- Home

- »

- Clothing, Footwear & Accessories

- »

-

Skateboard Market Size, Share And Trends Report, 2030GVR Report cover

![Skateboard Market Size, Share & Trends Report]()

Skateboard Market Size, Share & Trends Analysis Report By Product (Street Board, Long Board), By End-user (Kids, Teenagers, Adults), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-213-6

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Report Overview

The global skateboard market size was estimated at USD 3.22 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 3.5% from 2023 to 2030. The rising enthusiasm for sports among younger individuals is poised to generate higher demand for products in the market. The increasing global popularity of skating as a sport is a key factor driving the upsurge in product demand across multiple countries. Apart from providing enjoyable experiences, skating also contributes to maintaining flexibility and achieving good physical fitness. Furthermore, the prevailing fitness trend has resulted in significant growth in outdoor sporting events, which is expected to fuel market growth throughout the projected period.

Increasing awareness regarding skateboarding as a result of various competitions held such as X Games and Street League has resulted in growth in the sales of skateboards. Moreover, in 2016, the International Olympic Committee announced the inclusion of skateboarding in the 2020 Summer Olympics. Furthermore, graphics play a vital role in increasing the adoption of skateboards by consumers. Increasing inclination of consumers, particularly teenagers, towards funky and attractive graphics displayed on the boards has increased their interest to ride on these boards. As a result, companies follow effective marketing tactics to popularize their brands as a symbol on skateboards. Companies also use various slogans and keywords popular in the market to derive effective sales.

One of the primary factors contributing to the rising popularity of the skateboard is its accessibility and enjoyment for beginners. Skateboarding appeals to a wide range of individuals, including those new to the sport, as it offers a fun and engaging experience. The availability of different types of skateboards, such as cruiser boards and longboards, further enhances accessibility. This diverse range of equipment caters to various preferences and riding styles, enabling beginners and enthusiasts to find the perfect skateboard that suits their needs and enhances their overall skateboarding experience.

Traditional skateboards are low in cost compared to electric skateboards making them easily accessible and affordable for consumers who opt for cost-effective products, including beginners. Traditional skateboards require less maintenance as it consists less mechanical components providing a simple hands-on experience to the user resulting in their high adoption. In addition, the adoption of the traditional skateboard also enables users to express their style and creativity through tricks, as traditional products require a high level of skill.

The media and popular culture are primarily responsible for the skateboard market's visibility. Films, documentaries, television programs, and periodicals that highlighted the remarkable achievements of the sport and the personality of its best skaters helped skateboarding acquire popularity. Moreover, innovations in skateboard design, materials, and technology have continually pushed the boundaries of what is possible. From the introduction of new deck shapes and concaves to advancements in truck and wheel technology, these innovations have contributed to enhancing the overall skateboarding experience.

However, the rising popularity of scooters poses a threat to the growing market of skateboards. Youth is expected to be the major contributor in choosing scooters as compared to skateboards. Moreover, consumers are opting for alternative sports for their safety measures due to the increasing number of casualties caused by the sport.

Companies develop constant efforts and strategize to gain popularity in innovation and increase their share in the skateboard market. For instance, in 2016, at Paris Fashion Week, Dior launched its winter collection on a neon-colored skateboard catwalk ramp. In addition, several fashion designers and retailers use skateboard iconography. For instance, Santa Cruz Skateboards designer, Jim Phillips earned a renowned status in the California market. Furthermore, renowned companies offer sponsorship to players to promote their products. For instance, Nike, Inc., PEPSICO INC., and Mountain Dew have sponsored famous skateboarders from the industry such as Eric Koston, Paul Rodriguez, and Sean Malto. This, in turn, has helped the brand become prominent and favored in the market.

