- Home

- »

- Medical Devices

- »

-

Slit Lamps Market Size, Share And Growth Report, 2030GVR Report cover

![Slit Lamps Market Size, Share & Trends Report]()

Slit Lamps Market (2024 - 2030 ) Size, Share & Trends Analysis Report By Modality, By Type (Analog, Digital), By Application (Cataract, Dry Eye Syndrome), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-309-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Slit Lamps Market Summary

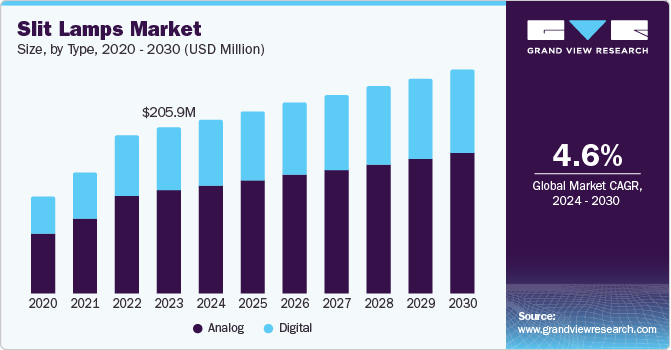

The global slit lamps market size was estimated to be USD 205.9 million in 2023 and is projected to reach USD 283.6 million by 2030, growing at a CAGR of 4.6% from 2024 to 2030. The slit lamp market is a crucial segment within the ophthalmic diagnostic equipment industry, experiencing steady growth due to the rising global prevalence of eye disorders such as cataracts, glaucoma, and macular degeneration.

Key Market Trends & Insights

- North America slit lamps market dominated the overall global market and accounted for the 40.33% revenue share in 2023.

- The slit lamps market in Asia Pacific region is expected to grow at the fastest growth rate during the forecast period.

- Based on type, the analog segment accounted for the largest market share in 2023 and shows the fastest CAGR over the forecast period.

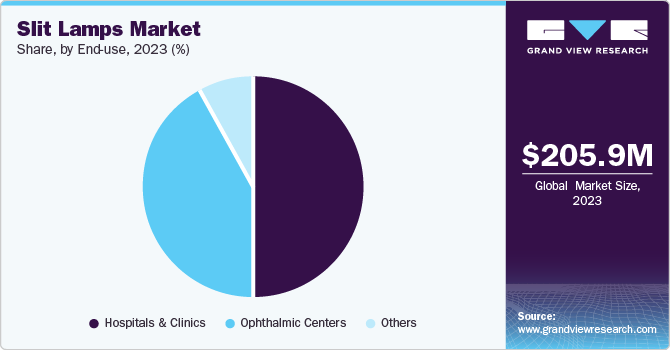

- In terms of end-use, the hospitals & clinics segment accounted for the largest revenue share of 49.5% in 2023 and shows the fastest CAGR over the forecast period.

- Based on modality, the portable segment accounted for the largest market share in 2023 and shows the fastest CAGR over the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 205.9 Million

- 2030 Projected Market Size: USD 283.6 Million

- CAGR (2024-2030): 4.6%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

The aging population is a significant driver of this market, as older individuals are more susceptible to these conditions, requiring regular eye examinations and advanced diagnostic tools. Technological advancements have led to the development of more sophisticated slit lamps, integrating features such as digital imaging, enhanced illumination systems, and improved ergonomics. For instance, an article by Healio published in January 2022 mentioned that some companies are developing 3D slit lamps, which will offer enhanced ergonomics.

These innovations enhance diagnostic accuracy and patient comfort, making slit lamps indispensable in both routine eye exams and specialized ophthalmic procedures. In addition, the rising prevalence of vision loss, due to conditions such as glaucoma and age-related macular degeneration, underscores the importance of slit lamps in the market. These devices are crucial for early detection and management, driving demand for advanced diagnostic tools in ophthalmology.

