- Home

- »

- Advanced Interior Materials

- »

-

Smart Building Materials Market Size, Industry Report, 2033GVR Report cover

![Smart Building Materials Market Size, Share & Trends Report]()

Smart Building Materials Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Smart Glass, Phase-Change Materials), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-824-4

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Building Materials Market Summary

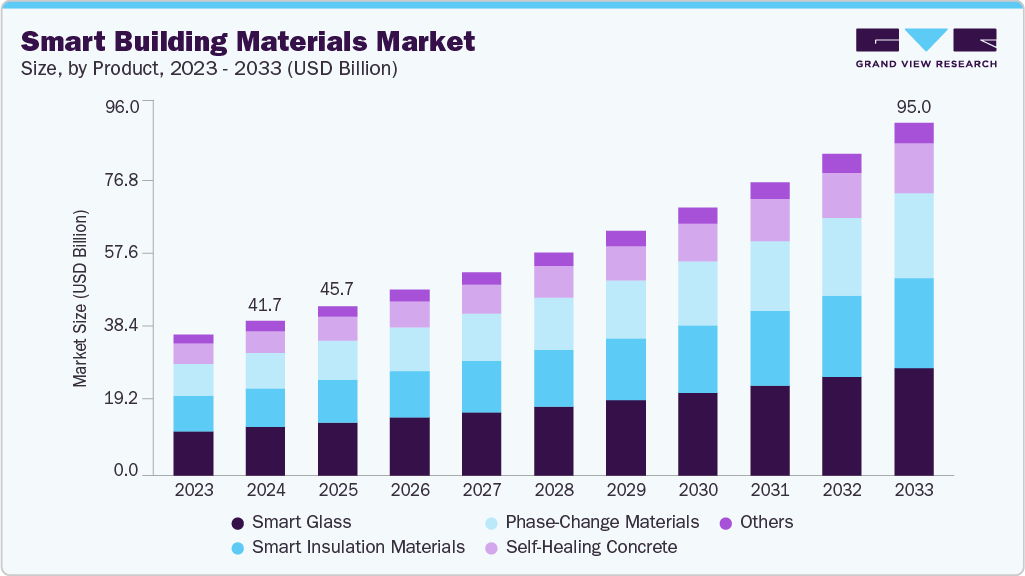

The global smart building materials market size was estimated at USD 41.65 billion in 2024 and is projected to reach USD 95.04 billion by 2033, growing at a CAGR of 9.6% from 2025 to 2033, driven by growing global emphasis on energy efficiency and resource optimization. Governments, corporations, and building owners are increasingly adopting advanced materials that regulate temperature, manage light, and reduce energy consumption.

Key Market Trends & Insights

- Asia Pacific dominated the smart building materials market with the largest revenue share of 38.9% in 2024.

- By product, the phase-change materials segment is expected to grow at the fastest CAGR of 10.3% over the forecast period.

- By end use, the infrastructural segment is expected to grow at the fastest CAGR of 10.0% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 41.65 Billion

- 2033 Projected Market Size: USD 95.04 Billion

- CAGR (2025-2033): 9.6%

- Asia Pacific: Largest market in 2024

Smart insulating systems, dynamic glazing, and energy-responsive facades are becoming essential in modern construction. These technologies help lower operating costs while supporting carbon reduction targets.Sustainability initiatives and green certifications are accelerating the adoption of smart building materials across both commercial and residential sectors. Materials that support reduced waste, longer life cycles, and enhanced recyclability are receiving strong interest from architects and developers. LEED, BREEAM, and other certification frameworks increasingly reward the use of adaptive, low-emission, and environmentally responsive materials. This trend encourages investment in innovative solutions such as self-healing concrete, phase-change materials, and smart ventilation components.

The integration of IoT-enabled systems is another key force driving demand for smart building materials. Modern buildings require materials that can interact with sensors, automation platforms, and real-time monitoring systems to enhance safety and operational control. Smart flooring, responsive facades, and embedded structural health monitoring materials allow continuous data collection and performance assessment. These capabilities improve predictive maintenance and strengthen building resilience.

