- Home

- »

- Medical Devices

- »

-

Small Molecule CDMO Market Size, Industry Report, 2033GVR Report cover

![Small Molecule CDMO Market Size, Share & Trends Report]()

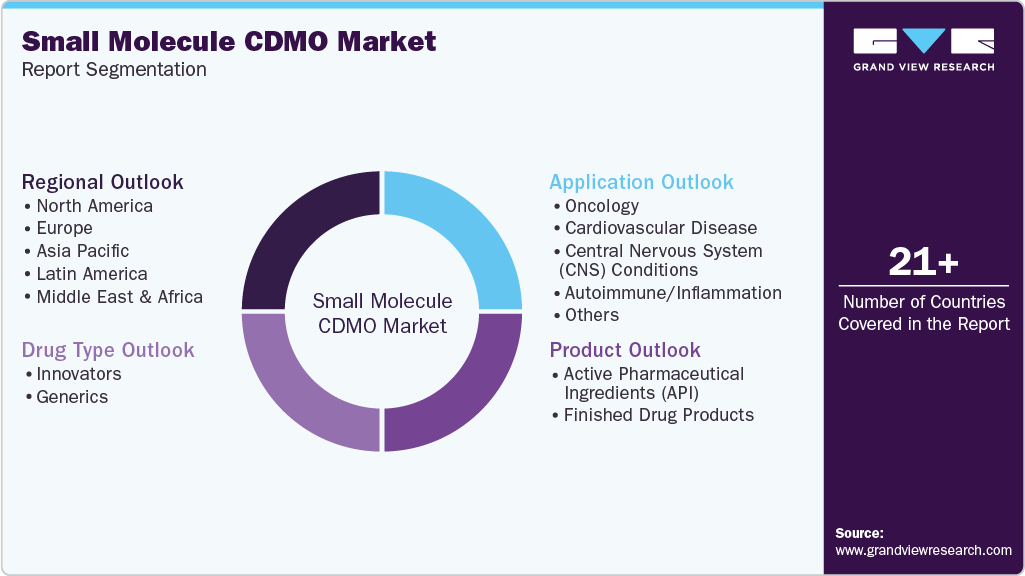

Small Molecule CDMO Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (APIs, Finished Drug Products), By Drug Type (Generics, Innovators), By Application (Oncology, CVD, CNS Conditions, Autoimmune, Others), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-165-6

- Number of Report Pages: 145

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Small Molecule CDMO Market Summary