Product Insights

The street board emerged as the largest product segment and accounted for a 44.4% share of overall revenue in 2022. These skateboards are also known as popsicle boards and are predominant in street skating. Street boards are typically manufactured with dimensions of 33 inches in length and 7.5 - 8.75 inches in width. The wheels of the board are smaller and harder as compared to other types of skateboards owing to the uneven and rough surface of roads. These are frequently used by beginners and are available at much cheaper prices compared to other kinds. Companies are investing in the manufacturing of skateboards to ascertain some percentage of the market share. For instance, in 2018, Inter IKEA Systems B.V. launched its first skateboard as a part of its furniture and clothing line in Southern California.

The long board segment is expected to grow at a CAGR of 3.8% from 2023 to 2030. The segment growth is attributed to its longer dimensions and the convenience of flipping over. These boards are longer in dimension consisting of 44 inches in length and 22 - 26 inches in width and are available in a wide variety of shapes and sizes. The product is comparatively faster on account of its wheel size, construction, and hardware material. The end-users of longboards comprise cruising, traveling, and downhill racing. Longboard dance and freestyle are emerging as popular styles, which help the rider to experience free fluid-like movements.

End-user Insights

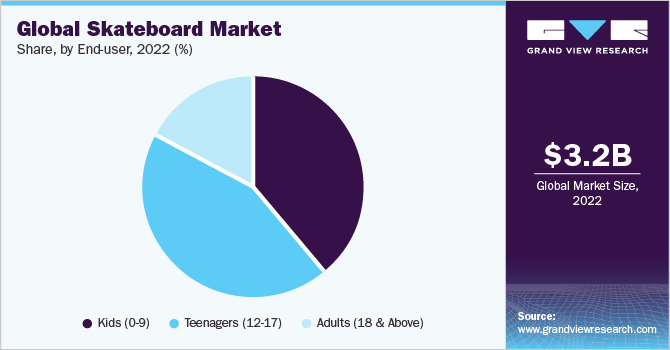

The teenagers segment emerged as the largest segment and accounted for 38.4% share of overall revenue in 2022. Teenagers pertain to the age bracket of 12- 17 years. The segment growth is attributed to a large population in the respective age bracket. For instance, in 2017, the U.S. children in the age bracket of 12 - 17 years comprise 34% of the total children under 18 years of age. The preference of adolescents for a viable, challenging, and recreational sport has made skateboarding a favorite choice among millions of youths.The skateboard target market predominantly consists of teenagers and young adults, who are deeply connected to youth culture. This demographic is particularly attracted to the exhilaration, sense of liberation, and avenue for self-expression that skateboarding provides.

The use of skateboards by various college students for commuting inside the college premises is also driving the market for skates. Moreover, the emergence of skateboards with new and innovative designs is witnessing a surge in the market. The usage of skateboards by teenagers exhibits the trend of being rebellious, which motivates them to ride on the skateboard.

Adoption of skateboards among kids is projected to grow at a CAGR of 4.1% from 2023 to 2030 owing to the growing population among the age criteria. Kids pertain to the age bracket of 0 - 9 years. According to the United Nations Department of Economic and Social Affairs (UN DESA), the global population in the 0 - 9 age bracket consists of 1.3 billion in 2015, while there were 1.2 billion people under the same age category in 2000. Furthermore, growing health concerns over obesity and physical inactivity have gained importance among parents, who motivate their kids for the sport. In addition, it provides the added advantage of no cost fee or coaching, which makes it a cheap and easy mode of transport for children.

Regional Insights

North America emerged as the largest regional market, accounting for 41.2% share of global revenue in 2022. Increased awareness regarding skateboarding as well as wide product availability in the region are the key driving factors. According to the findings, 6.4 million people participated in skateboarding in the U.S. in 2016. Moreover, the U.S. has the largest production of skateboards across the globe.

