- Home

- »

- Medical Devices

- »

-

Small Molecule Innovator API CDMO Market Report, 2033GVR Report cover

![Small Molecule Innovator API CDMO Market Size, Share & Trends Report]()

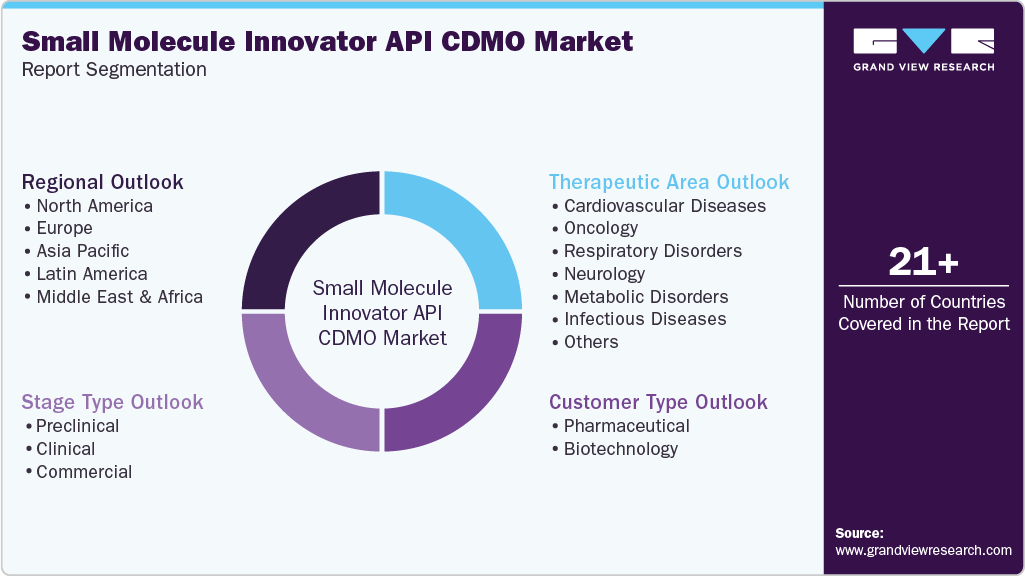

Small Molecule Innovator API CDMO Market (2026 - 2033) Size, Share & Trends Analysis Report By Stage Type (Preclinical, Clinical, Commercial), By Customer Type (Pharmaceutical, Biotechnology), By Therapeutic Area, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-250-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Small Molecule Innovator API CDMO Market Summary

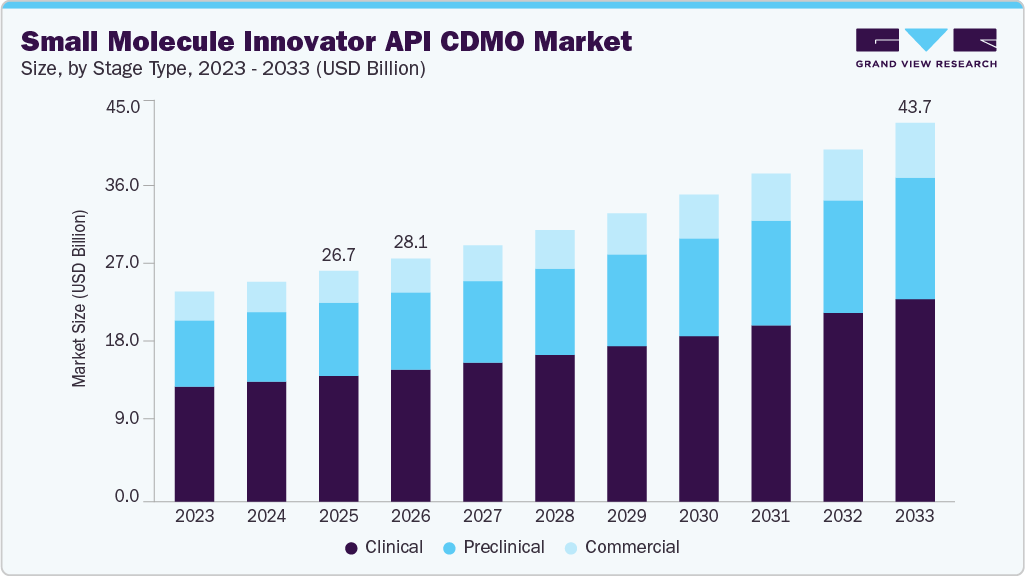

The global small molecule innovator API CDMO market size was estimated at USD 26.66 billion in 2025 and is projected to reach USD 43.75 billion by 2033, growing at a CAGR of 6.55% from 2026 to 2033. The market is experiencing growth driven by increasing demand for small molecule drugs, increasing outsourcing trends among pharmaceutical companies and surge in number of clinical trials.

