- Home

- »

- Advanced Interior Materials

- »

-

Small Caliber Ammunition Market Size, Industry Report, 2033GVR Report cover

![Small Caliber Ammunition Market Size, Share & Trends Report]()

Small Caliber Ammunition Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Rimfire, Centerfire), By Caliber (5.56mm, 7.62mm, 9mm), By Region (North America, Europe, APAC, Central & South America, MEA), And Segment Forecasts

- Report ID: GVR-4-68039-969-2

- Number of Report Pages: 109

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Small Caliber Ammunition Market Summary

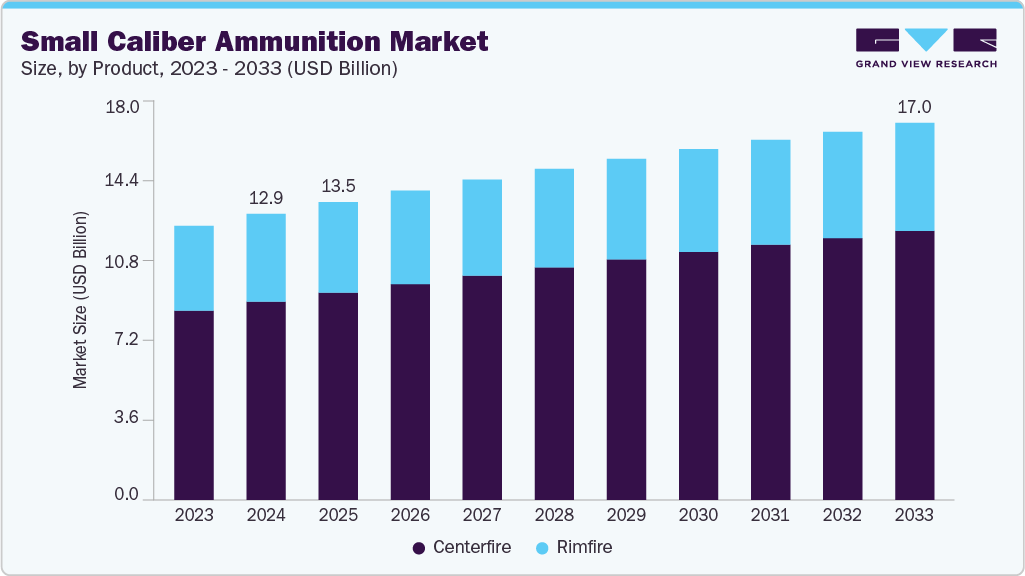

The global small caliber ammunition market size was estimated at USD 12.93 billion in 2024 and is anticipated to reach USD 17.04 billion by 2033, growing at a CAGR of 3.0% from 2025 to 2033, driven by the increasing global military expenditure and modernization of defense forces.

