Sirolimus Market Size & Trends

The global sirolimus market size is expected to grow at a compound annual growth rate of 5.8% from 2024 to 2030. Sirolimus is a mTOR inhibitor drug used for immunosuppression in patients. The increasing number of organ transplantations is the major reason behind the growth of the sirolimus market. According to an article published by the United Network for Organ Sharing, more than 42,800 organ transplants were reported in 2022 in the U.S. The increasing need for immunosuppressant drugs has surged the market. Immunosuppressant drugs are the most prescribed drug class in European countries. In addition, the increasing research in immunosuppressant drugs is further aiding market growth. The increasing number of clinical studies and approvals for drugs unveil the future demand for the sirolimus market. For instance, in 2021, the FDA approved the JAK inhibitor tofacitinib and the mTOR inhibitor everolimus for clinical use.

As an alternative, drug-eluting device for the currently available paclitaxel coat balloon platforms (for the management of peripheral artery disease (PAD)), sirolimus-coated balloons (SCB) have shown tremendous potential. They have undergone thorough preclinical testing, showing both anti-restenosis efficacy and clinical safety when used to treat coronary artery disease. Thus, it will propel the demand for sirolimus among healthcare professionals and further boost the segment growth in the coming years.

Moreover, the Anti-proliferative feature of the sirolimus is expected to propel the market growth. The sirolimus medication can be followed by patients who underwent angioplasty. It prevents the growth and multiplication of cells in a patient under treatment, which impedes the chances of restenosis in blood vessels. Hence, it encourages the physicians to prefer the medicine to critical patients. Therefore, the antiproliferation properties add to the growth of the sirolimus market.

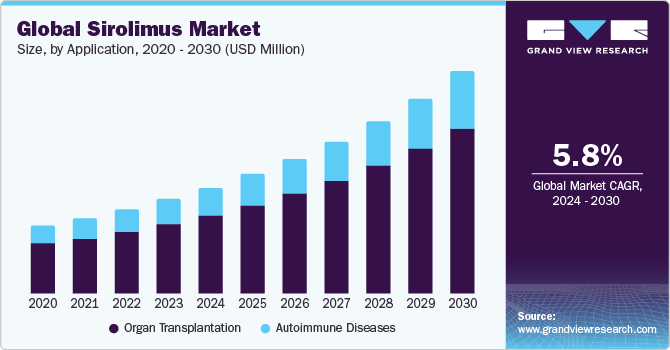

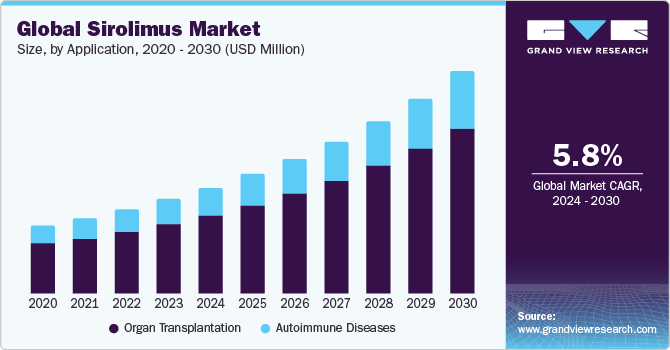

Application Insights

On the basis of application, the market is bifurcated into organ transplantation and autoimmune diseases. The organ transplantation segment held the largest market share in 2023. Sirolimus medication is mostly recommended to patients who underwent organ transplantation. The medication reduces the chance of rejection of foreign objects (transplanted objects in the body) as the immune system acts towards it. The sirolimus is administered to the patient to reduce the act of the immune system rejecting the foreign object so that the transplanted object fits the body and its functions. According to the report from Global Observatory On Donation And Transplantation, it is estimated that 16 organ transplants took place in an hour in the year 2021. The report reveals that 144,302 organ transplants are conducted annually.

The autoimmune diseases segment is expected to witness significant growth in coming years. Sirolimus is mainly used to avert several autoimmune diseases, including myasthenia gravis, arthritis, lupus, rheumatoid arthritis, and Crohn’s disease. These are used as medication to reduce the replication of cells in psoriasis andinflammatory bowel disease. Also, in cases of autoimmune hepatitis, it helps reduce liver inflammation and prevent further damage. Hence, the demand for sirolimus is expected to increase during the forecast period.