Key Market Trends & Insights

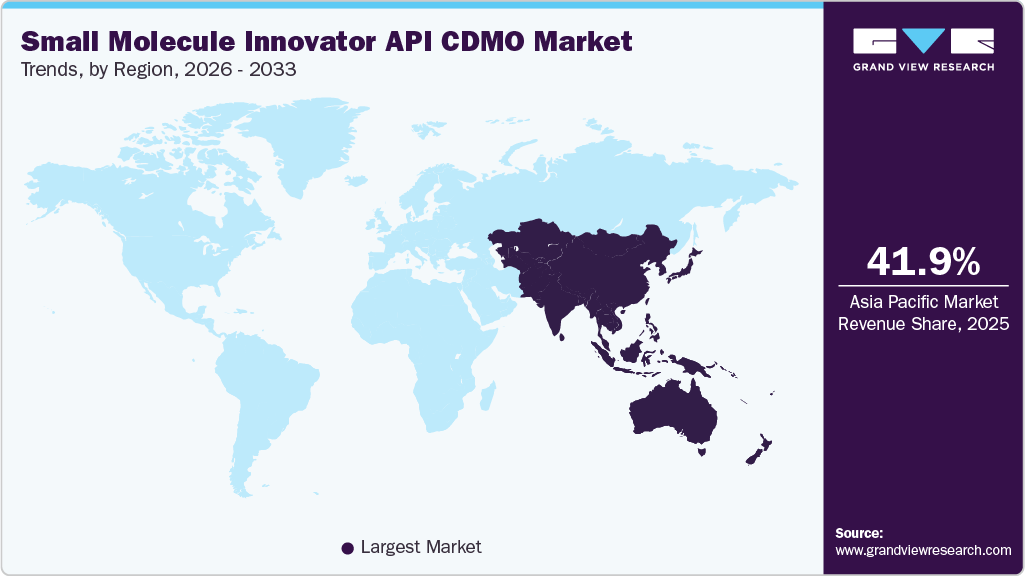

- Asia Pacific small molecule innovator API CDMO market held the largest share of 41.96% of the global market in 2025.

- The small molecule innovator API CDMO in the India is expected to grow significantly over the forecast period.

- Based on stage type, the clinical segment held the largest market share of 54.44% in 2025.

- Based on customer type, pharmaceutical segment held the largest market share in 2025.

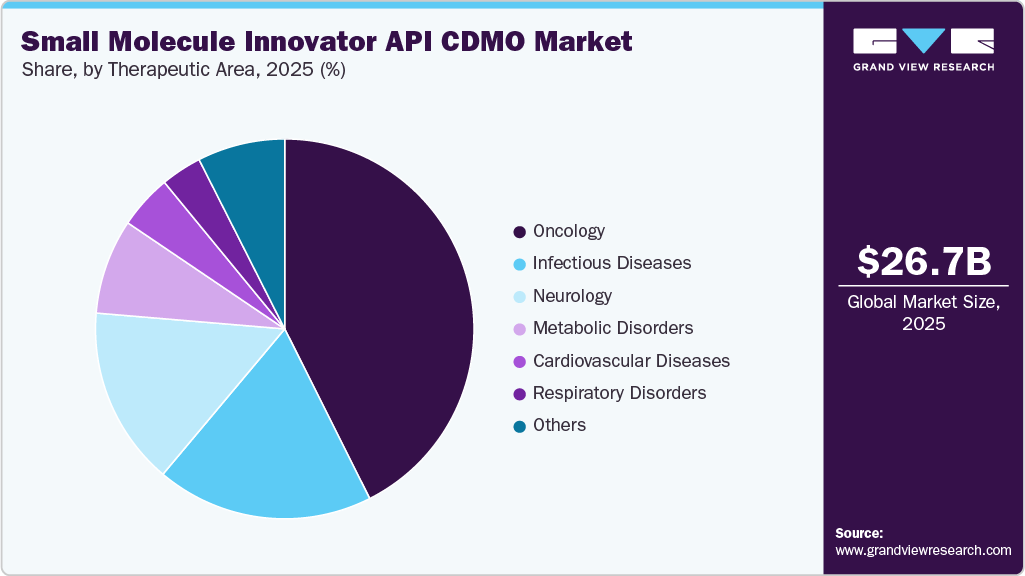

- Based on therapeutic area, the oncology segment held the highest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 26.66 Billion

- 2033 Projected Market Size: USD 43.75 Billion

- CAGR (2026-2033): 6.55%

- Asia Pacific: Largest market in 2025

Small molecules continue to play an important role in developing new treatments globally. Specialty medicines are driving global pharmaceutical growth, particularly in developed markets, with small molecule applications accounting for over half of specialty sales. According to the U.S. FDA, 46 novel drugs were approved in 2025, including therapies targeting advanced cancers and rare diseases, while 1 novel drug has been approved so far in 2026. Moreover, according to an article published by the American Chemical Society in January 2024, the U.S. FDA approved 50 new drugs in 2024, marking a notable increase from the 37 approvals in 2022. Thus, small molecule drugs continue to dominate the pharmaceutical industry’s drug development pipeline. As pharmaceutical companies focus on developing new small molecule drugs to address various medical needs, they require the services of API CDMOs to manufacture these active ingredients efficiently and cost-effectively.