Projected Change in Vision Loss 2020 to 2050 (in millions):

Category

2020

2050

Male

497

780

Female

609

978

Total

1,106

1,758

Geographically, North America and Europe dominate the market due to well-established healthcare infrastructures and high awareness of eye health. However, the Asia Pacific region is emerging as a lucrative market, driven by increasing healthcare investments, growing awareness, and a large patient pool. Nearly two-thirds of patients with moderate-to-severe vision impairment are from East, South, and Central Asia, despite these regions making up only 51% of the global population. High-income countries in the Asia Pacific have the highest myopia rates at 53.4%, with Singapore having one of the world's highest myopia rates. By 2050, 80% to 90% of Singaporean adults over 18 may be myopic, and 15% to 25% could have high myopia. Despite a large population needing eye care, this demand remains unmet in the Asia Pacific. In Southeast Asia, only 4 out of 10 countries meet the target ophthalmologist-population ratio (1:100,000), with most ophthalmologists concentrated in urban areas.

Governments and private sectors are increasing investments in advanced ophthalmic equipment and infrastructure. For example, India's NPCBVI program has received significant funding to improve eye care services and reduce blindness. China's "Healthy China 2030" initiative includes public awareness campaigns, free eye screenings, and educational programs to promote regular eye check-ups and early disease detection. Non-profits such as the Fred Hollows Foundation are also active, organizing cataract surgery camps and distributing glasses to underserved communities. These efforts are enhancing eye care access and encouraging regular eye health maintenance. Thus, expanding the market for slit lamps.

Market Concentration & Characteristics

The slit lamps market is characterized by a high level of industry concentration, dominated by a few key players such as Haag-Streit, Topcon Corporation, and Carl Zeiss Meditec. These companies lead in technological innovation and market share. The market is driven by increasing demand for advanced diagnostic tools, fueled by the rising prevalence of eye disorders and an aging population. Technological advancements, such as digital imaging and enhanced ergonomics, are crucial features.

The slit lamps industry exhibits a notable degree of innovation, with companies continuously introducing advanced features to enhance diagnostic accuracy and patient comfort. According to the Indian Journal of Ophthalmology, in March 2022, slit lamp‑based intraocular lens microscope (SLIM) transforms the slit lamp into a microscope for swift screening and treatment of pathogens in clinics. This DIY setup saves time and costs, empowering medical staff to rapidly diagnose and treat infections.

Regulations play a significant role in shaping the slit lamp industry, ensuring product safety, efficacy, and quality standards. Compliance with regulatory requirements, such as FDA approvals in the U.S. and CE markings in the European Union, is essential for market entry. Stringent regulations also influence product development, innovation, and manufacturing practices to meet established standards. In addition, regulatory changes and updates impact market dynamics, affecting market players' strategies and investments. Overall, adherence to regulations fosters consumer trust promotes market transparency and drives continuous improvement in slit lamp technology and practices.

Mergers and acquisitions in the slit lamps industry are rising due to the need for research and development, reflecting the industry's dynamic nature. Companies are leveraging M&A activities to innovate and offer advanced solutions that meet the evolving needs of healthcare professionals. For instance, in November 2022, Advancing Eyecare, a leading provider of ophthalmic instruments in North America, announced its acquisition of Veatch Ophthalmic Instruments, a prominent U.S. distributor of ophthalmic equipment.

In the slit lamps industry, potential substitutes include handheld ophthalmoscopes and portable fundus cameras. Handheld ophthalmoscopes, while less advanced, offer basic eye examination capabilities and are more affordable and portable. Portable fundus cameras provide high-resolution imaging of the retina, making them suitable alternatives for specific diagnostic needs, especially in remote or mobile settings. In May 2024, the FDA approved Aurora AEye, the first handheld AI fundus camera. This device can instantly detect diabetic retinopathy with a single image of each eye. However, these substitutes often lack the comprehensive diagnostic capabilities and versatility of slit lamps. Despite these alternatives, slit lamps remain the preferred choice for detailed anterior and posterior segment examinations due to their superior imaging quality and functionality in clinical practice.

In the slit lamps industry, regional expansion is driven by the growing demand for advanced ophthalmic diagnostic tools and services. Market players are strategically expanding their presence into new geographic regions to capitalize on emerging opportunities and meet the evolving needs of healthcare providers and patients. Topcon Corporation's 2025 mid-term business plan aims to boost production capacity for business expansion and enhance production efficiency via digitalization and automation, with a planned investment of 10 million yen. By expanding their reach, companies aim to tap into underserved markets, increase brand visibility, and drive revenue growth while contributing to improved eye care access and outcomes on a global scale.

