- Home

- »

- Advanced Interior Materials

- »

-

Sludge Dewatering Equipment Market, Industry Report, 2033GVR Report cover

![Sludge Dewatering Equipment Market Size, Share & Trends Report]()

Sludge Dewatering Equipment Market (2025 - 2033) Size, Share & Trends Analysis Report By Technology Type (Belt Filter Press, Centrifuges, Screw Press) By Application (Industrial, Municipal), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-672-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Sludge Dewatering Equipment Market Summary

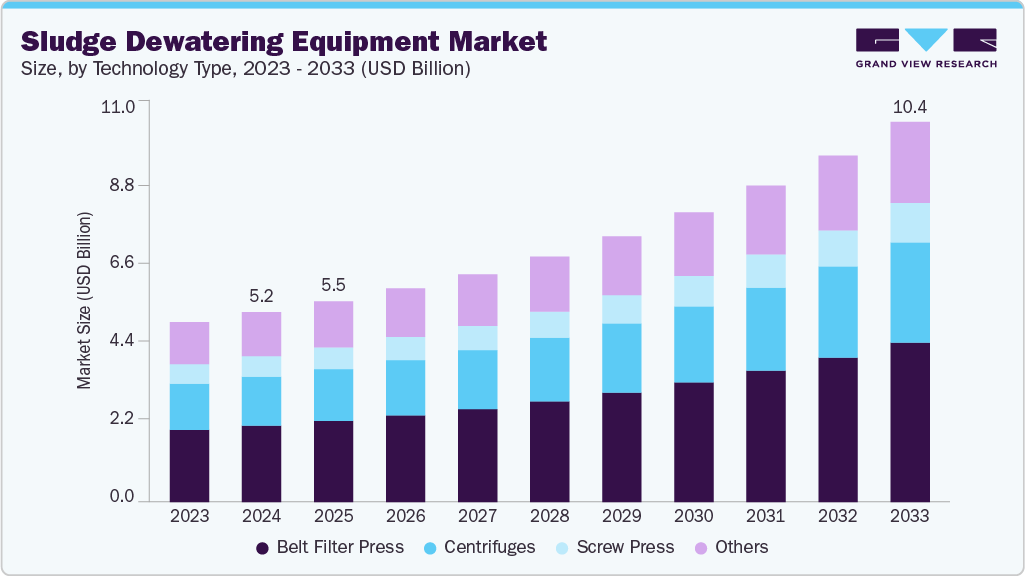

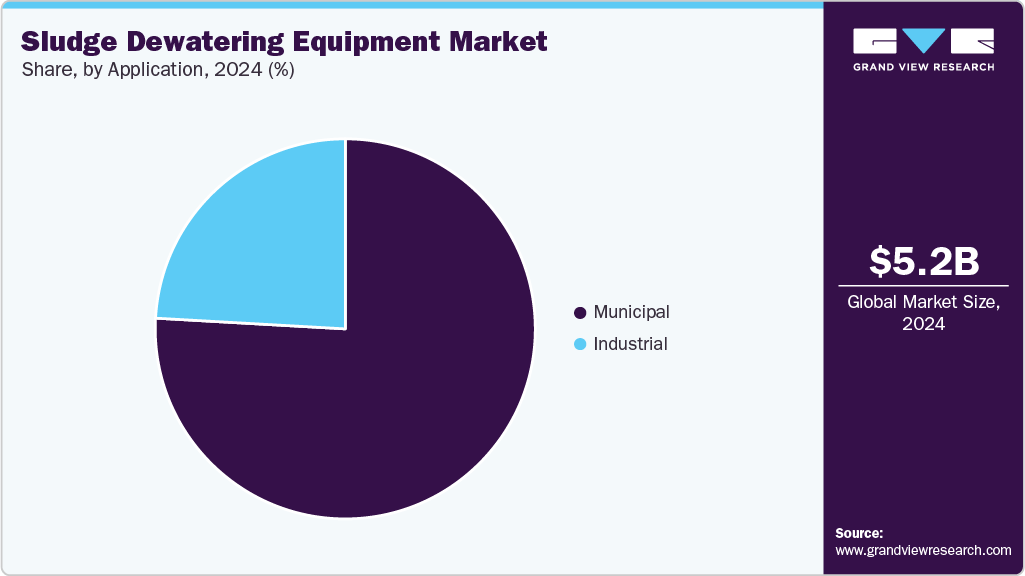

The global sludge dewatering equipment market size was estimated at USD 5,205.0 million in 2024 and is projected to reach USD 10,417.7 million by 2033, growing at a CAGR of 8.3% from 2025 to 2033. Growth is driven by increasing industrialization, stricter environmental regulations, and rising wastewater treatment demands.