Furthermore, pharmaceutical companies have been outsourcing small-molecule API production to CDMOs to enhance efficiency, control costs, and accelerate time-to-market. In addition, rising R&D expenses, complex regulatory requirements, and the need for resilient supply chains drive this shift. CDMOs provide specialized expertise, advanced infrastructure, and scalable manufacturing without heavy capital investment, reducing financial and operational risks. Besides this, long-term partnerships also support innovation and global market access. For instance, in August 2025, the U.S. FDA launched FDA PreCheck to strengthen domestic supply chains, as most APIs are sourced overseas and only 11% are U.S.-based. Thus, growing utilization of CDMOs in the pharmaceutical sector stems from various reasons, with cost-effectiveness as the prominent factor.

Moreover, the surge in clinical trials globally is fueling demand for small-molecule APIs, driving growth in the CDMO market. As pharmaceutical and biotech companies advance more compounds into preclinical and clinical stages, the need for reliable, scalable API production has intensified. In addition, outsourcing to CDMOs enables firms to meet this growing demand efficiently, leveraging specialized expertise, flexible manufacturing capacity, and regulatory compliance. This trend enables companies to accelerate development timelines and bring novel therapies to market more quickly. Similarly, as of February 2024, the global count of registered clinical trials on ClinicalTrials.gov is 483,592, reflecting a noteworthy increase compared to the reported over 365,000 registered trials in early 2021. Among the current number, 66,206 trials actively recruit participants. This expansion underscores the continual growth of the clinical research landscape. Several factors contribute to the rise in registered studies, including advancements in medical technology, an upsurge in diseases under investigation, and the imperative for novel treatments.

Some of the notable clinical trials focusing on small molecules innovator API are highlighted as follows:

Study Title

Conditions

Interventions

Sponsor

Collaborators

Enrollment

Primary Completion Date

Safety, Tolerability and Efficacy of Intravitreal KIO-104 in Patients With Macular Edema

Macular Edema

DRUG: KIO-104

Kiora Pharmaceuticals, Inc.

28

2026 - 11

Novel Small Molecule EBNA1 Inhibitor, VK 2019, in Patients With Epstein Barr Virus (EBV)-Positive Nasopharyngeal Cancer (NPC) and Other Epstein-Barr Virus (EBV)-Associated Cancers, With Pharmacokinetic and Pharmacodynamic Correlative Studies

Nasopharyngeal Cancer| Epstein-Barr Virus Related Carcinoma

DRUG: VK-2019

Stanford University

National Institutes of Health (NIH)|National Cancer Institute (NCI)

13

6/17/2026

Source: Clinicaltrails.gov

Opportunity Analysis

The market for small molecule innovator API CDMO is entering a robust growth phase, fueled by ongoing advancements in targeted therapies, oncology, CNS disorders, and rare diseases. As pharmaceutical companies place greater emphasis on complex and high-potency APIs (HPAPIs), the need for specialized development, scaling up, and commercial manufacturing capabilities is on the rise. In addition, innovator companies are opting for strategic outsourcing to better allocate capital, expedite clinical timelines, and leverage advanced technologies like continuous manufacturing and green chemistry.

Furthermore, increasing regulatory requirements and the diversification of supply chains especially efforts to localize manufacturing in the U.S. and Europe are generating new opportunities for technologically advanced CDMOs with solid compliance histories. Moreover, the expanding pipeline of small molecule drugs in Phase II and III indicates a robust future demand for commercial manufacturing. Besides this, mid-sized and specialized CDMOs that provide integrated services from early development to commercialization are well-positioned to secure long-term contracts, fostering a positive growth for the sector.

Impact of U.S. Tariffs on Small Molecule Innovator API CDMO Market

U.S. tariffs are significantly transforming the market. To date, more than 80% of APIs are produced overseas, primarily in China and India, with India itself 70-80% dependent on Chinese APIs. Chinese APIs are used in nearly 40% of U.S. generic drugs, exposing substantial supply chain vulnerability. Besides this, regulatory scrutiny has intensified. For instance, in February 2025, FDA issued warning letters to Chinese manufacturers Nuowei Chemistry and Innovation Pharmaceutical over non-compliance with U.S. Pharmacopoeia standards and data gaps.

Furthermore, in April 2025, the U.S. imposed tariffs of 25% to 245% on Chinese imports, including 125% reciprocal duties and additional penalties, with pharmaceutical-specific tariffs potentially reaching 250% by 2027. These measures are accelerating reshoring. Eli Lilly’s USD 27 billion U.S. investment in four new facilities, including three API plants, signals strong domestic manufacturing momentum. Thus, U.S.-based CDMOs are poised to benefit from increased localization, long-term supply agreements, and strategic capacity expansion.