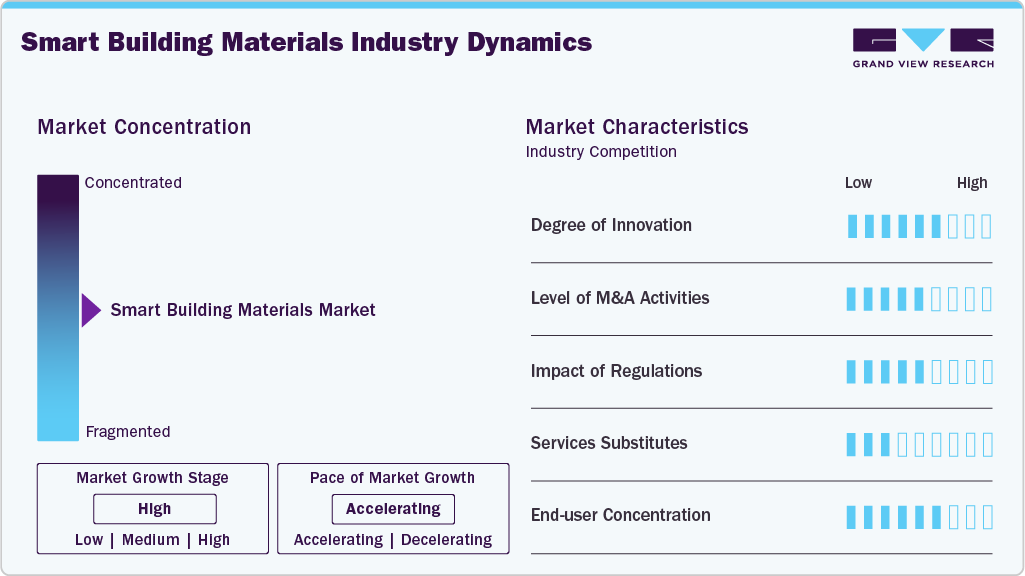

Market Concentration & Characteristics

The smart building materials industry is characterized by moderate to high innovation intensity, driven by continuous advancements in energy-efficient materials, intelligent facades, and self-regulating systems. Innovation is reinforced by increasing integration of IoT and digital monitoring technologies, which require materials capable of interacting with sensors and automated platforms. The market also experiences steady merger and partnership activity, as larger building-solution providers acquire niche technology firms to broaden their portfolios and strengthen R&D capabilities. This environment supports rapid development cycles while elevating the competitive threshold for smaller players.

Regulatory frameworks exert a significant influence on market dynamics, particularly through energy-efficiency mandates, sustainable construction codes, and environmental performance standards. Compliance with these regulations encourages widespread adoption of smart materials while limiting the relevance of traditional substitutes. Service substitutes remain relatively limited, as few conventional materials can match the functional advantages of adaptive or sensor-enabled systems. End-user concentration is moderate, with demand spread across the commercial, industrial, and residential sectors. However, large developers and institutional builders account for a substantial share of purchases, driven by their focus on long-term operational efficiency and sustainability targets.

Product Insights

The smart glass segment led the market and accounted for the largest revenue share of 31.6% in 2024, driven by the growing demand for energy-efficient building solutions that support dynamic control of heat and light. Advancements in electrochromic, thermochromic, and photochromic technologies are enabling greater comfort and reduced HVAC loads in modern buildings. Rising adoption in commercial offices, healthcare facilities, and high-end residential projects is expanding market penetration. Government incentives for energy-saving materials further encourage the integration of smart glazing in new constructions.

The phase-change materials segment is expected to grow at the fastest CAGR of 10.3% over the forecast period, driven by the increasing demand for thermal energy storage solutions that improve building energy efficiency. These materials help regulate indoor temperatures by absorbing, storing, and releasing heat, thereby reducing reliance on mechanical heating and cooling. Increased awareness of green building certifications is encouraging developers to adopt PCM-based solutions for walls, ceilings, and insulation systems. Their compatibility with both retrofit and new construction projects enhances their market appeal.

