- Home

- »

- Pharmaceuticals

- »

-

Sinusitis Drugs Market Size & Share, Industry Report, 2033GVR Report cover

![Sinusitis Drugs Market Size, Share & Trends Report]()

Sinusitis Drugs Market (2025 - 2033) Size, Share & Trends Analysis Report By Disease (Acute Sinusitis, Chronic Sinusitis), By Drug Class (Analgesics, Antihistamines, Corticosteroids, Antibiotics), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-781-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Sinusitis Drugs Market Summary

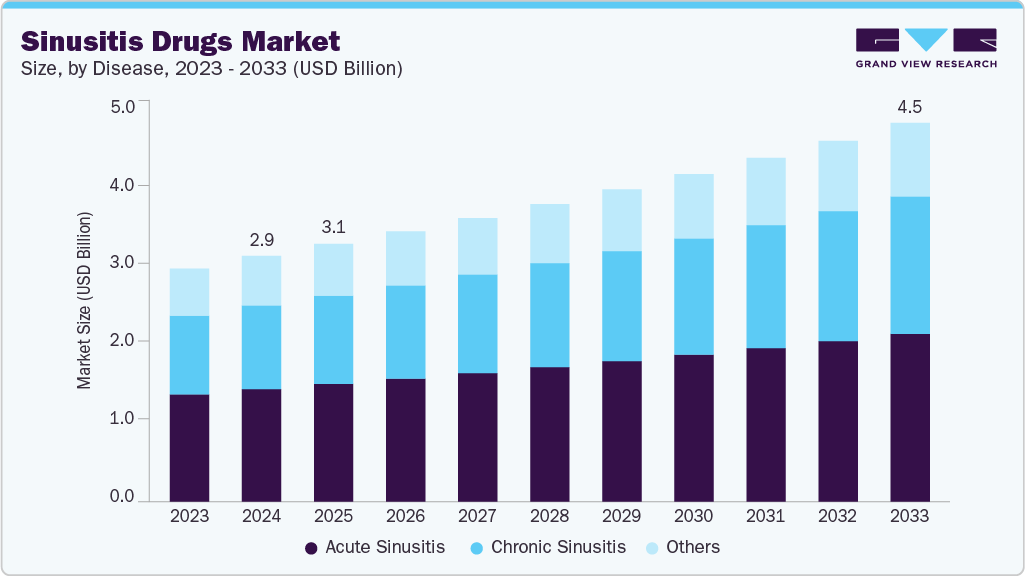

The global sinusitis drugs market size was estimated at USD 2.91 billion in 2024 and is projected to reach USD 4.49 billion by 2033, growing at a CAGR of 4.9% from 2025 to 2033. The industry is driven by the high prevalence of sinus-related conditions worldwide. Sinusitis, including acute and chronic forms, affects millions of people, leading to significant healthcare visits, lost productivity, and reduced quality of life.