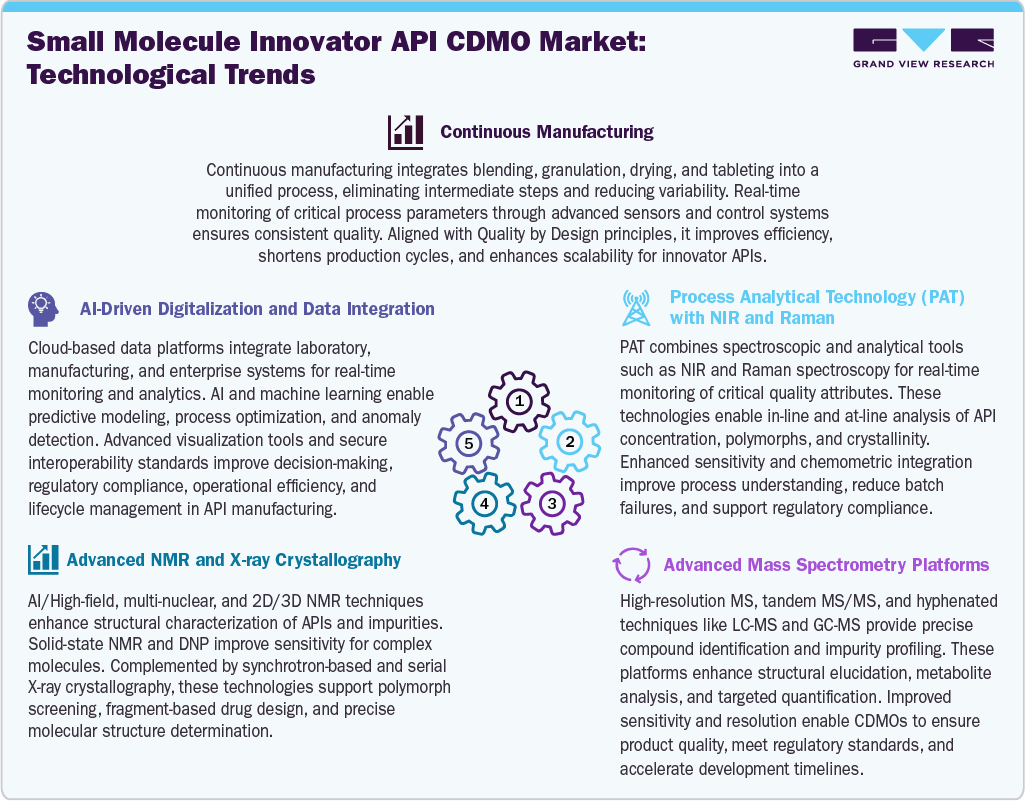

Technological Advancements

The small molecule innovator API CDMO market is being transformed by major technological advancements across manufacturing, analytics, and digitalization. The continuous manufacturing integrates multiple unit operations into a single streamlined process, reducing variability and enhancing efficiency while aligning with Quality by Design principles. In addition, process analytical technology (PAT), including NIR and Raman spectroscopy, enables real-time monitoring of critical quality attributes, ensuring consistent product quality and regulatory compliance. Besides this, advanced analytical platforms such as high-resolution mass spectrometry and multi-dimensional NMR improve structural characterization, impurity profiling, and polymorph analysis. X-ray crystallography further supports precise molecular structure determination and drug design. Furthermore, AI-driven digitalization and cloud-based data integration platforms enhance predictive modeling, process optimization, and real-time decision-making, strengthening operational efficiency and accelerating development timelines.