Key Market Trends & Insights

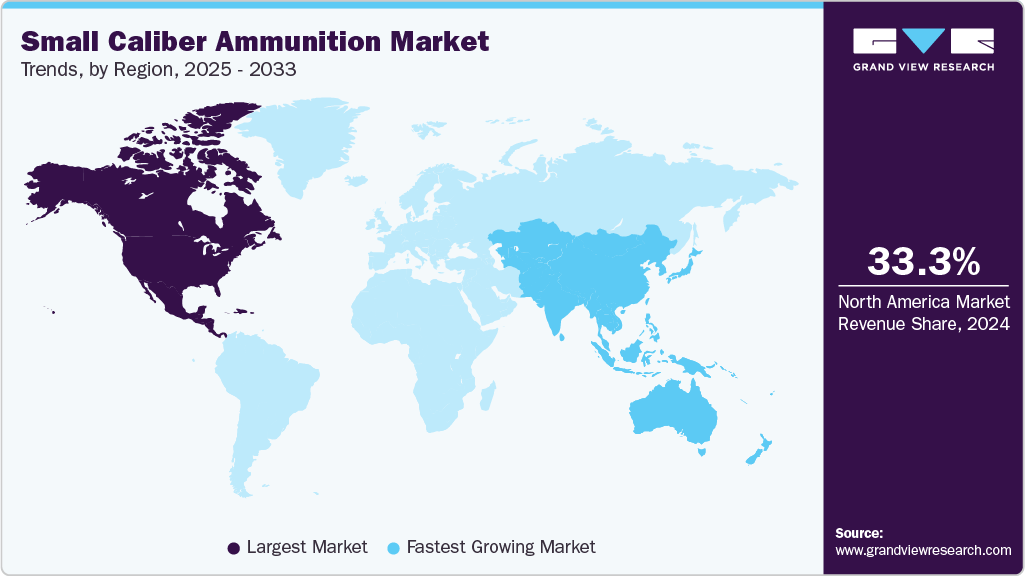

- North America dominated the small caliber ammunition market with the largest revenue share of 33.3% in 2024.

- By product, centerfire segment is expected to grow at fastest CAGR of 3.3% over the forecast period.

- By caliber, 7.62 mm segment is expected to grow significantly at CAGR of 3.0% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 12.93 Billion

- 2033 Projected Market Size: USD 17.04 Billion

- CAGR (2025-2033): 3.0%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market in 2024

Many countries are upgrading their infantry and security forces with advanced weapon systems that rely heavily on small caliber ammunition for tactical versatility and cost-effective training. The ongoing geopolitical tensions and internal security challenges across regions such as Eastern Europe, the Middle East, and parts of Asia have prompted governments to invest more in defense readiness, which includes consistent procurement of small caliber rounds for training and combat purposes. Technological advancements in ammunition design are also propelling market growth. Manufacturers are focusing on developing lightweight, lead-free, and more efficient rounds that offer improved performance, reduced environmental impact, and compatibility with a wide range of firearms. Innovations such as polymer-cased ammunition, non-toxic primers, and enhanced ballistic performance are appealing to both military and civilian end-users, creating new avenues for product differentiation and market expansion.

Another significant driver is the rising demand from civilian sectors, particularly for sporting, hunting, and self-defense products. With the growing popularity of shooting sports and hunting in countries such as the U.S., Canada, and parts of Europe, the demand for small caliber ammunition has witnessed steady growth. In addition, the increase in gun ownership among civilians, driven by perceived threats to personal security and relaxed firearm regulations in some regions, is contributing to greater consumption of ammunition in the commercial market.

