- Home

- »

- Biotechnology

- »

-

Single-use Mixers Market Size, Share, Industry Report, 2033GVR Report cover

![Single-use Mixers Market Size, Share & Trends Report]()

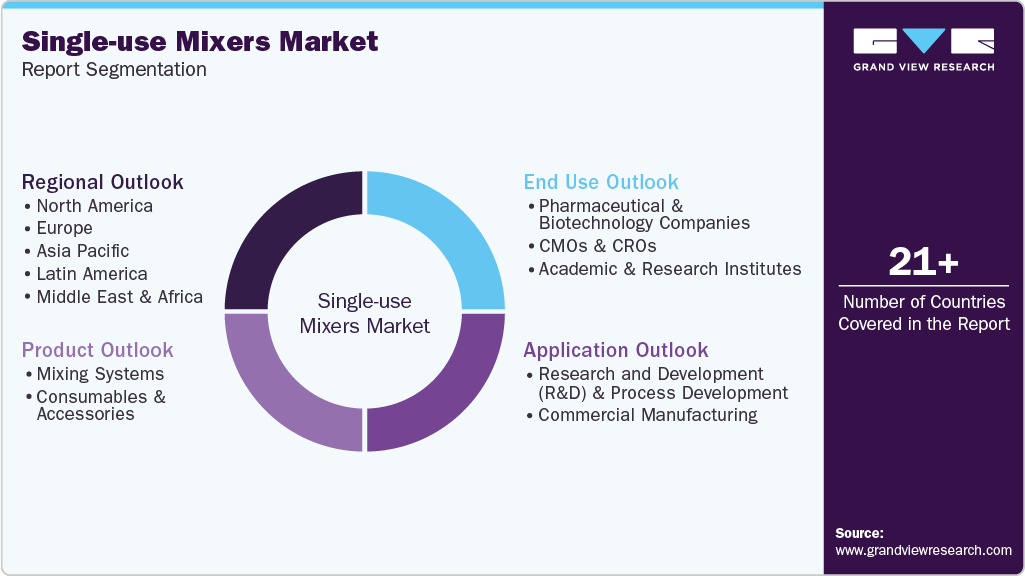

Single-use Mixers Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Mixing Systems, Consumables & Accessories), By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-069-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Single-use Mixers Market Summary