Key Market Trends & Insights

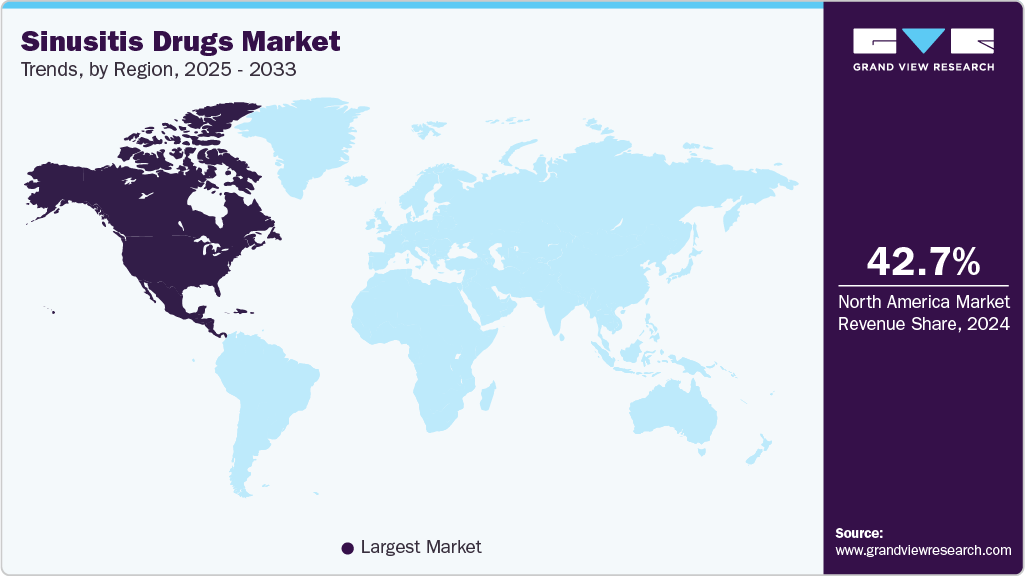

- North America sinusitis drugs market held the largest share of 42.7% of the global market in 2024.

- The sinusitis drugs industry in the U.S. is expected to register the highest CAGR from 2025 to 2033.

- By disease, the chronic sinusitis segment held the highest market share of 45.8% in 2024.

- By drug class, the antibiotics segment held the highest market share in 2024.

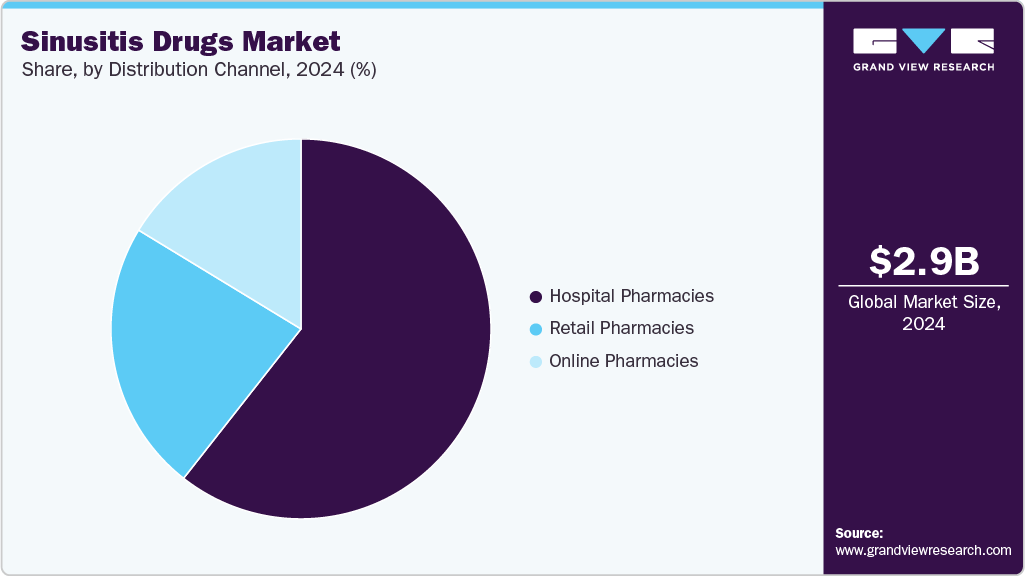

- By distribution channel, the hospital pharmacies segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.91 Billion

- 2033 Projected Market Size: USD 4.49 Billion

- CAGR (2025-2033): 4.9%

- North America: Largest market in 2024

For instance, according to a report published by TGH in December 2023, sinusitis is a common health issue in the U.S., affecting approximately 29 million adults, or about 11.6% of the adult population. Its high prevalence makes it one of the leading reasons for doctor visits, highlighting a significant demand for effective treatment options in the healthcare market. Advancements in drug delivery technologies are further driving the demand for the drugs. Innovations such as nasal sprays that enable direct delivery to sinus cavities enhance treatment efficacy and patient compliance. In addition, developing combination therapies that integrate medical and surgical approaches improves patient outcomes and drives the adoption of new treatment modalities. These technological advancements attract investment and foster competition among pharmaceutical companies, stimulating market growth.