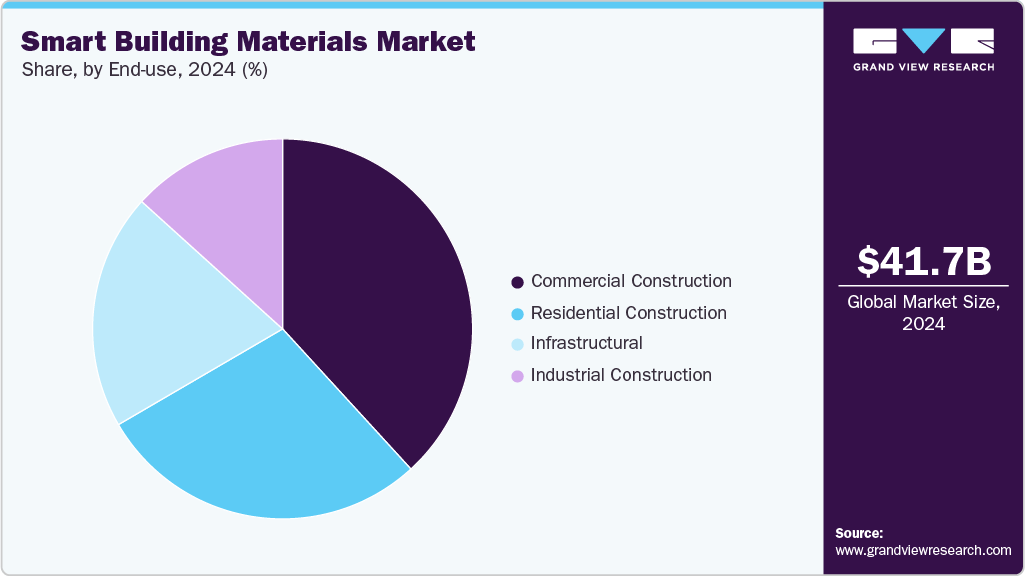

End Use Insights

The commercial construction segment dominated the market and accounted for the largest revenue share of 38.2% in 2024, driven by the rising investments in intelligent building technologies aimed at enhancing operational efficiency and occupant comfort. Office buildings, retail centers, hotels, and institutional facilities increasingly incorporate smart materials to optimize energy consumption and reduce maintenance demands. Growing employer focus on wellness and productivity is encouraging the use of responsive materials such as smart glass and self-healing coatings.

The infrastructural segment is expected to grow at the fastest CAGR of 10.0% over the forecast period, driven by global initiatives to modernize public utilities, transportation hubs, and civic structures using durable and adaptive materials. Smart building materials enhance long-term performance, reduce repair cycles, and provide real-time monitoring for bridges, tunnels, and public facilities. Governments are increasingly prioritizing resilient construction materials to mitigate risks from environmental stress and aging infrastructure. Integration of self-sensing and weather-responsive materials also supports infrastructure sustainability goals.

Regional Insights

The Asia Pacific smart building materials industry held the largest revenue market share of 38.9% in 2024, benefiting from large-scale urbanization, rising infrastructure development, and increasing investment in high-efficiency buildings. Governments across the region are implementing more rigorous building-energy codes, which encourage adoption of smart insulation, dynamic glazing, and adaptive structural materials. Advancements in local manufacturing capabilities make high-tech materials more cost-effective. The rapid expansion of smart city initiatives is boosting demand for integrated building technologies. Increasing awareness of sustainability and indoor environmental quality strengthens consumer and developer preferences. Population growth and high construction output further sustain market expansion.

The China smart building materials industry is propelled by strong government directives promoting energy conservation and carbon neutrality. Massive urban redevelopment projects create consistent demand for intelligent façades, thermal materials, and embedded monitoring systems. The country’s focus on large-scale smart cities accelerates the deployment of IoT-compatible building components. Growing manufacturing expertise enables rapid commercialization of advanced construction materials. Rising environmental standards and the need for emissions control drive the transition toward sustainable materials.

North America Smart Building Materials Market Trends

The smart building materials industry in North America is driven by strong adoption of energy-efficient construction practices and stringent federal and state sustainability mandates. Increasing investments in green commercial real estate, such as smart offices and institutional buildings, further accelerate demand. Technological maturity and rapid integration of IoT in infrastructure enhance the need for intelligent materials. Government incentives for net-zero and low-emission buildings strengthen market penetration. The region’s advanced construction ecosystem supports early adoption of innovative façade, insulation, and structural materials. Rising renovation activity in aging buildings also contributes to sustained demand.

U.S. Smart Building Materials Market Trends

The U.S. smart building materials industry has gained momentum from widespread policy focus on carbon reduction and energy efficiency, fueling strong demand for advanced building materials. Federal programs promoting electrification, grid-interactive buildings, and high-performance envelopes directly support market expansion. The country’s leadership in proptech and smart infrastructure drives the incorporation of sensor-enabled and adaptive materials. Growing corporate commitments to ESG standards encourage the use of sustainable and intelligent construction solutions. Public and private investments in smart cities further enhance market opportunities.

Europe Smart Building Materials Market Trends

The smart building materials industry in Europe is primarily driven by stringent EU directives targeting energy performance, circularity, and carbon reduction in buildings. Widespread regulatory pressure encourages the adoption of low-emission, recyclable, and adaptive materials. Strong R&D activity and government-supported innovation programs promote technological advancements in building systems. High renovation rates in older structures create a steady need for smart insulation, glazing, and monitoring materials.