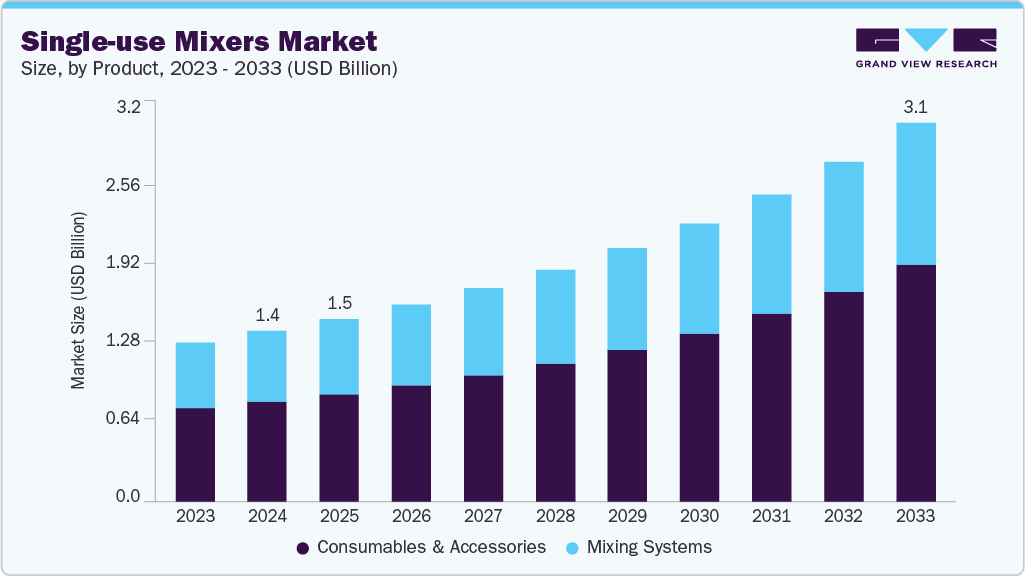

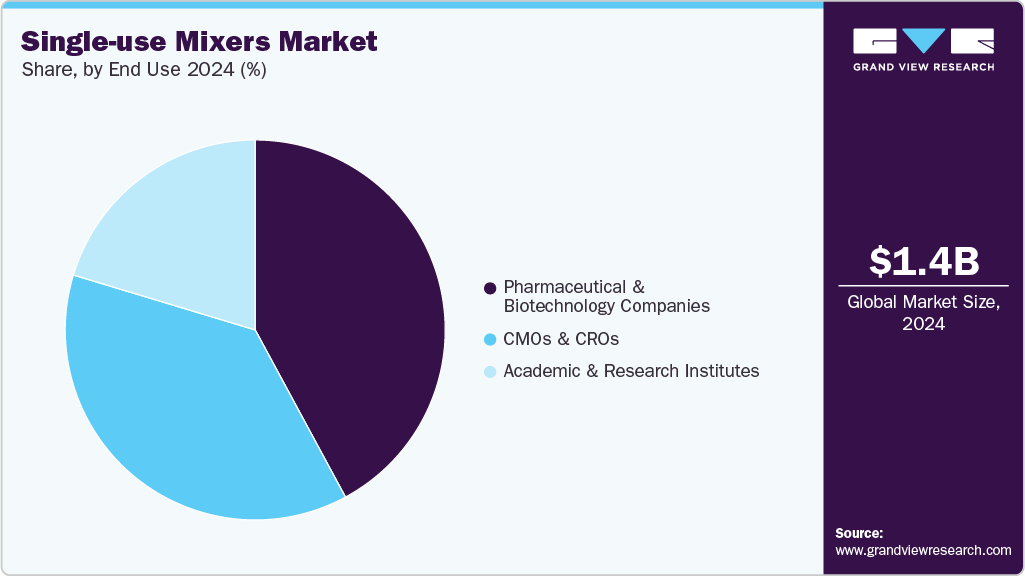

The global single-use mixers market size was estimated at USD 1.41 billion in 2024 and is projected to reach USD 3.13 billion by 2033, growing at a CAGR of 9.53% from 2025 to 2033. The growing demand for biopharmaceuticals, the increasing concern for the environment, and the rising menace of cross-contamination are the major factors responsible for the growth of the single-use mixers industry.

Key Market Trends & Insights

- North America dominated the single-use mixers market with the largest revenue share of 36.03% in 2024.

- The single-use mixers industry in the U.S. accounted for the largest market revenue share in 2024.

- By product, the consumables & accessories segment accounted for the largest market revenue share in 2024.

- Based on application, the research and development (R&D) & process development segment accounted for the largest market revenue share in 2024.

- By end use, the pharmaceutical & biotechnology companies segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.41 Billion

- 2033 Projected Market Size: USD 3.13 Billion

- CAGR (2025-2033): 9.53%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Flexibility & ScalabilityA key driver of the single-use mixer industry is the flexibility and scalability provided to biopharma manufacturers, which is difficult to achieve with traditional stainless-steel systems that require infrastructure and time to set up. Single-use mixers allow companies to adjust their production capacity based on project needs easily. This is particularly advantageous during the early stages of research, clinical trials, and commercial manufacturing scale because it allows for easy transition from small batch to large scale without significant capital expenditures. The ability to scale up or down quickly is crucial in today’s dynamic biopharma landscape, where demand for biologics, vaccines, and cell-based therapies can fluctuate rapidly.