Type Insights

The analog segment accounted for the largest market share in 2023 and shows the fastest CAGR over the forecast period. This significant market share is attributed to the reliability, cost-effectiveness, and widespread adoption of analog slit lamps in various clinical settings. Despite advancements in digital technology, many healthcare providers prefer analog devices for their simplicity and proven performance. The ongoing demand for analog diagnostic tools, coupled with continuous improvements in analog slit lamp design and functionality, drives the robust growth of this segment in the slit lamps market.

Digital segment held substantial market share in 2023. Digital slit lamps offer features such as adjustable magnification, filters, and image enhancement capabilities. These features enable ophthalmologists to examine specific structures of the eye in greater detail, providing a more comprehensive picture of eye health.

End-use Insights

The hospitals & clinics segment accounted for the largest revenue share of 49.5% in 2023 and shows the fastest CAGR over the forecast period. Slit lamps are essential diagnostic tools utilized by ophthalmologists and optometrists for comprehensive eye examinations, including assessments of anterior and posterior segments, aiding in the diagnosis and management of various eye conditions. These devices play a critical role in routine eye care, pre-operative evaluations, and post-operative follow-ups, contributing to improved patient outcomes and vision health. The hospitals and clinics segment represents a significant market opportunity driven by increasing demand for advanced ophthalmic diagnostics and treatments.

Ophthalmic centers segment held significant market share in 2023. Ophthalmic centers offer a wider range of eye care services compared to optometrists' offices. This necessitates a broader range of diagnostic tools, including slit lamps for detailed examinations of the eye's anterior and posterior segments. Ophthalmic centers often specialize in treating complex eye conditions such as glaucoma, retinal diseases, and corneal disorders. Slit lamps are essential for diagnosing and monitoring these conditions effectively, thereby fostering the market growth.

Modality Insights

The portable segment accounted for the largest market share in 2023 and shows the fastest CAGR over the forecast period. These portable slit lamps offer convenience, flexibility, and ease of transportation, enabling on-the-go eye examinations and screenings. For instance, the LED lamp employed in the SL-150 Portable Slit Lamp boasts a 20,000-hour lifespan at full power, nearly ten times longer than a typical Halogen lamp. Its energy efficiency allows the SL-150 to operate for extended periods without requiring battery replacements. They are particularly beneficial for outreach programs, mobile clinics, and telemedicine initiatives, extending eye care access to underserved populations and remote regions. With advancements in battery technology and lightweight designs, portable slit lamps provide reliable and efficient diagnostic capabilities, contributing to improved eye health outcomes and increased healthcare accessibility worldwide.

Tabletop segment is anticipated to foster remarkable CAGR during the forecast period. They offer a wider range of functionalities compared to portable models. These features, such as adjustable illumination, high magnification, and various filters, enable detailed examinations of the anterior and posterior segments of the eye, crucial for comprehensive eye care in ophthalmic centers. Advanced tabletop slit lamps provide high-resolution digital imaging capabilities. This allows for better visualization of eye structures, facilitates documentation for patient records.

Application Insights

The cataract segment accounted for the largest market share in 2023, and is expected to grow with the fastest CAGR over the forecast period. Slit lamps equipped with specialized lenses and imaging capabilities enable precise evaluation of cataract severity, aiding in treatment planning and surgical decision-making. These devices facilitate detailed examination of the anterior segment of the eye, including the lens, cornea, and anterior chamber, allowing ophthalmologists to monitor cataract progression and assess post-operative outcomes. The cataract segment plays a vital role in improving patient care and visual outcomes through accurate diagnosis and tailored treatment approaches.

Macular degeneration segment witnessed considerable CAGR during the forecast period. Age-related macular degeneration is a leading cause of vision loss in people over 50. As the global population ages, the prevalence of AMD is expected to increase significantly, driving the demand for diagnostic tools such as slit lamps. The medical community increasingly emphasizes early intervention for AMD to preserve vision. Slit lamps are a critical tool for this approach.

Regional Insights

North America slit lamps market dominated the overall global market and accounted for the 40.33% revenue share in 2023. Some key factors contributing to the growth include the high prevalence of eye disorders, an aging population, and increasing healthcare expenditure. Technological advancements, including digital imaging and integration with electronic health records, are enhancing diagnostic accuracy and efficiency, further fueling market demand. Government initiatives and programs aimed at improving vision health, alongside a strong focus on preventive eye care, also contribute to market growth. In addition, the presence of leading medical device manufacturers and continuous innovation in ophthalmic equipment bolster the expansion of the slit lamps market in North America.