Key Market Trends & Insights

- Asia Pacific dominated the sludge dewatering equipment market with the largest revenue share of 33.9% in 2024.

- The sludge dewatering equipment in the U.S. is expected to grow at a substantial CAGR of 5.8% from 2025 to 2033.

- By technology type, the belt filter press segment is expected to grow in revenue at a considerable CAGR of 8.8 % from 2025 to 2033.

- By application, industrial segment is expected to grow at a considerable CAGR of 8.7% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 5,205.0 Million

- 2033 Projected Market Size: USD 10,417.7 Million

- CAGR (2025-2033): 8.3%

- Asia Pacific: Largest market in 2024

Municipal and industrial sectors are investing in efficient dewatering technologies to reduce sludge volume, disposal costs, and environmental impact, driving consistent adoption across developing and developed regions alike. Technological advancements are significantly driving the market by enhancing efficiency, reducing operational costs, and improving environmental compliance. Innovations such as high-performance centrifuges, advanced screw press designs, and membrane filtration systems enable better solid-liquid separation and minimize sludge volume. Smart automation and IoT integration allow real-time monitoring, predictive maintenance, and optimized energy usage.

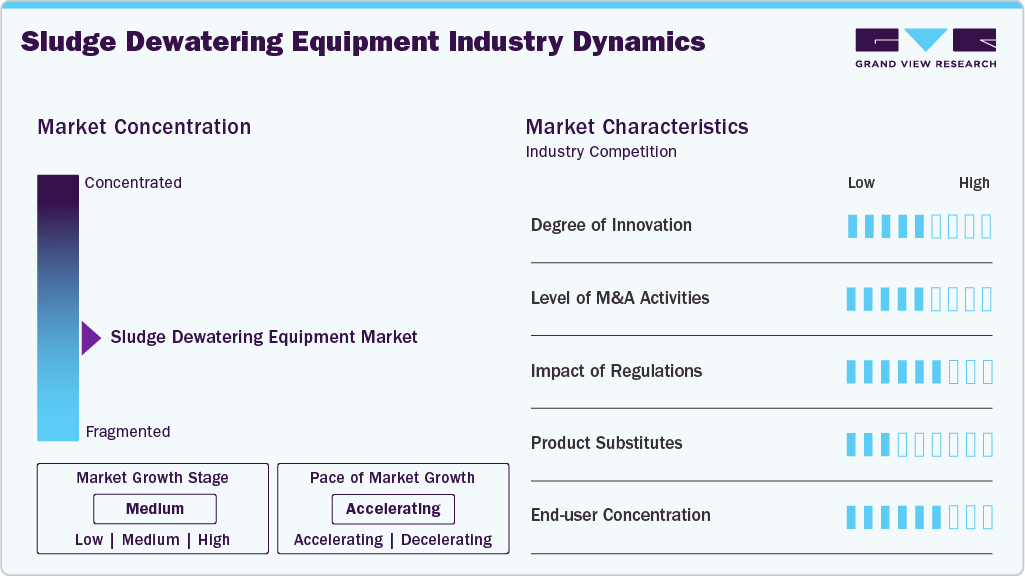

Market Concentration & Characteristics

The global sludge dewatering equipment market is moderately fragmented, with a mix of established global players and regional manufacturers competing based on innovation, efficiency, and customization. Leading companies dominate in terms of technological expertise, production capacity, and global distribution networks, giving them a competitive edge in large-scale municipal and industrial projects. However, regional players thrive in local markets by offering cost-effective solutions tailored to specific customer needs. Strategic partnerships, acquisitions, and investment in R&D are common strategies to gain market share.