Furthermore, single-use mixers are critical at multiproduct manufacturing sites where biologics or therapies are produced in the same facility. Traditionally, when products were changed, there were lengthy downtimes to address extensive cleaning, validation, and testing. Internally, this posed inefficiencies, increased the opportunity for cross-contamination, and decreased time-to-market for the new product. Single-use systems remove bottlenecks, permitting seamless transition, faster changeovers, and minimizing downtime. This allows for even better productivity and responsiveness to market needs. As companies increasingly focus on personalized medicines and high-value biologics requiring more flexible production processes, the appetite for adaptable and scalable approaches like single-use mixers is increasing.

Reduced Risk of Contamination

The decreased risk of contamination in biopharmaceutical manufacturing is driving the adoption of single-use mixers. Traditional stainless-steel systems always require cleaning and sterilizing between each batch to prevent contamination, which presents a time-consuming operation and risks if cleaning validation is not performed correctly. In single-use mixers, the need for all of this cleaning is removed entirely since the system can only be used once. Each new production run will initiate with a sterile and contamination-free system. Therefore, as a result, there will be minimal chance of product failure, recalls, or regulatory and compliance issues. The safety that this approach can provide is important for all manufacturers, especially those developing high-value biologics. Even a small risk of contamination in those products may lead to significant negative financial consequences and ruin the business's reputation.

Furthermore, the regulatory framework supports this trend. Global regulatory bodies, including the U.S. FDA and EMA, have implemented strict Good Manufacturing Practice (GMP) requirements to ensure the safety and quality of drugs. As biologics and cell- and gene-based therapies continue to dominate pipelines, the assurance of contamination-free production provided by single-use mixers has become a strategic enabler for companies seeking compliance and consistent product quality.