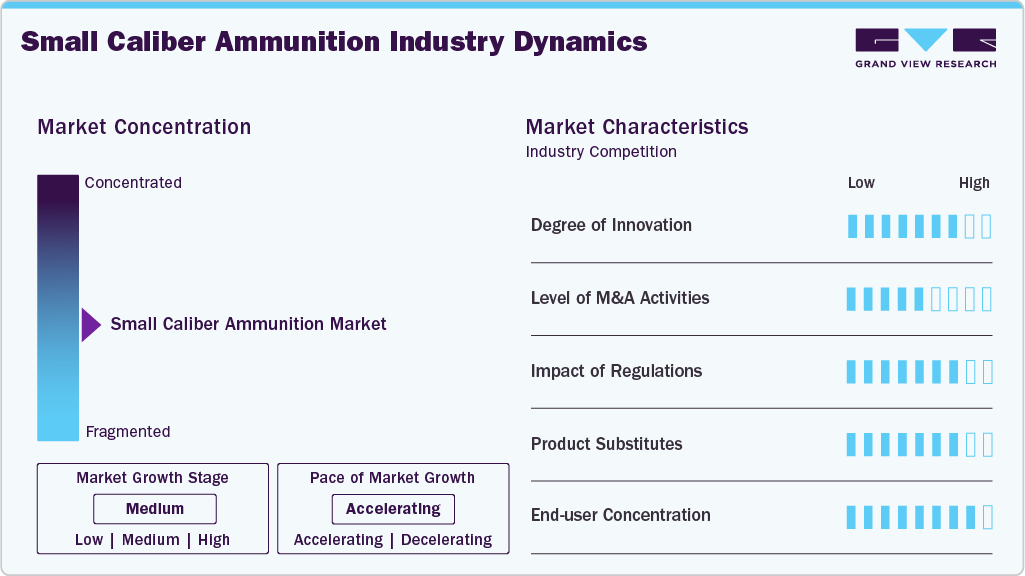

Market Concentration & Characteristics

The small caliber ammunition market exhibits a moderate to high degree of market concentration, with several prominent players such as Northrop Grumman Corporation, General Dynamics Corporation, and FN Herstal holding significant market shares. Innovation plays a crucial role in product differentiation, with manufacturers continuously developing advanced, environmentally friendly, and performance-enhancing ammunition. Technological advancements, including polymer-cased rounds, lead-free primers, and non-toxic materials, are helping companies meet stringent environmental regulations while addressing evolving end-user requirements. These innovations are essential in both military and civilian segments, ensuring consistent demand and enabling companies to maintain competitive advantages.

Mergers and acquisitions are common within the market, as key players aim to expand their geographical footprint, enhance production capabilities, and access new technologies. Regulatory frameworks, especially those concerning the use of toxic materials and firearm safety laws, significantly influence manufacturing practices and market accessibility across different regions. While there are limited direct product substitutes for small caliber ammunition in defense and law enforcement products, alternative training methods such as laser-based simulators may pose minor competitive pressure. Moreover, end user concentration is high in government and defense sectors, where long-term contracts and bulk procurement significantly impact overall market dynamics.

Product Insights

Centerfire held the highest revenue share of 63.9% in 2024, driven by its superior reliability, higher pressure tolerance, and reusability of cartridge cases. Centerfire ammunition is widely used in military, law enforcement, and civilian applications due to its consistent ignition, enhanced ballistic performance, and compatibility with a broad range of firearms including rifles, pistols, and machine guns. This segment is particularly favored for combat and tactical use, as it can withstand rigorous operational conditions and supports high-caliber rounds like 5.56mm, 7.62mm, and .50 caliber.

Rimfire segment is expected to grow significantly at CAGR of 2.2% over the forecast period, driven by its cost-effectiveness, low recoil, and suitability for training, recreational shooting, and small game hunting. Rimfire cartridges, particularly the popular .22 caliber, are widely used by beginners, sport shooters, and hunters due to their affordability and ease of use. Their lightweight nature and relatively quiet firing characteristics make them ideal for introductory firearms training and target practice.