The sludge dewatering equipment market demonstrates a high degree of innovation, with advancements in automation, energy-efficient technologies, and smart monitoring systems. New designs focus on enhancing throughput, reducing environmental impact, and integrating IoT-based predictive maintenance, making operations more cost-effective and sustainable across municipal, industrial, and agricultural wastewater treatment facilities.

Merger and acquisition activities in the sludge dewatering equipment market are driven by the need for technological expansion and market penetration. Leading players are acquiring niche companies to enhance their technology type portfolios and enter new geographies. For instance, in May 2025 Pelagia acquired aquaculture equipment supplier Fjord Solutions. Through its Blue Ocean Technology brand, Pelagia offers sludge and water treatment systems focused on dewatering, storage, and value creation, expanding its reach in sustainable aquaculture operations.

Regulations are significantly shaping the market by enforcing stricter environmental and wastewater management standards. These mandates compel municipalities and industries to adopt advanced, efficient dewatering technologies that minimize waste volumes, improve disposal practices, and ensure compliance, ultimately driving sustained investment and innovation in sludge treatment solutions.

Drivers, Opportunities & Restraints

Rapid industrialization across sectors such as food processing, pharmaceuticals, chemicals, and textiles has led to a substantial increase in industrial wastewater output globally. These industries produce sludge with complex compositions that require effective dewatering before treatment or disposal. As environmental compliance becomes more rigorous, industries are compelled to adopt advanced sludge dewatering technologies to minimize disposal volume, reduce treatment costs, and meet discharge standards.

The increasing focus on circular economy models and sustainability is creating new opportunities in the sludge dewatering equipment market. Treated sludge, once seen as waste, is now recognized for its potential as a feedstock for biogas and energy production. Dewatering plays a crucial role in optimizing the calorific value of sludge before it undergoes thermal or anaerobic treatment.

One of the primary challenges hindering the broader adoption of sludge dewatering equipment is the high capital expenditure involved in acquiring advanced systems like centrifuges or belt filter presses. In addition, operational costs such as energy consumption, maintenance, and skilled labor requirements further deter small-scale facilities from investing.

Technology Type Insights

The belt filter press segment dominated the market in 2024 by accounting for a share of 40.3% due to its cost-effectiveness, continuous operation capability, and suitability for large-scale municipal and industrial applications. Its ability to handle high volumes of sludge with low operating costs makes it a preferred choice across wastewater treatment facilities worldwide.

The centrifuges segment is witnessing strong growth in the market due to its high efficiency in separating solids from liquids, compact design, and adaptability to various sludge types. Industries prefer centrifuges for their rapid processing, reduced footprint, and ability to handle high-throughput operations with minimal manual intervention.

Application Insights

The municipal segment dominated the market in 2024 and is witnessing significant expansion as urbanization and population growth strain wastewater treatment infrastructure. Governments and local bodies are investing in modern sludge dewatering solutions to improve sewage management, comply with environmental standards, and optimize operational efficiency, fueling growth in the market

The industrial segment due to rising waste generation from sectors such as food processing, chemicals, and mining. Industries are adopting efficient dewatering systems to meet environmental regulations, reduce disposal costs, and enhance sustainability, driving increased demand for advanced, energy-efficient dewatering technologies

Regional Insights

North America sludge dewatering equipment marketis expected to grow at 6.5% CAGR during forecast period, driven by stringent environmental regulations, rising industrial waste generation, and growing investments in wastewater infrastructure. Technological advancements and sustainability goals further propel adoption across both municipal and industrial applications, strengthening the region's market position in coming years.

U.S. Sludge Dewatering Equipment Market Trends

The sludge dewatering equipment market in the U.S. is expected to grow at a CAGR of 5.8% from 2025 to 2033. U.S. is poised for strong growth in the market due to increasing regulatory compliance requirements, aging wastewater treatment facilities, and government investments in infrastructure upgrades. A focus on automation and energy-efficient equipment further supports adoption, particularly across municipal utilities and industrial facilities seeking cost-effective waste management solutions.

