- Home

- »

- Medical Devices

- »

-

Sleep Apnea Devices Market Size And Share Report, 2030GVR Report cover

![Sleep Apnea Devices Market Size, Share & Trends Report]()

Sleep Apnea Devices Market Size, Share & Trends Analysis Report By Product Type (Diagnostic Devices, Therapeutic Devices, Sleep Apnea Masks), By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-265-5

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Sleep Apnea Devices Market Size & Trends

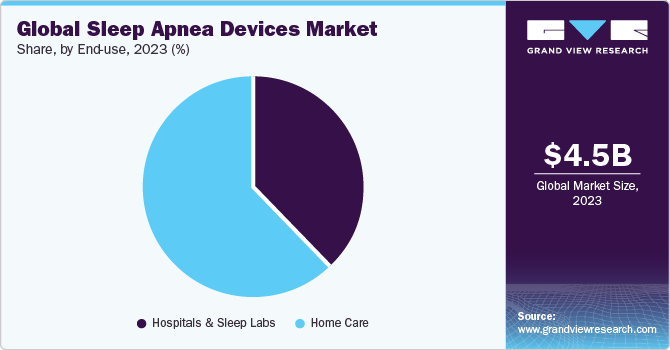

The global sleep apnea devices market size was valued at USD 4.5 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 6.2% from 2023 to 2030. As of October 2023, National Council on Aging data indicates that Obstructive Sleep Apnea (OSA), characterized by irregular breathing and reduced oxygen supply to the brain, affects about 39 million adults in the U.S. and an estimated 936 million adults globally.

The high prevalence of sleep apnea in an elderly population often goes undiagnosed due to factors like lack of awareness and non-specific symptoms. With the global population aged 60 and above projected to reach 2 billion by 2050 and the elderly population expected to double from 12% to 22%, the incidence of sleep disorders, particularly OSA, is on the rise. OSA affects 13% to 32% of individuals aged 65 and above. The growing geriatric population's vulnerability to sleep apnea is expected to drive the adoption of sleep apnea devices. Notably, as reported by the U.S. Securities and Exchange Commission, over 8 million CPAP interfaces are sold annually in the U.S., with an additional 2.5 million sold globally.

Market expansion is driven by the entry of new players and an increased focus on innovative product development, resulting in technologically advanced solutions. For instance, the FDA-approved Inspire implant stands out as a unique OSA therapy, addressing the root cause of sleep apnea internally, ensuring regular breathing, and promoting sound sleep.

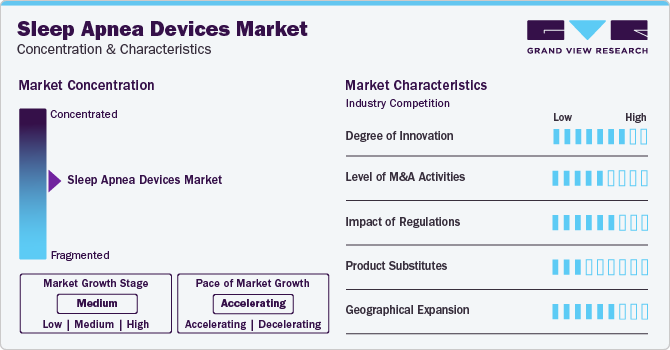

Market Concentration & Characteristics

The sleep apnea devices market is currently in a moderate growth stage, with an accelerating pace. This is driven by factors such as a growing geriatric population, a significant patient pool with sleep apnea, an increased prevalence of comorbidities linked to sleep apnea, and the development of advanced devices. For example, NovaResp Technologies Inc. is developing an AI-enabled CPAP algorithm compatible with various CPAP devices, predicting apnea events during sleep.

Market players are utilizing key strategies, including new product launches, expansions, acquisitions, partnerships, etc. For instance, in September 2023, ResMed announced a strategic partnership with Nyxoah to enhance awareness of obstructive sleep apnea and increase therapy penetration in Germany, contributing to market growth in the forecast period.

Degree of Innovation: The sleep apnea devices market has witnessed advancements focused on improving patient comfort, compliance, efficacy, and overall treatment outcomes. Integration of smart technology and digital sensors to enhance therapy management is a key driving factor in the market,

Level of M&A Activities: Mergers and acquisitions in the Sleep Apnea Devices Market are on the rise. Companies are leveraging multiple acquisitions to strengthen product offerings, expand their global footprint, diversify portfolios, integrate technologies, and enhance industry positioning.

Regional Expansion: The global prevalence of sleep apnea presents opportunities and competition across regions. Growing markets in the United Kingdom (UK), Germany, France, Italy, and Spain are driven by aging populations, lifestyle factors, healthcare reforms, and regulatory harmonization. Meanwhile, the well-established U.S. and Canada markets are characterized by high prevalence rates of sleep apnea and advanced healthcare systems.

Product Type Insights

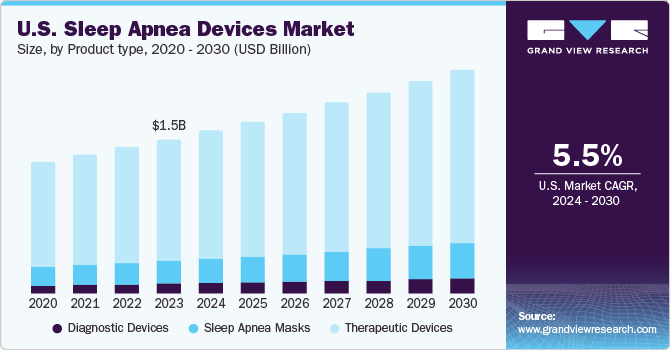

In 2023, therapeutic devices segment led the market with a 79.0% share. This category includes Positive Airway Pressure devices, nasal devices, oral devices, and chin straps. Market players are introducing innovations such as comfortable and lightweight masks, softer materials, smaller masks, and noise-reduction features. Advanced technologies are being integrated to enhance PAP device efficiency and deliver optimal clinical outcomes. The growing patient compliance rate, supported by favorable insurance coverage tied to adherence standards for PAP therapy, is driving widespread adoption, with studies indicating that 80% of diagnosed obstructive sleep apnea patients opt for PAP devices.

Sleep apnea mask segment is anticipated to grow at the fastest rate of 7.6%, driven by the widespread adoption of these masks, increasing prevalence of comorbidities related to OSA, and higher adoption of CPAP machines in disease management. Key players are actively looking to innovate product strategies to meet the rising demand. For instance, in October 2023, Fisher & Paykel Healthcare Corporation Limited launched the F&P Solo mask in New Zealand and Australia for obstructive sleep apnea (OSA) treatment. This AutoFit nasal and pillow mask simplifies the setup process, enhancing user convenience. Such initiatives are expected to fuel the segment's growth.

End Use Insights

In 2023, homecare settings held a dominant market share of over 60%. Technological innovations have resulted in the creation of more portable, user-friendly, and quieter sleep apnea devices suitable for home use. Compact CPAP, BiPAP, and APAP machines, accompanied by lightweight masks and accessories, allow patients to manage their sleep apnea treatment at home comfortably. This preference for homecare settings, driven by enhanced comfort and convenience, contributes to the growth of this segment.

Hospital and sleep lab segment is anticipated to experience substantial growth as sleep apnea devices play a crucial role in these settings for diagnosing, monitoring, managing, treating, and supporting patients with sleep-related breathing disorders. In addition, in critical care settings like ICUs, hospitals utilize sleep apnea devices such as Continuous Positive Airway Pressure (CPAP) and Bi-level Positive Airway Pressure (BiPAP) to aid patients with compromised respiratory functions, thereby driving segment growth.

Regional Insights

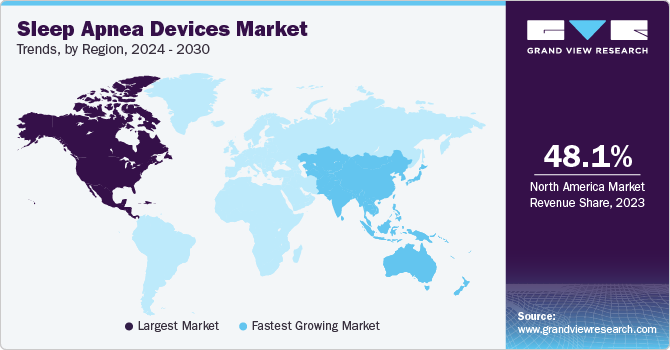

North America segment dominated the market with share of 48.1% in 2023. Changing lifestyles, growing disposable income, presence of renowned players, growing obese population, rising prevalence of respiratory diseases, growing awareness about OSA, and favorable government initiatives are some of the key factors driving the growth. Some of the key participants present in North America are Philips Respironics; Somnetics International Inc.; and ResMed. These companies have a strong business presence and have well-established supply & distribution channels across North America.