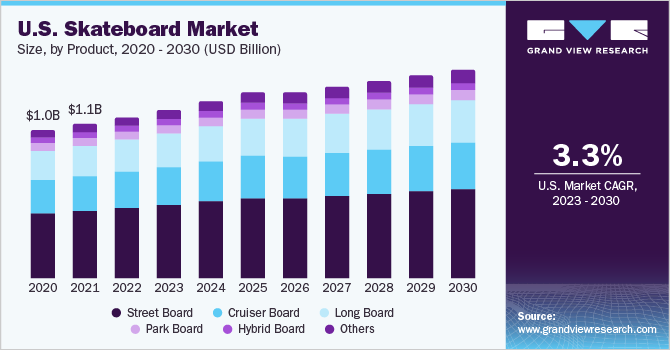

The data published by Boarding Universe in 2022, highlights the enduring popularity of skating as an American pastime and its current resurgence among a broader range of participants. In 2021, an impressive 8.75 million people were estimated to have engaged in skating activities in the United States. This substantial number of participants has significantly contributed to the growth of the U.S. skateboard market, underscoring the increased interest and demand for skateboarding in the country. The U.S. skateboard market is anticipated to experience growth at a CAGR of 3.3% during the forecast period, fueled by the rising number of individuals participating in skateboarding activities.

According to a recent survey, skateboarding is marked at the third position in the most popular sports category after football and basketball. The inclination of the younger generation is increasing toward the sport as a result of the rise in the number of competitions held annually in the region. Various competitions that are expected to take place in 2019 are the 26th Annual Tampa Am in Florida, Jackalope Festival, Central Mass Skate Festival, and X Games Minneapolis.

The Europe skateboard market size was estimated at USD 796.6 million in 2022. Skateboarding is gaining popularity as a recreational and sport activity among people of all ages in European countries. The rise of skateboarding influencers, skateboarding events, and skate parks have contributed to the growth of the Europe market.

Based on the data released by Our Sporting Life, skateboarding has experienced a steady rise in participation in the UK since 2016. In June 2020, an estimated 53,000 individuals were actively involved in skateboarding activities across the country. The increasing popularity of skateboarding in the UK is propelling the growth of the skateboard market in the region, with a projected growth rate of 3.7% during the forecast period. This upward trend in skateboarding participation is driving the demand for skateboard products and contributing to the expansion of the market.

Prominent skateboarding events like SKTWK, SKATE Contest, and the European Freestyle Skateboarding Championships have captured substantial attention in Germany. These events serve as major attractions for both skilled skateboarders and the general public, creating a buzz that contributes to the growth of the Germany skateboard market, which is expected to grow at a CAGR of 3.5% during the forecast period. The presence of such events not only draws talented skateboarders but also sparks curiosity and interest among a wider audience, fostering the expansion of the market. Skateboarding has transitioned from being a niche activity to a mainstream sport in Nordic countries. The inclusion of skateboarding in major sporting events, such as the X Games and the Olympic Games, has helped elevate its status and attract a broader audience.

Asia Pacific is anticipated to register a CAGR of 4.2% over the forecast period on account of increasing awareness of outdoor sports activities. The region witnessed the highest growth of childhood obesity with a 38% rise between 2000 to 2016 among children aged under five years. Moreover, according to the WHO, more than 340 million population aged 5 - 19 years were overweight or obese in 2016. As a result, parents and institutions are encouraging kids to indulge themselves in outdoor sporting activities.

In the Asia Pacific skateboard market, China is expected to grow with a CAGR of 4.5% over the forecast period. Skateboarding in China has undergone a remarkable transformation, shifting from a niche activity associated with lifestyle and counterculture to a mainstream sport with widespread recognition, including its inclusion in the Olympics. This transformation is reflected in the rapid growth of the China skateboard market. One notable example is DBH, a local brand renowned for its vibrant and colorful decks, which experienced a substantial surge in sales. From 2021 to 2022, DBH witnessed an impressive sales increase of 200 percent, showcasing the escalating popularity of skateboarding in China.

The growth of skateboarding in India is closely tied to the emergence of vibrant skateboarding communities and groups. These communities have become catalysts for the popularity and expansion of the Indian skateboard market. With the formation of more skateboarding communities across the country, the market is expected to experience steady growth during the forecast period. These communities provide a platform for skateboarders to connect, share knowledge, organize events, and collaborate on initiatives to further develop the skateboarding culture in the country.