U.S. Slit Lamps Market Trends

The slit lamps market in the U.S. held a significant share of North America's slit lamps market in 2023, driven by factors such as aging population, rising prevalence of eye diseases, and advancements in diagnostic technology. According to CDC, in December 2023, around 1.8 million Americans aged 40+ have AMD, with another 7.3 million at high risk due to large drusen. AMD is the leading cause of permanent vision impairment for reading and close-up tasks in those aged 65 and older.

Europe Slit Lamps Market Trends

The European slit lamps market is witnessing growth fueled by technological advancements, the quality of healthcare infrastructure, and the rising awareness of eye health and early disease detection. With well-established healthcare systems across European countries, there is a notable demand for advanced and high-quality medical equipment, which is expected to increase the demand for these devices in the European market. Increasing demand for advanced eye care solutions and preventive measures are key trends shaping the slit lamps market in Europe.

In the UK the slit lamps market is witnessing significant growth driven by several factors. These include an aging population with increasing prevalence of age-related eye conditions, such as cataracts and glaucoma. For instance, according to The Royal College of Ophthalmologists, in the UK, over 700,000 individuals have glaucoma, with half unaware of their condition. Glaucoma UK's urging for eye tests comes as the number of people with glaucoma is projected to rise by nearly a third between 2020 and 2035.

The slit lamps market in France is witnessing growth, driven by increased healthcare investments and initiatives like L'OCCITANE France's support for Helen Keller Europe's "Plan Vue" program in 2023-2024. Inspired by the ChildSight initiative, this project aims to raise awareness and screen, treat, and monitor visual impairments among schoolchildren in priority areas of Nanterre and Aubervilliers. Such programs enhance the demand for advanced diagnostic tools, including slit lamps, by emphasizing early detection and treatment of eye conditions. Additionally, the aging population and a strong focus on preventive eye care further fuel the market growth in France.

The Germany slit lamps market is experiencing notable growth, driven by the country's advanced healthcare infrastructure and high prevalence of eye disorders. Increasing demand for precision diagnostic tools and technological advancements, such as digital imaging and integration with electronic health records, are key trends. Germany's aging population and a strong focus on preventive eye care contribute to the rising need for slit lamps. According to AARP, Germany's population aged 65 and older is expected to increase by 41 percent, reaching 24 million by 2050, which will represent almost one-third of the country's total population.

Asia Pacific Slit Lamps Market Trends

The slit lamps market in Asia Pacific region is expected to grow at the fastest growth rate during the forecast period. China and Japan are poised to lead the Asia Pacific market in the upcoming period. Moreover, the availability of trained professionals and the presence of developing healthcare facilities are expected to drive market growth over the forecast period.

The slit lamps market in Japan is projected to grow rapidly. According to the Organization for Economic Cooperation & Development, Japan's healthcare spending, which accounted for 9.8% of its GDP in 2022, is expected to drive this market expansion during the forecast period. Increasing investments in healthcare infrastructure and advanced diagnostic tools further bolster this growth.

The China slit lamps market is expected to grow in the Asia Pacific in 2023. The expanding healthcare infrastructure, growing healthcare workforce, and well-established medical facilities in China are anticipated to drive market expansion in the future. For instance, according to CEIC data from 2022, the number of hospitals in China increased to 36,976 units from the previous figure of 36,570 units in 2021.

The slit lamps market in India is expanding rapidly, driven by a growing prevalence of eye disorders, increased healthcare spending, and advancements in ophthalmic technology. Factors such as an aging population, rising diabetes rates, and heightened awareness of eye health contribute to the demand for sophisticated diagnostic tools such as slit lamps. Sightsavers India launched the Vidyajyoti School Eye Health Programme to ensure optimal eye health for school children, screening students in government schools to prevent eye diseases and vision impairments. The growth of private eye care centers, along with the adoption of digital slit lamps and telemedicine, enhances diagnostic capabilities, making India a key market for slit lamp devices.

Latin America Slit Lamps Market Trends

The slit lamps market in Latin America is driven by rise in healthcare spending, and infrastructural investments. Furthermore, expanding ophthalmic services and the adoption of advanced diagnostic tools are driving demand in the region.

