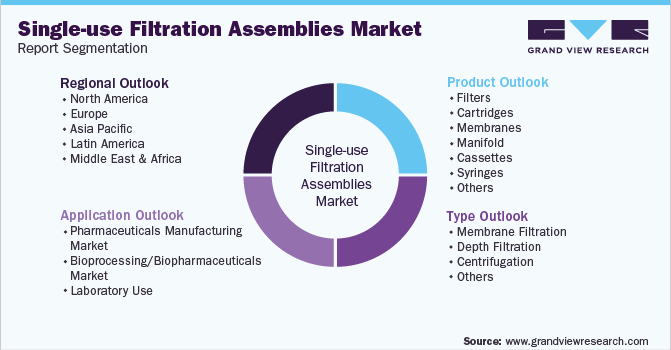

Global Single-use Filtration Assemblies Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, grand view research has segmented the global single-use filtration assemblies market report on the basis of type, application, product, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Membrane Filtration

-

Tangential Flow Filtration (TFF)

-

Ultra/Diafiltration

-

Micro-Filtration

-

-

Direct Flow Filtration (DFF) /Dead-end Filtration /Normal Flow Filtration

-

-

Depth Filtration

-

Centrifugation

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceuticals Manufacturing Market

-

Bioprocessing/Biopharmaceuticals Market

-

Laboratory Use

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Filters

-

Cartridges

-

Membranes

-

Manifold

-

Cassettes

-

Syringes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the market growth include increasing use of single-use technology in bio-processing industry coupled with operational benefits of single-use filtration units

b. The global single-use filtration assemblies market size was estimated at USD 2.99 billion in 2022 and is expected to reach USD 3.56 billion in 2023.

b. The global single-use filtration assemblies market is expected to grow at a compound annual growth rate of 18.70% from 2023 to 2030 to reach USD 11.80 billion by 2030.

b. Single-use membrane filtration, particularly, Tangential Flow Filtration (TFF) dominated the single-use filtration assemblies market with a share of 47.8% in 2022. This is attributable to the fact that a substantial number of companies have actively invested in advancing the use of TFF systems to enhance downstream bioprocessing

b. Some key players operating in the single-use filtration assemblies market include 3M; MEISSNER FILTRATION PRODUCTS, INC.; Sartorius AG; Repligen Corporation; Danaher; Cellab; Merck Millipore; Thermo Fisher Scientific, Inc.; Medela; and DrM, Dr. Mueller AG.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.