Asia Pacific segment is anticipated to grow at the fastest rate of 7.7% over the forecast period owing to the growing geriatric population and rising prevalence of lifestyle diseases such as cardiovascular diseases, cancer, hypertension, diabetes, and chronic respiratory diseases. As per the OECD iLibrary article on Asia/Pacific 2020, approximately 227 million individuals are diagnosed with type 2 diabetes in the Asia Pacific. The growing prevalence of chronic conditions is expected to contribute to the surge in OSA and drive the adoption of sleep apnea devices in countries in the Asia Pacific.

Key Companies & Market Share Insights

The competitive sleep apnea devices market is characterized by a few notable players, including ResMed, Philips Respironics (a division of Philips), Fisher & Paykel Healthcare, among others. These manufacturers are actively pursuing strategic initiatives such as mergers and acquisitions to strengthen their market positions. For instance, in July 2023, ResMed acquired Somnoware, a U.S. leader in sleep and respiratory care Home Care software.

Key Sleep Apnea Devices Companies:

- ResMed

- Respironics (a subsidiary of Koninklijke Philips N.V.)

- Fisher & Paykel Healthcare Limited

- Curative Medical, Inc.

- React Health (Respiratory Product Line from Invacare Corporation)

- Somnetics International, Inc.

- BMC Medical Co., Ltd.

- Natus Medical Incorporated

- SOMNOmedics GmbH

- Compumedics

- Itamar Medical Ltd.

- Nihon Kohden Corporation

Recent Developments

-

In November 2023, Vivos Therapeutics obtained FDA 510(k) Clearance for its CARE (Complete Airway Repositioning and/or Expansion) oral devices tailored for adults with severe obstructive sleep apnea (OSA). This clearance covers the company's prominent DNA, mRNA, and mmRNA oral appliances.

-

In October 2023, ResMed and Bittium Biosignals Ltd, a Bittium Corporation subsidiary, entered an agreement where ResMed becomes a distributor of Bittium Respiro, an advanced Home Sleep Apnea Test and Analysis Solution. The comprehensive solution includes the Bittium Respiro measuring device, its accessories, and the Bittium Respiro Analyst software analysis tool and service platform. The non-exclusive agreement covers Norway, the United Kingdom (UK), Switzerland, the Republic of Ireland, Finland, and Sweden

Sleep Apnea Devices Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4.5 billion

Revenue forecast in 2030

USD 6.9 billion

Growth Rate

CAGR of 6.2% from 2023 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends, clinical trials outlook, volume analysis

Segments covered

Product Type, End Use and Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country Scope

U.S.; Canada; UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

ResMed; Respironics (a subsidiary of Koninklijke Philips N.V.); Fisher & Paykel Healthcare Limited; Curative Medical, Inc.; React Health (Respiratory Product Line from Invacare Corporation); Somnetics International, Inc.; BMC Medical Co., Ltd.; Natus Medical Incorporated; SOMNOmedics GmbH; Compumedics; Itamar Medical Ltd.; Nihon Kohden Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sleep Apnea Devices Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the sleep apnea devices market report based on product type end use, and region.

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostic Devices

-

Actigraphs

-

Polysomnography (PSG) device

-

Respiratory Polygraphs

-

Pulse Oximeters

-

-

Therapeutic Devices

-

Positive Airway Pressure (PAP) Devices

-

CPAP

-

APAP

-

Bi-PAP

-

-

Oral Devices

-

Nasal Devices

-

Chin Straps

-

-

Sleep Apnea Masks

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals and Sleep Labs

-

Home Care

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Singapore

-

Thailand

-

-

Latin America

-

Mexico

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

U.A.E.

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global sleep apnea devices market size was estimated at USD 4.2 billion in 2022 and is expected to reach USD 4.5 billion in 2023.

b. The global sleep apnea devices market is expected to grow at a compound annual growth rate of 6.2% from 2023 to 2030 to reach USD 6.9 billion by 2030.

b. Therapeutic devices dominated the sleep apnea devices market with a share of 79.4% in 2021. This is attributable to promising reimbursement guidelines in various countries.

b. Some key players operating in the sleep apnea devices market include Curative Medical Inc.; Philips Respironics; ResMed; Fisher & Paykel Healthcare; Cadwell Laboratories; and Invacare Corporation.

b. Key factors that are driving the sleep apnea devices market growth include the increasing number of patients suffering from obstructive sleep apnea (OSA).

Table of Contents

Chapter 1. Sleep Apnea Devices Market: Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Segment Definitions

1.2.1. Product Type

1.2.2. End Use

1.2.3. Regional scope

1.2.4. Estimates and forecasts timeline

1.3. Research Methodology

1.4. Information Procurement

1.4.1. Purchased database

1.4.2. GVR’s internal database

1.4.3. Secondary sources

1.4.4. Primary research

1.4.5. Details of primary research

1.4.5.1. Data for primary interviews in North America

1.4.5.2. Data for primary interviews in Europe

1.4.5.3. Data for primary interviews in Asia Pacific

1.4.5.4. Data for primary interviews in Latin America

1.4.5.5. Data for Primary interviews in MEA

1.5. Information or Data Analysis

1.5.1. Data analysis models

1.6. Market Formulation & Validation

1.7. Model Details

1.7.1. Commodity flow analysis (Model 1)

1.7.2. Approach 1: Commodity flow approach

1.7.3. Volume price analysis (Model 2)

1.7.4. Approach 2: Volume price analysis

1.8. List of Secondary Sources

1.9. List of Primary Sources

Chapter 2. Sleep Apnea Devices Market: Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.2.1. Product Type outlook

2.2.2. End Use Outlook

2.2.3. Regional outlook

2.3. Competitive Insights

Chapter 3. Sleep Apnea Devices Market: Variables, Trends, & Scope

3.1. Market Lineage Outlook

3.1.1. Parent Market Outlook

3.1.2. Ancillary Market Outlook

3.2. Market Dynamics

3.2.1. Market Driver Analysis

3.2.1.1. Rising prevalence of obstructive sleep apnea

3.2.1.2. Technological advancement

3.2.1.3. Supportive initiatives by private organizations

3.2.2. Market Restraint Analysis

3.2.2.1. Complex regulatory and reimbursement frameworks

3.3. Sleep Apnea Devices Market Analysis Tools

3.3.1. Industry Analysis - Porter’s

3.3.1.1. Bargaining power of the suppliers

3.3.1.2. Bargaining power of the buyers

3.3.1.3. Threats of substitution

3.3.1.4. Threats from new entrants

3.3.1.5. Competitive rivalry

3.3.2. PESTEL Analysis

3.3.2.1. Political landscape

3.3.2.2. Economic and Social landscape

3.3.2.3. Technological landscape

3.4. Impact of COVID 19 on sleep apnea devices market

Chapter 4. Sleep Apnea Devices Market: Product Type Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. Sleep Apnea Devices Market: Product Type Movement Analysis, USD Million, 2023 & 2030

4.2.1. Diagnostic Devices

4.2.1.1. Diagnostic Devices Market Estimates And Forecasts, 2018 - 2030 (USD Billion)

4.2.1.2. Actigraphs

4.2.1.2.1. Actigraphs Market Estimates And Forecasts, 2018 - 2030 (USD Billion)

4.2.1.3. Polysomnography (PSG) device

4.2.1.3.1. Polysomnography (PSG) device Market Estimates And Forecasts, 2018 - 2030 (USD Billion)

4.2.1.4. Respiratory Polygraphs

4.2.1.4.1. Respiratory Polygraphs Market Estimates And Forecasts, 2018 - 2030 (USD Billion)

4.2.1.5. Pulse Oximeters

4.2.1.5.1. Pulse Oximeters Market Estimates And Forecasts, 2018 - 2030 (USD Billion)

4.2.2. Therapeutic Devices

4.2.2.1. Therapeutic Devices Market Estimates And Forecasts, 2018 - 2030 (USD Billion)

4.2.2.2. Positive Airway Pressure (PAP) Devices

4.2.2.2.1. Positive Airway Pressure (PAP) Devices Market Estimates And Forecasts, 2018 - 2030 (USD Billion)

4.2.2.2.2. CPAP

4.2.2.2.2.1. CPAP Market Estimates And Forecasts, 2018 - 2030 (USD Billion)

4.2.2.2.3. APAP

4.2.2.2.3.1. APAP Market Estimates And Forecasts, 2018 - 2030 (USD Billion)

4.2.2.2.4. Bi-PAP

4.2.2.2.4.1. Bi-PAP Market Estimates And Forecasts, 2018 - 2030 (USD Billion)

4.2.2.3. Oral Devices

4.2.2.3.1. Oral devices Market Estimates And Forecasts, 2018 - 2030 (USD Billion)

4.2.2.4. Nasal Devices

4.2.2.4.1. Nasal Devices Market Estimates And Forecasts, 2018 - 2030 (USD Billion)

4.2.2.5. Chin Straps

4.2.2.5.1. Chin Straps Market Estimates And Forecasts, 2018 - 2030 (USD Billion)

4.2.3. Sleep Apnea Masks

4.2.3.1. Sleep Apnea Masks Market Estimates And Forecasts, 2018 - 2030 (USD Billion)

Chapter 5. Sleep Apnea Devices Market: End Use Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. Sleep Apnea Devices Market: End Use Movement Analysis, USD Million, 2023 & 2030