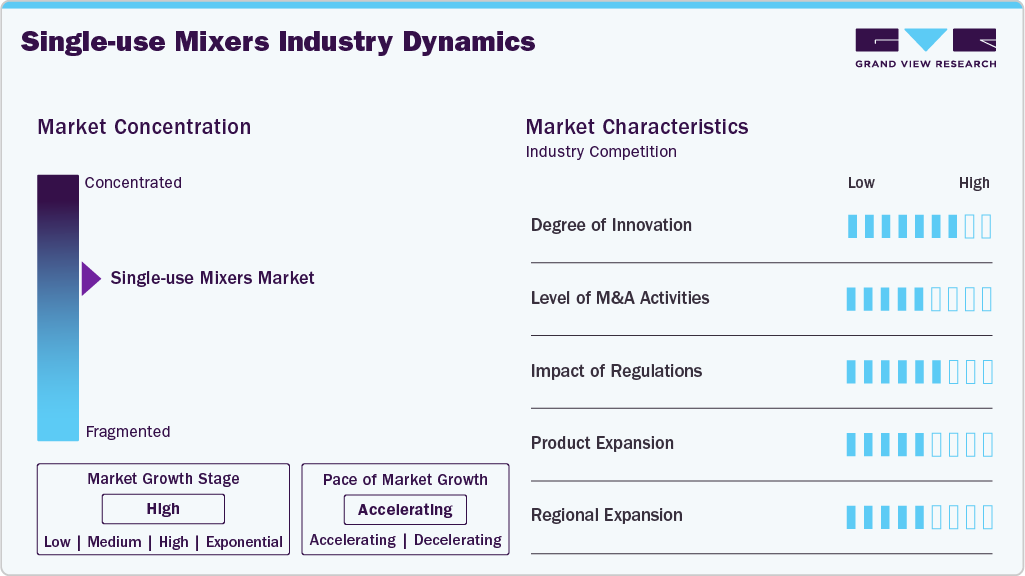

Market Concentration & Characteristics

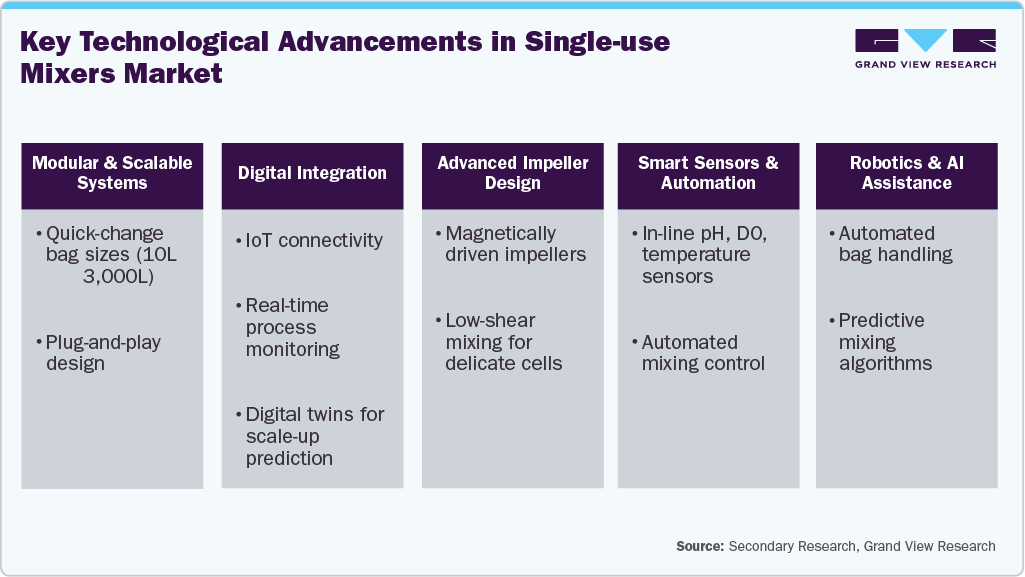

The degree of innovation in the single-use mixers industry is high, driven by continuous advancements in bioprocessing technologies and the increasing demand for flexible manufacturing solutions. Innovations like integrated closed-system solutions, modular platforms, and interoperability with continuous bioprocessing provide better process reliability and regulatory compliance. Furthermore, trends toward sustainable design, including recyclable materials and decreased plastic usage, will shape the future of product design. For instance, in April 2025, Thermo Fisher Scientific introduced its 5L DynaDrive single-use bioreactor in the United States, providing a first-of-its-kind bench-scale system designed to simplify process development and enable seamless scalability. These innovations differentiate market players and accelerate the adoption of single-use mixers across biopharma, vaccines, and cell and gene therapy manufacturing.

The level of M&A activities in the single-use mixers industry is moderate to high, reflecting the increasing strategic importance of single-use technologies in the broader bioprocessing ecosystem. Leading biopharma suppliers and technology providers are actively pursuing acquisitions to strengthen their portfolios, expand global reach, and integrate complementary technologies such as sensors, automation tools, and downstream processing solutions. For instance, in August 2025, Tezalon Biotech partnered with Ireland-based Strikebox to advance scalable bioprocess solutions, combining modular single-use systems with precision fabrication to accelerate therapy development in the U.S. and Europe. These consolidations allow companies to offer end-to-end bioprocessing solutions and intensify competition by creating vertically integrated giants with strong customer bases.

The impact of regulations on the single-use mixer industry is significant, as compliance with stringent quality and safety standards is critical in biopharmaceutical manufacturing. Regulatory agencies like the U.S. FDA, EMA, and other global bodies impose strict requirements for Good Manufacturing Practice (GMP), including sterility, validation, and traceability for equipment and processes. This creates a regulatory framework that drives and shapes the market by expecting companies to adopt innovative single-use solutions to meet globally acceptable quality standards.

Product innovation is an important driver in the single-use mixers industry as manufacturers are actively introducing new products to meet the changing needs of biopharmaceutical production methods. Manufacturers are introducing mixers that provide better mixing performance, are available in larger or flexible volumes, and can be used with a greater range of biologics, cell cultures, and buffers. Component suppliers are diversifying their offerings to provide end-to-end solutions that offer mixing, storage, and transfer in a single-use design to support upstream and downstream workflows. This ongoing diversification of products is aimed toward specific customer needs while encouraging a competitive advantage for suppliers, resulting in increased adoption of single-use technologies across vaccine, biologic, and cell and gene therapy processes.