The growth of the Australia skateboard market is being driven by the introduction of innovative skateboards such as longboards. Twelve Board Store, a renowned retailer specializing in skateboarding and snowboarding equipment, has witnessed a significant increase in the demand for skateboarding gear, particularly during the pandemic.

The combination of accessibility, enjoyment for beginners, and the availability of innovative skateboards has propelled the growth of the Australia market. As more individuals discover the thrills and benefits of skateboarding, the market is expected to continue expanding in the coming years.

Increasing awareness regarding skateboarding as a result of different competitions and contests held at the country and regional levels also motivates kids to engage in the sport. For instance, the inclusion of Skateboarding in the Tokyo Summer Olympics 2020 has provided a boost to all skateboarders to excel in the field. Furthermore, Skate Philippines Summer Championship, the 31st Annual Skate Japan, and Skate Malaysia are some other competitions to be held in the year 2019.

Key Companies & Market Share Insights

The leading players in the market are focusing on product innovation and development to gain a greater market share at a global level. New product launches in the market help to keep the interest alive of the consumers on account of the increasing preference for outdoor sporting and inclination towards newer sports in the majority of the regions.

Some of the industry participants are introducing innovation in their products as their key strategy is to increase their market share.

-

In June 2023, Hot Wheels Skate announced its partnership with X Games and Tony hawk's Vert Alert to demonstrate its backing for the Hot Wheels Skate line.

-

In September 2022, Rovio Entertainment announced its partnership with Capsule Skateboards to launch a new range of skateboards featuring Angry Birds.

Some prominent players in the global skateboard market include:

-

Boardriders

-

Krown Skateboards

-

Sk8factory

-

Skate One

-

Absolute Board Co.

-

Alien Workshop

-

Zero Skateboards

-

CONTROL SKATEBOARDS INC.

-

Razor USA LLC

-

Almost Skateboards

Skateboard Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.38 billion

Revenue forecast in 2030

USD 4.25 billion

Growth rate

CAGR of 3.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

August 2023

Quantitative units

Revenue in USD billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-user, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia & New Zealand; Brazil; Argentina; UAE; South Africa

Key companies profiled

Boardriders; Krown Skateboards; Sk8factory; Skate One; Absolute Board Co.; Alien Workshop; Zero Skateboards; CONTROL SKATEBOARDS INC.; Razor USA LLC; Almost Skateboards

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Skateboard Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global skateboard market report based on product, end-user, and region:

-

Product Outlook (Revenue, USD Billion, 2017 - 2030)

-

Street Board

-

Cruiser Board

-

Long Board

-

Park Board

-

Hybrid Board

-

Others

-

-

End-user Outlook (Revenue, USD Billion, 2017 - 2030)

-

Kids (0-9)

-

Teenagers (12-17)

-

Adults (18 & Above)

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. North America dominated the global skateboard market with a share of 41.2% in 2022. This is attributed to the increased awareness regarding skateboarding as well as wide product availability in the region.

b. Some key players operating in white spirits market include Boardriders; Krown Skateboards; Sk8factory; Skate One; Absolute Board Co.; Alien Workshop; Zero Skateboards; CONTROL SKATEBOARDS INC.; Razor USA LLC; and Almost Skateboards

b. Key factors that are driving the market growth include the rising enthusiasm for sports among younger individuals and the increasing global popularity of skating as a sport.

b. The global skateboard market size was estimated at USD 3.22 billion in 2022 and is expected to reach USD 3.38 billion in 2023.

b. The global skateboard market is expected to grow at a compounded growth rate of 3.5% from 2023 to 2030 to reach USD 4.25 billion by 2030.

b. The U.K. skateboard market is expected to grow at a compound annual growth rate of 3.7% from 2023 to 2030.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."