- Home

- »

- Medical Devices

- »

-

Small Bone And Joint Devices Market Report, 2020-2027GVR Report cover

![Small Bone And Joint Devices Market Size, Share & Trends Report]()

Small Bone And Joint Devices Market (2020 - 2027) Size, Share & Trends Analysis Report By Type (Shoulder Reconstruction Devices, Foot & Ankle, Plate & Screws), By Application (Foot, Hand), And Segment Forecasts

- Report ID: GVR-4-68038-543-4

- Number of Report Pages: 107

- Format: PDF

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Small Bone And Joint Devices Market Summary

The global small bone and joint devices market size was estimated at USD 5.1 billion in 2019 and is projected to reach USD 9.6 billion by 2027, growing at a CAGR of 8.3% from 2020 to 2027. Primary drivers for the market include rising adoption of reconstructive surgeries, the incidence of degenerative disorders, such as osteoporosis and arthritis, and cases of road accidents.

Key Market Trends & Insights

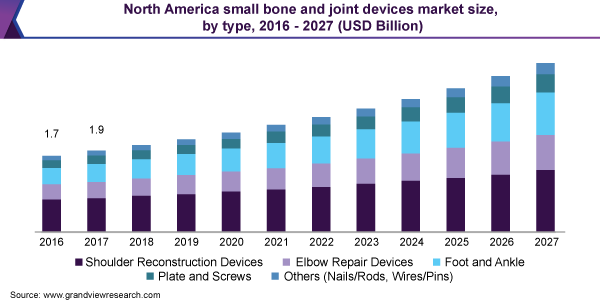

- North America held the largest market share of over 42% in 2019 and will retain its dominant position over the forecast years.

- The Asia Pacific is estimated to be the fastest-growing regional market from 2020 to 2027.

- Based on type, the shoulder reconstruction segment held the largest share of 34.2% in 2019.

- In terms of type, the foot & ankle segment is anticipated to register the fastest CAGR of 9.2% over the forecast period.

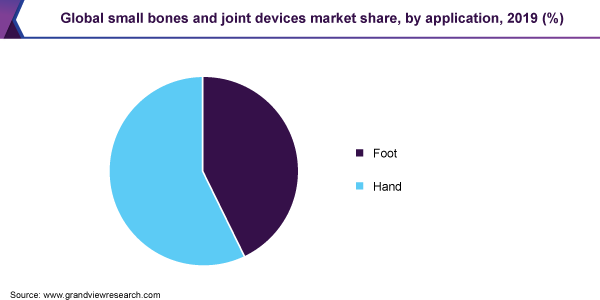

- Based on application, the hand segment held the largest share of over 56% in 2019.

Market Size & Forecast

- 2019 Market Size: USD 5.1 Billion

- 2027 Projected Market Size: USD 9.6 Billion

- CAGR (2020-2027): 8.3%

- North America: Largest market in 2019

- Asia Pacific: Fastest growing market

Furthermore, an increasing number of diabetic foot reconstruction activities along with the growing geriatric population is anticipated to support market growth. As per the International Osteoporosis Foundation, in 2017, osteoporosis affected 75 million people in the U.S., Europe, and Japan.Menopausal women were majorly affected. It was established that 1 out of 3 women suffer from an osteoporotic fracture, which may often lead to surgery. Diabetic foot problems continue to remain one of the major health concerns for patients suffering from diabetes mellitus.

It is the fastest-growing chronic problem of diabetes mellitus, with more than 400 million individuals diagnosed globally as stated by the National Center for Biotechnology Information in 2019. Increasing cases of road accidents and sports injuries are further fueling the chances of surgeries.

As per the National Safety Council, the U.S. observed 2,841 deaths due to road accidents and nearly 4.6 million people suffer an injury every year. Road accidents often lead to shoulder, foot, or ankle surgeries. Moreover, as per the U.S. National Library of Medicine, the prevalence of diabetes mellitus is likely to grow in the future, which in turn will drive the small bone and joint orthopedic device market.

Type Insights

The shoulder reconstruction segment held the largest share of 34.2% in 2019. Shoulder reconstruction surgery is one of the most dependable treatment choices for degenerative shoulder joint disorders. As per CDC, by 2040 an estimated 78.4 million adults would be diagnosed with arthritis, which often leads to shoulder surgery. Hence, the rising target population would accentuate the need for shoulder replacement surgical procedures. Moreover, companies like Depuy Synthes have launched advanced shoulder reconstruction devices, such as GLOBAL UNITE Reverse Fracture Shoulder, intended to operate on patients suffering from rotator cuff disorder, which will support segment growth.