5.2.1. Hospitals & Sleep Labs

5.2.1.1. Hospitals & Sleep Labs Market Estimates And Forecasts, 2018 - 2030 (USD Billion)

5.2.2. Home Care

5.2.2.1. Home Care Market Estimates And Forecasts, 2018 - 2030 (USD Billion)

Chapter 6. Sleep Apnea Devices Market: End use Type Estimates & Trend Analysis

6.1. Segment Dashboard

6.2. Sleep Apnea Devices Market: End use Type Movement Analysis, USD Million, 2023 & 2030

6.2.1. Providers

6.2.1.1. Providers Market Estimates And Forecasts, 2018 - 2030 (USD Billion)

6.2.2. Insurers

6.2.2.1. Insurers Market Estimates And Forecasts, 2018 - 2030 (USD Billion)

6.2.3. Healthcare Consumers

6.2.3.1. Healthcare Consumers Market Estimates And Forecasts, 2018 - 2030 (USD Billion)

6.2.4. Others

6.2.4.1. Others Market Estimates And Forecasts, 2018 - 2030 (USD Billion)

Chapter 7. Sleep Apnea Devices Market: Regional Estimates & Trend Analysis

7.1. Regional Market Share Analysis, 2023 & 2030

7.2. Regional Market Dashboard

7.3. Global Regional Market Snapshot

7.4. Market Size, & Forecasts Trend Analysis, 2018 to 2030:

7.5. North America

7.5.1. U.S.

7.5.1.1. Key country dynamics

7.5.1.2. Regulatory framework/ reimbursement structure

7.5.1.3. Competitive scenario

7.5.1.4. U.S. market estimates and forecasts 2018 to 2030 (USD Million)

7.5.2. Canada

7.5.2.1. Key country dynamics

7.5.2.2. Regulatory framework/ reimbursement structure

7.5.2.3. Competitive scenario

7.5.2.4. Canada market estimates and forecasts 2018 to 2030 (USD Million)

7.6. Europe

7.6.1. UK

7.6.1.1. Key country dynamics

7.6.1.2. Regulatory framework/ reimbursement structure

7.6.1.3. Competitive scenario

7.6.1.4. UK market estimates and forecasts 2018 to 2030 (USD Million)

7.6.2. Germany

7.6.2.1. Key country dynamics

7.6.2.2. Regulatory framework/ reimbursement structure

7.6.2.3. Competitive scenario

7.6.2.4. Germany market estimates and forecasts 2018 to 2030 (USD Million)

7.6.3. France

7.6.3.1. Key country dynamics

7.6.3.2. Regulatory framework/ reimbursement structure

7.6.3.3. Competitive scenario

7.6.3.4. France market estimates and forecasts 2018 to 2030 (USD Million)

7.6.4. Italy

7.6.4.1. Key country dynamics

7.6.4.2. Regulatory framework/ reimbursement structure

7.6.4.3. Competitive scenario

7.6.4.4. Italy market estimates and forecasts 2018 to 2030 (USD Million)

7.6.5. Spain

7.6.5.1. Key country dynamics

7.6.5.2. Regulatory framework/ reimbursement structure

7.6.5.3. Competitive scenario

7.6.5.4. Spain market estimates and forecasts 2018 to 2030 (USD Million)

7.6.6. Norway

7.6.6.1. Key country dynamics

7.6.6.2. Regulatory framework/ reimbursement structure

7.6.6.3. Competitive scenario

7.6.6.4. Norway market estimates and forecasts 2018 to 2030 (USD Million)

7.6.7. Sweden

7.6.7.1. Key country dynamics

7.6.7.2. Regulatory framework/ reimbursement structure

7.6.7.3. Competitive scenario

7.6.7.4. Sweden market estimates and forecasts 2018 to 2030 (USD Million)

7.6.8. Denmark

7.6.8.1. Key country dynamics

7.6.8.2. Regulatory framework/ reimbursement structure

7.6.8.3. Competitive scenario

7.6.8.4. Denmark market estimates and forecasts 2018 to 2030 (USD Million)

7.7. Asia Pacific

7.7.1. Japan

7.7.1.1. Key country dynamics

7.7.1.2. Regulatory framework/ reimbursement structure

7.7.1.3. Competitive scenario

7.7.1.4. Japan market estimates and forecasts 2018 to 2030 (USD Million)

7.7.2. China

7.7.2.1. Key country dynamics

7.7.2.2. Regulatory framework/ reimbursement structure

7.7.2.3. Competitive scenario

7.7.2.4. China market estimates and forecasts 2018 to 2030 (USD Million)

7.7.3. India

7.7.3.1. Key country dynamics

7.7.3.2. Regulatory framework/ reimbursement structure

7.7.3.3. Competitive scenario

7.7.3.4. India market estimates and forecasts 2018 to 2030 (USD Million)

7.7.4. Australia

7.7.4.1. Key country dynamics

7.7.4.2. Regulatory framework/ reimbursement structure

7.7.4.3. Competitive scenario

7.7.4.4. Australia market estimates and forecasts 2018 to 2030 (USD Million)

7.7.5. South Korea

7.7.5.1. Key country dynamics

7.7.5.2. Regulatory framework/ reimbursement structure

7.7.5.3. Competitive scenario

7.7.5.4. South Korea market estimates and forecasts 2018 to 2030 (USD Million)

7.7.6. Thailand

7.7.6.1. Key country dynamics

7.7.6.2. Regulatory framework/ reimbursement structure

7.7.6.3. Competitive scenario

7.7.6.4. Thailand market estimates and forecasts 2018 to 2030 (USD Million)

7.8. Latin America

7.8.1. Brazil

7.8.1.1. Key country dynamics

7.8.1.2. Regulatory framework/ reimbursement structure

7.8.1.3. Competitive scenario

7.8.1.4. Brazil market estimates and forecasts 2018 to 2030 (USD Million)

7.8.2. Mexico

7.8.2.1. Key country dynamics

7.8.2.2. Regulatory framework/ reimbursement structure

7.8.2.3. Competitive scenario

7.8.2.4. Mexico market estimates and forecasts 2018 to 2030 (USD Million)

7.8.3. Argentina

7.8.3.1. Key country dynamics

7.8.3.2. Regulatory framework/ reimbursement structure

7.8.3.3. Competitive scenario

7.8.3.4. Argentina market estimates and forecasts 2018 to 2030 (USD Million)

7.9. MEA

7.9.1. South Africa

7.9.1.1. Key country dynamics

7.9.1.2. Regulatory framework/ reimbursement structure

7.9.1.3. Competitive scenario

7.9.1.4. South Africa market estimates and forecasts 2018 to 2030 (USD Million)

7.9.2. Saudi Arabia

7.9.2.1. Key country dynamics

7.9.2.2. Regulatory framework/ reimbursement structure

7.9.2.3. Competitive scenario

7.9.2.4. Saudi Arabia market estimates and forecasts 2018 to 2030 (USD Million)

7.9.3. UAE

7.9.3.1. Key country dynamics

7.9.3.2. Regulatory framework/ reimbursement structure

7.9.3.3. Competitive scenario

7.9.3.4. UAE market estimates and forecasts 2018 to 2030 (USD Million)

7.9.4. Kuwait

7.9.4.1. Key country dynamics

7.9.4.2. Regulatory framework/ reimbursement structure

7.9.4.3. Competitive scenario

7.9.4.4. Kuwait market estimates and forecasts 2018 to 2030 (USD Million)

Chapter 8. Competitive Landscape

8.1. Recent Developments & Impact Analysis, By Key Market Participants

8.2. Company/Competition Categorization

8.3. Vendor Landscape

8.3.1. Key company market share analysis, 2023

8.3.2. ResMed

8.3.2.1. Company overview

8.3.2.2. Financial performance

8.3.2.3. Product benchmarking

8.3.2.4. Strategic initiatives

8.3.3. Respironics (a subsidiary of Koninklijke Philips N.V.)

8.3.4.