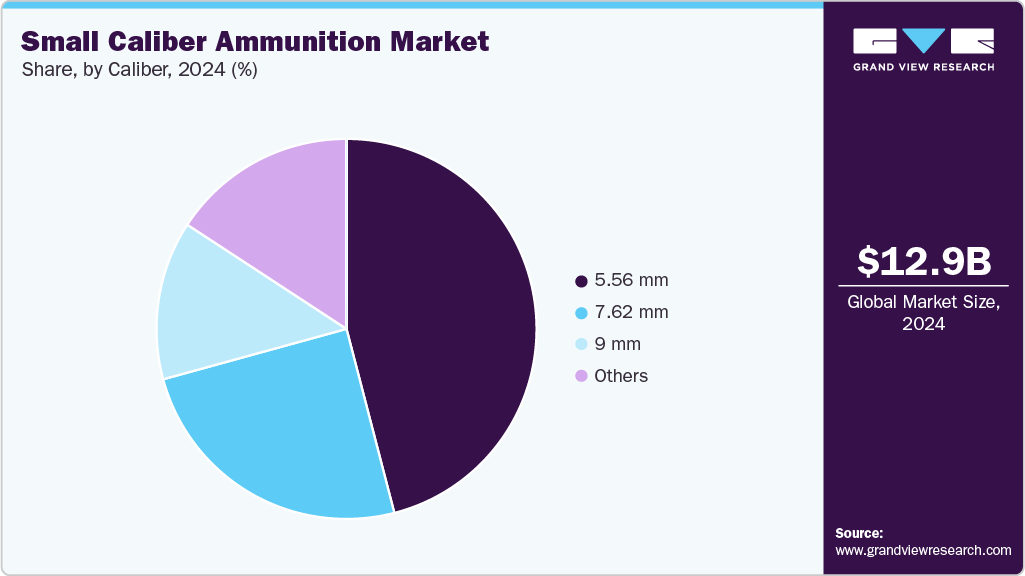

Caliber Insights

5.56mm segment held the highest revenue share of 45.9% in 2024, driven by its widespread adoption by military and law enforcement agencies across the globe. Recognized for its optimal balance between lethality, range, and recoil, the 5.56×45mm NATO round is the standard issue for many armed forces, particularly among NATO member countries. Its compatibility with widely used assault rifles such as the M16, M4 Carbine, and FN SCAR further reinforces demand.

7.62mm segment is expected to grow significantly at CAGR of 3.0% over the forecast period, driven by its superior stopping power, longer effective range, and high penetration capability, making it ideal for designated marksman rifles, machine guns, and sniper platforms. Militaries around the world continue to rely on 7.62×51mm NATO and 7.62×39mm rounds for operations requiring increased lethality and versatility in both urban and open combat scenarios. The segment’s demand is particularly high among defense forces engaged in counter-insurgency, border patrol, and tactical missions where deeper penetration through barriers is critical.

Regional Insights

North America Small Caliber Ammunition Market Trends

North America dominated the small caliber ammunition market in 2024 with the revenue share of 33.3% and is further expected to grow at a significant rate over forecast period. North America remains one of the largest and most mature markets for small caliber ammunition, driven by consistent defense spending, high rates of civilian gun ownership, and a strong culture of recreational shooting and hunting. The region benefits from the presence of well-established industry leaders and robust supply chains. U.S. military and homeland security initiatives contribute significantly to the demand for advanced, specialized ammunition. Recurring training needs, modernization efforts, and support to allied forces abroad keep procurement levels stable. Innovation in materials and manufacturing processes, such as polymer-cased cartridges and green ammunition, further enhances market competitiveness.

U.S. Small Caliber Ammunition Market Trends

The U.S. is the dominant contributor to the North American small caliber ammunition market, supported by expansive military operations, domestic law enforcement, and civilian gun ownership. The country has one of the world’s highest per capita firearm ownership rates, which directly influences steady consumer-level demand. Furthermore, U.S. defense agencies invest heavily in advanced ammunition types for training, combat readiness, and homeland security. The presence of leading manufacturers like Winchester, Remington, and Federal Premium ensures ongoing innovation and supply reliability. Recent geopolitical developments and federal procurement initiatives have also resulted in increased production and stockpiling of small caliber rounds.

Asia Pacific Small Caliber Ammunition Market Trends

Asia Pacific small caliber ammunition market is driven by increasing defense budgets and growing geopolitical tensions, particularly among countries such as India, China, Japan, and Australia. The need for military modernization programs and border security enhancements is propelling ammunition procurement across the region. In addition, the rising number of private firearm owners and shooting sports enthusiasts in countries such as Australia and Thailand supports civilian demand. Local manufacturing initiatives and strategic government collaborations with global defense companies are also bolstering market growth. Furthermore, ongoing threats of regional insurgency and terrorism contribute to consistent ammunition consumption by law enforcement agencies.

In China, the small caliber ammunition market is fueled by a strong emphasis on military modernization, domestic production capabilities, and government-led defense programs. The country is actively enhancing the combat readiness of its armed forces through increased procurement of small arms and related ammunition. China's extensive investments in research and development of advanced military technologies, including lead-free and environmentally friendly ammunition, are helping its defense industry meet global standards. Moreover, strict gun control laws limit civilian use, thereby making the military and paramilitary sectors the primary consumers. Strategic partnerships between state-owned enterprises and private players further stimulate market growth.

