- Home

- »

- Automotive & Transportation

- »

-

Scooter Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Scooter Market Size, Share & Trends Report]()

Scooter Market (2023 - 2030) Size, Share & Trends Analysis Report By Product Type (Normal Scooter, Electric Scooter), By Electric Scooter Type (Conventional Electric Scooter, Swappable Electric Scooter), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-622-6

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Scooter Market Summary

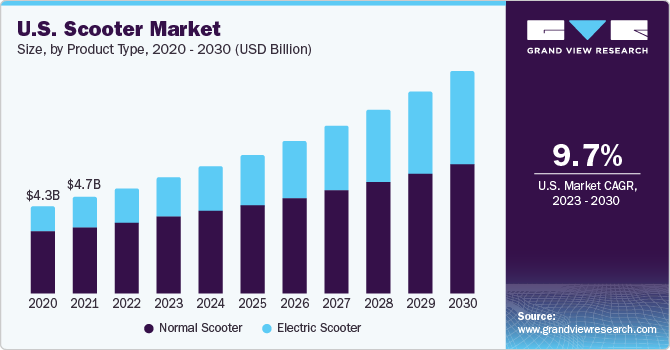

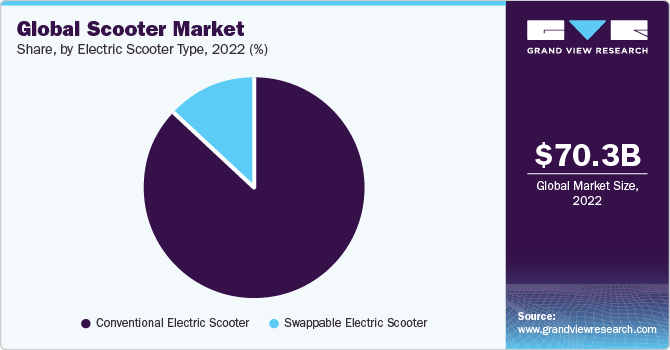

The global scooter market size was valued at USD 70.26 billion in 2022 and is projected to reach USD 111.37 billion by 2030, growing at a CAGR of 6.1% from 2023 to 2030. The rapid rate of urbanization and improving road connectivity in emerging economies have created a high demand for transportation.

Key Market Trends & Insights

- Asia Pacific dominated the global scooter market revenue share of 66.4% in 2022.

- By product type, the normal scooter segment accounted for the largest revenue share of 68.3% in 2022.

- By electric scooter type, the conventional scooter segment accounted for the largest revenue share of around 86.9% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 70.26 Billion

- 2030 Projected Market Size: USD 111.37 Billion

- CAGR (2023-2030): 6.1%

- Asia Pacific: Largest market in 2022

The unavailability of public vehicles at remote locations encourages consumers to purchase personal vehicles. Consumers are looking for lightweight, easy-to-drive & operate, and economical vehicles; thus, scooters are widely preferred. Battery-powered electric scooters require no fuel and are free from vehicular pollution, thereby fostering the market growth.

Although various factors contribute to the scooter market's growth, the pandemic portrayed severe impacts. Global lockdown, supply chain disruption, and limited transportation led to low or no demand for the vehicle. The market witnessed a sharp decline in the sales of automobiles like scooters, both conventional and electric. Post-COVID-19, there has been a spike in demand for electric scooters, mostly from China and India. Thus, to cope with demand, scooter manufacturers are launching new vehicle ranges with the latest technologies in the market. In addition, they are working on enhancing the existing design, colors, weight, safety, and experience of the scooters to gain consumers' traction.

Growing regulatory norms, a ban on internal combustion engine (ICE) vehicles, a lower import duty on electric vehicles, and improved battery charging infrastructure have shifted consumer preference. They are adopting electric scooters over conventional ones. Electric scooters are lightweight, easy to operate, and battery-powered; thus, they can be used for short-distance travel and local sightseeing. Further, the high mechanical efficiency, lower noise level, lower total cost of ownership, and lesser maintenance of electric scooters propel their demand. Besides, there is a rising adoption of electric scooters for sharing services in developed countries, which is expected to foster the growth of the market.