8.3.4.1. Company overview

8.3.4.2. Financial performance

8.3.4.3. Product benchmarking

8.3.4.4. Strategic initiatives

8.3.5. Fisher & Paykel Healthcare Limited

8.3.5.1. Company overview

8.3.5.2. Financial performance

8.3.5.3. Product benchmarking

8.3.5.4. Strategic initiatives

8.3.6. Curative Medical, Inc.

8.3.6.1. Company overview

8.3.6.2. Financial performance

8.3.6.3. Product benchmarking

8.3.6.4. Strategic initiatives

8.3.7. React Health (Respiratory Product Line from Invacare Corporation)

8.3.7.1. Company overview

8.3.7.2. Financial performance

8.3.7.3. Product benchmarking

8.3.7.4. Strategic initiatives

8.3.8. Somnetics International, Inc.

8.3.8.1. Company overview

8.3.8.2. Financial performance

8.3.8.3. Product benchmarking

8.3.8.4. Strategic initiatives

8.3.9. BMC Medical Co., Ltd.

8.3.9.1. Company overview

8.3.9.2. Financial performance

8.3.9.3. Product benchmarking

8.3.9.4. Strategic initiatives

8.3.10. Natus Medical Incorporated

8.3.10.1. Company overview

8.3.10.2. Financial performance

8.3.10.3. Product benchmarking

8.3.10.4. Strategic initiatives

8.3.11. SOMNOmedics GmbH

8.3.11.1. Company overview

8.3.11.2. Financial performance

8.3.11.3. Product benchmarking

8.3.11.4. Strategic initiatives

8.3.12. Compumedics

8.3.12.1. Company overview

8.3.12.2. Financial performance

8.3.12.3. Product benchmarking

8.3.12.4. Strategic initiatives

8.3.13. Itamar Medical Ltd.

8.3.13.1. Company overview

8.3.13.2. Financial performance

8.3.13.3. Product benchmarking

8.3.13.4. Strategic initiatives

8.3.14. Nihon Kohden Corporation

8.3.14.1. Company overview

8.3.14.2. Financial performance

8.3.14.3. Product benchmarking

8.3.14.4. Strategic initiatives

List of Tables

Table 1. List of Secondary Sources

Table 2. List of Abbreviations

Table 3. Global Sleep Apnea Devices Market, by Product type, 2018 - 2030 (USD Million)

Table 4. Global Sleep Apnea Devices Market, by end use, 2018 - 2030 (USD Million)

Table 5. Global Sleep Apnea Devices Market, by Region, 2018 - 2030 (USD Million)

Table 6. North America Sleep Apnea Devices Market, by Country, 2018 - 2030 (USD Million)

Table 7. North America Sleep Apnea Devices Market, by Product type, 2018 - 2030 (USD Million)

Table 8. North America Sleep Apnea Devices Market, by end use, 2018 - 2030 (USD Million)

Table 9. U.S. Sleep Apnea Devices Market, by Product type, 2018 - 2030 (USD Million)

Table 10. U.S. Sleep Apnea Devices Market, by end use, 2018 - 2030 (USD Million)

Table 11. Canada Sleep Apnea Devices Market, by Product type, 2018 - 2030 (USD Million)

Table 12. Canada Sleep Apnea Devices Market, by end use, 2018 - 2030 (USD Million)

Table 13. Europe Sleep Apnea Devices Market, by Country, 2018 - 2030 (USD Million)

Table 14. Europe Sleep Apnea Devices Market, by Product type, 2018 - 2030 (USD Million)

Table 15. Europe Sleep Apnea Devices Market, by end use, 2018 - 2030 (USD Million)

Table 16. Germany Sleep Apnea Devices Market, by Product type, 2018 - 2030 (USD Million)

Table 17. Germany Sleep Apnea Devices Market, by end use, 2018 - 2030 (USD Million)

Table 18. UK Sleep Apnea Devices Market, by Product type, 2018 - 2030 (USD Million)

Table 19. UK Sleep Apnea Devices Market, by end use, 2018 - 2030 (USD Million)

Table 20. France Sleep Apnea Devices Market, by Product type, 2018 - 2030 (USD Million)

Table 21. France Sleep Apnea Devices Market, by end use, 2018 - 2030 (USD Million)

Table 22. Italy Sleep Apnea Devices Market, by Product type, 2018 - 2030 (USD Million)

Table 23. Italy Sleep Apnea Devices Market, by end use, 2018 - 2030 (USD Million)

Table 24. Spain Sleep Apnea Devices Market, by Product type, 2018 - 2030 (USD Million)

Table 25. Spain Sleep Apnea Devices Market, by end use, 2018 - 2030 (USD Million)

Table 26. Denmark Sleep Apnea Devices Market, by Product type, 2018 - 2030 (USD Million)

Table 27. Denmark Sleep Apnea Devices Market, by end use, 2018 - 2030 (USD Million)

Table 28. Sweden Sleep Apnea Devices Market, by Product type, 2018 - 2030 (USD Million)

Table 29. Sweden Sleep Apnea Devices Market, by end use, 2018 - 2030 (USD Million)

Table 30. Norway Sleep Apnea Devices Market, by Product type, 2018 - 2030 (USD Million)

Table 31. Norway Sleep Apnea Devices Market, by end use, 2018 - 2030 (USD Million)

Table 32. Asia Pacific Sleep Apnea Devices Market, by Country, 2018 - 2030 (USD Million)

Table 33. Asia Pacific Sleep Apnea Devices Market, by Product type, 2018 - 2030 (USD Million)

Table 34. Asia Pacific Sleep Apnea Devices Market, by end use, 2018 - 2030 (USD Million)

Table 35. China Sleep Apnea Devices Market, by Product type, 2018 - 2030 (USD Million)

Table 36. China Sleep Apnea Devices Market, by end use, 2018 - 2030 (USD Million)

Table 37. Japan Sleep Apnea Devices Market, by Product type, 2018 - 2030 (USD Million)

Table 38. Japan Sleep Apnea Devices Market, by end use, 2018 - 2030 (USD Million)

Table 39. India Sleep Apnea Devices Market, by Product type, 2018 - 2030 (USD Million)

Table 40. South Korea Sleep Apnea Devices Market, by Product type, 2018 - 2030 (USD Million)

Table 41. South Korea Sleep Apnea Devices Market, by end use, 2018 - 2030 (USD Million)

Table 42. Australia Sleep Apnea Devices Market, by Product type, 2018 - 2030 (USD Million)

Table 43. Australia Sleep Apnea Devices Market, by end use, 2018 - 2030 (USD Million)

Table 44. Thailand Sleep Apnea Devices Market, by Product type, 2018 - 2030 (USD Million)

Table 45. Thailand Sleep Apnea Devices Market, by end use, 2018 - 2030 (USD Million)

Table 46. Latin America Sleep Apnea Devices Market, by Country, 2018 - 2030 (USD Million)

Table 47. Latin America Sleep Apnea Devices Market, by Product type, 2018 - 2030 (USD Million)

Table 48. Latin America Sleep Apnea Devices Market, by end use, 2018 - 2030 (USD Million)

Table 49. Brazil Sleep Apnea Devices Market, by Product type, 2018 - 2030 (USD Million)

Table 50. Brazil Sleep Apnea Devices Market, by end use, 2018 - 2030 (USD Million)

Table 51. Mexico Sleep Apnea Devices Market, by Product type, 2018 - 2030 (USD Million)

Table 52. Mexico Sleep Apnea Devices Market, by end use, 2018 - 2030 (USD Million)

Table 53. Argentina Sleep Apnea Devices Market, by Product type, 2018 - 2030 (USD Million)

Table 54. Argentina Sleep Apnea Devices Market, by end use, 2018 - 2030 (USD Million)

Table 55. Middle East & Africa Sleep Apnea Devices Market, by Country, 2018 - 2030 (USD Million)

Table 56. Middle East & Africa Sleep Apnea Devices Market, by Product type, 2018 - 2030 (USD Million)

Table 57. Middle East & Africa Sleep Apnea Devices Market, by end use, 2018 - 2030 (USD Million)

Table 58. South Africa Sleep Apnea Devices Market, by Product type, 2018 - 2030 (USD Million)

Table 59. South Africa Sleep Apnea Devices Market, by end use, 2018 - 2030 (USD Million)

Table 60. Saudi Arabia Sleep Apnea Devices Market, by Product type, 2018 - 2030 (USD Million)

Table 61. Saudi Arabia Sleep Apnea Devices Market, by end use, 2018 - 2030 (USD Million)

Table 62. UAE Sleep Apnea Devices Market, by Product type, 2018 - 2030 (USD Million)

Table 63. UAE Sleep Apnea Devices Market, by end use, 2018 - 2030 (USD Million)

Table 64. Kuwait Sleep Apnea Devices Market, by Product type, 2018 - 2030 (USD Million)

Table 65. Kuwait Sleep Apnea Devices Market, by end use, 2018 - 2030 (USD Million)

Table 66. Participant’s Overview

Table 67. Financial Performance

Table 68. Service Benchmarking

Table 69. Strategic Initiatives

List of Figures

Fig. 1 Sleep apnea devices market segmentation

Fig. 2 Market research process

Fig. 3 Information procurement

Fig. 4 Primary research pattern

Fig. 5 Market research approaches

Fig. 6 Value chain-based sizing & forecasting

Fig. 7 QFD modeling for market share assessment

Fig. 8 Market formulation & validation

Fig. 9 Sleep apnea devices market estimation process

Fig. 10 Sleep apnea devices market snapshot (USD Million), 2023

Fig. 11 Sleep apnea devices market trends & outlook

Fig. 12 Penetration & growth prospect mapping

Fig. 13 Sleep apnea devices market driver impact

Fig. 14 Sleep apnea restraint impact

Fig. 15 Sleep Apnea Devices Market - PESTLE Analysis

Fig. 16 Sleep Apnea Devices Market - PORTER’s Analysis

Fig. 17 Sleep apnea devices market, product outlook: Key takeaways

Fig. 18 Sleep apnea devices market: Product type movement analysis

Fig. 19 Diagnostic device estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 20 Global actigraphs market, 2018 - 2030 (USD Million)