Regional expansion is becoming a major growth driver in the market for single-use mixers as manufacturers are moving to capitalize on opportunities in emerging biopharmaceutical hubs worldwide. Suppliers are opening local sales offices and distribution networks, setting up service centers to take advantage of those opportunities, and entering into partnerships with regional contract development and manufacturing organizations (CDMOs). The development of these developing regions allows increased market penetration and local presence for manufacturers to provide quicker support, enhance customer relationships, and provide customized solutions, including unique regulatory and operational requirements.

Product Insights

The consumables & accessories segment accounted for the largest market revenue share in 2024, and is also expected to grow at the fastest CAGR throughout the forecast period, due to the growing demand for mixing fluids, such as buffers, culture media, and processes, for various research purposes and vaccine developments. Many consumables and some accessories, such as mixing bags, can even be customized based on the client's demands, enabling the cost to be less and reducing the risk of contamination for a cleaner environment.

The mixing systems segment is expected to grow at a significant CAGR throughout the forecast period, as they are useful tools for R&D applications in the biopharmaceutical industry. Factors such as flexibility, scalability, cost-effectiveness, and reduced contamination risk make them appealing to R&D centers. Combining mixing with removing, cleaning, and sterilization will reduce the time and resources spent preparing and running an experiment.

Application Insights

The research and development (R&D) & process development segment accounted for the largest market revenue share in 2024, due to the tractability, scalability, cost-effectiveness, and reproducibility provided by these systems. Single-use mixers are particularly well-suited for vaccine development, where small variations in experimental conditions can significantly impact the final product. Thus, R&D & process development centers are increasingly turning to single-use technology to support them in conducting experiments speedily and with greater precision, which is driving the progress of the industry's research and development (R&D) & process development segment.

The commercial manufacturing segment is anticipated to grow at the fastest CAGR during the forecast period. These mixers generate less waste than traditional mixing methods, which helps reduce the environmental impact of commercial manufacturing processes. Biopharma companies have slowly started using single-use mixers for commercial manufacturing, that is, large-scale biologics production, focusing on efficient and consistent output, supporting market expansion.

End Use Insights

The pharmaceutical and biotechnology companies segment led the market with the largest revenue share of 42.12% in 2024, due to biologics' major commercial success. Benefits such as cost-effectiveness, compliance, flexibility, and the adoption of innovative techniques give pharmaceutical and biotechnology companies opportunities to improve the manufacturing process. Thus, the rising demand for better production of vaccines and other biologics in a cost-effective way is anticipated to strengthen the industry over the forecast period.

The CMOs & CROs segment is expected to grow at the fastest CAGR during the forecast period. Contract Manufacturing Organizations (CMOs) and Contract Research Organizations (CROs) maintain competitiveness by producing biologics more effectively and affordably, especially for R&D and clinical trials. For instance, according to an article published by SIAPARTNERS in April 2022, approximately 60% of the companies indicated savings of around 10% to 25% through outsourcing, while the remaining 40% reported their savings up to 40%. Using single-use technologies offers many benefits for CMOs and CROs, including improved flexibility, faster turnaround times, and reduced capital expenditures, which increase the adoption of single-use mixers.

Regional Insights

North America dominated the single-use mixers market with the largest revenue share of 36.03% in 2024. This region's large share is attributed to an increase in the adoption of novel technologies and biopharmaceuticals for the analysis and treatment of clinical ailments. Moreover, the supporting regulatory environment, increased investments in R&D, and new clinical studies for innovative therapies continue to bolster single-use mixer adoption in North America and sustain its position as the largest market worldwide.

U.S. Single-use Mixers Market Trends

The single-use mixers market in the U.S. is highly competitive, fueled by the strong presence of global bioprocessing leaders, rapid adoption of advanced manufacturing technologies, and the increasing demand for biologics and personalized medicines. Continuous innovation in single-use systems, including integration with automation, sensors, and real-time monitoring tools, has further intensified competition among suppliers.