The foot & ankle segment is anticipated to register the fastest CAGR of 9.2% over the forecast period due to the rising number of Diabetic Foot Ulcers (DFUs) and sports injuries, which often lead to foot surgery. In 2017, as per the study by the Elite Collegiate Athletes, the incidence and epidemiology of sports injuries were the prominent cause of over 21% of foot and ankle injuries. These injuries include syndesmotic sprains, mid-foot injuries, medial ankle ligament sprains, lateral ankle ligament sprains, and first metatarsophalangeal joint injuries, which often call for surgery and thus support the market growth.

Application Insights

The hand segment held the largest share of over 56% in 2019. The segment is further subdivided into thumb, wrist, elbow, shoulder, and others. The growing geriatric population and rising cases of ailments like musculoskeletal disorders of the hand are the prime factors driving this segment. Moreover, M&A activities by major companies will fuel the segment growth. For example, Acumed, LLC acquired Bluefish Orthopedics, LLC in April 2019 to launch a new elbow arthroplasty technology (TEA) in the market.

The foot and ankle segment is projected to register the fastest CAGR of 9.2% from 2020 to 2027. Increasing incidence of sports injuries and trauma and resultant foot surgeries will propel the growth of this segment. Moreover, extensive M&A activities by major companies is likely to fuel segment growth. In June 2019, Smith & Nephew acquired Brainlab Orthopaedic Joint Reconstruction Business to introduce the robotics ecosystem for foot and ankle surgery.

Regional Insights

North America held the largest market share of over 42% in 2019 and will retain its dominant position over the forecast years. This growth is attributed to rising instances of sports injuries and a well-established healthcare infrastructure facilitating minimally invasive surgical procedures. Moreover, with the growing number of arthritis patients, the demand for lower and upper extremity surgeries is likely to increase. The Asia Pacific is estimated to be the fastest-growing regional market from 2020 to 2027 due to the rising target population, demand for advanced surgical options, and rapidly growing economy.

Key Companies & Market Share Insights

Major players are focusing on product development and innovative business strategies, such as regional expansion, mergers, partnerships, and distribution agreements, to increase their market share. For instance, in November 2019, Stryker bought Wright Medical for USD 4.0 billion. The acquisition is seen to be a good fit for the shoulder business for Stryker. Moreover, it also includes complimentary devices offered in the lower and upper extremities to Stryker's orthopedics line.

In addition, companies are also introducing new technologies to improve product performance and augment their portfolio. For instance, in March 2018, Stryker Corporation launched Stryker F1, a small bone power system that offers a balanced, cordless, and lightweight solution for procedures of the extremities. Some of the prominent players in the small bone and joint device market include:

-

DePuy Synthes Companies

-

Smith & Nephew PLC

-

Zimmer Biomet

-

Stryker Corporation

-

Wright Medical Group N.V.

Small Bone And Joint Devices Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 5.5 billion

Revenue forecast in 2027

USD 9.6 billion

Growth Rate

CAGR of 8.3% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Japan; China; India; Australia; South Korea; Brazil; Mexico; South Africa; Saudi Arabia; UAE

Key companies profiled

DePuy Synthes Companies; Smith & Nephew PLC; Zimmer Biomet; Stryker Corporation; Wright Medical Group N.V.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global small bone and joint devices market report on the basis of type, application, and region:

-

Type Outlook (Revenue, USD Million, 2016 - 2027)

-

Shoulder Reconstruction Devices

-

Elbow Repair Devices

-

Foot and Ankle

-

Plate and Screws

-

Others

-

-

Application Outlook (Revenue, USD Million, 2016 - 2027)

-

Foot

-

Ankle

-

Toe

-

-

Hand

-

Thumb

-

Wrist

-

Elbow

-

Shoulder

-

Others

-

-

-

Regional Outlook (Revenue, USD Million; 2016 - 2027)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global small bone and joint devices market size was estimated at USD 5.15 billion in 2019 and is expected to reach USD 5.54 billion in 2020.

b. The global small bone and joint devices market is expected to grow at a compound annual growth rate of 8.3% from 2020 to 2027 to reach USD 9.68 billion by 2027.

b. North America dominated the small bone and joint devices market with a share of 42.6% in 2019. This is attributable to growing prevalence of the target population, surgical procedures, and government initiatives.

b. Some key players operating in the small bone and joint devices market include Acumed, LLC, Depuy Synthes (Johnson & Johnson), Smith & Nephew plc., Flower Orthopedics, Tecomet, Inc., Zimmer Biomet , Stryker Corporation, Wright Medical Group N.V., DJO Global, Inc., and Arthrex, Inc.

b. Key factors that are driving the market growth include rising adoption of reconstructive surgeries, the incidence of degenerative disorders such as osteoporosis and arthritis, and road accidents.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.