Fig. 21 Global Polysomnography (PSG) device market, 2018 - 2030 (USD Million)

Fig. 22 Global respiratory polygraphs market, 2018 - 2030 (USD Million)

Fig. 23 Global cardiologist market, 2018 - 2030 (USD Million)

Fig. 24 Global ENT specialist market, 2018 - 2030 (USD Million)

Fig. 25 Global homecare nurses market, 2018 - 2030 (USD Million)

Fig. 26 Global sleep physicians market, 2018 - 2030 (USD Million)

Fig. 27 Global pulse oximeters market, 2018 - 2030 (USD Million)

Fig. 28 Therapeutic device estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 29 Global PAP device market, 2018 - 2030 (USD Million)

Fig. 30 Global CPAP device market, 2018 - 2030 (USD Million)

Fig. 31 Global APAP device market, 2018 - 2030 (USD Million)

Fig. 32 Global BiPAP device market, 2018 - 2030 (USD Million)

Fig. 33 Global oral device market, 2018 - 2030 (USD Million)

Fig. 34 Global nasal device market, 2018 - 2030 (USD Million)

Fig. 35 Global chinstraps market, 2018 - 2030 (USD Million)

Fig. 36 Sleep apnea masks estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 37 Hospitals and Sleep Labs market, 2018 - 2030 (USD Million)

Fig. 38 Home Care estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 39 Regional marketplace: Key takeaways

Fig. 40 Sleep apnea devices market: Regional movement analysis (USD Million)

Fig. 41 North America sleep apnea devices market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 42 U.S. sleep apnea devices market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 43 Canada sleep apnea devices market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 44 Europe sleep apnea devices market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 45 U.K. sleep apnea devices market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 46 Germany sleep apnea devices market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 47 Spain sleep apnea devices market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 48 France sleep apnea devices market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 49 Italy sleep apnea devices market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 50 Sweden sleep apnea devices market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 51 Denmark sleep apnea devices market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 52 Norway sleep apnea devices market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 53 Asia Pacific sleep apnea devices market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 54 China sleep apnea devices market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 55 Japan sleep apnea devices market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 56 India sleep apnea devices market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 57 South Korea sleep apnea devices market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 58 Singapore sleep apnea devices market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 59 Australia sleep apnea devices market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 60 Thailand sleep apnea devices market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 61 Latin America sleep apnea devices market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 62 Brazil sleep apnea devices market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 63 Argentina sleep apnea devices market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 64 Mexico sleep apnea devices market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 65 MEA sleep apnea devices market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 66 South Africa sleep apnea devices market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 67 Saudi Arabia sleep apnea devices market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 68 UAE sleep apnea devices market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 69 Kuwait sleep apnea devices market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 70 Company market share analysis for therapeutic devices, 2023 (%)

Fig. 71 Company market share analysis for diagnostic devices, 2023 (%)What questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Sleep Apnea Devices Product Type Outlook (Revenue, USD Million, 2018 - 2030)

- Diagnostic Devices

- Actigraphs

- Polysomnography (PSG) device

- Respiratory Polygraphs

- Pulse Oximeters

- Therapeutic Devices

- Positive Airway Pressure (PAP) Devices

- CPAP

- APAP

- Bi-PAP

- Oral Devices

- Nasal Devices

- Chin Straps

- Positive Airway Pressure (PAP) Devices

- Sleep Apnea Masks

- Diagnostic Devices

- Sleep Apnea Devices End Use Outlook (Revenue, USD Million, 2018 - 2030)

- Hospitals and Sleep Labs

- Home Care

- Sleep Apnea Devices Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- North America Sleep Apnea Devices Market, by Product Type

- Diagnostic Devices

- Actigraphs

- Polysomnography (PSG) device

- Respiratory Polygraphs

- Pulse Oximeters

- Therapeutic Devices

- Positive Airway Pressure (PAP) Devices

- CPAP

- APAP

- Bi-PAP

- Oral Devices

- Nasal Devices

- Chin Straps

- Positive Airway Pressure (PAP) Devices

- Sleep Apnea Masks

- Diagnostic Devices

- North America Sleep Apnea Devices Market, by End Use

- Hospitals and Sleep Labs

- Home Care

- U.S.

- U.S. Sleep Apnea Devices Market, by Product Type

- Diagnostic Devices

- Actigraphs

- Polysomnography (PSG) device

- Respiratory Polygraphs

- Pulse Oximeters

- Therapeutic Devices

- Positive Airway Pressure (PAP) Devices

- CPAP

- APAP

- Bi-PAP

- Oral Devices

- Nasal Devices

- Chin Straps

- Positive Airway Pressure (PAP) Devices

- Sleep Apnea Masks

- Diagnostic Devices

- U.S. Sleep Apnea Devices Market, by End Use

- Hospitals and Sleep Labs

- Home Care

- U.S. Sleep Apnea Devices Market, by Product Type

- Canada

- Canada Sleep Apnea Devices Market, by Product Type

- Diagnostic Devices

- Actigraphs

- Polysomnography (PSG) device

- Respiratory Polygraphs

- Pulse Oximeters

- Therapeutic Devices

- Positive Airway Pressure (PAP) Devices

- CPAP

- APAP

- Bi-PAP

- Oral Devices

- Nasal Devices

- Chin Straps

- Positive Airway Pressure (PAP) Devices

- Sleep Apnea Masks

- Diagnostic Devices

- Canada Sleep Apnea Devices Market, by End Use

- Hospitals and Sleep Labs

- Home Care

- Canada Sleep Apnea Devices Market, by Product Type

- North America Sleep Apnea Devices Market, by Product Type

- Europe

- Europe Sleep Apnea Devices Market, by Product Type

- Diagnostic Devices

- Actigraphs

- Polysomnography (PSG) device

- Respiratory Polygraphs

- Pulse Oximeters

- Therapeutic Devices

- Positive Airway Pressure (PAP) Devices

- CPAP

- APAP

- Bi-PAP

- Oral Devices

- Nasal Devices

- Chin Straps

- Positive Airway Pressure (PAP) Devices

- Sleep Apnea Masks

- Diagnostic Devices

- Europe Sleep Apnea Devices Market, by End Use

- Hospitals and Sleep Labs

- Home Care

- U.K.