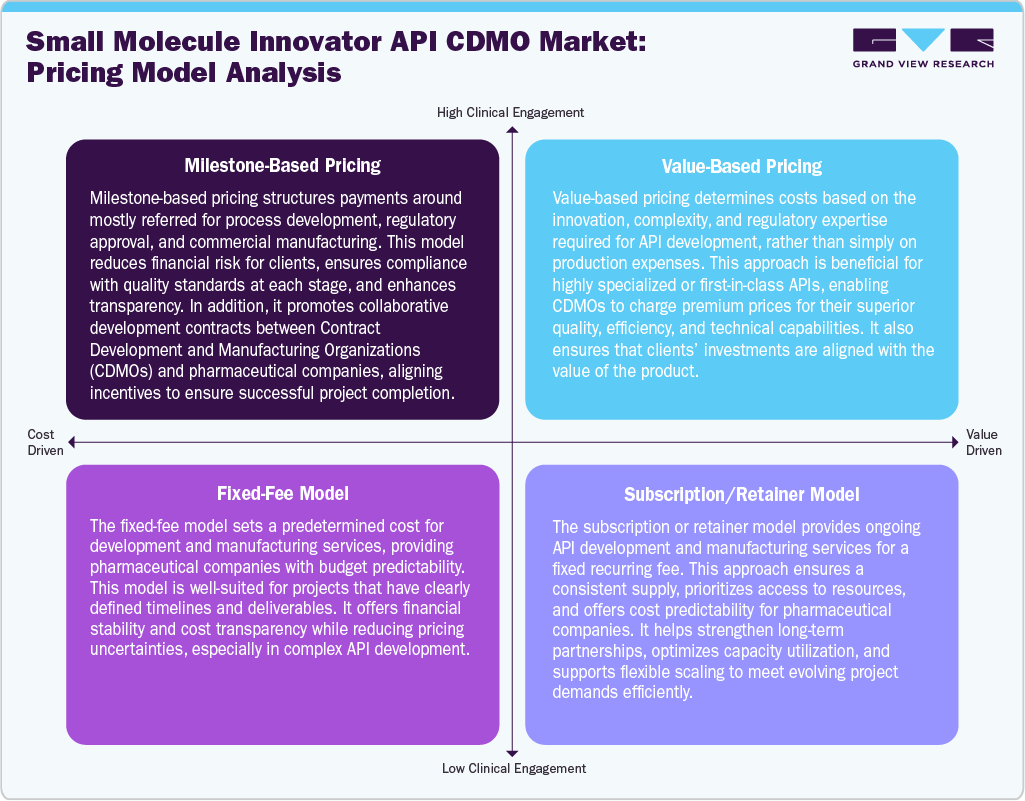

Pricing Model Analysis

The pricing models in small molecule innovator API CDMO operate under various pricing models to balance cost efficiency, innovation, and regulatory compliance while ensuring profitability. Fixed-fee model pricing is one of the standard approaches, covering production expenses plus a fixed margin for transparency. Besides this, milestone-based pricing links payments to development stages like formulation, regulatory approval, and production, reducing financial risk. In addition, value-based pricing is gaining attention for highly complex or differentiated APIs, which reflects innovation and technical expertise. Volume-based pricing benefits long-term partnerships, offering tiered discounts for bulk production. In addition, subscription or retainer models provide stability for clients requiring continuous supply and dedicated capacity. Hence, most CDMOs are increasingly adopting flexible pricing strategies to remain competitive, aligning cost structure requirements, regulatory needs, and technological advancements, ensuring new growth in the global market.

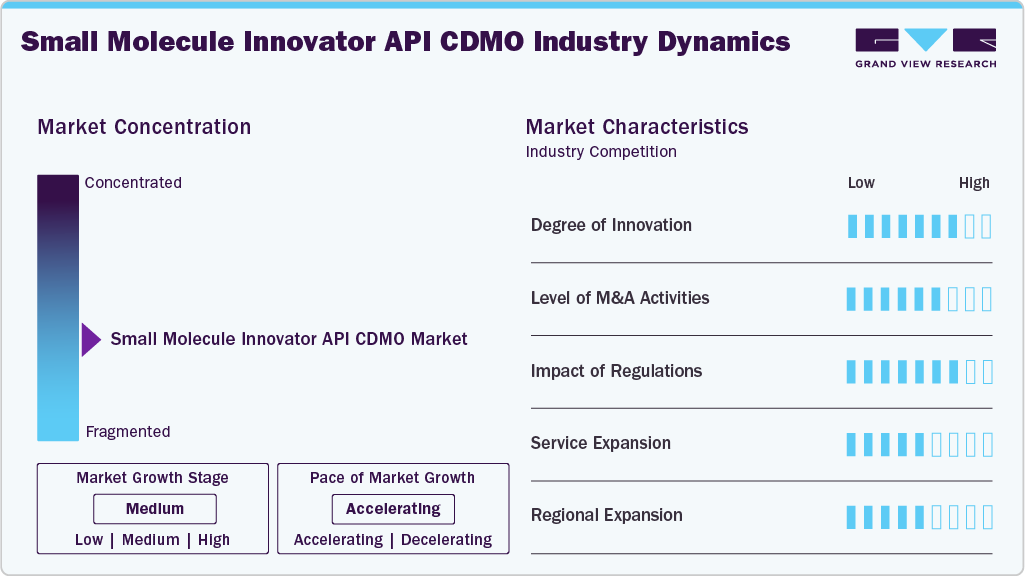

Market Concentration & Characteristics

Market growth stage is stable and is expected to accelerate over the estimated period. The small molecule innovator API CDMO market is characterized by technologies, regulatory considerations, and globalization & outsourcing of product processes to influence advantages and specialized capabilities.

The small molecule innovator API products innovations is continuously evolving to meet the industry’s demands for innovation, efficiency, and regulatory compliance. Several advancements have shaped the small molecule innovator API CDMO market, enhancing drug development, manufacturing processes, and productivity.

Compliance with stringent regulatory requirements, particularly in the pharmaceutical industry, is a critical component. CDMOs in this market are emphasizing robust quality assurance practices and adherence to regulatory standards thereby witnessing lucrative growth opportunities.

Small molecule innovator API CDMO players in the market leverage strategies such as collaborations, partnerships, and acquisitions to promote the reach of their offerings and increase their product capabilities globally. For instance, in January 2026, Agno Pharma in the U.S. acquired Actylis’s Eugene, Oregon CDMO manufacturing asset (legacy Cascade Chemistry business), expanding its cGMP small-molecule API development and manufacturing capabilities from early-phase to commercial production.

Service expansion in the small molecule innovator API CDMO market focuses on integrated end-to-end capabilities, from early-stage process development to commercial-scale manufacturing. CDMOs are adding high-potency API suites, continuous manufacturing lines, and advanced analytical services.

The local presence of several established pharmaceutical, rising number of ongoing clinical studies, technologically advanced formulation development, and demand for small molecule innovator API products fuels market growth.

Stage Type Insights

On the basis of stage type segment, the market is segregated into preclinical, clinical, and commercial. The clinical segment led small molecule innovator API CDMO market and accounted for 54.44% of global revenue in 2025. The clinical segment is further sub-segmented to Phase I, Phase II, and Phase III. The segment growth is driven by improving access to medicine, robust small molecule development pipeline, and launch of new drugs. Besides, these clinical small molecule innovator API CDMOs provide support, expertise, and services for appropriate drug formulation, clinical trials (phase I-IV), scale-up, validation & large-scale commercial manufacturing, among others. Clinical CDMOs ensure that appropriate drug products are developed & tested for clinical trials, offer expertise, and save time for APIs at the clinical stage, fueling the market demand.