Moreover, the growing prevalence of comorbidities such as asthma, allergic rhinitis, and other respiratory disorders, which often exacerbate sinusitis, is driving the growth of the sinusitis drug industry. Patients with multiple conditions frequently require specialized treatment plans, creating demand for innovative and effective medications. This trend is pushing pharmaceutical companies to develop therapies that target both sinusitis and associated conditions, expanding the range of available products.

Economic factors and increasing healthcare expenditure are also contributing to market growth. Rising disposable income in emerging economies allows more patients to afford branded and advanced sinusitis drugs. In addition, health insurance coverage and reimbursement policies are improving access to prescription medications, making treatments more accessible to a larger population. This financial support helps drive sustained market expansion.

Market Concentration & Characteristics

The industry demonstrates moderate innovation, with a focus on advanced antibiotic formulations, corticosteroid sprays, and biologics for chronic sinusitis management. Companies are developing combination therapies targeting both bacterial infection and inflammation. Research on nasal drug delivery systems, including nebulized and metered-dose formulations, supports improved patient adherence and localized action. The integration of biologics targeting interleukins and immune pathways signifies a shift toward precision treatment. Continuous innovation enhances therapeutic outcomes and drives differentiation among market participants.

Entry barriers in the industry are moderate to high due to the need for substantial clinical validation and regulatory compliance. Existing players benefit from strong brand recognition, physician preference, and established distribution networks. Development of novel therapies requires significant investment in formulation research and trials demonstrating efficacy and safety over generics. Regulatory complexity surrounding antibiotic stewardship and biologic approval adds to entry challenges. Patent exclusivity and manufacturing standards further protect incumbents, maintaining moderate market concentration.

Regulatory frameworks significantly shape the industry, emphasizing safety, antimicrobial resistance control, and efficacy. Authorities such as the FDA and EMA enforce strict guidelines for antibiotics, corticosteroids, and biologics used in sinusitis management. Post-market surveillance and labeling compliance are mandatory to ensure responsible prescribing. Regulatory emphasis on reducing antibiotic overuse encourages the adoption of alternative therapies, such as biologics and corticosteroid-based treatments. Evolving clinical practice guidelines continue to influence product positioning and approval timelines.

Substitutes for sinusitis drugs include non-pharmacological treatments such as nasal irrigation, steam therapy, and functional endoscopic sinus surgery (FESS) for chronic cases. Within pharmaceuticals, alternative drug classes like saline sprays and antihistamines compete with antibiotics and corticosteroids for mild sinusitis management. The availability of OTC decongestants and generic formulations reduces dependence on branded prescription drugs. The presence of substitutes affects pricing, prescription trends, and treatment preferences, particularly in self-managed sinusitis cases.

Geographical expansion in the industry is driven by increasing healthcare accessibility and rising prevalence of allergic and chronic sinusitis in developing economies. North America and Europe maintain dominant shares due to established diagnostic infrastructure and high treatment awareness. Emerging regions in Asia-Pacific and Latin America offer growth potential through improved healthcare spending and urban pollution-related sinus disorders. Companies pursue partnerships, local production, and regional distribution strategies to strengthen market reach and align with diverse regulatory environments.

Disease Insights

The chronic sinusitis segment dominated the market with the largest revenue share of 45.8% in 2024. The market is driven by the rising global prevalence of chronic sinusitis, especially among adults, smokers, and those with comorbidities, which is driving increased demand for effective long-term treatments. According to an article published by NIH in November 2024, a recent systematic review and meta-analysis examined chronic rhinosinusitis (CRS) using data from 28 population-based studies across 20 countries, covering over 237 million people. The study found that about 8.7% of the global population has CRS, while CRS with nasal polyps affects around 0.65%. Prevalence was higher in adults, smokers, individuals with obesity, and those with comorbid conditions such as asthma, nasal septal deviation, diabetes mellitus, and eczema. In addition, increased awareness among healthcare providers and patients about the complications of untreated chronic sinusitis has led to higher rates of diagnosis and treatment initiation, creating steady demand for drugs targeted at chronic cases.