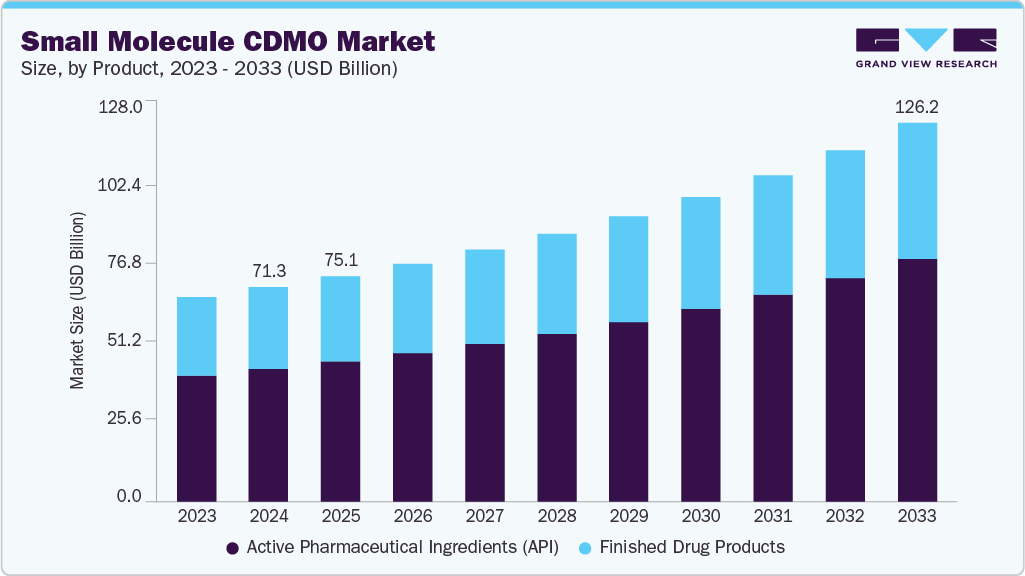

The global small molecule CDMO market was estimated at USD 71.3 billion in 2024 and is projected to reach USD 126.2 billion by 2033, growing at a CAGR of 6.7% from 2025 to 2033. The growth of the market is due to a convergence of strategic outsourcing trends, robust pharmaceutical pipelines, and global manufacturing shifts.

Key Market Trends & Insights

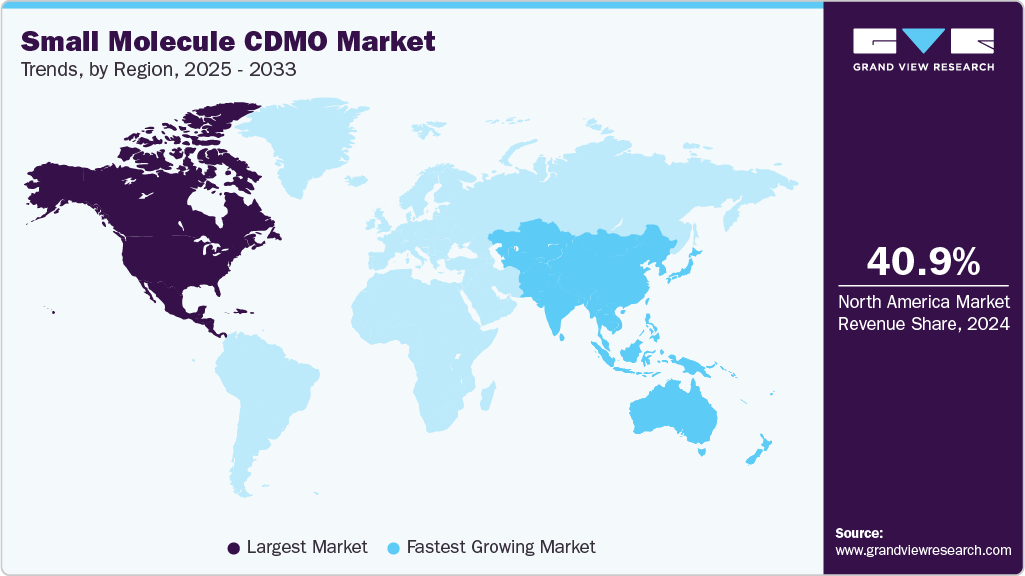

- North America small molecule CDMO market held the largest share of 40.9% of the global market in 2024.

- The small molecule CDMO industry in the U.S. is expected to grow significantly over the forecast period.

- By Product, the Active Pharmaceutical Ingredients (API) segment led the market with the largest revenue share of 61.8% in 2024.

- Based on Drug Type, the innovators segment led the market with the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 71.3 Billion

- 2033 Projected Market Size: USD 126.2 Billion

- CAGR (2025-2033): 6.7%

- North America: Largest market in 2024

- Asia-Pacific: Fastest growing market

Pharmaceutical and biotech companies increasingly rely on CDMOs to streamline R&D costs, accelerate time-to-market, and access specialized capabilities, particularly for highly potent APIs and complex chemistries. The consistent approval of small molecule drugs, especially in therapeutic areas such as oncology, infectious diseases, and cardiology, sustains strong demand for both clinical and commercial-scale manufacturing.