Mexico sludge dewatering equipment market is expected to witness notable growth, driven by expanding urban populations, increasing industrial activity, and growing awareness of sustainable waste management. Government initiatives to improve wastewater treatment infrastructure and rising demand from industries such as food processing and chemicals fuel the country’s market potential.

Europe Sludge Dewatering Equipment Market Trends

Europe is witnessing strong growth in the sludge dewatering equipment market due to strict environmental regulations such as Urban Wastewater Treatment Directive (91/271/EEC), and rising investments in sustainable infrastructure. The push for circular economy practices and advanced treatment technologies further fuels market demand across industrial and municipal applications.

Germany sludge dewatering equipment market is growing rapidly driven by robust environmental policies, advanced industrial base, and strong government focus on sustainable wastewater management. Ongoing technological innovations and the integration of energy-efficient systems in municipal and industrial sectors are expected to boost adoption of dewatering solutions.

UK sludge dewatering equipment market issupported by regulatory pressure from the Environment Agency, rising public infrastructure upgrades, and increasing industrial wastewater volumes. Growing demand for cost-effective, energy-efficient solutions in both public utilities and private sectors contributes to market expansion.

Asia Pacific Sludge Dewatering Equipment Market Trends

Asia Pacific dominated sludge dewatering equipment market over the forecast period accounting for 33.9% market share in 2024, due to rapid industrialization, urban expansion, and rising environmental awareness. Government initiatives for wastewater treatment and increasing investments in sustainable infrastructure are driving demand for advanced dewatering solutions across municipal and industrial sectors in countries such as China, India, and Japan.

China sludge dewatering equipment market is growing rapidly, driven by strict government regulations on wastewater discharge, large-scale infrastructure projects, and smart city initiatives. Rising urbanization and industrial output are generating significant sludge volumes, prompting investments in efficient, automated dewatering technologies to ensure environmental compliance and resource recovery.

India sludge dewatering equipment market is growing rapidly in the market due to increasing focus on wastewater treatment under programs such as Swachh Bharat Mission and AMRUT. Growing urban population, industrial waste generation, and emphasis on improving sanitation infrastructure are boosting demand for cost-effective, energy-efficient dewatering solutions in both public and private sectors.

Middle East & Africa Sludge Dewatering Equipment Market Trends

Middle East & Africa is poised for steady growth in the sludge dewatering equipment market due to rising investments in water infrastructure, increasing industrialization, and growing awareness of water scarcity. Governments are emphasizing wastewater reuse and environmental compliance, creating demand for efficient dewatering technologies across municipal and industrial wastewater treatment facilities.

Saudi Arabia sludge dewatering equipment market is growing as the country prioritizes water reuse and environmental sustainability under Vision 2030. Expanding industrial zones, desalination plant upgrades, and smart city projects are driving the adoption of sludge dewatering technologies to manage wastewater and support a circular water economy.

Latin America Sludge Dewatering Equipment Market Trends

The sludge dewatering equipment market in Latin America is growing steadily, due to increasing urbanization, stricter environmental regulations, and the need for improved wastewater management infrastructure. Government efforts to enhance sanitation services and industrial sector expansion are driving demand for efficient sludge treatment technologies across the region.

Brazil sludge dewatering equipment market is expected to grow as the country invests in modernizing its wastewater treatment infrastructure. Rising awareness of water pollution, regulatory push for sustainable waste management, and growth in industrial activities are fueling the adoption of advanced sludge dewatering equipment to improve operational efficiency and environmental compliance.

Key Sludge Dewatering Equipment Company Insights

Some of the key players operating in the market include Alfa Laval, ANDRITZ, Veolia Water Technologies, HUBER SE.

-

Alfa Laval is a global provider of specialized products and engineering solutions based on its key technologies of heat transfer, separation, and fluid handling. In the sludge dewatering equipment market, the company holds a prominent position due to its extensive range of decanter centrifuges and belt filter presses that serve both municipal and industrial wastewater treatment applications. Alfa Laval’s dewatering solutions are designed to optimize dry solids content while minimizing energy consumption and operational costs.