The acute sinusitis segment is projected to grow at the fastest CAGR of 5.6% over the forecast period. The segment is driven by factors such as the sudden-onset nature and short-term impact. Seasonal allergies, viral infections, and environmental triggers cause frequent spikes in cases, creating high demand for treatment of the disease. The rising healthcare burden, with several doctor visits and substantial treatment costs, creates strong demand for effective and standardized therapies.

Drug Class Insights

The antibiotics segment held the largest revenue share of the sinusitis drugs market in 2024. This is due to its role as the primary treatment for bacterial sinus infections. High prevalence of acute bacterial sinusitis and the need for rapid symptom relief drive consistent demand for these medications. As the first-line therapy in treatment guidelines, antibiotics are widely prescribed, and growing awareness and improved diagnosis of bacterial sinusitis ensure more patients receive timely care. The antimicrobial therapy remains the cornerstone of treatment, with the choice of antibiotic depending on whether the infection is acute, chronic, or recurrent.

The corticosteroids segment is projected to grow at the fastest CAGR over the forecast period. Demand for this segment is expected to increase due to its strong ability to control sinus inflammation, relieving congestion, swelling, and nasal blockage. As a non-antibiotic treatment option, corticosteroids are increasingly preferred amid concerns over antibiotic resistance, especially for chronic and recurrent sinusitis. Advances in targeted nasal sprays, topical steroids, and inhalation technologies enhance drug delivery directly to the sinuses, improving efficacy while minimizing side effects.

Distribution Channel Insights

The hospital pharmacies segment held the largest share in the sinusitis drugs market in 2024, due to its direct access to prescribed medications for patients with severe or complicated cases. High patient volumes drive consistent demand, especially for acute and chronic sinusitis. Hospital pharmacies are equipped to provide various advanced therapeutic options, including biologics and combination therapies, essential for treating complex sinusitis cases.

The online pharmacies segment is anticipated to register the fastest CAGR over the forecast period. This is due to the convenience of ordering medications from home, especially for patients in remote areas or with limited mobility. Increased adoption of digital health platforms and telemedicine has made it easier to access prescription and over-the-counter drugs online. According to an article published by Business Standard in August 2025, Zepto launched Zepto Pharmacy. This new quick-commerce service delivers medicines within 10 minutes in select cities, including Mumbai, Bengaluru, Delhi-NCR, and Hyderabad.

Regional Insights

North America sinusitis drugs market dominated the global industry and accounted for a 42.7% share in 2024, driven by several key factors, including the high prevalence of sinus-related disorders, advanced healthcare infrastructure, and the strong presence of leading pharmaceutical companies. Growing awareness about sinusitis and its complications has increased diagnosis and treatment rates, further supported by widespread access to prescription and over-the-counter medications.

U.S. Sinusitis Drugs Market Trends

The sinusitis drugs market in the U.S. accounted for the largest share in North America in 2024. The adoption of advanced therapies and innovative drug delivery methods, supported by a strong focus on research and development, is driving the growth of the sinusitis drug industry. In March 2024, Optinose announced that the FDA approved XHANCE (fluticasone propionate) nasal spray as the first and only medication for treating adults with chronic rhinosinusitis (chronic sinusitis) without nasal polyps, expanding its use beyond patients with nasal polyps.

Europe Sinusitis Drugs Market Trends

The sinusitis drugs market in Europe represented a significant market share in 2024. Growth is driven by aging populations and increasing rates of asthma and allergic conditions in the region. Advances in biologic therapies and innovative treatment options are expanding the range of effective medications. In September 2025, AstraZeneca and Amgen’s Tezspire (tezepelumab) has been recommended for approval in the EU for treating adult patients suffering from chronic rhinosinusitis with nasal polyps (CRSwNP).