Europe Single-use Mixers Market Trends

The single-use mixers market in Europe is experiencing steady growth due to an established biopharmaceutical manufacturing sector, increasing investments in advanced therapies, and the implementing of flexible manufacturing technologies. While the ongoing demand for monoclonal antibodies, vaccines, and cell and gene therapies leads biopharma companies to adopt single-use systems, the demand benefits from improving their scalability, production efficiency, and compliance with EU regulations.

The UK single-use mixers market is expanding, supported by the country’s strong biopharmaceutical and life sciences ecosystem and increasing investments in advanced manufacturing technologies. Moreover, the UK has specialized contract manufacturing and research organizations that offer access to single-use technologies, making them a key part of the country's evolving bioprocessing landscape.

The single-use mixer market in Germany is growing because of supportive government initiatives to strengthen domestic biotech production. The presence of leading global pharma and biotech players further contributes to market expansion. Moreover, Germany’s emphasis on regulatory compliance, process standardization, and sustainable manufacturing practices aligns well with the benefits of single-use mixers, reinforcing their growing role in the country’s bioprocessing ecosystem.

Asia Pacific Single-use Mixers Market Trends

The single-use mixers market in the Asia Pacific is anticipated to grow at the fastest CAGR of 13.75% during the forecast period. The significant progress in the pharmaceutical and biotechnology industries in the region is one of the major factors contributing to the development of single-use technology. Countries like China, India, and Japan are estimated to witness lucrative growth due to growing government investment in R&D centers, thus influencing the significant use of SUM in vaccine production and other research.

The China single-use mixers market is growing rapidly, due to the push by the country to upgrade its biomanufacturing infrastructure and decrease dependence on imported systems. Unlike the more mature markets, the growth in China largely depends on the government's "Made in China 2025" strategy, which places a heavy emphasis on local production of biologics and advanced therapies. Domestic biotech firms and startups are increasingly integrating single-use mixers to shorten facility build times and lower upfront capital expenditure, which is crucial in a cost-sensitive but fast-expanding market. International suppliers are also creating joint ventures or partnerships with Chinese companies to pull in advanced technology while integrating local cost and regulatory considerations, which speeds up adoption further.

The single-use mixers market in Japan is growing, supported by the country’s strong focus on precision medicine, regenerative therapies, and advanced biologics. Japan's healthcare system is notable for the early uptake of new treatments, such as stem cell and gene therapies, which need smaller, flexible, and contamination-free production systems, making single-use mixers attractive. The country’s emphasis on high-quality standards and efficient facility utilization positions single-use mixers as a critical enabler in advancing its biopharma and regenerative medicine sectors.

MEA Single-use Mixers Market Trends

The single-use mixers market in the Middle East and Africa (MEA) is emerging, driven by rising investments in healthcare infrastructure, growing interest in local biopharmaceutical manufacturing, and an increasing focus on vaccine and biologics production. Countries in the region, like the UAE, Saudi Arabia, and South Africa, have made biotechnology part of their national healthcare and economic diversification plans, creating new opportunities for adopting flexible single-use technologies. Moreover, global biopharma companies are forming partnerships with local governments and research institutions to expand access to advanced therapies and vaccines, which is boosting demand for modular, scalable, and contamination-free bioprocessing equipment. As awareness and investment grow, MEA is increasingly positioned as a frontier market for single-use mixers, particularly in contract manufacturing and vaccine development.

The Kuwait single-use mixers market is developing but steadily growing, driven by the country’s initiatives to expand its biotechnology and healthcare manufacturing capabilities. With increasing government investment in advanced healthcare infrastructure and a focus on local production of vaccines and biologics, Kuwait is gradually adopting flexible, scalable, and contamination-free single-use technologies such as single-user mixers.