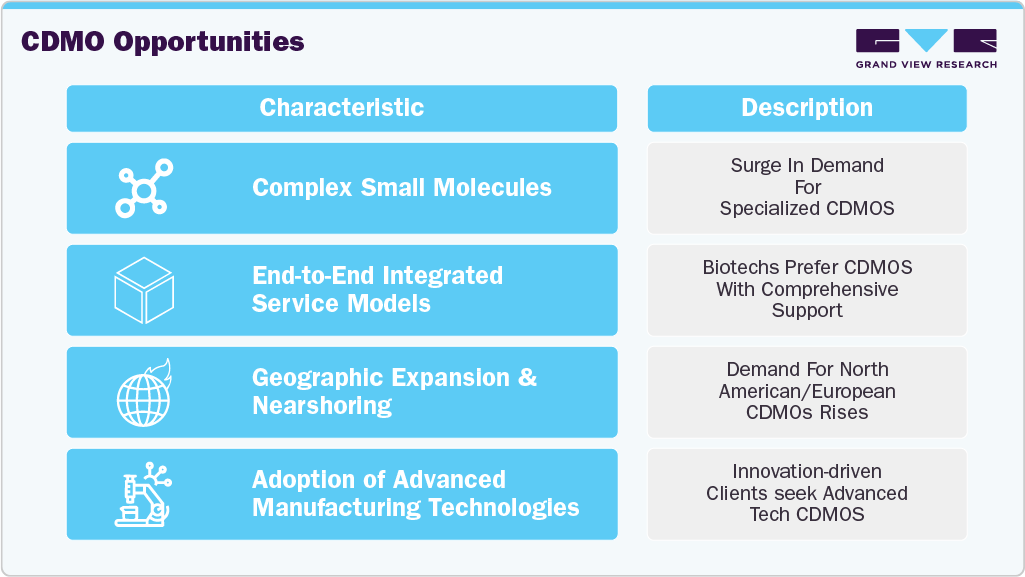

The market is driven by the evolving nature of pharmaceutical innovation and the changing economic landscape of drug development. The emergence of biotech firms and virtual pharma companies, which often lack in-house infrastructure for R&D, scale up, or GMP manufacturing, is driving the market growth. These companies are turning to CDMOs not just as suppliers but as strategic collaborators to bring their molecules to market quickly and compliantly. Unlike in the past where outsourcing was cost-driven, today’s engagements are increasingly innovation-driven-relying on CDMOs for specialized process chemistry, formulation science, and regulatory knowledge. This shift is particularly evident in the development of high-value small molecules such as antibody-drug conjugates (ADCs), HPAPIs, and targeted oncology drugs, where manufacturing complexity and containment needs are high.