-

ANDRITZ is a globally recognized engineering group headquartered in Austria, offering innovative and sustainable technology solutions across multiple sectors, including water and wastewater management. In the sludge dewatering equipment market, ANDRITZ stands out for its robust portfolio of mechanical dewatering technologies such as belt presses, screw presses, and decanter centrifuges. The company’s innovative solutions such as the ANDRITZ C-Press screw press and D-Series decanter centrifuges are designed for maximum performance, reliability, and cost-efficiency.

Key Sludge Dewatering Equipment Companies:

The following are the leading companies in the sludge dewatering equipment market. These companies collectively hold the largest market share and dictate industry trends.

- ALFA LAVAL

- ANDRITZ

- HUBER SE

- Evoqua Water Technologies LLC

- Komline

- Phoenix Process Equipment

- Kontek Ecology Systems Inc.

- Flottweg SE

- AMCON Europe s.r.o.

- Groupe Industries Fournier Inc.

- Hitachi Zosen Corporation

- Benenv Co. Ltd.

- Kurita Water Industries Ltd.

- MSE Filterpressen GmbH

- Veolia Water Technologies

Recent Developments

-

In October 2024, the Los Angeles Department of Water and Power announced an investment exceeding USD 6 billion in an advanced water infrastructure initiative, previously known as Operation Next (OpNEXT). This initiative focuses on enhancing local water supply resilience against risks such as aging infrastructure, droughts, earthquakes, and dependence on imported water. The project also includes the integration of sludge dewatering equipment throughout the city, which is expected to support market growth.

-

In September 2024, Andritz secured a significant procurement contract from MVA Bielefeld-Herford GmbH, a waste management firm in Germany. The contract involves supplying an EcoFluid bubbling fluidized bed (BFB) boiler system for a new mono-incineration plant designed to treat concentrated sewage waste. This solution will support efficient waste management and facilitate phosphorus recovery from sewage sludge.

Sludge Dewatering Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5,503.0 million

Revenue forecast in 2033

USD 10,417.7 million

Growth rate

CAGR of 8.3% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology type, application, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; Japan; India; Australia; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

ALFA LAVAL; ANDRITZ; HUBER SE; Evoqua Water Technologies LLC; Komline; Phoenix Process Equipment; Kontek Ecology Systems Inc.; Flottweg SE; AMCON Europe s.r.o.; Groupe Industries Fournier Inc.; Hitachi Zosen Corporation; Benenv Co. Ltd.; Kurita Water Industries Ltd.; MSE Filterpressen GmbH; Veolia Water Technologies

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sludge Dewatering Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global sludge dewatering equipment market report based on technology type, application, and region.

-

Technology Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Belt Filter Press

-

Centrifuges

-

Screw Press

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Industrial

-

Pulp & Paper

-

Textile

-

Food & Beverage

-

Chemical

-

Others

-

-

Municipal

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global sludge dewatering equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 8.3% from 2025 to 2033 to reach USD 10,417.7 million by 2033.

b. The belt filter press segment accounted for a share of 40.3% in 2024 due to its cost-effectiveness, continuous operation capability, and suitability for large-scale municipal and industrial applications. Its ability to handle high volumes of sludge with low operating costs makes it a preferred choice across wastewater treatment facilities worldwide.

b. Some of the key players operating in the global sludge dewatering equipment market include ALFA LAVAL, ANDRITZ, HUBER SE, Evoqua Water Technologies LLC, Komline, Phoenix Process Equipment, Kontek Ecology Systems Inc., Flottweg SE, AMCON Europe s.r.o., Groupe Industries Fournier inc., Hitachi Zosen Corporation, Benenv Co. Ltd., Kurita Water Industries Ltd., MSE Filterpressen GmbH, Veolia Water Technologies.

b. Key factors driving the global sludge dewatering equipment market include stringent environmental regulations, rising wastewater treatment needs, growing industrialization, increasing municipal waste generation, technological advancements, and a focus on sustainable water management solutions to reduce disposal costs and enhance resource recovery efficiency across various sectors.

b. The global sludge dewatering equipment market size was estimated at USD 5,205.0 million in 2024 and is expected to be USD 5,503.0 million in 2025.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.