The economic development of a country highly depends on its road connectivity. The governments of emerging nations are investing in building safe and reliable roads. Investment in road construction has brought new growth opportunities for the transportation and logistics sector. Many people in business have started entering the logistics market by setting up their firms or partnering with existing firms. Thus, they require vehicles to deliver goods at a minimum time and cost; scooters are one of the preferred vehicles. Scooters can navigate conveniently through the traffic and need less fuel than bikes, mopeds, and cars.

Furthermore, scooter manufacturers are majorly focusing on incorporating new technology into the vehicles to increase their speed, enhance battery efficiency, and make them cost-effective for customers. Besides, electric scooter manufacturers have introduced a range of scooters in emerging economies. For instance, in February 2022, Silence, a Spanish company, introduced Silence 01 and 02 in South Africa; these models have fast charging features, load-carrying capacity, and removable batteries. Therefore, such strategies adopted by the automakers are expected to create new growth opportunities for scooters.

Electric Scooter Type Insights

The conventional scooter segment accounted for the largest revenue share of around 86.9% in 2022. Conventional electric scooters are lightweight, robust, and have lower initial and maintenance costs than their counterparts, thus widely adopted by consumers. Further, conventional electric scooter manufacturers focus on developing technologically advanced electric scooters at a minimum price, contributing to a high segmental share.

The swappable scooter segment is estimated to register the fastest CAGR of 18.6% over the forecast period. The segment growth is attributed to the increasing focus of automobile manufacturers on developing battery-swapping technology to enable scooter owners to replace depleted batteries with fully charged ones. Battery-swappable electric scooter manufacturers are introducing scooters without installed batteries. Vehicles without batteries allow consumers to choose the batteries according to their budget and requirements.

Regional Insights

Asia Pacific dominated the market and accounted for the largest revenue share of 66.4% in 2022. This high share of the market is attributed to the increasing disposable income of the consumers in the region. Rather than relying on public buses, consumers prefer independent vehicles that save time spent in traffic jams. Furthermore, compared to electric motorcycles and electric mopeds, the electric scooter is inexpensive in terms of both the initial purchase price and the ongoing maintenance costs. Since electric vehicles are battery-powered, they provide consumers with relief from rising oil prices in the region.

North America and Latin America both are expected to expand at the fastest CAGR of 9.8% during the forecast period. Shifting consumers’ preference for rental electric scooters over other two-wheelers is a major contributing factor to the growth of the North American market.

European electric scooter manufacturers, such as GOVECS AG, Torrot Electric Europa S.A., and Unu GmbH, are introducing technologically advanced vehicles. Such vehicles comprise exceptional features such as security, alerts, self-diagnosis & remote telemetry, GPS tracking, motor & power deactivation, and speed limitation, thus making the scooters smarter and more secure. The growth in innovation in the region is expected to drive the demand for electric vehicles in the market.

Product Type Insights

The normal scooter segment accounted for the largest revenue share of 68.3% in 2022. There is increasing consumer traction towards a vehicle that offers comfortable rides with gearless driving systems and operates at a minimal cost, propelling the sales of normal scooters. Normal scooters provide high mileage as well as robust body-enhanced maneuverability, contributing to the high share segment.

The electric scooter segment is expected to expand at the fastest CAGR of 7.8% during the forecast period. Increasing awareness of greenhouse gases, carbon emissions, and pollutants, coupled with the rising demand for fuel-efficient vehicles, is expected to propel the growth of the electric scooter segment. Further, governments worldwide are formulating new policies and regulations to increase the penetration of electric scooters by offering various incentives and benefits to consumers. Besides, an upsurge in the adoption of electric scooters for rental-sharing services has spurred the demand for electric scooters.