The UK sinusitis drugs market maintains stable growth, supported by a high prevalence of acute and chronic sinus infections. Hospitals and clinics emphasize antibiotic stewardship and personalized treatment protocols. Over-the-counter decongestants and nasal corticosteroids remain widely used through retail pharmacies. Rising cases linked to seasonal allergies and pollution increase demand for anti-inflammatory therapies. Ongoing clinical research supports the use of combination drugs to enhance efficacy. The UK’s integrated healthcare system ensures broad patient access, sustaining consistent prescription and non-prescription drug utilization.

The sinusitis drugs market in Germany holds a prominent position in Europe’s sinusitis drugs market, with a strong focus on evidence-based treatment approaches in hospitals and specialty clinics. The increasing incidence of chronic rhinosinusitis drives demand for antibiotics, corticosteroids, and saline-based nasal formulations. Pharmaceutical companies invest in advanced drug delivery systems to improve mucosal penetration and patient adherence. Retail pharmacies contribute to over-the-counter product sales for symptom relief. Public awareness initiatives promote early diagnosis and management of sinus conditions. Germany’s comprehensive healthcare infrastructure and emphasis on preventive ENT care ensure stable market expansion.

France sinusitis drugs market shows consistent market growth in sinusitis drugs, driven by rising cases of acute and chronic sinus infections. Hospitals and ENT specialists emphasize rational use of antibiotics and corticosteroids to manage bacterial and inflammatory conditions. Retail pharmacies contribute significantly through sales of decongestants, saline sprays, and antihistamines for symptomatic relief. Seasonal allergies and air pollution continue to increase sinusitis prevalence, supporting ongoing demand for both prescription and over-the-counter therapies. Pharmaceutical companies focus on improved formulations and nasal delivery systems. France’s organized healthcare framework ensures broad accessibility and steady market performance.

Asia-Pacific Sinusitis Drugs Market Trends

The sinusitis drugs market in Asia Pacific is anticipated to grow at the fastest CAGR of 6.2% over the forecast period. The market is growing due to rising cases of acute and chronic sinusitis driven by pollution, smoking, and respiratory infections. Expansion of healthcare infrastructure, including hospitals and specialty ENT centers, with increased public awareness and improved diagnostic facilities, is expected to drive the market's growth. Rising disposable incomes and a growing middle-class population enable patients to access advanced therapies and branded medications. In addition, the adoption of innovative treatments, such as nasal corticosteroids, biologics, and combination therapies, combined with the growth of online pharmacies and telemedicine, is improving accessibility and convenience. Moreover, government healthcare initiatives further support market expansion across the region.

India sinusitis drugs market is experiencing significant growth, driven by high air pollution and lifestyle changes, which increase the prevalence of respiratory conditions such as sinusitis. Moreover, smoking and allergen exposure further contribute to rising cases of the disease.

The sinusitis drugs market in China is growing rapidly due to several key factors. The rising prevalence of sinusitis, especially chronic cases, creates a strong demand for effective treatments. Environmental pollution and urbanization are increasing the number of people affected, while greater public awareness and better diagnostic tools are helping more patients seek care. In January 2025, GSK’s Nucala (mepolizumab) was approved in China to treat adults with chronic rhinosinusitis with nasal polyps (CRSwNP). It is the only anti-IL-5 therapy available in China for this condition, affecting around 30 million people who experience symptoms such as breathing problems, sleep disturbances, and loss of smell.

Japan sinusitis drugs market records stable growth, supported by a rising incidence of chronic rhinosinusitis and allergic sinus conditions. Hospitals and specialized ENT clinics adopt combination therapies involving corticosteroids, antibiotics, and antihistamines for comprehensive management. Over-the-counter decongestants and nasal sprays witness strong sales through retail pharmacies. High urban pollution and seasonal allergens contribute to recurrent sinus infections, driving continuous drug demand. Pharmaceutical companies emphasize advanced nasal drug delivery technologies to enhance treatment outcomes. Japan’s well-established healthcare infrastructure and insurance coverage ensure sustained market utilization across both acute and chronic cases.