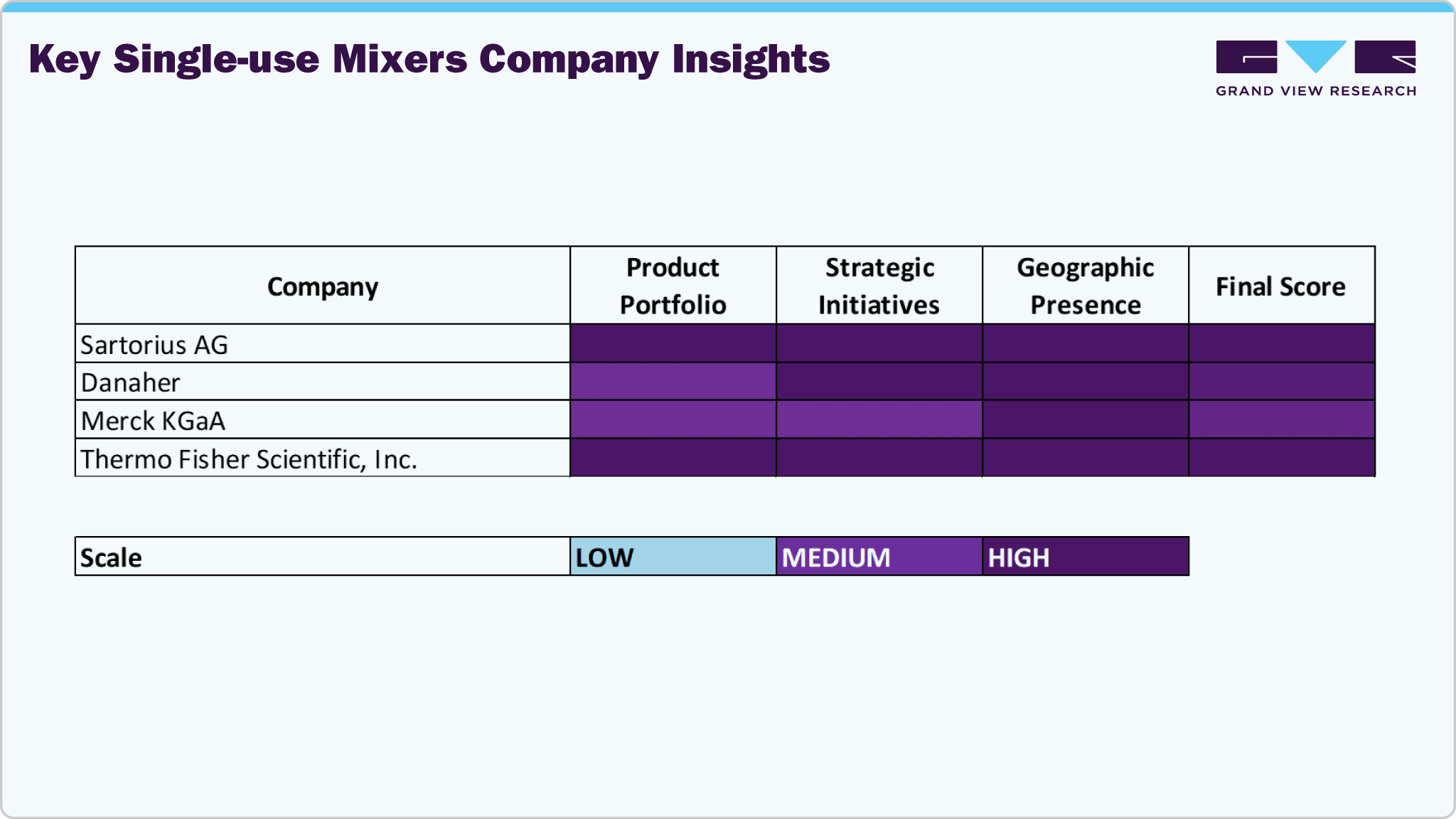

Key Single-use Mixers Company Insights

The single-use mixers industry is characterized by several established players who maintain dominance through comprehensive product portfolios, technological innovation, and strategic partnerships. Top players in the industry, like Sartorius AG, Danaher, Merck KGaA, and Thermo Fisher Scientific, Inc., have obtained considerable shares of the market due to their superior single-use technologies, strong process automation involved, and large worldwide distribution networks. These firms continue to set industry standards by offering scalable, contamination-free mixing systems that cater to biopharmaceutical, vaccine, and cell and gene therapy manufacturing.