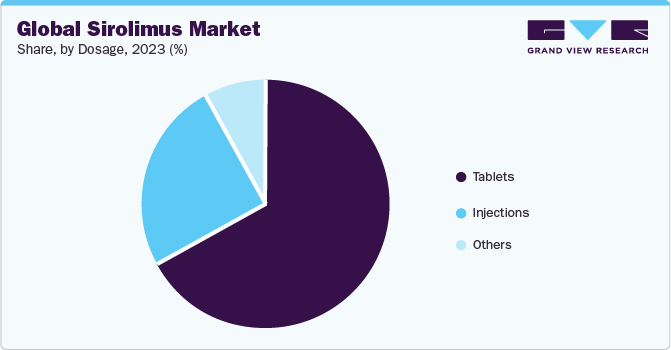

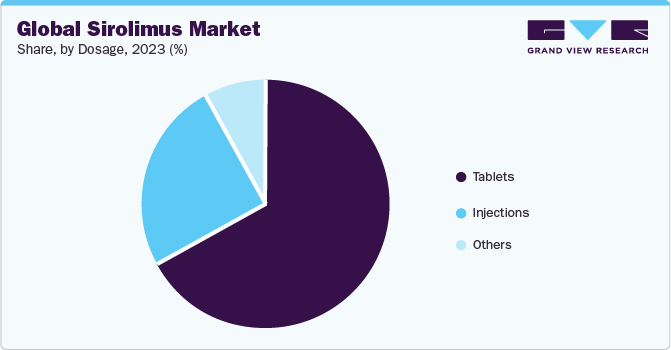

Dosage Insights

Based on dosage, the market is categorized into injections, tablets, and others. The tablet segment held the largest market share in 2023, attributed to ease of administration and affordability. The average cost of 30 sirolimus tablets is USD 273.54. In addition, the prescription of sirolimus for autoimmune disease patients adds to the market growth. Moreover, the drug is mostly absorbed by the body rather than by injections. However, prescribing sirolimus medication to autoimmune disease patients is not instructed and encouraged by medical ethics. Hence, this may hinder the segment's growth.

The injection segment is expected to exhibit significant growth. The injection is the only administrative method to treat critical patients and patients who underwent organ transplantation. Also, sirolimus injections show immediate effect in patients, and their dose can be adjusted by the physician. In addition, the increasing number of cancer patients is expected to drive the segment. The sirolimus injection is administered to patients who do not respond to other treatments.

Distribution channel Insights

Based on the distribution channel, the global sirolimus market is categorized as hospital pharmacies, retail pharmacies, and online pharmacies. The hospital pharmacy segment accounted for the largest market share in 2023. This is due to the wide use of sirolimus in organ transplantation, which is conducted in hospitals. The initial dose of sirolimus is administered soon after the transplantation.

Online pharmacies are estimated to witness the fastest CAGR during the forecast period. The discounts and more choices provided by online pharmacies drive the market segment. The popularity of eCommerce channels is another major reason for the market growth. In addition, the increasing consumer preference for online channels is expected over the forecast period. The convenience of customers in purchasing the medicine also adds to the segment's growth.

Regional Insights

In 2023, North America dominated the sirolimus market. Increasing expenditure in healthcare, the presence of many large biotechnology and medical devices companies, and the rising number of transplants are escalating the demand for the sirolimus market. In addition, the initiatives by government and healthcare organizations to support organ donation fuels the market growth. Arthrex, Inc., Zimmer Biomet, Medtronic, Novartis AG, and Stryker are the major players in the region.

Asia Pacific is projected to grow at the fastest CAGR during the forecast period, owing to the increasing R&D investment by pharmaceutical companies. The number of research initiatives in this region is also expected to increase the region's growth. Dr. Reddy's Laboratories Ltd., Torrent Pharmaceuticals Ltd., Biocon, Intas Pharmaceuticals Ltd, and Concord Biotech are major players in the regional market.

Competitive Insights

Some of the key players operating in the market are Accord Healthcare Actiza Pharmaceutical Private Limited, Delphis Pharmaceutical, Apotex Inc, Biocon Concept Medical Intas Pharmaceuticals Ltd (India), Concord Biotech (India), Livzon, Amneal Pharmaceuticals LLC., Pfizer Inc., Zydus Cadila, and Dr. Reddy's Laboratories Ltd. The key players in the market are engaged in various strategic initiatives such as acquisition, product launch, expansion, collaboration, and partnership. In March 2022, Nobelpharma’s Hyftor (sirolimus topical gel) received U.S. FDA approval to be used in the treatment of facial angiofibroma associated with tuberous sclerosis in adults and patients above 6 years of age.