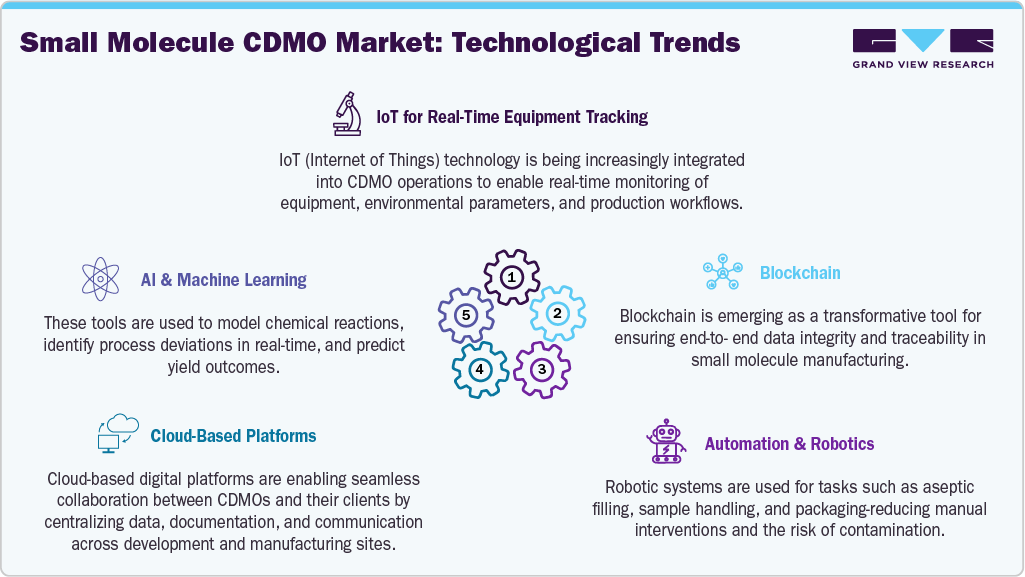

Moreover, the growing trend towards digitalization and advanced manufacturing technologies within the CDMO ecosystem is also contributing to market growth. AI-driven predictive modeling, continuous flow processing, and real-time release testing (RTRT) are transforming the cost-efficiency and flexibility of small molecule production. These innovations allow CDMOs to differentiate their offerings, improve batch yields, and meet quality requirements in a faster, more data-rich environment. In addition, large pharmaceutical companies are seeking sustainability in their supply chains, and CDMOs with green chemistry capabilities or low-carbon production practices are becoming more attractive partners. The market is also benefiting from regional shifts in supply chain strategy due to geopolitical instability and drug shortages-prompting Western pharma firms to diversify their supplier base and seek CDMOs in North America and Europe with redundant capacity.

Technological Advancements

The technological landscape in the small molecule CDMO market is rapidly evolving, driven by the need for faster, safer, and more cost-effective drug development. CDMOs are increasingly adopting continuous manufacturing, flow chemistry, and process intensification technologies to improve scalability, reduce waste, and meet regulatory expectations for quality and efficiency. Automation and digital process control systems, including PAT (Process Analytical Technology) and real-time release testing (RTRT), are enhancing batch consistency and reducing manual interventions.

Advanced data analytics, AI-driven modeling, and digital twins are being used to optimize process parameters, predict yield variations, and accelerate tech transfer. Moreover, demand for sustainable production has led to investments in green chemistry techniques, such as solvent recycling and bio-catalysis. These technological advancements are not only enabling faster time-to-market but also allowing CDMOs to serve as innovation partners, particularly for clients developing complex APIs, personalized medicine, and fast-track therapeutics.

Pricing Analysis

A pricing analysis model in the small molecule CDMO market typically incorporates multiple cost-driving variables, including molecule complexity, development phase, volume requirements, regulatory compliance needs, and service depth (e.g., standalone API manufacturing vs. full end-to-end development). For early-phase projects, pricing often follows a milestone-based model with fixed fees for preclinical development, formulation, and initial GMP batch production. In later phases, cost-plus or FTE (full-time equivalent)-based pricing models become more common, especially when long-term partnerships are involved. High-potency APIs, specialized containment, or accelerated timelines command premium pricing due to higher operational and compliance burdens. In addition, geographic location, manufacturing capacity utilization, and quality track record influence a CDMO’s ability to price competitively. CDMOs that offer integrated services and digital transparency often justify higher rates by reducing total time-to-market and minimizing tech transfer risks.

Product Insights

The Active Pharmaceutical Ingredients (API) segment accounted for the largest revenue share in the small molecule CDMO industry of 61.8% in 2024. The growth of the segment is due to the increasing demand for complex and high-potency small molecule therapies across a range of therapeutic areas, particularly oncology, infectious diseases, and cardiovascular disorders. As pharmaceutical pipelines become more innovation-focused, drug developers are outsourcing API manufacturing to CDMOs with advanced synthetic capabilities, containment infrastructure for HPAPIs, and proven regulatory track records.

The finished drug products segment is anticipated to grow at a considerable CAGR during the forecast period. The segment growth is driven due to increasing pharmaceutical industry trends toward outsourcing formulation development, aseptic filling, and packaging to specialized CDMOs. Rising complexity in drug delivery systems, such as controlled-release formulations, biologics combination products, and personalized medicines, requires advanced expertise and state-of-the-art manufacturing facilities that many pharma companies prefer to access via outsourcing.