- U.K. Sleep Apnea Devices Market, by Product Type

- Diagnostic Devices

- Actigraphs

- Polysomnography (PSG) device

- Respiratory Polygraphs

- Pulse Oximeters

- Therapeutic Devices

- Positive Airway Pressure (PAP) Devices

- CPAP

- APAP

- Bi-PAP

- Oral Devices

- Nasal Devices

- Chin Straps

- Positive Airway Pressure (PAP) Devices

- Sleep Apnea Masks

- Diagnostic Devices

- U.K. Sleep Apnea Devices Market, by End Use

- Hospitals and Sleep Labs

- Home Care

- U.K. Sleep Apnea Devices Market, by Product Type

- Germany

- Germany Sleep Apnea Devices Market, by Product Type

- Diagnostic Devices

- Actigraphs

- Polysomnography (PSG) device

- Respiratory Polygraphs

- Pulse Oximeters

- Therapeutic Devices

- Positive Airway Pressure (PAP) Devices

- CPAP

- APAP

- Bi-PAP

- Oral Devices

- Nasal Devices

- Chin Straps

- Positive Airway Pressure (PAP) Devices

- Sleep Apnea Masks

- Diagnostic Devices

- Germany Sleep Apnea Devices Market, by End Use

- Hospitals and Sleep Labs

- Home Care

- Germany Sleep Apnea Devices Market, by Product Type

- France

- France Sleep Apnea Devices Market, by Product Type

- Diagnostic Devices

- Actigraphs

- Polysomnography (PSG) device

- Respiratory Polygraphs

- Pulse Oximeters

- Therapeutic Devices

- Positive Airway Pressure (PAP) Devices

- CPAP

- APAP

- Bi-PAP

- Oral Devices

- Nasal Devices

- Chin Straps

- Positive Airway Pressure (PAP) Devices

- Sleep Apnea Masks

- Diagnostic Devices

- France Sleep Apnea Devices Market, by End Use

- Hospitals and Sleep Labs

- Home Care

- France Sleep Apnea Devices Market, by Product Type

- Italy

- Italy Sleep Apnea Devices Market, by Product Type

- Diagnostic Devices

- Actigraphs

- Polysomnography (PSG) device

- Respiratory Polygraphs

- Pulse Oximeters

- Therapeutic Devices

- Positive Airway Pressure (PAP) Devices

- CPAP

- APAP

- Bi-PAP

- Oral Devices

- Nasal Devices

- Chin Straps

- Positive Airway Pressure (PAP) Devices

- Sleep Apnea Masks

- Diagnostic Devices

- Italy Sleep Apnea Devices Market, by End Use

- Hospitals and Sleep Labs

- Home Care

- Italy Sleep Apnea Devices Market, by Product Type

- Spain

- Spain Sleep Apnea Devices Market, by Product Type

- Diagnostic Devices

- Actigraphs

- Polysomnography (PSG) device

- Respiratory Polygraphs

- Pulse Oximeters

- Therapeutic Devices

- Positive Airway Pressure (PAP) Devices

- CPAP

- APAP

- Bi-PAP

- Oral Devices

- Nasal Devices

- Chin Straps

- Positive Airway Pressure (PAP) Devices

- Sleep Apnea Masks

- Diagnostic Devices

- SpainSleep Apnea Devices Market, by End Use

- Hospitals and Sleep Labs

- Home Care

- Spain Sleep Apnea Devices Market, by Product Type

- Sweden

- Sweden Sleep Apnea Devices Market, by Product Type

- Diagnostic Devices

- Actigraphs

- Polysomnography (PSG) device

- Respiratory Polygraphs

- Pulse Oximeters

- Therapeutic Devices

- Positive Airway Pressure (PAP) Devices

- CPAP

- APAP

- Bi-PAP

- Oral Devices

- Nasal Devices

- Chin Straps

- Positive Airway Pressure (PAP) Devices

- Sleep Apnea Masks

- Diagnostic Devices

- Sweden Sleep Apnea Devices Market, by End Use

- Hospitals and Sleep Labs

- Home Care

- Sweden Sleep Apnea Devices Market, by Product Type

- Denmark

- Denmark Sleep Apnea Devices Market, by Product Type

- Diagnostic Devices

- Actigraphs

- Polysomnography (PSG) device

- Respiratory Polygraphs

- Pulse Oximeters

- Therapeutic Devices

- Positive Airway Pressure (PAP) Devices

- CPAP

- APAP

- Bi-PAP

- Oral Devices

- Nasal Devices

- Chin Straps

- Positive Airway Pressure (PAP) Devices

- Sleep Apnea Masks

- Diagnostic Devices

- Denmark Sleep Apnea Devices Market, by End Use

- Hospitals and Sleep Labs

- Home Care

- Denmark Sleep Apnea Devices Market, by Product Type

- Norway

- Norway Sleep Apnea Devices Market, by Product Type

- Diagnostic Devices

- Actigraphs

- Polysomnography (PSG) device

- Respiratory Polygraphs

- Pulse Oximeters

- Therapeutic Devices

- Positive Airway Pressure (PAP) Devices

- CPAP

- APAP

- Bi-PAP

- Oral Devices

- Nasal Devices

- Chin Straps

- Positive Airway Pressure (PAP) Devices

- Sleep Apnea Masks

- Diagnostic Devices

- Norway Sleep Apnea Devices Market, by End Use

- Hospitals and Sleep Labs

- Home Care

- Norway Sleep Apnea Devices Market, by Product Type

- Europe Sleep Apnea Devices Market, by Product Type

- Asia Pacific

- Asia Pacific Sleep Apnea Devices Market, by Product Type

- Diagnostic Devices

- Actigraphs

- Polysomnography (PSG) device

- Respiratory Polygraphs

- Pulse Oximeters

- Therapeutic Devices

- Positive Airway Pressure (PAP) Devices

- CPAP

- APAP

- Bi-PAP

- Oral Devices

- Nasal Devices

- Chin Straps

- Positive Airway Pressure (PAP) Devices

- Sleep Apnea Masks

- Diagnostic Devices

- Asia Pacific Sleep Apnea Devices Market, by End Use

- Hospitals and Sleep Labs

- Home Care

- Japan

- JapanSleep Apnea Devices Market, by Product Type

- Diagnostic Devices

- Actigraphs

- Polysomnography (PSG) device

- Respiratory Polygraphs

- Pulse Oximeters

- Therapeutic Devices

- Positive Airway Pressure (PAP) Devices

- CPAP

- APAP

- Bi-PAP

- Oral Devices

- Nasal Devices

- Chin Straps

- Positive Airway Pressure (PAP) Devices

- Sleep Apnea Masks

- Diagnostic Devices

- Japan Sleep Apnea Devices Market, by End Use

- Hospitals and Sleep Labs

- Home Care

- JapanSleep Apnea Devices Market, by Product Type

- China

- China Sleep Apnea Devices Market, by Product Type

- Diagnostic Devices

- Actigraphs

- Polysomnography (PSG) device

- Respiratory Polygraphs

- Pulse Oximeters

- Therapeutic Devices

- Positive Airway Pressure (PAP) Devices

- CPAP

- APAP

- Bi-PAP

- Oral Devices

- Nasal Devices

- Chin Straps

- Positive Airway Pressure (PAP) Devices

- Sleep Apnea Masks

- Diagnostic Devices

- China Sleep Apnea Devices Market, by End Use

- Hospitals and Sleep Labs

- Home Care

- China Sleep Apnea Devices Market, by Product Type

- India

- India Sleep Apnea Devices Market, by Product Type

- India Sleep Apnea Devices Market, by End Use

- Hospitals and Sleep Labs

- Home Care

- Australia

- Australia Sleep Apnea Devices Market, by Product Type

- Diagnostic Devices

- Actigraphs

- Polysomnography (PSG) device

- Respiratory Polygraphs

- Pulse Oximeters

- Therapeutic Devices

- Positive Airway Pressure (PAP) Devices

- CPAP

- APAP

- Bi-PAP

- Oral Devices

- Nasal Devices

- Chin Straps

- Positive Airway Pressure (PAP) Devices

- Sleep Apnea Masks

- Diagnostic Devices

- Australia Sleep Apnea Devices Market, by End Use

- Hospitals and Sleep Labs

- Home Care

- Australia Sleep Apnea Devices Market, by Product Type

- South Korea

- South Korea Sleep Apnea Devices Market, by Product Type

- Diagnostic Devices

- Actigraphs

- Polysomnography (PSG) device

- Respiratory Polygraphs

- Pulse Oximeters

- Therapeutic Devices

- Positive Airway Pressure (PAP) Devices

- CPAP

- APAP

- Bi-PAP

- Oral Devices

- Nasal Devices

- Chin Straps

- Positive Airway Pressure (PAP) Devices

- Sleep Apnea Masks

- Diagnostic Devices

- South Korea Sleep Apnea Devices Market, by End Use

- Hospitals and Sleep Labs

- Home Care

- South Korea Sleep Apnea Devices Market, by Product Type

- Singapore

- Singapore Sleep Apnea Devices Market, by Product Type

- Singapore Sleep Apnea Devices Market, by End Use

- Hospitals and Sleep Labs

- Home Care

- Thailand

- Thailand Sleep Apnea Devices Market, by Product Type

- Diagnostic Devices

- Actigraphs

- Polysomnography (PSG) device

- Respiratory Polygraphs

- Pulse Oximeters

- Therapeutic Devices

- Positive Airway Pressure (PAP) Devices

- CPAP

- APAP

- Bi-PAP

- Oral Devices

- Nasal Devices

- Chin Straps

- Positive Airway Pressure (PAP) Devices

- Sleep Apnea Masks

- Diagnostic Devices

- Thailand Sleep Apnea Devices Market, by End Use

- Hospitals and Sleep Labs

- Home Care

- Thailand Sleep Apnea Devices Market, by Product Type

- Asia Pacific Sleep Apnea Devices Market, by Product Type

- Latin America

- Latin America Sleep Apnea Devices Market, by Product Type

- Diagnostic Devices

- Actigraphs

- Polysomnography (PSG) device

- Respiratory Polygraphs

- Pulse Oximeters

- Therapeutic Devices

- Positive Airway Pressure (PAP) Devices

- CPAP

- APAP

- Bi-PAP

- Oral Devices

- Nasal Devices

- Chin Straps

- Positive Airway Pressure (PAP) Devices

- Sleep Apnea Masks

- Diagnostic Devices

- Latin America Sleep Apnea Devices Market, by End Use

- Hospitals and Sleep Labs

- Home Care

- Mexico

- Mexico Sleep Apnea Devices Market, by Product Type

- Diagnostic Devices

- Actigraphs

- Polysomnography (PSG) device

- Respiratory Polygraphs

- Pulse Oximeters

- Therapeutic Devices

- Positive Airway Pressure (PAP) Devices

- CPAP

- APAP

- Bi-PAP

- Oral Devices

- Nasal Devices

- Chin Straps

- Positive Airway Pressure (PAP) Devices

- Sleep Apnea Masks

- Diagnostic Devices

- Mexico Sleep Apnea Devices Market, by End Use

- Hospitals and Sleep Labs

- Home Care

- Mexico Sleep Apnea Devices Market, by Product Type

- Brazil

- Canada Sleep Apnea Devices Market, by Product Type

- Diagnostic Devices

- Actigraphs

- Polysomnography (PSG) device

- Respiratory Polygraphs

- Pulse Oximeters

- Therapeutic Devices

- Positive Airway Pressure (PAP) Devices

- CPAP

- APAP

- Bi-PAP

- Oral Devices

- Nasal Devices

- Chin Straps