The Germany smart building materials industry growth is driven by ambitious national energy-efficiency goals and strict building performance regulations such as EnEV and BEG standards. The country’s engineering expertise supports early adoption of advanced materials, including smart façades and self-regulating insulation. Germany’s strong industrial base encourages integration of automation and structural monitoring technologies. High utility costs further incentivize the adoption of efficient building solutions. Public funding programs for green retrofits stimulate market expansion.

Central & South America Smart Building Materials Market Trends

The smart building materials industry in Central & South America has received impetus from increasing urbanization and a growing need for modernized infrastructure capable of improving energy efficiency. Governments in the region are gradually introducing stricter building codes and sustainability incentives that support smart material adoption. Rising interest in climate-resilient construction, driven by weather-related risks, underscores the need for adaptable and durable materials. International investments in green real estate and commercial expansions stimulate demand.

Middle East & Africa Smart Building Materials Market Trends

The smart building materials industry in the Middle East & Africa is driven by large-scale urban development and the region’s strong focus on constructing technologically advanced cities. Harsh climatic conditions create high demand for materials that offer superior thermal performance and energy savings. Government vision programs, such as national smart-city strategies, significantly promote the adoption of smart buildings. Increasing adoption of renewable energy integration in buildings supports the use of intelligent materials. Growing investments in tourism, hospitality, and commercial infrastructure enhance market opportunities.

Key Smart Building Materials Company Insights

Some of the key players operating in the market include Saint-Gobain and Sika AG, among others.

-

Saint-Gobain focuses on material technologies that improve building comfort, sustainability, and energy performance. Its offerings include dynamic glass, multi-layer insulation systems, and lightweight structural materials tailored for modern smart buildings.

-

Sika AG emphasizes durability, energy conservation, and structural enhancement through material innovation. Its product portfolio includes reflective roof systems, temperature-responsive coatings, and advanced sealing solutions that elevate building efficiency and resilience.

AGC Inc., 3M are some of the emerging market participants in the smart building materials market.

-

AGC Inc. specializes in high-performance architectural glass, dynamic glazing, and façade materials designed for smart, energy-efficient buildings. The company is known for its electrochromic glass and solutions that regulate heat and light based on environmental conditions. AGC’s offerings support sustainable design and smart building envelopes that optimize energy usage and occupant comfort.

-

3M offers a diverse range of smart building materials, including window films, reflective insulation, and structural adhesives. The company’s technologies enhance energy savings, interior climate control, and building safety. Its advanced films and coatings are widely used in commercial buildings to reduce heat gain, improve natural lighting, and support modern sustainability requirements.

Key Smart Building Materials Companies:

The following are the leading companies in the smart building materials market. These companies collectively hold the largest market share and dictate industry trends.

- Saint-Gobain

- MASDAR CITY

- Sika AG

- AGC Inc.

- 3M

- BASF SE

- Johnson Controls

- Honeywell International Inc.

- Dow Inc.

Recent Developments

-

In August 2025, Johnson Controls completed the sale of its residential and light commercial HVAC business, focusing its transformation on becoming a pure-play innovative building solutions provider.

Smart Building Materials Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 45.65 billion

Revenue forecast in 2033

USD 95.04 billion

Growth rate

CAGR of 9.6% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End Use, product, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; India; Japan

Key companies profiled

Saint-Gobain; MASDAR CITY; Sika AG; AGC Inc.; 3M; BASF SE; Johnson Controls; Honeywell International Inc.; Dow Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Building Materials Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global smart building materials market report based on product, end use, and region:

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

Smart Glass

-

Phase-Change Materials

-

Self-Healing Concrete

-

Smart Insulation Materials

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Residential Construction

-

Commercial Construction

-

Industrial Construction

-

Infrastructural Construction

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global smart building materials market size was estimated at USD 41.65 billion in 2024 and is expected to reach USD 50.03 billion in 2025.

b. The global smart building materials market is expected to grow at a compound annual growth rate of 9.6% from 2025 to 2033 to reach USD 95.04 billion by 2033.

b. Commercial construction segment dominated the market and accounted for the largest revenue share of 38.2% in 2024, driven by rising investments in intelligent building technologies aimed at enhancing operational efficiency and occupant comfort.

b. Some of key players in the smart building materials market are Saint-Gobain, MASDAR CITY, Sika AG, AGC Inc., 3M, BASF SE, Johnson Controls, Honeywell International Inc., and Dow Inc.

b. The key factors driving the smart building materials market include rising demand for energy-efficient construction, advancements in responsive and self-regulating materials, growing sustainability regulations, and increasing adoption of intelligent building technologies across commercial and infrastructural projects.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.