Drug Type Insights

The innovators segment held the largest market share in 2024 due to the increasing focus of pharmaceutical companies on developing novel small molecule drugs with unique mechanisms of action, particularly in high-value therapeutic areas such as oncology, immunology, and rare diseases. Innovator companies typically require extensive R&D support, specialized manufacturing capabilities, and stringent regulatory compliance, which drive significant demand for advanced CDMO services.

The generics segment is anticipated to grow at the fastest CAGR over the forecast period. The growth is attributed to the increasing demand for affordable and accessible medications worldwide as healthcare systems focus on cost containment and expanding patient access. Patent expirations of several blockbuster small molecule drugs are creating significant opportunities for generic manufacturers to enter the market, driving a surge in outsourcing needs for large-scale, cost-efficient API and finished product manufacturing.

Application Insights

The oncology segment held the largest market share in 2024 due to the rapidly growing global prevalence of cancer and the continuous introduction of novel targeted therapies and small molecule anticancer drugs. The high unmet medical need for effective and personalized cancer treatments has driven significant investment in oncology drug development, resulting in a robust pipeline of innovative molecules requiring specialized CDMO services.

The autoimmune/inflammation segment is anticipated to grow at a considerable CAGR over the forecast period. The growth of the segment is due to the rising global prevalence of autoimmune disorders such as rheumatoid arthritis, psoriasis, and inflammatory bowel disease, which are driving increased demand for effective small molecule therapies. Advances in the understanding of immune system pathways have led to the development of novel targeted drugs that require specialized manufacturing processes, including complex synthesis and formulation techniques, making outsourcing to experienced CDMOs essential.

Regional Insights

North America small molecule CDMO market dominated the global market with the largest share of 40.9% in 2024, owing to the increased R&D investments, the presence of global players, and rising efforts to come up with newer patents. In addition, the increasing number of clinical trials is also fueling market growth.

U.S. Small Molecule CDMO Market Trends

The small molecule CDMO market in the U.S. held the largest share in 2024. This is attributed to the increasing number of clinical trials in the U.S. For instance, according to the National Clinical Trials Registry (NCT), around 12,326 clinical trials studies were underway across various phases for the treatment of cancer in 2022.

Europe Small Molecule CDMO Market Trends

The small molecule CDMO market in Europe is expected to grow significantly due to rising focus on clinical trial studies, favorable government initiatives and policies, compliance with the Good Clinical Practice (GCP) standards, larger patient pools and rising number of clinical trials are some of the key factors fueling the market growth.

The small molecule CDMO market in Germany is driven by factors such as advanced medical expertise and easy access to patients, low rate of saturation of competing trials, and high number of participants contributing to the clinical research studies.

UK small molecule CDMO market is driven by factors such as rising government spending on clinical research and rising number of clinical trial studies in the region. According to the National Institute for Health Research (NIHR), UK, clinical research is worth USD 3.74 billion each year and includes USD 2.07 billion from commercial sources, which supports around 47,000 jobs.

Asia Pacific Small Molecule CDMO Market Trends

Asia Pacific is expected to be the fastest growing market due togrowing investment by developed countries in the regions and various amendments made by the regulatory agencies to facilitate local manufacturing & contract services.

The small molecule CDMO market in China held the largest share in 2024. The growth is attributed to the government initiatives to regulate the clinical trials as per the global standards and better infrastructure, which includes 4,000 hospital beds. Initially in China, Centre of Drug Evaluation (CDE) was responsible was regulating the clinical trials

Japan small molecule CDMO market is expected to grow over the forecast period. The regulatory process is supportive of faster clinical trial approval. For instance, clinical trials can be started once the probable benefits are demonstrated by carrying out a relatively smaller number of clinical trials.