- Positive Airway Pressure (PAP) Devices

- Sleep Apnea Masks

- Diagnostic Devices

- Canada Sleep Apnea Devices Market, by End Use

- Hospitals and Sleep Labs

- Home Care

- Canada Sleep Apnea Devices Market, by Product Type

- Argentina

- Argentina Sleep Apnea Devices Market, by Product Type

- Diagnostic Devices

- Actigraphs

- Polysomnography (PSG) device

- Respiratory Polygraphs

- Pulse Oximeters

- Therapeutic Devices

- Positive Airway Pressure (PAP) Devices

- CPAP

- APAP

- Bi-PAP

- Oral Devices

- Nasal Devices

- Chin Straps

- Positive Airway Pressure (PAP) Devices

- Sleep Apnea Masks

- Diagnostic Devices

- Argentina Sleep Apnea Devices Market, by End Use

- Hospitals and Sleep Labs

- Home Care

- Argentina Sleep Apnea Devices Market, by Product Type

- Latin America Sleep Apnea Devices Market, by Product Type

- Middle East & Africa

- Middle East & Africa Sleep Apnea Devices Market, by Product Type

- Diagnostic Devices

- Actigraphs

- Polysomnography (PSG) device

- Respiratory Polygraphs

- Pulse Oximeters

- Therapeutic Devices

- Positive Airway Pressure (PAP) Devices

- CPAP

- APAP

- Bi-PAP

- Oral Devices

- Nasal Devices

- Chin Straps

- Positive Airway Pressure (PAP) Devices

- Sleep Apnea Masks

- Diagnostic Devices

- Middle East & Africa Sleep Apnea Devices Market, by End Use

- Hospitals and Sleep Labs

- Home Care

- South Africa

- South Africa Sleep Apnea Devices Market, by Product Type

- Diagnostic Devices

- Actigraphs

- Polysomnography (PSG) device

- Respiratory Polygraphs

- Pulse Oximeters

- Therapeutic Devices

- Positive Airway Pressure (PAP) Devices

- CPAP

- APAP

- Bi-PAP

- Oral Devices

- Nasal Devices

- Chin Straps

- Positive Airway Pressure (PAP) Devices

- Sleep Apnea Masks

- Diagnostic Devices

- South Africa Sleep Apnea Devices Market, by End Use

- Hospitals and Sleep Labs

- Home Care

- South Africa Sleep Apnea Devices Market, by Product Type

- Saudi Arabia

- Saudi Arabia Sleep Apnea Devices Market, by Product Type

- Diagnostic Devices

- Actigraphs

- Polysomnography (PSG) device

- Respiratory Polygraphs

- Pulse Oximeters

- Therapeutic Devices

- Positive Airway Pressure (PAP) Devices

- CPAP

- APAP

- Bi-PAP

- Oral Devices

- Nasal Devices

- Chin Straps

- Positive Airway Pressure (PAP) Devices

- Sleep Apnea Masks

- Diagnostic Devices

- Saudi Arabia Sleep Apnea Devices Market, by End Use

- Hospitals and Sleep Labs

- Home Care

- Saudi Arabia Sleep Apnea Devices Market, by Product Type

- U.A.E.

- U.A.E. Sleep Apnea Devices Market, by Product Type

- Diagnostic Devices

- Actigraphs

- Polysomnography (PSG) device

- Respiratory Polygraphs

- Pulse Oximeters

- Therapeutic Devices

- Positive Airway Pressure (PAP) Devices

- CPAP

- APAP

- Bi-PAP

- Oral Devices

- Nasal Devices

- Chin Straps

- Positive Airway Pressure (PAP) Devices

- Sleep Apnea Masks

- Diagnostic Devices

- U.A.E. Sleep Apnea Devices Market, by End Use

- Hospitals and Sleep Labs

- Home Care

- U.A.E. Sleep Apnea Devices Market, by Product Type

- Kuwait

- Kuwait Sleep Apnea Devices Market, by Product Type

- Diagnostic Devices

- Actigraphs

- Polysomnography (PSG) device

- Respiratory Polygraphs

- Pulse Oximeters

- Therapeutic Devices

- Positive Airway Pressure (PAP) Devices

- CPAP

- APAP

- Bi-PAP

- Oral Devices

- Nasal Devices

- Chin Straps

- Positive Airway Pressure (PAP) Devices

- Sleep Apnea Masks

- Diagnostic Devices

- Kuwait Sleep Apnea Devices Market, by End Use

- Hospitals and Sleep Labs

- Home Care

- Kuwait Sleep Apnea Devices Market, by Product Type

- Middle East & Africa Sleep Apnea Devices Market, by Product Type

- North America

Sleep Apnea Devices Market Dynamics

Driver: Increasing Geriatric Population

The prevalence of sleep apnea is high in the elderly population and remains underdiagnosed owing to factors such as lack of awareness among people and non-specific presentation of the disease. The growing geriatric population due to increasing life expectancy is expected to lead to a rise in the prevalence of sleep disorders. For instance, according to WHO, in 2018, the world’s population of people aged 60 and above is expected to reach 2 billion by 2050. Moreover, the global elderly population (above 60 years) will double from 12% to 22%. In addition, OSA is a common disorder in the elderly population, affecting around 13% to 32% of people aged over 65 years. An increase in geriatric population is expected to boost the adoption of sleep apnea devices, as this population group is more susceptible to sleep apnea. Furthermore, the prevalence of sleep apnea is increasing in the geriatric population, as comorbidities associated with sleep apnea are high in the elderly population.

Driver: Large Patient Pool Suffering from Sleep Apnea

Sleep apnea is a sleeping disorder, characterized by irregular breathing, thus providing insufficient oxygen to the brain. According to the American Sleep Association, an estimated 50 million to 70 million people in the U.S. are suffering from some form of sleep disorder. Moreover, according to the Canadian Respiratory Journal, in 2014, around 5.4 million adults in Canada were diagnosed with sleep apnea or were at higher risk of developing OSA. According to a study conducted by ResMed in 2018, around 175 million people in Europe were suffering from sleep apnea. Moreover, people with obesity and hypertension are more likely to develop sleep apnea. As per the analysis made by the CDC, the prevalence of obesity in the U.S. is 39.8%, accounting for nearly 93.3 million adults in 2015–2016. According to WHO, in 2019, more than 50% of men and women living in Europe were estimated to be overweight. The average obesity rate in the region is 23.3%. Hence, the number of people affected with sleep apnea is likely to increase over the forecast period.

Restraint: High Cost of the Pap Devices

The initial cost of a PAP device set-up at home consists of renting of the CPAP machine, humidifier, face or nasal mask, heated hose, filters, and many other accessories. Their cost varies between USD 1,000 and USD 4,000 (without insurance), depending on the brand, model of machine, and features. Although health insurance covers the cost of sleep apnea treatment, patients are required to bear some part of the total cost. Moreover, portable travel-friendly CPAP devices launched in the market are considered luxury items and are not covered by any insurance company. Furthermore, patients who are undergoing sleep apnea treatment, usually rent CPAP devices, for which they are required to purchase accessories such as tubing and masks separately, which increases the cost of treatment. This high cost of PAP devices is limiting the market growth. According to the Journal of Clinical Sleep Medicine in 2017, the main reason for Indians not using CPAP devices is its high cost.

What Does This Report Include?

This section will provide insights into the contents included in this sleep apnea devices market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Sleep apnea devices market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Sleep apnea devices market quantitative analysis

-

Market size, estimates, and forecast from 2018 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

A three-pronged approach was followed for deducing the sleep apnea devices market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for sleep apnea devices market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of sleep apnea devices market data depending on the type of information we’re trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-

Qualitative Functional Deployment (QFD) Modelling for market share assessment.

Market formulation and validation: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilize different methods of data analysis depending on the type of information we’re trying to uncover in our research.

-

Market Formulation: This step involves the finalization of market numbers. This step on an internal level is designed to manage outputs from the Data Analysis step.

-

Data Normalization: The final market estimates and forecasts are then aligned and sent to industry experts, in-panel quality control managers for validation.

-

This step also entails the finalization of the report scope and data representation pattern.

-

Validation: The process entails multiple levels of validation. All these steps run in parallel, and the study is forwarded for publishing only if all three levels render validated results.

Sleep Apnea Devices Market Categorization:

The sleep apnea devices market was categorized into three segments, namely product type (Diagnostic Devices, Therapeutic Devices, Sleep Apnea Masks), end-use (Hospitals and Sleep Labs, Home Care), and region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa).

Segment Market Methodology:

The sleep apnea devices market was segmented into product type, end-use, and regions. The demand at a segment level was deduced using a funnel method. Concepts like the TAM, SAM, SOM, etc., were put into practice to understand the demand. We at GVR deploy three methods to deduce market estimates and determine forecasts. These methods are explained below:

Market research approaches: Bottom-up

-

Demand estimation of each product across countries/regions summed up to from the total market.

-

Variable analysis for demand forecast.