Middle East and Africa (MEA) Slit Lamp Market Trends

The Middle East and Africa (MEA) slit lamp market creates wide opportunities with rising healthcare investments, growing disposable incomes, and increasing eye disease prevalence. However, limited infrastructure, skilled personnel shortages, and affordability concerns create challenges.

The Saudi Arabia slit lamps market is anticipated to expand in the forecast period. The rise in healthcare spending, projected at USD 50.4 billion for 2023 according to a report by the International Trade Administration and the U.S. Department of Commerce, is expected to drive this expansion. Additionally, the increasing presence of hospitals and healthcare professionals stands as a key factor fueling market growth.

The slit lamps market in Kuwait is expected to witness moderate growth due to increasing investments in healthcare infrastructure and rising awareness of eye health. Kuwait is experiencing an increase in eye diseases such as diabetes-related eye problems, cataracts, and age-related macular degeneration (AMD). This growing awareness necessitates accessible and advanced diagnostic tools like slit lamps for early detection and treatment.

Key Slit Lamps Company Insights

The competitive scenario in the slit lamps market is highly competitive, with key players such as NIDEK CO., LTD; Takagi Seiko Co., Ltd; and Haag Streit holding significant positions.

The major companies are undertaking various organic as well as inorganic strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion for serving the unmet needs of their customers.

Key Slit Lamps Companies:

The following are the leading companies in the slit lamps market. These companies collectively hold the largest market share and dictate industry trends.

- NIDEK CO., LTD

- Inami & CO., Ltd

- Veatch, Ophthalmic Instruments

- Takagi Seiko Co., Ltd

- TOPCON CORPORATION

- Essilor Instruments USA

- Keeler

- Haag Streit

- Reichert, Inc.

- HEINE Optotechnik GmbH & Co. KG

Recent Developments

-

In March 2024, Haag-Streit is thrilled to announce the return of its "Slit Lamp Imaging Competition" for the sixth year. This contest allows eye care professionals to display their slit lamp imaging abilities, with judging focused on image quality, technical skill, and the relevance of the disease captured.

-

In January 2024, CSO, a prominent company in ophthalmological instruments, is excited to announce the official release of the SL99K Elite, the highly anticipated technological upgrade of the famous Elite SL9900 model.

-

In June 2022, Takagi Seiko Co., Ltd. globally launched the 2ZL BG Slit Lamp Microscope and Flat Base for OM-6.

Slit Lamps Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 216.4 million

Revenue forecast in 2030

USD 283.6 million

Growth Rate

CAGR of 4.6% from 2024 to 2030

Actual Data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Modality, type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

NIDEK CO., LTD, Inami & CO., Ltd, Veatch, Ophthalmic Instruments, Takagi Seiko Co., Ltd., TOPCON CORPORATION, Essilor Instruments USA, Keeler, Haag Streit, Reichert, Inc., HEINE Optotechnik GmbH & Co. KG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Slit Lamps Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global slit lamps market report on the basis of modality, type, application, end-use and region:

-

Modality Outlook (Revenue, USD Million, 2018 - 2030)

-

Portable

-

Tabletop

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Analog

-

Digital

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cataract

-

Dry eye syndrome

-

Macular degeneration

-

Glaucoma

-

Others

-

-

End-Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Ophthalmic centers

-

Others

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global slit lamps market size was estimated at USD 205.9 million in 2023 and is expected to reach USD 216.4 million in 2024.

b. The global slit lamps market is expected to grow at a compound annual growth rate of 4.6% from 2024 to 2030 to reach USD 283.6 million by 2030.

b. North America dominated the slit lamps market with a share of 40.33% in 2023. This is attributable to advancements in slit lamps, and rising aging population.

b. Some key players operating in the slit lamps market include NIDEK CO., LTD, Inami & CO.,Ltd, Veatch, Ophthalmic Instruments, Takagi Seiko Co., Ltd., TOPCON CORPORATION, Essilor Instruments USA, Keeler, Haag Streit, Reichert, Inc., HEINE Optotechnik GmbH & Co. KG

b. Key factors that are driving the slit lamps market growth include the rising prevalence of eye diseases, technological advancements, and government initiatives for increasing awareness regarding visual impairment.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.