The commercial segment is projected to experience the fastest growth reflecting strong demand for large-scale, GMP-compliant manufacturing following regulatory approval. As novel therapies and orphan drugs increase, pharmaceutical companies are outsourcing to CDMOs to access advanced infrastructure, scalability, and regulatory expertise. Commercial CDMOs support seamless scale-up from laboratory to full production while ensuring cGMP compliance and rigorous quality control. Their established facilities enable cost-efficient, high-quality drug substance and product manufacturing. Rising investments, strategic expansions, and M&A activity are further strengthening commercial capabilities, positioning this segment for sustained growth in the coming years.

Customer Type Insights

On the basis of the customer type, the pharmaceutical segment dominated the industry in 2025. In addition, several pharmaceutical companies are shifting their focus to CDMOs to develop novel small molecule innovator API drugs for the treatment of various indications in areas such as oncology, immunology, and infectious diseases. This has enabled medical breakthroughs and helped address unmet medical needs, saving several lives through the small molecule innovator API. Moreover, in recent years, constant advancements in small molecule API innovations have created new possibilities for innovative approaches to develop potential therapies. Furthermore, rapid advancements in structure-based design, prediction, and imaging, as well as automation, Artificial Intelligence (AI), and machine learning, have become major enablers of small-molecule-led optimization, increasing speed and enhancing success rates.

The biotechnology segment accounted for second fastest segment in the market over the forecast period. The segment's expansion is driven by rising demand for biotechnology and enhanced molecular efficiency. Furthermore, high investments in the biotechnology industry and constant improvements in molecular biology have resulted in the advent of new scientific disciplines such as metabolomics, proteomics, and genomics. The growing use of biotech solutions has aided in the innovation of therapeutic proteins and other medications. Furthermore, the growing R&D pipeline is expected to positively impact on the market.

Therapeutic Area Insights

On the basis of the therapeutic area, the oncology segment dominated the industry in 2025, due to the increasing number of cancer cases worldwide. For instance, the Cancer Atlas predicts that there will be 29 million cancer cases globally by 2040. Recent trends in pharmaceutical products have shifted with growing R&D for cancer treatments. The pharmaceutical sector has witnessed significant growth due to the rising demand for oncology drugs & therapies fueled by innovative targeted treatments and personalized medicine approaches, which has led to a rise in demand for the small molecule innovator API CDMOs

The infectious diseases segment is the second fastest growing over the forecast period of 2026-2033 owing to infectious diseases caused by bacterial and viral pathogens that has witnessed dynamic trends and scenarios across various disease segments. Such diseases are a major cause of death worldwide and establish an ever-growing medical need. The growing prevalence of severe diseases caused by harmful bacteria, fungi, viruses, and parasites, such as Severe Acute Respiratory Syndrome (SARS), has resulted in growth of the infectious diseases market and need for new drugs. Small molecule innovator API CDMO focuses on the discovery and research & development of new drugs and therapies.

Regional Insights

North America small molecule innovator API CDMO market is expected to grow over the forecast period. This can be attributed to increasing investments by pharmaceutical companies and growing R&D of small molecule drugs. This has led to a surge in demand for contract development and manufacturing services. The local presence of several established pharmaceutical, biotechnology, & CDMO entities and the increasing number of clinical trials are key factors expected to contribute to market growth. These regional entities are focused on small molecule innovator API transactions with geographic expansion & capacity deals in novel therapeutics, which mostly include acquiring new capabilities.

U.S. Small Molecule Innovator API CDMO Market Trends

Pharmaceutical companies are outsourcing their development & manufacturing activities to CDMOs to reduce costs, accelerate time to market, and access specialized expertise. This trend is fueling the U.S. small molecule innovator API CDMO market as CDMOs expand to meet the growing demand for outsourcing services. This expansion involves investments in new facilities, equipment upgrades, & process improvements. Furthermore, the growing number of companies expanding their manufacturing facilities to cater to the rising pharmaceutical demand is likely to propel market growth. In August 2025, Esteve expanded its US footprint by acquiring Regis Technologies, strengthening small-molecule API CDMO capabilities across development and manufacturing, while enhancing analytical services and supporting rare disease-focused growth

Canada small molecule innovator API CDMO market is anticipated to grow from 2026 to 2033 due to a notable trend of Canadian pharmaceutical entities outsourcing drug development. In addition, the growing trend of outsourcing drug R&D & manufacturing to CDMOs to accelerate product development and increase manufacturing efficiency is expected to drive the country’s market. In July 2024, Eurofins CDMO Alphora completed a new GMP API manufacturing facility in Canada, expanding small molecule capacity, reactor scale, and clinical-to-commercial manufacturing capabilities. Furthermore, pharmaceutical/biotechnology companies increasingly opt for CDMO services to influence their expertise. CDMOs offer flexibility & scalability in manufacturing capacity, allowing pharmaceutical companies to adapt to changing market demands and accelerate time to market for new therapies.