Europe Small Caliber Ammunition Market Trends

In Europe, market growth is primarily driven by rising defense expenditures, increasing participation in NATO-led missions, and efforts to modernize military forces. Heightened regional security concerns due to tensions in Eastern Europe have compelled countries such as Poland, France, and the Baltic states to boost ammunition procurement. Civilian firearm use for sports shooting and hunting remains prevalent in countries such as Finland, Sweden, and the Czech Republic, supporting the commercial market. Moreover, environmental regulations are pushing manufacturers to develop non-toxic and biodegradable ammunition, which is gradually gaining market traction. Cross-border defense collaborations and joint ammunition programs are also aiding market consolidation.

Germany's small caliber ammunition market is supported by a robust defense manufacturing sector, stringent quality standards, and steady demand from both military and civilian segments. Although gun ownership is highly regulated, Germany has a strong tradition of sport shooting, which contributes to consistent civilian consumption. The country’s involvement in NATO and EU defense missions further amplifies military procurement. Recent moves to strengthen national defense capabilities and increase readiness levels in response to European geopolitical instability are also supporting ammunition stockpiling and modernization. Moreover, German manufacturers are investing in eco-friendly ammunition solutions to comply with EU environmental standards.

Latin America Small Caliber Ammunition Market Trends

Latin America’s small caliber ammunition market is primarily driven by rising crime rates, internal conflicts, and the need for stronger law enforcement. Countries such as Brazil, Mexico, and Colombia are significant consumers due to ongoing security challenges and efforts to modernize police and military forces. Civilian firearm ownership, often for self-defense, is also a major contributor to demand in the region. Although local manufacturing is limited, increasing government partnerships with international suppliers are helping to address ammunition shortages. Political instability and cross-border smuggling concerns further incentivize investments in defense and ammunition infrastructure.

Middle East & Africa Small Caliber Ammunition Market Trends

The small caliber ammunition market in the Middle East & Africa is shaped by regional conflicts, counterterrorism efforts, and growing military investments. Nations such as Saudi Arabia, UAE, and the UAE are expanding their ammunition stockpiles in response to persistent security threats. Meanwhile, African countries such as Nigeria and South Africa are boosting procurement for anti-insurgency operations and peacekeeping missions. Civil unrest and weak law enforcement in parts of the region also lead to demand from private security sectors. However, inconsistent regulations and limited local manufacturing capacity create reliance on imports, prompting regional collaborations and defense partnerships to enhance self-sufficiency.

Key Small Caliber Ammunition Company Insights

Some of the key players operating in the market include Northrop Grumman Corporation, FN Herstal:

-

Northrop Grumman Corporation is a leading American aerospace and defense technology company headquartered in Falls Church, Virginia. It operates across multiple segments, including aeronautics systems, defense systems, mission systems, and space systems. In the small caliber ammunition market, Northrop Grumman plays a significant role through its subsidiary Alliant Techsystems Operations LLC (ATK), offering a wide range of ammunition solutions for military and law enforcement products. The company’s product portfolio includes 5.56mm, 7.62mm, and .50 caliber cartridges, designed for both training and combat purposes.

-

FN Herstal, headquartered in Herstal, Belgium, is a globally recognized manufacturer of firearms and ammunition, serving military, law enforcement, and commercial markets. The company is a subsidiary of the Herstal Group and has a strong legacy of producing reliable and innovative weapon systems. In the small caliber ammunition segment, FN Herstal offers a broad range of NATO-standard cartridges, including 5.56x45mm, 7.62x51mm, and 9x19mm calibers.

Hornady Manufacturing Company, Inc., General Dynamics Corporation are some of the emerging participants in the market.

-

Hornady Manufacturing Company, Inc. is a prominent American producer of ammunition and reloading components. Hornady’s offerings in the small caliber segment include premium handgun and rifle ammunition in popular calibers such as .223 Remington, .308 Winchester, and 9mm Luger. Their product lines include the Critical Defense, American Gunner, and TAP (Tactical Product Police) series, tailored for law enforcement and personal defense.