The small molecule CDMO market in India is anticipated to grow at the lucrative CAGR over the forecast period. This can be attributed to the increasing government funds. The government of India focuses on expanding affordable healthcare facilities in the country. This propelled the growth of clinical trials sector in India. In addition, local Indian players such as Vitas Pharma (Hyderabad) and Bugworks (Bengaluru) ventured into drug development activities.

Key Small Molecule CDMO Company Insights

Several key players are acquiring various strategic initiatives to strengthen their market position offering diverse services to customers. The prominent strategies adopted by companies are service launches, mergers & acquisitions/joint ventures merger, partnership & agreements, expansions, and others to increase market presence & revenue and gain a competitive edge drives the market growth.

Key Small Molecule CDMO Companies:

The following are the leading companies in the small molecule CDMO market. These companies collectively hold the largest market share and dictate industry trends.

- Lonza

- Catalent, Inc.

- Thermo Fisher Scientific Inc.

- Cambrex Corporation

- Bellen Chemistry

- Siegfried Holding AG

- Recipharm AB

- Eurofins Scientific

- Aurigene Pharmaceutical Services Ltd.

- CordenPharma International

Recent Developments

-

In October 2024, Thermo Fisher launched its Accelerator Drug Development offerings designed to support both emerging biotech firms and major pharmaceutical companies. This comprehensive suite encompasses manufacturing, clinical research, and supply chain services across various modalities-including small molecules, biologics, and cell and gene therapies-covering the entire journey from preclinical stages through to commercial launch.

-

In June 2024, Siegfried plans to acquire an early-phase CDMO site in Wisconsin, U.S., specializing in highly potent APIs. The site will serve as a hub for early-phase development and manufacturing services, strengthening Siegfried's global capabilities.

Small Molecule CDMO Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 75.1 billion

Revenue forecast in 2033

USD 126.2 billion

Growth rate

CAGR of 6.7% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, drug type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; Kuwait; UAE

Key companies profiled

Lonza; Catalent, Inc.; Catalent, Inc.; Thermo Fisher Scientific Inc.; Cambrex Corporation; Bellen Chemistry; Siegfried Holding AG; Recipharm AB; Eurofins Scientific; Aurigene Pharmaceutical Services Ltd.; CordenPharma International

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Small Molecule CDMO Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global small molecule CDMO market report based on product, drug type, application, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Active Pharmaceutical Ingredients (API)

-

Finished Drug Products

-

-

Drug Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Innovators

-

Generics

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Oncology

-

Cardiovascular Disease

-

Central Nervous System (CNS) Conditions

-

Autoimmune/Inflammation

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global small molecule CDMO market size was estimated at USD 71.3 billion in 2024 and is expected to reach USD 75.1 billion in 2025.

b. The global small molecule CDMO market is expected to grow at a compound annual growth rate of 6.70% from 2025 to 2033 to reach USD 126.2 billion by 2033.

b. Active Pharmaceutical Ingredients (API) small molecule CDMO segment accounted for the largest revenue share of 61.8% in 2024. The high burden of diseases such as cancer, diabetes, and cardiovascular disorders across the globe and initiatives by the government to improve access to generic drugs are some of the primary factors contributing to segment growth.

b. LLonza, Catalent, Inc.; Thermo Fisher Scientific Inc.; Cambrex Corporation; Bellen Chemistry; Siegfried Holding AG; Recipharm AB; Eurofins Scientific; Aurigene Pharmaceutical Services Ltd.; CordenPharma International are some of the dominant players operating in the small molecule CDMO market.

b. Key factors that are driving the market growth include ia convergence of strategic outsourcing trends, robust pharmaceutical pipelines, and global manufacturing shifts. Pharmaceutical and biotech companies increasingly rely on CDMOs to streamline R&D costs, accelerate time-to-market, and access specialized capabilities, particularly for highly potent APIs and complex chemistries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.