Europe Small Molecule Innovator API CDMO Market Trends

Europe held a significant market share in 2025. The region has a robust pharmaceutical sector, with numerous companies engaged in drug discovery, development, and manufacturing. The growing number of pharmaceutical activities is expected to improve the demand for CDMOs. Moreover, the rising trend of outsourcing services to European countries is expected to contribute to the increasing demand for small molecule innovator API CDMOs. Furthermore, the growing prevalence of rare diseases, the presence of well-established pharmaceutical companies, the increasing demand for new drugs, and the expansion of new facilities are among the major factors expected to drive market growth over the forecast period.

Germany records the highest healthcare spending in Europe and maintains a strong healthcare system supported by high-quality medical services. The Federal Institute for Drugs and Medical Devices regulates APIs, ensuring strict compliance standards. Besides this, demand for small molecule innovator API CDMO services has grown due to therapeutic advancements, rising clinical trial activity, increasing product complexity, and stringent regulatory requirements. In addition, government initiatives supporting research and innovation further stimulate outsourcing demand.

The UK is considered a lucrative market for pharmaceutical companies due to its extensive R&D initiatives, excellent early innovation medicine platforms, and pharmaceutical clinical trials being undertaken to address the challenges posed by various diseases. Moreover, the presence of various multinational CDMOs in the country is anticipated to contribute to market growth. Furthermore, increasing focus on research activities, expertise in characterization & functionality, high-quality drugs, and commercial high-volume continuous production are some factors expected to contribute to the dominance of the UK in the Europe market.

Asia Pacific Small Molecule Innovator API CDMO Market Trends

Asia Pacific held the largest share of 41.96% in 2025 and is expected to maintain this dominance over the forecast period. In the past decade, the manufacturing of pharmaceutical products has been outsourced to Asian countries, such as India and China. Asia Pacific is expected to witness rapid growth in its pharmaceutical industry due to rising healthcare expenditure, increasing prevalence of chronic diseases, and improving healthcare infrastructure. This is expected to drive the demand for small molecule APIs and CDMO services to support drug development and manufacturing.

China held a significant share in the market in 2025. A rising geriatric population and expanding middle-income group are increasing API demand, while cost-effective labor continues to attract global outsourcing. Growing clinical trial activity over 12,400 active studies registered as of February 2024 further supports market expansion. In addition, chinese CDMOs are strengthening global presence; for instance, Asymchem’s 2024 acquisition of Pfizer’s former U.K. API facility enhances international capabilities. Furthermore, large number of companies are securing drug manufacturing licenses, such as Crystal Pharmatech, reinforcing GMP compliance, expanding capacity, and driving sustained market growth and competitiveness.

The Japan small molecule innovator API CDMO market is expected to grow over the forecast period due Regulatory compliance, technological advancements, strong R&D capabilities, skilled workforce, strategic location, and favorable government initiatives.

The small molecule innovator API CDMO market in India is expected to experience significant growth at a significant CAGR during the forecast period. The country is witnessing considerable growth due to low labor costs, improving healthcare infrastructure, skilled technical expertise, and rising government R&D funding, including a USD 602 million pharmaceutical innovation scheme. Besides this, investments such as Navin Molecular’s USD 35 million GMP facility expansion strengthen manufacturing capacity and global competitiveness. In addition, increasing regulatory focus on quality compliance, expanding clinical trial activity, and growing outsourcing from multinational pharmaceutical companies further support market growth.

Latin America Small Molecule Innovator API CDMO Market Trends

Latin America, including Brazil, Mexico, and Argentina, is emerging as a key hub for small molecule API CDMO services, driven by a growing pipeline of drugs in oncology, neurology, and infectious diseases. Improving clinical research infrastructure and supportive government policies are encouraging both local and multinational companies to expand operations in the region.

The small molecule innovator API CDMO market in Brazil is expected to grow over the forecast period. The country is witnessing government initiatives promoting import substitution, domestic manufacturing, and foreign-local partnerships attracting multinational pharmaceutical investments and supporting expansion, product launches, and M&A activity. In addition, growing clinical trial activity, with nearly 700 active studies registered as of February 2024, further strengthens opportunities. Furthermore, regulatory support, including ANVISA’s GMP certification for facilities such as Dipharma’s, enhances quality compliance and boosts market growth.

Middle East and Africa Small Molecule Innovator API CDMO Market Trends

The MEA accounted for a significant revenue share in the global small molecule innovator API CDMO market in 2025. The growth in the region can be attributed to the complex treatment strategies and the rising incidence of chronic diseases. Furthermore, improvements in government initiatives, evolving regulations for API production, and shifts in geopolitical dynamics are expected to propel the MEA small molecule innovator API CDMO market in the coming decade. Besides this, increasing awareness about biopharmaceuticals and advanced therapeutics is another factor likely to positively impact market growth over the forecast period.

The South Africa Small Molecule Innovator API CDMO Market is witnessing growth due to the increasing demand for small molecule drugs, the attractiveness of the pharmaceutical industry, and the presence of a diverse population in the country. Moreover, the availability, affordability, accessibility, & quality of small molecule API products in South Africa are anticipated to fuel market growth during the forecast period. However, slow economic growth & development of the healthcare system, imports of APIs, and potentially rising medicine prices in the country are anticipated to impede market growth in the coming decade.