Key Companies & Market Share Insights

The industry players are adopting strategic initiatives, such as regional expansion, merger & acquisition, partnership, and collaboration to sustain their market positions. Organic growth remains the key strategy for most of the market's incumbents. Electric scooter manufacturers focus on product launching activities in emerging nations. For instance, in April 2022, Bird, an electric scooter manufacturer, launched an e-scooter in Helsinki. The scooter is incorporated with advanced safety features and has an IP68-rated waterproof battery. Moreover, in May 2021, Bird Rides, Inc. introduced a next-generation scooter, "Bird Three", in Berlin, with enhanced features, such as a diagnostic monitoring system and a longer-range battery,

Key Scooter Companies:

- Yadea Technology Group Co., Ltd.

- Ninebot Ltd

- NEUTRON HOLDINGS, INC.

- Bird Rides, Inc.

- Spin

- GOTRAX

- SEGWAY INC.

- Razor USA LLC.

- Uber Technologies Inc.

- OKAI Inc.

Recent Developments

-

In February 2023, Ola Electric, one of the leading manufacturers of electric vehicles (EVs), introduced the Ola S1 Air, a new line of e-scooters. Three variations of the scooters in this category are expected to be offered: 2KWh, 3KWh, and 4KWh. Additionally, the company also introduced a brand new S1 model with a 2KWh battery pack.

-

In January 2023, Yadea Technology Group Co. Ltd. introduced the Yadea Keeness VFD at the Consumer Electronics Show (CES) in Las Vegas, Nevada. With a 10KW mid-mounted high-performance motor, the Keeness VFD model has a top speed of 100 km/h and can accelerate from 0 to 50 km/h in under 4 seconds.

-

In January 2023, Hero Electric and Maxwell Inc. entered into a long-term agreement for the delivery of advanced battery management technologies. Under this agreement, Maxwell planned to supply Hero Electric with over 10 lakh Battery Management Systems (BMS) by 2026.

-

In October 2022, Niu International. announced the KQi3 Max, their newest kick scooter. The KQi3 Max kick scooter provides the highest levels of performance, comfort, and stability with a top speed of 20 mph and a range of 40 miles.

-

In August 2022, HUSE and SEGWAY INC. announced a strategic alliance to sell and market Segway products in India. Through the agreement, both companies established a targeted electric micro-mobility solution for the Indian market.

-

In April 2022, Init Esports Inc., the Esports powerhouse, partnered with NIU Technologies, the world's leading provider of smart urban mobility solutions. In association with NIU Technologies, Init Esports Inc. promoted the American Motorcyclist Association (AMA) World's Fastest Motorcycle Gamer Challenge, where users could sign up for a chance to win an NIU electric kick scooter.

Scooter Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 73.68 billion

Revenue forecast in 2030

USD 111.37 billion

Growth rate

CAGR of 6.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, electric scooter type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

Yadea Technology Group Co., Ltd.; Ninebot Ltd; NEUTRON HOLDINGS, INC.; Bird Rides, Inc.; Spin; GOTRAX; SEGWAY INC.; Razor USA LLC.; Uber Technologies Inc.; OKAI Inc

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Scooter Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global scootermarket report based on product type, electric scooter type, and region:

-

Product Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Electric Scooter

-

Normal Scooter

-

-

Electric Scooter Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Conventional Electric Scooter

-

Swappable Electric Scooter

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global scooter market size was estimated at USD 70.26 billion in 2022 and is expected to reach USD 73.68 billion in 2023.

b. The global scooters market is expected to grow at a compound annual growth rate of 6.1% from 2023 to 2030 to reach USD 111.37 billion by 2030.

b. Asia Pacific dominated the scooters market with a share of 66.4% in 2022. The concerns across countries such as China, India, and Japan over fluctuating fuel prices and air pollution caused by gas emissions have encouraged regional demand.

b. Some key players operating in the scooter market include Gogoro, Inc.; Piaggio & C. S.P.A.; Suzuki Motor Corporation; Honda Motor Co., Ltd.; and YAMAHA Motor Pvt. Ltd, among others.

b. Key factors that are driving the scooter market growth include benefits offered using scooters including inexpensive last-mile transportation as against the on-demand transportation, rising consumer awareness of eco-friendly transportation, and increasing demand for electric scooter sharing services.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.