-

Demand estimation via analyzing paid database, and company financials either via annual reports or paid database.

-

Primary interviews for data revalidation and insight collection.

Market research approaches: Top-down

-

Used extensively for new product forecasting or analyzing penetration levels.

-

Tool used invoice product flow and penetration models Use of regression multi-variant analysis for forecasting Involves extensive use of paid and public databases.

-

Primary interviews and vendor-based primary research for variable impact analysis.

Market research approaches: Combined

- This is the most common method. We apply concepts from both the top-down and bottom-up approaches to arrive at a viable conclusion.

Regional Market Methodology:

The sleep apnea devices market was analyzed at a regional level. The globe was divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa, keeping in focus variables like consumption patterns, export-import regulations, consumer expectations, etc. These regions were further divided into twenty-three countries, namely, the U.S.; Canada; the UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

All three above-mentioned market research methodologies were applied to arrive at regional-level conclusions. The regions were then summed up to form the global market.

Sleep apnea devices market companies & financials:

The sleep apnea devices market was analyzed via companies operating in the sector. Analyzing these companies and cross-referencing them to the demand equation helped us validate our assumptions and conclusions. Key market players analyzed include:

-

BMC Medical Co., Ltd. (BMC) - BMC Medical Co., Ltd. (BMC) is a China-based private device manufacturer of home respiratory care devices. The company’s main product portfolio consists of Sleep Disorder Breathing (SDB) diagnostic devices, flow generators, and patient interface devices. The company categorizes its business offerings into three segments: home care, medical care, and respiratory consumables. It has received U.S. FDA clearance, internationally recognized ISO quality certification, CE Mark from the EU, CFDA clearance from China, and many other regulatory approvals from other countries, which allow it to sell & trade products globally. As of 2020, it is operating in more than 180 countries.

-

CareFusion Corp. (Part of Becton, Dickinson & Company) - CareFusion Corp. is a medical device manufacturer, as well as a distributor of diagnostic home sleep apnea recorders, sleep sensors, & therapeutic intraoral equipment. The company also specializes in automation solutions and provides management solutions. Its key products include Alaris infusion pumps, Pyxis automated dispensing solutions, Avea, and Airlife & LTV ventilation & respiratory products. The company’s business is divided into products and solutions: Ultima sensors, PureFlow, disposable airflow, MediByte, dental sleep solutions, cardiac sleep solutions, and sleep labs. It has a broad portfolio of products with a strong international customer pool across 6 continents. CareFusion came into existence in 2009 as a medical technology business spinoff from Cardinal Health. The company was acquired by Becton, Dickinson & Company in March 2015, with a combined portfolio offering integrated medication management solutions and smart devices for hospital pharmacies to point-of-care facilities, across 150 countries globally.

-

GE Healthcare - GE Healthcare is a subsidiary of General Electric Company (GE). The company provides medical technologies and services to deliver advanced patient care across the world. Its main area of expertise includes technologies and services, such as medical diagnostics, drug discovery, medical imaging & information technologies, patient monitoring systems, performance solution services, and biopharmaceutical technologies. GE Healthcare serves healthcare professionals and patients in around 100 countries globally. GE Healthcare’s IT solutions offer integrated care solutions, which enable better clinical and financial outcomes.

-

Koninklijke Philips N.V. - Koninklijke Philips N.V. operates in three business areas: healthcare, consumer lifestyle, and lighting. The company is a manufacturer of diagnostic and therapeutic devices. Its subsidiary—Philips Respironics—currently offers products related to respiratory disorders. The company has a large portfolio of solutions catering to Continuous Positive Airway Pressure (CPAP) devices, sleep therapy, durable medical equipment, sleep apnea, respiratory care, COPD, portable oxygen, and home health. Its healthcare business is divided into four segments: clinical informatics & home healthcare solutions, imaging systems, customer services, and patient care. The company owns well-recognized oxygen concentrator brands, such as DreamStation CPAP & BiPAP.

-

ResMed - ResMed is a healthcare company that develops, manufactures, and distributes medical devices & cloud-based software for diagnosis & treatment of sleep & respiratory disorders, such as Sleep Disordered Breathing (SDB), neuromuscular diseases, & COPD. Products manufactured by the company for SDB include devices used for various therapeutic, diagnostic, and management purposes, which can help in treating obstructive sleep & respiratory disorders. The company operates in more than 120 countries through its subsidiaries and independent distributors.

-

Compumedics Ltd. - Compumedics Limited is involved in the expansion, production, and development of diagnostic technology for enhancement of sleep, and brain function, & multiple applications associated with monitoring ultrasonic blood flow. The company’s subsidiaries—Neuroscan and DWL Elektronishe Systeme GmbH—along with Compumedics, have a wide international reach, including the Americas, Australia, APAC, Middle East, & Europe. The company provides solutions by converting large amounts of data into valuable information, which can lead to precise diagnoses for serious health conditions. It caters to customers in the field of sleep diagnostics, neurology diagnostics, magnetoencephalography, and brain research. The company previously focused on its growth in the home monitoring market and international sleep clinics.

-

Curative Medical - Curative Medical is a privately held company involved in designing and manufacturing medical devices for the diagnosis & treatment of cardiopulmonary diseases & sleep disorders. The company manufactures devices such as bilevel, PAP, & CPAP respirators, sleep diagnostic solutions, cardiovascular catheters, and breathing & ventilation masks. It currently operates in the U.S., Germany, and China. In October 2015, Curative Medical was acquired by ResMed China to expand business operations in the Chinese market. The two companies serve as independent identities in China.

-

Fisher & Paykel Healthcare Ltd. - Fisher & Paykel Healthcare Limited is a medical devices company involved in designing, developing, and manufacturing medical devices & systems for respiratory care, OSA, & neonatal care. The company provides devices such as masks and CPAP devices for hospitals and home care. It also offers solutions for adult and infant respiratory problems such as masks, nasal flow therapy, & ventilators. It has offices in 37 countries and offers products in over 120 countries across the globe.

-

Imthera Medical, Inc. - Imthera Medical, Inc. is a medical device manufacturing company that designs and manufactures devices for the treatment of OSA. The sleep apnea implant by Imthera has been approved as an investigational device exemption by the U.S. F.D.A. This was expected to help in evaluating the safety and effectiveness of the therapy in individuals who find it difficult to try PAP therapy or any other related sleep apnea treatments.

-

Invacare Corporation - Invacare Corporation is a leading manufacturer and distributor of medical equipment used in nonacute care settings. The company manufactures, designs, and distributes homecare & long-term care medical devices, such as powered wheelchairs, scooters, walkers, pressure care, as well as other respiratory products including PAP devices & oxygen concentrators. Furthermore, the company offers mobility products and various medical devices that cater to conditions such as COPD, brain injury, pressure ulcers, & spinal cord injury. It has a presence in 80 countries across the globe.

Value chain-based sizing & forecasting

Supply Side Estimates

-

Company revenue estimation via referring to annual reports, investor presentations, and Hoover’s.

-

Segment revenue determination via variable analysis and penetration modeling.

-

Competitive benchmarking to identify market leaders and their collective revenue shares.

-

Forecasting via analyzing commercialization rates, pipelines, market initiatives, distribution networks, etc.

Demand side estimates

-

Identifying parent markets and ancillary markets

-

Segment penetration analysis to obtain pertinent

-

revenue/volume

-

Heuristic forecasting with the help of subject matter experts

-

Forecasting via variable analysis

Sleep Apnea Devices Market Report Objectives:

-

Understanding market dynamics (in terms of drivers, restraints, & opportunities) in the countries.

-

Understanding trends & variables in the individual countries & their impact on growth and using analytical tools to provide high-level insights into the market dynamics and the associated growth pattern.

-

Understanding market estimates and forecasts (with the base year as 2023, historic information from 2018 to 2023, and forecast from 2024 to 2030). Regional estimates & forecasts for each category are available and are summed up to form the global market estimates.

Sleep Apnea Devices Market Report Assumptions:

-

The report provides market value for the base year 2023 and a yearly forecast till 2030 in terms of revenue/volume or both. The market for each of the segment outlooks has been provided on region & country basis for the above-mentioned forecast period.

-

The key industry dynamics, major technological trends, and application markets are evaluated to understand their impact on the demand for the forecast period. The growth rates were estimated using correlation, regression, and time-series analysis.

-

We have used the bottom-up approach for market sizing, analyzing key regional markets, dynamics, & trends for various products and end-users. The total market has been estimated by integrating the country markets.

-

All market estimates and forecasts have been validated through primary interviews with the key industry participants.

-

Inflation has not been accounted for to estimate and forecast the market.

-

Numbers may not add up due to rounding off.

-

Europe consists of EU-8, Central & Eastern Europe, along with the Commonwealth of Independent States (CIS).

-

Asia Pacific includes South Asia, East Asia, Southeast Asia, and Oceania (Australia & New Zealand).

-

Latin America includes Central American countries and the South American continent

-

Middle East includes Western Asia (as assigned by the UN Statistics Division) and the African continent.

Primary Research