Saudi Arabia is emerging as a competitive hub in the small molecule innovator API CDMO market, driven by growing awareness about the benefits of effective pharmaceutical solutions, and rising investments in R&D. The pharmaceutical industry in Saudi Arabia is expected to gain substantial benefits over the forecast period due rising prevalence of diseases, presence of CMOs/CDMOs, and the growing number of clinical trials. For instance, in June 2023, Lifera was launched by the Public Investment Fund, Saudi Arabia’s global investment organization. It is a commercial-scale CDMO that enables the growth of the local bio/pharmaceutical industry and supports the country’s position as a global pharmaceutical manufacturing destination. Hence, the growing number of CDMOs in the country is anticipated to drive market growth over the forecast period.

Key Small Molecule Innovator API CDMO Company Insights

The major players operating across the small molecule innovator API CDMO industry focus on adopting in-organic strategic initiatives such as mergers, partnerships, acquisitions, etc. The prominent strategies companies adopt are service launches, mergers & acquisitions/joint ventures, mergers, partnership & agreements, expansions, and others to increase market presence & revenue and gain a competitive edge driving market growth. Hence, increasing adoption of in-organic strategic initiatives is highly anticipated to boost the market share of prominent players. For instance, in November 2025, AGC Pharma Chemicals inaugurated a state-of-the-art 7,500 m² manufacturing plant in Malgrat de Mar, Barcelona, Spain, investing funds to expand production capacity by 30% and introduce high-potency API (HPAPI) capabilities from R&D to commercial supply.

Key Small Molecule Innovator API CDMO Companies:

The following key companies have been profiled for this study on the small molecule innovator API CDMO market.

- Lonza Group Ltd.

- Novo Holdings (Catalent, Inc.)

- Thermo Fisher Scientific, Inc.

- Siegfried Holding AG

- Recipharm AB

- CordenPharma International

- Samsung Biologics

- Labcorp

- Ajinomoto Bio-Pharma Services

- Piramal Pharma Solutions

- Jubilant Life Sciences (Jubilant Biosys Limited)

- WuXi AppTec Co., Ltd.

Recent Developments

-

In October 2025, Cambrex invested USD 120 million in the U.S., expanding its Charles City, Iowa site by 40% to strengthen API and peptide manufacturing and support domestic drug supply chain resilience.

-

In September 2025, Thermo Fisher completed its acquisition of Sanofi’s sterile fill-finish and packaging site in Ridgefield, New Jersey, expanding U.S. manufacturing capacity to support pharma and biotech customers.

-

In July 2025, Radyus Research (U.S.) and Eurofins CDMO Alphora (Canada) formed a strategic partnership to integrate early-stage drug development and GMP manufacturing for small molecule APIs, streamlining preclinical through clinical proof-of-concept services for global biotech clients.

Small Molecule Innovator API CDMO Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 28.06 billion

Revenue forecast in 2033

USD 43.75 billion

Growth rate

CAGR of 6.55% from 2026 to 2033

Historical year

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD billion/million and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Stage type, customer type, therapeutic area, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Thailand; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait; Oman; Qatar

Key companies profiled

Lonza Group Ltd.; Novo Holdings (Catalent, Inc.); Thermo Fisher Scientific, Inc.; Siegfried Holding AG; Recipharm AB; CordenPharma International; Samsung Biologics; Labcorp; Ajinomoto Bio-Pharma Services; Piramal Pharma Solutions; Jubilant Life Sciences (Jubilant Biosys Limited); WuXi AppTec Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Small Molecule Innovator API CDMO Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global small molecule innovator API CDMO market based on stage type, customer type, therapeutic area and region:

-

Stage Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Preclinical

-

Clinical

-

Phase I

-

Phase II

-

Phase III

-

-

Commercial

-

-

Customer Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical

-

Small

-

Medium

-

Large

-

-

Biotechnology

-

Small

-

Medium

-

Large

-

-

-

Therapeutic Area Outlook (Revenue, USD Million, 2021 - 2033)

-

Cardiovascular Diseases

-

Oncology

-

Respiratory Disorders

-

Neurology

-

Metabolic Disorders

-

Infectious Diseases

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Oman

-

Qatar

-

-

Frequently Asked Questions About This Report

b. The global small molecule innovator API CDMO market size was valued at USD 26.66 billion in 2025 and is projected to reach USD 28.06 billion by 2026.

b. The global small molecule innovator API CDMO market size is projected to reach USD 43.75 billion by 2033, growing at a CAGR of 6.55% from 2026 to 2033.

b. Key factors driving the market growth include increasing demand for small molecule drugs, increasing outsourcing trends among pharmaceutical companies and surge in number of clinical trials.

b. Asia Pacific small molecule innovator API CDMO market held the largest share of 41.96% of the global market in 2025, attributed to rising geriatric population and expanding middle-income group are increasing API demand and cost-effective labor that continues to attract global outsourcing.

b. Some key players operating in the small molecule innovator API CDMO market include Lonza Group Ltd., Novo Holdings (Catalent, Inc.); Thermo Fisher Scientific, Inc.; Siegfried Holding AG; Recipharm AB; CordenPharma International; Samsung Biologics; Labcorp; Ajinomoto Bio-Pharma Services; Piramal Pharma Solutions; Jubilant Life Sciences (Jubilant Biosys Limited); WuXi AppTec Co., Ltd

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.