Organizations, including Meissner Filtration Products, Dr. Mueller AG, VWR International, CerCell A/S, AGILITECH, and Holloway America, LLC, are broadening their reach by delivering specialized and customizable single-use solutions. Their products meet the increasing demand for flexible, modular, high-performance mixers that optimize operations, minimize risk of cross-contamination, and speed time-to-market of critical biologics and advanced therapies.

The combination of technological innovation and applied engineering expertise increasingly impacts the competitive environment. Strategic partnerships, mergers and acquisitions, and ongoing investment in R&D drive greater mixing performance, sterilization assurance, and the ability to monitor mixing in real time. The factors moving forward that are most likely to shape the path of the single-use mixers industry are accessibility, efficient manufacturing processes, large-scale inputs, and regulatory compliance, as they align with overarching trends in flexible biomanufacturing and sustainable production.

Key Single-use Mixers Companies:

The following are the leading companies in the single-use mixers market. These companies collectively hold the largest market share and dictate industry trends.

- Sartorius AG

- Danaher

- Merck KGaA

- Thermo Fisher Scientific, Inc.

- Meissner Filtration Products, Inc.

- Dr. M, Dr. Mueller AG

- VWR International, LLC.

- CerCell A/S

- AGILITECH

- Holloway America, LLC.

Recent Developments

-

In September 2025, FlackTek launched the MEGA FlackTek in the United States, the world’s largest high-speed bladeless planetary mixer, enabling high-throughput, precision mixing from R&D to full-scale production.

-

In May 2025, Avantor launched its magnetic mixing systems in the United States, offering scalable single-use mixers from 10 L to 1,500 L for homogeneous, low-shear biologics processing.

Single-use Mixers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.51 billion

Revenue forecast in 2033

USD 3.13 billion

Growth rate

CAGR of 9.53% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Sartorius AG; Danaher; Merck KGaA; Thermo Fisher Scientific, Inc.; Meissner Filtration Products, Inc.; DrM, Dr. Mueller AG; VWR International, LLC.; CerCell A/S; AGILITECH; Holloway America, LLC.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Single-use Mixers Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global single-use mixers market report based on product, application, end use, and region.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Mixing Systems

-

Consumables & Accessories

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Research and Development (R&D) & Process Development

-

Commercial Manufacturing

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical & Biotechnology Companies

-

CMOs & CROs

-

Academic & Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global single-use mixers market size was estimated at USD 1.41 billion in 2024 and is expected to reach USD 1.51 billion in 2025

b. The global single-use mixers market is expected to grow at a compound annual growth rate of 9.53% from 2025 to 2033 to reach USD 3.13 billion by 2033

b. The consumables & accessories segment dominated the single-use mixers market in 2024. This is attributed to the increasing demand for mixing various fluids such as buffers, culture media, and processes for various research purposes and vaccine production. Thus, anticipated to propel the development of the market during the estimated period.

b. Some of the key players operating in the single-use mixers market include Sartorius Stedim Biotech, Danaher, Merck KGaA, Thermo Fisher Scientific, Inc., Meissner Filtration Products, Inc., DrM, Dr. Mueller AG, VWR International, LLC., CerCell A/S, AGILITECH, and Holloway America, LLC.

b. The growing demand for biopharmaceuticals, the increasing concern for the environment, and the rising menace of cross-contamination are the major factors responsible for the growth of the single-use mixers market. In addition, increasing adoption of single-use technology, and huge cost benefits in terms of construction and operation are other drivers which are expected to fuel the market growth of single-use mixers (SUM).

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.