-

General Dynamics Corporation is a major U.S. defense contractor headquartered in Reston, Virginia, engaged in aerospace, combat systems, marine systems, and information technology. Through its subsidiary, General Dynamics Ordnance and Tactical Systems (GD-OTS), the company manufactures a comprehensive range of small caliber ammunition. GD-OTS produces 5.56mm, 7.62mm, and .50 caliber cartridges that meet U.S. military standards, including specialized variants such as armor-piercing, tracer, and blank ammunition.

Key Small Caliber Ammunition Companies:

The following are the leading companies in the small caliber ammunition market. These companies collectively hold the largest market share and dictate industry trends.

- Northrop Grumman Corporation

- FN Herstal

- Hornady Manufacturing Company, Inc.

- General Dynamics Corporation

- Nosler, Inc.

- Rheinmetall Defense

- Remington Arms Company LLC

- Vista Outdoor Operations LLC

- Sierra Bullets

- Australian Munitions

- Nammo AS

- Poongsan Corporation

- ST Engineering

- DSG Technology AS

- Winchester Ammunition, Inc.

Recent Developments

- In May 2025, Nammo entered into a landmark agreement with the Swedish Defense Materiel Administration, securing a SEK 1.8 billion (USD 190 million) contract for the provision of small-caliber ammunition. This deal represents Nammo’s largest contract with Sweden to date and underscores the country’s commitment to strengthening its defense readiness. Structured as a 10-year framework agreement, the contract outlines a delivery schedule spanning from 2026 to 2028.

Small Caliber Ammunition Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 13.46 billion

Revenue forecast in 2033

USD 17.04 billion

Growth rate

CAGR of 3.0% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Report updated

July 2025

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, caliber, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; Spain; Poland; France; Russia; Turkey; China; India; Australia; Japan; Singapore; Brazil; Argentina; Saudi Arabia; UAE

Key companies profiled

Northrop Grumman Corporation; FN Herstal; Hornady Manufacturing Company, Inc.; General Dynamics Corporation; Nosler, Inc.; Rheinmetall Defense; Remington Arms Company LLC; Vista Outdoor Operations LLC; Sierra Bullets; Australian Munitions; Nammo AS; Poongsan Corporation; ST Engineering; DSG Technology AS; Winchester Ammunition, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Small Caliber Ammunition Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the industry trends in each of the segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the small caliber ammunition market on the basis of product, caliber, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Rimfire

-

Centerfire

-

-

Caliber Outlook (Revenue, USD Million, 2021 - 2033)

-

5.56mm

-

7.62mm

-

9mm

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Russia

-

Turkey

-

Spain

-

Poland

-

-

Asia Pacific

-

China

-

Australia

-

India

-

Japan

-

Singapore

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global small caliber ammunition market size was estimated at USD 12.93 billion in 2024 and is expected to reach USD 13.46 billion in 2025

b. The global small caliber ammunition market is expected to grow at a compound annual growth rate (CAGR) of 3.0% from 2025 to 2033 to reach USD 17.04 billion by 2033.

b. Centerfire held the highest revenue share of 63.9% in 2024, driven by its superior reliability, higher pressure tolerance, and reusability of cartridge cases.

b. Some key players operating in the small caliber ammunition market include Northrop Grumman Corporation, FN Herstal, Hornady Manufacturing Company, Inc., General Dynamics Corporation, Nosler, Inc., Rheinmetall Defense, Remington Arms Company LLC, Vista Outdoor Operations LLC, Sierra Bullets, Australian Munitions, Nammo AS, Poongsan Corporation, ST Engineering, DSG Technology AS, Winchester Ammunition, Inc.

b. The key factors that are driving the small caliber ammunition market growth include rising defense expenditures, increasing demand for modernized military equipment, and the growing popularity of shooting sports and personal defense applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.