Latin America Sinusitis Drugs Market Trends

The sinusitis drugs market in Latin America experiences moderate growth, supported by rising prevalence of chronic and allergic sinusitis. Increasing pollution and respiratory infections contribute to higher treatment rates. Hospitals and retail pharmacies are expanding access to antibiotics, corticosteroids, and antihistamines. Awareness regarding early diagnosis and self-medication with over-the-counter nasal sprays is increasing. Local and regional pharmaceutical companies enhance affordability through generic options. Advancements in nasal drug delivery improve treatment compliance. Overall, growing healthcare access and patient education drive market expansion across the region.

Brazil leads Latin America’s sinusitis drugs market due to a large patient base and expanding healthcare infrastructure. Rising cases of allergic rhinitis and sinus infections drive prescription and over-the-counter drug sales. Hospitals and ENT clinics adopt combination therapy involving corticosteroids, antibiotics, and decongestants. Retail and online pharmacies ensure wide product availability. Domestic manufacturers strengthen affordability and market reach with generic formulations. Increasing use of nasal sprays and topical corticosteroids enhances treatment outcomes. Brazil’s growing healthcare access and patient awareness sustain consistent market growth.

Middle East & Africa Sinusitis Drugs Market Trends

The sinusitis drugs market in the Middle East & Africa records gradual expansion driven by rising prevalence of upper respiratory infections and improving healthcare facilities. Hospitals and clinics increasingly prescribe antibiotics and corticosteroids for acute and chronic sinusitis. Awareness of self-care options supports sales of over-the-counter decongestants. Local pharmaceutical production enhances accessibility and cost efficiency. Expanding healthcare infrastructure across Gulf countries and North Africa boosts drug demand. The adoption of non-invasive and intranasal therapies supports broader market utilization across the region.

Saudi Arabia sinusitis drugs market represents a key MEA market, supported by growing awareness of sinus and respiratory health. Hospitals and outpatient clinics increasingly prescribe antibiotics, nasal corticosteroids, and antihistamines for acute and chronic sinusitis. Retail pharmacies expand access to nasal sprays and decongestants. Increasing pollution and allergic triggers contribute to consistent demand for symptomatic treatments. Domestic and international pharmaceutical players invest in innovative formulations and wider distribution. Saudi Arabia’s modern healthcare network and insurance coverage support continued market growth.

Key Sinusitis Drugs Companies Insights

Key players operating in the sinusitis drugs market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Sinusitis Drugs Companies:

The following are the leading companies in the sinusitis drugs market. These companies collectively hold the largest market share and dictate industry trends.

- GSK plc.

- Sanofi

- AstraZeneca

- Pfizer Inc.

- Novartis AG

- Merck & Co., Inc.

- Bayer AG

- Johnson & Johnson and its affiliates

- Amneal Pharmaceuticals LLC.

- Teva Pharmaceutical Industries Ltd.

- Sun Pharmaceutical Industries Ltd.

- Bausch Health Companies Inc.

Recent Developments

-

In September 2024, Sanofi and Regeneron’s Dupixent (dupilumab) announced that it was now available for patients as young as 12 years old with inadequate CRSwNP.

Sinusitis Drugs Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.06 billion

Revenue forecast in 2033

USD 4.49 billion

Growth rate

CAGR of 4.9% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Disease, drug class, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; Italy; France; Spain; Sweden; Denmark; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key company profiled

GSK plc; Sanofi; AstraZeneca; Pfizer Inc.; Novartis AG; Merck & Co., Inc.; Bayer AG; Johnson & Johnson and its affiliates; Amneal Pharmaceuticals LLC.; Teva Pharmaceutical Industries Ltd.; Sun Pharmaceutical Industries Ltd.; Bausch Health Companies Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sinusitis Drugs Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global sinusitis drugs market report based on disease, drug class, distribution channel, and region:

-

DiseaseOutlook (Revenue, USD Million, 2021 - 2033)

-

Acute Sinusitis

-

Chronic Sinusitis

-

Others

-

-

Drug Class Outlook (Revenue, USD Million, 2021 - 2033)

-

Analgesics

-

Antihistamines

-

Corticosteroids

-

Antibiotics

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.